Global Basalt Fiber Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD2394

December 2024

92

About the Report

Global Basalt Fiber Market Overview

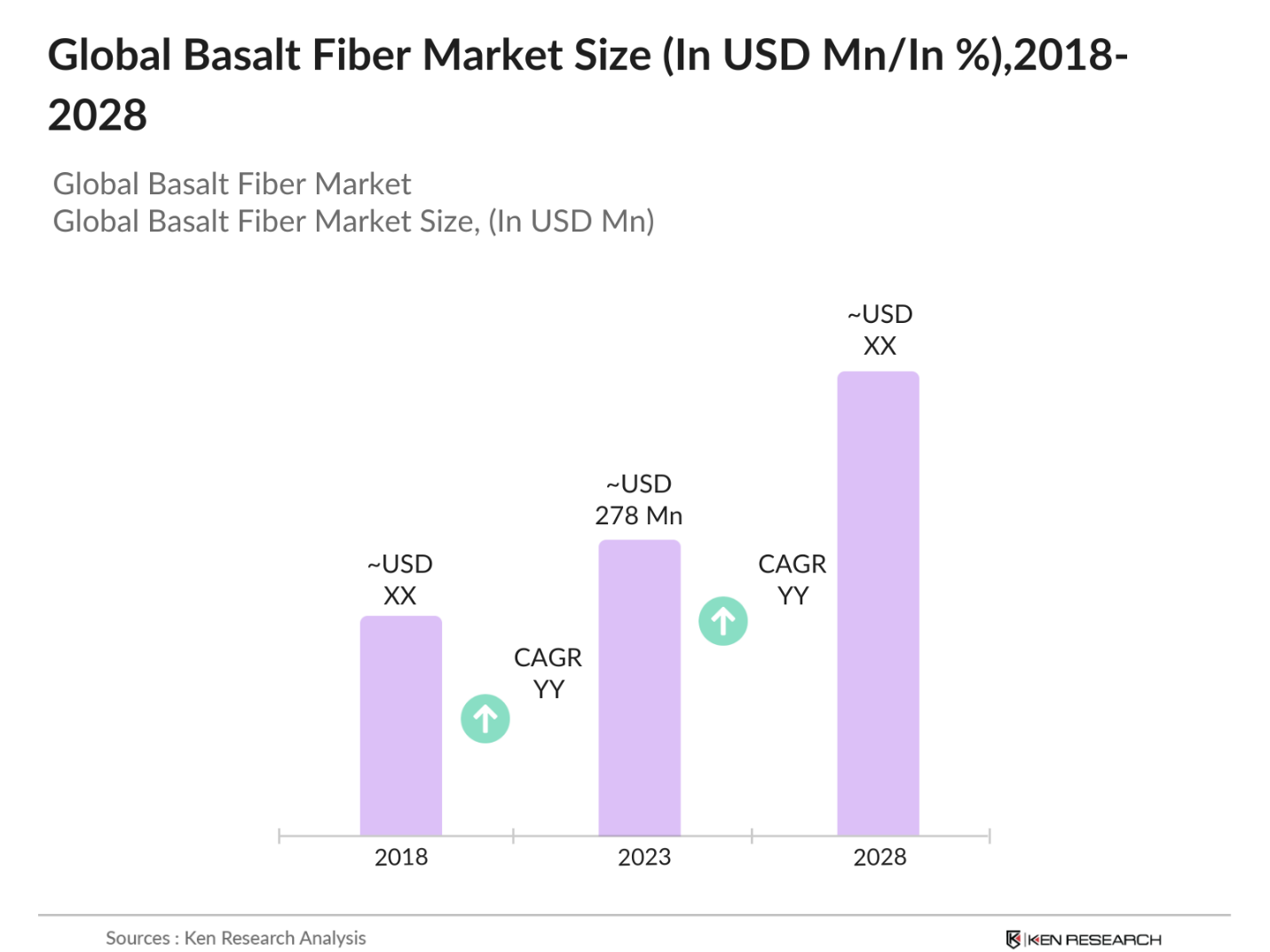

- The Global Basalt Fiber Market is valued at USD 278 million, based on an in-depth analysis of the past five years. The market is driven primarily by the increasing demand for eco-friendly, high-performance fibers in construction, automotive, and aerospace industries. Basalt fibers high tensile strength, durability, and lightweight properties make it an excellent alternative to traditional materials like fiberglass and carbon fiber. Growing infrastructure development, particularly in regions focusing on sustainable construction practices, has further accelerated market growth.

