Global Automotive Headliner Market Outlook to 2030

Region:Global

Author(s):Sanjna Verma

Product Code:KROD1127

October 2024

84

About the Report

Global Automotive Headliner Market Overview

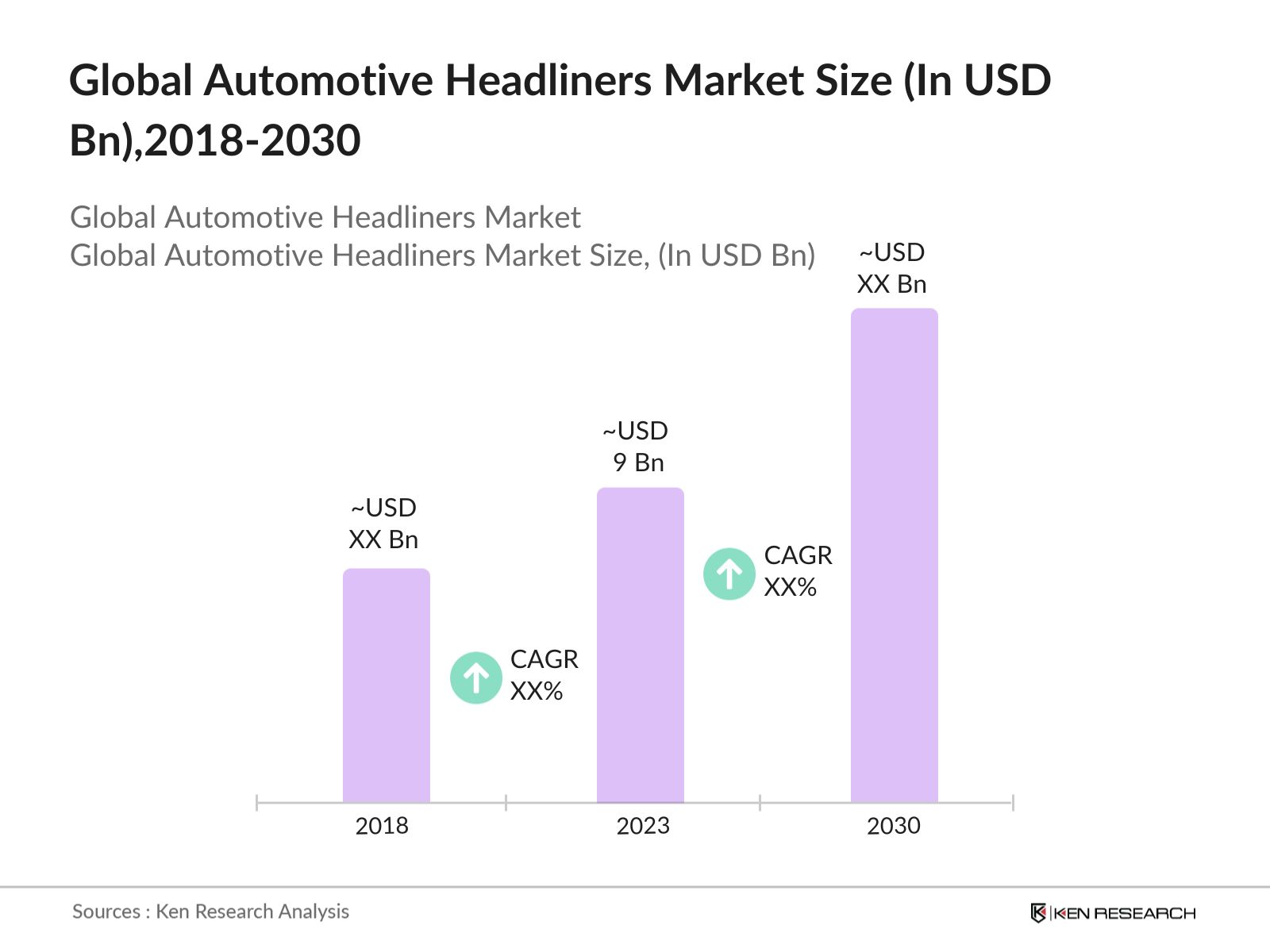

- Global Automotive Headliners Market was valued at USD 9 billion in 2023, driven by increased vehicle production and growing demand for premium features in automobiles. As automotive manufacturers seek to enhance the driving experience, the need for lightweight, durable, and aesthetically appealing headliners has surged.

- Prominent players in Global Automotive Headliners Market include Grupo Antolin, Toyota Boshoku Corporation, Sage Automotive Interiors, Motus Integrated Technologies, and International Automotive Components Group. These companies have established themselves as industry leaders by leveraging their extensive experience, innovation in material usage.

