Global Biotechnology Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD7172

November 2024

84

About the Report

Global Biotechnology Market Overview

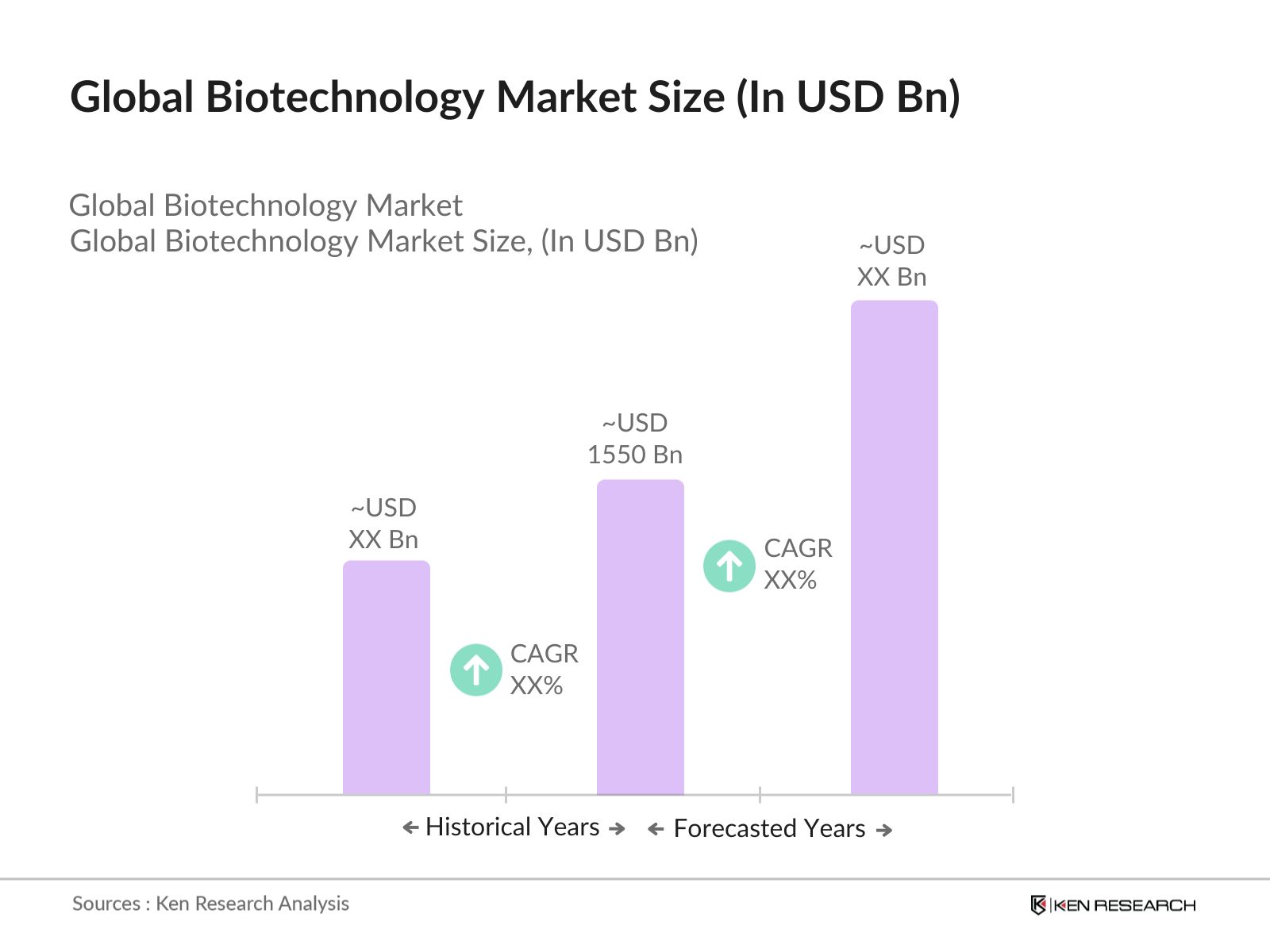

- The global biotechnology market is valued at USD 1,550 billion, driven by the increasing adoption of innovative technologies in healthcare, agriculture, and industrial sectors. The growth is primarily fueled by advancements in genomics, personalized medicine, and biomanufacturing. The rise in demand for biopharmaceuticals, especially vaccines and gene therapies, alongside developments in CRISPR technology, is also contributing to the robust market expansion. Additionally, government investments in research and development (R&D) are bolstering innovation and supporting market growth.

