Global Automotive Software Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD4913

December 2024

96

About the Report

Global Automotive Software Market Overview

- The global automotive software market is valued at USD 19 billion, reflecting an upward trajectory driven by the rising adoption of connected and autonomous vehicle technologies. This growth is reinforced by increasing vehicle electrification and a surge in demand for advanced driver-assistance systems (ADAS). Automotive software is central to enabling intelligent systems and enhancing vehicle safety and performance, positioning it as a critical asset for manufacturers and users alike.

- North America and Europe are leading markets for automotive software, with a substantial share due to high consumer demand for electric and autonomous vehicles. Both regions have well-established automotive industries, backed by government regulations mandating safety and emission standards, which fuel the adoption of automotive software. Additionally, these areas benefit from advanced infrastructure for vehicle-to-everything (V2X) technology and robust investments in research and development, fostering market dominance.

- ISO 26262 compliance has become essential for automotive software providers as governments mandate functional safety in vehicles. In 2023, regulatory bodies across Europe and Asia required adherence to ISO 26262 standards for advanced driver assistance systems (ADAS) and other critical automotive software applications. Compliance ensures the reliability of safety-critical software, safeguarding users and meeting the legal requirements for vehicle safety.

Global Automotive Software Market Segmentation

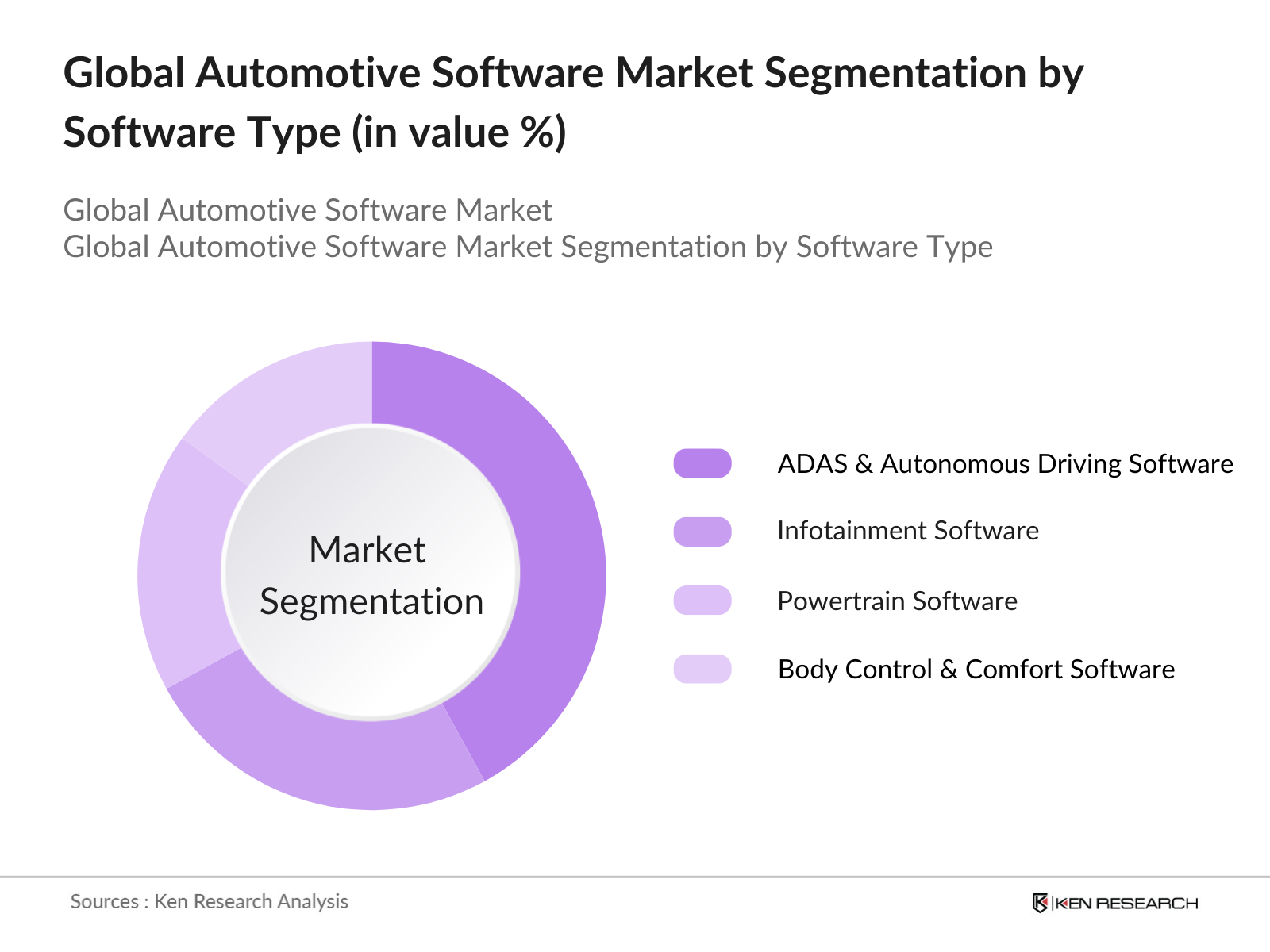

By Software Type: The global automotive software market is segmented by software type into ADAS & autonomous driving software, infotainment software, powertrain software, body control & comfort software, and safety & security software. Recently, ADAS & autonomous driving software holds a dominant market share in this segmentation, driven by heightened consumer interest in safety and convenience, alongside regulatory requirements for ADAS installation. These systems enable enhanced safety features, including collision avoidance, adaptive cruise control, and lane departure warnings, making them essential in modern vehicles.

By Region: The automotive software market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads due to its strong automotive manufacturing base and supportive regulatory framework that encourages autonomous and electric vehicle development. Furthermore, consumer demand for connected car services and extensive R&D investments in advanced automotive technologies solidify North Americas position in this market.

