Global Automotive Tappet Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD9288

December 2024

89

About the Report

Global Automotive Tappet Market Overview

- The global automotive tappet market is valued at USD 7.2 billion, largely driven by increased vehicle production, demand for fuel-efficient vehicles, and improvements in tappet technologies. Notably, growing investments in engine performance enhancement and aftermarket maintenance contribute to the markets strength. Cities with high automotive output like Detroit, Tokyo, and Stuttgart lead in adoption due to their established manufacturing hubs and extensive automotive supply chains.

- Countries such as Germany, Japan, and the United States dominate the market due to their advanced automotive industries and high investment in R&D for vehicle efficiency. Additionally, the presence of key automotive manufacturers and a robust consumer base for vehicles bolster these regions' dominance.

- Global emissions regulations have tightened, with over 100 countries adopting or enforcing new standards in 2023, targeting reductions in CO2 emissions from ICE vehicles. Tappets play a role in controlling valve timing, helping engines meet emission standards by enhancing combustion efficiency. Manufacturers are thus under pressure to develop tappets that comply with emission norms, aligning with the broader regulatory goals of reducing environmental impact.

Global Automotive Tappet Market Segmentation

By Product Type: The global automotive tappet market is segmented by product type into flat tappets and roller tappets. Roller tappets hold a dominant market share due to their reduced friction, improved fuel efficiency, and longer lifespan, making them preferable in high-performance engines.

