Global Bioplastic Production Market Outlook to 2030

Region:Global

Author(s):Paribhasha Tiwari

Product Code:KROD2315

December 2024

90

About the Report

Global Bioplastic Production Market Overview

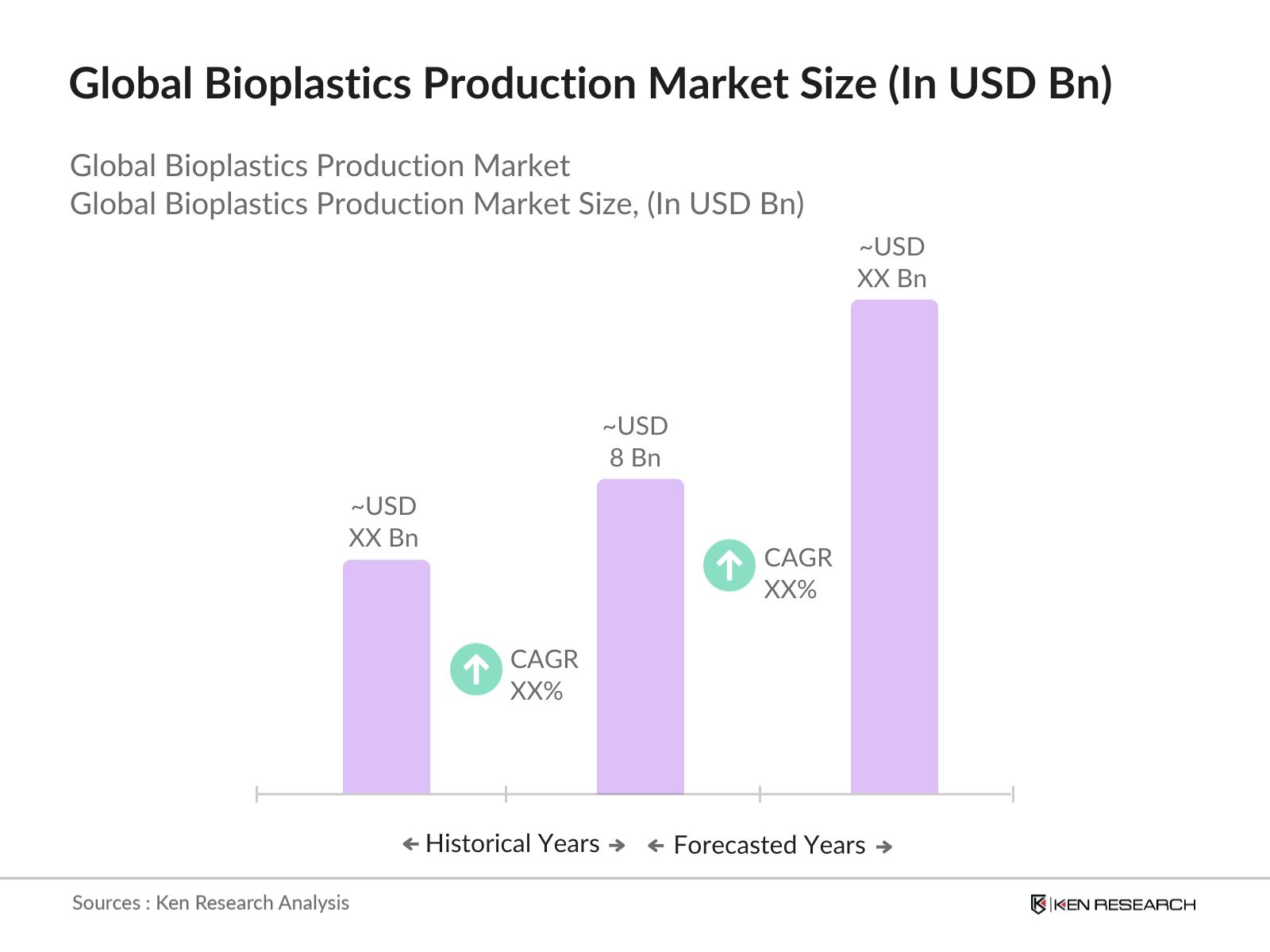

- The Global Bioplastic Production Market, as of 2023, is valued at USD 8 billion, driven by growing environmental concerns, increasing demand for sustainable packaging, and government initiatives promoting eco-friendly materials. The shift toward a circular economy and the rising awareness of plastic pollution have led to significant investment in the bioplastics industry. Companies in the packaging, consumer goods, and automotive sectors are leading this transformation by integrating bioplastics into their supply chains. This growth is driven by large-scale production and technological innovations in biodegradable polymers.

