Region:Global

Author(s):Geetanshi

Product Code:KRAD0140

Pages:88

Published On:August 2025

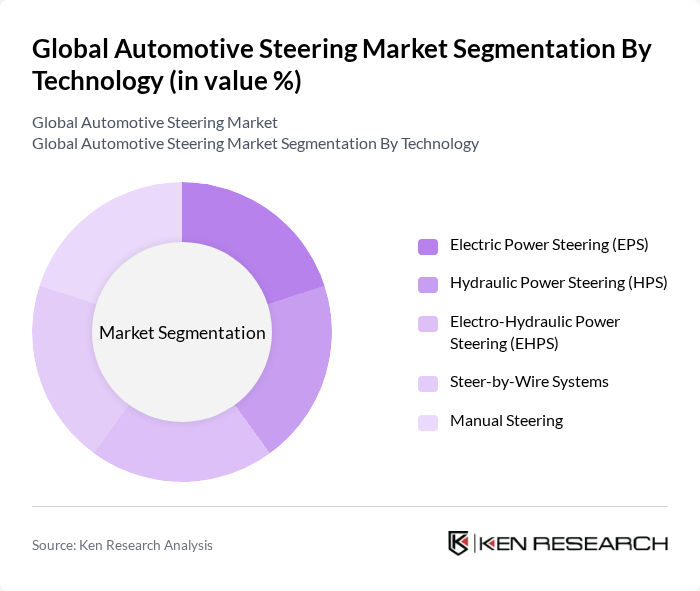

By Technology:The technology segment includes various steering systems that cater to different vehicle requirements. The subsegments are Electric Power Steering (EPS), Hydraulic Power Steering (HPS), Electro-Hydraulic Power Steering (EHPS), Steer-by-Wire Systems, and Manual Steering. Electric Power Steering is currently the leading technology due to its efficiency, ability to reduce fuel consumption, and compatibility with electric and autonomous vehicles, making it the preferred choice among manufacturers .

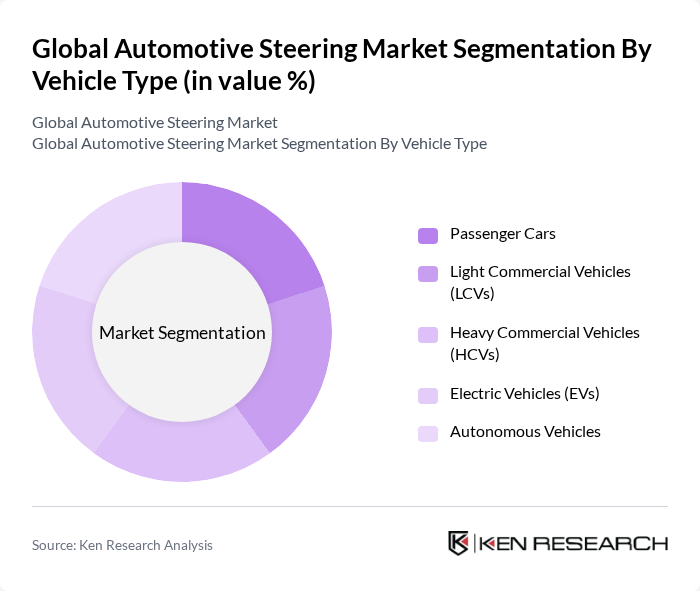

By Vehicle Type:The vehicle type segment encompasses Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs), and Autonomous Vehicles. Passenger Cars dominate this segment due to their high production volume and consumer preference for advanced steering technologies that enhance driving comfort and safety. The adoption of electric and autonomous vehicles is also rising, further diversifying demand for advanced steering systems .

The Global Automotive Steering Market is characterized by a dynamic mix of regional and international players. Leading participants such as ZF Friedrichshafen AG, JTEKT Corporation, Nexteer Automotive, Robert Bosch GmbH (Bosch Automotive Steering), thyssenkrupp AG (thyssenkrupp Presta), Mando Corporation, Hyundai Mobis Co., Ltd., Aisin Corporation, DENSO Corporation, NSK Ltd., Showa Corporation, Sona BLW Precision Forgings Ltd., Hitachi Astemo, Ltd., American Axle & Manufacturing Holdings, Inc. (AAM), and Knorr-Bremse AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive steering market is poised for significant transformation, driven by the increasing integration of electric and autonomous vehicle technologies. As manufacturers prioritize sustainability, the shift towards electric power steering systems will continue to gain momentum. Additionally, the growing emphasis on safety and connectivity will likely spur innovations in steering systems, enhancing vehicle performance and user experience. This evolving landscape presents a unique opportunity for companies to invest in research and development, ensuring they remain competitive in a rapidly changing market.

| Segment | Sub-Segments |

|---|---|

| By Technology | Electric Power Steering (EPS) Hydraulic Power Steering (HPS) Electro-Hydraulic Power Steering (EHPS) Steer-by-Wire Systems Manual Steering |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs) Electric Vehicles (EVs) Autonomous Vehicles |

| By Component | Steering Gear Steering Column Steering Wheel Electronic Control Unit (ECU) Sensors & Actuators |

| By Sales Channel | OEMs Aftermarket |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Steering Systems | 100 | Product Managers, Automotive Engineers |

| Commercial Vehicle Steering Solutions | 60 | Fleet Managers, Procurement Specialists |

| Electric Vehicle Steering Technologies | 50 | R&D Directors, Technology Officers |

| Aftermarket Steering Components | 40 | Retail Managers, Supply Chain Analysts |

| Steering System Innovations | 40 | Industry Analysts, Automotive Consultants |

The Global Automotive Steering Market is valued at approximately USD 28 billion, driven by the increasing demand for advanced steering technologies, particularly electric power steering, which enhances vehicle efficiency and safety.