Global Bamboo Clothing Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD4454

October 2024

95

About the Report

Global Bamboo Clothing Market Overview

- The global bamboo clothing market is valued at USD 1.83 billion, based on a five-year historical analysis. The increasing demand for eco-friendly and sustainable apparel is a primary driver of this market, with bamboo being recognized for its renewable nature, soft texture, and environmental benefits. Major brands have integrated bamboo clothing into their portfolios, driven by consumer awareness of environmental sustainability and the rising preference for natural fabrics over synthetics.

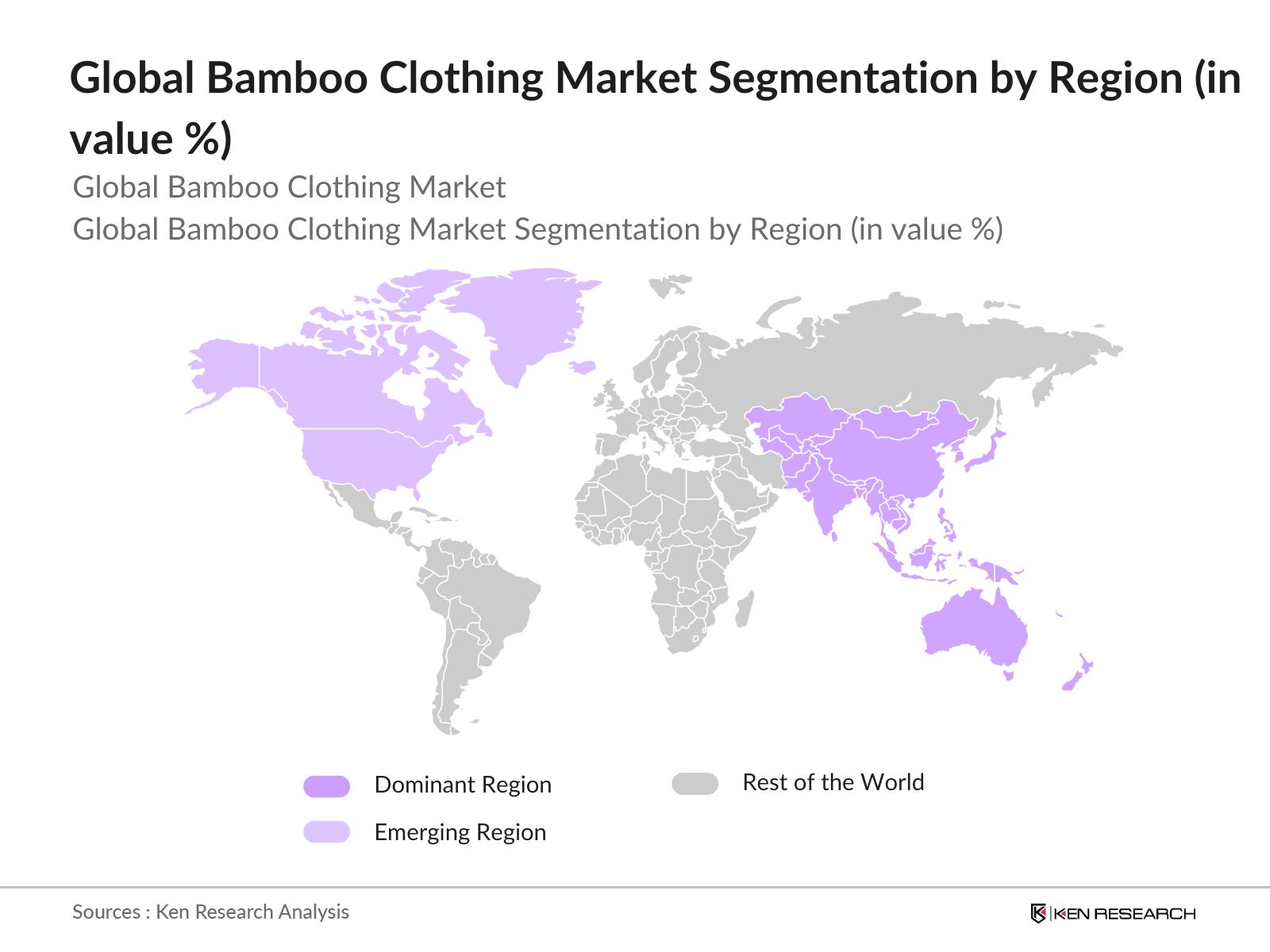

- Countries like China, India, and the United States dominate the market due to several factors. China leads due to its vast bamboo forests and well-established textile manufacturing infrastructure, while India benefits from abundant raw materials and growing demand for sustainable fashion. In the United States, the market is driven by strong consumer awareness regarding eco-friendly fashion and ethical production methods.

- TheNational Bamboo Mission (NBM), aims to enhance bamboo cultivation across India. The initiative targets an increase of1 lakh hectaresunder bamboo plantations, promoting sustainable livelihoods and reducing dependency on imports. It operates in24 states, connecting farmers to markets and fostering rural development.