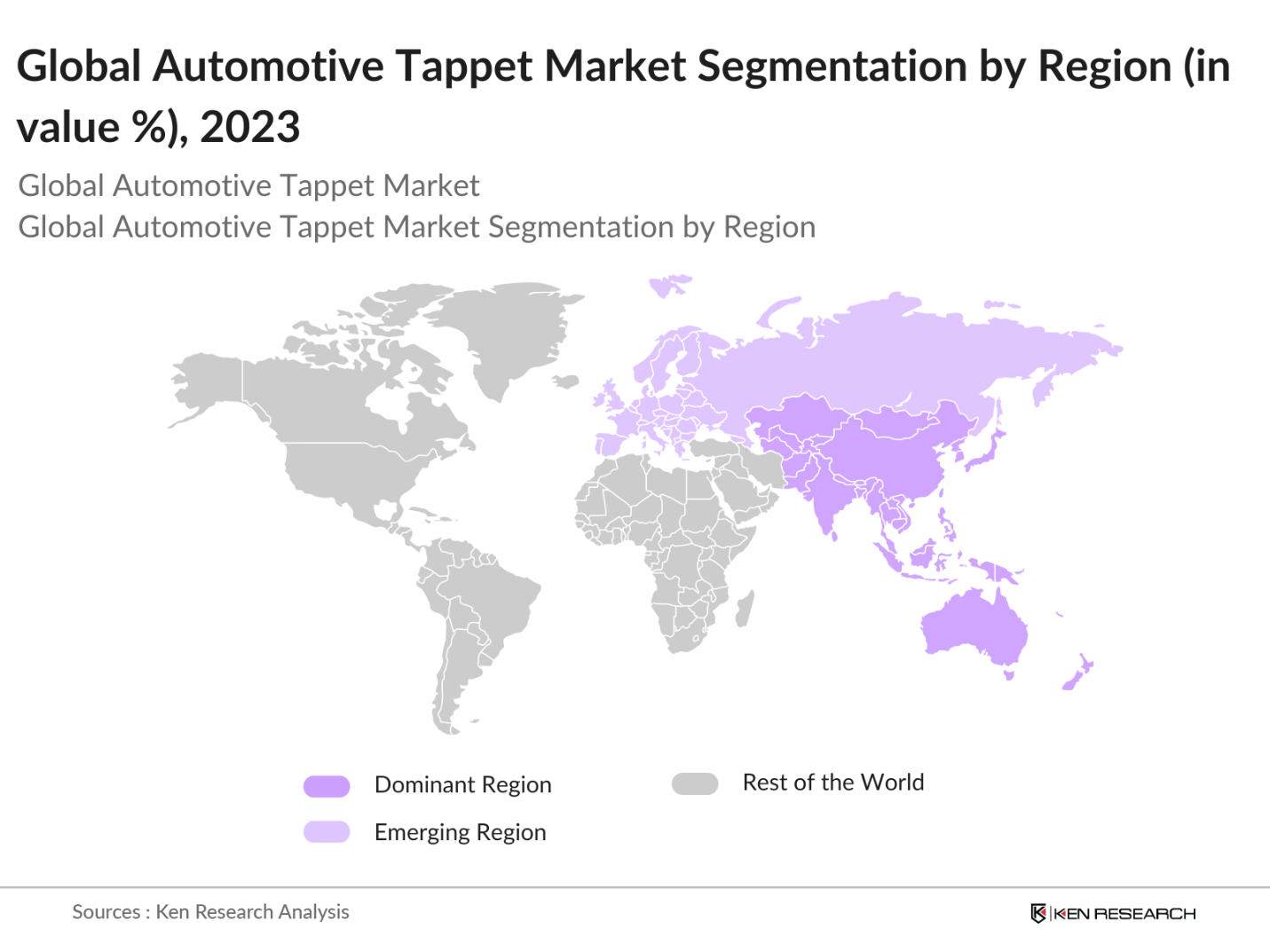

By Region: The market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominates due to the extensive automotive manufacturing base in countries like China, Japan, and India, alongside a significant rise in disposable income and vehicle demand.

By Engine Capacity: By engine capacity, the automotive tappet market is segmented into <4-cylinder, 46 cylinder, and >6-cylinder engines. The 46 cylinder engines segment leads the market due to the broad usage in both passenger and light commercial vehicles, which constitute a large portion of global vehicle production.

Global Automotive Tappet Market Competitive Landscape

The global automotive tappet market is dominated by both established and emerging companies, with significant influence from long-standing manufacturers who offer reliable and advanced tappet technology. The global automotive tappet markets competitive landscape is primarily led by international players that prioritize R&D investments to innovate tappet designs and improve efficiency.

Global Automotive Tappet Industry Analysis

Growth Drivers

- Increasing Global Vehicle Production and Sales: The global automotive industry is witnessing a significant rise in vehicle production, with total production exceeding 85 million units in 2023 according to the International Organization of Motor Vehicle Manufacturers (OICA). This robust production and sales trend directly boosts demand for automotive components, including tappets. As more vehicles enter the market, the demand for efficient, high-performance engines with precise valve control becomes paramount. The adoption of tappets, a critical component in the valve train system, supports engine efficiency and performance. This expansion in production has made tappets an essential item in the automotive supply chain.

- Rising Demand for Fuel-Efficient Engines: In 2023, global fuel consumption reached over 4,000 million metric tons, with countries like India and China being major consumers. Governments worldwide are enforcing stricter fuel efficiency standards to curb this consumption. Automotive tappets play a crucial role in enhancing fuel efficiency by optimizing the performance of internal combustion engines (ICEs), leading to lower fuel consumption. As fuel efficiency remains a core focus, demand for components like tappets that contribute to achieving these standards continues to grow, especially in regions enforcing rigorous fuel economy regulations.

- Technological Advancements in Engine Components Design: The engine components market has seen a shift towards precision-engineered parts, with tappets evolving to meet stringent automotive requirements. In 2023, investments in automotive R&D exceeded USD 200 billion globally, a portion of which focused on enhancing engine components. Advanced tappets now incorporate cutting-edge materials and technologies, improving their lifespan and performance. This trend aligns with global automakers goals to achieve lower emissions and better efficiency in ICEs, driving increased investment in tappet innovation.

Market Challenges

- Growing Adoption of Electric Vehicles: In 2023, over 14 million electric vehicles (EVs) were sold globally, representing a steady increase in EV adoption. EVs operate without conventional engines, eliminating the need for components like tappets. As EV adoption grows, especially in North America, Europe, and China, traditional internal combustion engine markets face reduced demand for parts specific to these engines. This shift presents a challenge for tappet manufacturers, pushing them to adapt to the evolving automotive landscape.