- In terms of dominant countries, Russia, China, and the United States are at the forefront of the basalt fiber market due to abundant raw material availability and a well-established manufacturing base. Russia leads with extensive basalt reserves and a strong technological infrastructure, while China benefits from cost-effective production processes. In the United States, government initiatives supporting green building solutions and the growing automotive sector drive demand for basalt fibers.

- Strict environmental impact regulations are influencing the adoption of basalt fiber in industries such as construction and automotive. In 2024, many countries, including members of the European Union, implemented stringent emission reduction policies aimed at lowering industrial CO2 outputs. Basalt fiber, being a more sustainable alternative to glass and carbon fibers, aligns with these regulations due to its lower environmental impact during production. These regulations are creating opportunities for basalt fiber manufacturers to expand their product offerings to meet the growing demand for eco-friendly materials .

Global Basalt Fiber Market Segmentation

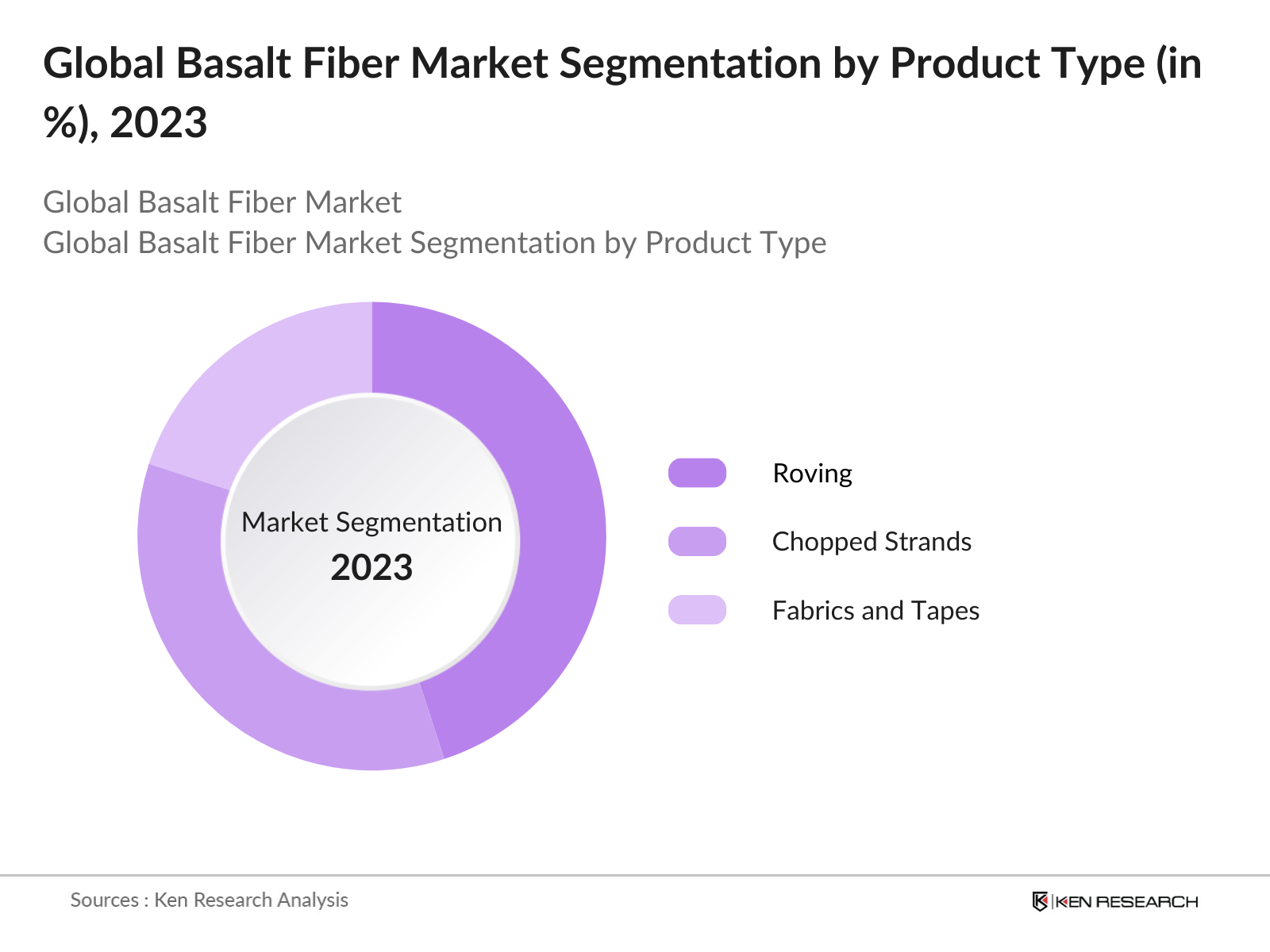

By Product Type: The Global Basalt Fiber Market is segmented by product type into roving, chopped strands, and fabrics and tapes. Roving dominates the market due to its widespread applications in pultrusion, filament winding, and resin transfer molding. This product type is highly preferred for its excellent balance of strength and flexibility, making it ideal for reinforcing composite materials in construction and automotive components. The versatility of roving in various manufacturing processes has solidified its dominance within the product type segmentation.

By Region: Geographically, the market is divided into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Europe leads the market due to its strong focus on sustainable development and its well-established construction industry. The regions stringent regulations on the use of environmentally friendly materials in infrastructure projects have driven the demand for basalt fiber. Meanwhile, the Asia-Pacific region is experiencing significant growth, especially in China and India, driven by large-scale industrialization and infrastructural developments.

By Application: The basalt fiber market is segmented by application into construction, automotive, aerospace, marine, and electrical and electronics. Construction holds the largest share within this segment due to the increasing adoption of basalt fiber in reinforced concrete and structural applications. Its superior durability, corrosion resistance, and lightweight properties contribute to the widespread use of basalt fiber in infrastructure projects such as bridges, highways, and buildings, particularly in regions prone to harsh environmental conditions.

Global Basalt Fiber Market Competitive Landscape