- In 2023, Grupo Antolin announced the launch of a new sustainable headliner solution made from 100% recycled materials, targeting automotive manufacturers focused on reducing their carbon footprint. This development highlights the industry's shift towards sustainability and the growing demand for eco-friendly automotive components.

- Detroit, Michigan, known as the hub of the U.S. automotive industry, continues to dominate the automotive headliners market in 2023 due to its concentration of major automotive manufacturers and suppliers. The citys extensive infrastructure, skilled labor force, and proximity to key markets make it a strategic location for headliner production.

Global Automotive Headliner Market Segmentation

The Global Automotive Headliner Market can be segmented based on several factors:

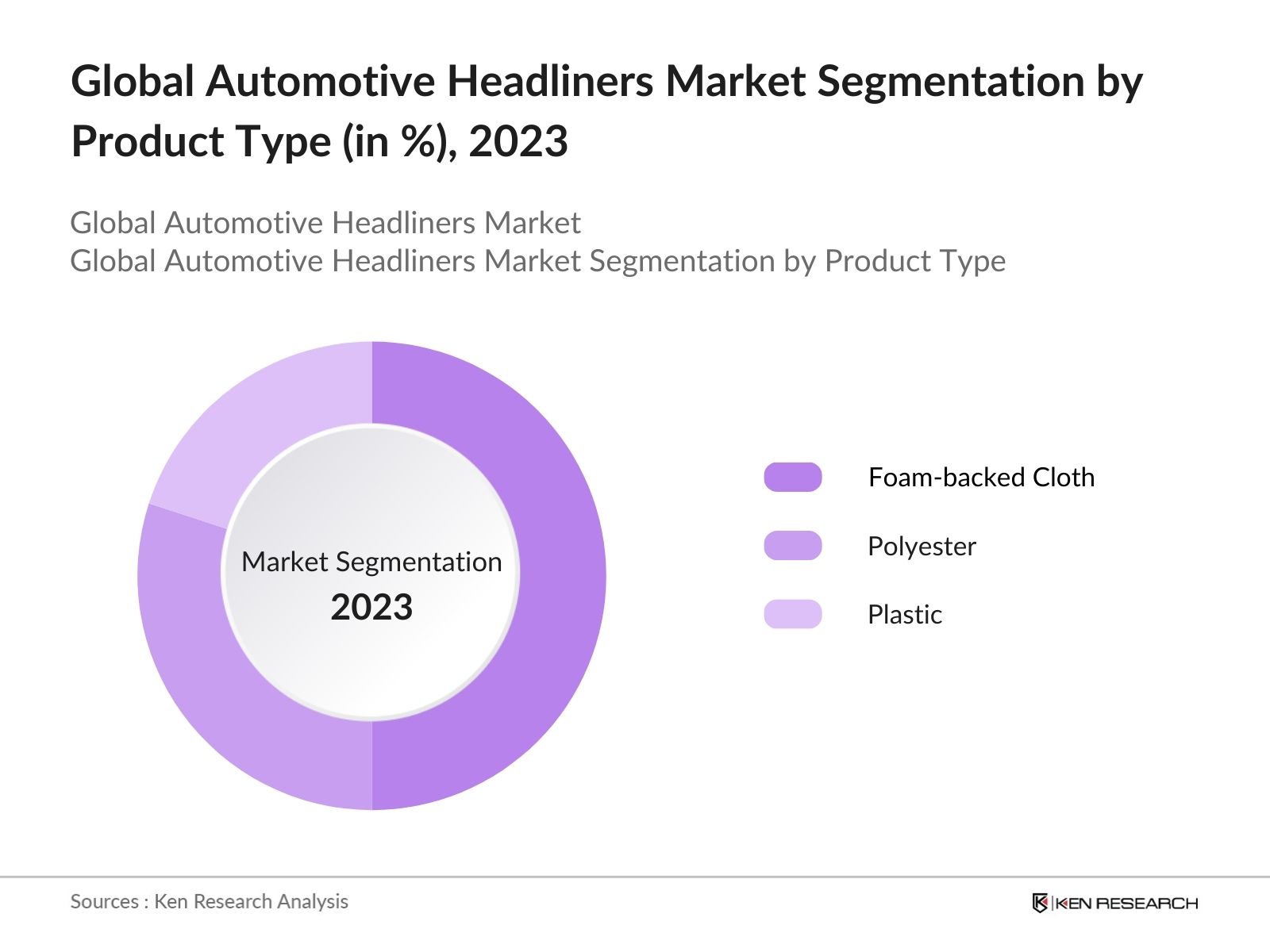

By Product Type: Global Automotive Headliners Market is segmented by material type into foam-backed cloth, polyester, and plastic. In 2023, foam-backed cloth held the largest market share due to its superior durability, sound absorption properties, and cost-effectiveness. This material is particularly favored by automakers in North America and Europe for its ability to meet stringent safety and comfort standards.