- High Competition Among Market Players: The automotive components industry, valued at over USD 2 trillion globally, is intensely competitive, with numerous manufacturers vying for market share. The tappet market, being specialized yet integral, is characterized by high competition, which pressures players to reduce costs and innovate consistently. With established global players and local manufacturers, this competitive landscape makes it challenging to maintain profitability without substantial R&D investments, putting smaller firms at a disadvantage.

Global Automotive Tappet Market Future Outlook

The global automotive tappet market is projected to experience significant growth in the next five years. Key growth factors include advancements in tappet technologies, demand for enhanced vehicle efficiency, and the expanding automotive production in emerging economies. Moreover, stringent fuel efficiency and emission regulations worldwide are likely to spur demand for high-performance tappets.

Opportunities

- Expansion into Emerging Markets: Emerging markets, particularly in Asia and Latin America, accounted for over 60% of new vehicle registrations in 2023. Tappet manufacturers can tap into these high-growth regions where ICE vehicles dominate, and aftermarket services are expanding rapidly. Many countries in these regions are also seeing increasing demand for aftermarket parts due to high vehicle usage and prolonged lifespans. This presents an opportunity for manufacturers to increase market penetration and gain long-term growth prospects.

- Development of Advanced Tappet Technologies: The global investment in automotive innovation reached over USD 100 billion in 2023, a significant portion of which supports developing high-performance, efficient engine components. Tappet manufacturers can leverage this innovation trend by advancing tappet materials and designs, such as self-lubricating or friction-reducing tappets, which extend engine lifespan. Such advancements are in line with automakers goals of enhancing ICE efficiency, thus positioning tappet manufacturers as integral to the automotive innovation ecosystem.

Scope of the Report

|

By Product Type |

Flat Tappets Roller Tappets |

|

By Engine Capacity |

<4 Cylinder Engine 46 Cylinder Engine >6 Cylinder Engine |

|

By Vehicle Type |

Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles |

|

By Distribution Channel |

Original Equipment Manufacturers (OEMs) Aftermarket |

|

By Material |

Steel, Cast Iron Aluminum Alloys |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Original Equipment Manufacturing Industries

Automotive Aftermarket Companies

Automotive Parts Supplier Companies

Automotive Engineering and Design Companies

Government and Regulatory Bodies (e.g., Environmental Protection Agency, European Environment Agency)

Investment and Venture Capitalist Companies

Tappet Material Supplier Companies

Companies

Players Mentioned in the Report

Schaeffler AG

Federal-Mogul Corporation

NSK Ltd.

Rane Engine Valve Ltd.

Crower Cams & Equipment Co.

Lunati LLC

Johnson Lifters LLC

Otics USA Inc.

SM Motorenteile GmbH

SKF Group

Table of Contents

1. Global Automotive Tappet Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Automotive Tappet Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Automotive Tappet Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Global Vehicle Production and Sales

3.1.2. Rising Demand for Fuel-Efficient Engines

3.1.3. Technological Advancements in Engine Components Design

3.1.4. Growth in Automotive Aftermarket and Maintenance Services

3.2. Market Challenges

3.2.1. Growing Adoption of Electric Vehicles

3.2.2. High Competition Among Market Players

3.2.3. Fluctuating Raw Material Prices

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Development of Advanced Tappet Technologies

3.3.3. Strategic Collaborations and Partnerships

3.4. Trends

3.4.1. Integration of Advanced Valve Train Technologies

3.4.2. Adoption of Lightweight Materials

3.4.3. Emphasis on Reducing Friction and Wear

3.5. Government Regulations

3.5.1. Emission Standards and Compliance

3.5.2. Fuel Efficiency Norms

3.5.3. Environmental Policies Impacting Engine Design

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Automotive Tappet Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Flat Tappets

