Global Baby Food Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD6039

November 2024

80

About the Report

Global Baby Food Market Overview

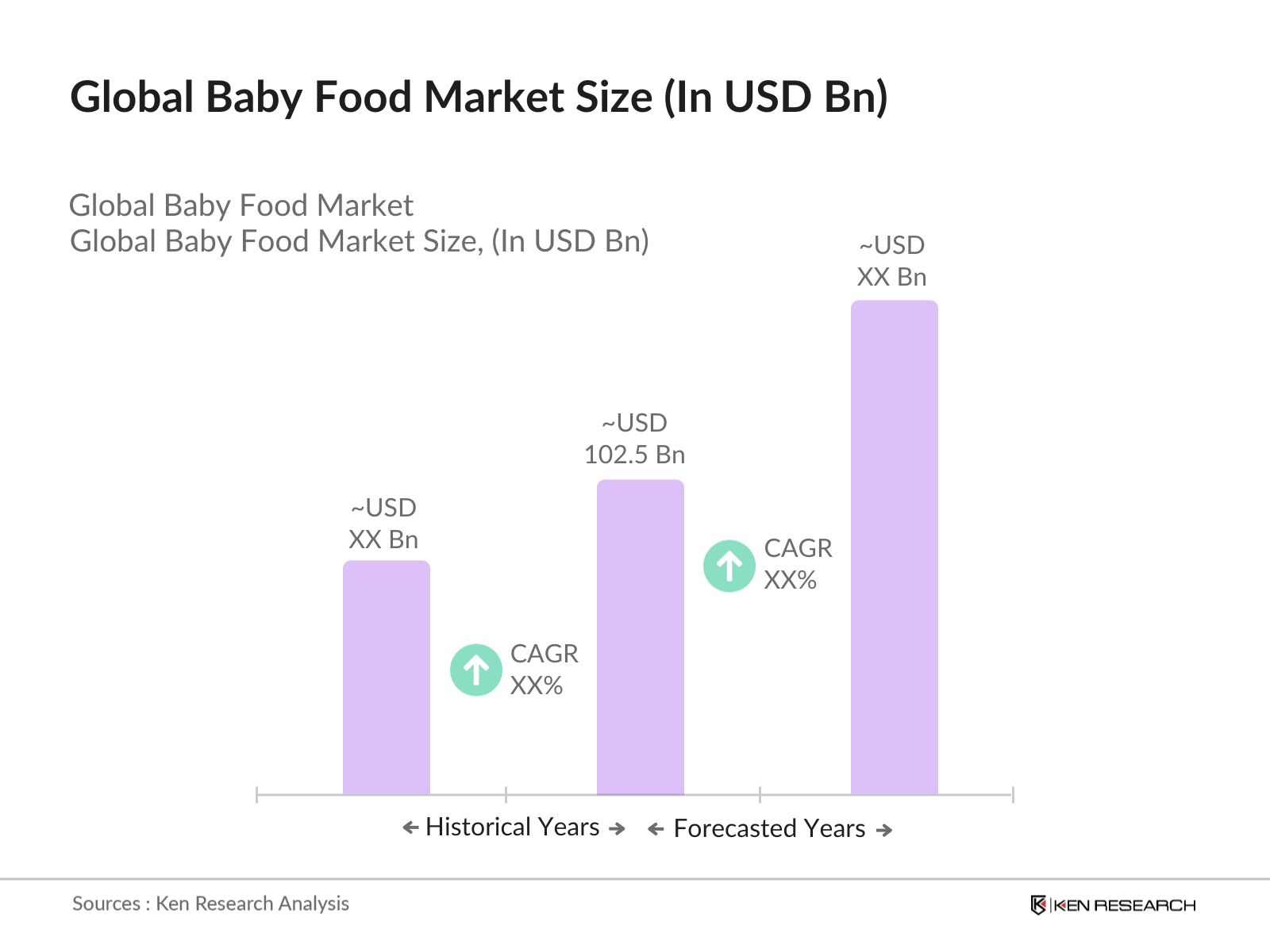

- The Global Baby Food market is valued at USD 102.5 billion based on a five-year historical analysis. This growth is largely driven by increased awareness about infant nutrition, rising disposable incomes, and urbanization. Parents are prioritizing convenience and nutrition, leading to a rise in demand for pre-packaged baby food products, including organic and non-GMO variants. Additionally, advancements in e-commerce and wider distribution channels have enhanced product accessibility globally, contributing to the markets expansion.

