Region:Global

Author(s):Shubham

Product Code:KRAC0752

Pages:84

Published On:August 2025

By Type:The biopharmaceutical fermentation market is segmented into various types, including microbial fermentation, mammalian cell culture fermentation, single-use bioreactor fermentation, stainless steel fermentation, continuous/perfusion fermentation, and hybrid fermentation. Among these, microbial fermentation is the most widely used due to its cost-effectiveness and efficiency in producing a variety of biopharmaceuticals, including vaccines and enzymes. The increasing adoption of single-use bioreactors is also notable, as they offer flexibility and reduced contamination risks.

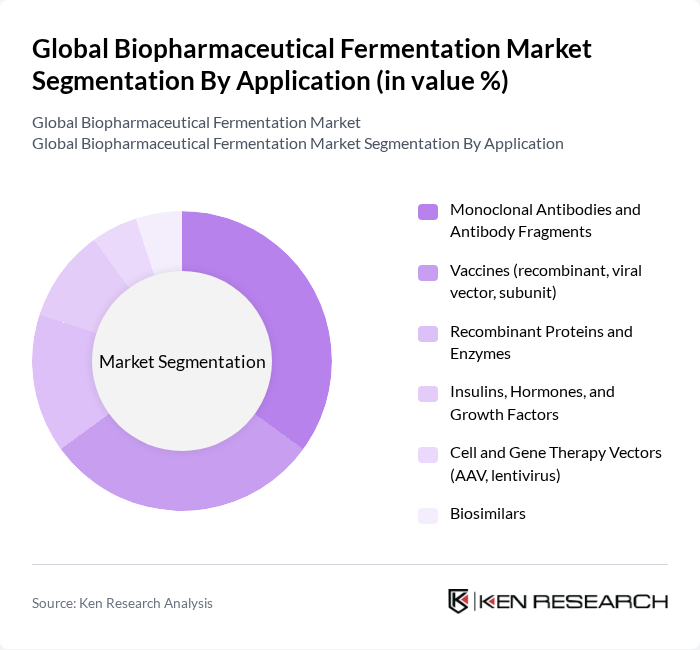

By Application:The applications of biopharmaceutical fermentation include monoclonal antibodies, vaccines, recombinant proteins, insulins, hormones, and gene therapy vectors. The monoclonal antibodies segment is leading the market due to the increasing demand for targeted therapies in cancer treatment and autoimmune diseases. Vaccines are also a significant application area, especially in light of the recent global health challenges that have heightened the focus on vaccine development.

The Global Biopharmaceutical Fermentation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Genentech, Inc. (Roche), Merck KGaA (MilliporeSigma), Pfizer Inc., Novartis AG (Sandoz), F. Hoffmann-La Roche Ltd., Sanofi S.A., GSK plc, AbbVie Inc., Takeda Pharmaceutical Company Limited, Bayer AG, Regeneron Pharmaceuticals, Inc., Biogen Inc., Lonza Group AG, WuXi Biologics, Samsung Biologics, Sartorius AG, Cytiva (Danaher), Thermo Fisher Scientific Inc., Boehringer Ingelheim Biopharmaceuticals GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biopharmaceutical fermentation market appears promising, driven by technological advancements and a growing focus on personalized medicine. As companies increasingly adopt automation and AI in fermentation processes, production efficiency is expected to improve significantly. Additionally, the shift towards sustainable practices will likely influence production methods, aligning with global environmental goals. These trends indicate a dynamic market landscape, fostering innovation and enhancing the availability of biopharmaceuticals to meet diverse healthcare needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Microbial Fermentation (bacteria, yeast) Mammalian Cell Culture Fermentation (e.g., CHO) Single-Use/SUS Bioreactor Fermentation Stainless Steel/Traditional Fed-Batch Fermentation Continuous/Perfusion Fermentation Hybrid/Intensified (fed-batch + perfusion) |

| By Application | Monoclonal Antibodies and Antibody Fragments Vaccines (recombinant, viral vector, subunit) Recombinant Proteins and Enzymes Insulins, Hormones, and Growth Factors Cell and Gene Therapy Vectors (AAV, lentivirus) Biosimilars |

| By End-User | Biopharma Innovators (Pharmaceutical Companies) Biotechnology Firms (SMEs and Startups) Contract Development & Manufacturing Organizations (CDMOs/CMOs) Academic & Research Institutes Others (diagnostic, CRO pilot plants) |

| By Scale of Operation | Commercial Scale (?1,000 L) Pilot Scale (100–999 L) Clinical/Small Scale (<100 L) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology/Equipment | Upstream: Bioreactors/Fermentors (single-use, stainless steel) Upstream: Media, Feeds, and Supplements Downstream: Filtration and Separation Systems Downstream: Chromatography Systems and Resins Sensors, PAT, and Process Control/Automation |

| By Fermentation Organism | Bacterial Systems (E. coli, others) Yeast Systems (Pichia, Saccharomyces) Mammalian Cells (CHO, HEK293) Insect/Other Cells (Sf9, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical Production Facilities | 120 | Production Managers, Quality Control Analysts |

| Fermentation Technology Providers | 90 | Sales Directors, Technical Support Engineers |

| Regulatory Affairs in Biopharma | 70 | Regulatory Affairs Managers, Compliance Officers |

| Research Institutions and Universities | 60 | Research Scientists, Academic Professors |

| Investment Analysts in Biopharma | 50 | Market Analysts, Financial Advisors |

The Global Biopharmaceutical Fermentation Market is valued at approximately USD 25 billion, driven by the increasing demand for biopharmaceuticals, advancements in fermentation technologies, and the rising prevalence of chronic diseases requiring innovative therapies.