Global Barley Tea Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD6279

October 2024

99

About the Report

Global Barley Tea Market Overview

- The global barley tea market is valued at USD 1204.12 million, driven by increasing consumer preferences for healthier and caffeine-free beverage options. The market has grown steadily due to the demand for traditional, natural drinks with numerous health benefits, including antioxidant and anti-inflammatory properties. The expansion is also supported by the growing awareness around the nutritional advantages of barley, such as aiding digestion and improving metabolism.

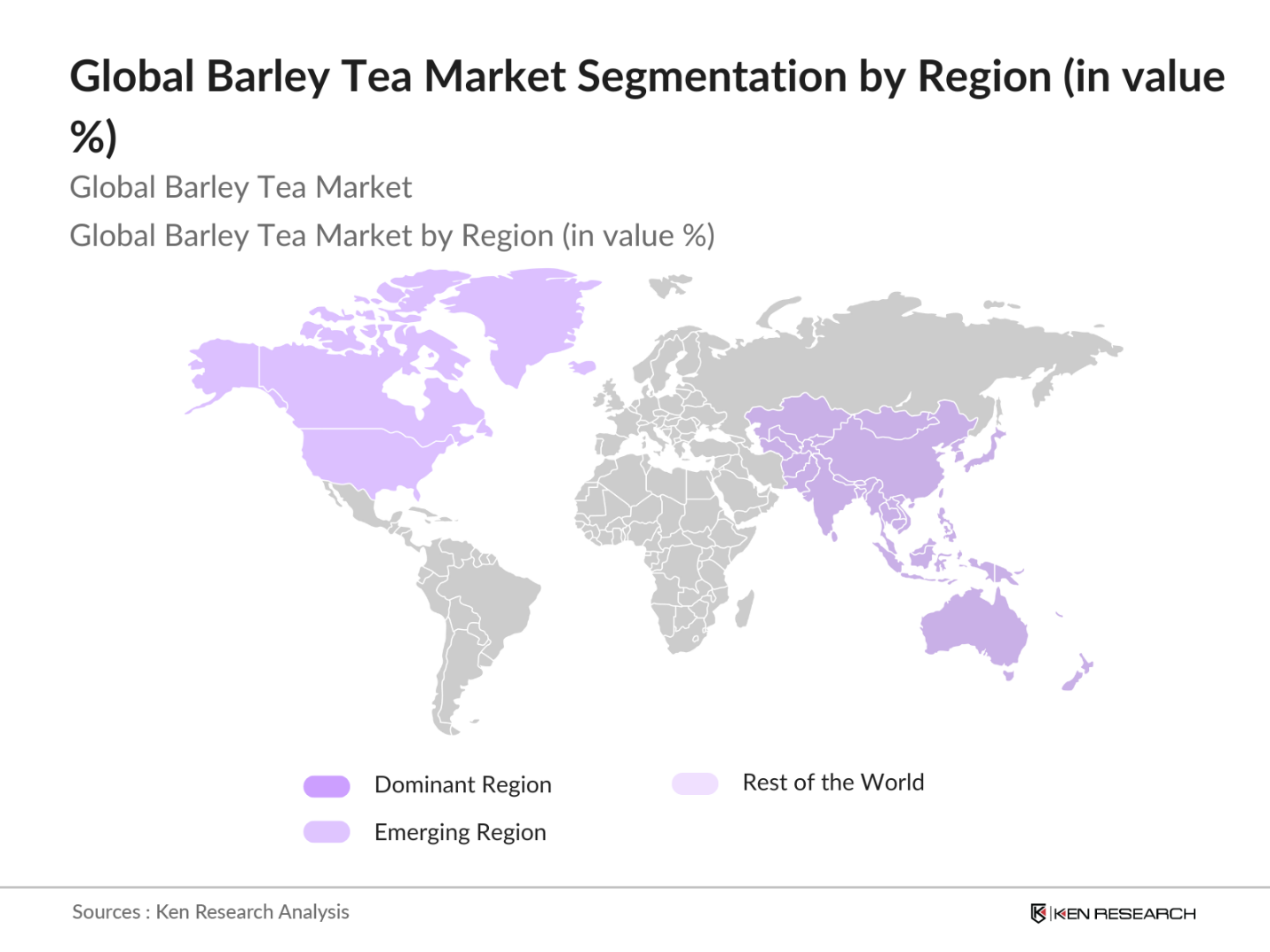

- Asian countries, particularly Japan and South Korea, dominate the global barley tea market due to their longstanding tradition of consuming barley-based drinks. In these regions, barley tea is a staple beverage, widely available in restaurants, homes, and retail stores. Japan's cultural integration of barley tea as a go-to summer drink, coupled with a high domestic production of barley, ensures a stable supply chain. South Korea also maintains a strong market presence due to its significant consumption of barley tea, particularly as a healthy, caffeine-free alternative to other popular drinks. The dominance of these countries is further reinforced by established distribution networks and strong consumer trust in locally produced goods.

- Governments in countries like Japan and South Korea have initiated campaigns to promote the consumption of healthy, caffeine-free beverages such as barley tea. For example, the South Korean Ministry of Health and Welfare allocated USD 120 million in 2023 towards public health campaigns encouraging the shift from sugary and caffeinated beverages to healthier alternatives. These initiatives have significantly boosted barley tea consumption, particularly among the aging population, as it is perceived as a healthier, functional beverage.

Global Barley Tea Market Segmentation

By Product Type: The barley tea market is segmented by product type into loose barley tea, tea bags, and ready-to-drink barley tea. Ready-to-drink barley tea dominates this segment due to its convenience and increased consumer demand for beverages that fit into fast-paced lifestyles. With advancements in packaging and the rise of health-conscious consumers, ready-to-drink products have gained widespread popularity in retail stores and online platforms, particularly in urban areas. This segments dominance is attributed to its accessibility and ease of use, offering a quick, healthy alternative to traditional caffeinated beverages.