- North America dominates the global biotechnology market, with the United States leading due to its well-established infrastructure for research and development, highly skilled workforce, and substantial funding for biotech startups. Cities such as Boston and San Francisco serve as global hubs for biotechnology, driven by their proximity to top-tier academic institutions, leading biotech companies, and venture capital firms. Europe, particularly countries like Germany and Switzerland, also plays a significant role in the global biotechnology landscape due to favorable government policies and strong research infrastructure.

- Global biotech safety standards, such as Good Manufacturing Practice (GMP), are increasingly emphasized in 2024 to ensure the ethical and safe development of biotech products. Countries like the U.S., Japan, and Germany are leading efforts to strengthen biotech regulations, with the U.S. FDA implementing stricter GMP compliance in 2023.

Global Biotechnology Market Segmentation

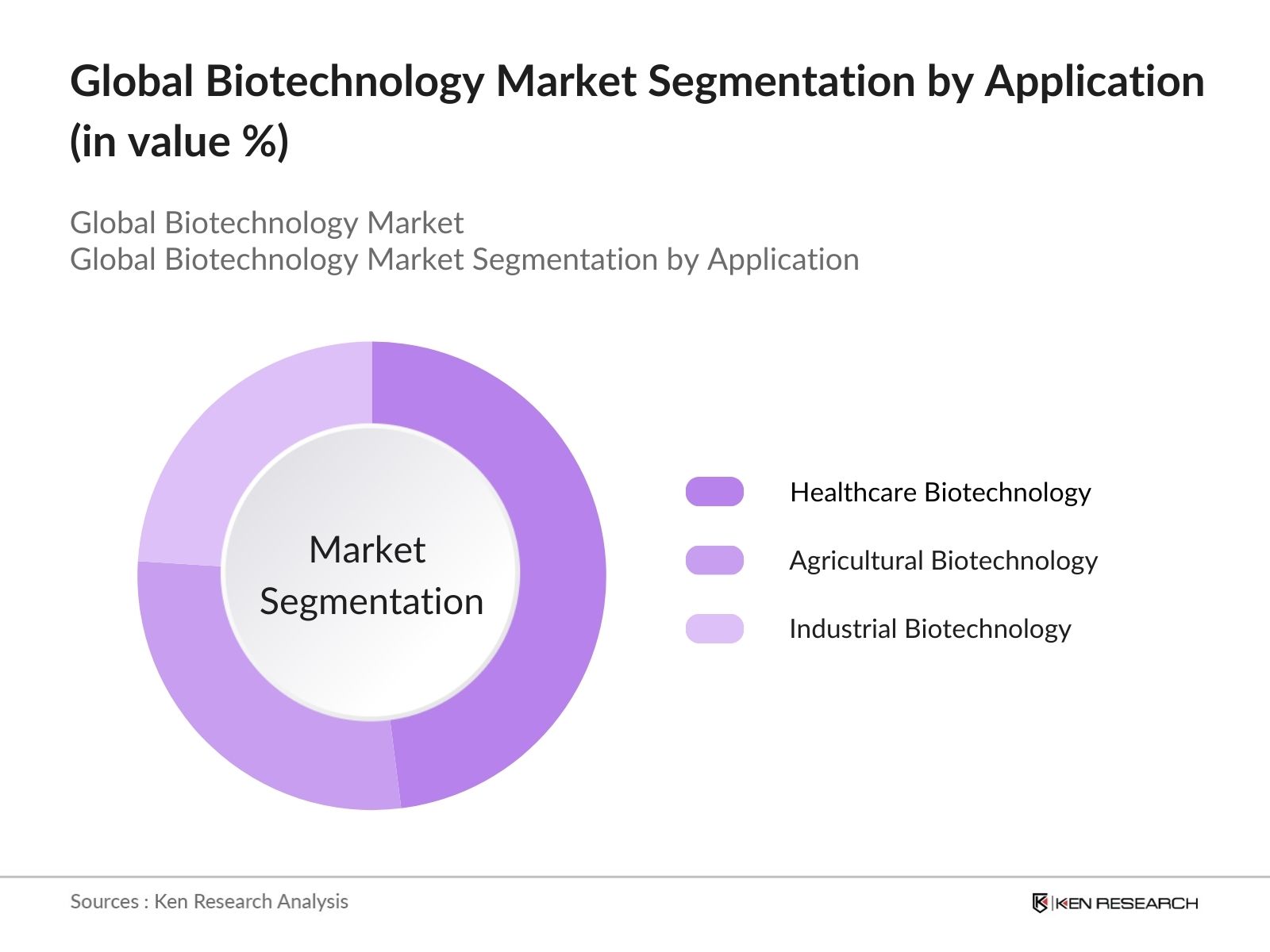

- By Application: The biotechnology market is segmented by application into healthcare, agricultural biotechnology, and industrial biotechnology. Healthcare biotechnology, including biopharmaceuticals and gene therapies, holds a dominant share in the market due to the growing demand for precision medicine and personalized treatments. The development of new biologics, combined with increasing investments in research to find cures for chronic diseases, is further driving the growth of this segment. Biopharmaceutical companies are rapidly adopting advanced technologies such as CRISPR and mRNA-based therapies, contributing to this segments dominance.

