Global Bicycle Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD9685

November 2024

92

About the Report

Global Bicycle Market Outlook to 2028

Global Bicycle Market Overview

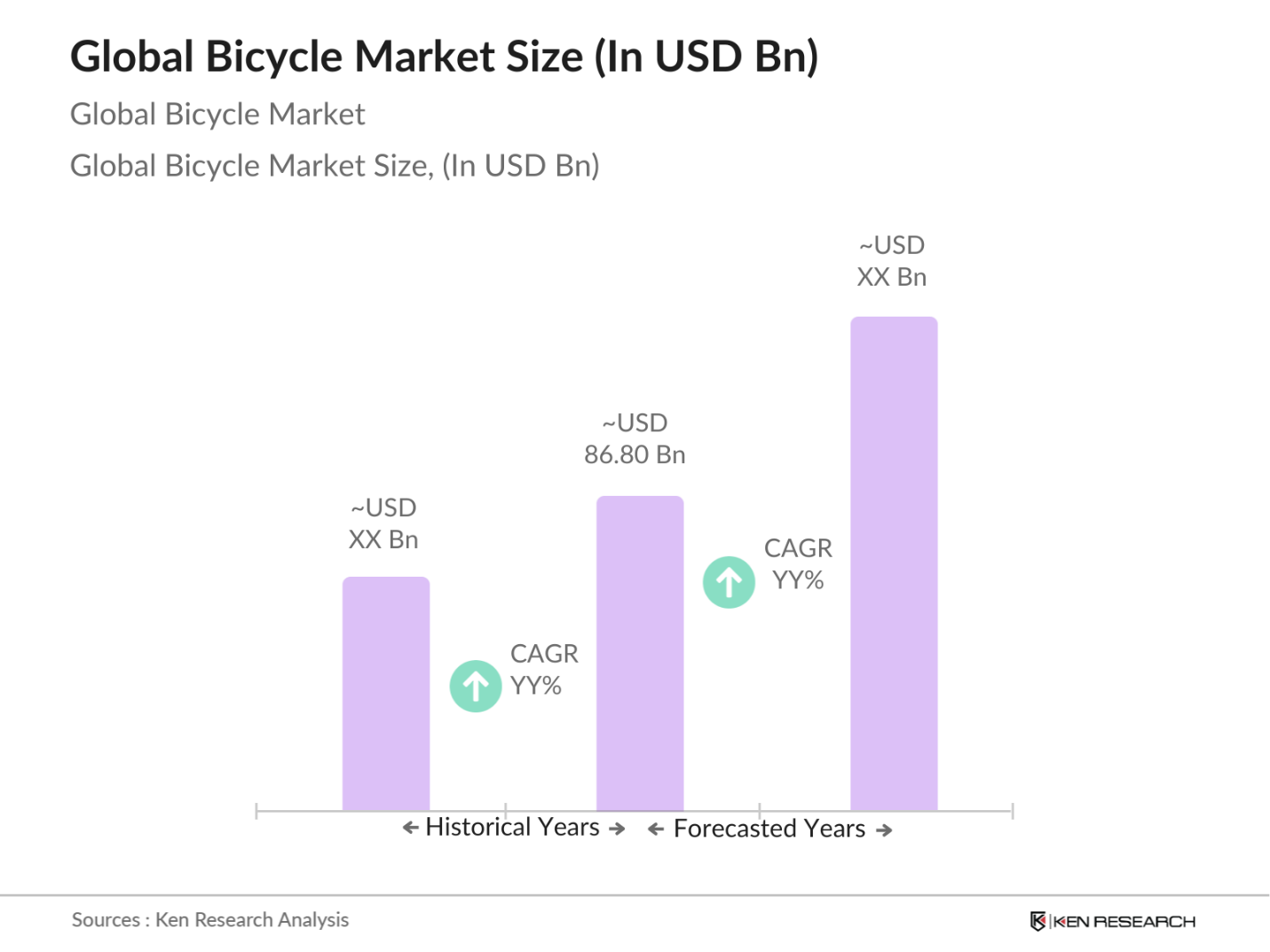

- The global bicycle market is valued at approximately USD 86.80 billion, driven primarily by the increasing consumer preference for eco-friendly and health-conscious transportation options. This growth is supported by the surge in electric bicycles and the demand for lightweight, technologically enhanced bicycles, which cater to urban commuters and fitness enthusiasts alike. Expansion of bicycle infrastructure in cities and rising awareness of environmental benefits have further propelled market expansion, establishing bicycles as both practical transportation and leisure tools globally.

