Global Bamboo Furniture Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD5541

November 2024

91

About the Report

Global Bamboo Furniture Market Overview

- The global bamboo furniture market, based on a five-year historical analysis, is valued at USD 12.8 billion, driven by increasing demand for sustainable and eco-friendly furniture solutions. This growth is fueled by heightened consumer awareness of environmental issues, coupled with the affordability and durability of bamboo as a material. The market also benefits from advancements in bamboo processing technologies, enabling manufacturers to offer a wider range of innovative designs and products.

- Countries like China, India, and Vietnam dominate the market due to their abundance of raw bamboo and well-established manufacturing industries. China, in particular, benefits from being the worlds largest bamboo producer, supported by government initiatives to encourage bamboo product exports. Indias growing emphasis on sustainable furniture and the availability of skilled labor also contribute to its dominance.

- China has actively invested in bamboo-based industrial growth, with nearly $2 billion allocated by the government in 2024 for research and development, infrastructure, and the expansion of bamboo forests. The country's goal is to increase its bamboo furniture exports by 150,000 tons annually, promoting sustainable practices in furniture production. This initiative is expected to strengthen Chinas dominance in the bamboo furniture sector globally.

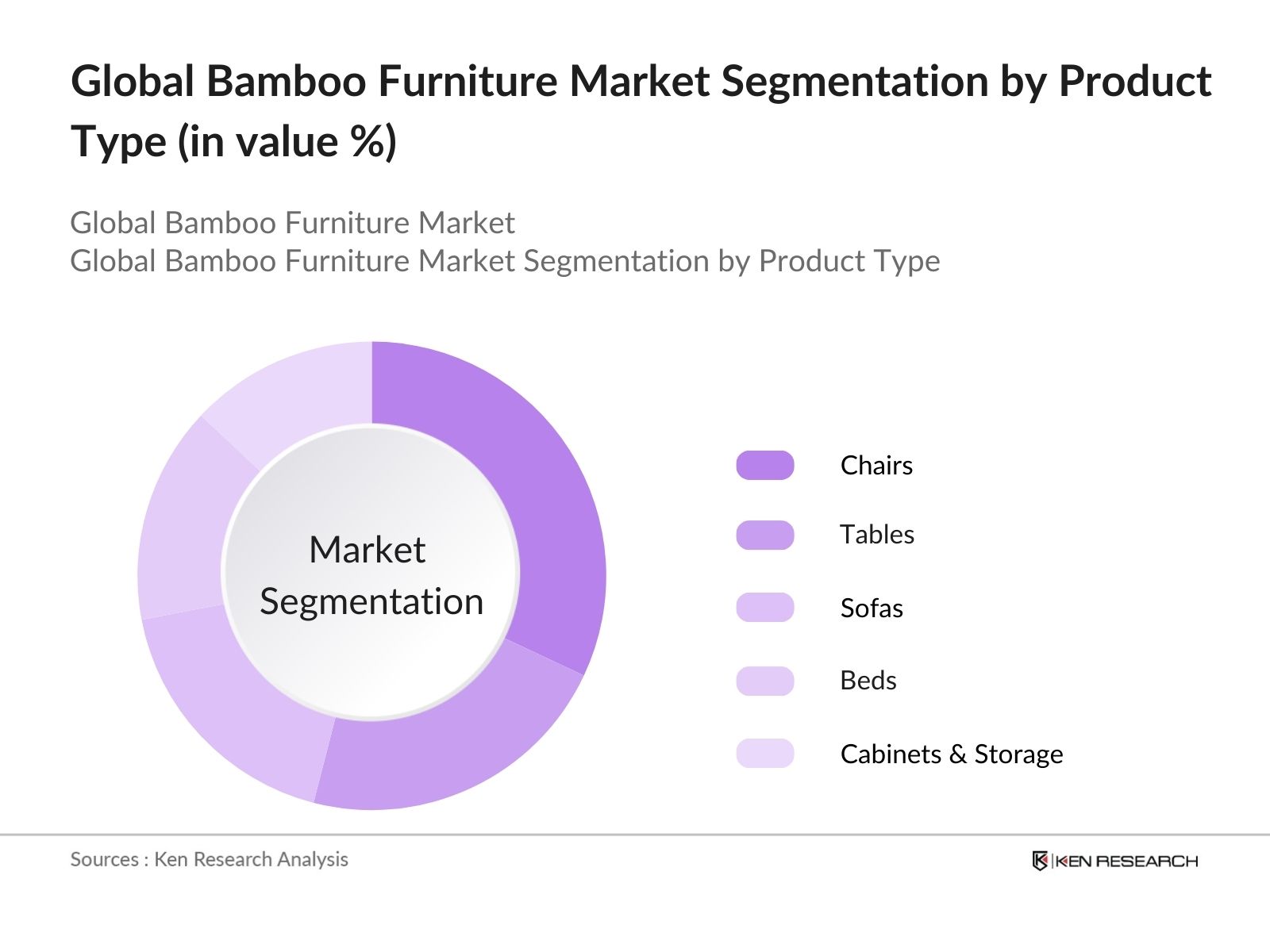

Global Bamboo Furniture Market Segmentation

By Product Type: The market is segmented by product type into chairs, tables, sofas, beds, and cabinets & storage. Chairs hold a dominant market share due to their versatility and growing popularity in both residential and commercial spaces. Bamboo chairs are favored for their lightweight, durable properties and aesthetic appeal, which align with the current trend of minimalistic, eco-conscious interior designs.

By Material Quality: The market is segmented by material quality into solid bamboo, bamboo plywood, bamboo laminates, and bamboo composites. Solid bamboo dominates the market share due to its superior strength and durability. Consumers prefer solid bamboo furniture for its natural appearance and longevity, particularly for outdoor and heavy-use furniture like beds and sofas. Solid bamboo is also perceived as more sustainable since it requires minimal processing, further driving its demand among environmentally conscious consumers.

