Global Automotive Filters Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5537

November 2024

82

About the Report

Global Automotive Filters Market Overview

- The global automotive filters market reached a valuation of approximately USD 19.99 billion, based on historical analysis. This market is driven by the increasing global vehicle production and stringent emission norms that mandate the use of filters in automobiles. Factors such as rising consumer awareness of air quality and health, coupled with the growing demand for fuel-efficient vehicles, have also played a significant role in the market's growth.

- The automotive filters market is dominated by countries such as the United States, Germany, and Japan due to their well-established automotive industries, stringent emission regulations, and high demand for aftermarket services. In these regions, automakers prioritize environmental sustainability, making emission-control technologies and high-performance filters critical components of modern vehicles.

- The European Union's Euro 6d standards, implemented in 2023, set stringent CO2 limits at 95 g/km for passenger vehicles, compelling automakers to adopt advanced filtration systems to meet these targets. Similarly, the United States EPA reinforced its NOx emission limits, particularly for heavy-duty vehicles. These regulations necessitate the use of high-performance filters to reduce engine emissions, ensuring compliance with government mandates while promoting cleaner air quality.

Global Automotive Filters Market Segmentation

By Product Type: The global automotive filters market is segmented by product type into oil filters, air filters, cabin filters, and fuel filters. Oil filters hold a dominant market share in this segment due to their critical role in enhancing engine performance by removing contaminants from the oil. With the increased usage of vehicles and longer service intervals, demand for efficient oil filters has been on the rise, especially in regions where car ownership rates are high.

