Global Beer and Cider Market Outlook to 2030

Region:Global

Author(s):Shivani

Product Code:KROD10652

November 2024

81

About the Report

Global Beer and Cider Market Overview

- The global beer and cider market is valued at approximately USD 106.67 billion, driven by increased consumer demand for a diverse range of alcoholic beverages. This growth is primarily fueled by the rising popularity of craft beer and premium cider products, alongside a growing preference for healthier, gluten-free alcoholic beverages like cider. The introduction of non-alcoholic and low-alcohol variants of beer and cider, as well as their expanding availability across both on-trade (bars, pubs, restaurants) and off-trade (retail, supermarkets, e-commerce) channels, has further driven market expansion.

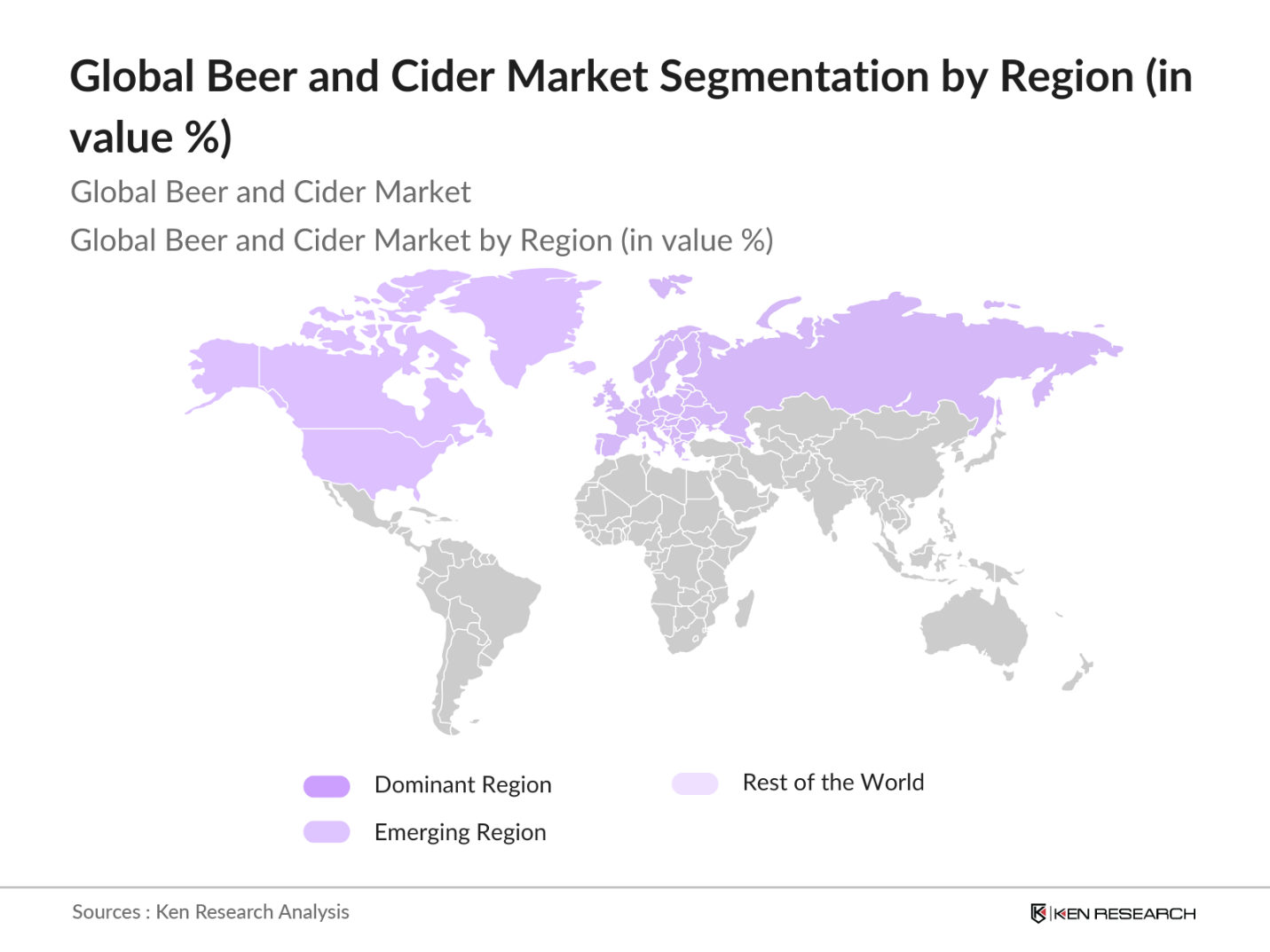

- In terms of market dominance, Europe and North America lead the global beer and cider market. Key countries like Germany, the United States, and the United Kingdom play dominant roles, owing to their deeply ingrained beer and cider cultures, alongside high levels of product innovation. In these regions, consumers have shown a significant shift towards premium and craft categories, while emerging markets like China and Brazil are experiencing rapid growth due to rising disposable incomes and an expanding middle class, leading to increased alcohol consumption.

- Governments in various regions have been promoting local production through subsidies and grants to boost the beer and cider market. For example, the U.S. governments Craft Beverage Modernization and Tax Reform Act provided tax breaks for small-scale breweries and cider producers, lowering federal excise taxes for producers who manufacture less than 2 million barrels annually. In Australia, the government offers a Wine Equalisation Tax Rebate for cider producers, encouraging small and regional manufacturers to scale up production. This has bolstered the local craft beer and cider industries.

Global Beer and Cider Market Segmentation

By Product Type: The beer and cider market is segmented by product type into beer and cider. Beer includes various subtypes such as lager, ale, stout, pilsner, and specialty beers, while cider is categorized into dry cider, sweet cider, sparkling cider, still cider, and other niche products. Among these, beer, particularly lager, holds the dominant market share due to its longstanding presence and affordability, making it a popular choice among consumers globally. The extensive marketing strategies of large corporations like Anheuser-Busch InBev and Heineken have also helped maintain lagers dominance, especially in developing markets.