- Countries like the United States, China, and Germany dominate the global baby food market. The U.S. holds a significant position due to the high purchasing power of consumers and a well-established retail network. China is experiencing rapid growth due to its large population and the increasing adoption of premium baby food products by a growing middle class. Germany leads the European market due to its strong preference for organic and natural baby food products, along with strict regulatory standards that favor high-quality offerings.

- Organic and non-GMO certifications are becoming crucial for baby food brands to appeal to health-conscious parents. As of 2023, over 60 countries, including the United States, Germany, and Australia, have implemented organic certification standards for baby food products. These certifications ensure that baby food is free from synthetic pesticides, GMOs, and chemical additives. The USDA Organic seal in the United States and the European Organic certification are some of the most recognized certifications worldwide, providing reassurance to consumers about product quality.

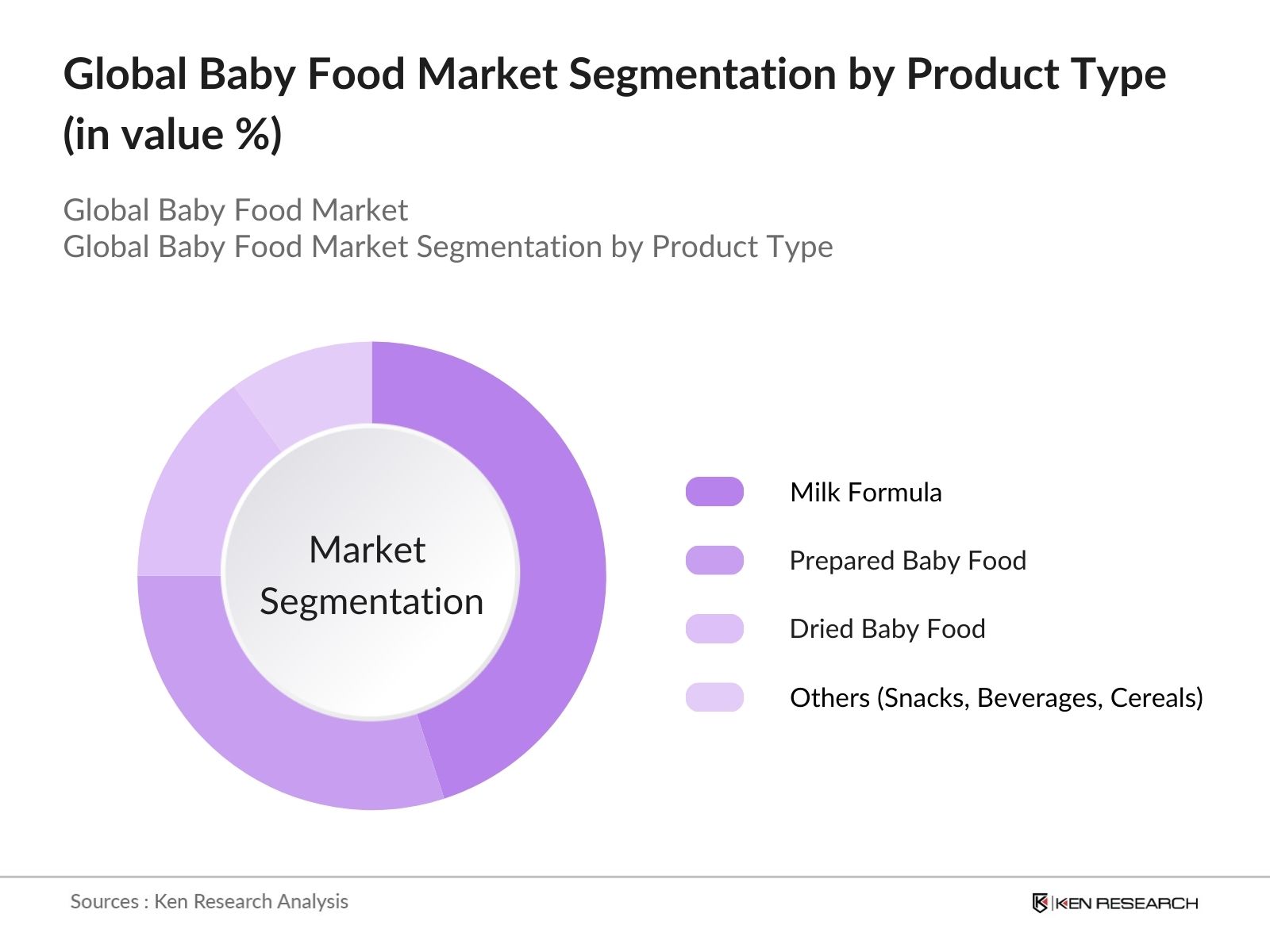

Global Baby Food Market Segmentation

- By Product Type: The Global Baby Food market is segmented by product type into milk formula, prepared baby food, dried baby food, and others (snacks, beverages, cereals). Recently, milk formula holds a dominant market share under the segmentation by product type. This dominance is driven by its high nutritional value and suitability for infants who are unable to breastfeed. Brands like Nestls NAN and Abbotts Similac have cemented their positions due to strong clinical backing and widespread consumer trust, making milk formula the preferred choice for parents seeking healthy infant nutrition alternatives.

