Global Autonomous Vehicle Solution Market Outlook to 2030

Region:Global

Author(s):Rohan and Shashank

Product Code:KENGR004

September 2024

89

About the Report

Global Autonomous Vehicle Solution Market Overview

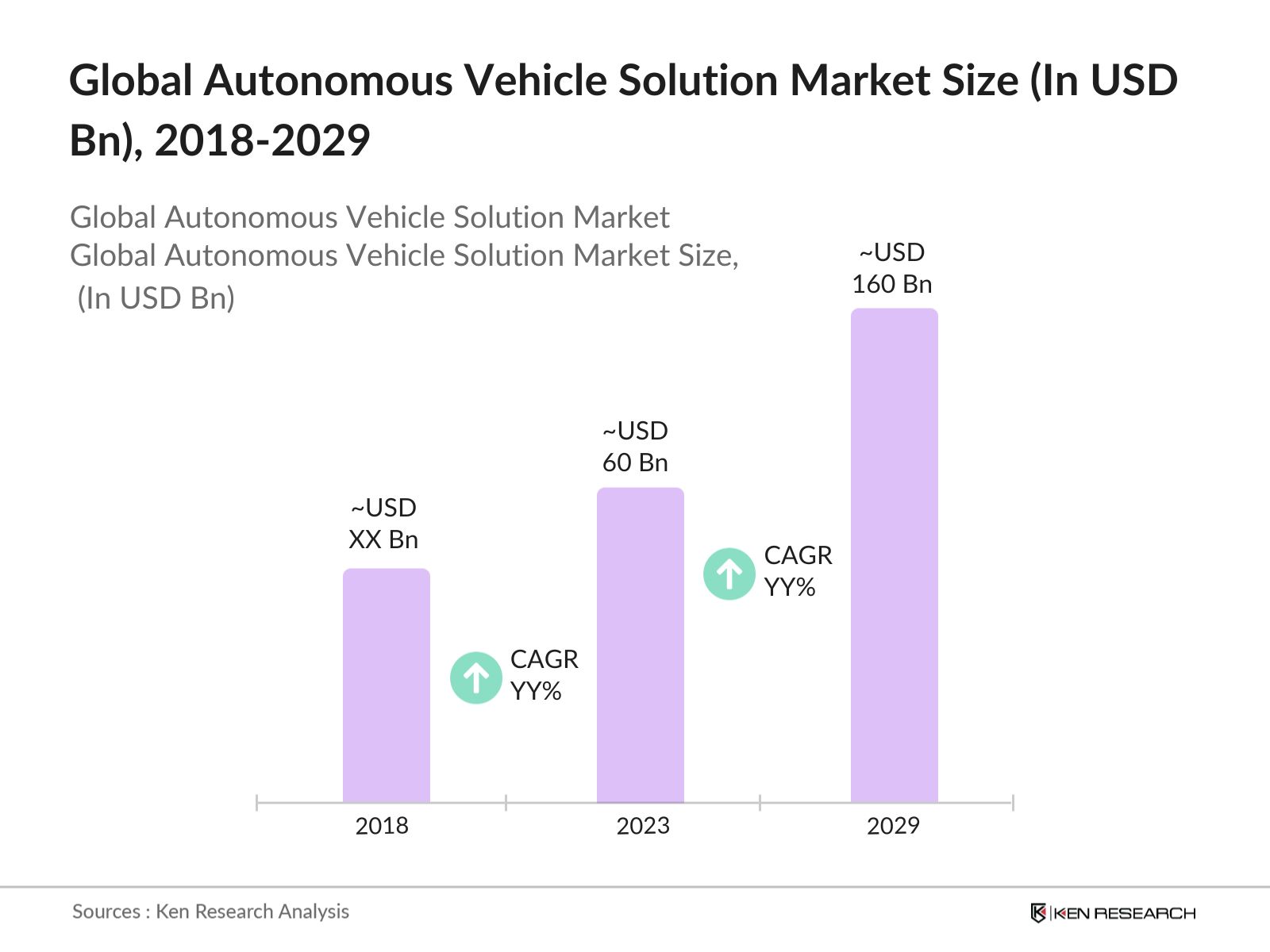

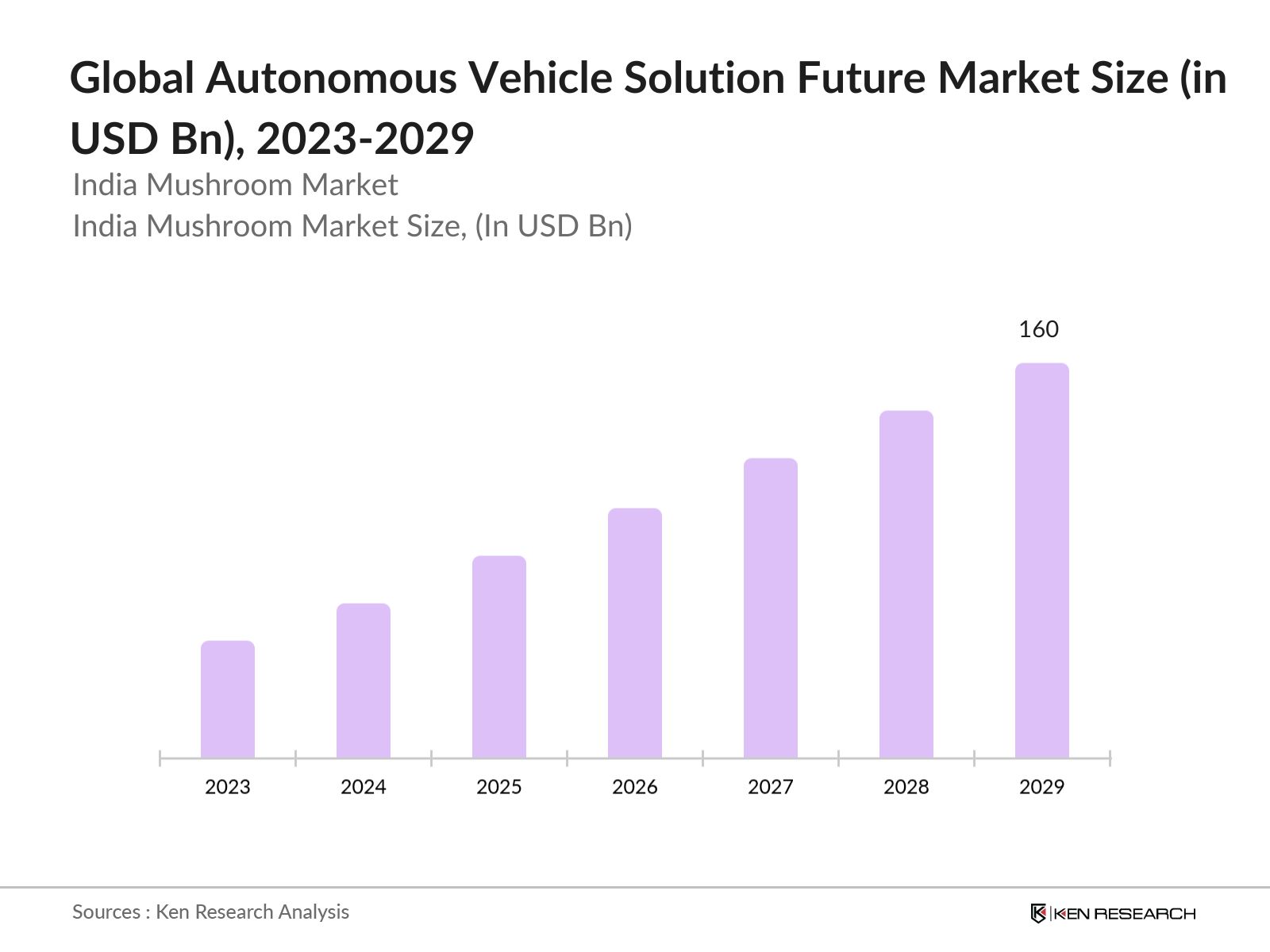

- The Global Autonomous Vehicle Solution market, valued at USD 60 Bn in 2023, is expected to grow substantially, reaching USD 160 Bn by 2029. This growth is driven by advancements in AI and ML technologies. Increasing demand for safe, efficient transportation and substantial R&D investments from key players are also key factors contributing to this expansion.

- The market is dominated by several key players, including BYD, Tesla, Toyota, Ford, General Motors, NIO and Rivian LG. The dominance of these companies is attributed to their advanced self-driving technology, sophisticated autopilot systems, all-electric self-driving cars, innovative driving solutions and significant progress in autonomous driving projects.

- In October 2023, Waymo announced the expansion of its fully autonomous ride-hailing service to Los Angeles. This marks the company's fourth operational city after Phoenix, San Francisco, and Austin. The service utilizes Waymo's latest fifth-generation Waymo Driver, capable of navigating complex urban environments with no human intervention.

