Global Automotive Interior Ambient Lighting Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD6607

November 2024

97

About the Report

Global Automotive Interior Ambient Lighting Market Overview

- The Global Automotive Interior Ambient Lighting Market is valued at USD 1.62 billion, based on a five-year historical analysis. This market is primarily driven by the increasing adoption of premium interior features in modern vehicles, as well as advancements in LED and OLED lighting technologies. Automotive manufacturers are integrating ambient lighting to enhance in-cabin experiences, providing passengers with improved comfort, safety, and aesthetics. This demand is particularly high in luxury and electric vehicles, where consumers prioritize sophisticated interior design elements that complement advanced vehicle technology.

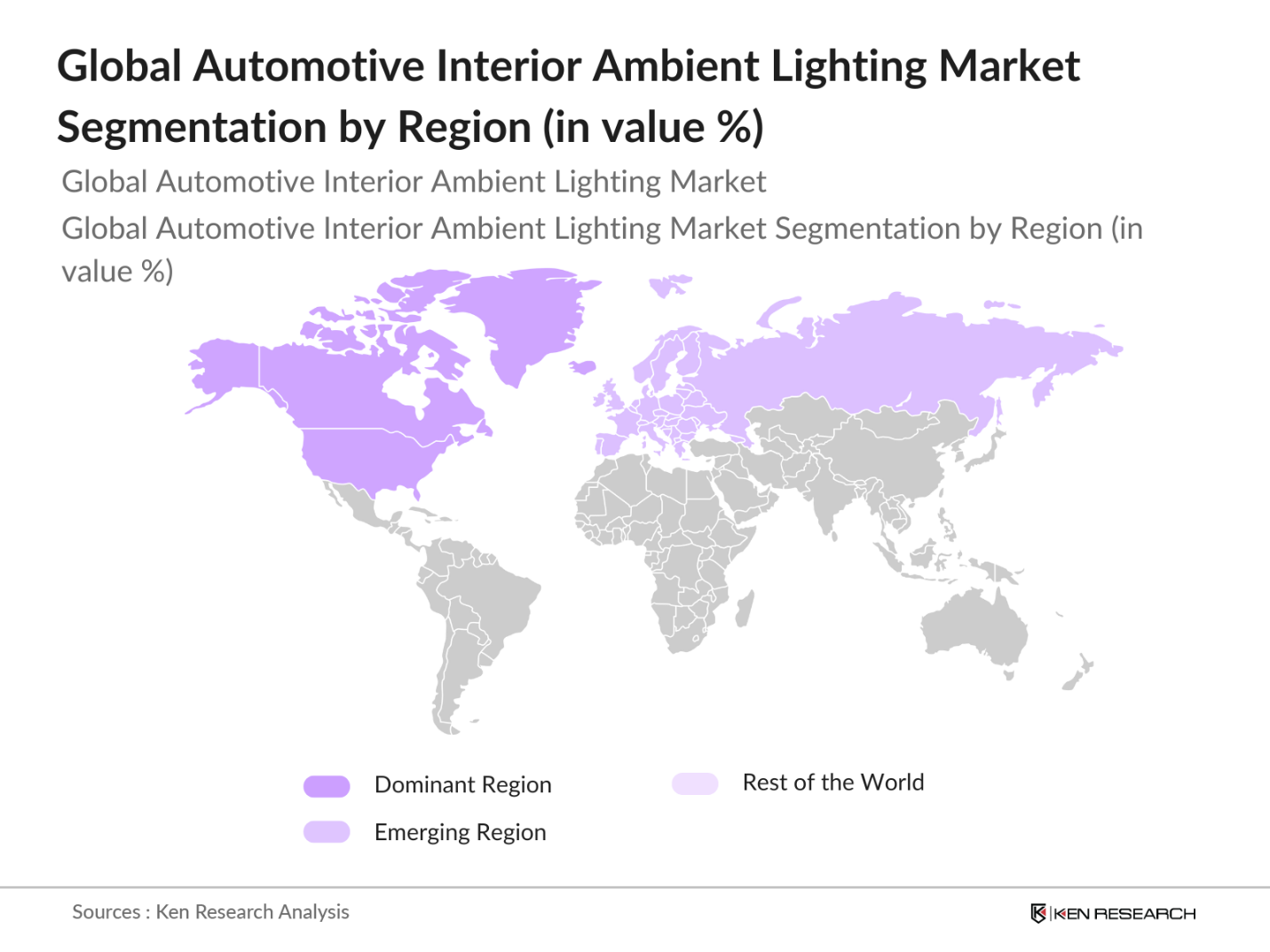

- Dominant regions in this market include Europe, Asia Pacific (APAC), and North America. Europe leads the market due to its robust automotive manufacturing industry, particularly in countries like Germany, and the region's strong focus on luxury vehicles and cutting-edge vehicle technology. The Asia Pacific region is rapidly gaining prominence, driven by Chinas large automotive market and increasing demand for electric vehicles, supported by favorable government initiatives. North America remains a key player, primarily due to the high demand for premium vehicles and continuous innovations in automotive lighting technology in the United States.

