Global Biomarkers Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2916

December 2024

86

About the Report

Global Biomarkers Market Overview

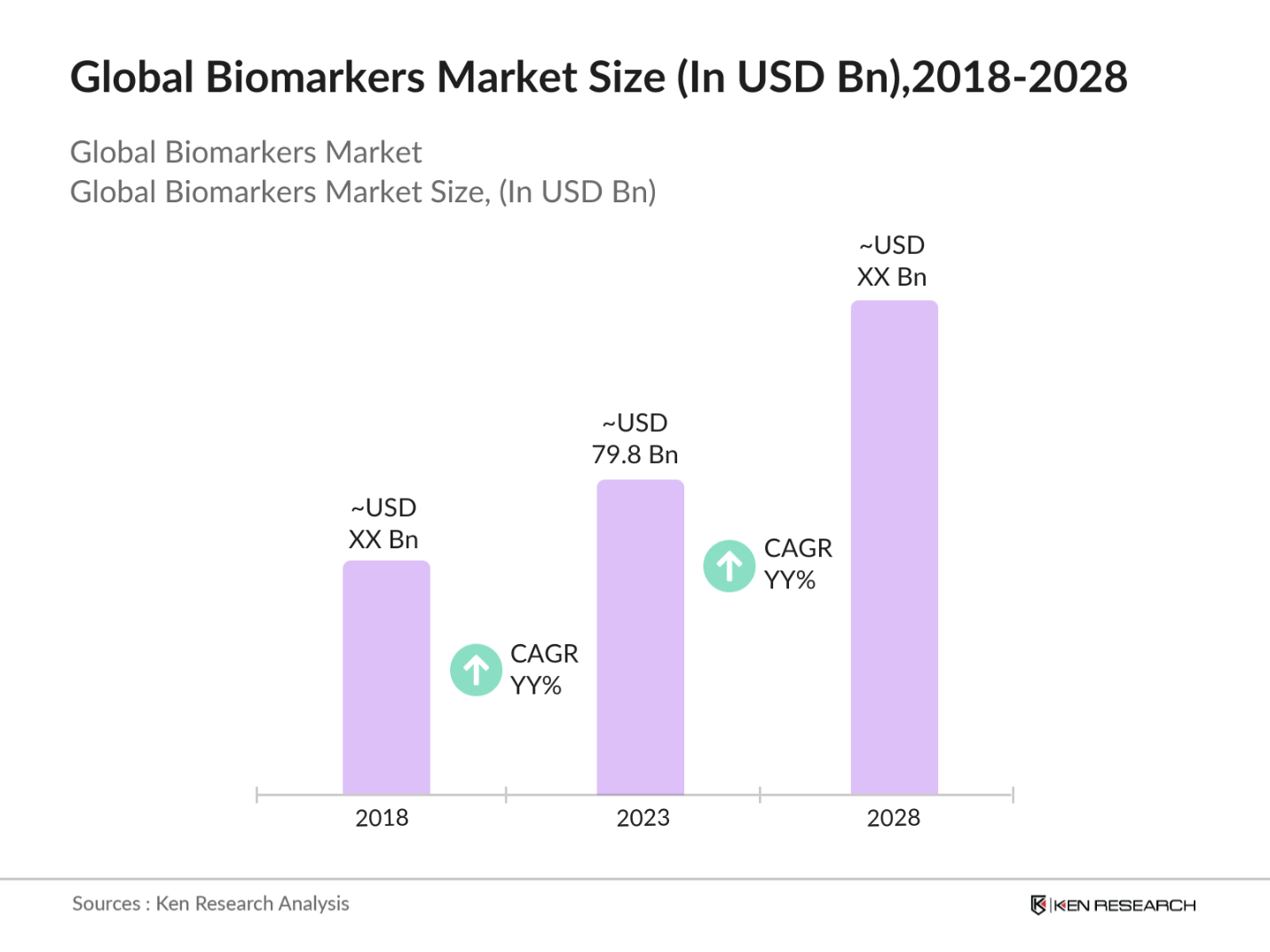

- The global biomarkers market is valued at USD 79.8 billion in 2023, driven by increasing investments in precision medicine, the rise in chronic diseases, and the growth of personalized therapies. Biomarkers are essential in early diagnosis, aiding in improving patient outcomes, especially for cancer, cardiovascular diseases, and neurological conditions. This growth is accelerated by pharmaceutical companies adopting biomarkers to enhance the efficacy of drugs and reduce development time, contributing significantly to market expansion.