By Region: The beer and cider market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Each region shows unique trends in beer and cider consumption due to cultural, economic, and regulatory differences. Europe dominates the global market owing to its rich brewing history, diverse beer and cider traditions, and the high popularity of premium and craft beers. The growing trend toward premiumization and sustainability has particularly influenced beer consumption in countries like Germany, the UK, and Belgium. Meanwhile, Asia-Pacific is witnessing significant growth, driven by expanding middle-class populations and increasing disposable incomes, especially in China and India. These markets are also showing an increasing preference for Western-style beverages like craft beer and flavored ciders.

Global Beer and Cider Market Competitive Landscape

The global beer and cider market is characterized by a few major players that dominate through global operations, extensive distribution networks, and strong brand portfolios. The presence of local breweries and small craft beer companies, particularly in regions like Europe and North America, adds to the competitive intensity of the market. Large players like Anheuser-Busch InBev and Heineken N.V. are focusing on premiumization, sustainability initiatives, and expanding their portfolio to include low-alcohol and non-alcoholic beers to capture the shifting consumer preferences.

|

Company |

Year of Establishment |

Headquarters |

Revenue (USD) |

Global Reach |

Number of Brands |

Sustainability Practices |

Product Diversification |

R&D Investment |

|

Anheuser-Busch InBev |

2008 |

Belgium |

55 billion |

|||||

|

Heineken N.V. |

1864 |

Netherlands |

34 billion |

|||||

|

Molson Coors Beverage Co. |

2005 |

USA/Canada |

10 billion |

|||||

|

Diageo plc |

1997 |

UK |

22 billion |

|||||

|

Asahi Group Holdings |

1889 |

Japan |

20 billion |

Global Beer and Cider Market Analysis

Market Growth Drivers

- Increasing Global Beer Consumption (Volume & Per Capita): Global beer consumption has been steadily increasing, supported by rising disposable incomes and urbanization. In 2023, global beer consumption stood at approximately 188 million kiloliters, driven by demand from emerging economies like China and Brazil. In China alone, per capita beer consumption reached 34 liters in 2023, making it one of the highest consumers of beer globally. Similarly, Latin America, with Brazil at the forefront, witnessed a per capita consumption of 62 liters. This growth aligns with increasing urbanization, where more than 4.4 billion people lived in urban areas in 2022.