- In 2023, the European Union mandated the adoption of energy-efficient lighting technologies, such as LED and OLED, in all new vehicles to support emissions reduction goals. These regulations have spurred automakers to invest in innovative lighting systems, including interior ambient lighting, to meet the new energy efficiency standards and align with environmental targets.

Global Automotive Interior Ambient Lighting Market Segmentation

By Product Type: The Market is segmented by product type into LED Ambient Lighting, OLED Ambient Lighting, and Laser-Based Lighting. LED ambient lighting continues to dominate this segment due to its energy efficiency, longer lifespan, and cost-effectiveness. The popularity of LED lighting in vehicles has been growing due to advancements in LED technology, which allow for customizable and multi-zone lighting that improves the overall in-cabin experience for passengers.

By Vehicle Type: The market is further segmented into Passenger Cars, Commercial Vehicles, and Electric Vehicles. Passenger cars hold the largest market share in this segment. This dominance is attributed to the high adoption of interior ambient lighting systems in mid-range and luxury cars, where automakers are focusing on enhancing in-cabin experiences.

By Region: The market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominates the regional segment due to the region's robust automotive industry, which is heavily focused on premium and luxury cars where interior ambient lighting is a standard feature. In addition, the region's emphasis on eco-friendly technologies, along with stringent energy efficiency regulations, further drives the adoption of LED and OLED lighting solutions.