Global Autonomous Vehicle Solution Current Market Analysis

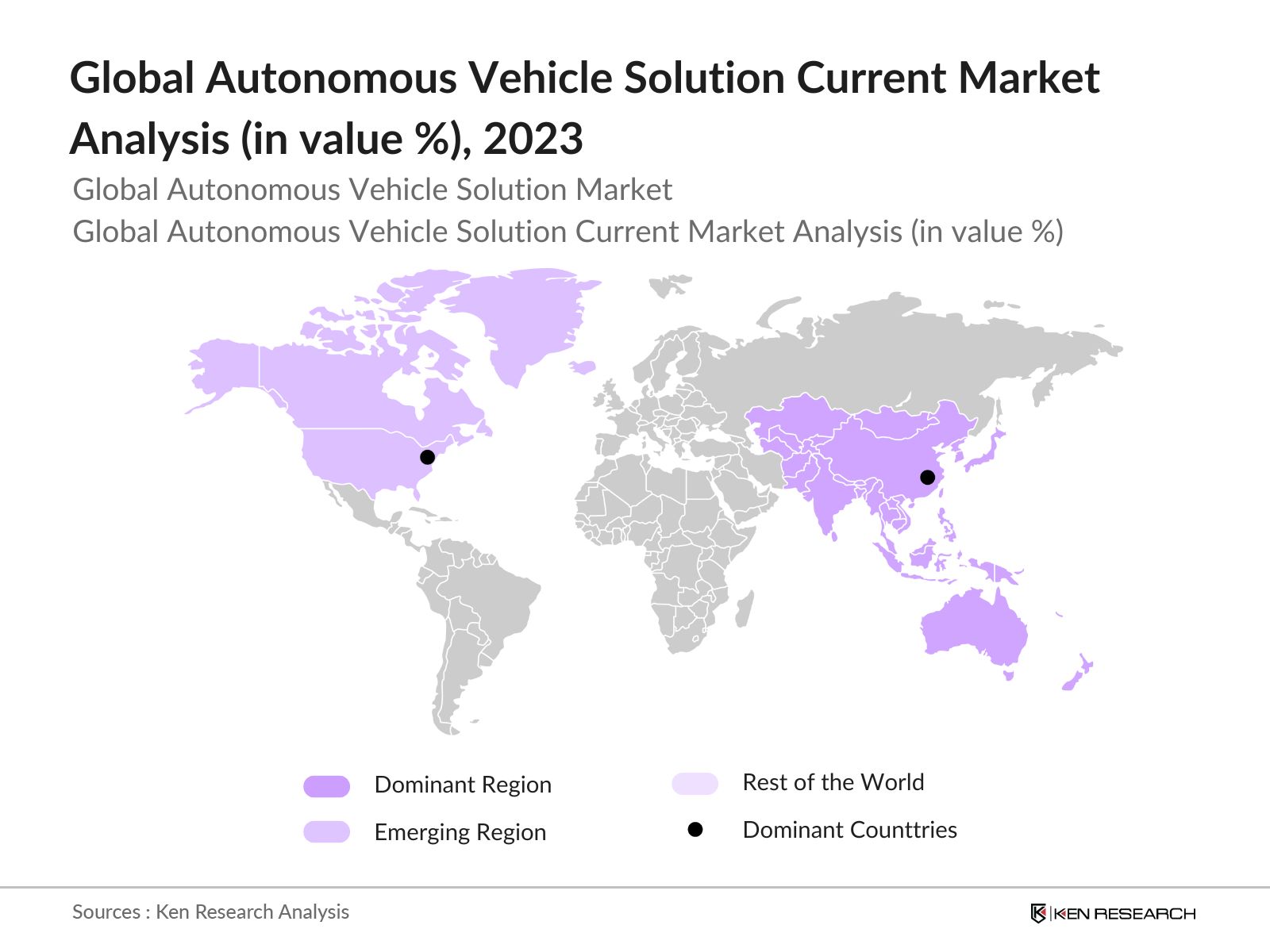

- APAC as dominant region: The Asia-Pacific (APAC) region leads the global autonomous vehicle solution market due to significant investments in technology and rapid adoption of advanced driving systems. Countries in this region, particularly Japan and South Korea, are at the forefront of integrating autonomous technologies with their existing automotive industries. Till January 2022, South Korea had accumulated 720,000 kilometers of self-driving mileage using a fleet of 200-250 vehicles.