By Region: The barley tea market is dominated by Asia Pacific, followed by North America and Europe. Asia Pacifics dominance is largely due to its traditional consumption of barley tea, with high demand in countries like Japan and South Korea. The region benefits from an ingrained cultural preference for barley-based beverages and high production capacity. North America is seeing rising demand for barley tea, driven by increasing consumer awareness of its health benefits, while Europe is witnessing a slow but steady rise, particularly in countries focusing on wellness trends and herbal beverages.

Global Barley Tea Market Competitive Landscape

The global barley tea market is characterized by the presence of a few dominant players that control a significant portion of the market. These players focus on expanding their product lines, leveraging established distribution channels, and enhancing brand visibility through marketing campaigns.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Organic Certification |

Distribution Network |

Revenue Growth |

R&D Initiatives |

Market Penetration |

|

Soken Tea |

1928 |

Japan |

Loose Tea, Tea Bags |

|||||

|

Ito En |

1966 |

Japan |

Ready-to-Drink |

|||||

|

House Foods |

1913 |

Japan |

Functional Beverages |

|||||

|

Dong Suh Foods |

1952 |

South Korea |

Bottled Barley Tea |

|||||

|

Shin Dong Bang Corp |

1955 |

South Korea |

Tea Bags, Loose Tea |

Global Barley Tea Market Analysis

Market Growth Drivers

- Increasing Health Consciousness: The growing health consciousness worldwide has been driving the demand for barley tea, which is rich in antioxidants and free from caffeine. According to the World Bank's 2024 macroeconomic analysis, global healthcare expenditure reached USD 8.3 trillion in 2022, reflecting the shift toward health and wellness products. Barley tea, known for its digestive benefits and high fiber content, is increasingly popular among health-conscious consumers, particularly in regions like East Asia, where holistic wellness practices are widespread. This growing awareness is contributing significantly to the expansion of the barley tea market in 2023.

- Demand for Functional Teas: Functional beverages are experiencing increased demand, with global sales of functional teas reaching USD 23.5 billion in 2022, as per World Bank data. Barley tea, known for its digestive properties and ability to regulate blood sugar, is emerging as a preferred functional tea. Consumers, especially in Japan and South Korea, are opting for barley tea due to its perceived benefits in reducing cholesterol levels and improving gut health, thereby driving market growth in 2023.