By Deployment Type: The market is segmented by deployment type into cloud-based and on-premise software solutions. Cloud-based deployment currently dominates due to its scalability, real-time updates, and cost-effectiveness, allowing automotive firms to streamline processes and reduce downtime. This segment is further propelled by the growing reliance on connected car services and the integration of cloud-based IoT platforms within the automotive ecosystem, facilitating remote diagnostics, OTA updates, and enhanced cybersecurity.

Global Automotive Software Market Competitive Landscape

The global automotive software market is dominated by major players, with key companies leveraging innovative technologies and partnerships to solidify their market positions. The industry features prominent companies like Robert Bosch GmbH and Aptiv PLC, which hold significant influence due to their long-standing experience, extensive R&D initiatives, and wide-reaching market presence.

Global Automotive Software Industry Analysis

Growth Drivers

- Rise in Connected Vehicles: The global automotive industry has seen significant advancements in connected vehicle technology, with the number of connected vehicles reaching approximately 250 million globally in 2023. This rise in connected vehicles aligns with increased adoption of embedded software for safety, navigation, and real-time vehicle diagnostics, underscoring the softwares role in automotive value creation. Countries such as the United States and Germany have nearly 80 million connected vehicles on the road, spurred by government incentives for enhanced road safety and communication systems. This increase in connected vehicles promotes continuous software innovations for automotive applications.

- Demand for Autonomous Driving Features: The demand for autonomous driving capabilities is on the rise, with an estimated 6 million vehicles globally equipped with Level 2 or higher autonomous driving features in 2023. Autonomous vehicles, particularly in regions like North America and Europe, demand advanced software integration for adaptive cruise control, lane-keeping, and emergency braking. This growth is bolstered by government initiatives in these regions that mandate safety automation. By 2024, the development of Levels 3 and 4 autonomy will likely further propel software demand in the automotive sector.

- Increasing Regulatory Requirements: Emission regulations have intensified in recent years, with mandates in the European Union setting a carbon dioxide (CO2) target of 95 grams per kilometer for passenger cars. Compliance with these stringent emission regulations has driven software development, as manufacturers require advanced systems to monitor and control emissions. Similarly, in countries like Japan and Canada, automotive software is essential for adhering to fuel economy standards, influencing demand for software solutions focused on reducing emissions. This regulatory environment creates a continuous need for innovation in automotive software systems.

