Global Biodegradable Packaging Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2985

November 2024

92

About the Report

Global Biodegradable Packaging Market Overview

- The global biodegradable packaging market is valued at USD 468.16 billion, driven by increasing consumer demand for eco-friendly alternatives and stringent government regulations aimed at reducing plastic waste. The market is experiencing steady growth as industries such as food & beverages, healthcare, and personal care sectors shift toward sustainable packaging. The rising awareness among consumers about environmental sustainability and the demand for organic, recyclable packaging materials have significantly boosted market demand.

- The global biodegradable packaging market is dominated by regions such as Germany, the United States, and China, driven by robust government regulations, heavy investments in research and development, and the presence of multinational corporations. Germany's strict regulations on single-use plastics, alongside China's massive manufacturing capabilities and proactive environmental policies, propel these regions to the forefront. The U.S. leads through innovation, with its packaging and material science sectors advancing eco-friendly solutions that cater to a wide range of industries.

- Government regulations are a significant driving force in the biodegradable packaging market. As of 2023, more than 40 countries, including China, France, and Kenya, have enforced strict bans on single-use plastics, pushing businesses to adopt biodegradable packaging alternatives. The European Unions Packaging Waste Directive sets strict targets for reducing packaging waste, further encouraging the shift to eco-friendly packaging solutions. Extended Producer Responsibility (EPR) policies in countries like Germany and Canada hold manufacturers accountable for the entire lifecycle of their packaging, compelling them to adopt biodegradable materials to meet compliance standards.