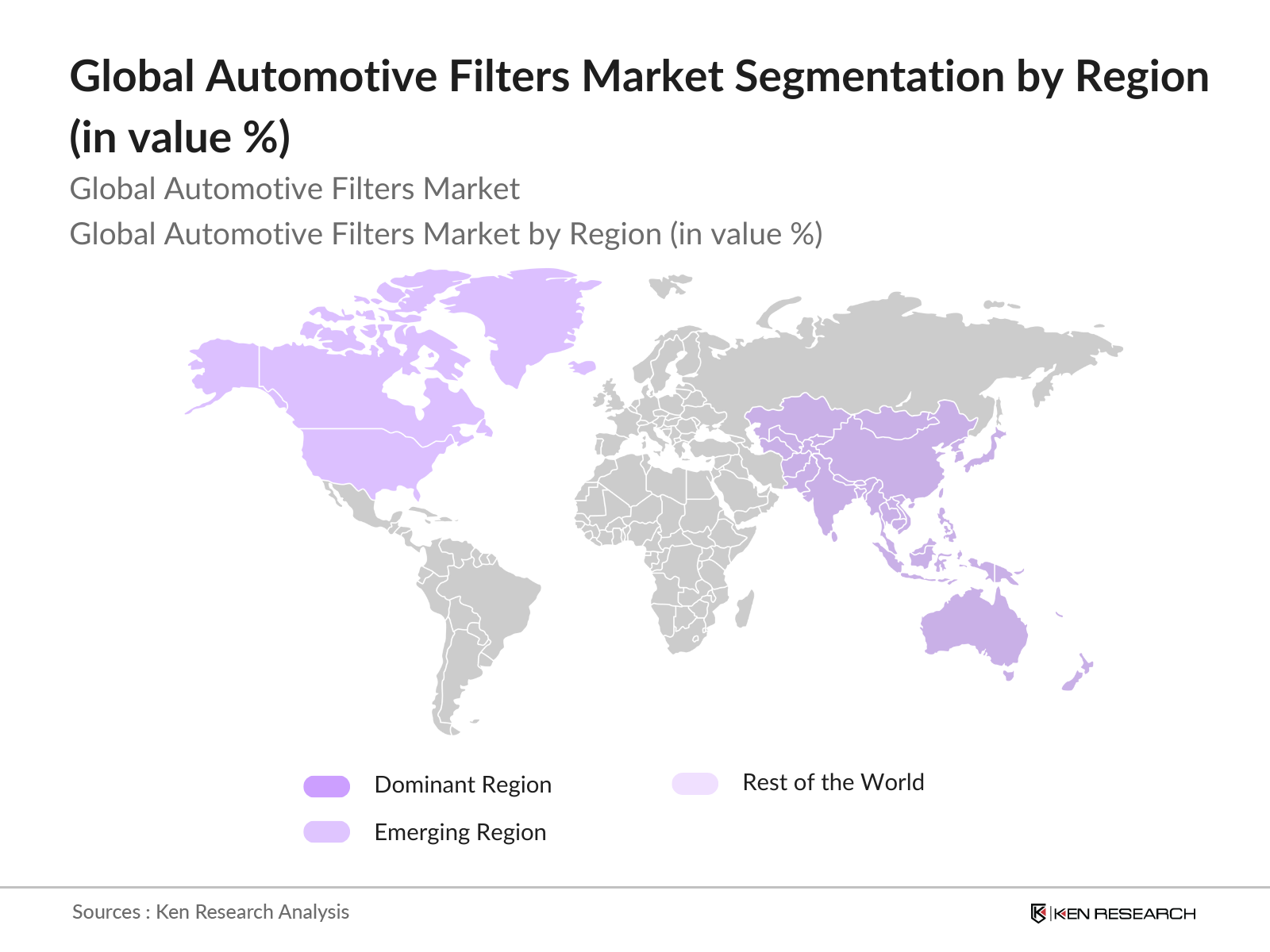

By Region: The global automotive filters market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific leads the markest due to the high automotive production in countries like China, India, and Japan. These nations are home to some of the world's largest car manufacturers, contributing to the demand for automotive filters to meet emission standards and improve fuel efficiency.

Global Automotive Filters Market Competitive Landscape

The global automotive filters market is highly competitive, with several major players dominating the landscape. The key players in the market invest heavily in research and development to enhance filter efficiency, durability, and environmental compliance. Market consolidation is also prominent, with established companies acquiring smaller players to expand their product portfolios and global reach.

|

Company |

Established |

Headquarters |

Product Portfolio |

Global Presence |

R&D Investment |

Patents Held |

Revenue (USD) |

Employees |

|

Robert Bosch GmbH |

1886 |

Germany |

||||||

|

Mann+Hummel Group |

1941 |

Germany |

||||||

|

Denso Corporation |

1949 |

Japan |

||||||

|

Mahle GmbH |

1920 |

Germany |

||||||

|

Donaldson Company Inc. |

1915 |

USA |

Global Automotive Filters Market Analysis

Market Growth Drivers

- Increasing Vehicle Production: The global vehicle production reached approximately 85 million units in 2023, driven by strong demand in key markets such as the U.S., China, and India. For instance, India alone produced around 4.5 million vehicles in 2023, ranking it among the top five global producers. The rise in vehicle manufacturing creates a robust demand for automotive filters, particularly in regions adhering to strict emission norms and higher standards of air quality. This increase in production underpins the need for advanced filtration systems to ensure cleaner engine operation and air quality for drivers and passengers.

- Stringent Emission Norms: Global emissions regulations are pushing manufacturers to adopt more efficient filtration systems. In 2023, the European Union implemented tighter standards for CO2 emissions, limiting passenger vehicle emissions to under 95 g/km. Similarly, in the U.S., the Environmental Protection Agency (EPA) has established that new cars must meet stringent NOx standards, particularly for diesel engines. These regulations are pushing manufacturers to integrate high-performance filters that reduce pollutant emissions, driving demand in both the OEM and aftermarket segments.

- Increasing Consumer Awareness About Health & Air Quality: The World Health Organization (WHO) has consistently highlighted the link between poor air quality and adverse health outcomes. In 2023, reports indicated that over 7 million deaths annually were attributed to air pollution globally. This growing awareness has led to increased demand for cabin air filters, especially in urban areas with high pollution levels. Governments in countries like India and China have also promoted initiatives aimed at improving air quality, further driving the need for effective automotive filtration systems to improve in-car air quality.

