Global Bioethanol Market Outlook 2030

Region:Global

Author(s):Shivani

Product Code:KROD7972

October 2024

88

About the Report

Global Bioethanol Market Overview

- The global bioethanol market is valued at USD 83.4 billion, driven by a growing emphasis on renewable energy sources and government mandates promoting ethanol blending in transportation fuels. Bioethanol has emerged as a cost-competitive alternative to fossil fuels, particularly in the transportation sector. This market's expansion is underpinned by technological advancements in bioethanol production, especially in second-generation bioethanol from non-food biomass like agricultural residues. The market's growth is also fueled by increased demand for eco-friendly fuels to meet global carbon emission reduction goals.

- Countries like the U.S., Brazil, and China dominate the bioethanol market, primarily due to favorable government policies, abundant feedstock availability, and well-established production infrastructures. The U.S. benefits from significant corn production, while Brazil capitalizes on its sugarcane resources, making them the world's leading producers of bioethanol. Additionally, both nations have enforced stringent ethanol blending mandates that drive domestic demand, supported by strong agricultural sectors that provide cost-efficient raw materials.

- Governments worldwide are offering incentives to bioethanol producers. In 2022, the U.S. government provided $600 million in subsidies for bioethanol production under the Renewable Energy for America Program (REAP). Similarly, the Brazilian government introduced tax breaks for bioethanol exporters, which led to a 15% increase in bioethanol exports in 2023. These incentives are critical in supporting the industrys growth.