- Key players dominating the global biomarkers market include Roche Diagnostics, Thermo Fisher Scientific, Abbott Laboratories, Qiagen N.V., and Siemens Healthineers. These companies are at the forefront of innovations, regularly launching new biomarker assays and platforms. For instance, Roche Diagnostics holds a large share due to its advanced oncology and cardiology biomarker portfolios. Collaborations between these players and healthcare institutions for clinical trials and research are further driving their market leadership.

- In May 2023, Thermo Fisher Scientific and Pfizer announced a partnership aimed at expanding access to next-generation sequencing (NGS)-based testing for lung and breast cancer patients in over 30 countries, particularly in regions where such advanced genomic testing has been limited or unavailable. The collaboration's goal is to enhance local access to these testing capabilities, which can provide faster results and potentially improve patient outcomes.

- Major cities such as Boston, San Francisco, and Basel dominate the biomarkers market due to their dense concentration of biotechnology firms, pharmaceutical giants, and advanced research institutions. Boston, home to prominent medical schools and research hospitals, has seen significant advancements in cancer biomarkers, while San Franciscos robust biotech ecosystem supports innovation in neurological biomarkers. Basel, Switzerland, hosts Roches headquarters, a leader in oncology biomarkers, contributing to its dominance.

Global Biomarkers Market Segmentation

The Global Biomarkers Market is divided into the following segments:

