Global Automotive Wheel Rims Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD7975

December 2024

83

About the Report

Global Automotive Wheel Rims Market Overview

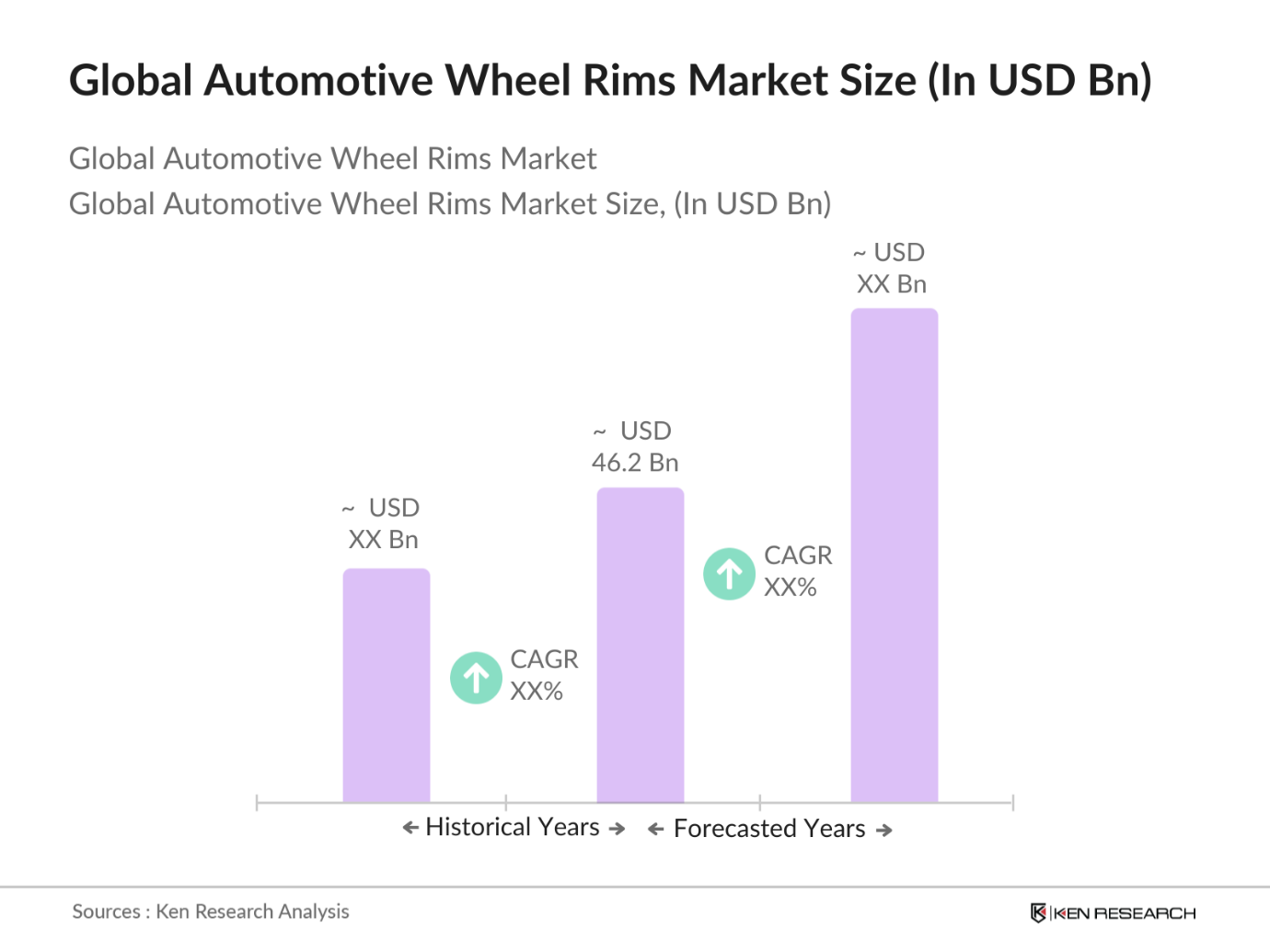

- The global automotive wheel rims market is valued at USD 46.2 billion, according to a five-year analysis. The markets growth is significantly driven by the surge in the automotive industrys demand for lightweight, durable rims. This growth is further supported by advancements in rim materials like aluminum and carbon fiber, which offer superior performance and efficiency, particularly for electric vehicles. The rise in customization trends and consumer preference for aesthetics in vehicle exteriors also play a substantial role in driving market expansion.