- Shift Towards Premium and Craft Beers (Value Addition, Category Expansion): The shift towards premium and craft beers has become a defining trend, with consumers increasingly seeking unique flavors and artisanal products. In the U.S., craft beer production rose to 24 million barrels in 2023, fueled by a consumer focus on quality and authenticity. Premium beer consumption has also grown significantly in regions like Europe, driven by rising income levels and a consumer desire for higher-value products. The expansion of premium and craft beer categories is further supported by the global GDP reaching $104 trillion in 2023, encouraging spending on luxury and niche beverages.

- Growing Popularity of Cider (Health Trends, Gluten-Free Appeal): Cider is becoming increasingly popular due to its health benefits and gluten-free appeal. In the UK, cider consumption reached a total of 600 million liters in 2023, driven by health-conscious consumers opting for gluten-free alternatives. In Australia, the cider market saw a significant rise in demand as consumers prioritized healthier and more natural beverages. This trend is supported by the growing awareness of gluten intolerance, which affects millions of people globally. The increasing focus on health-conscious choices is boosting cider demand, especially among consumers looking for low-calorie or gluten-free options.

Market Challenges:

- Regulatory Barriers (Alcohol Taxation, Labeling Laws, Import Restrictions): Regulatory barriers remain a significant challenge for the beer and cider market. Countries like India impose high alcohol taxes, with some states implementing exceptionally high rates in 2023, which has hindered market growth. Additionally, strict labeling laws in the European Union, requiring detailed ingredient transparency and health warnings, have increased production costs for manufacturers. Import restrictions in regions such as the Middle East, where alcohol sales are tightly controlled, further impact trade. In 2023, tariffs on imported alcohol in the Gulf Cooperation Council (GCC) created significant obstacles for exporters, limiting market access.

- Rising Raw Material Prices (Barley, Hops, Sugar): The rising prices of raw materials like barley, hops, and sugar have directly impacted the production costs of beer and cider. Global barley prices surged to $275 per ton in 2023, largely due to climate-related disruptions in major producing regions like Ukraine and Canada. Hops prices also increased to $5.50 per pound in 2023, driven by supply shortages. Additionally, sugar, a key ingredient in cider production, saw price hikes to $0.44 per kilogram in 2023, further squeezing profit margins for manufacturers.

Global Beer and Cider Market Future Outlook

Over the next five years, the global beer and cider market is projected to experience steady growth driven by the rising consumer demand for premium and craft beverages, coupled with the introduction of healthier options like low- and no-alcohol beers. The surge in e-commerce platforms for alcohol sales, as well as increasing environmental consciousness leading to more sustainable brewing practices, are expected to further enhance the markets expansion. Additionally, growing disposable incomes in emerging economies will contribute to higher demand for premium and craft beers.

Market Opportunities:

- Expansion in Emerging Markets (Latin America, Asia-Pacific): Emerging markets like Latin America and Asia-Pacific present significant opportunities for the beer and cider market. In 2023, beer consumption in Latin America reached 17 billion liters, with Brazil accounting for 10 billion liters. Asia-Pacific, led by countries like India and Vietnam, also saw substantial growth, with Indias beer market expanding to 6 billion liters in 2023. These regions are experiencing rapid urbanization and a growing middle class, with Asias middle-class population estimated to reach 1.4 billion by 2023, driving demand for alcoholic beverages.

- Rise of Premiumization (Artisanal Brews, Regional Specialties): Premiumization is becoming increasingly important in the beer and cider market, with a growing demand for artisanal brews and regional specialties. In 2023, artisanal beer production in Europe reached 12 million hectoliters, reflecting the rising consumer interest in unique, high-quality products. Regional specialties, particularly in countries like Belgium and Germany, have seen a resurgence, with local breweries reporting increased sales by 5 million liters. This trend is driven by consumers seeking authentic, locally-sourced beverages, supported by rising global disposable incomes, which hit $8.5 trillion in 2023.