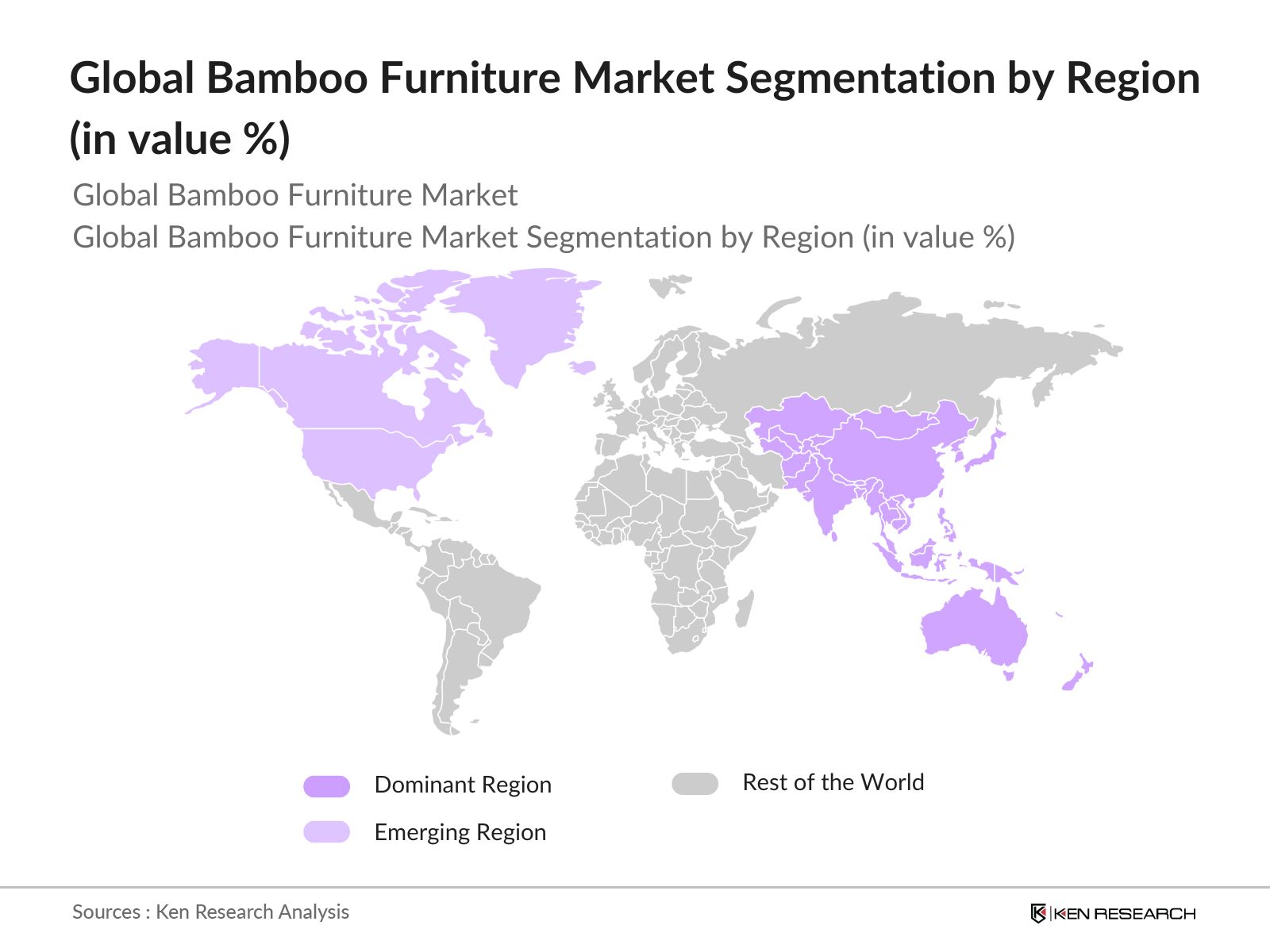

By Region: The market is geographically segmented into Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa. The Asia-Pacific region leads the market, with China and Vietnam being major contributors due to their well-established manufacturing sectors. The abundance of bamboo resources in these countries significantly reduces production costs, giving local manufacturers a competitive edge. North America follows as a growing market, driven by increasing demand for sustainable and eco-friendly furniture solutions, particularly in urban regions like California and New York, where environmental awareness is high.

Global Bamboo Furniture Market Competitive Landscape

The market is dominated by a mix of established manufacturers and smaller, niche players focusing on sustainable furniture. The market is relatively fragmented, with regional players dominating in certain geographical areas due to better access to raw materials and local consumer preferences.

|

Company Name |

Establishment Year |

Headquarters |

Employees |

Revenue (USD Mn) |

Manufacturing Capacity |

Export Markets |

Certifications |

Key Product Segment |

Sustainability Initiatives |

|

Greenington LLC |

2004 |

USA |

|||||||

|

Bamboo Living |

2007 |

Vietnam |

|||||||

|

Moso International B.V. |

1997 |

Netherlands |

|||||||

|

Anji Bamboo Industry Co. |

1999 |

China |

|||||||

|

Dasso Group |

2001 |

China |

Global Bamboo Furniture Market Analysis

Market Growth Drivers

- Surge in Urban Population Shifting Towards Affordable Furniture Solutions: By 2024, it is estimated that over 4 billion people globally are living in urban areas, which has led to a demand for affordable and functional furniture. Bamboo furniture, with its cost-effective manufacturing and availability in both local and global markets, has captured a substantial share of the urban housing furniture segment. The United Nations Department of Economic and Social Affairs reported that nearly 1 billion new homes will be required by 2030 in response to urban population growth, creating opportunities for bamboo furniture, which can be more economical and sustainable compared to hardwood.