- North America and Europe lead the global wheel rims market, with countries like the United States and Germany at the forefront due to their well-established automotive industries and strong consumer demand for high-performance vehicles. The dominance of these regions is attributed to high purchasing power, advanced manufacturing capabilities, and the presence of major automotive OEMs and aftermarket providers. Asia-Pacific, led by China, is rapidly emerging as a significant market due to growing vehicle production and increased consumer focus on rim customization and aesthetics.

- Governments globally are implementing stricter emission standards for aluminum and steel manufacturers. In the United States, industrial emissions accounted for approximately 20% of greenhouse gas emissions, driving the need for stringent regulations. Manufacturers must now invest in cleaner production technologies, impacting operational costs and production methods in the wheel rims industry.

Global Automotive Wheel Rims Market Segmentation

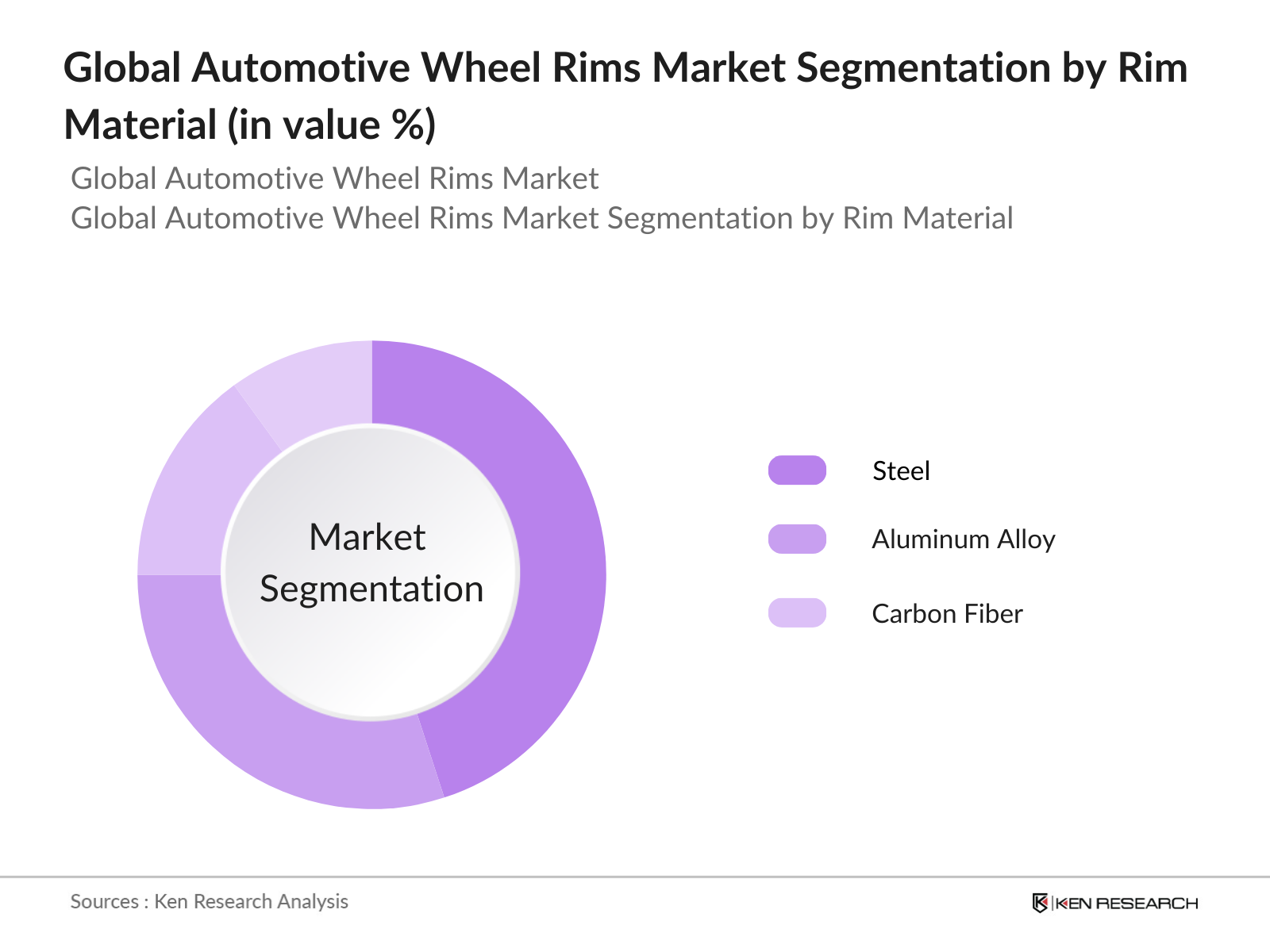

1. By Rim Material

The automotive wheel rims market is segmented by material type into steel, aluminum alloy, and carbon fiber. Among these, aluminum alloy rims hold the dominant market share due to their lightweight properties and compatibility with a wide range of vehicle types, including electric vehicles. This material's popularity is further fueled by its durability and superior corrosion resistance, making it a preferred choice among automakers and consumers alike for both performance and aesthetic appeal.