- Rising Popularity in Asian Markets: Asia is the dominant region for barley tea consumption, particularly in countries like Japan, China, and South Korea. The Ministry of Agriculture, Forestry, and Fisheries of Japan reported that barley tea consumption increased by 7 million liters in 2023. This is driven by traditional preferences for herbal teas in these regions. In Japan alone, the annual production of barley for tea purposes crossed 60,000 metric tons in 2023, reflecting the beverages deep-rooted cultural significance.

Market Challenges

- Limited Awareness Outside Key Regions: Despite its popularity in Asia, barley tea faces limited awareness in Western markets like North America and Europe. According to the US Department of Agriculture, barley imports remained stable at 8.5 million metric tons in 2023, but only a fraction of this was used for tea production. Low recognition of barley teas benefits outside Asia is a key challenge for global expansion, with marketing efforts needed to educate consumers in these regions.

- Competition from Other Herbal Teas: Barley tea faces stiff competition from other popular herbal teas like chamomile and green tea. According to the European Herbal & Traditional Medicines Report, herbal tea sales in Europe reached USD 6.8 billion in 2023, with barley tea accounting for only a small percentage. Consumers often opt for more widely recognized herbal teas, making it difficult for barley tea to capture significant market share, particularly in non-Asian regions.

Global Barley Tea Market Future Outlook

Over the next five years, the global barley tea market is poised for substantial growth, driven by rising consumer interest in healthier, caffeine-free beverages and the expanding popularity of traditional herbal drinks. Companies will likely focus on enhancing product variety, such as introducing new flavors and packaging formats, to cater to diverse consumer preferences. Additionally, the increasing demand for organic and sustainably sourced products will further fuel market growth. Expansion into new regions, particularly North America and Europe, will create more opportunities for market players.

Market Opportunities:

- Product Diversification (Flavored Varieties): The introduction of flavored barley teas presents a significant opportunity for market growth. According to a report from the Food and Agriculture Organization (FAO), the global demand for flavored herbal teas rose to USD 4.5 billion in 2023. The inclusion of flavors like lemon, mint, and honey in barley tea products can attract a broader audience, particularly younger consumers seeking variety in their beverage choices. Flavored barley tea variants have shown success in markets like South Korea and China, where innovation in tea products is highly valued.

- Expansion in Health & Wellness Stores: With the rise of health and wellness retail chains, there is an increasing opportunity to expand the presence of barley tea in these stores. Global retail sales in the health and wellness sector grew to USD 1.5 trillion in 2023, according to World Bank data. Barley tea, with its perceived health benefits, is well-positioned to capitalize on this trend, particularly in North America and Europe, where consumers are actively seeking natural, functional beverages in wellness-focused outlets.

Scope of the Report

|

By Product Type |

Loose Barley Tea Tea Bags Ready-to-Drink |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Stores Specialty Stores Convenience Stores |

|

By Flavor |

Original Flavored (Lemon, Mint, etc.) |

|

By Packaging Type |

Bottled Canned Pouches |

|

By Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Beverage Manufacturers

Food and Beverage Distributors

Health and Wellness Product Retailers

Supermarkets and Hypermarkets

Organic Food Retailers

Venture Capital Firms and Investment Groups

Government and Regulatory Bodies (US FDA, EFSA)

E-commerce Platforms

Companies

Players Mentioned in the Report

Soken Tea

Ito En

House Foods

Shin Dong Bang Corp

Dong Suh Foods

Oi Ocha

Hakubaku

Asahi Group Holdings

Coca-Cola (Georgia Japan Craftman)

Kirin Holdings

Tsuchiya Co., Ltd.

Takaokaya Tea Co., Ltd.

Nagatanien

MAO Feng Tea Co.