Global Bamboo Clothing Market Segmentation

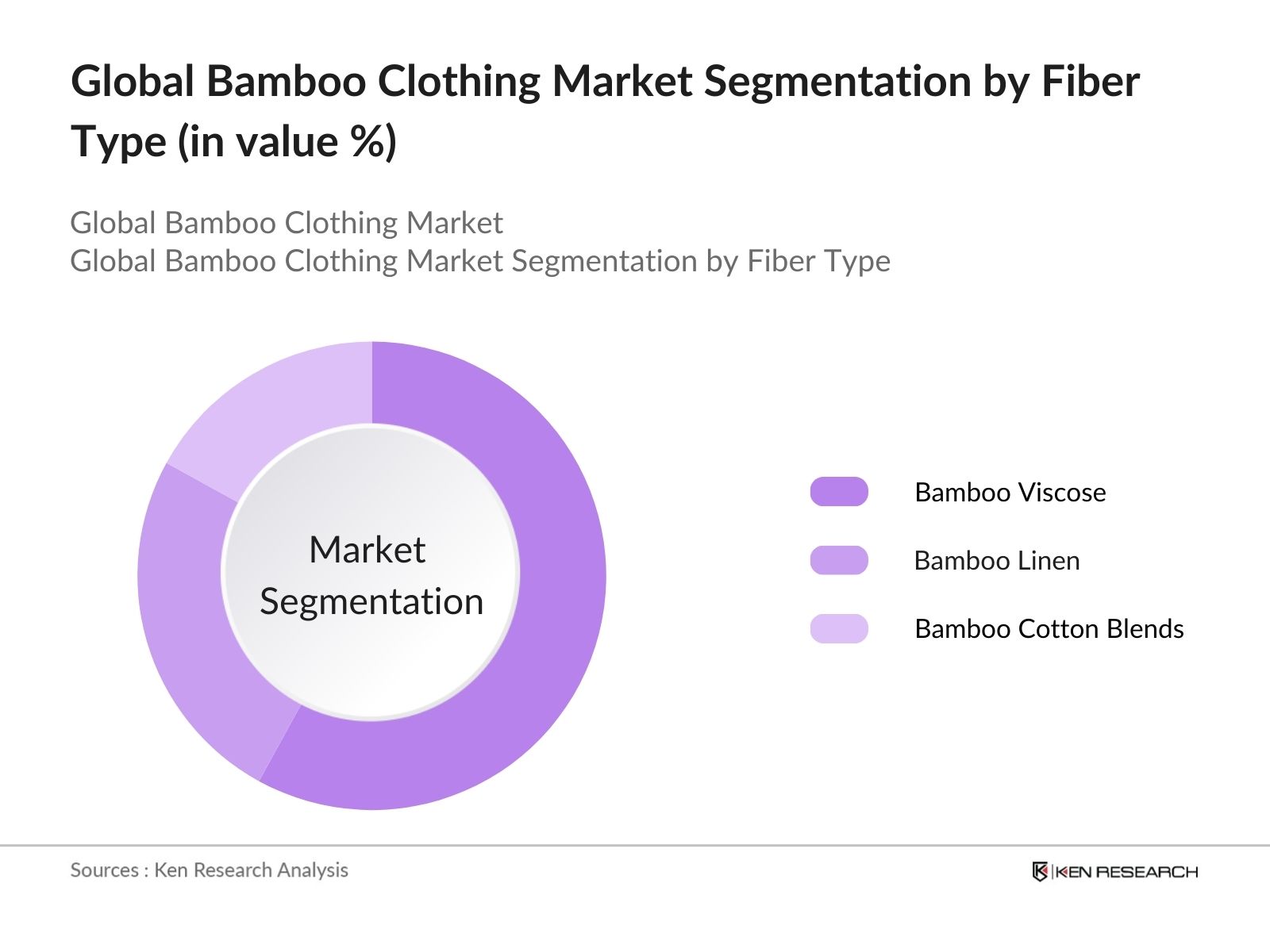

By Fiber Type: The market is segmented by fiber type into bamboo viscose, bamboo linen, and bamboo cotton blends. Bamboo viscose dominates the market, this is due to its superior softness, breathability, and moisture-wicking properties, which have gained significant traction among consumers seeking comfortable and sustainable clothing options. The ease of processing bamboo into viscose also allows for mass production, contributing to its market dominance.

By Application: The market is segmented by application into casual wear, activewear, sleepwear, and underwear. Casual wear holds the largest market share due to its broad appeal across various demographics and the versatility of bamboo fabric for everyday use. The growing popularity of sustainable fashion among consumers in casual settings drives this segment, with an increasing number of brands offering bamboo-based T-shirts, dresses, and other casual items.

By Region: The market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific is the dominant region, driven by the large-scale availability of bamboo and well-established manufacturing hubs in China and India. The rising demand for sustainable clothing in these countries, coupled with strong textile infrastructure, supports the regions dominance.

Global Bamboo Clothing Market Competitive Landscape

The market is dominated by a mix of global and local players, each focusing on sustainable clothing solutions. These companies are leveraging advancements in fabric technology, increasing awareness around ethical fashion, and robust distribution networks to maintain their market positions.

|

Company |

Establishment Year |

Headquarters |

Market Penetration |

Revenue (USD Bn) |

Product Diversification |

Sustainability Initiatives |

Key Product Segment |

|

Boody |

2011 |

Sydney, Australia |

|||||

|

Thought Clothing |

1995 |

London, UK |

|||||

|

BAM Clothing |

2006 |

Plymouth, UK |

|||||

|

Cariloha |