Global Bioethanol Market Segmentation

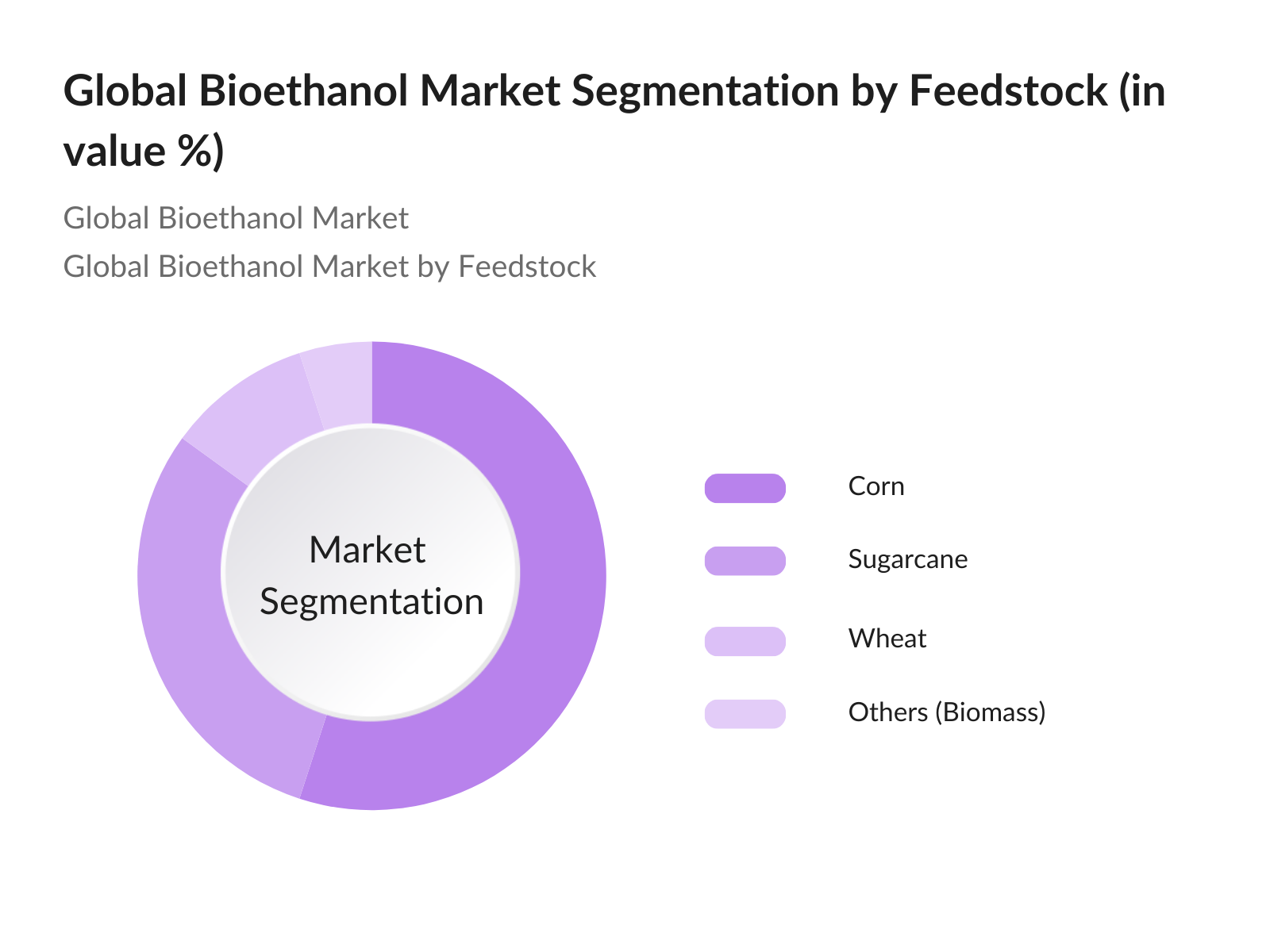

By Feedstock: The global bioethanol market is segmented by feedstock into sugarcane, corn, wheat, and others such as lignocellulosic biomass. Corn-based ethanol dominates the market due to its vast cultivation in the U.S., which is the world's largest producer of bioethanol. The infrastructure in the U.S. supports large-scale bioethanol production, and the country's extensive ethanol blending policies further solidify corn's dominance in this segment. Sugarcane-based ethanol also holds a substantial share, driven primarily by Brazil, where sugarcane production is highly efficient and integrated into bioethanol production systems.