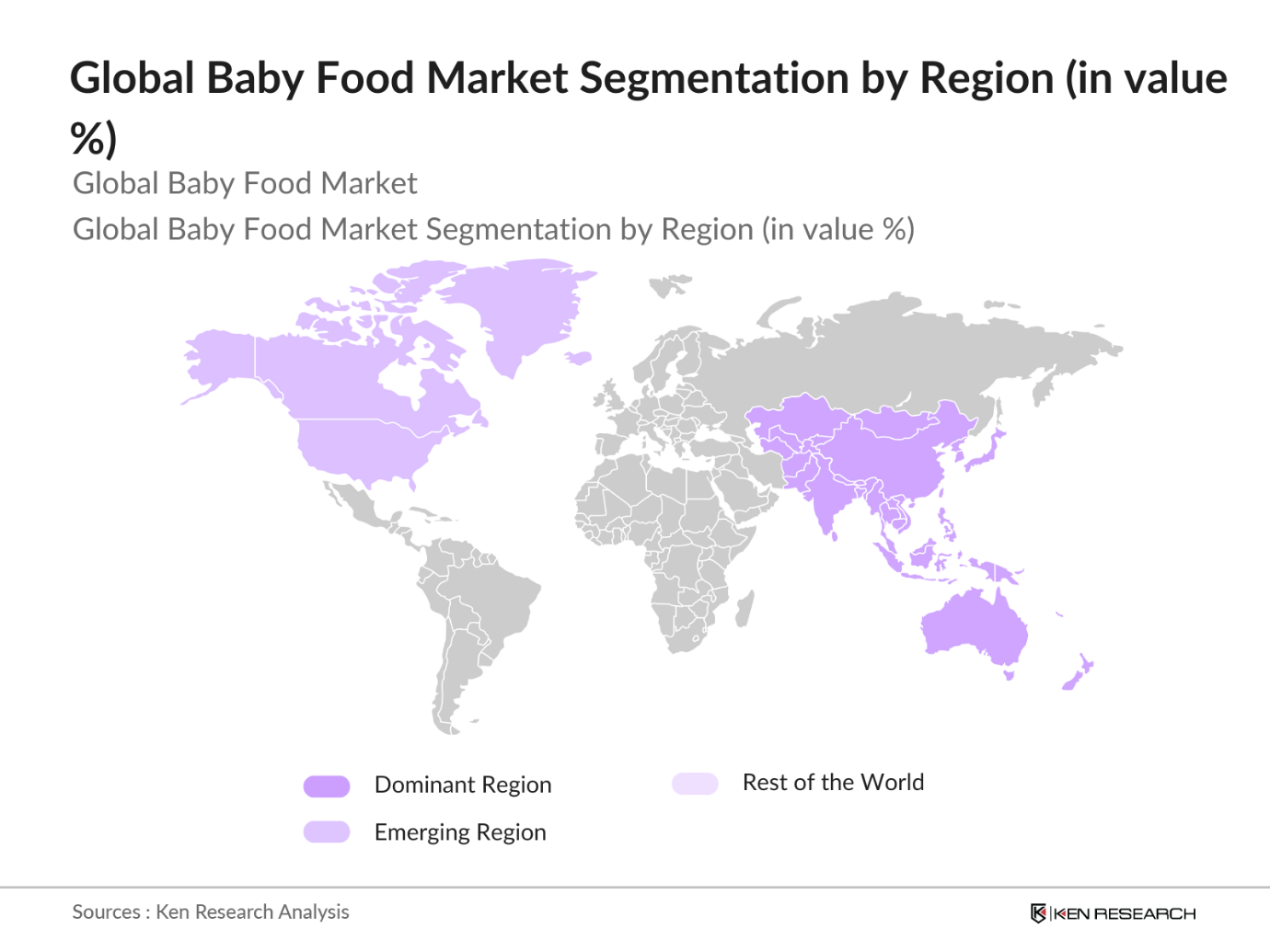

- By Region: The Global Baby Food market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific is currently leading the market due to rapid urbanization, population growth, and increasing disposable incomes in countries like China and India. The strong preference for premium products and the rise in e-commerce adoption have fueled the demand in this region. Moreover, government initiatives in promoting child health and nutrition are also supporting market growth in Asia-Pacific.

- By Age Group: The Global Baby Food market is segmented by age group into 0-6 months, 6-12 months, 12-24 months, and above 24 months. The 0-6 months age group is currently dominating the market. This is largely due to the critical nutritional requirements for newborns and the importance of early-stage dietary supplements such as infant formula and breast milk substitutes. The first six months of an infants life are crucial for development, and parents are increasingly relying on premium baby food products to ensure optimal growth during this phase.

Global Baby Food Market Competitive Landscape

The Global Baby Food market is characterized by a mix of multinational corporations and local companies, with key players focusing on innovation, product diversification, and geographic expansion. The competition is intense, especially in the milk formula and organic baby food segments. Major companies such as Nestl, Abbott, and Danone dominate the market, leveraging their global presence and well-established supply chains to capture significant market share.

|

Company |

Year Established |

Headquarters |

Product Range |

Number of Employees |

Revenue (USD Bn) |

Distribution Channels |

Organic Product Offerings |

Innovation Initiatives |

Sustainability Efforts |

|

Nestl S.A. |

1867 |

Switzerland |

- |

- |

- |

- |

- |

- |

- |

|

Abbott Laboratories |

1888 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Danone S.A. |

1919 |

France |

- |

- |

- |

- |

- |

- |

- |

|

Reckitt Benckiser Group |

1823 |

UK |

- |

- |

- |

- |

- |

- |

- |

|

The Kraft Heinz Company |

2015 |

USA |

- |

- |

- |

- |

- |

- |

- |

Global Baby Food Industry Analysis

Growth Drivers