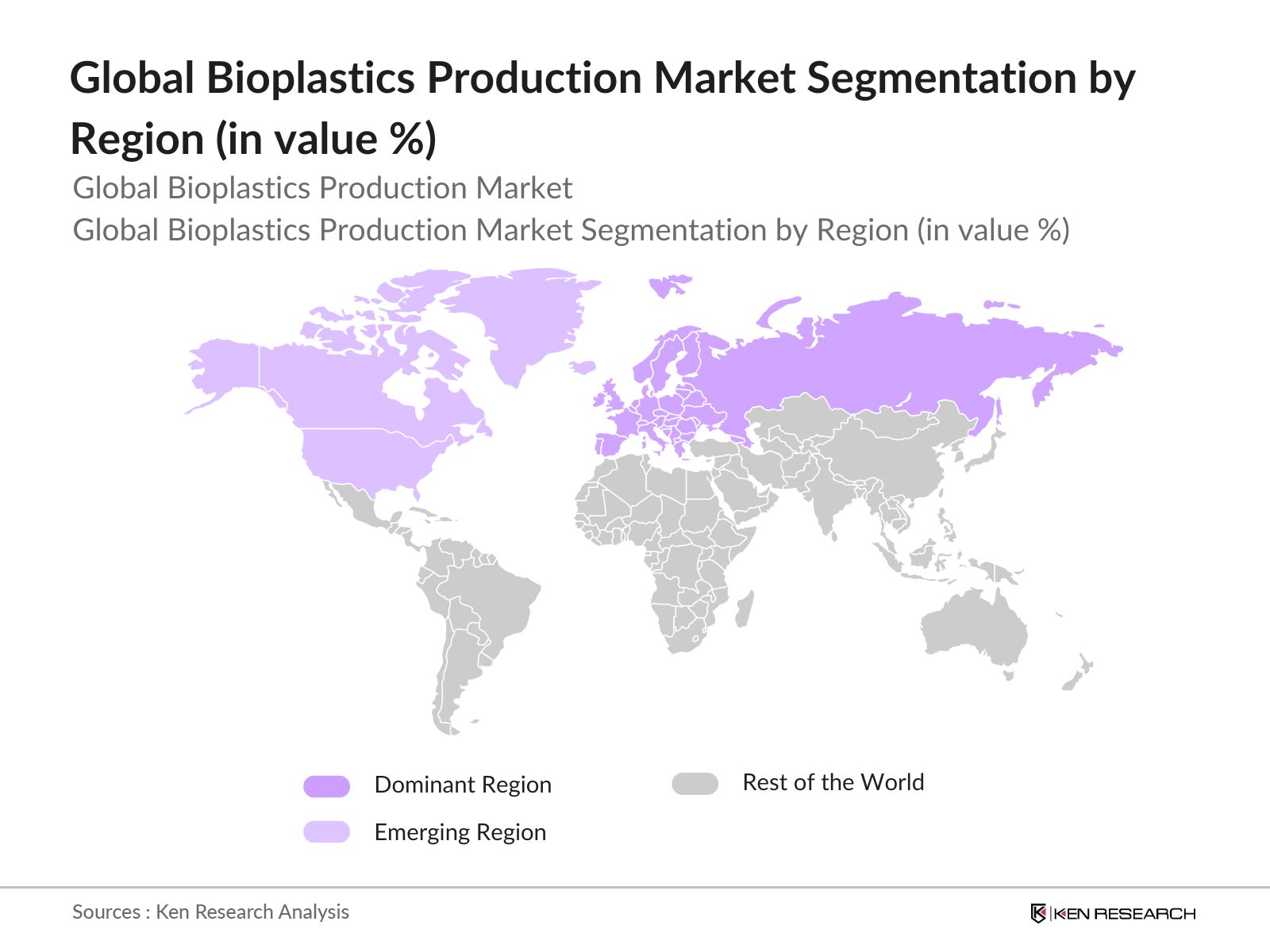

- Countries such as Germany, Japan, and the United States dominate the global bioplastic production market due to their advanced infrastructure, strong government support, and leading roles in technological advancements. These nations benefit from established manufacturing sectors, as well as access to raw materials like corn and sugarcane, used to produce bioplastics. In particular, Europe has been at the forefront of adopting bioplastic solutions, propelled by stringent regulations against single-use plastics and a robust emphasis on sustainable solutions.

