Global Bioplastics Market Outlook to 2030

Region:Global

Author(s):Shivani

Product Code:KROD10653

November 2024

91

About the Report

Global Bioplastics Market Overview

- The global bioplastics market, valued at USD 29.9 billion, is driven by growing concerns over plastic pollution and increased regulatory support for biodegradable alternatives. This surge in demand stems from industries like packaging, automotive, and consumer goods seeking sustainable solutions. Government initiatives in major economies to promote bio-based materials further push market growth, particularly in sectors where companies are transitioning to eco-friendly packaging solutions.

- Key countries dominating the market include Germany, the United States, and Japan. Germany's dominance is attributed to its strong regulatory framework promoting sustainability and investment in bio-based products. The U.S. leads due to its innovation in biotechnology and high consumer demand for sustainable packaging, while Japan is notable for its focus on reducing plastic waste, supported by government policies promoting the use of bioplastics across various sectors.

- The U.S. Department of Agriculture (USDA) operates the BioPreferred Program, which promotes the purchase and use of biobased products, including bioplastics. This program provides certification and labeling to biobased products and prioritizes federal procurement of these materials. In 2022, the USDA allocated substantial funding to increase the use of biobased materials, which includes bioplastics, as part of its efforts to reduce fossil fuel dependency and encourage the adoption of sustainable alternatives.