- Key markets such as the United States, China, and the Netherlands dominate the global bicycle industry. In the United States, increased awareness of health and fitness, combined with urban initiatives to reduce emissions, has fueled the demand for bicycles. China remains dominant due to its massive population, government support for bicycle usage, and the popularity of bike-sharing programs. Meanwhile, the Netherlands stands out due to its established cycling culture and infrastructure, positioning bicycles as integral to daily life and transportation.

- Governments have launched health and fitness campaigns to address rising obesity and inactivity levels. In the U.K., the government has invested over 50 million in Cycle to Work programs, aimed at encouraging physical activity among citizens. These campaigns align with broader health objectives to reduce public healthcare burdens by promoting cycling as a preventative health measure.

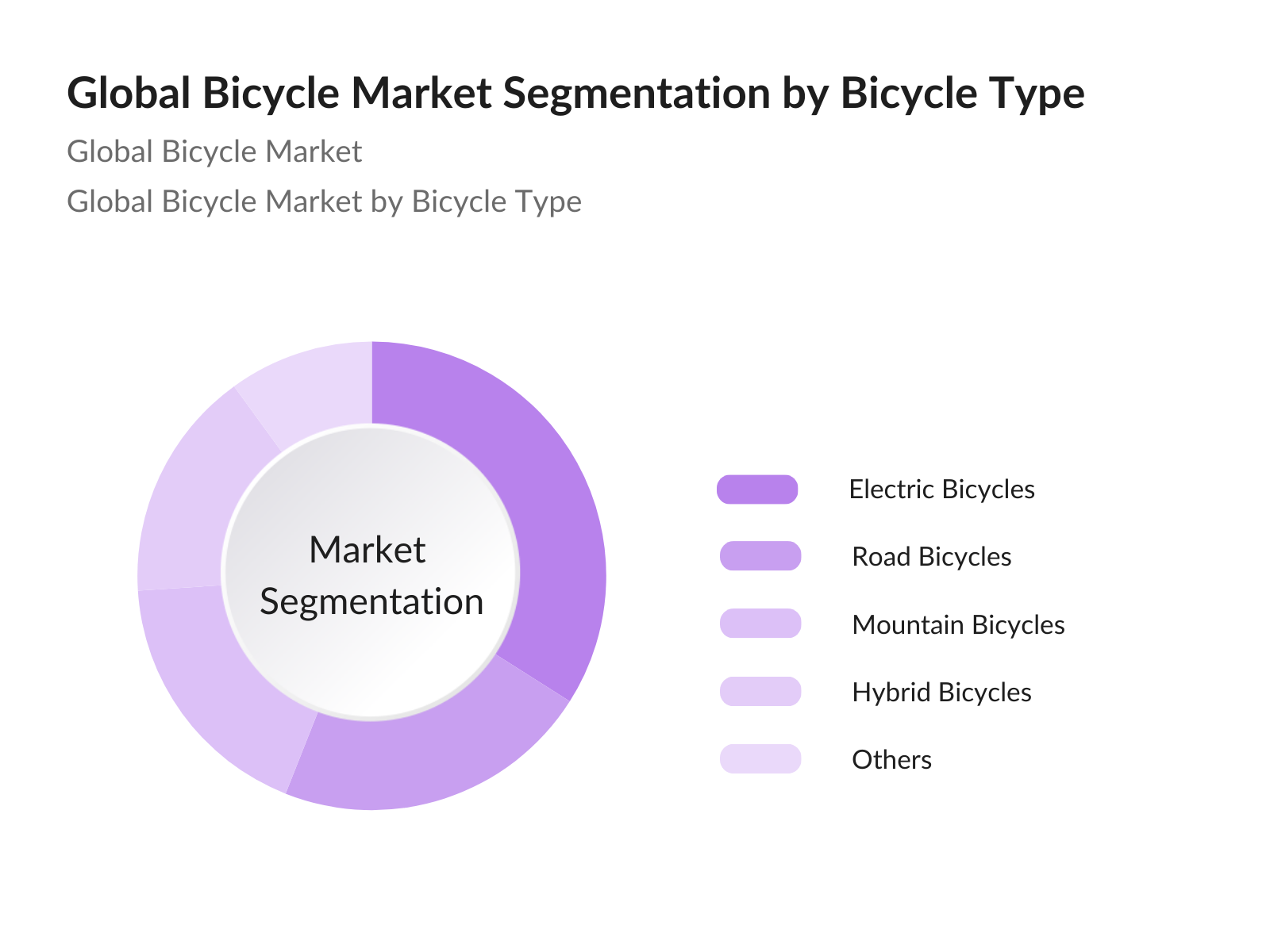

Global Bicycle Market Segmentation

By Bicycle Type: The global bicycle market is segmented by type into mountain bicycles, road bicycles, hybrid bicycles, electric bicycles, and others (including specialty bikes like folding and tandem bicycles). Electric bicycles have recently held the dominant market share within this category, driven by technological advancements in battery and motor systems, making them ideal for urban commutes. Additionally, e-bikes offer an eco-friendly and efficient solution for personal mobility, aligning with the global shift toward reducing carbon emissions.