- Governments around the world are actively promoting the adoption of bioplastics through various policy measures. In the European Union, for instance, the European Green Deal emphasizes a shift toward sustainable production, including the use of bio-based plastics. As part of this initiative, the EU Single-Use Plastics Directive, implemented in 2021, aims to reduce plastic waste by banning certain single-use plastic products and promoting bioplastics as alternatives. This regulatory framework encourages member states to adopt stricter recycling goals and to invest in biodegradable and compostable plastic technologies, thus fostering growth in the bioplastic market.

Global Bioplastic Production Market Segmentation

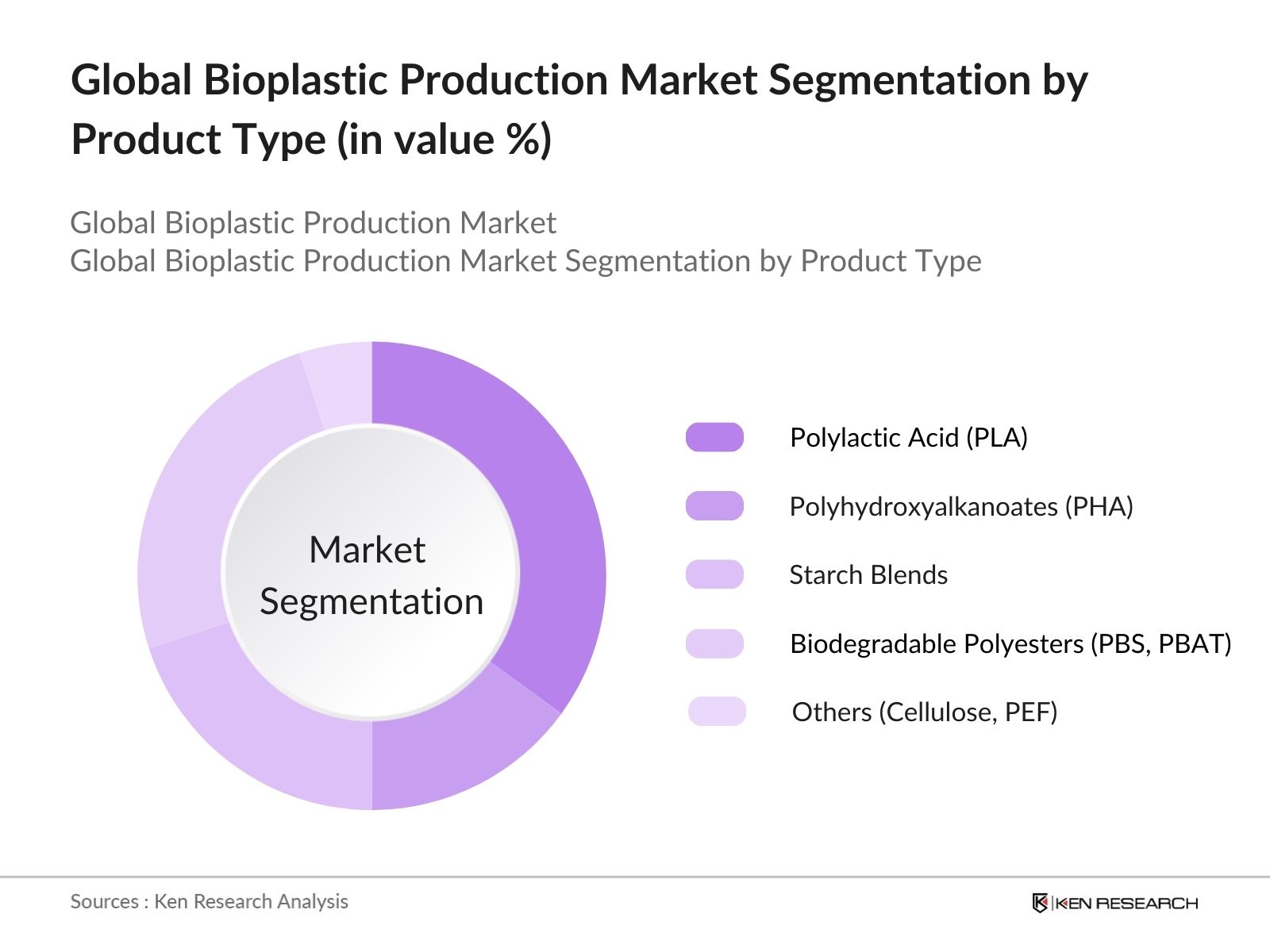

By Product Type: The Global Bioplastic Production Market is segmented by product type into polylactic acid (PLA), polyhydroxyalkanoates (PHA), starch blends, biodegradable polyesters (PBS, PBAT), and others such as cellulose and PEF. Recently, PLA has gained dominance under the product type segmentation due to its widespread application in packaging, especially in food products and consumer goods. The versatility of PLA and its cost-effectiveness make it a preferred choice for manufacturers seeking sustainable packaging solutions. As it can be produced from renewable resources like corn starch, PLA meets the growing consumer demand for biodegradable packaging.

By Region: The market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominates the regional segment, primarily due to its strict regulations on single-use plastics and strong sustainability initiatives. The European Unions directives on reducing plastic waste, combined with the region's mature bioplastic manufacturing industry, have positioned Europe as a leader in the market. North America follows closely, driven by consumer demand for eco-friendly products and increasing investments in bioplastic production facilities. Asia Pacific is emerging as a significant player due to its large-scale manufacturing capacity and growing awareness of environmental issues.

Global Bioplastic Production Market Competitive Landscape

The Global Bioplastic Production Market is dominated by several key players who have established strong brand recognition, extensive R&D capabilities, and a broad distribution network. The market is highly competitive with both multinational corporations and regional players striving for market share. This consolidation highlights the growing importance of bioplastics in various industries and the focus on sustainability and innovation.

|

Company |