Global Biodegradable Packaging Market Segmentation

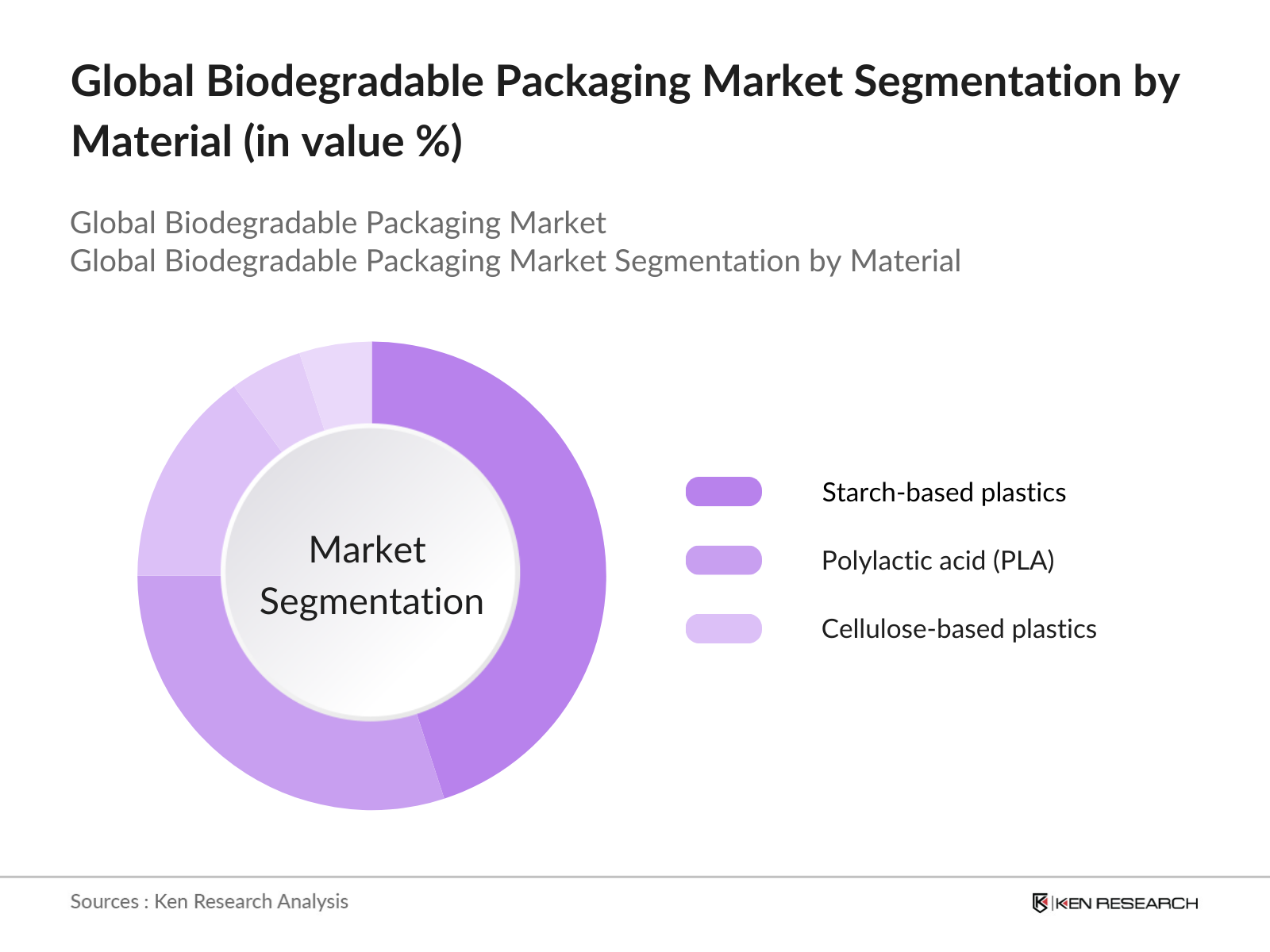

By Material: The global biodegradable packaging market is segmented by material into starch-based plastics, polylactic acid (PLA), and cellulose-based plastics. PLA has a dominant market share under the material segmentation due to its versatility and ability to be used in a wide range of packaging applications, especially in the food & beverage industry. PLA is also popular because it is derived from renewable sources like corn starch, making it a favorable choice for sustainable packaging solutions.