By Region: Global Automotive Headliners Market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa regions. In 2023, North America was the dominant sub-segment. The U.S. holds a significant share due to its established automotive industry, innovation in materials, and stringent regulatory environment that drives demand for advanced headliner materials.

By Application: Global Automotive Headliners Market is segmented by vehicle type into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger vehicles dominated the market in 2023, driven by the global increase in vehicle ownership and the demand for enhanced interior aesthetics and comfort. The growth in electric and hybrid passenger vehicles has also contributed to the higher adoption of advanced headliners.

Global Automotive Headliner Market Competitive Landscape

|

Company Name |

Year of Establishment |

Headquarters |

|

Grupo Antolin |

1950 |

Burgos, Spain |

|

Toyota Boshoku Corporation |

1918 |

Kariya, Japan |

|

Sage Automotive Interiors |

1948 |

Greenville, USA |

|

Motus Integrated Technologies |

2014 |

Michigan, USA |

|

International Automotive Components Group |

2006 |

Luxembourg |

- Grupo Antolin: In 2023, Grupo Antolin introduced a new headliner solution made from recycled materials, specifically a substrate that includes polyurethane foam derived from renewable feedstock and a textile laminated from recycled polyester fibers. This innovation aligns with the growing demand from automakers for sustainable materials.

- Toyota Boshuku Corporation: In 2023, Toyota Boshoku Corporation announced plans to establish a new manufacturing facility named TOYOTA BOSHOKU WESTERN KENTUCKY, LLC. This facility will be located in Hopkinsville, Christian County, Kentucky, and is set to produce automotive interior parts, specifically focusing on seat frame mechanism components such as seat tracks and seat recliners.

Global Automotive Headliner Industry Analysis

Growth Drivers:

- Increasing Production of Electric Vehicles (EVs): The automotive headliners market is significantly driven by the rising production of electric vehicles (EVs) globally. In 2023, the production of EVs reached 14 million units which represents a 35% increase from 2022. EVs require lightweight and sound-absorbing headliners to enhance energy efficiency and cabin acoustics.

- Stringent Environmental Regulations: The European Union's End-of-Life Vehicles (ELV) Directive mandates that 85% of a vehicle's material content be reusable or recyclable. This shift towards sustainable materials is expected to continue, driven by stricter environmental regulations globally.

- Growth in the Automotive Aftermarket: As vehicle owners increasingly seek to enhance the aesthetics and comfort of their vehicles, there is a growing demand for aftermarket headliner replacements and upgrades. The demand for premium and custom headliners, particularly in luxury and high-performance vehicles, is expected to contribute to market growth over the next few years.

Challenges:

- Volatility in Raw Material Prices The automotive headliners market faces challenges due to the volatility in raw material prices, particularly in foam-backed cloth and polyester. This price fluctuation directly impacts the cost of headliners, making it difficult for manufacturers to maintain stable pricing and profit margins.

- Supply Chain Disruptions: Supply chain disruptions, exacerbated by global events such as the COVID-19 pandemic and geopolitical tensions, have significantly impacted the automotive headliners market. This decline in vehicle production has had a ripple effect on the demand for automotive headliners, as manufacturers faced delays in production schedules and material shortages.

Government Initiatives:

- U.S. Federal Buy Clean Initiative: Launched on December 8, 2021, this initiative seeks to leverage the federal government's purchasing power to prioritize materials with lower embodied emissions. This initiative has encouraged automotive manufacturers to adopt eco-friendly headliner materials to meet government standards.

- Indias Vehicle Scrappage Policy: India's Vehicle Scrappage Policy, introduced in 2021, aims to phase out old and unfit vehicles to reduce pollution and enhance road safety. The policy mandates that passenger vehicles older than 20 years and commercial vehicles over 15 years must pass a fitness and emissions test to remain registered. This policy has led to an increase in the production of new vehicles, thereby boosting the demand for automotive components, including headliners.

Global Automotive Headliner Future Market Outlook

The Global Automotive Headliner Market is projected to reach USD 13 bn by 2030, being driven by the increasing adoption of electric vehicles, advancements in material technology, and stringent environmental regulations.

Future Market Trends

- Rise of Smart Headliners: The integration of smart technologies into automotive headliners is expected to revolutionize the market. Future headliners will incorporate advanced features such as ambient lighting, noise cancellation systems, and even health monitoring sensors, transforming the vehicle interior into a more interactive and personalized space. This trend will cater to the growing consumer demand for connected and intelligent vehicle interiors.

- Increased Use of Sustainable Materials: As sustainability becomes a central focus in the automotive industry, the use of biodegradable and recyclable materials in headliners will become more prevalent. Manufacturers will invest in the development of bio-based composites and other eco-friendly materials that reduce the environmental impact of automotive production.