Establishment Year |

Headquarters |

R&D Investments |

Product Portfolio |

Production Capacity |

Sustainability Initiatives |

Strategic Partnerships |

Revenue (2023) |

Global Presence |

|

NatureWorks LLC |

2001 |

USA |

- | - | - | - | - | - | - |

|

BASF SE |

1865 |

Germany |

- | - | - | - | - | - | - |

|

Total Corbion PLA |

2017 |

Netherlands |

- | - | - | - | - | - | - |

|

Novamont S.p.A. |

1990 |

Italy |

- | - | - | - | - | - | - |

|

Braskem |

1972 |

Brazil |

- | - | - | - | - | - | - |

Global Bioplastic Production Market Analysis

Growth Drivers

- Rising Environmental Concerns: The world is experiencing rising environmental challenges, with nearly 400 million tons of plastic waste generated annually, much of it non-biodegradable. Countries like Germany and France have introduced robust initiatives to promote the use of biodegradable plastics, reflecting a global shift towards sustainable production. In 2024, the U.N. estimates that over 12 million metric tons of plastic waste enter the oceans annually, making bioplastic alternatives critical to addressing this crisis

- Biodegradability and Composability Mandates: Regulations mandating compostable and biodegradable materials are accelerating the shift towards bioplastics. In California, stringent rules on single-use plastic products led to increased adoption of compostable bioplastics in food packaging. In 2024, the U.S. Food and Drug Administration supports bioplastic use for certain applications in the food sector, signaling greater governmental acceptance of these materials.

- Packaging Industry Shift to Sustainable Solutions: The packaging industry is a major driver of bioplastics, particularly as major brands like Coca-Cola and PepsiCo commit to increasing the use of plant-based materials in their packaging. Global packaging companies, facing consumer pressure, are investing in bioplastic alternatives to reduce environmental footprints. As of 2024, global packaging demand is heavily influenced by regulatory measures promoting single-use plastic bans in the EU, Southeast Asia, and Latin America.

Market Challenges

- High Production Costs Compared to Petroplastics: One of the primary challenges in the bioplastics market is the high production cost. As of 2024, bioplastic production costs remain approximately 20% to 100% higher than conventional plastics due to the complex manufacturing process and the reliance on feedstock like corn and sugarcane. Government subsidies in countries like Brazil and the U.S. partially offset these costs, but they still present a hurdle for widespread adoption.