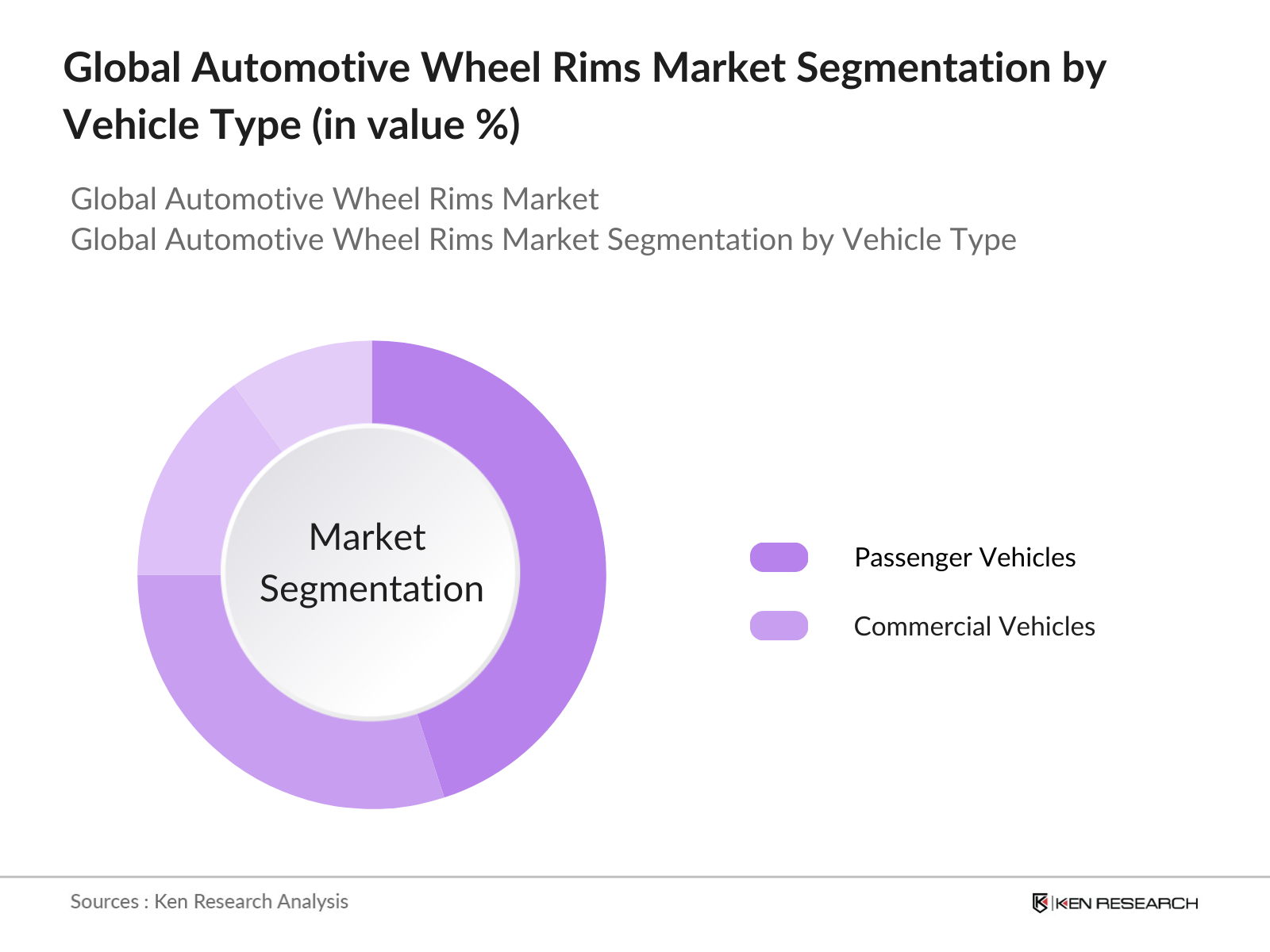

2. By Vehicle Type

The market is also segmented by vehicle type into passenger vehicles and commercial vehicles. Passenger vehicles dominate this segment due to the high demand for lightweight, aesthetically appealing rims that enhance both the performance and visual appeal of these vehicles. The surge in electric vehicle adoption, particularly in regions like North America and Europe, also contributes to the strong demand for lightweight rims in this category, with aluminum alloy and carbon fiber rims being particularly sought after.

Global Automotive Wheel Rims Market Competitive Landscape

The global automotive wheel rims market is dominated by a blend of established brands and innovative newcomers, each contributing to the markets competitive intensity. Companies such as Enkei Corporation and Ronal Group continue to lead, thanks to their extensive product portfolios and advanced manufacturing capabilities. Emerging players are also gaining traction by focusing on sustainable and lightweight materials, aiming to align with the growing demand for fuel efficiency and sustainability in automotive components.

Global Automotive Wheel Rims Market Analysis

Growth Drivers

- Rising Demand from Electric Vehicles: The global increase in electric vehicle (EV) production is creating significant demand for lightweight materials like aluminum and carbon fiber, both critical in manufacturing automotive wheel rims. EV sales recently reached over 10 million units, driven by global emission reduction goals and government incentives. This shift has amplified the need for efficient, lightweight rims to extend EV battery range and performance. Aluminum wheel rims, in particular, have seen heightened adoption due to their compatibility with EV requirements.