Radha Madhav Corporation

Table of Contents

Global Barley Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Global Barley Tea Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Global Barley Tea Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Consciousness

3.1.2. Shift Towards Caffeine-Free Beverages

3.1.3. Demand for Functional Teas

3.1.4. Rising Popularity in Asian Markets

3.2. Market Challenges

3.2.1. Limited Awareness Outside Key Regions

3.2.2. Competition from Other Herbal Teas

3.2.3. Seasonality of Demand

3.3. Opportunities

3.3.1. Product Diversification (flavored varieties)

3.3.2. Expansion in Health & Wellness Stores

3.3.3. Online Retail Channels

3.4. Trends

3.4.1. Organic Barley Tea Options

3.4.2. Demand for Sustainable Packaging

3.4.3. Growth in Ready-to-Drink Barley Tea

3.5. Government Regulation

3.5.1. Health and Safety Standards

3.5.2. Organic Certification Requirements

3.5.3. Import and Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

Global Barley Tea Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Loose Barley Tea

4.1.2. Tea Bags

4.1.3. Ready-to-Drink Barley Tea

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Online Stores

4.2.3. Specialty Stores

4.2.4. Convenience Stores

4.3. By Flavor (In Value %)

4.3.1. Original

4.3.2. Flavored (lemon, mint, etc.)

4.4. By Packaging Type (In Value %)

4.4.1. Bottled

4.4.2. Canned

4.4.3. Pouches

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

Global Barley Tea Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Soken Tea

5.1.2. Ito En

5.1.3. House Foods

5.1.4. Shin Dong Bang Corp

5.1.5. Dong Suh Foods

5.1.6. Oi Ocha

5.1.7. Hakubaku

5.1.8. Asahi Group Holdings

5.1.9. Coca-Cola (Georgia Japan Craftman)

5.1.10. Kirin Holdings

5.1.11. Tsuchiya Co., Ltd.

5.1.12. Takaokaya Tea Co., Ltd.

5.1.13. Nagatanien

5.1.14. MAO Feng Tea Co.

5.1.15. Radha Madhav Corporation

5.2. Cross Comparison Parameters (Market-specific comparison: Product Range, Organic Certification, Regional Presence, Distribution Network, Revenue Growth, R&D Initiatives, Branding Strategies, Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

Global Barley Tea Market Regulatory Framework

6.1. Global Health and Safety Standards

6.2. Organic Product Certification

6.3. Export and Import Regulations

Global Barley Tea Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Global Barley Tea Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Flavor (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

Global Barley Tea Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying the major stakeholders within the barley tea market through extensive desk research. Secondary and proprietary databases are used to gather industry-level information. The goal is to map key variables that shape the market, including production capacity, distribution networks, and consumer preferences.

Step 2: Market Analysis and Construction

This step focuses on compiling historical data related to market penetration, sales volumes, and revenue generation. The analysis includes evaluating the competitive landscape, understanding distribution trends, and assessing product performance within the market.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated through expert consultations with stakeholders from across the value chain. Interviews with industry experts, manufacturers, and distributors provide insights into market dynamics, consumer behavior, and pricing strategies.

Step 4: Research Synthesis and Final Output

In this phase, detailed data from multiple sources are synthesized into actionable insights. Direct consultations with leading manufacturers verify and complement the bottom-up market analysis, ensuring an accurate and comprehensive final report.

Frequently Asked Questions

01. How big is the Global Barley Tea Market?

The global barley tea market is valued at USD 1204.12 million, with growth driven by the increasing demand for health-conscious and caffeine-free beverages worldwide.

02. What are the challenges in the Global Barley Tea Market?

The primary challenges include limited awareness of barley tea outside Asia and competition from other herbal beverages. Additionally, fluctuating raw material costs can impact pricing and profitability.

03. Who are the major players in the Global Barley Tea Market?

Major players include Soken Tea, Ito En, House Foods, Dong Suh Foods, and Shin Dong Bang Corp. These companies dominate due to strong distribution networks and brand recognition in key markets.

04. What are the growth drivers of the Global Barley Tea Market?

Growth is driven by increasing consumer preferences for natural, caffeine-free beverages, the rising popularity of functional drinks, and growing awareness about the health benefits of barley tea.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.