Global Bioplastics Market Segmentation

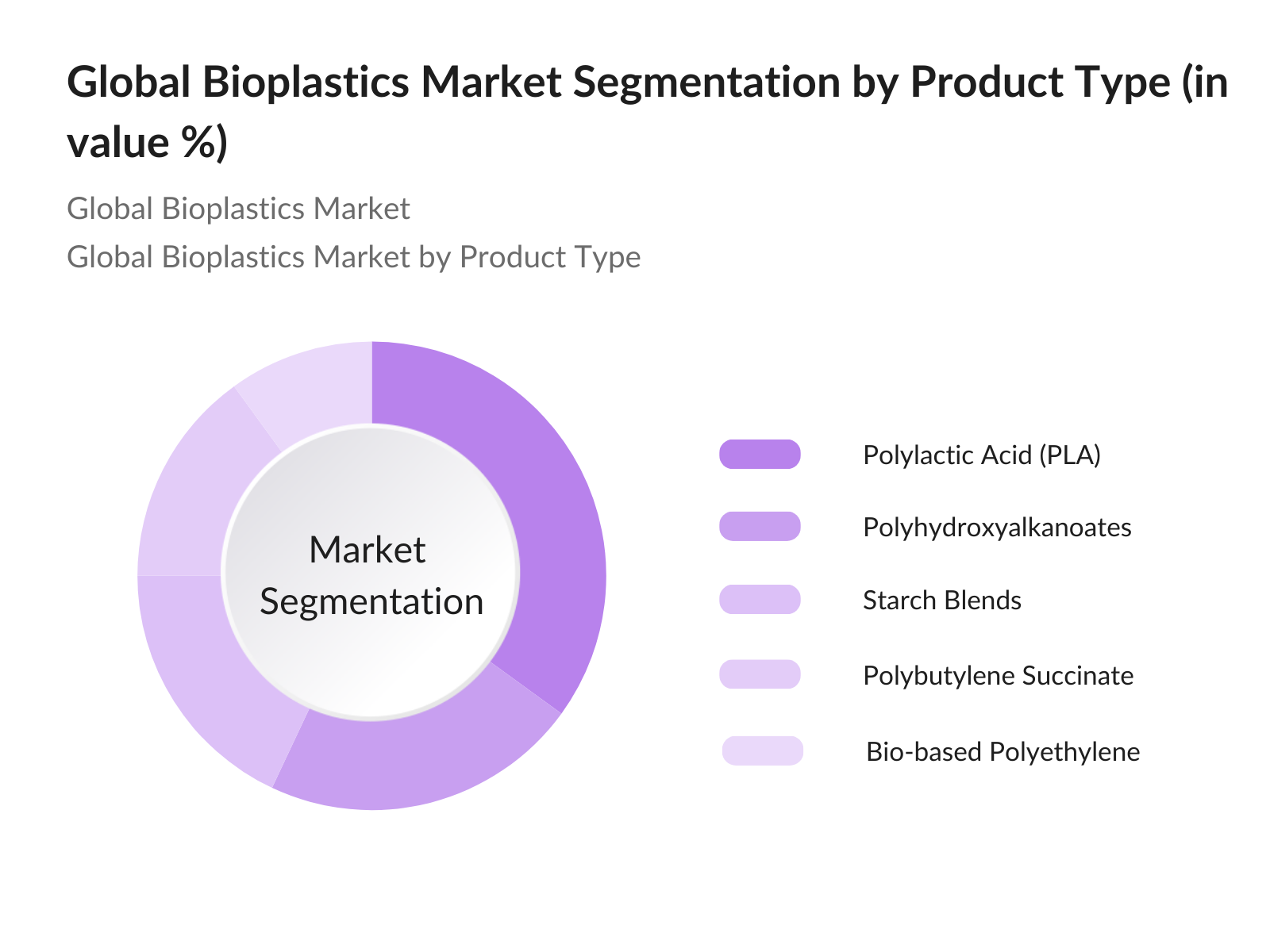

By Product Type: The global bioplastics market is segmented by product type into Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Polybutylene Succinate (PBS), Starch Blends, and Bio-based Polyethylene (Bio-PE). Among these, PLA holds the dominant market share due to its widespread use in packaging and consumer goods applications. PLA's versatility, coupled with its compostability, makes it an attractive alternative to conventional plastics, especially for brands looking to improve sustainability and meet regulatory requirements.