- Growing Automotive Production in Emerging Markets: Automotive production has surged in emerging economies, particularly in Asia. China and India produced over 40 million passenger and commercial vehicles combined, driven by urbanization, industrialization, and a growing middle class. This production surge has heightened demand for robust and affordable rims, particularly steel and aluminum, to cater to a diverse consumer base. Increased consumer purchasing power in these regions also accelerates the demand for quality wheel rims as people invest in new vehicles.

- Customization and Aesthetic Appeal: With the automotive aftermarket industry booming, consumer interest in customization has increased substantially. The global aftermarket industry was valued at USD 500 billion, with a significant portion dedicated to customized wheel rims. Consumers in regions such as North America and Europe are increasingly opting for customized aluminum and carbon fiber rims, driving innovation in rim designs, colors, and finishes to meet demand. This trend aligns with a growing preference for personalization in automotive parts, leading manufacturers to expand their portfolios of custom options.

Market Challenges

- Volatility in Raw Material Prices: Raw materials used in rim production, particularly aluminum and steel, have seen price volatility influenced by global supply chain issues. The global aluminum price recently increased by USD 300 per metric ton due to high demand and supply constraints, especially from primary producers in Asia. This price fluctuation poses challenges for manufacturers striving to balance production costs while maintaining quality. Such volatility directly affects profit margins, impacting smaller manufacturers who rely heavily on consistent raw material costs.