- Increasing Birth Rates: The global birth rate has remained stable in certain regions, contributing to the demand for baby food. As of 2023, according to the United Nations, around 140 million babies are born annually, with high birth rates particularly in countries like India, where approximately 24 million births occur per year, and Nigeria, with 7.9 million births annually. This steady influx of newborns drives the need for baby nutrition products, as parents seek convenient and nutritious food options to meet the dietary needs of their infants.

- Rising Parental Concerns for Infant Nutrition: Growing awareness about infant nutrition has spurred demand for fortified and specialized baby foods. In 2023, UNICEF reported that malnutrition affects over 144 million children under the age of 5 globally, which has led to increased awareness about the importance of proper infant nutrition. Countries like Brazil and China are witnessing an increasing trend of parents opting for nutrient-enriched baby foods, especially those containing iron, calcium, and vitamins, to support healthy growth during early childhood. These concerns have amplified the demand for premium and nutritious baby food products.

- Urbanization and Lifestyle Changes: Rapid urbanization is transforming consumer habits, with more families opting for ready-made baby food due to busier lifestyles in urban areas. As of 2023, 56% of the worlds population resides in urban areas, as reported by the World Bank. In countries like China and India, urbanization has been especially significant, leading to higher baby food consumption in cities compared to rural areas. Urban parents prefer convenient baby food options that meet strict quality standards and save time, thereby driving the growth of the packaged baby food market.

Market Restraints

- Regulatory Compliance (Global and Regional Baby Food Regulations): Compliance with global and regional regulations poses challenges for baby food manufacturers. The World Health Organization (WHO) and local regulatory bodies enforce strict guidelines on infant nutrition products to ensure safety. In 2022, the FDA in the United States implemented tighter regulations on heavy metals in baby food, which affected production processes. Similarly, the European Unions regulatory framework, as outlined by EFSA, imposes stringent safety standards, requiring companies to undertake costly compliance testing and certification processes to enter the market.

