Region:Global

Author(s):Geetanshi

Product Code:KRAB0070

Pages:95

Published On:August 2025

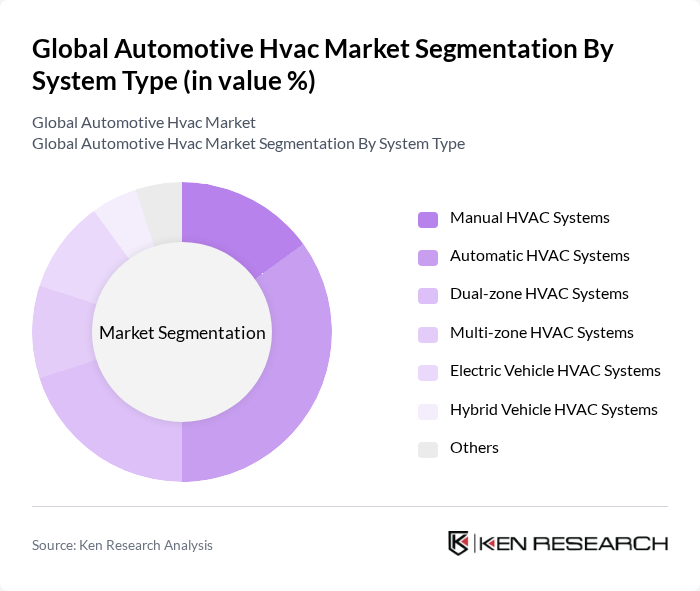

By System Type:The automotive HVAC market is segmented by system type, including Manual HVAC Systems, Automatic HVAC Systems, Dual-zone HVAC Systems, Multi-zone HVAC Systems, Electric Vehicle HVAC Systems, Hybrid Vehicle HVAC Systems, and Others. Automatic and dual-zone systems are gaining significant traction due to their convenience, integration with smart vehicle features, and enhanced comfort. The adoption of electric and hybrid vehicle HVAC systems is rising as automakers focus on energy efficiency and advanced thermal management for new vehicle platforms.

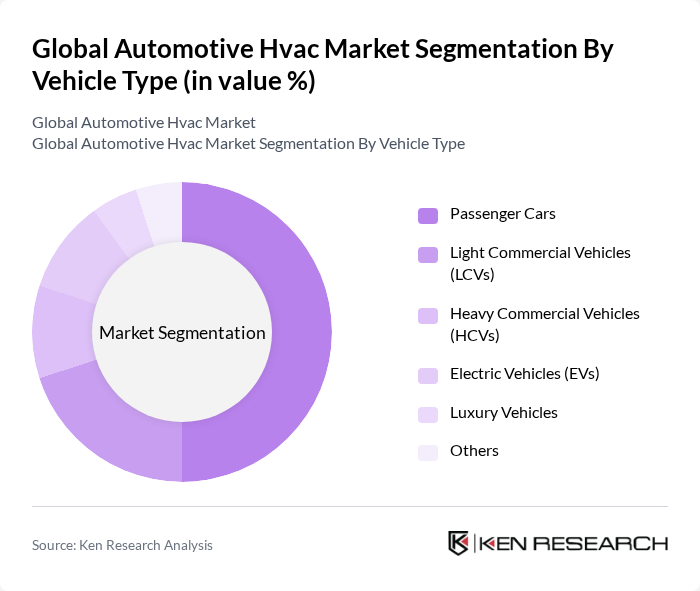

By Vehicle Type:The market is also segmented by vehicle type, including Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs), Luxury Vehicles, and Others. The passenger car segment dominates the market due to high global sales volumes and increasing consumer demand for comfort and climate control features. The electric and luxury vehicle segments are experiencing rapid growth, driven by premiumization trends and the integration of advanced HVAC technologies.

The Global Automotive HVAC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Denso Corporation, Valeo SA, Mahle GmbH, Hanon Systems, Delphi Technologies, Calsonic Kansei Corporation (now Marelli Corporation), Johnson Controls International plc, Sanden Holdings Corporation, Brose Fahrzeugteile GmbH & Co. KG, Sogefi S.p.A., Eberspächer Group, Webasto SE, Continental AG, Aisin Seiki Co., Ltd. (now Aisin Corporation), and Tenneco Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive HVAC market appears promising, driven by the increasing integration of smart technologies and a shift towards sustainable solutions. As electric vehicle adoption accelerates, HVAC systems will need to adapt to new energy sources and efficiency standards. Furthermore, the growing emphasis on energy-efficient designs will likely lead to innovations that enhance system performance while reducing environmental impact. These trends indicate a dynamic market landscape poised for transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By System Type | Manual HVAC Systems Automatic HVAC Systems Dual-zone HVAC Systems Multi-zone HVAC Systems Electric Vehicle HVAC Systems Hybrid Vehicle HVAC Systems Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs) Electric Vehicles (EVs) Luxury Vehicles Others |

| By Component | Compressors Condensers Evaporators Expansion Valves Receiver Driers Sensors & Controls HVAC Ducts Others |

| By Sales Channel | OEMs Aftermarket Online Retail Offline Retail Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Application | Heating Ventilation Air Conditioning Climate Control Air Purification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle HVAC Systems | 100 | Product Managers, Automotive Engineers |

| Commercial Vehicle HVAC Solutions | 60 | Fleet Managers, Procurement Specialists |

| HVAC Component Suppliers | 50 | Sales Directors, Supply Chain Managers |

| Aftermarket HVAC Services | 40 | Service Center Owners, Technicians |

| Regulatory Compliance in HVAC Systems | 40 | Compliance Officers, Regulatory Affairs Managers |

The Global Automotive HVAC Market is valued at approximately USD 51 billion, driven by increasing demand for passenger comfort, advancements in climate control technologies, and the rising production of electric and hybrid vehicles.