- Environmental Compliance and Regulations: Increasingly stringent environmental regulations are impacting wheel rim production, particularly in regions with high manufacturing activity. Emissions from metal production are one of the largest contributors to industrial CO emissions. Countries in the EU are enforcing stricter emissions standards for aluminum and steel manufacturing facilities, adding compliance costs to rim manufacturers. Adapting production processes to meet environmental standards while maintaining output presents a considerable challenge for manufacturers operating globally.

Global Automotive Wheel Rims Market Future Outlook

Over the next five years, the automotive wheel rims market is expected to grow significantly, driven by the continued adoption of lightweight and durable materials, increased EV adoption, and a rising demand for customizations. The shift towards aluminum alloy and carbon fiber rims will further accelerate due to their efficiency and environmental benefits. With the global automotive industry emphasizing fuel economy and carbon footprint reduction, the market for lightweight rims is set to expand.

Market Opportunities

- Increased Adoption of Lightweight Materials: As the demand for fuel-efficient and eco-friendly vehicles increases, there is an opportunity to develop and expand lightweight wheel rims made from materials like carbon fiber and magnesium alloys. Reducing vehicle weight by 100 pounds can improve fuel efficiency by 2%, which drives demand for lightweight components. This trend has encouraged manufacturers to innovate in material technology, positioning the wheel rims market for growth as automakers prioritize fuel efficiency and reduced emissions.

- Expansion in the Aftermarket Segment: The automotive aftermarket has significant growth potential, with a notable consumer shift toward customization and performance enhancement. North America alone had an aftermarket industry valued at USD 200 billion, with a substantial portion of that spent on performance rims and aesthetic upgrades. This demand for aftermarket rims opens opportunities for companies to capture market share by offering customized solutions and unique designs that appeal to a diverse consumer base.

Scope of the Report

|

Segment |

Sub-segments |

|

Material Type |

Steel, Aluminum Alloy, Carbon Fiber, Magnesium Alloy, Composite Materials |

|

Product |

OEM, Aftermarket |

|

Vehicle Type |

Passenger Cars, Commercial Vehicles, Electric Vehicles, Two-Wheelers, Sports Cars |

|

Distribution Channel |

Offline, Online, Direct-to-Consumer, Retailers, Dealerships |

|

Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Automotive OEMs

Automotive Aftermarket Distributors

Automotive Dealerships

Electric Vehicle Manufacturers

Performance Car Manufacturers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies

Material Suppliers

Companies

Players mentioned in the report

Enkei Corporation

Maxion Wheels

Ronal Group

Borbet GmbH

Superior Industries

Iochpe-Maxion S.A.

Accuride Corporation

Vossen Wheels

BBS Kraftfahrzeugtechnik AG

OZ S.p.A.

Topy Industries, Ltd.

Alcoa Wheels

Wheel Pros, LLC

Fuel Off-Road Wheels

HRE Performance Wheels

Table of Contents

1. Global Automotive Wheel Rims Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Landscape

1.4 Market Segmentation Overview

1.5 Key Market Milestones

2. Global Automotive Wheel Rims Market Size (USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Developments & Milestones