2007 |

Utah, USA |

|||||

|

Tasc Performance |

2009 |

New Orleans, USA |

Global Bamboo Clothing Market Analysis

Market growth Drivers

- Rising Environmental Concerns and Sustainability Initiatives: With over 4 billion metric tons of CO2 emissions being generated globally from the textile industry each year (UN Environment Programme), bamboo clothing is emerging as a sustainable alternative. Bamboo's natural properties such as biodegradability and lower water consumption make it an ideal solution. Nations like Germany and Japan are advocating for more eco-friendly textile production, which includes bamboo, through sustainable fashion mandates.

- Shift Toward Circular Fashion Models: The fashion industry is moving towards circular models, where materials are reused or recycled. Bamboo clothing fits perfectly into this model due to its biodegradability. As per the Ellen MacArthur Foundation, global corporations like H&M and Zara are now integrating bamboo into their supply chains, utilizing the natural fibers to create more sustainable clothing lines.

- Increased Consumer Preference for Ethical Clothing: According to the Global Consumer Trends Report, more than 600 million consumers globally prefer buying ethically sourced products, including bamboo clothing. Ethical sourcing, combined with eco-friendly production, makes bamboo clothing appealing to this large consumer segment. Countries like the U.K. and Australia have reported an increase in consumer spending on sustainable fashion by $2 billion in 2024.

Market Challenges

- Limited Processing Infrastructure: One of the main challenges in the bamboo clothing market is the limited infrastructure for processing bamboo fibers. Only 15% of textile factories globally have the necessary technology to process bamboo fibers, as reported by the International Labor Organization. Countries like Bangladesh, Vietnam, and Cambodia, which are textile manufacturing hubs, lack sufficient facilities for bamboo processing, which hampers the scalability of bamboo clothing.