|

Feedstock |

Market Share (2023) |

|---|---|

|

Corn |

55% |

|

Sugarcane |

30% |

|

Wheat |

10% |

|

Others (Biomass) |

5% |

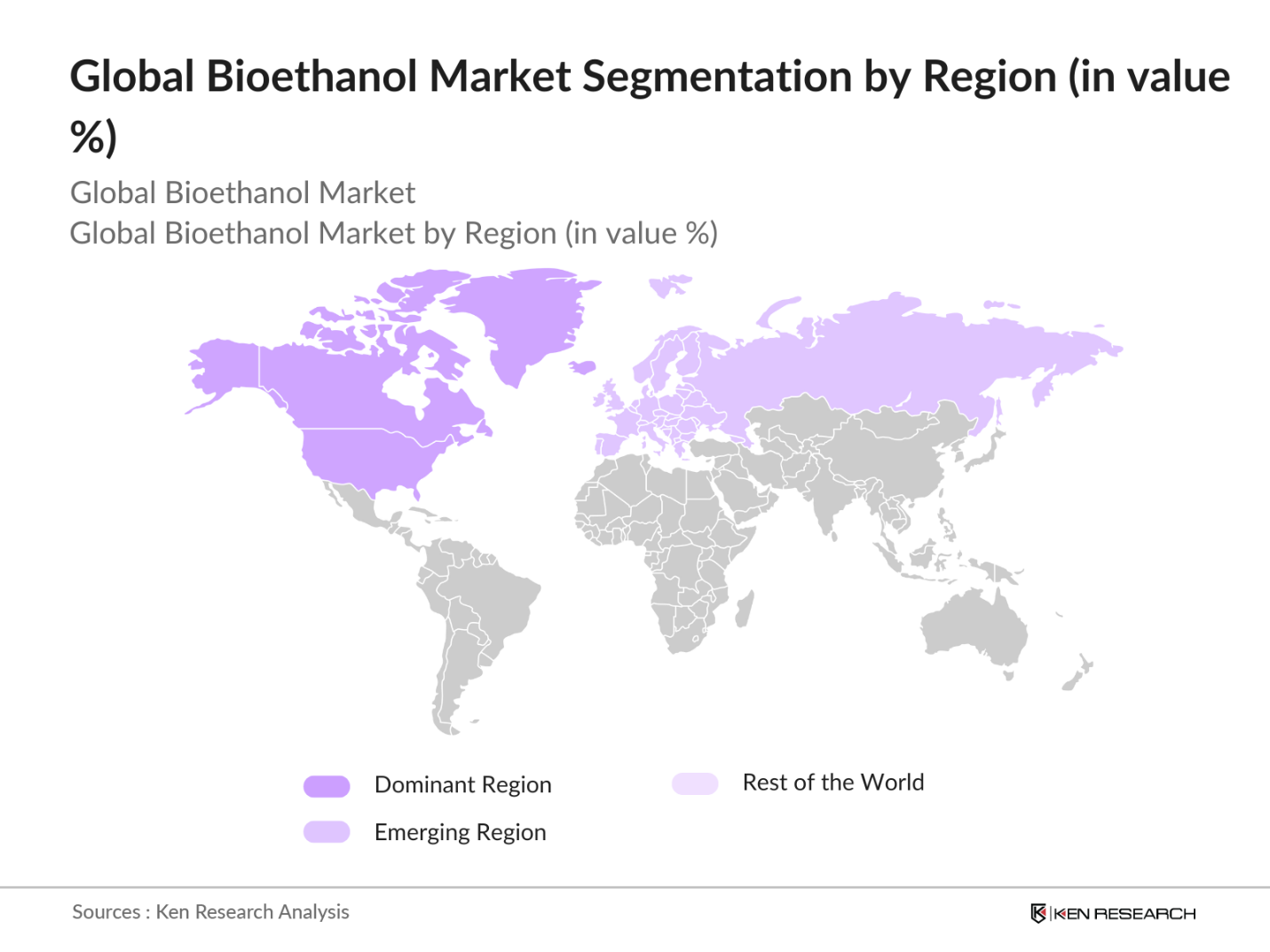

By Region: The global bioethanol market is dominated by North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market, supported by the U.S.s leadership in bioethanol production and consumption. The region benefits from a well-developed infrastructure and strong government mandates for ethanol use. Latin America, led by Brazil, also holds a significant market share due to its established sugarcane-based ethanol industry, which has gained recognition for its lower carbon footprint compared to other feedstocks.

|

Region |

Market Share (2023) |

|---|---|

|

North America |

45% |

|

Europe |

25% |

|

Latin America |

15% |

|

Asia-Pacific |

10% |

|

Middle East & Africa |

5% |

Global Bioethanol Market Competitive Landscape

The global bioethanol market is highly competitive, with a few key players holding substantial market shares. Major players in the market include Archer Daniels Midland Company, POET LLC, and Green Plains Inc. These companies have established strong production capacities and benefit from access to key feedstocks, particularly corn and sugarcane. Strategic partnerships with government bodies and ongoing investments in technological advancements have allowed these companies to maintain their dominance in the market.

|

Company |

Establishment Year |

Headquarters |

Feedstock Source |

Production Capacity |

Strategic Partnerships |

R&D Investments |

Sustainability Practices |

Global Footprint |

|

Archer Daniels Midland Co. |

1902 |

USA |

Corn |

|||||

|

POET LLC |

1983 |

USA |

Corn |

|||||

|

Green Plains Inc. |

2004 |

USA |

Corn |

|||||

|

Valero Energy Corporation |

1980 |

USA |

Corn |

|||||

|

Razen S.A. |

2011 |

Brazil |

Sugarcane |

Global Bioethanol Market Analysis

Market Growth Drivers:

- Rising Demand for Renewable Energy: The global shift towards renewable energy is significantly driving bioethanol demand. As of 2024, the International Energy Agency (IEA) estimates that renewable energy is becoming a central component of the global energy mix, with biofuels, including bioethanol, playing a critical role. Government-backed renewable energy projects, especially in countries like the United States and Brazil, have pushed bioethanol production to 54 billion liters and 36 billion liters, respectively, in 2023. These volumes are pivotal in reducing dependency on fossil fuels and aligning with global energy security goals.

- Government Policies Supporting Ethanol Blending: Governments globally are implementing ethanol blending mandates to lower carbon emissions. For instance, the Indian government has mandated ethanol blending in petrol by 2025. Brazil, a leading bioethanol producer, has maintained its blending rate since 2022. The U.S. Renewable Fuel Standard (RFS) ensures 15 billion gallons of ethanol blending annually. These policies not only reduce emissions but also create opportunities for higher bioethanol production, driving the global market toward meeting renewable energy goals and reducing reliance on fossil fuels.

- Rising Environmental Awareness (Carbon Footprint Reduction): Bioethanol, as a renewable fuel, significantly reduces greenhouse gas emissions compared to gasoline, according to a 2023 report by the U.S. Environmental Protection Agency (EPA). Countries like Germany and France are leading in reducing their transportation carbon footprint, with bioethanol consumption cutting emissions by 22 million metric tons globally in 2022. This increase in environmental awareness, along with governmental incentives, is pushing industries and consumers towards adopting bioethanol as a sustainable alternative to traditional fossil fuels.