Global Automotive Interior Ambient Lighting Market Competitive Landscape

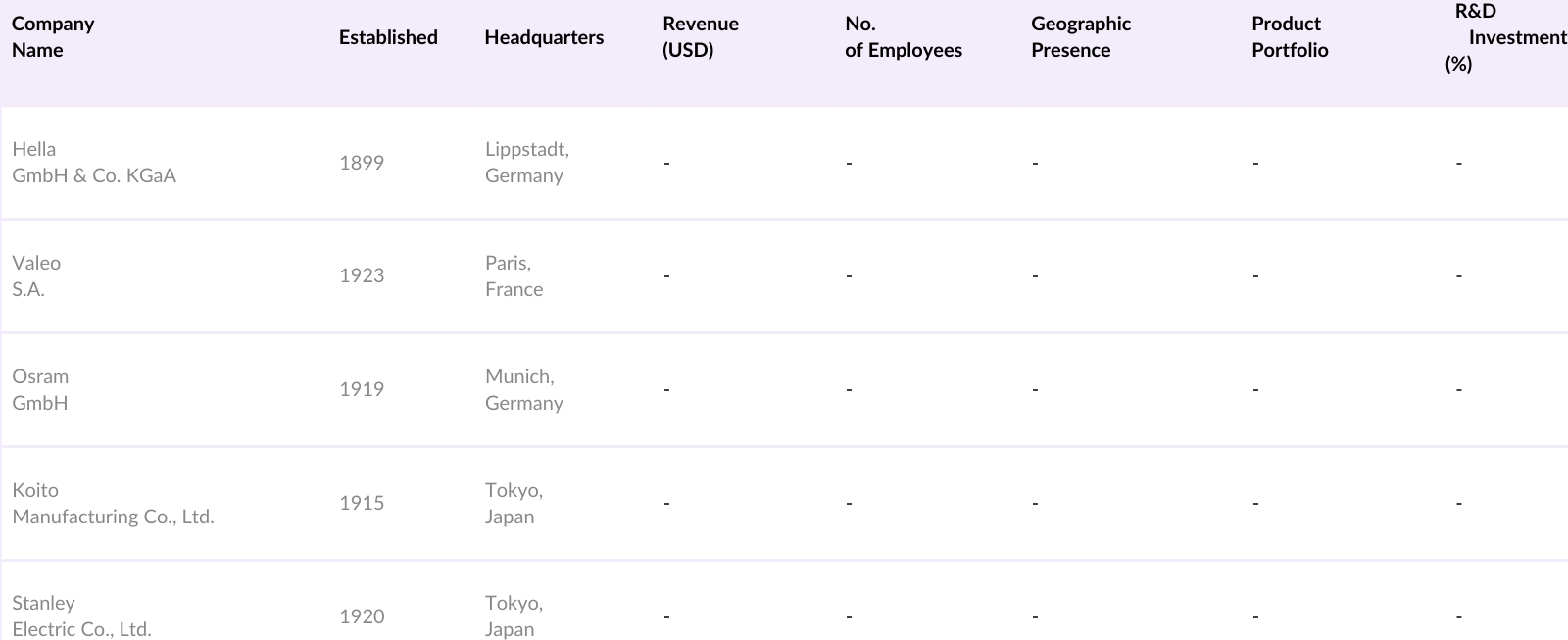

The Global Automotive Interior Ambient Lighting Market is dominated by a few major players, including key lighting manufacturers and automotive component suppliers. These companies have built a strong presence in the market by investing in research and development to offer advanced lighting solutions that meet the evolving demands of automakers. Major players in the market also benefit from strategic partnerships and acquisitions, allowing them to expand their global reach and strengthen their product portfolios.

Global Automotive Interior Ambient Lighting Industry Analysis

Growth Drivers

- Increased Adoption of Electric Vehicles (EV market penetration %): The rapid growth of the electric vehicle (EV) market has significantly driven the demand for ambient lighting. In 2022, global electric car sales reached over 10 million, doubling the number from 2020, and accounting for nearly 13% of total vehicle sales. Countries like China, with over 6 million EVs sold in 2022, are leading this trend, pushing automakers to focus on advanced lighting technologies to differentiate their EV interiors.

- Consumer Demand for Premium Vehicle Interiors (luxury vehicle sales %): Consumer preference for premium automotive interiors has increased, especially in the luxury vehicle segment. In 2023, luxury car sales in the U.S. alone exceeded 2.6 million units, accounting for 17% of the total market, with automakers like BMW and Mercedes-Benz seeing substantial growth. These vehicles often feature advanced ambient lighting systems as part of a broader trend toward personalization and enhancing the in-cabin experience. interiors.

- Technological Advancements in Lighting Solutions (R&D investments %): Investment in research and development for advanced lighting technologies is a major growth driver. Global automakers and lighting manufacturers allocated over $30 billion in R&D spending toward lighting innovations in 2022, focusing on enhancing energy efficiency and aesthetics. For instance, the development of adaptive lighting systems and integration of lighting with infotainment and safety features are key areas of innovation.

Market Challenges

- High Costs of Smart Lighting Systems (Cost of installation, maintenance): The cost of installing and maintaining smart lighting systems remains a challenge for the market, especially in non-luxury segments. In 2023, the average cost of equipping a vehicle with a full ambient lighting system was estimated to be around $1,200, a price point that restricts widespread adoption in budget and mid-range vehicles.

- Limited Penetration in Budget and Mid-Range Vehicles: Ambient lighting remains largely confined to luxury and premium segments, with minimal penetration in budget and mid-range vehicles. In 2022, less than 5% of vehicles in the mid-range segment in Europe were equipped with advanced ambient lighting. The high cost of smart lighting systems and limited consumer awareness in non-premium segments continue to pose barriers, especially in price-sensitive markets such as India and Southeast Asia.