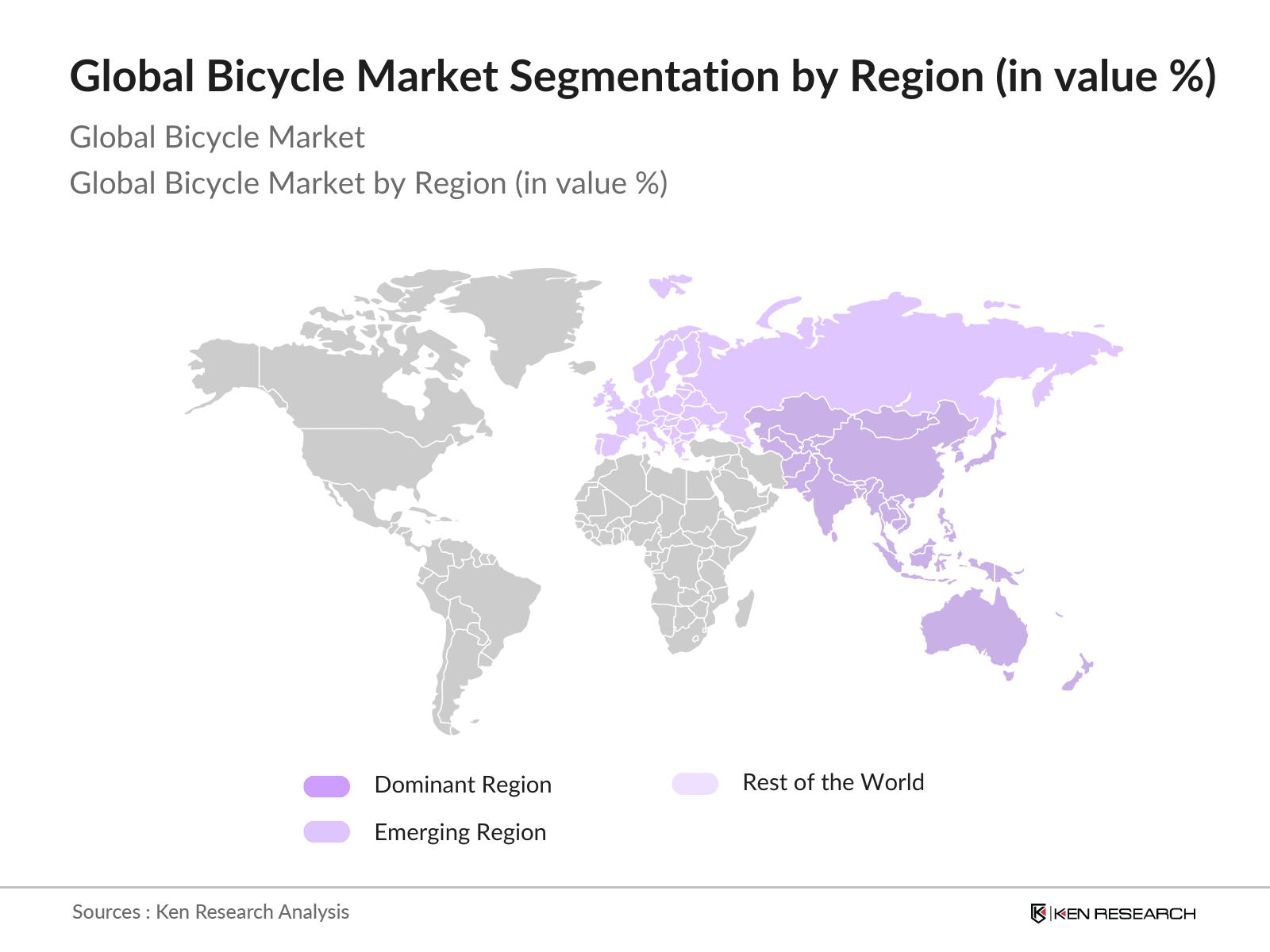

By Region: The global bicycle market is also segmented by region into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific leads the market due to China and Indias significant population base and government policies promoting bicycle use for reducing pollution. Europe follows closely, with its high adoption of bicycles in countries like the Netherlands and Germany, driven by eco-friendly transportation initiatives and extensive cycling infrastructure.

Global Bicycle Market Competitive Landscape

The global bicycle market is dominated by key players with significant market influence. Leading companies leverage innovative product lines, extensive distribution networks, and brand loyalty to maintain competitive advantages.

|

Company |

Established Year |

Headquarters |

Global Reach |

Product Innovation |

Sustainability Initiatives |

Market Share |

Production Capacity |

Customer Loyalty |

Partnerships |

|

Giant Manufacturing Co., Ltd. |

1972 |

Taiwan |

|||||||

|

Trek Bicycle Corporation |

1976 |

United States |

|||||||

|

Merida Industry Co., Ltd. |

1972 |

Taiwan |

|||||||

|

Specialized Bicycle Components |

1974 |

United States |

|||||||

|

Cannondale Bicycle Corporation |

1971 |

United States |

Global Bicycle Market Analysis

Market Growth Drivers

- Rising Urban Mobility Demand (Urbanization): The global shift towards urbanization has heightened demand for bicycles as a convenient, sustainable mode of transport. As of 2024, over 4.4 billion people live in urban areas, comprising more than of the global population, according to the World Bank. Urban congestion levels are worsening, with cities like New York reporting average speeds below 7 mph in central areas. In response, bicycles provide an efficient alternative, particularly for short-distance commutes. National governments are increasingly promoting bicycles to alleviate congestion and reduce greenhouse gas emissions.