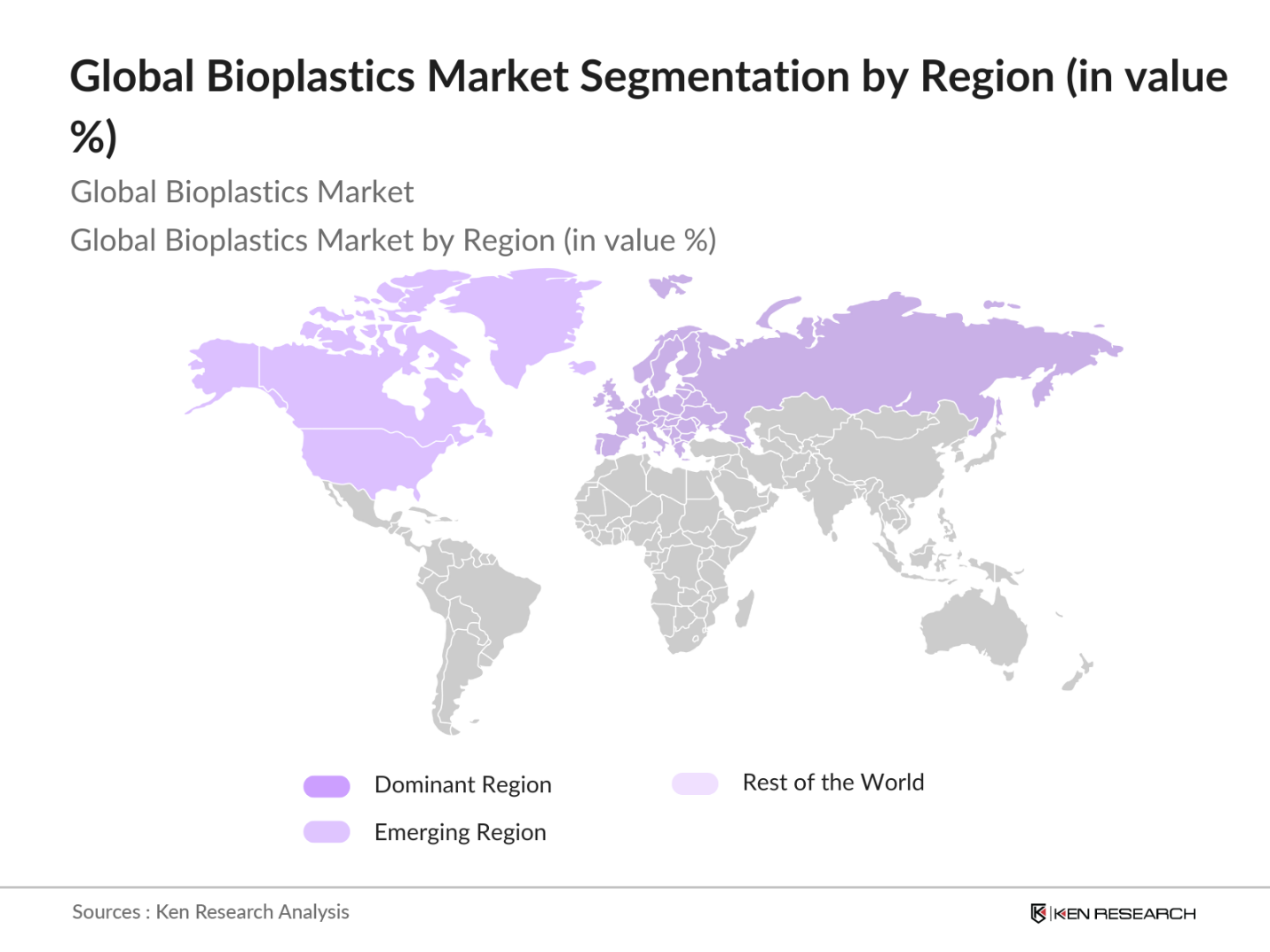

By Region: The bioplastics market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Europe leads the market, supported by stringent regulations around plastic usage and high consumer demand for sustainable products. The European Union's push towards a circular economy and its aggressive regulatory frameworks have made Europe the global hub for bioplastics production and consumption, with major players operating extensively in this region.

Global Bioplastics Market Competitive Landscape

The global bioplastics market is characterized by several key players that drive innovation and development. The consolidation of these companies highlights their significant influence on market trends and developments.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

No. of Employees |

Sustainability Initiatives |

R&D Investments |

Production Capacity |

Partnerships/Collaborations |

Certifications |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

USD 95 Bn |

||||||

|

NatureWorks LLC |

1989 |

Minnesota, USA |

USD 1 Bn |

||||||

|

Braskem |

1972 |

So Paulo, Brazil |

USD 19 Bn |

||||||

|

Novamont S.p.A |

1990 |

Novara, Italy |

USD 1.5 Bn |

||||||

|

TotalEnergies Corbion |

2017 |

Gorinchem, Netherlands |

USD 500 Mn |

Global Bioplastics Market Analysis

Market Growth Drivers

- Biodegradability: The demand for biodegradable plastics is driven by increasing environmental awareness and sustainability goals set by governments globally. The European Union, for instance, has enforced the Circular Economy Action Plan, focusing on reducing plastic waste and promoting biodegradable materials. A 2023 report by the World Bank highlights the issue of unmanaged plastic waste globally, emphasizing the urgent need for biodegradable alternatives. This has driven investments in the sector, especially in countries like Germany, where biodegradable plastics are playing an increasingly important role in waste management initiatives.

- Government Regulations: Government policies have been instrumental in boosting the bioplastics market. The EUs single-use plastic ban, which came into full effect in 2021, significantly increased the demand for biodegradable and bio-based plastics in Europe. Similarly, the Indian government enforced regulations in 2022, aiming to eliminate single-use plastics by promoting alternatives such as bioplastics. The impact of such measures was visible in trade data, as there was a notable increase in imports of bio-based plastics into India in 2023, further driving the adoption of sustainable materials.

- Sustainability Goals: The growing push towards sustainability goals, such as the UN's Sustainable Development Goals (SDGs), has driven industries to adopt bioplastics to reduce carbon footprints. For example, the automotive industry in Japan has increasingly integrated bioplastics into its production processes, reducing the use of traditional plastics and contributing to sustainability targets. These shifts align with global climate commitments, including the Paris Agreement, which encourages industries to reduce reliance on fossil fuels by adopting bio-based solutions, furthering their contribution to environmental sustainability.