- North America as emerging region: North America, particularly the United States and Canada, shows strong potential in the autonomous vehicle market due to substantial R&D investments. In May 2023, the U.S. Department of Transportation awarded a $9.85 million federal grant to the University of Michigan to enhance connected vehicle research, showcasing governmental support for infrastructure development in this sector.

- China as dominant country: China stands out as the leading country in the global autonomous vehicle solution market, driven by its large automotive market and substantial government support for automotive innovations. Cities like Wuhan are investing heavily in infrastructure, with a budget of $2.3 billion allocated for smart parking and road transformation projects aimed at supporting autonomous vehicle operations. Moreover, China’s vast urban areas provide a large-scale testing ground for autonomous systems.

Global Autonomous Vehicle Solution Market Segmentation

The Global Autonomous Vehicle Solution market can be segmented based on several factors:

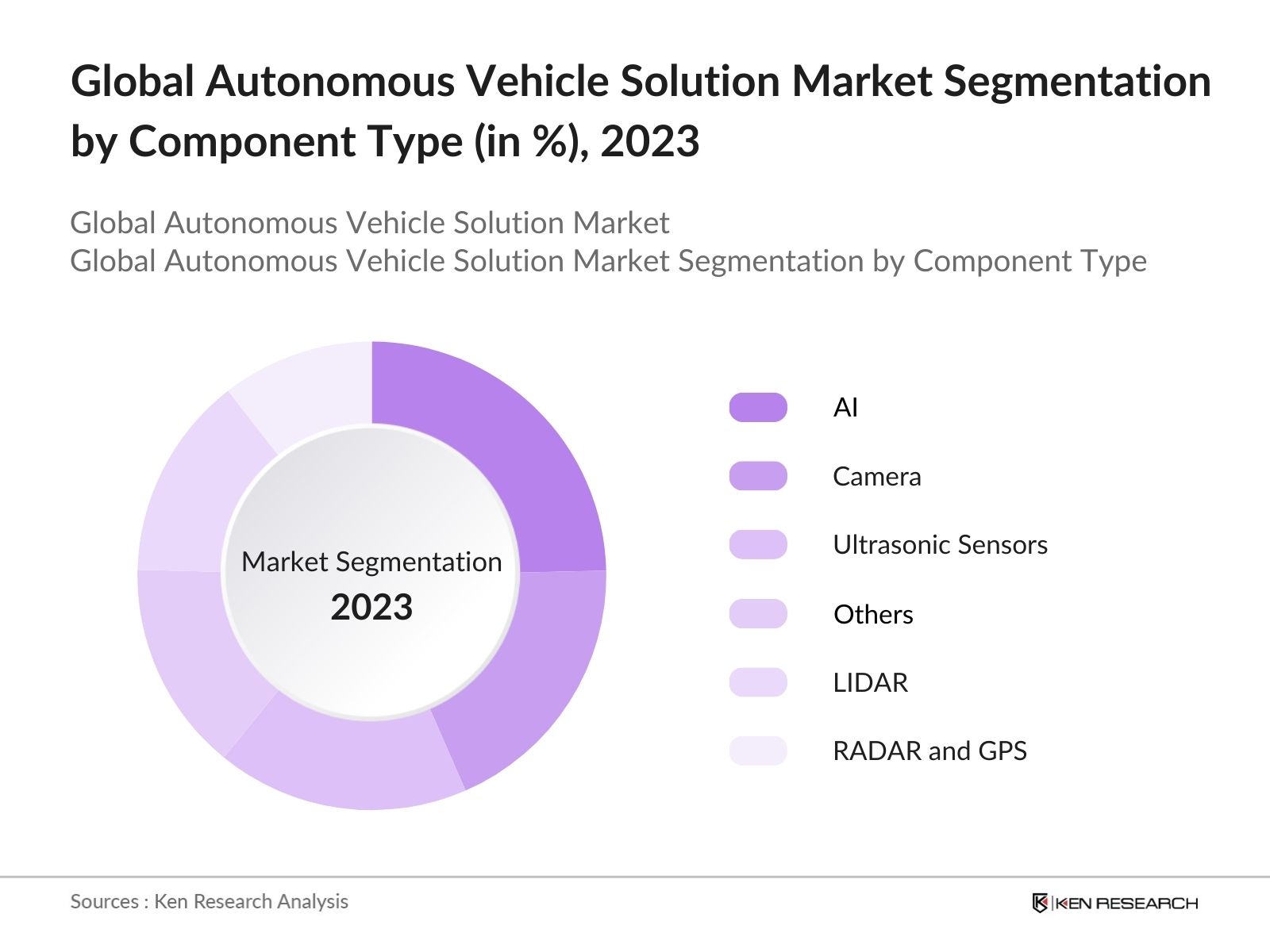

By Component Type: Global autonomous vehicle solution market segmentation by component type is divided into AI, Camera, Ultrasonic Sensors, LIDAR, RADAR, GPS and others. In 2023, AI dominates the autonomous vehicle market due to technological advancements enhancing the precision and reliability of driving systems. Sophisticated AI algorithms for real-time decision-making and environment interpretation are crucial, driving AI's increased market value and dominance.