- Health and Environmental Awareness (Health Trends, Eco-Consciousness): The bicycle market benefits from growing health consciousness, as global concerns over obesity and sedentary lifestyles have reached unprecedented levels. WHO data indicates that more than 1.9 billion adults were overweight in 2023, driving people toward cycling for physical fitness. Bicycles also offer an eco-friendly transport solution, supporting the decline in urban air pollution. For example, CO2 emissions in the U.S. saw a reduction of approximately 2 million tons due to increased bicycle use, according to the EPA.

- Government Support (Subsidies, Tax Incentives): Governments worldwide are offering financial incentives to encourage bicycle usage. For instance, France's Mobility Orientation Law allows employees to earn 400 per year for cycling to work. Similar tax breaks and incentives are provided in Germany, where electric bicycle subsidies range from 500 to 1,000. In the United States, a proposed tax credit under the E-BIKE Act could offer individuals up to $1,500 toward an electric bike purchase, with federal support helping to reduce overall transportation emissions.

Market Challenges:

- High Cost of Electric Bicycles (E-bike Affordability): The initial investment for electric bicycles remains a barrier, with many models priced between $1,000 and $5,000, which is significantly higher than traditional bicycles. According to a European Union report, the high costs deter lower-income consumers from opting for electric bikes, despite the potential long-term savings on commuting costs. The battery alone represents a substantial portion of the total e-bike cost, further complicating affordability. This issue is particularly pronounced in developing regions, where disposable incomes are often limited, making e-bikes a less accessible option.