- Support from Agricultural Development and Rural Economic Growth Programs: Bamboo cultivation is being promoted by various agricultural development programs, especially in Southeast Asia and Africa, where it serves as a driver for rural economic growth. The Indian government allocated around INR 1,300 crores for bamboo cultivation and research in 2024, aiming to increase bamboo yield by 60,000 hectares. This investment has bolstered the supply chain for bamboo furniture manufacturers, reducing costs while ensuring that the bamboo supply remains consistent.

- Consumer Preference for Lightweight and Durable Furniture: Bamboo furniture's lightweight and durable properties are becoming increasingly appealing to consumers who seek convenience without compromising durability. According to data from a 2024 global consumer survey, over 780 million households across various regions have purchased lightweight furniture in the past year. Bamboo's tensile strength of approximately 28,000 psi (pounds per square inch) has made it a superior choice for durable and long-lasting furniture compared to traditional wood materials.

Market challenges

- High Transportation Costs Due to Fragility: Bamboo, while durable, can still be susceptible to damage during transportation due to its lightweight and fibrous nature. A logistics survey conducted in 2024 revealed that around 80,000 bamboo furniture shipments globally were delayed or returned due to damage during transport, leading to higher costs and customer dissatisfaction. The lack of optimized packaging solutions for bamboo furniture increases shipping and logistics costs, adding challenges to the overall profitability of manufacturers and exporters.