- By Region: Geographically, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America remains the largest regional market, driven by the U.S., which is home to the world's largest biotechnology companies, a favorable regulatory framework, and significant R&D spending. The Asia-Pacific region is experiencing rapid growth, driven by increasing government investments in biotechnology research and rising healthcare needs in countries like China and India. Europe also holds a significant market share, with Germany and the UK being key players in biotechnological advancements.

- By Technology: The market is further segmented by technology into DNA sequencing, PCR technology, tissue engineering, and CRISPR and gene editing. CRISPR and gene editing hold a dominant position in this segment due to the revolutionary impact of CRISPR-Cas9 technology, which allows for precise modifications to DNA. This technology has transformed areas such as disease treatment, agricultural biotechnology, and drug discovery. Companies and research institutions are heavily investing in CRISPR research, making it a key driver in the biotechnology market.

Global Biotechnology Market Competitive Landscape

The global biotechnology market is dominated by key players who invest heavily in research, product development, and collaborations. The competitive landscape highlights both well-established companies and emerging startups, which contribute to innovation and growth within the industry.

|

Company |

Establishment Year |

Headquarters |

R&D Expenditure |

Revenue (USD) |

Employees |

Key Patents |

Product Portfolio |

Collaborations |

|

Amgen Inc. |

1980 |

Thousand Oaks, USA |

- |

- |

- |

- |

- |

- |

|

Gilead Sciences, Inc. |

1987 |

Foster City, USA |

- |

- |

- |

- |

- |

- |

|

Roche Holding AG |

1896 |

Basel, Switzerland |

- |

- |

- |

- |

- |

- |

|

Illumina, Inc. |

1998 |

San Diego, USA |

- |

- |

- |

- |

- |

- |

|

Biogen Inc. |

1978 |

Cambridge, USA |

- |

- |

- |

- |

- |

- |

Global Biotechnology Industry Analysis

Growth Drivers

- Advancements in Genomics: The rapid advancements in genomics have been primarily driven by breakthroughs in genome sequencing technologies and tools like CRISPR-Cas9. As of 2024, the number of human genomes sequenced globally surpassed 60 million. These advancements have accelerated research into personalized medicine and genetic therapies. According to the National Human Genome Research Institute (NHGRI), the cost of sequencing a human genome dropped from $1,000 in 2021 to under $500 by 2023, boosting accessibility to genomic data across industries. Further, research and development spending in the biotechnology sector hit $80 billion in 2022, according to World Bank data.

- Increased Funding for Biotechnology Startups: Funding for biotechnology startups saw significant growth between 2022 and 2024, with venture capital investments in the sector reaching $36 billion by the end of 2023. The surge in investments was fueled by both private equity and government-led initiatives aimed at boosting innovation in biotech. Notably, the U.S. government allocated $2 billion under the ARPA-H (Advanced Research Projects Agency for Health) program in 2023 to support early-stage biotech companies focused on advanced therapeutics and diagnostics. This influx of funding has been critical in accelerating the growth and commercial viability of new biotech ventures.

- Demand for Biologics and Biosimilars: The demand for biologics and biosimilars has risen sharply due to increased global healthcare spending and the expiration of patents on blockbuster biologic drugs. In 2023, global spending on biologic medicines was recorded at $375 billion, reflecting the demand for advanced therapies. Furthermore, patent expirations of leading biologic drugs such as Humira (adalimumab) opened the door for biosimilar products, leading to increased competition and availability of lower-cost options. World Health Organization (WHO) reports highlight that biologics now account for 30% of total pharmaceutical sales in high-income countries, driving innovation in the field.

Market Restraints

- High R&D Costs: The biotechnology sector is highly capital-intensive, with R&D costs often exceeding $2 billion per new drug, according to the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA). In 2023, global R&D expenditures in the biotech industry were estimated to be over $150 billion. The significant costs are attributed to the lengthy clinical trial processes, regulatory compliance requirements, and the high failure rates in drug development. Further exacerbating these costs are delays in regulatory approvals, with clinical trials alone consuming 60-70% of total R&D expenditures.