The Global Basalt Fiber Market is dominated by a select group of companies, including key players such as Basaltex NV, Kamenny Vek, Zhejiang GBF Basalt Fiber Co., Ltd., Mafic SA, and Sudaglass Fiber Technology. These companies have established a strong presence in the market through extensive production capacities, continuous product innovation, and strategic partnerships. The consolidation of major manufacturers has created a competitive environment focused on expanding applications for basalt fibers in high-performance sectors.

|

Company Name |

Establishment Year |

Headquarters Location |

Production Capacity |

Global Reach |

Key Applications |

Revenue (USD million) |

Patents |

R&D Spending (USD million) |

|

Basaltex NV |

2004 |

Belgium |

- |

- |

- |

- |

- |

- |

|

Kamenny Vek |

2003 |

Russia |

- |

- |

- |

- |

- |

- |

|

Zhejiang GBF Basalt Fiber Co. |

2005 |

China |

- |

- |

- |

- |

- |

- |

|

Mafic SA |

2014 |

United States |

- |

- |

- |

- |

- |

- |

|

Sudaglass Fiber Technology |

1997 |

United States |

- |

- |

- |

- |

- |

- |

Global Basalt Fiber Industry Analysis

Global Basalt Fiber Market Growth Drivers

- Strength-to-Weight Ratio: Basalt fibers are increasingly favored in construction and aerospace sectors due to their superior strength-to-weight ratio compared to traditional materials like steel. For example, basalt fibers possess a tensile strength of approximately 4,800 MPa, making them ideal for high-stress environments such as aircraft components and construction reinforcements. In 2024, with infrastructure projects rising globally, especially in countries like China and India, basalt fiber use in reinforcement has become essential. This trend is also supported by growing investments in large-scale infrastructure projects, which require durable and lightweight materials.

- Non-Corrosive Nature: The non-corrosive nature of basalt fibers makes them ideal for applications in industries like marine and construction, where traditional materials such as steel corrode over time. The World Bank highlighted that corrosion in infrastructure leads to annual losses of around USD 2.5 trillion globally. Basalt fiber, being non-corrosive, is used extensively in the production of rebar, wind turbine blades, and shipbuilding components, thereby extending the life span of these structures. In 2024, government infrastructure investments in coastal regions are further accelerating the adoption of basalt fiber.

- Thermal Resistance: Basalt fibers are highly resistant to thermal changes, withstanding temperatures up to 1,000C, which is significantly higher than conventional glass fibers. This feature is driving their demand in applications like automotive and fireproof construction materials. With the global focus on energy-efficient buildings, basalt fiber is being adopted in insulation materials for green building solutions. In 2024, the UN estimated that the global construction industry was responsible for nearly 39% of energy-related CO2 emissions, which basalt-based insulation helps mitigate by providing superior energy efficiency.