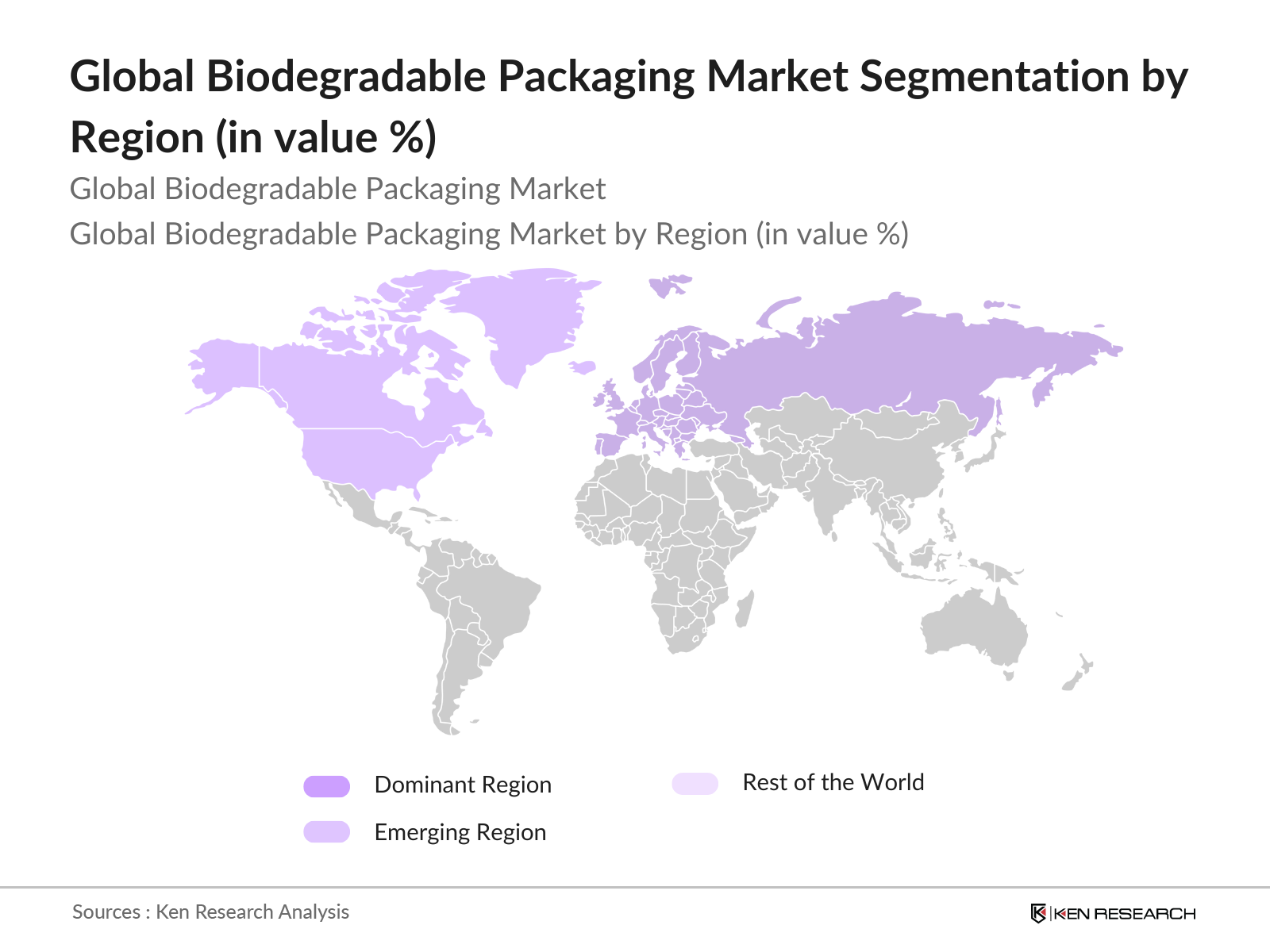

By Region: The global biodegradable packaging market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Europe holds a significant market share due to its stringent regulations on waste management and sustainability. The European Unions ban on single-use plastics and its extended producer responsibility (EPR) policies have significantly accelerated the adoption of biodegradable packaging solutions, positioning Europe as a leader in sustainability-focused packaging innovations.

Global Biodegradable Packaging Market Competitive Landscape

The global biodegradable packaging market is consolidated, with key players adopting strategies such as product innovation, mergers and acquisitions, and sustainability initiatives. Companies like Tetra Pak International and Amcor Plc have established a strong foothold in the market through continuous investments in research and development, while others like BASF SE are pushing for large-scale production of biodegradable materials to meet the growing market demand.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Product Portfolio |

Sustainability Initiatives |

Market Share |

R&D Investment |

Global Reach |

|

Tetra Pak International |

1951 |

Switzerland |

11.5 |

Paper-based cartons |

Renewable packaging |

25% |

High |

Global |

|

Amcor Plc |

1860 |

Switzerland |

12.9 |

Flexible & rigid |

2025 sustainability targets |

20% |

Medium |

Global |

|

BASF SE |

1865 |

Germany |

67.7 |

Biodegradable plastics |

Eco-efficiency analysis |

15% |

High |

Global |

|

Mondi Group |

1967 |

UK |

7.3 |

Paper & plastic |

Circular economy focus |

10% |

Medium |

Europe, APAC |

|

Smurfit Kappa Group |

1934 |

Ireland |

10.3 |

Corrugated packaging |

Recycling & waste reduction |

8% |

Medium |

Europe, Americas |

Global Biodegradable Packaging Industry Analysis

Global Biodegradable Packaging Market Growth Drivers

- Rising Demand for Sustainable Packaging: Global demand for biodegradable packaging is surging due to environmental concerns and consumer preference for sustainable products. This trend reflects a growing awareness of plastic waste issues and a shift toward eco-friendly alternatives. Government policies also play a significant role in boosting demand for biodegradable packaging options. As more consumers prioritize sustainability in their purchasing decisions, brands are increasingly adopting biodegradable materials to meet these expectations.

- Corporate Sustainability Goals: Many corporations are adopting sustainable packaging to meet their environmental targets. Major global brands like Nestl and Unilever have committed to making their packaging recyclable or reusable in the coming years. These initiatives align with national goals in several countries to reduce plastic waste, such as the UK's 25-Year Environment Plan. Such corporate-driven demand is a significant driver for innovation and investment in biodegradable packaging solutions, particularly in the food and beverage industries.

- Consumer Awareness and Preference: Consumer demand for eco-friendly packaging is another key driver of growth. Many consumers in North America and Europe consider sustainability when making purchasing decisions. This shift in consumer preference has influenced retailers and manufacturers to adopt biodegradable packaging solutions. Additionally, the rise of e-commerce, particularly in food delivery services, has heightened the need for environmentally friendly packaging, further driving the market.