- Regulatory Barriers: Regulatory challenges remain a significant hurdle for biotech companies, especially in navigating the complex approval processes of agencies like the FDA (U.S.) and EMA (Europe). In 2023, FDA approvals for new biotech products took an average of 12 months, up from 9 months in 2021, owing to increased scrutiny over safety and efficacy. Additionally, regulatory discrepancies between regions complicate global market access, with intellectual property disputes also hindering the commercialization of innovative therapies. As of 2024, the cost of regulatory compliance for biotech firms averaged $300 million per drug.

Global Biotechnology Market Future Outlook

Over the next five years, the global biotechnology market is expected to witness significant growth driven by continued advancements in genomics, gene editing technologies, and biomanufacturing. The increasing focus on personalized medicine, especially in cancer treatment, is expected to open new revenue streams for companies. Furthermore, the expansion of agricultural biotechnology and industrial applications like biofuels and biodegradable plastics will further bolster market growth

Market Opportunities

- Personalized Medicine: Personalized medicine is transforming healthcare by offering tailored therapies based on genetic testing and molecular profiling. As of 2024, more than 300 personalized therapies are approved for clinical use globally, and spending on precision medicine reached $80 billion in 2023, according to the World Health Organization (WHO). The increase in patient-specific treatments, particularly in oncology and rare genetic diseases, is expected to drive further innovation in gene therapies and diagnostics. Advances in next-generation sequencing (NGS) have enabled faster, more affordable genetic testing, contributing to the rise in personalized treatments.

- into Emerging Markets: Emerging markets, particularly in Asia-Pacific (APAC), are witnessing rapid growth in biotechnology, fueled by supportive government policies and expanding healthcare infrastructure. The APAC biotechnology market saw a 20% increase in new biotech ventures between 2022 and 2023, with countries like China and India leading the charge. The Chinese government invested $9 billion in biotech R&D in 2023, while India launched the National Biopharma Mission, backed by a $250 million fund to promote biotech innovation. This region presents immense opportunities for growth in biologics, biosimilars, and agricultural biotechnology.

Scope of the Report

|

By Application |

Healthcare Agricultural Biotechnology Industrial Biotechnology Environmental Biotechnology |

|

By Technology |

DNA Sequencing PCR Technology Tissue Engineering CRISPR and Gene Editing |

|

By Product |

Biopharmaceuticals Diagnostic Products Agricultural Products |

|

By End-User |

Pharmaceutical & Biotechnology Companies Academic & Research Institutes Hospitals & Diagnostic Laboratories |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Biopharmaceutical Companies

Agricultural Biotechnology Firms

Industrial Biotechnology Companies

Government and Regulatory Bodies (FDA, EMA, TGA)

Venture Capital and Private Equity Firms

Hospitals and Diagnostic Laboratories

R&D Institutions

Contract Research Organizations (CROs)

Companies

Players Mentioned in the Report:

Amgen Inc.

Gilead Sciences, Inc.

Biogen Inc.

Regeneron Pharmaceuticals, Inc.

Roche Holding AG

Illumina, Inc.

Celgene Corporation

Thermo Fisher Scientific, Inc.

Novozymes A/S

Moderna, Inc.

Vertex Pharmaceuticals Incorporated

CRISPR Therapeutics

Agilent Technologies

Bayer AG

Pfizer Inc.

Table of Contents

1. Global Biotechnology Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Biotechnology Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Biotechnology Market Analysis