- Competition from Homemade Food Solutions (Home-Based Food Trends for Infants): The growing trend of homemade baby food is impacting the packaged baby food market, especially in countries with cultural preferences for natural food preparation. A 2022 survey by the FAO indicated that in regions such as Sub-Saharan Africa and Southeast Asia, nearly 65% of parents still prefer homemade solutions due to cultural beliefs, affordability, and control over ingredients. This rising competition from home-based solutions presents a challenge for commercial baby food manufacturers in capturing rural markets, where homemade baby food remains dominant.

Global Baby Food Market Future Outlook

Over the next five years, the Global Baby Food market is expected to experience steady growth, driven by increasing consumer demand for organic, clean-label, and nutrient-dense products. The market will be supported by advancements in product development, such as plant-based baby foods and customized nutrition solutions, as well as expanding e-commerce channels. Moreover, government initiatives promoting child health and nutrition are anticipated to further propel market growth.

Market Opportunities

- Expansion into Emerging Markets (Baby Food Demand in Emerging Economies): Emerging markets present significant growth opportunities for baby food companies. According to the World Bank, regions like Sub-Saharan Africa and South Asia are witnessing a rise in disposable incomes, leading to higher expenditure on nutrition products. In India, where 27% of the population is under 14 years old as of 2023, demand for baby food is rising rapidly, particularly in urban centers. Similarly, African nations like Nigeria and Kenya are seeing growing demand for affordable baby food products as urbanization and income levels increase.

- Technological Advancements in Product Formulation (Innovations in Baby Food Production): Innovations in baby food formulation are creating new opportunities for growth. As of 2023, research into probiotics and prebiotics for infant gut health is becoming a key focus. The use of advanced processing techniques like cold pasteurization has gained traction, as it preserves nutrients better than traditional methods. In the United States, 2023 saw a 7% increase in patents related to baby food formulations that include bioactive compounds and organic ingredients, indicating a growing focus on health-driven product innovation.

Scope of the Report

|

By Product Type |

Milk Formula Prepared Baby Food Dried Baby Food Others (Snacks, Beverages, Cereals) |

|

By Age Group |

0-6 Months 6-12 Months 12-24 Months Above 24 Months |

|

By Distribution Channel |

Supermarkets and Hypermarkets Pharmacies and Drug Stores Online Channels Specialty Stores |

|

By Nature |

Organic Baby Food Non-Organic Baby Food |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Infant Formula Manufacturers

Baby Food Retailers and Distributors

Government and Regulatory Bodies (FDA, EFSA)

Organic Product Certifiers

Investors and Venture Capitalist Firms

E-commerce Platforms and Marketplaces

Packaging Solution Providers

Pediatric Nutrition Specialists

Companies

Players Mentioned in the Report:

Nestl S.A.

Abbott Laboratories

Danone S.A.

Reckitt Benckiser Group Plc

The Kraft Heinz Company

Perrigo Company Plc

Hero Group

Campbell Soup Company

FrieslandCampina

Mead Johnson & Company, LLC

Bellamys Organic Pty Ltd

Hain Celestial Group

Arla Foods Amba

Ellas Kitchen Group Ltd

Hipp GmbH & Co. Vertrieb KG

Table of Contents

1. Global Baby Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Baby Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Baby Food Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Birth Rates (Global Birth Rate Statistics)