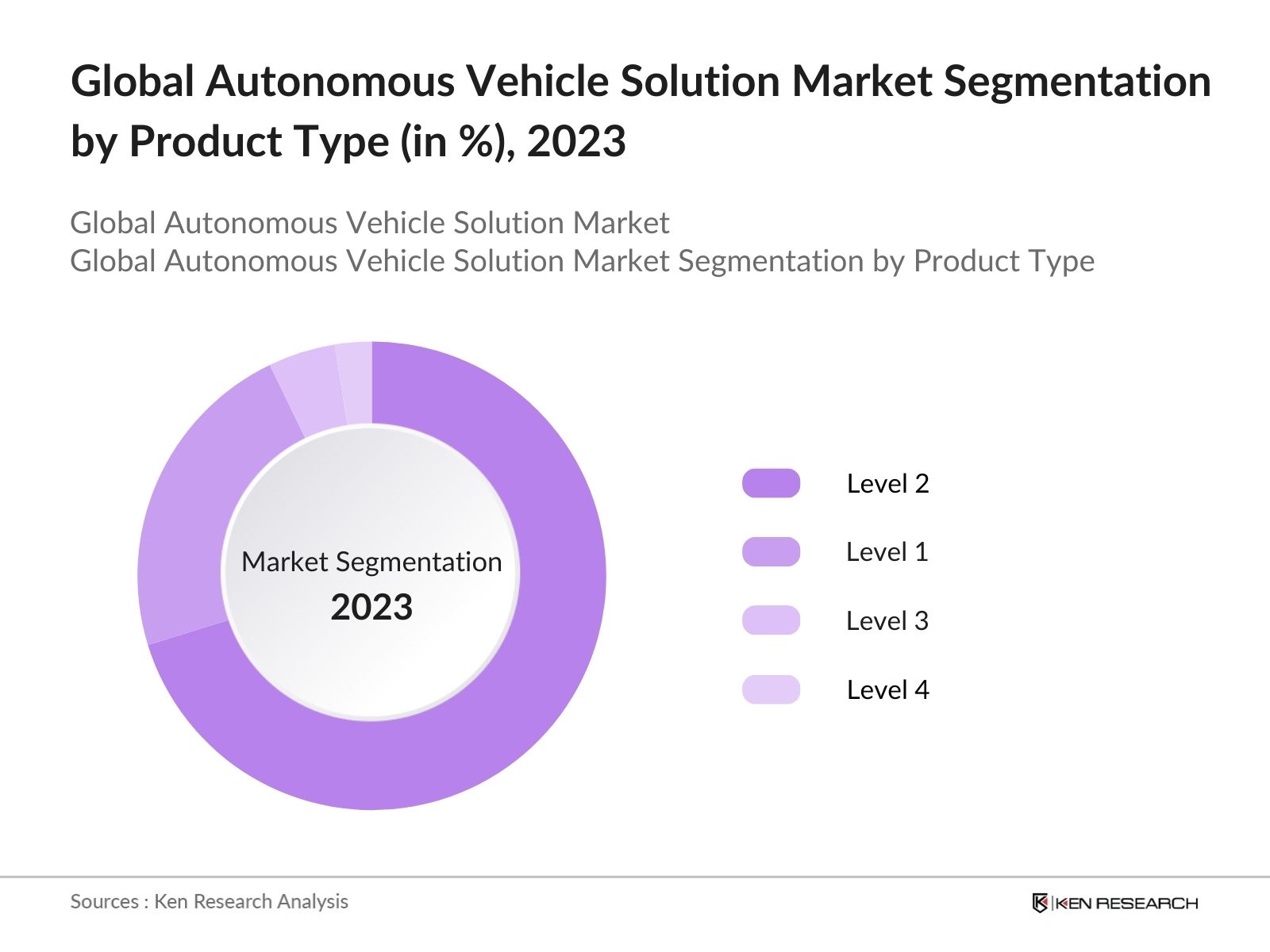

By Product Type: Global autonomous vehicle solution market segmentation by product type is divided into Level 1, Level 2, Level 3 and Level 4. In 2023, Level 2 autonomous vehicles dominate the market due to their advanced driver-assistance systems (ADAS) which enhance driving safety and convenience, and their affordability and regulatory acceptance compared to higher autonomy levels.