Market Challenges

- Adoption of Electric Vehicles (EVs): In 2023, global electric vehicle (EV) sales surpassed 10 million units, with China and Europe leading the adoption. EVs, which have fewer moving parts compared to traditional internal combustion engine vehicles, require fewer oil and fuel filters, posing a significant challenge to the traditional automotive filter market. However, opportunities for filters such as cabin air and battery coolant filters remain, though the overall demand for certain filter types is expected to decrease as EV penetration rises.

- Increasing Consumer Awareness About Health & Air Quality: The World Health Organization (WHO) has consistently highlighted the link between poor air quality and adverse health outcomes. In 2023, reports indicated that over 7 million deaths annually were attributed to air pollution globally. This growing awareness has led to increased demand for cabin air filters, especially in urban areas with high pollution levels. Governments in countries like India and China have also promoted initiatives aimed at improving air quality, further driving the need for effective automotive filtration systems to improve in-car air quality.

Global Automotive Filters Market Future Outlook

Over the next five years, the automotive filters market is projected to experience substantial growth driven by advancements in filter technology, rising consumer awareness of air quality, and government regulations aimed at reducing vehicle emissions. The increasing penetration of electric vehicles (EVs), although a challenge for traditional filter products, presents opportunities for new types of filters such as those used in battery cooling systems.

Market Opportunities:

- Integration of Filter Monitoring Sensors: By 2023, over 10 million vehicles globally had integrated real-time filter monitoring systems that alert drivers when a filter needs replacement. This trend has been primarily driven by advancements in IoT and smart sensor technologies. These systems not only improve vehicle efficiency but also extend the lifespan of filters by ensuring timely replacements. Automakers are increasingly incorporating these sensors into both premium and mass-market models, catering to consumer demand for enhanced vehicle maintenance.

- Eco-Friendly and Recyclable Filter Materials: The global shift toward sustainability has led manufacturers to invest in developing eco-friendly and recyclable filters. In 2023, automotive filter production in Europe increasingly focused on using biodegradable and recyclable materials, significantly reducing the environmental impact of traditional filters, which are often discarded after use. This trend aligns with the European Unions environmental directives aimed at minimizing automotive waste and encouraging the use of sustainable materials across the industry. Manufacturers adopting these innovations are responding to growing environmental concerns and stringent regulatory requirements.

Scope of the Report

|

By Product Type |

Oil Filters Air Filters Cabin Filters Fuel Filters |

|

By Vehicle Type |

Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles |

|

By Sales Channel |

OEMs Aftermarket |

|

By Material Type |

Synthetic Filters Cellulose Filters Activated Carbon Filters Nano-Fiber Filters |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Automotive OEMs

Aftermarket Service Providers

Automotive Parts Manufacturers

Government and Regulatory Bodies (EPA, NHTSA)

Environmental Protection Agencies

Venture Capitalist Firms

Investment Banks

Automotive Dealership Networks

Companies

Players Mention in the Report

Robert Bosch GmbH

Mann+Hummel Group

Denso Corporation

Mahle GmbH

Donaldson Company Inc.

Hengst SE

Sogefi Group

Parker Hannifin Corp

K&N Engineering Inc.

Cummins Filtration

UFI Filters

Baldwin Filters

ACDelco

Ahlstrom-Munksj Oyj

FRAM Group

Table of Contents

01. Global Automotive Filters Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Automotive Filters Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Automotive Filters Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Vehicle Production