Global Automotive Interior Ambient Lighting Market Future Outlook

Over the next five years, the Global Automotive Interior Ambient Lighting Market is expected to experience significant growth. This expansion will be driven by advancements in lighting technologies, the increasing popularity of electric vehicles, and a growing consumer demand for vehicles equipped with premium in-cabin features. The shift towards more sustainable and energy-efficient solutions like LED and OLED lighting will continue to accelerate market growth, particularly as automakers focus on reducing carbon emissions and enhancing vehicle efficiency.

Market Opportunities

- Integration of Ambient Lighting with ADAS Systems (Advanced Driver Assistance Systems): The integration of ambient lighting with Advanced Driver Assistance Systems (ADAS) offers a significant growth opportunity. By 2024, nearly all new vehicles sold in Europe and North America are expected to include some form of ADAS, according to the European Commissions reports. Ambient lighting integrated with ADAS can enhance driver alertness through visual signals, such as lane departure warnings, and provide an interactive interface that improves overall safety and user experience.

- Expanding Role of Ambient Lighting in Autonomous Vehicle Designs: The shift toward autonomous vehicles is reshaping the automotive interior landscape, and ambient lighting plays a crucial role in the cabin experience. Autonomous vehicle interiors are being designed with more emphasis on creating comfortable, engaging environments, with ambient lighting providing mood enhancement and interaction feedback for passengers. In 2023, global autonomous vehicle testing grew by 20%, with major automakers investing in lighting technologies to enhance user interaction during autonomous driving.

Scope of the Report

|

By Product Type |

LED Ambient Lighting OLED Ambient Lighting Laser-Based Lighting |

|

By Vehicle Type |

Passenger Cars Commercial Vehicles Electric Vehicles |

|

By Sales Channel |

OEMs Aftermarket |

|

By Application |

Dashboard Lighting Door Panel Lighting Footwell Lighting Roof Lighting |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Automotive Manufacturers

Automotive Component Suppliers

Energy-Efficient Lighting Technology Developers

Electric Vehicle Manufacturers

Automotive Designers and Engineers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Union, National Highway Traffic Safety Administration)

In-Car Entertainment and Infotainment System Providers

Companies

Players Mentioned in the Report

Hella GmbH & Co. KGaA

Valeo S.A.

Osram GmbH

Koito Manufacturing Co., Ltd.

Stanley Electric Co., Ltd.

General Electric

Magneti Marelli S.p.A.

Koninklijke Philips N.V.

Grupo Antolin

Drxlmaier Group

Table of Contents

1. Global Automotive Interior Ambient Lighting Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR %, Year-on-Year)

1.4. Market Segmentation Overview

2. Global Automotive Interior Ambient Lighting Market Size (in USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Automotive Interior Ambient Lighting Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption of Electric Vehicles (EV market penetration %)

3.1.2. Consumer Demand for Premium Vehicle Interiors (luxury vehicle sales %)

3.1.3. Technological Advancements in Lighting Solutions (R&D investments %)

3.1.4. Regulatory Push for Energy-Efficient Lighting Systems

3.2. Market Challenges

3.2.1. High Costs of Smart Lighting Systems (Cost of installation, maintenance)

3.2.2. Limited Penetration in Budget and Mid-Range Vehicles

3.2.3. Competition from Aftermarket Products

3.3. Opportunities

3.3.1. Integration of Ambient Lighting with ADAS Systems (Advanced Driver Assistance Systems)

3.3.2. Expanding Role of Ambient Lighting in Autonomous Vehicle Designs

3.3.3. Growing Demand for Customizable Interior Features

3.4. Trends

3.4.1. Adoption of RGB Lighting and Multi-Zone Control (New lighting technologies)

3.4.2. Use of LED and OLED for Energy-Efficiency

3.4.3. Increasing Consumer Preference for Mood Lighting (In-cabin experience trends)

3.5. Regulatory Environment

3.5.1. Energy Efficiency Standards for Automotive Lighting

3.5.2. Safety Regulations for Interior Lighting Systems

3.5.3. European and North American Standards for In-Cabin Lighting

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Automotive Interior Ambient Lighting Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. LED Ambient Lighting