By Application: Global autonomous vehicle solution market segmentation by application is divided into personal, public, logistics, industrial and others. In 2023, the personal application segment dominates due to high demand for enhanced safety and convenience features. The adoption of Level 1 and Level 2 autonomous features like adaptive cruise control and automated parking in personal vehicles drives this segment's growth.

Global Autonomous Vehicle Solution Market Competitive Landscape

|

Name of Company |

Headquarter |

Establishment Year/Vintage |

Level of Autonomy |

|

BYD |

Shenzhen, China |

1995 |

L1, L2 |

|

Tesla |

Palo Alto, California, USA |

2003 |

L1, L2, L4 |

|

Toyota |

Toyota City, Japan |

1937 |

L1, L2 |

|

Ford |

Dearborn, Michigan, USA |

1903 |

L1, L2 |

|

General Motors |

Detroit, Michigan, USA |

1908 |

L1, L2 |

|

NIO |

Shanghai, China |

2014 |

L1, L2 |

|

Rivian |

Irvine, California, USA |

2009 |

L1, L2 |

|

BMW |

Munich, Germany |

1916 |

L1, L2 |

|

Mercedes-Benz |

Stuttgart, Germany |

1886 |

L1, L2, L3 |

- Volkswagen Accelerates with Mobileye in 2024: In 2024, Volkswagen intensified its collaboration with Mobileye to develop new automated driving functions, investing USD 300 million in joint R&D efforts. This partnership aims to enhance Volkswagen's autonomous driving capabilities, leveraging Mobileye's advanced AI and vision technology to deliver safer and more reliable automated driving solutions.

- Honda Cruises Ahead in Autonomous Vehicle Race: In 2024, Honda announced the integration of GM’s Cruise Automation technology into its vehicle lineup, deploying 1,000 autonomous test vehicles in Japan. This collaboration aims to enhance Honda Sensing's suite of safety and driver-assistive technologies, positioning Honda as a key player in the autonomous vehicle market.

- Hyundai Powers Up Smart Sense for Autonomous Driving: In 2024, Hyundai announced the advancement of its Smart Sense technology, enhancing Level 3 autonomous driving capabilities. Furthermore, Hyundai's joint venture with Aptiv has progressed significantly, aiming to deploy 500 autonomous vehicles for public trials by the end of the year. This development underscores Hyundai's commitment to innovation in autonomous driving.

Global Autonomous Vehicle Solution Industry Analysis

Global Autonomous Vehicle Solution Market Growth Drivers:

- Innovation in Driving Systems: Rapid progress in AI, machine learning, and sensor technologies is crucial for the development of reliable autonomous driving systems. According to Waymo, continuous improvements in AI and sensor fusion technologies have enabled the company to drive over 20 million miles autonomously on public roads as of 2021, demonstrating enhanced safety and reliability.

- Regulatory Support: Government policies and regulations that facilitate autonomous vehicle testing and deployment can significantly boost market growth. In California, for example, over 60 permits for autonomous vehicle testing were issued, enabling companies like Cruise and Zoox to conduct extensive testing, which accelerates technological advancements and supports the broader adoption of autonomous vehicles.

- Consumer Demand for Safety and Convenience: Rising consumer demand for safer and more convenient transportation options is driving the growth of the autonomous vehicle market. Tesla reported that by 2023, more than 100,000 vehicles in the U.S. were equipped with its Full Self-Driving (FSD) beta, reflecting high consumer interest in advanced safety features and convenience.

Global Autonomous Vehicle Solution Market Challenges:

- Technological Limitations: Achieving fully autonomous driving remains a significant challenge due to technical issues, particularly in complex environments. For example, Uber faced substantial technological hurdles that led to the suspension of its autonomous vehicle program after a fatal accident, underscoring the need for more development and stringent safety measures.

- High Development Costs: The development of autonomous vehicles involves prohibitively high R&D and infrastructure costs, limiting competition to well-funded companies. Ford and Volkswagen’s joint venture with Argo AI, which saw investments exceeding $7 billion, illustrates the immense financial resources required for advancing autonomous vehicle technology.