Market challenges:

- High Production Costs (Feedstock Costs): Bioethanol production costs remain high, largely driven by the cost of feedstock, such as corn and sugarcane. As of 2024, the global average price of corn reached $250 per ton, up from previous years. In Brazil, sugarcane feedstock prices have also risen, leading to increased bioethanol production costs. These higher costs reduce profit margins and limit competitive pricing in certain regions, posing a challenge to bioethanol producers who aim to balance production efficiency with market competitiveness.

- Competition from Alternative Fuels: Alternative renewable fuels, such as biodiesel and hydrogen, are increasingly competing with bioethanol. According to a 2023 report from the International Energy Agency (IEA), biodiesel production in the EU has seen notable growth, while hydrogen fuel infrastructure has rapidly expanded. This increased adoption of alternative fuels is shifting attention away from bioethanol as industries and consumers explore more sustainable and cost-effective energy options. This competition presents a challenge for bioethanol producers as the market for renewable energy diversifies and new technologies gain traction.

Global Bioethanol Market Future Outlook

The global bioethanol market is expected to witness substantial growth in the coming years, driven by continuous government initiatives supporting renewable energy adoption, advancements in second-generation bioethanol production, and increased consumer awareness regarding carbon emissions. With major economies focusing on reducing their carbon footprints, bioethanol will play a crucial role in the global shift towards cleaner energy. Key markets like the U.S., Brazil, and China are expected to continue leading the market due to favorable policies and technological advancements in bioethanol production.

Market Opportunities:

- Expansion into Emerging Markets (Regional Market Penetration): Emerging economies in Southeast Asia and Africa are increasingly adopting bioethanol to meet their renewable energy needs. The World Bank estimates that these regions will require an additional 20 million liters of bioethanol annually by 2025 to meet their energy demands. Countries like Vietnam and Kenya are investing heavily in bioethanol production infrastructure, with Kenya announcing a $500 million investment plan in 2023 for bioethanol refineries.

- Development of Second-Generation Bioethanol (Cellulosic Ethanol): Second-generation bioethanol, produced from non-food crops like agricultural waste, presents a promising opportunity. In 2023, U.S. bioethanol producers reported a 12% increase in cellulosic ethanol production, amounting to 500 million liters. This shift reduces dependency on food-based crops, addressing concerns about food security. Technological advancements in the production process are further reducing costs, making cellulosic ethanol a viable alternative.

Scope of the Report

|

By Feedstock |

Sugarcane Corn Wheat Others |

|

By Application |

Transportation Power Generation Industrial Solvents Pharmaceutical & Cosmetics |

|

By End-Use Industry |

Automotive Energy & Power Chemicals Healthcare |

|

By Production Process |

Fermentation Synthetic Ethanol Enzymatic Hydrolysis |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Bioethanol Producers

Automobile Manufacturers

Government and Regulatory Bodies (EPA, USDA)

Ethanol Blending Companies

Energy and Power Companies

Industrial Solvents Manufacturers

Investors and Venture Capitalist Firms

Biofuel Technology Providers

Companies

Global Bioethanol Market

-

Archer Daniels Midland Company

POET LLC

Green Plains Inc.

Valero Energy Corporation

Flint Hills Resources

BP Biofuels

Royal Dutch Shell Plc

Abengoa Bioenergy

Pacific Ethanol, Inc.

Cargill, Inc.

Razen S.A.

Novozymes A/S

Clariant

Greenfield Global

CropEnergies AG

Table of Contents

1. Global Bioethanol Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Bioethanol Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Bioethanol Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Renewable Energy