Market Restraints

- High R&D Costs: Automakers have increased their R&D expenditure, often allocating nearly 10% of their revenue to innovation in 2023, translating to significant financial commitments for software development. For example, the R&D spending in the European automotive sector alone reached an estimated $75 billion in 2023, with software development comprising a large portion of this investment. The high cost of developing, testing, and deploying automotive software, especially for safety and compliance features, remains a considerable market challenge.

- Cybersecurity Threats: The increasing connectivity in vehicles has led to over 1,000 recorded cybersecurity breaches globally in the automotive sector by 2023. As connected vehicles proliferate, the need for cybersecurity within automotive software intensifies, particularly in North America and Europe, where high connectivity rates increase the risk of hacking. This cybersecurity challenge is further compounded by the rapid evolution of cyber threats, requiring manufacturers to invest continuously in advanced cybersecurity solutions to protect vehicle data and ensure user safety.

Global Automotive Software Market Future Outlook

The global automotive software market is expected to experience sustained growth due to technological advancements, regulatory support, and an increased focus on autonomous and connected vehicles. The surge in demand for electric vehicles, coupled with the shift towards smart cities, will further amplify the importance of automotive software in improving transportation efficiency and safety. Additionally, strategic collaborations between software and automotive companies will likely drive market expansion.

Market Opportunities

- Electrification of Vehicles: The shift towards electric vehicles (EVs) has created a substantial demand for specialized software, particularly for battery management, charging infrastructure, and powertrain control. With global EV sales reaching 10 million units in 2023, markets like China and Europe, which account for the majority of sales, require advanced software solutions for efficient EV operations. This demand for EV-specific software underscores a significant growth area for automotive software, especially as governments implement incentives to accelerate EV adoption.

- Cloud Integration in Automotive Systems: Cloud integration is reshaping automotive software, with over 60% of global automakers adopting cloud-based solutions for vehicle data management and diagnostics in 2023. The clouds flexibility allows for real-time data access, which is crucial for predictive maintenance and fleet management. With government-backed incentives for digital transformation in regions like North America, cloud-based software adoption is set to increase, driving software opportunities across the automotive sector.

Scope of the Report

|

By Software Type |

ADAS & Autonomous Driving Software |

|

By Deployment Type |

Cloud-based |

|

By Vehicle Type |

Passenger Vehicles |

|

By Application |

Predictive Maintenance |

|

By Region |

North America |

Products

Key Target Audience

Automotive Original Equipment Manufacturers (OEMs)

Automotive Software Developers

Tier 1 and Tier 2 Suppliers

Autonomous Vehicle Solution Providers

Vehicle Telematics Companies

Government and Regulatory Bodies (NHTSA, European Commission)

Investor and Venture Capitalist Firms

Electric Vehicle Infrastructure Companies

Companies

Players Mentioned in the Report:

Robert Bosch GmbH

NXP Semiconductors

Elektrobit Automotive GmbH

NVIDIA Corporation

Aptiv PLC

Continental AG

Denso Corporation

BlackBerry QNX

Renesas Electronics Corporation

Intel Corporation

Table of Contents

1. Global Automotive Software Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Growth Indicators

1.4 Market Segmentation Overview

2. Global Automotive Software Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Milestones and Market Developments

3. Global Automotive Software Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Connected Vehicles (connected vehicle penetration)