Global Biodegradable Packaging Market Challenges

- Higher Production Costs: Biodegradable packaging materials are generally more expensive to produce than traditional plastic. For instance, according to a report from the World Economic Forum, biodegradable materials such as PLA and PHA can cost 2-3 times more than conventional plastic packaging materials. The higher cost can be a significant deterrent for small and medium-sized businesses, especially in price-sensitive markets like Southeast Asia and Africa. These cost differences are expected to remain a challenge unless economies of scale are achieved.

- Underdeveloped Recycling and Composting Infrastructure: Many regions, particularly in developing countries, lack adequate recycling or composting infrastructure to manage biodegradable packaging waste. Infrastructure challenges in areas like sub-Saharan Africa and parts of Asia hinder the effective disposal of biodegradable packaging. This poses a significant barrier to the widespread adoption of biodegradable packaging, as waste management systems struggle to keep up with new material requirements.

Global Biodegradable Packaging Market Future Outlook

Over the next five years, the global biodegradable packaging market is expected to experience significant growth, driven by increased government support for sustainable initiatives and rising consumer demand for environmentally friendly packaging options. The adoption of biodegradable packaging will continue to accelerate, especially in industries like food & beverages and healthcare, which are under constant scrutiny regarding their environmental footprint.

Market Opportunities:

- Technological Advancements in Biodegradable Packaging Materials: The development of advanced biodegradable materials, such as algae-based polymers and bio-derived nanocomposites, is gaining traction in the packaging industry. According to the International Energy Agency (IEA), breakthroughs in manufacturing techniques are improving the barrier properties of biodegradable materials, making them more suitable for packaging applications in the food, beverage, and pharmaceutical industries. These technological advancements are helping biodegradable packaging compete with conventional plastics in terms of performance and shelf life.

- Circular Economy Initiatives: Many countries are implementing circular economy initiatives aimed at promoting sustainable production and consumption. The European Union's Circular Economy Action Plan focuses on reducing packaging waste and encouraging the use of biodegradable materials. These initiatives are transforming the packaging industry by promoting the adoption of biodegradable materials and reducing plastic waste.

Scope of the Report

|

By Material |

Starch-based Plastics Cellulose-based Plastics PLA PHA Bio-polyethylene Bio-polypropylene |

|

By Packaging Type |

Flexible Packaging Rigid Packaging Coatings |

|

By End-Use Industry |

Food & Beverages Healthcare Personal Care Homecare Industrial Agricultural |

|

By Distribution Channel |

B2B (Direct Sales OEMs) B2C (Retail E-commerce) |

|

By Region |

North America Midwest West Coast Southern States |

Products

Key Target Audience

Food & Beverage Manufacturers

Healthcare & Pharmaceutical Companies

Personal Care & Cosmetic Companies

Packaging Material Manufacturers

Environmental Agencies (EPA, European Environment Agency)

Government & Regulatory Bodies (European Union, US FDA)

Venture Capital Firms & Investors

Waste Management & Recycling Companies

Companies

Players Mention in the Report

Tetra Pak International S.A.

Amcor Plc

BASF SE

Mondi Group

Smurfit Kappa Group

Sealed Air Corporation

Stora Enso Oyj

DS Smith Plc

Novamont S.p.A

NatureWorks LLC

Huhtamki Oyj

WestRock Company

TIPA Corp Ltd.

Vegware Ltd.

Klabin S.A.

Table of Contents

1. Global Biodegradable Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Value %, Volume %)

1.4. Market Segmentation Overview (Based on Materials, End-Use, Packaging Type, Region)

2. Global Biodegradable Packaging Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (Market Growth Rate)

2.3. Key Market Developments and Milestones

3. Global Biodegradable Packaging Market Analysis

3.1. Growth Drivers (Rising Demand for Sustainable Packaging, Government Regulations, Consumer Awareness)

3.2. Market Challenges (Higher Costs, Limited Availability of Raw Materials, Recycling Infrastructure)

3.3. Opportunities (Expansion into Emerging Markets, Innovation in Biodegradable Materials, Strategic Partnerships)

3.4. Trends (Technological Advancements, Increased Adoption of Plant-based Packaging, Circular Economy Initiatives)

3.5. Government Regulations (Bans on Single-Use Plastics, Packaging Waste Directives, Extended Producer Responsibility Policies)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces (Supplier Power, Buyer Power, Competitive Rivalry, Threat of Substitution, Threat of New Entrants)