3.1.2. Stringent Emission Norms

3.1.3. Rise in Vehicle Aftermarket Sales

3.1.4. Increasing Consumer Awareness About Health & Air Quality

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices

3.2.2. Adoption of Electric Vehicles (EVs)

3.2.3. Complex Supply Chain Management

3.3. Opportunities

3.3.1. Increasing Demand for High-Efficiency Filters

3.3.2. Growth in Aftermarket Sales Channels

3.3.3. Technological Advancements in Filter Media

3.4. Trends

3.4.1. Adoption of Cabin Air Filters

3.4.2. Integration of Filter Monitoring Sensors

3.4.3. Eco-Friendly and Recyclable Filter Materials

3.5. Government Regulation

3.5.1. Emission Standards (CO2 and NOx limits)

3.5.2. Vehicle Inspection Regulations

3.5.3. Environmental Protection Laws

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

04. Global Automotive Filters Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Oil Filters

4.1.2. Air Filters

4.1.3. Cabin Filters

4.1.4. Fuel Filters

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Cars

4.2.2. Light Commercial Vehicles

4.2.3. Heavy Commercial Vehicles

4.2.4. Electric Vehicles

4.3. By Sales Channel (In Value %)

4.3.1. OEMs

4.3.2. Aftermarket

4.4. By Material Type (In Value %)

4.4.1. Synthetic Filters

4.4.2. Cellulose Filters

4.4.3. Activated Carbon Filters

4.4.4. Nano-Fiber Filters

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global Automotive Filters Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Robert Bosch GmbH

5.1.2. Mann+Hummel Group

5.1.3. Denso Corporation

5.1.4. Donaldson Company Inc.

5.1.5. Sogefi Group

5.1.6. Mahle GmbH

5.1.7. Hengst SE

5.1.8. Parker Hannifin Corp

5.1.9. K&N Engineering Inc.

5.1.10. Ahlstrom-Munksj Oyj

5.1.11. Cummins Filtration

5.1.12. UFI Filters

5.1.13. FRAM Group

5.1.14. ACDelco

5.1.15. Baldwin Filters

5.2. Cross Comparison Parameters (Number of Employees, Inception Year, Headquarters, Revenue, Product Offerings, R&D Investments, Global Presence, Patents)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global Automotive Filters Market Regulatory Framework

6.1. Emission and Environmental Standards

6.2. Vehicle Safety and Compliance Standards

6.3. Certification and Compliance Requirements

07. Global Automotive Filters Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Automotive Filters Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Sales Channel (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

09. Global Automotive Filters Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first stage focuses on mapping the ecosystem of the automotive filters market, identifying all the stakeholders such as manufacturers, service providers, and consumers. The goal is to define the critical factors influencing market dynamics, including technological trends and regulatory frameworks.

Step 2: Market Analysis and Construction

In this step, historical data of the global automotive filters market is collected and analyzed to construct market trends. This involves examining vehicle production rates, emission standards, and aftermarket sales. The analysis also evaluates the impact of these factors on market revenue.

Step 3: Hypothesis Validation and Expert Consultation

During this phase, we conduct expert interviews with key automotive filter manufacturers and industry specialists. These consultations provide insights into technological innovations, supply chain dynamics, and emerging opportunities in the market.

Step 4: Research Synthesis and Final Output

The final step synthesizes all research data into a comprehensive analysis. This includes verifying the market segmentation data and validating trends in filter technology. The resulting report is a detailed and accurate portrayal of the global automotive filters market.

Frequently Asked Questions

01. How big is the global automotive filters market?

The global automotive filters market was valued at USD 19.99 billion, driven by increasing vehicle production and stringent emission standards across key markets.

02. What are the major challenges in the global automotive filters market?

The major challenges include the shift towards electric vehicles, which require fewer traditional filters, and fluctuations in raw material prices, impacting the cost structure of filter manufacturers.

03. Who are the key players in the global automotive filters market?

Key players in the market include Robert Bosch GmbH, Mann+Hummel Group, Denso Corporation, Mahle GmbH, and Donaldson Company Inc. These companies lead due to their extensive R&D, product innovation, and strong global distribution networks.

04. What factors are driving the growth of the automotive filters market?

The market is driven by increasing consumer awareness of air quality, rising vehicle production, and government regulations aimed at reducing emissions. Advancements in filter technologies are also contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.