- Market Fragmentation (Local and Global Brands): The bicycle market is highly fragmented, with numerous local and international players. The presence of a vast range of brands, each offering distinct products and price ranges, has led to a crowded marketplace. For example, over 500 bicycle brands operate within Europe, creating intense competition, especially in the electric bicycle segment. This fragmentation hampers brand loyalty and makes consumer decision-making challenging, impacting the profitability of individual brands.

Global Bicycle Market Future Outlook

Over the next five years, the global bicycle market is anticipated to experience substantial growth, driven by the widespread adoption of electric bicycles, increasing investments in bicycle infrastructure, and growing environmental awareness. Factors such as government incentives to reduce carbon footprints, urban mobility programs, and advancements in electric and smart bicycle technology are expected to significantly boost market expansion. Furthermore, the push for fitness and sustainable commuting options will continue to strengthen demand across various regions.

Market Opportunities:

- Growing Leisure and Adventure Cycling (Cycling Tourism, Events): Cycling tourism and adventure cycling have seen growth as people seek active leisure activities. The EU reported that cycling-related tourism generated an estimated 50 billion annually, with countries like France and Italy attracting large numbers of cycling tourists. Adventure cycling events in the United States, such as Bikepacking Adventures, have seen participant numbers double in recent years, reflecting growing interest in outdoor cycling experiences.

- Rising Demand for Sustainable Transport Solutions: Bicycles have become increasingly popular as a sustainable transportation mode amidst the global push for lower carbon emissions. According to the International Energy Agency, cycling currently offsets over 4 million tons of CO2 annually in urban areas, contributing to lower air pollution. The rise of zero-emission zones in cities such as London has further fueled bicycle adoption as an alternative to cars and motorbikes.

Scope of the Report

|

By Bicycle Type |

Mountain Bicycles Road Bicycles Hybrid Bicycles Electric Bicycles Others |

|

By Component |

Frame (Material Types) Wheels Gears & Brakes Electric Drive Units (Battery, Motor) Accessories & Add-ons |

|

By Distribution Channel |

Offline Retail (Bike Shops, Sports Stores) Online Sales (eCommerce Platforms) Direct Sales |

|

By End-User |

Personal Commercial (Bike-Sharing, Rental Services) |

|

By Region |

North America Europe, Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Bicycle Manufacturers and Suppliers

Electric Vehicle Component Manufacturers

Government and Regulatory Bodies (e.g., Environmental Protection Agency, Department of Transportation)

Investment and Venture Capitalist Firms

Bicycle Accessories and Equipment Manufacturers

Cycling Clubs and Event Organizers

Urban Mobility Solution Providers

Sustainability and Environmental NGOs

Companies

Players Mention in the Report

Giant Manufacturing Co., Ltd.

Trek Bicycle Corporation

Merida Industry Co., Ltd.

Specialized Bicycle Components, Inc.

Cannondale Bicycle Corporation

Accell Group N.V.

Dorel Industries Inc.

Derby Cycle

Santa Cruz Bicycles

Brompton Bicycle Ltd.

Kona Bicycle Company

Cervlo Cycles Inc.

Hero Cycles Ltd.

Scott Sports SA

Yamaha Motor Co., Ltd.

Table of Contents

01. Global Bicycle Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02. Global Bicycle Market Size (USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