Market Challenges:

- Cost Competitiveness: Bioplastics face challenges in competing with conventional plastics, particularly due to higher production costs. In 2023, bio-based plastics were still more expensive to produce compared to petroleum-based plastics, largely due to the limited scale of production and the higher cost of raw materials like bio-feedstock. These factors contribute to the cost disparity. However, subsidies and incentives for green products in countries like Canada have been implemented to help reduce this cost gap, and advancements in technology are expected to further bring down production costs in the future.

- Limited Feedstock Availability: A significant challenge in bioplastics production is the limited availability of bio-feedstock. Agricultural crops like corn and sugarcane, used to produce bioplastics, are also critical for food security. In 2022, global food supply shortages, particularly in developing nations, resulted in governments prioritizing food production over industrial uses. For instance, Brazil, a major bio-feedstock producer, experienced a decline in sugarcane exports for bioplastics in 2023 due to drought and the prioritization of food supply needs.

Global Bioplastics Market Future Outlook

Over the next five years, the global bioplastics market is expected to experience significant growth, driven by stringent environmental regulations, increasing consumer awareness of plastic pollution, and technological advancements in bio-based materials. Key sectors such as packaging, automotive, and agriculture will continue to adopt bioplastics to meet sustainability goals and reduce reliance on fossil-based plastics. Innovations in feedstock, alongside a strong push from governments worldwide, are expected to propel the market further.

Market Opportunities:

- Emerging Technologies in Production: Technological advancements in bioplastics production are creating new growth opportunities. In 2023, research into microbial production of PHA (polyhydroxyalkanoates), a type of biodegradable plastic, showed significant potential for improving production efficiency. This new technology could help reduce production costs while enhancing biodegradability. Governments in Europe and the U.S. have recognized this potential and begun funding research projects. For example, the EU allocated 200 million in 2023 to advance bioplastic technologies, highlighting the global push toward innovation in this sector.

- Brand Adoption: As brands shift toward sustainability, bioplastics adoption has surged. In 2023, 15 of the top 100 global consumer brands, including Coca-Cola and Unilever, integrated bioplastics into their packaging strategies. These companies are motivated by increasing consumer demand for eco-friendly products and government pressures to meet environmental targets. This trend is particularly strong in the food and beverage industry, which saw a 20% increase in bioplastic packaging in 2023.

Scope of the Report

|

By Product Type |

Polylactic Acid (PLA) Polyhydroxyalkanoates (PHA) PBS Starch Blends Bio-PE |

|

By Application |

Packaging Agriculture Consumer Goods Automotive Textile |

|

By End-User Industry |

Packaging Agriculture Consumer Goods Automotive Healthcare |

|

By End-User |

Corn Sugarcane Cassava Wood Fibers |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Bioplastic Manufacturers

Raw Material Suppliers

Packaging Industry Leaders

Automotive Industry OEMs

Agriculture Industry Leaders

Consumer Goods Companies

Government and Regulatory Bodies (e.g., European Commission, U.S. Environmental Protection Agency)

Investment and Venture Capital Firms

Companies

Major Players

BASF SE

NatureWorks LLC

TotalEnergies Corbion

Braskem

Novamont S.p.A

Mitsubishi Chemical Corporation

Biome Bioplastics

Danimer Scientific

Plantic Technologies Ltd.

Cardia Bioplastics

FKuR Kunststoff GmbH

Synbra Technology B.V.

Biotec GmbH & Co. KG

Avantium

Green Dot Bioplastics

Table of Contents

1. Global Bioplastics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Bioplastics Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Bioplastics Market Analysis

3.1. Growth Drivers (Biodegradability, Government Regulations, Sustainability Goals, Fossil Fuel Dependency Reduction)

3.2. Market Challenges (Cost Competitiveness, Limited Feedstock Availability, Processing Challenges, Infrastructure Gaps)

3.3. Opportunities (Emerging Technologies in Production, Brand Adoption, Circular Economy, Investment in Bio-based Raw Materials)

3.4. Trends (Increasing R&D Investment, Partnerships for Raw Material Supply, Certification Requirements, Consumer Preference Shift Towards Eco-Friendly Products)