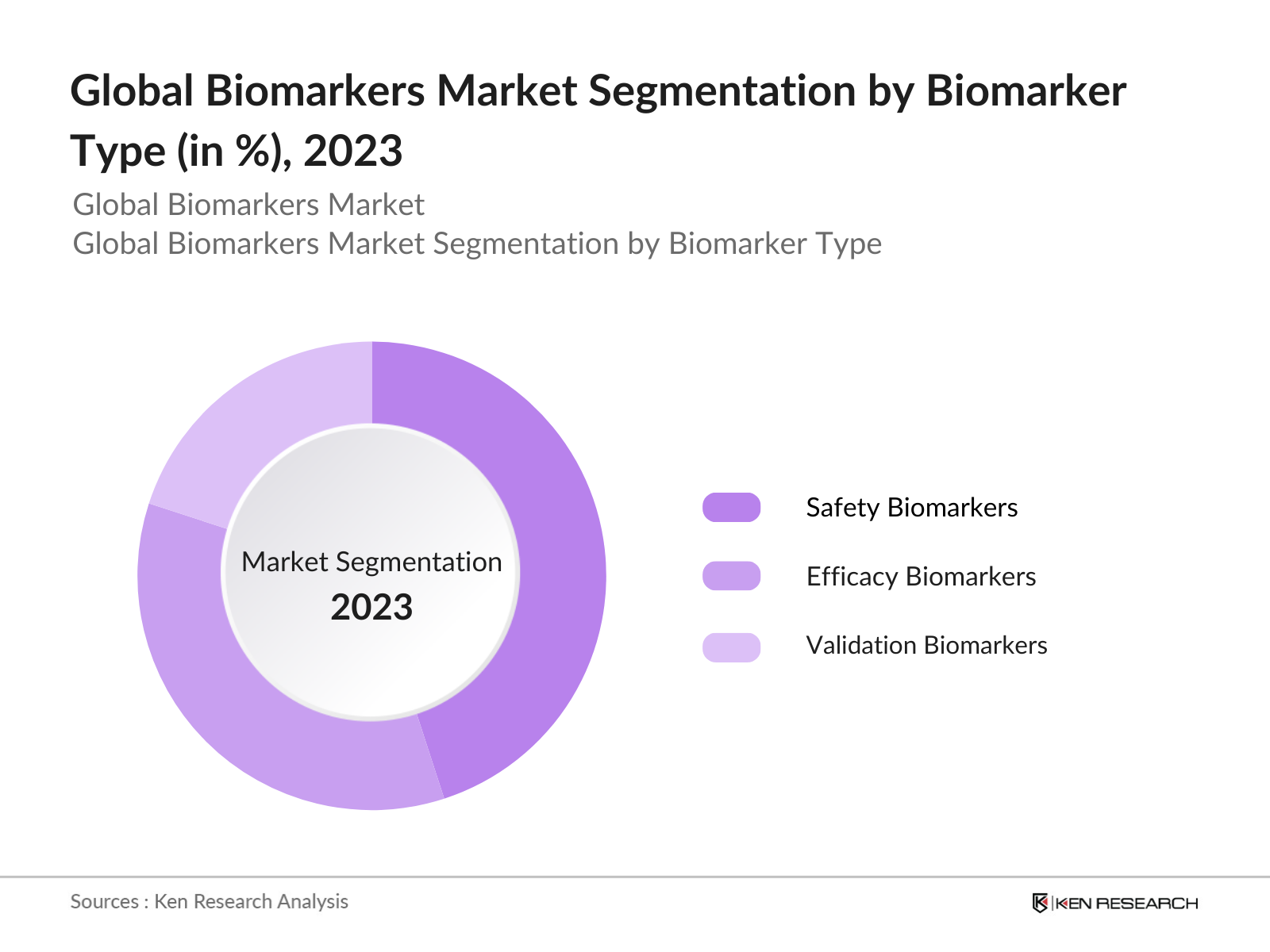

By Biomarker: The global biomarkers market is segmented by biomarker types into safety biomarkers, efficacy biomarkers, and validation biomarkers. In 2023, safety biomarkers dominated the market, driven by their extensive use in drug development. Pharmaceutical companies rely heavily on safety biomarkers to assess the toxicity and safety of new drugs, ensuring compliance with regulatory standards. Efficacy biomarkers are also gaining importance, particularly in precision medicine, where they help monitor therapeutic responses and optimize treatment outcomes.

By Region: The global biomarkers market is segmented by region into North America, Europe, Asia-Pacific (APAC), Latin America, and the Middle East & Africa (MEA). In 2023, North America held the largest market share due to the presence of key players, advanced healthcare infrastructure, and substantial R&D investments. The U.S., in particular, is leading the biomarker market, driven by government initiatives such as the Precision Medicine Initiative and the dominance of biotech hubs like Boston and San Francisco. Europe, led by Germany and the UK, also holds a significant share.

By Application: The global biomarkers market is segmented by application into oncology, cardiology, and neurology. In 2023, oncology biomarkers dominated the market, capturing the largest share due to the rapid adoption of biomarkers in cancer diagnostics and therapeutics. Companies such as Roche Diagnostics are leveraging oncology biomarkers to develop companion diagnostics for cancer drugs, helping clinicians personalize treatments. The rising prevalence of cancer, along with increased funding for cancer research, has contributed significantly to the growth of this segment.

Global Biomarkers Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Roche Diagnostics |

1896 |

Basel, Switzerland |

|

Thermo Fisher Scientific |

1956 |

Waltham, Massachusetts, USA |

|

Abbott Laboratories |

1888 |

Illinois, USA |

|

Qiagen N.V. |

1984 |

Hilden, Germany |

|

Siemens Healthineers |

2018 |

Erlangen, Germany |

- Thermo Fisher Scientific: Thermo Fisher, in collaboration with Pfizer, introduced a non-small cell lung cancer (NSCLC) biomarker test in 2023. This collaboration is aimed at accelerating the adoption of companion diagnostics in lung cancer, which accounts for a significant share of cancer biomarker applications. The new test, combined with Pfizer's therapies, is expected to improve patient outcomes in NSCLC.

- Abbott Laboratories: In 2024, Abbott announced the expansion of its biomarker testing capabilities in cardiovascular disease. By leveraging their i-STAT handheld device, they aim to bring point-of-care biomarker testing to more hospitals globally. This expansion is anticipated to improve the early diagnosis of cardiovascular diseases, reducing treatment costs and enhancing patient outcomes.

Global Biomarkers Market Analysis

Global Biomarkers Market Growth Drivers

- Expansion in Precision Medicine Initiatives: The growing focus on precision medicine, especially for oncology and cardiovascular diseases, is a major driver for the biomarker market. The global push for more personalized treatment plans is directly increasing the demand for biomarkers in diagnostics and treatment monitoring. For instance, in 2023, the Precision Medicine Initiative in the U.S. aims to enroll one million patients into studies incorporating genetic biomarkers to identify optimal treatment options. These initiatives are contributing to the higher adoption of biomarkers across various healthcare systems worldwide.