3. Global Automotive Wheel Rims Market Analysis

3.1 Growth Drivers (Production Volume, Alloy Availability, Customization Demand)

3.1.1 Lightweighting Trends

3.1.2 Electric Vehicle Demand

3.1.3 Rising Consumer Demand for Aesthetic Customization

3.1.4 Growth in Aftermarket Sales

3.2 Market Challenges (Raw Material Sourcing, Trade Policies, Price Volatility)

3.2.1 Supply Chain Disruptions

3.2.2 High Production Costs for Premium Rims

3.2.3 Tariffs and International Trade Policies

3.3 Market Opportunities (Technological Integration, Sustainable Materials)

3.3.1 IoT-Integrated Smart Wheels

3.3.2 Recyclable Material Innovations

3.3.3 Expansion into Emerging Markets

3.3.4 Strategic OEM Partnerships

3.4 Market Trends (Customization, Lightweight Alloys, Sustainability)

3.4.1 Trend Toward Premium Finishes

3.4.2 Growth in Forged Aluminum Segment

3.4.3 Integration of Eco-Friendly Production Techniques

3.5 Government Regulations

3.5.1 Emission Standards & Fuel Efficiency Requirements

3.5.2 Safety Standards in Manufacturing

3.5.3 Recycling and Environmental Norms

4. Global Automotive Wheel Rims Market Segmentation

4.1 By Material Type (Steel, Aluminum Alloy, Carbon Fiber, Magnesium Alloy, Composite Materials)

4.2 By Product (OEM, Aftermarket)

4.3 By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles, Two-Wheelers, Sports Cars)

4.4 By Distribution Channel (Offline, Online, Direct-to-Consumer, Retailers, Dealerships)

4.5 By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa)

5. Global Automotive Wheel Rims Market Competitive Analysis

5.1 Profiles of Major Competitors

5.1.1 Maxion Wheels

5.1.2 Enkei Corporation

5.1.3 Borbet GmbH

5.1.4 Ronal Group

5.1.5 Superior Industries

5.1.6 Accuride Corporation

5.1.7 CiTiC Dicastal

5.1.8 Topy Industries Ltd.

5.1.9 Zhejiang Wanfeng Auto Wheel

5.1.10 Uniwheels Group

5.1.11 Alcoa Wheels

5.1.12 Mangels Industrial S/A

5.1.13 YHI International Limited

5.1.14 MHT Luxury Alloys

5.1.15 OZ Group

5.2 Cross Comparison Parameters (Headquarters, Production Capacity, OEM Partnerships, Product Portfolio Diversity, R&D Investments, Manufacturing Technology, Sustainability Initiatives, Employee Count)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers & Acquisitions

5.6 Investment Landscape

5.7 Joint Ventures & Alliances

5.8 New Product Launches

6. Global Automotive Wheel Rims Market Regulatory Framework

6.1 Compliance Standards in Major Markets

6.2 Recycling and Waste Management Regulations

6.3 Emission and Efficiency Standards

6.4 Safety and Quality Control Standards

7. Global Automotive Wheel Rims Market Future Market Size (USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. Global Automotive Wheel Rims Market Future Market Segmentation

8.1 By Material Type

8.2 By Product

8.3 By Vehicle Type

8.4 By Distribution Channel

8.5 By Region

9. Global Automotive Wheel Rims Market Analysts' Recommendations

9.1 Strategic Positioning Analysis

9.2 Product Development Opportunities

9.3 Market Entry Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with defining critical variables influencing the global automotive wheel rims market. By developing an ecosystem map that includes automotive OEMs, aftermarket distributors, and key material suppliers, we identify variables crucial to market dynamics.

Step 2: Market Analysis and Construction

Historical data from reputable automotive associations and proprietary sources is analyzed to construct market size estimates. This involves examining production volumes, material usage trends, and consumer preferences across regions.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including representatives from major rim manufacturers and automotive OEMs, are consulted to validate initial hypotheses. Through CATIs and email surveys, insights on market trends, material preferences, and segment dominance are obtained.

Step 4: Research Synthesis and Final Output

The final phase synthesizes findings with direct feedback from industry stakeholders to ensure an accurate market assessment. This involves verifying segmentation data and confirming findings with a bottom-up analysis, establishing a well-rounded view of the market.

Frequently Asked Questions

-

How big is the Global Automotive Wheel Rims Market?

The global automotive wheel rims market is valued at USD 46.2 billion, driven by the rising demand for lightweight materials and customized rims. -

What are the challenges in the Global Automotive Wheel Rims Market?

The market faces challenges, including raw material price volatility and strict environmental regulations, which impact production and cost-efficiency. -

Who are the major players in the Global Automotive Wheel Rims Market?

Key players include Enkei Corporation, Ronal Group, Borbet GmbH, and Superior Industries, with strong brand presence and manufacturing capabilities. -

What are the growth drivers of the Global Automotive Wheel Rims Market?

Demand for fuel-efficient vehicles, the growing trend for customized vehicle exteriors, and the rise in electric vehicles drive the market growth. -

Which material dominates the Global Automotive Wheel Rims Market?

Aluminum alloy rims dominate the market, attributed to their lightweight properties, durability, and suitability for electric and performance vehicles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.