- Regulatory Hurdles: Diverse and evolving regulations across different regions create substantial complexity and uncertainty for deploying autonomous vehicles. For instance, Waymo, despite its advancements, encounters regulatory challenges that restrict its operational footprint to a few states in the U.S., such as Arizona and California.

Global Autonomous Vehicle Solution Future Market Outlook

By 2029, the Global Autonomous Vehicle Solution market is expected to reach USD 160 Bn, driven by ongoing advancements in AI, improved sensor technologies, and increasing regulatory support. The shift towards electric and hybrid autonomous vehicles, coupled with the integration of smart city initiatives, will further accelerate market growth.

Future Market Trends

- Expansion of Autonomous Ride-Hailing Services: Over the next five years, autonomous ride-hailing services will expand significantly, driven by advancements in AI and increased consumer acceptance. Companies are expected to deploy a large number of autonomous vehicles, enhancing urban transportation options and reducing dependency on traditional vehicles. Regulatory frameworks are evolving to support this growth, providing a safer and more efficient transportation system.

- Integration with Smart Cities: Autonomous vehicles will become a crucial component of smart city initiatives globally. These integrations will improve urban mobility, reduce traffic congestion, and enhance overall transportation efficiency. Smart city projects will leverage autonomous transportation solutions to create more sustainable and interconnected urban environments, addressing the growing need for efficient and eco-friendly transportation systems.

Scope of the Report

| Category | Options |

|---|---|

| By Region |

North America Europe, APAC Latin America MEA |

| By Component Type |

AI Camera Ultrasonic Sensors LiDAR Radar GPS Others |

| By Product Type |

Level 1 Level 2 Level 3 Level 4 |

| By Application |

Personal Public Logistics Industrial Others |

| By Vehicle Type |

Passenger Cars Commercial Vehicles |

| By Fuel Type |

ICE (Internal Combustion Engine) Electric Hybrid |

Products

Key Target Audience:

- Autonomous Vehicle Manufacturers

- Automotive Component Suppliers

- Tech Companies (AI and ML solutions)

- Telecommunications Companies

- Policy Makers and Regulatory Bodies/Urban Planners and Smart City Developers

- Investment and Venture Capitalist Firms

- Cab Aggregator/ Taxi Fleet Operators

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

- BYD

- Tesla

- Toyota

- Ford

- General Motors

- NIO

- Rivian

- BMW

- Mercedes-Benz

- Volkswagen

- Honda

- Hyundai

- Audi (Volkswagen Group)