3.9. Competition Ecosystem

4. Global Biodegradable Packaging Market Segmentation

4.1. By Material (In Value %) 4.1.1. Starch-based Plastics

4.1.2. Cellulose-based Plastics

4.1.3. Polylactic Acid (PLA)

4.1.4. Polyhydroxyalkanoates (PHA)

4.1.5. Others (Bio-polyethylene, Bio-polypropylene)

4.2. By Packaging Type (In Value %)

4.2.1. Flexible Packaging

4.2.2. Rigid Packaging

4.2.3. Coatings

4.3. By End-Use Industry (In Value %)

4.3.1. Food & Beverages

4.3.2. Healthcare

4.3.3. Personal Care

4.3.4. Homecare

4.3.5. Others (Industrial, Agricultural)

4.4. By Distribution Channel (In Value %) 4.4.1. B2B (Direct Sales, OEMs)

4.4.2. B2C (Retail, E-commerce)

4.5. By Region (In Value %) 4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Biodegradable Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tetra Pak International S.A.

5.1.2. Amcor Plc

5.1.3. BASF SE

5.1.4. Smurfit Kappa Group

5.1.5. Mondi Group

5.1.6. Sealed Air Corporation

5.1.7. Stora Enso Oyj

5.1.8. DS Smith Plc

5.1.9. Klabin S.A.

5.1.10. Novamont S.p.A

5.1.11. NatureWorks LLC

5.1.12. Huhtamki Oyj

5.1.13. WestRock Company

5.1.14. TIPA Corp Ltd.

5.1.15. Vegware Ltd.

5.2. Cross Comparison Parameters (Market Capitalization, Production Volume, Market Share, Environmental Certifications, R&D Investment, Innovation Index, Sustainability Score, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Innovations, Regional Expansions, Sustainability Initiatives)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Venture Capital Funding, Government Grants, Private Equity Investments)

6. Global Biodegradable Packaging Market Regulatory Framework

6.1. Environmental Standards (ISO Certifications, EU Packaging and Waste Directive, US EPA Standards)

6.2. Compliance Requirements (Packaging and Packaging Waste Directive, Compostability Standards, Certifications like ASTM D6400, EN 13432)

6.3. Certification Processes (OK Compost, Home Compost Certifications, BPI Certifications)

7. Global Biodegradable Packaging Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Biodegradable Packaging Future Market Segmentation

8.1. By Material (In Value %)

8.2. By Packaging Type (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Biodegradable Packaging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with mapping the ecosystem of the biodegradable packaging market. This involves identifying key variables such as government policies, market trends, and technological advancements that influence market dynamics. Secondary research is conducted to collect reliable data from credible sources such as government reports, industry whitepapers, and proprietary databases.

Step 2: Market Analysis and Construction

In this phase, we analyze the historical data of the biodegradable packaging market to assess market size, growth trends, and penetration levels. Detailed research is conducted on various market segments, including material types, packaging types, and regions, to establish accurate growth estimates.

Step 3: Hypothesis Validation and Expert Consultation

We conduct expert interviews with industry professionals to validate our market hypotheses and gain insights into the latest industry developments. This phase includes discussions with key players, material scientists, and industry regulators to cross-check the data and enhance the accuracy of our market projections.

Step 4: Research Synthesis and Final Output

The final step is the synthesis of all gathered data, which includes integrating inputs from industry experts with quantitative analysis. The research output is refined to ensure the highest level of accuracy and relevance for business professionals looking to make informed decisions in the biodegradable packaging market.

Frequently Asked Questions

01. How big is the global biodegradable packaging market?

The global biodegradable packaging market is valued at USD 468.16 billion, driven by increasing demand for eco-friendly packaging solutions and strict government regulations aimed at reducing plastic waste.

02. What are the challenges in the biodegradable packaging market?

Challenges in the market include the high cost of biodegradable materials, limited recycling infrastructure, and the technical difficulties in scaling up production for mass use across various industries.

03. Who are the major players in the global biodegradable packaging market?

Key players in the market include Tetra Pak International, Amcor Plc, BASF SE, Mondi Group, and Smurfit Kappa Group. These companies dominate due to their extensive product portfolios, strong R&D investments, and sustainability initiatives.

04. What are the growth drivers of the global biodegradable packaging market?

The market is driven by increasing consumer awareness of environmental issues, government regulations aimed at reducing plastic waste, and innovations in biodegradable material technology that make sustainable packaging more affordable and effective.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.