3.1.2. Rising Parental Concerns for Infant Nutrition (Parental Buying Trends, Nutritional Awareness)

3.1.3. Urbanization and Lifestyle Changes (Urban vs Rural Baby Food Consumption)

3.1.4. Growth of E-commerce and Online Distribution (E-commerce Sales Metrics for Baby Food)

3.2. Market Challenges

3.2.1. High Production and R&D Costs (Cost Analysis of Baby Food Manufacturing)

3.2.2. Regulatory Compliance (Global and Regional Baby Food Regulations)

3.2.3. Competition from Homemade Food Solutions (Home-Based Food Trends for Infants)

3.3. Opportunities

3.3.1. Expansion into Emerging Markets (Baby Food Demand in Emerging Economies)

3.3.2. Technological Advancements in Product Formulation (Innovations in Baby Food Production)

3.3.3. Growing Focus on Organic and Clean Label Products (Growth in Organic Baby Food Segment)

3.4. Trends

3.4.1. Increasing Demand for Plant-Based Baby Food (Growth Rate of Plant-Based Baby Foods)

3.4.2. Customization and Personalized Baby Nutrition (Consumer Demand for Custom Baby Foods)

3.4.3. Packaging Innovations (Sustainability in Baby Food Packaging Solutions)

3.5. Regulatory Landscape

3.5.1. FDA Regulations for Infant Formula and Baby Food (US Baby Food Safety Guidelines)

3.5.2. European Unions Baby Food Compliance Standards (EU Regulations and Safety Protocols)

3.5.3. Global Certifications for Organic and Non-GMO Baby Food (Certification Protocols in Baby Food Industry)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Baby Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Milk Formula

4.1.2. Prepared Baby Food

4.1.3. Dried Baby Food

4.1.4. Others (Snacks, Beverages, Cereals)

4.2. By Age Group (In Value %)

4.2.1. 0-6 Months

4.2.2. 6-12 Months

4.2.3. 12-24 Months

4.2.4. Above 24 Months

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Pharmacies and Drug Stores

4.3.3. Online Channels

4.3.4. Specialty Stores

4.4. By Nature (In Value %)

4.4.1. Organic Baby Food

4.4.2. Non-Organic Baby Food

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Baby Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nestl S.A.

5.1.2. Abbott Laboratories

5.1.3. Danone S.A.

5.1.4. Reckitt Benckiser Group Plc

5.1.5. The Kraft Heinz Company

5.1.6. Perrigo Company Plc

5.1.7. Hero Group

5.1.8. Campbell Soup Company

5.1.9. FrieslandCampina

5.1.10. Mead Johnson & Company, LLC

5.1.11. Bellamys Organic Pty Ltd

5.1.12. Hain Celestial Group

5.1.13. Arla Foods Amba

5.1.14. Ellas Kitchen Group Ltd

5.1.15. Hipp GmbH & Co. Vertrieb KG

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Distribution Channels, Product Diversification, Sustainability Efforts, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Baby Food Market Regulatory Framework

6.1. Nutritional Standards and Labeling Requirements

6.2. Compliance with Global Food Safety Regulations

6.3. Organic Certification and Non-GMO Standards

7. Global Baby Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Baby Food Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Age Group (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Nature (In Value %)

8.5. By Region (In Value %)

9. Global Baby Food Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves creating a comprehensive overview of the Global Baby Food Market ecosystem, covering key stakeholders such as manufacturers, retailers, and regulatory bodies. Secondary research is conducted using proprietary databases and credible industry reports to identify market trends, growth drivers, and key variables.

Step 2: Market Analysis and Construction

Historical data related to market size, product segmentation, and geographical expansion is analyzed to assess market penetration. Revenue generation data is also compiled to ensure accuracy, and insights into production and distribution channels are gathered to evaluate market structure.

Step 3: Hypothesis Validation and Expert Consultation

In this stage, market hypotheses are formulated and validated through consultations with industry experts and key players. This is achieved via computer-assisted telephone interviews (CATIs), providing firsthand insights into market trends and competitive strategies.

Step 4: Research Synthesis and Final Output

This final step involves synthesizing data collected from various stakeholders to develop a well-rounded market analysis. This includes detailed insights into consumer behavior, market dynamics, and future projections. Validation is ensured through cross-referencing with industry standards and expert opinions.

Frequently Asked Questions

1. How big is the Global Baby Food Market?

The global baby food market was valued at USD 102.5 billion, driven by increasing demand for infant nutrition, growing awareness about baby health, and expansion of e-commerce distribution.

2. What are the challenges in the Global Baby Food Market?

Challenges include high production costs, stringent regulatory frameworks, and growing competition from homemade and organic baby food alternatives, making it difficult for smaller players to sustain market share.

3. Who are the major players in the Global Baby Food Market?

Key players include Nestl, Abbott Laboratories, Danone, Reckitt Benckiser, and The Kraft Heinz Company. These companies lead the market due to their strong brand recognition, extensive distribution networks, and continuous product innovations.

4. What are the growth drivers of the Global Baby Food Market?

The market is driven by rising urbanization, increasing parental focus on nutrition, growth of e-commerce, and a shift towards organic and clean-label products. Technological innovations in packaging and product formulation are also contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.