Scope of the Report

|

By Region |

North America Europe Asia Pacific Latin America Middle East Africa |

|

By Product Type |

Foam-Backed Cloth Polyester Plastic |

|

By Application |

Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Automotive Manufacturers

Electric Vehicle Manufacturers

Automotive Interior Designers

Automotive Material Suppliers

Automotive Design and Engineering Companies

Investment & Venture Capitalist Firms

Government & Regulatory Bodies (e.g., NHTSA, EPA)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2030

Companies

Players Mentioned in the Report:

Grupo Antolin

Toyota Boshoku Corporation

Sage Automotive Interiors

Motus Integrated Technologies

International Automotive Components Group

Freudenberg Performance Materials

Atlas Roof Systems

Johns Manville

Glen Raven

Lear Corporation

Hayashi Telempu Corporation

UGN Inc.

Sanko Gosei Ltd.

Kasai Kogyo Co., Ltd.

Autoneum Holding AG

Table of Contents

1. Global Automotive Headliner Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Automotive Headliner Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Automotive Headliner Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Production of Electric Vehicles (EVs) (e.g., lightweight and sound-absorbing headliners)

3.1.2. Stringent Environmental Regulations (e.g., ELV Directive in the EU)

3.1.3. Growth in the Automotive Aftermarket (e.g., demand for premium headliners)

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices (e.g., foam-backed cloth, polyester)

3.2.2. Supply Chain Disruptions (e.g., geopolitical tensions and pandemic impacts)

3.3. Opportunities

3.3.1. Development of Lightweight Materials

3.3.2. Expansion into Emerging Markets (e.g., APAC regions)

3.3.3. Advancements in Acoustic and Thermal Insulation Technologies

3.4. Trends

3.4.1. Integration of Smart Features (e.g., ambient lighting, noise cancellation)

3.4.2. Use of Sustainable and Recyclable Materials

3.4.3. Growing Demand for Customized and Luxury Headliners

3.5. Government Regulations

3.5.1. Emission Reduction Policies

3.5.2. Safety Standards for Vehicle Interiors

3.5.3. Policies Supporting Automotive Manufacturing

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Automotive Headliner Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Foam-Backed Cloth

4.1.2. Polyester

4.1.3. Plastic

4.2. By Application (in Value %)

4.2.1. Passenger Vehicles

4.2.2. Light Commercial Vehicles

4.2.3. Heavy Commercial Vehicles

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East

4.3.6. Africa

5. Global Automotive Headliner Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Grupo Antolin (e.g., innovation in sustainable headliner solutions)

5.1.2. Sage Automotive Interiors (e.g., material innovation and design capabilities)

5.1.3. Toyota Boshoku Corporation (e.g., focus on expanding manufacturing facilities)

5.1.4. Motus Integrated Technologies (e.g., advancements in premium headliners)

5.1.5. International Automotive Components Group (e.g., leadership in recyclable materials)

5.1.6. Freudenberg Performance Materials

5.1.7. Atlas Roof Systems

5.1.8. Johns Manville

5.1.9. Glen Raven

5.1.10. Lear Corporation

5.1.11. Hayashi Telempu Corporation

5.1.12. UGN Inc.

5.1.13. Sanko Gosei Ltd.

5.1.14. Kasai Kogyo Co., Ltd.

5.1.15. Autoneum Holding AG

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Innovation Focus, Sustainability Initiatives, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Global Automotive Headliner Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Automotive Headliner Market Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Automotive Headliner Market Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Application (in Value %)

8.3. By Region (in Value %)

9. Global Automotive Headliner Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on Global Automotive HeadlinersMarket over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Automotive Headliners Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple automotive headliner companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from automotive headliner companies.

Frequently Asked Questions

01. How big is Global Automotive Headliner Market?

Global Automotive Headliners Market was valued at USD 9 billion in 2023, driven by increased vehicle production and growing demand for premium features in automobiles.

02. What are challenges in Global Automotive Headliners Market?

Challenges in the Global Automotive Headliners Market include volatility in raw material prices, supply chain disruptions, and the high cost of integrating advanced materials, which can impact manufacturers' profitability and product affordability.

03. Who are the major players in Global Automotive HeadlinersMarket?

Key players in the global automotive headliners market include Grupo Antolin, Toyota Boshoku Corporation, Sage Automotive Interiors, Motus Integrated Technologies, and International Automotive Components Group, known for their innovation and strong market presence.

04 What are the growth drivers of the Global Automotive HeadlinersMarket?

Global Automotive Headliners Market is driven by the increasing production of electric vehicles, stringent environmental regulations promoting the use of recyclable materials, and the growth of the automotive aftermarket, which demands premium interior upgrades.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.