4.1.2. OLED Ambient Lighting

4.1.3. Laser-Based Lighting

4.2. By Vehicle Type (in Value %)

4.2.1. Passenger Cars

4.2.2. Commercial Vehicles

4.2.3. Electric Vehicles

4.3. By Sales Channel (in Value %)

4.3.1. OEMs

4.3.2. Aftermarket

4.4. By Application (in Value %)

4.4.1. Dashboard Lighting

4.4.2. Door Panel Lighting

4.4.3. Footwell Lighting

4.4.4. Roof Lighting

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Automotive Interior Ambient Lighting Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Hella GmbH & Co. KGaA

5.1.2. Valeo S.A.

5.1.3. Osram GmbH

5.1.4. Koito Manufacturing Co., Ltd.

5.1.5. Stanley Electric Co., Ltd.

5.1.6. General Electric

5.1.7. Magneti Marelli S.p.A.

5.1.8. Koninklijke Philips N.V.

5.1.9. Grupo Antolin

5.1.10. Drxlmaier Group

5.1.11. Toyota Boshoku Corporation

5.1.12. Faurecia S.A.

5.1.13. Lear Corporation

5.1.14. Gentex Corporation

5.1.15. LG Electronics

5.2. Cross-Comparison Parameters (Revenue, Market Share, Product Portfolio, Geographic Presence, Innovations, M&A Activity, Employee Strength, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Automotive Interior Ambient Lighting Market Regulatory Framework

6.1. Environmental Standards for Lighting Materials

6.2. Compliance Requirements in Global Markets

6.3. Certification Processes

7. Global Automotive Interior Ambient Lighting Future Market Size (in USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Automotive Interior Ambient Lighting Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Vehicle Type (in Value %)

8.3. By Sales Channel (in Value %)

8.4. By Application (in Value %)

8.5. By Region (in Value %)

9. Global Automotive Interior Ambient Lighting Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 2: Market Analysis and Construction

This step involves gathering and analyzing historical data to understand market dynamics. It focuses on market penetration, pricing strategies, sales volumes, and regional market performance. The data gathered helps to establish market benchmarks, which serve as a foundation for the construction of the market model.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses regarding the market are formed based on historical analysis and current trends. These are then validated through interviews with industry experts, including lighting technology developers, automotive engineers, and market insiders, who provide insights on product development, consumer preferences, and market strategies.

Step 4: Research Synthesis and Final Output

In the final phase, data synthesis is performed to ensure all research findings are accurately represented in the report. The gathered insights are used to validate the market size estimates and segmentation. This phase also involves further validation with manufacturers to ensure the accuracy and comprehensiveness of the report.

Frequently Asked Questions

01. How big is the Global Automotive Interior Ambient Lighting Market?

The Global Automotive Interior Ambient Lighting Market is valued at USD 1.62 billion, based on a five-year historical analysis. This market is primarily driven by the increasing adoption of premium interior features in modern vehicles, as well as advancements in LED and OLED lighting technologies.

02. What are the challenges in the Global Automotive Interior Ambient Lighting Market?

Challenges in the market include the high cost of advanced lighting systems, especially in budget vehicles, as well as intense competition from aftermarket lighting products, which offer lower-cost alternatives.

03. Who are the major players in the Global Automotive Interior Ambient Lighting Market?

Key players in the market include Hella GmbH & Co. KGaA, Valeo S.A., Osram GmbH, Koito Manufacturing Co., Ltd., and Stanley Electric Co., Ltd. These companies have established strong global presence and are heavily involved in research and development.

04. What are the growth drivers of the Global Automotive Interior Ambient Lighting Market?

The growth of this market is driven by factors such as the rising demand for electric and luxury vehicles, technological advancements in LED and OLED lighting, and increasing consumer focus on vehicle aesthetics and comfort.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.