3.1.2 Demand for Autonomous Driving Features (autonomous driving levels)

3.1.3 Increasing Regulatory Requirements (emission regulations)

3.1.4 Advancements in Vehicle-to-Everything (V2X) Communication (V2X standards)

3.2 Market Challenges

3.2.1 High R&D Costs (R&D expenditure as % of revenue)

3.2.2 Cybersecurity Threats (cybersecurity breaches in automotive)

3.2.3 Data Privacy Concerns (compliance with data privacy laws)

3.3 Opportunities

3.3.1 Electrification of Vehicles (EV software demands)

3.3.2 Cloud Integration in Automotive Systems (cloud-based software services)

3.3.3 Expansion in Emerging Markets (regional adoption rates)

3.4 Trends

3.4.1 AI and Machine Learning in Vehicles (AI-powered solutions)

3.4.2 Real-time Over-the-Air (OTA) Updates (OTA market penetration)

3.4.3 Adoption of Open-Source Platforms (open-source adoption rates)

3.5 Regulatory Landscape

3.5.1 ISO 26262 Functional Safety Standards (functional safety compliance)

3.5.2 GDPR and Data Compliance in Automotive (data protection regulations)

3.5.3 Emission Norms and Eco-friendly Software Development (carbon footprint reduction)

3.6 Stakeholder Ecosystem

3.7 Porters Five Forces

3.8 Competitive Ecosystem

4. Global Automotive Software Market Segmentation

4.1 By Software Type (in value %)

4.1.1 ADAS & Autonomous Driving Software

4.1.2 Body Control & Comfort Software

4.1.3 Infotainment Software

4.1.4 Powertrain Software

4.1.5 Safety & Security Software

4.2 By Deployment Type (in value %)

4.2.1 Cloud-based

4.2.2 On-premise

4.3 By Vehicle Type (in value %)

4.3.1 Passenger Vehicles

4.3.2 Commercial Vehicles

4.3.3 Electric Vehicles

4.4 By Application (in value %)

4.4.1 Predictive Maintenance

4.4.2 Fleet Management

4.4.3 Telematics

4.4.4 Navigation & Mapping

4.5 By Region (in value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Automotive Software Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Robert Bosch GmbH

5.1.2 NXP Semiconductors

5.1.3 Elektrobit Automotive GmbH

5.1.4 NVIDIA Corporation

5.1.5 Aptiv PLC

5.1.6 Continental AG

5.1.7 Denso Corporation

5.1.8 BlackBerry QNX

5.1.9 Renesas Electronics Corporation

5.1.10 Intel Corporation

5.1.11 Microsoft Corporation

5.1.12 Harman International

5.1.13 TomTom N.V.

5.1.14 Valeo SA

5.1.15 Visteon Corporation

5.2 Cross Comparison Parameters (Employee Strength, Regional Presence, Revenue, R&D Expenditure, Market Share, Key Partnerships, Product Innovation Index, Customer Base)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers & Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Support

5.9 Private Equity Investments

6. Global Automotive Software Market Regulatory Framework

6.1 Data Security and Compliance Standards

6.2 Vehicle Safety Standards

6.3 Certification Processes for Automotive Software

6.4 Environmental Compliance Standards

7. Global Automotive Software Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Drivers for Future Market Growth

8. Global Automotive Software Future Market Segmentation

8.1 By Software Type (in value %)

8.2 By Deployment Type (in value %)

8.3 By Vehicle Type (in value %)

8.4 By Application (in value %)

8.5 By Region (in value %)

9. Global Automotive Software Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves defining the automotive software market ecosystem, including key players, product types, and technological trends. Extensive desk research is conducted using reliable sources and proprietary databases to map critical variables impacting market dynamics.

Step 2: Market Analysis and Construction

Historical data for the automotive software market is compiled, covering aspects such as market penetration, deployment ratios, and revenue generation. The analysis ensures precise data collection, enhancing the reliability of market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses are developed and validated through interviews with industry experts. These consultations offer in-depth operational insights and confirm market data, providing a holistic view of industry trends and competitive strategies.

Step 4: Research Synthesis and Final Output

In the final stage, direct engagement with automotive software developers and OEMs ensures comprehensive insights into sales performance, product segments, and end-user preferences, leading to an accurate, validated report output.

Frequently Asked Questions

01. How big is the Global Automotive Software Market?

The global automotive software market is valued at USD 19 billion, driven by factors like the surge in demand for connected cars, electric vehicles, and safety-focused technologies.

02. What challenges exist in the Global Automotive Software Market?

Key challenges include cybersecurity threats, high R&D costs, and stringent regulatory requirements for autonomous and connected vehicles, impacting the growth and innovation in the market.

03. Who are the major players in the Global Automotive Software Market?

Notable players include Robert Bosch GmbH, Aptiv PLC, NXP Semiconductors, Elektrobit Automotive GmbH, and NVIDIA Corporation, each leveraging strong market presence, partnerships, and extensive R&D to lead the market.

04. What factors drive the Global Automotive Software Market?

Market drivers include the increased adoption of electric vehicles, advancements in autonomous driving technologies, and the integration of V2X systems, enhancing the functionality and connectivity of modern vehicles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.