- Limited Raw Material Availability (Feedstock, PLA, PHA): Access to raw materials like PLA and PHA remains a limiting factor for scaling production. In 2024, demand for agricultural feedstock used in bioplastic production has spiked, leading to concerns over food security. For example, corn-based bioplastics, which constitute a significant portion of the market, compete with food crops, causing supply chain bottlenecks in countries like the U.S. and Mexico.

Global Bioplastic Production Market Future Outlook

Over the next five years, the Global Bioplastic Production Market is expected to experience substantial growth due to continued innovation in biopolymer technologies, heightened consumer demand for environmentally friendly packaging, and global regulatory pressure to reduce plastic waste. The rise in non-food feedstocks, such as algae and agricultural waste, will further enhance the scalability of bioplastics. Companies are anticipated to focus more on R&D, which will help in improving the mechanical properties of bioplastics, making them suitable for a broader range of industrial applications.

Market Opportunities

- Advances in Bio-Based Polymer Chemistry: Technological innovation is key to overcoming the challenges in the bioplastics market. As of 2024, advances in bio-based polymer chemistry, including innovations in PLA and PHA production, are helping reduce costs and improve performance. For instance, research from universities in the Netherlands is focusing on developing more resilient bioplastics for automotive use, creating new market opportunities.

- Integration into Consumer Goods and Electronics: The use of bioplastics in consumer goods and electronics is expanding, with companies like Samsung and Apple exploring bio-based materials in their products. In 2024, consumer demand for eco-friendly products, combined with governmental pressure, is accelerating this trend. Japan and South Korea, known for their tech innovations, are leading efforts to incorporate bioplastics into electronics manufacturing.

Scope of the Report

|

By Product Type |

Polylactic Acid (PLA) Polyhydroxyalkanoates (PHA) Starch Blends Biodegradable Polyesters (PBS, PBAT) Others (Cellulose, PEF) |

|

By Application |

Packaging Agriculture Automotive Consumer Goods Medical Devices |

|

By Feedstock |

Corn Starch Sugarcane Cassava Algae-Based Others (Agricultural Waste, Food Waste) |

|

By Processing Method |

Injection Molding Blow Molding Extrusion Thermoforming 3D Printing |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Bioplastic Manufacturers

Packaging Industry Leaders

Automotive Industry OEMs

Government and Regulatory Bodies (EU Single-Use Plastics Directive, FDA)

Raw Material Suppliers

Investments and Venture Capitalist Firms

FMCG Corporations

Agriculture Industry Players

Companies

Players Mentioned in the Report:

NatureWorks LLC

BASF SE

Total Corbion PLA

Novamont S.p.A.

Braskem

Danimer Scientific

Biome Bioplastics

Mitsubishi Chemical Corporation

FKuR Kunststoff GmbH

Indorama Ventures

Table of Contents

1. Global Bioplastic Production Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Bioplastic Production Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Bioplastic Production Market Analysis

3.1. Growth Drivers (Sustainability Initiatives, Government Policies, Consumer Demand)

3.1.1. Rising Environmental Concerns

3.1.2. Circular Economy Trends

3.1.3. Biodegradability and Compostability Mandates

3.1.4. Packaging Industry Shift to Sustainable Solutions

3.2. Market Challenges (Cost of Raw Materials, Scalability, Performance Issues)

3.2.1. High Production Costs Compared to Petroplastics

3.2.2. Limited Raw Material Availability (Feedstock, PLA, PHA)

3.2.3. Limited Performance in Specific Applications

3.2.4. Fragmented Recycling Infrastructure

3.3. Opportunities (Technological Innovation, Biodegradable Plastic Alternatives, Cross-Industry Applications)

3.3.1. Advances in Bio-Based Polymer Chemistry

3.3.2. Integration into Consumer Goods and Electronics

3.3.3. Global Initiatives on Plastic Waste Reduction

3.3.4. Expanding Use in Automotive and Medical Sectors

3.4. Trends (Feedstock Diversification, New Bioplastic Applications, Circular Economy)

3.4.1. Use of Non-Food Feedstocks (Algae, Agricultural Waste)

3.4.2. Shift Towards Bioplastic in Food Packaging

3.4.3. Increased Focus on Recycling and Closed-Loop Solutions

3.4.4. Lightweighting Initiatives in Automotive Industry

3.5. Government Regulation (Regulatory Frameworks Supporting Bioplastic Adoption)

3.5.1. EUs Single-Use Plastics Directive

3.5.2. Bioplastic Standards (ASTM D6400, EN 13432)

3.5.3. National-Level Incentives for Bioplastic Production

3.5.4. International Agreements on Plastic Waste Reduction

3.6. SWOT Analysis

3.7. Stake Ecosystem (Raw Material Suppliers, Bioplastic Producers, Recycling Facilities)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Bioplastic Production Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Polylactic Acid (PLA)