3.1.2 Government Policies Supporting Ethanol Blending

3.1.3 Technological Advancements in Fermentation Processes

3.1.4 Rising Environmental Awareness (Carbon Footprint Reduction)

3.2 Market Challenges

3.2.1 High Production Costs (Feedstock Costs)

3.2.2 Infrastructure Limitations (Logistics and Storage)

3.2.3 Competition from Alternative Fuels

3.3 Opportunities

3.3.1 Expansion into Emerging Markets (Regional Market Penetration)

3.3.2 Development of Second-Generation Bioethanol (Cellulosic Ethanol)

3.3.3 Integration with Carbon Capture and Storage (CCS)

3.4 Trends

3.4.1 Bioethanol as a Feedstock for Bioplastics

3.4.2 Increase in Flex-Fuel Vehicles Adoption

3.4.3 Sustainable Bioethanol Production Practices

3.5 Regulatory Landscape

3.5.1 Ethanol Blending Mandates (Regional Ethanol Blending Policies)

3.5.2 Incentives for Bioethanol Producers

3.5.3 Emission Reduction Targets (Renewable Energy Directives)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Feedstock Suppliers, Producers, Distributors)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Global Bioethanol Market Segmentation

4.1 By Feedstock (In Value %)

4.1.1 Sugarcane

4.1.2 Corn

4.1.3 Wheat

4.1.4 Others (e.g., Lignocellulosic Biomass)

4.2 By Application (In Value %)

4.2.1 Transportation (E10, E85, Flex-Fuel Vehicles)

4.2.2 Power Generation

4.2.3 Industrial Solvents

4.2.4 Pharmaceutical & Cosmetics

4.3 By End-Use Industry (In Value %)

4.3.1 Automotive

4.3.2 Energy and Power

4.3.3 Chemicals

4.3.4 Healthcare

4.4 By Production Process (In Value %)

4.4.1 Fermentation

4.4.2 Synthetic Ethanol

4.4.3 Enzymatic Hydrolysis

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Bioethanol Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Archer Daniels Midland Company

5.1.2 POET LLC

5.1.3 Green Plains Inc.

5.1.4 Valero Energy Corporation

5.1.5 Flint Hills Resources

5.1.6 BP Biofuels

5.1.7 Royal Dutch Shell Plc

5.1.8 Abengoa Bioenergy

5.1.9 Pacific Ethanol, Inc.

5.1.10 Cargill, Inc.

5.1.11 Razen S.A.

5.1.12 Novozymes A/S

5.1.13 Clariant

5.1.14 Greenfield Global

5.1.15 CropEnergies AG

5.2 Cross Comparison Parameters (Revenue, Market Share, Production Capacity, Bioethanol Yield, Feedstock Source, R&D Investments, Strategic Partnerships, Global Footprint)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers & Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Subsidies

5.9 Private Equity Investments

6. Global Bioethanol Market Regulatory Framework

6.1 Biofuel Regulations (Biofuel Quotas and Subsidies)

6.2 Compliance and Certification Standards (Sustainability Standards, ISCC)

6.3 Environmental Standards (GHG Emissions Regulations)

7. Global Bioethanol Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Bioethanol Future Market Segmentation

8.1 By Feedstock (In Value %)

8.2 By Application (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Production Process (In Value %)

8.5 By Region (In Value %)

9. Global Bioethanol Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step in the research process is mapping the bioethanol market ecosystem by identifying major stakeholders, such as feedstock suppliers, producers, and government bodies. This step relies on extensive desk research utilizing proprietary databases and secondary sources to gather market-specific data.

Step 2: Market Analysis and Construction

In this phase, historical data on bioethanol production, consumption, and import-export flows are analyzed. Special attention is given to market dynamics such as feedstock availability, production cost, and technological innovations in bioethanol production.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through consultations with industry experts via structured interviews. These consultations provide key insights on emerging trends, production challenges, and competitive strategies.

Step 4: Research Synthesis and Final Output

Finally, the data is synthesized to provide a comprehensive and validated market outlook. This phase also involves detailed analysis of production capacities, market growth drivers, and strategic initiatives by major players.

Frequently Asked Questions

1 How big is the Global Bioethanol Market?

The global bioethanol market is valued at USD 83.4 billion, driven by rising demand for renewable energy sources and government mandates supporting ethanol blending in transportation fuels.

2 What are the challenges in the Global Bioethanol Market?

Key challenges include high feedstock costs, competition from other biofuels, and the logistical constraints in bioethanol storage and transportation.

3 Who are the major players in the Global Bioethanol Market?

Major players include Archer Daniels Midland Company, POET LLC, Green Plains Inc., Valero Energy Corporation, and Razen S.A., leading the market through strong production capacities and technological advancements.

4 What are the growth drivers of the Global Bioethanol Market?

The market is propelled by government policies promoting ethanol blending, advancements in bioethanol production technologies, and the rising global focus on reducing carbon emissions from transportation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.