3.5. Government Regulations (National Plastic Waste Policies, Bio-based Material Incentives, Carbon Footprint Reduction Goals, Biodegradable Plastics Standards)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Raw Material Suppliers, Technology Providers, Bioplastic Manufacturers, End-Users, Recyclers)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Bioplastics Market Segmentation

4.1. By Product Type (In Value %)

Polylactic Acid (PLA)

Polyhydroxyalkanoates (PHA)

Polybutylene Succinate (PBS)

Starch Blends

Bio-based Polyethylene (Bio-PE) 4.2. By Application (In Value %)

Packaging

Agriculture

Consumer Goods

Automotive

Textile

4.3. By End-User Industry (In Value %)

Packaging Industry

Agriculture Industry

Consumer Goods Industry

Automotive Industry

Healthcare Industry

4.4. By Feedstock Type (In Value %)

Corn

Sugarcane

Cassava

Wood Fibers

4.5. By Region (In Value %)

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

5. Global Bioplastics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. NatureWorks LLC

5.1.3. TotalEnergies Corbion

5.1.4. Braskem

5.1.5. Novamont S.p.A

5.1.6. Biome Bioplastics

5.1.7. Mitsubishi Chemical Corporation

5.1.8. Danimer Scientific

5.1.9. Plantic Technologies Ltd.

5.1.10. Cardia Bioplastics

5.1.11. FKuR Kunststoff GmbH

5.1.12. Synbra Technology B.V.

5.1.13. Biotec GmbH & Co. KG

5.1.14. Avantium

5.1.15. Green Dot Bioplastics

5.2 Cross Comparison Parameters (Market Share, Revenue, Headquarters, Product Portfolio, Sustainability Initiatives, Number of Patents, Collaborations, Raw Material Sourcing)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Sustainability Drives, Expansion into New Regions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Bioplastics Market Regulatory Framework

6.1. Environmental Standards (EU Green Deal, U.S. BioPreferred Program, Japans Bioplastic Standards)

6.2. Compliance Requirements (Food Contact Regulations, Certification for Compostability, Biodegradability Standards)

6.3. Certification Processes (EN 13432, ASTM D6400, ISO 17088, OK Compost)

7. Global Bioplastics Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Bioplastics Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Feedstock Type (In Value %)

8.5. By Region (In Value %)

9. Global Bioplastics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Strategic Partnerships

9.4. Sustainability Goals Alignment

Research Methodology

Step 1: Identification of Key Variables

In the first phase, we identified the key stakeholders and mapped out the global bioplastics ecosystem. This involved extensive desk research, which incorporated a mix of secondary data sources such as government publications, industry reports, and proprietary databases to construct a detailed overview of market variables.

Step 2: Market Analysis and Construction

This phase involved compiling historical market data on the global bioplastics market, including production volumes, revenue generation, and technology adoption rates. We also assessed key developments in bio-based material research to ensure a comprehensive market analysis.

Step 3: Hypothesis Validation and Expert Consultation

We engaged industry experts through telephonic interviews and surveys to validate our hypotheses regarding the market's trajectory. These consultations provided key insights into industry practices and financial performance, which helped in refining our final analysis.

Step 4: Research Synthesis and Final Output

Finally, we synthesized the data collected from interviews and secondary research into a comprehensive report. This stage included detailed product segment analyses, consumer preferences, and competitive landscape evaluations to provide a validated, data-driven report.

Frequently Asked Questions

01. How big is the global bioplastics market?

The global bioplastics market, valued at USD 29.9 billion, is driven by increasing demand for eco-friendly packaging, regulatory pressures, and consumer preferences for sustainable products.

02. What are the challenges in the bioplastics market?

Key challenges include cost competitiveness with conventional plastics, limited infrastructure for composting and recycling, and the availability of sustainable raw materials.

03. Who are the major players in the bioplastics market?

Major players in the bioplastics market include BASF SE, NatureWorks LLC, TotalEnergies Corbion, Braskem, and Novamont S.p.A., known for their strong sustainability initiatives and bio-based product portfolios.

04. What are the growth drivers of the bioplastics market?

The growth of the bioplastics market is driven by regulatory support for reducing plastic waste, consumer demand for sustainable packaging, and innovations in bio-based materials and technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.