Scope of the Report

|

By Product Type |

Beer (Lager, Ale, Stout, Pilsner, Others) Cider (Dry Cider, Sweet Cider, Sparkling Cider, Still Cider, Others) |

|

By Packaging |

Bottled Beer and Cider Canned Beer and Cider Draught Beer and Cider |

|

By Distribution |

On-Trade (Bars, Restaurants, Pubs) Off-Trade (Supermarkets, Convenience Stores, E-Commerce) |

|

By Alcohol Content |

Low/No Alcohol Beers and Ciders Standard Alcohol Beers and Ciders High Alcohol Beers and Ciders |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Beer and Cider Manufacturers

Alcohol Distributors and Retailers

E-commerce Platforms for Alcoholic Beverages

Hospitality Industry (Bars, Restaurants, Hotels)

Government and Regulatory Bodies (World Health Organization, Alcohol Beverage Regulators)

Investors and Venture Capitalist Firms

Packaging and Logistics Companies

Agricultural Raw Material Suppliers (Barley, Hops, Sugar Suppliers)

Companies

Major Players in the Market

Anheuser-Busch InBev

Heineken N.V.

Molson Coors Beverage Company

Diageo plc

Asahi Group Holdings

Carlsberg Group

Kirin Holdings

Constellation Brands

Boston Beer Company

C&C Group plc

SABMiller

Royal Unibrew

Pabst Brewing Company

AB InBev Africa

Suntory Beverage & Food Limited

Table of Contents

1. Global Beer and Cider Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. Global Beer and Cider Market Size (in USD MN)

2.1. Historical Market Size (Production Volume, Revenue, and Consumption)

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones (Regional Investments, Global Trade Impact)

3. Global Beer and Cider Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Global Beer Consumption (Volume & Per Capita)

3.1.2. Shift Towards Premium and Craft Beers (Value Addition, Category Expansion)

3.1.3. Growing Popularity of Cider (Health Trends, Gluten-Free Appeal)

3.1.4. Expanding Distribution Channels (E-commerce, On-Trade, Off-Trade)

3.2. Market Challenges

3.2.1. Regulatory Barriers (Alcohol Taxation, Labeling Laws, Import Restrictions)

3.2.2. Rising Raw Material Prices (Barley, Hops, Sugar)

3.2.3. Competition from Non-Alcoholic Beverages

3.3. Opportunities

3.3.1. Expansion in Emerging Markets (Latin America, Asia-Pacific)

3.3.2. Product Innovation (Low/No Alcohol Beers, Flavored Ciders)

3.3.3. Sustainability Trends (Packaging Innovation, Circular Economy)

3.4. Trends

3.4.1. Rise of Premiumization (Artisanal Brews, Regional Specialties)

3.4.2. Influence of Social Media on Consumption Patterns

3.4.3. Craft Beer Movement (Microbreweries, Collaborations)

3.5. Government Regulation

3.5.1. Alcohol Consumption Policies (Legal Drinking Age, Sales Restrictions)

3.5.2. Excise Duties and Taxes on Alcoholic Beverages

3.5.3. Trade Agreements and Tariffs Impacting Beer and Cider Markets

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis

3.8. Competitive Ecosystem Overview

4. Global Beer and Cider Market Segmentation

4.1. By Product Type (in Value & Volume %)

4.1.1. Beer (Lager, Ale, Stout, Pilsner, Others)

4.1.2. Cider (Dry Cider, Sweet Cider, Sparkling Cider, Still Cider, Others)

4.2. By Packaging (in Value & Volume %)

4.2.1. Bottled Beer and Cider

4.2.2. Canned Beer and Cider

4.2.3. Draught Beer and Cider

4.3. By Distribution Channel (in Value & Volume %)

4.3.1. On-Trade (Bars, Restaurants, Pubs)

4.3.2. Off-Trade (Supermarkets, Convenience Stores, E-Commerce)

4.4. By Alcohol Content (in Value & Volume %)

4.4.1. Low/No Alcohol Beers and Ciders

4.4.2. Standard Alcohol Beers and Ciders

4.4.3. High Alcohol Beers and Ciders

4.5. By Region (in Value & Volume %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Beer and Cider Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Anheuser-Busch InBev