03. Global Bicycle Market Dynamics

3.1 Growth Drivers

3.1.1 Rising Urban Mobility Demand (Urbanization)

3.1.2 Health and Environmental Awareness (Health Trends, Eco-Consciousness)

3.1.3 Infrastructure Development (Bike Lanes, Smart Cities)

3.1.4 Government Support (Subsidies, Tax Incentives)

3.2 Market Challenges

3.2.1 High Cost of Electric Bicycles (E-bike Affordability)

3.2.2 Regulatory Challenges (Import Tariffs, Safety Standards)

3.2.3 Market Fragmentation (Local and Global Brands)

3.3 Opportunities

3.3.1 Technological Advancements (Smart Features, GPS, IoT)

3.3.2 Growing Leisure and Adventure Cycling (Cycling Tourism, Events)

3.3.3 Rising Demand for Sustainable Transport Solutions

3.4 Trends

3.4.1 Rise in Electric Bicycles (Battery Technology, Urban Commutes)

3.4.2 Shift to Carbon Fiber and Lightweight Materials

3.4.3 Increasing Popularity of Bike-Sharing Programs

3.5 Government Initiatives and Policies

3.5.1 Emission Reduction Goals

3.5.2 Public Health and Fitness Campaigns

3.5.3 Infrastructure Investments (Bike Lane Expansions)

3.6 SWOT Analysis

3.7 Industry Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Landscape

04. Global Bicycle Market Segmentation

4.1 By Bicycle Type (In Value %)

4.1.1 Mountain Bicycles

4.1.2 Road Bicycles

4.1.3 Hybrid Bicycles

4.1.4 Electric Bicycles

4.1.5 Others (Folding, Specialty)

4.2 By Component (In Value %)

4.2.1 Frame (Material Types)

4.2.2 Wheels

4.2.3 Gears & Brakes

4.2.4 Electric Drive Units (Battery, Motor)

4.2.5 Accessories & Add-ons

4.3 By Distribution Channel (In Value %)

4.3.1 Offline Retail (Bike Shops, Sports Stores)

4.3.2 Online Sales (eCommerce Platforms)

4.3.3 Direct Sales

4.4 By End-User (In Value %)

4.4.1 Personal

4.4.2 Commercial (Bike-Sharing, Rental Services)

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

05. Global Bicycle Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Giant Manufacturing Co., Ltd.

5.1.2 Trek Bicycle Corporation

5.1.3 Merida Industry Co., Ltd.

5.1.4 Specialized Bicycle Components, Inc.

5.1.5 Cannondale Bicycle Corporation

5.1.6 Accell Group N.V.

5.1.7 Dorel Industries Inc.

5.1.8 Derby Cycle

5.1.9 Santa Cruz Bicycles

5.1.10 Brompton Bicycle Ltd.

5.1.11 Kona Bicycle Company

5.1.12 Cervlo Cycles Inc.

5.1.13 Hero Cycles Ltd.

5.1.14 Scott Sports SA

5.1.15 Yamaha Motor Co., Ltd.

5.2 Cross Comparison Parameters (Revenue, Global Reach, Product Portfolio, Sustainability Initiatives, Production Capacity, Technological Advancements, Customer Satisfaction, Regional Dominance)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

06. Global Bicycle Market Regulatory Framework

6.1 Bicycle Safety Standards and Regulations

6.2 Compliance with Environmental Standards

6.3 Certification and Licensing Requirements

07. Global Bicycle Market Future Size (USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08. Global Bicycle Market Future Segmentation

8.1 By Bicycle Type (In Value %)

8.2 By Component (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

09. Global Bicycle Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior Insights

9.3 Branding and Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the entire global bicycle ecosystem, incorporating key stakeholders, end-users, and regulatory authorities. Extensive secondary research is carried out using proprietary databases to identify critical market variables influencing growth and demand.

Step 2: Market Analysis and Data Compilation

In this stage, historical and current data related to market segmentation, customer demand, and manufacturing trends are compiled and analyzed. Statistical models are used to determine trends in revenue generation and the share of each segment within the market.

Step 3: Validation through Expert Consultation

Market hypotheses are developed and validated by engaging with industry experts through interviews and questionnaires. This feedback provides essential qualitative insights that support the accuracy and reliability of the quantitative data.

Step 4: Synthesis and Final Output Generation

The final phase includes synthesizing the insights from direct engagement with manufacturers and stakeholders. This stage ensures that the market report presents a comprehensive, validated overview, highlighting critical growth opportunities and market dynamics.

Frequently Asked Questions

01. How big is the global bicycle market?

The global bicycle market is valued at approximately USD 86.80 billion, propelled by a growing consumer preference for eco-friendly and health-conscious transportation options.

02. What are the main challenges in the global bicycle market?

Key challenges include high costs associated with electric bicycles, regulatory compliance issues, and market fragmentation due to the presence of both local and global brands.

03. Who are the major players in the global bicycle market?

Prominent companies in the market include Giant Manufacturing, Trek Bicycle Corporation, and Specialized Bicycle Components, which lead due to their extensive product innovation and strong brand loyalty.

04. What drives growth in the global bicycle market?

Growth is driven by technological advancements in electric bicycles, government support for reducing emissions, and the rising trend of using bicycles as a fitness and lifestyle choice.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.