- Volvo

- SAIC Motor Corporation

Table of Contents

1. Executive Summary

1.1 Global Vehicle Solution Market

1.2 Global Autonomous Vehicle Solution Market

2. Global Overview

2.1 Overview of Global Vehicle Solutions

2.2 Overview of Global Automotive Industry

2.3 Global Vehicle Solution Sales (Connected, Autonomous, Electric, and Shared Mobility)

2.4 Global Vehicle Solution Infrastructure (Telematics, Charging Stations, and Maintenance Services)

3. Global Autonomous Vehicle Solution Market Overview

3.1 Global Autonomous Vehicle Solution Market Ecosystem

3.2 Global Autonomous Vehicle Solution Market Value Chain

4. Global Autonomous Vehicle Solution Market Size (in USD Bn), 2018-2023

5. Global Autonomous Vehicle Solution Market Segmentation (in value %), 2018-2023

5.1 Global Autonomous Vehicle Solution Market Segmentation by Region (in value %), 2018-2023

5.2 Global Autonomous Vehicle Solution Market Segmentation by Business Model (in value %), 2018-2023

5.3 Global Autonomous Vehicle Solution Market Segmentation by Component Type (in value %), 2018-2023

5.4 Global Autonomous Vehicle Solution Market Segmentation by Product Type (in value %), 2018-2023

5.5 Global Autonomous Vehicle Solution Market Segmentation by Application (in value %), 2018-2023

5.6 Global Autonomous Vehicle Solution Market Segmentation by Vehicle Type (in value %), 2018-2023

5.7 Global Autonomous Vehicle Solution Market Segmentation by Fuel Type (in value %), 2018-2023

6. Global Autonomous Vehicle Solution Market Competition Landscape

6.1 Global Autonomous Vehicle Solution Market Share Analysis

6.2 Global Autonomous Vehicle Solution Market Heat Map Analysis

6.3 Global Autonomous Vehicle Solution Market Cross Comparison

6.4 Global Autonomous Vehicle Solution Market Comparison Matrix

7. Global Autonomous Vehicle Solution Market Dynamics

7.1 Global Autonomous Vehicle Solution Market Growth Drivers

7.2 Global Autonomous Vehicle Solution Market Challenges

7.3 Global Autonomous Vehicle Solution Market Trends

7.4 Global Autonomous Vehicle Solution Market Case Studies

7.5 Global Autonomous Vehicle Solution Market Strategic Initiatives

8. Global Autonomous Vehicle Solution Future Market Size (in USD Bn), 2023-2029

9. Global Autonomous Vehicle Solution Future Market Segmentation (in value%), 2023-2029

9.1 Global Autonomous Vehicle Solution Future Market Segmentation by Region (in value %), 2023-2029

9.2 Global Autonomous Vehicle Solution FutureMarket Segmentation by Business Model (in value%), 2023-2029

9.3 Global Autonomous Vehicle Solution FutureMarket Segmentation by Component Type (in value %), 2023-2029

9.4 Global Autonomous Vehicle Solution Future Market Segmentation by Product Type of L-SBR (in value %), 2023-2029

9.5 Global Autonomous Vehicle Solution FutureMarket Segmentation by Application (in value %), 2023-2029

9.6 Global Autonomous Vehicle Solution Future Market Segmentation by Vehicle Type (in value %), 2023-2029

9.7 Global Autonomous Vehicle Solution Future Market Segmentation by Fuel Type (in value %), 2023-2029

10. Analyst Recommendations

11. Research Methodology

11.1 Market Definitions and Assumptions

11.2 Abbreviations

11.3 Market Sizing Approach

11.4 Consolidated Research Approach

11.5 Understanding Market Potential Through In-Depth Industry Interviews

11.6 Primary Research Approach

11.7 Limitations and Future Conclusion

Disclaimer

Contact Us

Research Methodology

Step 1: Hypothesis Creation

The research team initially formulated a hypothesis regarding the global Autonomous Vehicle Solutions market by analyzing prevailing industry elements sourced from company reports, magazines, journals, online articles, governmental bodies, and industry reports. We leveraged both public and proprietary databases to accurately define market segments and gather relevant data points.

Step 2: Hypothesis Testing

We conducted interviews with company management (including C-level executives, Directors, Country Heads, Product Heads, Heads of Sales, Business Development Executives, and Operations Supervisors) using Computer Assisted Telephonic Interviews (CATIs). These interviews were aimed at gathering insights on the market and verifying the initial hypothesis proposed by our team.

Step 3: Market Sizing Approach

The market size for the global Autonomous Vehicle Solutions sector was determined through a comprehensive top-to-bottom analysis. This involved identifying major market participants, analyzing their revenue streams, sales data for various levels of autonomy, vehicle types, applications, and fuel types, and their overall contribution to the market. The compiled market size data was then cross-verified with multiple secondary sources to ensure accuracy.

Step 4: Interpretation and Future Forecasting

The future projections were made by identifying key macro and industry-specific factors such as technological advancements, regulatory environments, the number of operating enterprises, and the presence of small and medium-sized enterprises (SMEs) and large conglomerates. These insights were combined with expert opinions to develop forecasts for the global Autonomous Vehicle Solutions market. The final analysis and interpretations were conducted by our team, which is proficient in utilizing modern digital communication tools for market analysis.

Frequently Asked Questions

01. How big is the Global Autonomous Vehicle Solution Market?

The Global Autonomous Vehicle Solution market, valued at USD 60 Bn in 2023, is driven by technological advancements, increased investment in autonomous technology, and the rising demand for safer and more efficient transportation solutions.

02. What are the challenges in the Global Autonomous Vehicle Solution Market?

Challenges in the Global Autonomous Vehicle Solution market include cybersecurity threats, regulatory hurdles, high development costs, and the complexity of integrating autonomous vehicles into existing transportation systems. Public trust and acceptance of autonomous driving technology also pose significant challenges.

03. Who are the major players in the Global Autonomous Vehicle Solution Market?

Key players in the Global Autonomous Vehicle Solution market include Waymo, Tesla, Inc., General Motors (Cruise), Ford Motor Company, and Uber Technologies. These companies lead due to their extensive research and development, innovative technologies, and strategic partnerships.

04. What are the growth drivers of the Global Autonomous Vehicle Solution Market?

The Global Autonomous Vehicle Solution market is propelled by factors such as technological advancements in AI and machine learning, government initiatives supporting autonomous vehicle development, increased consumer demand for safety and convenience, and the rise of smart city projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.