4.1.2. Roller Tappets

4.2. By Engine Capacity (In Value %)

4.2.1. <4 Cylinder Engine

4.2.2. 46 Cylinder Engine

4.2.3. >6 Cylinder Engine

4.3. By Vehicle Type (In Value %)

4.3.1. Passenger Cars

4.3.2. Light Commercial Vehicles

4.3.3. Heavy Commercial Vehicles

4.4. By Distribution Channel (In Value %)

4.4.1. Original Equipment Manufacturers (OEMs)

4.4.2. Aftermarket

4.5. By Material (In Value %)

4.5.1. Steel

4.5.2. Cast Iron

4.5.3. Aluminum Alloys

4.6. By Region (In Value %)

4.6.1. North America

4.6.2. Europe

4.6.3. Asia Pacific

4.6.4. Latin America

4.6.5. Middle East & Africa

5. Global Automotive Tappet Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Schaeffler AG

5.1.2. NSK Ltd.

5.1.3. Federal-Mogul Corporation

5.1.4. Rane Engine Valve Ltd.

5.1.5. Comp Cams

5.1.6. Lunati LLC

5.1.7. Johnson Lifters LLC

5.1.8. Otics USA Inc.

5.1.9. SM Motorenteile GmbH

5.1.10. SKF Group

5.1.11. Wuxi Xizhou Machinery Co., Ltd.

5.1.12. ACDelco

5.1.13. Crower Cams & Equipment Co.

5.1.14. Cranes Cams

5.1.15. Camcraft Cams

5.2. Cross Comparison Parameters (Revenue, Headquarters, Employee Count, Founding Year, Product Portfolio, Distribution Network, Key Markets Served, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Automotive Tappet Market Regulatory Framework

6.1. Emission Standards

6.2. Certification Requirements

6.3. Compliance Guidelines

7. Global Automotive Tappet Market Future Size (In USD Mn)

7.1. Projected Future Market Size

7.2. Key Factors Influencing Future Market Growth

8. Global Automotive Tappet Market Future Segmentation

8.1. By Product Type

8.2. By Engine Capacity

8.3. By Vehicle Type

8.4. By Distribution Channel

8.5. By Material

9. Global Automotive Tappet Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives

9.3. White Space Opportunity Analysis

9.4. Key Investment Pockets

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first stage involves identifying critical factors such as market dynamics, leading players, and consumer preferences within the automotive tappet market. This step is supported by comprehensive desk research and secondary data analysis to create an initial framework.

Step 2: Market Analysis and Data Collection

Data collection incorporates historical market analysis, capturing revenue trends and segment performance over the last five years. Insights into tappet production, technological advancements, and key regulations are gathered to refine market estimates.

Step 3: Hypothesis Validation and Industry Consultation

Hypotheses are validated through interviews with automotive industry experts, OEM representatives, and engineering specialists. Their insights are crucial for confirming data accuracy and understanding market nuances.

Step 4: Research Synthesis and Final Output

Finally, we synthesize all data and insights into a comprehensive report, employing both bottom-up and top-down approaches. This ensures that the Global Automotive Tappet Market analysis is accurate, detailed, and aligned with current industry trends.

Frequently Asked Questions

01. How big is the Global Automotive Tappet Market?

The global automotive tappet market is valued at USD 7.2 billion, driven by growing vehicle production, demand for fuel-efficient components, and enhanced engine performance needs across major automotive-producing countries.

02. What are the challenges in the Global Automotive Tappet Market?

Key challenges include the increasing shift toward electric vehicles, which require fewer internal combustion engine components, and fluctuating raw material prices that impact manufacturing costs.

03. Who are the major players in the Global Automotive Tappet Market?

Leading players include Schaeffler AG, Federal-Mogul Corporation, NSK Ltd., Rane Engine Valve Ltd., and Crower Cams & Equipment, which dominate through their established market presence and innovative tappet products.

04. What drives the growth of the Global Automotive Tappet Market?

The growth is driven by rising demand for high-efficiency engines, expanding vehicle production in emerging markets, and continuous innovations in tappet technology that enhance fuel efficiency and reduce emissions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.