- Lack of Supply Chain Integration: The lack of an integrated supply chain for bamboo clothing affects its global scalability. Bamboo textiles often require multiple stages of processing from harvesting to fiber treatment which are often disjointed and located in different countries. This increases transportation and processing costs by around $3-5 per kilogram of bamboo textile, as reported by the International Trade Centre. Addressing supply chain gaps remains a challenge for manufacturers seeking to reduce production costs and improve market reach.

Global Bamboo Clothing Market Future Outlook

Over the next five years, the global bamboo clothing industry is expected to experience growth, driven by the increasing demand for sustainable fashion, eco-friendly materials, and ethical production processes. As consumers grow more conscious of the environmental impact of their clothing choices, the bamboo clothing market is poised to benefit from this shift in preferences.

Future Market Opportunities

- Increased Adoption of Bamboo in Luxury Fashion: Over the next five years, luxury fashion brands like Gucci and Prada are expected to incorporate bamboo textiles into their collections. As sustainability becomes a key focus for the luxury market, bamboos soft texture and eco-friendly attributes will align with consumer demand for sustainable luxury products. By 2028, the luxury fashion sector is projected to use 10,000 metric tons of bamboo annually, driven by increasing demand from eco-conscious affluent consumers.

- Technological Advancements in Bamboo Fiber Processing: Advances in eco-friendly bamboo fiber processing technology are expected to reduce the environmental impact of bamboo textile production over the next five years. Companies are investing in enzyme-based processing methods, which will decrease water and chemical usage in fiber treatment by 20%. As these technologies are adopted globally, bamboo textile production will become more sustainable, lowering environmental risks.

Scope of the Report

|

By Fiber Type |

Bamboo Viscose Bamboo Linen Bamboo Cotton Blends |

|

By End-User |

Men Women Kids |

|

By Distribution Channel |

Online Retail Specialty Stores Supermarkets/Hypermarkets Direct Sales |

|

By Application |

Casual Wear Activewear Sleepwear Underwear |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Bamboo Fiber Producers

Textile Manufacturers

Sustainable Fashion Brands

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Environmental Protection Agency, U.S. Department of Agriculture)

E-Commerce Companies

Banks and Financial Institutions

Companies

Players Mentioned in the Report:

Boody

Thought Clothing

BAM Clothing

Ettitude

Cariloha

Tasc Performance

Cozy Earth

Free Fly Apparel

PandaSilk

Spun Bamboo

Green Apple Active

Yala Designs

Latuza

MeUndies

Bamboo Tribe

Table of Contents

1. Global Bamboo Clothing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Growth Rate of Eco-Friendly Fashion, Ethical Clothing)

1.4. Market Segmentation Overview (By Fiber Type, By End-User, By Distribution Channel, By Region, By Application)

2. Global Bamboo Clothing Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Sustainable Fashion Initiatives, Textile Innovation)

3. Global Bamboo Clothing Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Demand for Sustainable Fashion

3.1.2. Regulatory Support for Eco-Friendly Textiles

3.1.3. Advancements in Bamboo Fiber Processing Technology

3.1.4. Rising Awareness of Carbon Footprint Reduction

3.2. Market Challenges

3.2.1. High Production Costs (Eco-Friendly Clothing Production Cost vs. Traditional Clothing)

3.2.2. Limited Raw Material Availability

3.2.3. Supply Chain Complexities

3.3. Opportunities

3.3.1. Expansion of Sustainable Brands (Rise of Eco-Friendly Brands Globally)

3.3.2. Increasing Adoption of Ethical Manufacturing

3.3.3. Growth in Online Retail of Eco-Friendly Apparel

3.4. Trends

3.4.1. Rise of Circular Fashion Models

3.4.2. Use of Sustainable Blended Fabrics

3.4.3. Growth in Vegan and Cruelty-Free Clothing Demand

3.5. Government Regulations

3.5.1. Textile Sustainability Standards

3.5.2. National Eco-Friendly Certifications

3.5.3. Import/Export Policies for Bamboo Products

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Supply Chain Overview: Farmers, Manufacturers, Retailers)