Global Basalt Fiber Market Challenges

- High Production Costs: One of the major challenges in the basalt fiber market is the high production cost, driven by the energy-intensive process required to extract basalt rock and convert it into fibers. For instance, producing one ton of basalt fiber requires approximately 16,000 MJ of energy, which is much higher than for traditional materials like glass fiber.

- Limited Raw Material Sources: Basalt fiber production relies heavily on basalt rock, which is not as readily available as other raw materials like limestone for glass fibers. Basalt rock is primarily found in regions like Russia, Ukraine, and India, making the supply chain vulnerable to geopolitical issues and transportation constraints. In 2024, the ongoing conflict between Russia and Ukraine disrupted the supply of basalt rock, leading to production delays and increased costs.

Global Basalt Fiber Market Future Outlook

Over the next five years, the Global Basalt Fiber Market is expected to experience substantial growth, driven by increasing demand from industries such as automotive, aerospace, and construction. The global shift towards sustainable materials and the introduction of stricter environmental regulations will further support the adoption of basalt fibers. Technological advancements in manufacturing processes are anticipated to enhance the performance characteristics of basalt fiber, making it more cost-effective and expanding its applications. These factors are likely to position basalt fiber as a preferred choice for lightweight and durable materials in several high-performance industries.

Market Opportunities

- Increasing Demand in Aerospace and Automotive: The aerospace and automotive industries are witnessing increasing demand for lightweight, high-strength materials, positioning basalt fiber as an ideal solution. In 2024, the global automotive industry produced approximately 85 million vehicles, with many manufacturers focusing on reducing vehicle weight to improve fuel efficiency. Basalt fibers lightweight properties make it an attractive material for structural components in both electric and internal combustion engine vehicles.

- Green Building Solutions: As countries worldwide strive to meet their carbon reduction goals, the construction industry is turning to sustainable materials such as basalt fiber. In 2024, the global green building materials market grew significantly, driven by environmental regulations and rising demand for energy-efficient structures. Basalt fiber, being recyclable and energy-efficient in production, is increasingly used in insulation and reinforcement applications in green buildings.

Scope of the Report

|

Product Type |

Roving Chopped Strands Fabrics and Tapes |

|

Application |

Construction Automotive Aerospace Marine Electrical and Electronics |

|

Technology |

Pultrusion Filament Winding Resin Transfer Molding |

|

End-Use Industry |

Civil Engineering Industrial Applications Wind Energy |

|

Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Basalt Fiber Companies

Automotive OEMs

Construction Companies

Aerospace Component Companies

Marine Engineering Industry

Electrical and Electronics Companies

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Environmental Protection Agency, Ministry of Industry)

Companies

Players Mentioned in the Report:

Basaltex NV

Kamenny Vek

Zhejiang GBF Basalt Fiber Co., Ltd.

Mafic SA

Sudaglass Fiber Technology

Technobasalt-Invest LLC

Isomatex

HG GBF Basalt Fiber Co., Ltd.

Jiangsu Tianlong Continuous Basalt Fiber Co., Ltd.

Fiberbas Construction and Building Technologies

Polotsk-Steklovolokno OJSC

Raina Basalt Fiber Co., Ltd.

Shanxi Basalt Fiber Technology Co., Ltd.

Shanghai Russian Basalt Fiber

BASF SE

Table of Contents

1. Geo Satellite Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Structure Overview

1.4 Key Milestones and Market Developments

2. Geo Satellite Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Market Size by Geo Satellite Type (Large, Medium, Small)