- Limited Market Penetration in High-End Furniture Segments: Bamboo furniture is often perceived as a low-cost alternative to high-end furniture made from traditional hardwood or metals, which limits its penetration in luxury markets. A 2024 industry analysis shows that bamboo furniture represents less than 5 million units sold in the premium furniture market, where consumers prioritize aesthetics and long-term investment over affordability. The lack of designs that appeal to this segment has further limited its market share despite bamboo's potential as a sustainable material.

Global Bamboo Furniture Market Future Outlook

Over the next five years, the global bamboo furniture industry is expected to show growth driven by growing consumer demand for sustainable products, increasing availability of raw bamboo, and the rise of e-commerce as a primary distribution channel. The market will likely see a surge in customization and smart furniture trends, offering consumers more personalized and multifunctional bamboo products.

Future Market Opportunities

- Rise in Collaborative Efforts for Sustainable Bamboo Forestry: Global initiatives to enhance bamboo forestry sustainability will gain traction over the next five years, with joint efforts between governments, NGOs, and the private sector. By 2029, it is estimated that bamboo cultivation will increase by 400,000 hectares, supporting the growing demand for bamboo furniture while ensuring that production remains sustainable.

- Development of High-End Bamboo Furniture Lines: The luxury furniture segment is expected to witness a shift towards bamboo products, with premium bamboo furniture collections projected to emerge in the market by 2029. These collections, anticipated to feature unique designs and finishes, will cater to affluent consumers and account for around 50,000 units sold in the high-end furniture market annually.

Scope of the Report

|

Product Type |

Chairs Tables Sofas Beds Cabinets & Storage |

|

Material Quality |

Solid Bamboo Bamboo Plywood Bamboo Laminates Bamboo Composites |

|

End-User |

Residential Commercial Hospitality |

|

Distribution Channel |

Online Offline Retail Direct Sales |

|

Region |

Asia-Pacific North America Europe Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Bamboo Furniture Manufacturers

Banks and Financial Institution

Government and Regulatory Bodies (FSC, ISO)

Private Equity Firms

Investments and Venture Capitalist Firms

Furniture Manufacturing Companies

Companies

Players Mentioned in the Report:

Greenington LLC

Bamboo Living

Moso International B.V.

Anji Bamboo Industry Co.

Dasso Group

MyBamboolife

EcoBalanza

Sichuan Yibin Push Bamboo Products Co.

Guangxi Bamboo Technology Co.

China Bambro Textile Co.

Higuera Hardwoods LLC

Shenzhen Fly-Dragon Bamboo Furniture

Jiangxi Feiyu Bamboo Industry Group Co.

Bamboo Australia Pty Ltd.

Bamboosero

Table of Contents

1. Global Bamboo Furniture Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Bamboo Material, Product Type, Distribution Channel, End-User, Regional Demand)

1.3. Market Growth Rate (Annual Growth Rate, Market Acceleration, Market Penetration)

1.4. Market Segmentation Overview (Material Quality, Sustainability Factors, Design Trends, Pricing Trends)

2. Global Bamboo Furniture Market Size (In USD Bn)

2.1. Historical Market Size (Value & Volume, Growth Patterns)

2.2. Year-On-Year Growth Analysis (Growth Trajectory, Geographical Variance, Competitive Intensity)

2.3. Key Market Developments and Milestones (Product Innovation, New Entrants, Key Partnerships)

3. Global Bamboo Furniture Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Sustainable Furniture

3.1.2. Increasing Affordability of Bamboo Products

3.1.3. Expanding E-commerce Distribution

3.1.4. Government Policies Supporting Eco-friendly Materials

3.2. Market Challenges

3.2.1. Supply Chain Instability in Bamboo Cultivation

3.2.2. Competition from Conventional Furniture

3.2.3. Lack of Awareness in Some Regions

3.2.4. Price Volatility in Raw Bamboo Supply

3.3. Opportunities

3.3.1. Demand for Customizable Furniture

3.3.2. Expanding Middle-Class Consumer Base

3.3.3. Opportunities in Export Markets (North America, Europe)

3.3.4. Integration with Smart Furniture Technologies

3.4. Trends

3.4.1. Adoption of Modular Bamboo Furniture

3.4.2. Increased Focus on Sustainable Manufacturing Processes

3.4.3. Use of Bamboo Composites in Luxury Furniture

3.4.4. Growth of Direct-to-Consumer Brands

3.5. Regulatory and Compliance Environment

3.5.1. Certification for Sustainable Furniture (FSC Certification, ISO 9001)

3.5.2. Export Regulations and Trade Tariffs

3.5.3. Eco-friendly Product Standards

3.6. SWOT Analysis (Sustainability Factors, Raw Material Availability, Cost of Goods)

3.7. Stakeholder Ecosystem (Raw Material Suppliers, Manufacturers, Distributors, End Consumers)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Threat of Substitutes, Industry Rivalry, Entry Barriers)