- Rising Prevalence of Chronic Diseases: In 2023, the World Health Organization reported that chronic diseases such as cancer, diabetes, and cardiovascular conditions were a leading cause of global mortality. This rise in chronic diseases has significantly boosted the demand for biomarkers, which are essential for early diagnosis and personalized treatment. For example, cancer biomarkers help in detecting malignancies at earlier stages, which can lead to better patient outcomes. The increasing number of patients needing long-term disease management drives biomarker research and development, particularly in diagnostics.

- Increasing Investments in Clinical Research: Governments worldwide have been significantly increasing their budgets for medical research, particularly in biomarker technologies. In 2023, the U.S. government allocated$6 billiontowards cancer research under theCancer Moonshot Initiative. This initiative emphasizes biomarker-driven studies, which are crucial for advancing personalized medicine and improving cancer treatment outcomes. The focus on biomarkers is particularly relevant for identifying effective therapies for various cancer types, thereby enhancing precision medicine efforts.

Global Biomarkers Market Challenges

- High Costs Associated with Biomarker Development: Biomarker discovery and validation are costly processes, which pose a significant challenge for many organizations. Developing a single biomarker can cost millions of dollars and take several years to complete. For instance, the average cost for developing a biomarker for cancer diagnosis is estimated to be around $100 million. This financial burden limits the number of organizations that can afford extensive research and development, thereby restricting the availability of new biomarkers in the market.

- Limited Biomarker Validation for Neurological Disorders: Although there has been rapid progress in biomarker discovery for diseases like cancer and cardiovascular conditions, biomarkers for neurological diseases are still underdeveloped. In 2023, only a small number of biomarkers have been validated for major neurological diseases such as Alzheimer's disease (AD) and Parkinson's disease (PD). This scarcity complicates the diagnosis and treatment of these conditions.

Global Biomarkers Market Government Initiatives

- European Union Horizon Program: The EU launched its Horizon program to support biomarker research in various diseases, including rare genetic conditions and chronic diseases. The initiative focuses on early diagnosis through biomarkers and improving therapeutic options through personalized medicine. Several European countries, such as Germany and France, are collaborating with biotech firms to discover novel biomarkers, particularly in oncology.

- Japans Government Funding for Cancer Biomarkers: In 2023, the Japanese government announced a $1 billion investment to fund biomarker research for cancer diagnosis and treatment. This initiative is part of Japans broader healthcare reforms aimed at improving cancer survival rates. The funding will be directed toward developing biomarker-based diagnostic tools for early-stage cancer detection, contributing to Japans goal of significantly reducing cancer-related mortality in the coming years.

Global Biomarkers Market Outlook

The global biomarkers market is set to experience significant growth over the next five years, primarily driven by advancements in personalized medicine. As healthcare systems continue to shift toward individualized treatment plans, biomarkers are playing a crucial role in diagnostics, drug development, and patient care.

Future Trends:

- Growth of Biomarker-Based Companion Diagnostics: By 2028, the demand for biomarker-based companion diagnostics is projected to increase, especially in oncology and cardiology. The integration of biomarkers into clinical trials and drug development will reduce drug failure rates and improve the efficacy of treatments. With pharmaceutical companies investing heavily in this area, companion diagnostics will likely become a mainstream approach in treatment protocols for several chronic diseases.

- Increased Focus on Multi-Omics Approaches: In the future, multi-omics approaches that combine genomic, proteomic, and metabolomic biomarkers are anticipated to dominate the market. These approaches will enable a more comprehensive understanding of diseases and enhance the accuracy of diagnostics and treatment plans. Governments are expected to fund multi-omics research, particularly in regions like Europe and North America, making it a key driver of market growth by 2028.

Scope of the Report

|

By Biomarker |

Safety Biomarkers Efficacy Biomarkers Validation Biomarkers |

|

By Application |

Oncology Cardiology Neurology |

|

By Region |

North America Europe Asia-Pacific Latin America MEA |

|

By Disease |

Cancer Cardiovascular Diseases Neurological Diseases |

Products

Key Target Audience:

Pharmaceutical Companies

Biotechnology Firms

Hospitals and Clinical Laboratories

Government and Regulatory Bodies (EMA)

Investments and Venture Capitalist Firms

Diagnostic Device Manufacturers

Healthcare Service Providers

Public Health Organizations

Health Insurance Provider

Companies

Players Mentioned in the Report:

Roche Diagnostics

Thermo Fisher Scientific

Abbott Laboratories

Qiagen N.V.

Siemens Healthineers

PerkinElmer, Inc.