2.4 Geo Satellite Capacity Analysis (in Gbps, Mbps)

3. Geo Satellite Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Need for Communication in Remote Areas

3.1.2 Government Backing for Space Initiatives

3.1.3 Growth of Satellite Internet Services

3.2 Market Challenges

3.2.1 High Development and Launch Costs

3.2.2 Regulatory Compliance

3.2.3 Vulnerabilities to Space Debris

3.3 Opportunities

3.3.1 Expansion of Broadband in Emerging Economies

3.3.2 Increasing Defense Expenditure on Satellite Programs

3.3.3 Commercial Satellite Launch Partnerships

3.4 Trends

3.4.1 Adoption of Electric Propulsion for Satellites

3.4.2 Deployment of AI for Spacecraft Autonomy

3.4.3 Miniaturization of Satellites and Components

3.5 Government Regulation

3.5.1 National and International Regulatory Frameworks

3.5.2 Space Traffic Management Policies

3.5.3 ITAR Compliance and Export Control Laws

4. Geo Satellite Market Segmentation

4.1 By Satellite Type (In Value %)

4.1.1 Large Satellites (Over 1000kg)

4.1.2 Medium Satellites (500-1000kg)

4.1.3 Small Satellites (Under 500kg)

4.2 By Application (In Value %)

4.2.1 Communications

4.2.2 Earth Observation

4.2.3 Scientific Research

4.2.4 Navigation

4.3 By Orbit Type (In Value %)

4.3.1 Geostationary Orbit (GEO)

4.3.2 Medium Earth Orbit (MEO)

4.3.3 Low Earth Orbit (LEO)

4.4 By End-User (In Value %)

4.4.1 Government and Military

4.4.2 Commercial

4.4.3 Research Institutions

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Middle East and Africa

4.5.5 Latin America

5. Geo Satellite Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Airbus Defence and Space

5.1.2 Boeing Defense, Space & Security

5.1.3 Lockheed Martin

5.1.4 Northrop Grumman

5.1.5 Thales Alenia Space

5.1.6 SpaceX

5.1.7 L3Harris Technologies

5.1.8 Viasat Inc.

5.1.9 Eutelsat Communications

5.1.10 Inmarsat

5.1.11 SES S.A.

5.1.12 Maxar Technologies

5.1.13 Mitsubishi Electric Corporation

5.1.14 Hispasat

5.1.15 Telesat

5.2 Cross Comparison Parameters

5.2.1 Launch Capacity (Tons)

5.2.2 Launch Success Rate

5.2.3 Satellite Mass Capacity

5.2.4 Revenue Generation per Satellite

5.2.5 Manufacturing Turnaround Time

5.2.6 Geographic Reach

5.2.7 Satellite Lifetime (Years)

5.2.8 Number of Active Satellites in Fleet

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures & Collaborations

5.8 Government Space Contracts

6. Geo Satellite Market Regulatory Framework

6.1 Space Policy and National Security Considerations

6.2 Spectrum Allocation and Frequency Management

6.3 Satellite Launch Licensing Procedures

6.4 ITU Guidelines for Satellite Operation

7. Geo Satellite Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Influencing Future Market Growth

8. Geo Satellite Future Market Segmentation

8.1 By Satellite Type

8.2 By Application

8.3 By Orbit Type

8.4 By End-User

8.5 By Region

9. Geo Satellite Market Analysts Recommendations

9.1 Market Entry Strategies

9.2 Business Expansion Plans

9.3 Technological Adoption in Geo Satellites

9.4 Competitive Positioning and White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping the entire basalt fiber value chain, focusing on raw material suppliers, manufacturers, and end-users across the globe. Desk research from credible sources like industry reports, databases, and governmental publications helps define the market's core influencing factors.

Step 2: Market Analysis and Construction

Historical data for market size, growth trends, and key milestones were analyzed, along with detailed information on basalt fibers penetration into various industries such as construction, automotive, and aerospace. Revenue data from these segments further validated the overall market structure.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts and major manufacturers were conducted to validate market assumptions. This included consultations with companies involved in the production and R&D of basalt fiber to verify data accuracy and gain insights into future trends and challenges.

Step 4: Research Synthesis and Final Output

Finally, the data collected was synthesized and cross-verified with major manufacturers. The report underwent several quality checks to ensure all insights were thoroughly validated, providing a reliable and comprehensive analysis of the global basalt fiber market.

Frequently Asked Questions

01. How big is the Global Basalt Fiber Market?

The Global Basalt Fiber Market was valued at USD 278 million, driven by its widespread applications in industries such as construction, automotive, and aerospace.

02. What are the challenges in the Global Basalt Fiber Market?

Challenges include high production costs and limited availability of raw materials. Additionally, the lack of awareness about basalt fibers potential applications in some regions restricts market growth.

03. Who are the major players in the Global Basalt Fiber Market?

Key players in the market include Basaltex NV, Kamenny Vek, Zhejiang GBF Basalt Fiber Co., Ltd., Mafic SA, and Sudaglass Fiber Technology. These companies dominate due to their large production capacities, technological advancements, and wide global reach.

04. What are the growth drivers of the Global Basalt Fiber Market?

The market is driven by increasing demand for eco-friendly, high-performance materials in the construction and automotive industries, coupled with advancements in manufacturing technologies that improve fiber strength and durability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.