4.1.2. Polyhydroxyalkanoates (PHA)

4.1.3. Starch Blends

4.1.4. Biodegradable Polyesters (PBS, PBAT)

4.1.5. Others (Cellulose, PEF)

4.2. By Application (In Value %)

4.2.1. Packaging

4.2.2. Agriculture

4.2.3. Automotive

4.2.4. Consumer Goods

4.2.5. Medical Devices

4.3. By Feedstock (In Value %)

4.3.1. Corn Starch

4.3.2. Sugarcane

4.3.3. Cassava

4.3.4. Algae-Based

4.3.5. Others (Agricultural Waste, Food Waste)

4.4. By Processing Method (In Value %)

4.4.1. Injection Molding

4.4.2. Blow Molding

4.4.3. Extrusion

4.4.4. Thermoforming

4.4.5. 3D Printing

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Bioplastic Production Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. NatureWorks LLC

5.1.2. BASF SE

5.1.3. Total Corbion PLA

5.1.4. Novamont S.p.A.

5.1.5. Braskem

5.1.6. Danimer Scientific

5.1.7. Biome Bioplastics

5.1.8. Mitsubishi Chemical Corporation

5.1.9. FKuR Kunststoff GmbH

5.1.10. Indorama Ventures

5.1.11. Toray Industries

5.1.12. Plantic Technologies Limited

5.1.13. PTT Global Chemical Public Company Limited

5.1.14. Green Dot Bioplastics

5.1.15. Avantium N.V.

5.2. Cross Comparison Parameters (Product Portfolio, Production Capacity, R&D Investments, Global Presence, Revenue, Sustainability Initiatives, Strategic Collaborations, Supply Chain Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Bioplastic Production Market Regulatory Framework

6.1. Bioplastic Certifications (OK Compost, BPI, TV Austria)

6.2. Compliance Requirements (REACH, FDA Approvals for Food Contact)

6.3. Certification Processes

7. Global Bioplastic Production Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Bioplastic Production Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Feedstock (In Value %)

8.4. By Processing Method (In Value %)

8.5. By Region (In Value %)

9. Global Bioplastic Production Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the bioplastic production ecosystem by identifying all key stakeholders, including raw material suppliers, manufacturers, end-users, and regulatory bodies. This process is supported by comprehensive desk research, which involves the use of secondary and proprietary databases.

Step 2: Market Analysis and Construction

In this stage, historical data on market performance is compiled, focusing on key metrics such as production volumes, revenue generation, and adoption rates. Data is sourced from verified industry reports and market databases, ensuring reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through direct interviews with industry experts and stakeholders, including manufacturers and supply chain operators. This provides an on-the-ground perspective to validate and refine the market data.

Step 4: Research Synthesis and Final Output

In this final phase, insights from industry players are synthesized with the secondary research data to produce a holistic and validated market analysis. This stage also involves cross-verifying market projections with historical trends to ensure accuracy.

Frequently Asked Questions

01. How big is the Global Bioplastic Production Market?

The Global Bioplastic Production Market is valued at USD 8 billion, driven by the increasing focus on sustainable materials and government policies supporting the reduction of plastic waste.

02. What are the challenges in the Global Bioplastic Production Market?

Key challenges in the Global Bioplastic Production Market include the high production costs associated with bioplastics compared to conventional plastics, limited raw material availability, and underdeveloped recycling infrastructure in many regions.

03. Who are the major players in the Global Bioplastic Production Market?

Prominent players in the Global Bioplastic Production Market include NatureWorks LLC, BASF SE, Total Corbion PLA, Novamont S.p.A., and Braskem. These companies lead the market due to their strong R&D capabilities, global reach, and extensive product portfolios.

04. What are the growth drivers of the Global Bioplastic Production Market?

The Global Bioplastic Production Market is driven by growing environmental concerns, increasing government support for sustainable solutions, and rising demand from industries such as packaging, automotive, and agriculture for eco-friendly alternatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.