3.9. Competition Ecosystem (Regional Competitors, Local Manufacturers, Product Innovation Leaders)

4. Global Bamboo Furniture Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Chairs

4.1.2. Tables

4.1.3. Sofas

4.1.4. Beds

4.1.5. Cabinets and Storage

4.2. By Material Quality (In Value %)

4.2.1. Solid Bamboo

4.2.2. Bamboo Plywood

4.2.3. Bamboo Laminates

4.2.4. Bamboo Composites

4.3. By End-User (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Hospitality

4.4. By Distribution Channel (In Value %)

4.4.1. Online

4.4.2. Offline Retail

4.4.3. Direct Sales

4.5. By Region (In Value %)

4.5.1. Asia-Pacific

4.5.2. North America

4.5.3. Europe

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Bamboo Furniture Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Greenington LLC

5.1.2. Bamboo Living

5.1.3. MyBamboolife

5.1.4. Moso International B.V.

5.1.5. Bamboosero

5.1.6. EcoBalanza

5.1.7. Sichuan Yibin Push Bamboo Products Co.

5.1.8. Jiangxi Feiyu Bamboo Industry Group Co.

5.1.9. Guangxi Bamboo Technology Co.

5.1.10. China Bambro Textile Co.

5.1.11. Higuera Hardwoods LLC

5.1.12. Dasso Group

5.1.13. Anji Bamboo Industry Co.

5.1.14. Shenzhen Fly-Dragon Bamboo Furniture

5.1.15. Bamboo Australia Pty Ltd.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Manufacturing Capabilities, Innovation Investment, Production Capacity, Geographic Reach, Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Joint Ventures, Product Launches, Market Expansion)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Bamboo Furniture Market Regulatory Framework

6.1. Environmental Standards (Sustainability Certifications, FSC, ISO, LEED)

6.2. Compliance Requirements (Regional Guidelines, Eco-labeling)

6.3. Certification Processes (Bamboo Furniture Export, Import Regulations)

7. Global Bamboo Furniture Future Market Size (In USD Bn)

7.1. Future Market Size Projections (Value & Volume)

7.2. Key Factors Driving Future Market Growth (Sustainability Demand, Technological Advancements, Emerging Markets)

8. Global Bamboo Furniture Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Quality (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Bamboo Furniture Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives

9.3. Customer Cohort Analysis

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research began by mapping the bamboo furniture market ecosystem, identifying key stakeholders such as manufacturers, distributors, and consumers. Primary and secondary data sources were utilized to establish a comprehensive understanding of the market dynamics.

Step 2: Market Analysis and Construction

Historical data were compiled to analyze market penetration and revenue generation. The focus was on supply chain management, manufacturing capacity, and pricing trends to ensure accuracy in revenue estimates and market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through in-depth interviews with industry experts and manufacturers. These consultations provided critical insights into operational challenges and market opportunities, adding depth to the research findings.

Step 4: Research Synthesis and Final Output

The final research stage involved synthesizing all gathered data into actionable insights. A mix of top-down and bottom-up approaches ensured that the market projections were validated by industry insiders, with special attention given to future market growth drivers.

Frequently Asked Questions

How big is the global bamboo furniture market?

The global bamboo furniture market is valued at USD 12.8 billion in 2023, driven by rising demand for sustainable and affordable furniture solutions.

What are the challenges in the bamboo furniture market?

The global bamboo furniture market faces challenges such as supply chain instability in bamboo cultivation, price volatility, and competition from traditional wooden furniture.

Who are the major players in the bamboo furniture market?

Key players in the global bamboo furniture market include Greenington LLC, Moso International B.V., Anji Bamboo Industry Co., and Bamboo Living. These companies dominate due to their extensive distribution networks and sustainable practices.

What are the growth drivers of the bamboo furniture market?

Growth drivers in the global bamboo furniture market include increasing consumer awareness of sustainability, affordability of bamboo furniture, and innovations in bamboo processing technologies.

Which regions dominate the bamboo furniture market?

The Asia-Pacific region dominates, particularly China and Vietnam, due to their access to raw materials, established manufacturing sectors, and competitive pricing strategies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.