5.1.2. Heineken N.V.

5.1.3. Asahi Group Holdings

5.1.4. Molson Coors Beverage Company

5.1.5. Diageo

5.1.6. Carlsberg Group

5.1.7. Kirin Holdings

5.1.8. Constellation Brands

5.1.9. Boston Beer Company

5.1.10. SABMiller

5.1.11. AB InBev Africa

5.1.12. Pabst Brewing Company

5.1.13. C&C Group PLC

5.1.14. Suntory Beverage & Food Limited

5.1.15. Royal Unibrew

5.2. Cross Comparison Parameters (Revenue, Production Volume, Global Market Share, Number of Breweries, Global Reach, Premium Product Share, Sustainability Practices, Product Diversification)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers, Acquisitions, New Product Launches)

5.5. Investment Analysis

5.6. Private Equity Investments and Venture Capital Funding

6. Global Beer and Cider Market Regulatory Framework

6.1. Alcohol and Beverage Standards

6.2. Compliance Requirements (Labeling, Packaging)

6.3. Certification Processes (Organic, Sustainable)

7. Global Beer and Cider Market Future Outlook

7.1. Future Market Size Projections (in USD Mn and Volume)

7.2. Key Factors Driving Future Market Growth

8. Global Beer and Cider Market Future Segmentation

8.1. By Product Type (in Value & Volume %)

8.2. By Packaging (in Value & Volume %)

8.3. By Distribution Channel (in Value & Volume %)

8.4. By Alcohol Content (in Value & Volume %)

8.5. By Region (in Value & Volume %)

9. Global Beer and Cider Market Analysts Recommendations

9.1. Customer Cohort Analysis

9.2. White Space Opportunity Analysis

9.3. Sustainability Initiatives for Future Market Growth

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global beer and cider market. This is achieved through extensive desk research, relying on secondary sources like industry reports, proprietary databases, and government statistics to gather comprehensive market-level information. The primary objective is to identify and define critical variables influencing the market, such as production capacity, distribution networks, and changing consumer preferences.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the global beer and cider market is compiled and analyzed. This involves examining production volumes, the ratio of on-trade versus off-trade sales, and consumer preference trends. Additionally, service quality statistics and the markets supply chain efficiency are analyzed to ensure reliable and accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, expert consultations are conducted through interviews with key industry stakeholders. This step incorporates feedback from beer and cider manufacturers, distributors, and hospitality sector professionals to obtain operational and financial insights. These consultations help refine and corroborate market data for accuracy.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all data, providing a comprehensive market analysis. Input from beer and cider producers, combined with a bottom-up approach, ensures the reliability of the market insights. This process involves verifying production data, sales performance, and consumer trends across major regions.

Frequently Asked Questions

1. How big is the global beer and cider market?

The global beer and cider market was valued at approximately USD 106.67 billion, driven by rising consumer demand for premium and craft beverages, and the growth of e-commerce platforms for alcohol sales.

2. What are the key challenges in the global beer and cider market?

Key challenges include stringent regulatory environments, rising raw material costs (such as barley and hops), and competition from non-alcoholic beverages. These factors present challenges to profit margins and market expansion.

3. Who are the major players in the global beer and cider market?

Major players in the market include Anheuser-Busch InBev, Heineken N.V., Molson Coors, Diageo plc, and Asahi Group Holdings. These companies dominate due to their global reach, extensive brand portfolios, and significant investments in sustainability.

4. What are the growth drivers of the global beer and cider market?

Growth drivers include increasing consumer demand for craft and premium beverages, the rising popularity of low- and no-alcohol variants, and the expanding availability of beer and cider through e-commerce channels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.