Bio-Rad Laboratories

Agilent Technologies

Illumina, Inc.

Myriad Genetics

Merck KGaA

Danaher Corporation

GE Healthcare

Hologic, Inc.

Becton Dickinson

Table of Contents

01. Global Biomarkers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Biomarkers Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Biomarkers Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Precision Medicine

3.1.2. Rising Prevalence of Chronic Diseases

3.1.3. Government Investments in Biomarker Research

3.2. Challenges

3.2.1. High Development Costs

3.2.2. Regulatory Barriers

3.2.3. Limited Biomarker Validation for Neurology

3.3. Opportunities

3.3.1. Integration of Biomarkers in Clinical Trials

3.3.2. Development of Biomarkers for Rare Diseases

3.3.3. AI in Biomarker Discovery

3.4. Trends

3.4.1. Growth in Liquid Biopsy Adoption

3.4.2. Collaboration between Pharma and Diagnostic Companies

3.4.3. Focus on Multi-Omics Biomarker Research

3.5. Government Initiatives

3.5.1. U.S. Precision Medicine Initiative

3.5.2. EU Horizon 2024 Program

3.5.3. Japan's Cancer Biomarker Research Initiative

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

04. Global Biomarkers Market Segmentation, 2023

4.1. By Biomarker Type (in Value %)

4.1.1. Safety Biomarkers

4.1.2. Efficacy Biomarkers

4.1.3. Validation Biomarkers

4.2. By Application (in Value %)

4.2.1. Oncology

4.2.2. Cardiology

4.2.3. Neurology

4.3. By Disease Type (in Value %)

4.3.1. Cancer

4.3.2. Cardiovascular Diseases

4.3.3. Neurological Disorders

4.4. By End-User (in Value %)

4.4.1. Pharmaceutical Companies

4.4.2. Diagnostic Laboratories

4.4.3. Academic & Research Institutions

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific (APAC)

4.5.4. Latin America

4.5.5. Middle East & Africa (MEA)

05. Global Biomarkers Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Roche Diagnostics

5.1.2. Thermo Fisher Scientific

5.1.3. Abbott Laboratories

5.1.4. Qiagen N.V.

5.1.5. Siemens Healthineers

5.1.6. PerkinElmer, Inc.

5.1.7. Bio-Rad Laboratories

5.1.8. Agilent Technologies

5.1.9. Illumina, Inc.

5.1.10. Myriad Genetics

5.1.11. Merck KGaA

5.1.12. Danaher Corporation

5.1.13. GE Healthcare

5.1.14. Hologic, Inc.

5.1.15. Becton Dickinson

5.2. Cross Comparison Parameters (Inception Year, Headquarters, Employees, Revenue)

06. Global Biomarkers Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

07. Global Biomarkers Market Regulatory Framework

7.1. Biomarker Validation Requirements

7.2. Compliance and Standardization Regulations

7.3. Certification Processes for Biomarker Tests

08. Global Biomarkers Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

09. Global Biomarkers Market Future Market Segmentation, 2028

9.1. By Biomarker Type

9.2. By Application

9.3. By Disease Type

9.4. By End-User

9.5. By Region

10. Global Biomarkers Market Analysts' Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Competitive Positioning

10.3. Marketing and Branding Recommendations

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on the Global Biomarkers Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global Biomarkers Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Biomarkers and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Biomarkers.

Frequently Asked Questions

01. How big is the Global Biomarkers Market?

The global biomarkers market was valued at USD 79.8 billion in 2023. It is driven by increased investments in precision medicine, the rise in chronic diseases, and the growing use of biomarkers in personalized therapies, especially in oncology and cardiology.

02. What are the challenges in the Global Biomarkers Market?

Challenges in the global biomarkers market include high development costs, stringent regulatory requirements, and limited validation of biomarkers for neurological disorders. These factors hinder rapid market growth and delay the introduction of new biomarker tests.

03. Who are the major players in the Global Biomarkers Market?

Key players in the global biomarkers market include Roche Diagnostics, Thermo Fisher Scientific, Abbott Laboratories, Qiagen N.V., and Siemens Healthineers. These companies lead due to their advanced biomarker testing platforms and strong presence in diagnostics.

04. What are the growth drivers of the Global Biomarkers Market?

The global biomarkers market is propelled by the increasing demand for personalized medicine, the rise in chronic disease prevalence, and significant investments in clinical research. The growing use of biomarkers in drug development also drives market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.