3.8. Porters Five Forces

3.9. Competitive Landscape Analysis (Detailed Company Profiling)

4. Market Segmentation

4.1. By Fiber Type (In Value %)

4.1.1. Bamboo Viscose

4.1.2. Bamboo Linen

4.1.3. Bamboo Cotton Blends

4.2. By End-User (In Value %)

4.2.1. Men

4.2.2. Women

4.2.3. Kids

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Specialty Stores

4.3.3. Supermarkets/Hypermarkets

4.3.4. Direct Sales

4.4. By Application (In Value %)

4.4.1. Casual Wear

4.4.2. Activewear

4.4.3. Sleepwear

4.4.4. Underwear

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Bamboo Clothing Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Boody

5.1.2. Thought Clothing

5.1.3. BAM Clothing

5.1.4. Ettitude

5.1.5. Cariloha

5.1.6. Tasc Performance

5.1.7. Cozy Earth

5.1.8. Free Fly Apparel

5.1.9. PandaSilk

5.1.10. Spun Bamboo

5.1.11. Green Apple Active

5.1.12. Yala Designs

5.1.13. Latuza

5.1.14. MeUndies

5.1.15. Bamboo Tribe

5.2 Cross Comparison Parameters (Fiber Innovation, Production Capacity, Global Reach, Sustainability Metrics, Distribution Network, Eco-Certifications, Consumer Engagement, Social Responsibility Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Sustainability Goals, Carbon-Neutral Targets)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Bamboo Clothing Market Regulatory Framework

6.1. Sustainable Apparel Standards

6.2. Fiber Content Labeling Compliance

6.3. Fair Trade and Ethical Certifications

6.4. Environmental Laws Related to Bamboo Farming

7. Global Bamboo Clothing Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Green Consumerism, Ethical Fashion Movement)

8. Global Bamboo Clothing Market Future Market Segmentation

8.1. By Fiber Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Global Bamboo Clothing Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Persona and Cohort Analysis

9.3. Marketing Strategies for Sustainable Fashion

9.4. White Space Opportunity Analysis (Emerging Markets, New Fiber Technologies)

Research Methodology

Step 1: Identification of Key Variables

The first phase involved mapping out all relevant stakeholders in the global bamboo clothing market. Extensive desk research was conducted using a combination of secondary data and proprietary databases to capture the dynamics and influencers of the market.

Step 2: Market Analysis and Construction

In this step, historical data for the bamboo clothing market was analyzed, with a focus on market penetration, revenue streams, and production capacities. We also assessed market trends, consumer demand, and pricing structures.

Step 3: Hypothesis Validation and Expert Consultation

Following the data collection, hypotheses were developed and validated through consultations with industry experts. This included interviews with bamboo fiber manufacturers, textile producers, and fashion retailers to obtain insights and verify the data.

Step 4: Research Synthesis and Final Output

The final phase of the research involved the synthesis of insights from primary and secondary sources. This information was then validated to ensure a comprehensive understanding of the bamboo clothing market, including future growth potential and key drivers.

Frequently Asked Questions

01 How big is the Global Bamboo Clothing Market?

The global bamboo clothing market is valued at USD 1.83 billion, driven by the increasing demand for eco-friendly and sustainable fashion alternatives.

02 What are the challenges in the Global Bamboo Clothing Market?

Challenges in the global bamboo clothing market include the high cost of bamboo fabric production, supply chain complexities, and limited availability of high-quality raw bamboo in some regions.

03 Who are the major players in the Global Bamboo Clothing Market?

Key players in the global bamboo clothing market include Boody, Thought Clothing, BAM Clothing, Ettitude, and Cariloha, all of which are recognized for their sustainability initiatives and product innovations.

04 What are the growth drivers of the Global Bamboo Clothing Market?

The growth in the global bamboo clothing market is driven by increasing consumer awareness of sustainability, advancements in bamboo textile technology, and government support for eco-friendly practices in the fashion industry.

05 What regions dominate the Global Bamboo Clothing Market?

The Asia-Pacific region dominates the global bamboo clothing market due to its vast bamboo cultivation and manufacturing capacity, followed by North America and Europe, where sustainable fashion trends are on the rise.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.