3.1. Growth Drivers

3.1.1. Advancements in Genomics (R&D intensity, sequencing technologies, genome editing tools)

3.1.2. Increased Funding for Biotechnology Startups (venture capital, government initiatives)

3.1.3. Growing Demand for Biologics and Biosimilars (pharmaceutical growth, patent expirations)

3.1.4. Technological Convergence (AI, machine learning, nanotechnology in biotech)

3.2. Market Challenges

3.2.1. High R&D Costs (clinical trials, regulatory approval hurdles)

3.2.2. Regulatory Barriers (FDA, EMA, intellectual property issues)

3.2.3. Talent Shortage (skilled professionals, biotechnology expertise)

3.3. Opportunities

3.3.1. Personalized Medicine (precision therapies, genetic testing)

3.3.2. Expansion into Emerging Markets (APAC growth, government support)

3.3.3. Application of CRISPR Technology (gene editing, agricultural biotech)

3.4. Trends

3.4.1. Rise of Bioinformatics and Data-Driven Research (big data, bioinformatics platforms)

3.4.2. Increasing Adoption of Biomanufacturing (cell culture, fermentation technologies)

3.4.3. Collaboration Between Biotech and Tech Companies (AI partnerships, cloud platforms)

3.5. Government Regulations

3.5.1. International Biotech Safety Standards (GMP compliance, ethical concerns)

3.5.2. Gene Editing Guidelines (CRISPR regulations, bioethics)

3.5.3. Patent Law and Intellectual Property Rights (patent cliff, licensing)

3.6. SWOT Analysis (Industry-specific parameters: market consolidation, R&D agility, patent landscapes)

3.7. Stakeholder Ecosystem (biotech startups, pharmaceutical companies, academic institutions)

3.8. Porters Five Forces

3.9. Competition Ecosystem (global competitiveness, industry consolidation)

4. Global Biotechnology Market Segmentation

4.1. By Application (In Value %)

4.1.1. Healthcare (biopharmaceuticals, vaccines, gene therapy)

4.1.2. Agricultural Biotechnology (genetically modified crops, biofertilizers)

4.1.3. Industrial Biotechnology (biofuels, enzymes, bioplastics)

4.1.4. Environmental Biotechnology (bioremediation, wastewater treatment)

4.2. By Technology (In Value %)

4.2.1. DNA Sequencing (next-generation sequencing, Sanger sequencing)

4.2.2. PCR Technology (qPCR, digital PCR)

4.2.3. Tissue Engineering (bioprinting, organ regeneration)

4.2.4. CRISPR and Gene Editing (CRISPR-Cas9, ZFNs, TALENs)

4.3. By Product (In Value %)

4.3.1. Biopharmaceuticals (monoclonal antibodies, vaccines)

4.3.2. Diagnostic Products (molecular diagnostics, companion diagnostics)

4.3.3. Agricultural Products (genetically engineered seeds, herbicide-tolerant crops)

4.4. By End-User (In Value %)

4.4.1. Pharmaceutical & Biotechnology Companies

4.4.2. Academic & Research Institutes

4.4.3. Hospitals & Diagnostic Laboratories

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Biotechnology Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amgen Inc.

5.1.2. Gilead Sciences, Inc.

5.1.3. Biogen Inc.

5.1.4. Regeneron Pharmaceuticals, Inc.

5.1.5. Roche Holding AG

5.1.6. Illumina, Inc.

5.1.7. Celgene Corporation

5.1.8. Thermo Fisher Scientific, Inc.

5.1.9. Novozymes A/S

5.1.10. Moderna, Inc.

5.1.11. Vertex Pharmaceuticals Incorporated

5.1.12. CRISPR Therapeutics

5.1.13. Agilent Technologies

5.1.14. Bayer AG

5.1.15. Pfizer Inc.

5.2. Cross Comparison Parameters (R&D Expenditure, Market Capitalization, Revenue, Product Portfolio, Global Presence, Collaborations, Key Patents, Product Launches)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Biotechnology Market Regulatory Framework

6.1. Biopharmaceutical Regulations (FDA, EMA, TGA standards)

6.2. Agricultural Biotech Regulations (GMO approval processes, labeling requirements)

6.3. Environmental Biotech Compliance (carbon footprint, sustainability certifications)

6.4. Intellectual Property Protection (patent laws, licensing issues)

7. Global Biotechnology Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Biotechnology Future Market Segmentation

8.1. By Application (In Value %)

8.2. By Technology (In Value %)

8.3. By Product (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global Biotechnology Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Entry Strategy Recommendations

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the global biotechnology market ecosystem, focusing on key stakeholders, including pharmaceutical companies, research institutes, and regulatory agencies. Extensive desk research was performed using both secondary sources and proprietary databases to gather critical industry data, including market size, trends, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the biotechnology market was compiled, focusing on market penetration and the expansion of key technologies such as CRISPR. Revenue generation from different segments was analyzed, and projections were created based on current industry growth patterns and new technological innovations.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through interviews with industry experts and executives from leading biotechnology companies. These interviews helped refine the projections and provided insights into emerging trends, challenges, and opportunities within the biotechnology market.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from various sources and generating a comprehensive report. Insights from major biotechnology companies were incorporated to ensure accuracy, and projections were verified through a combination of top-down and bottom-up approaches.

Frequently Asked Questions

01. How big is the global biotechnology market?

The global biotechnology market is valued at USD 1,550 billion, driven by advancements in healthcare, agricultural biotechnology, and industrial applications, supported by strong R&D investments and technological innovation.

02. What are the challenges in the global biotechnology market?

Challenges include high R&D costs, stringent regulatory requirements, and a shortage of skilled professionals. Additionally, the lengthy approval process for biotech products and the complexity of intellectual property rights further hinder market growth.

03. Who are the major players in the global biotechnology market?

Major players include Amgen, Gilead Sciences, Biogen, Roche, and Illumina. These companies dominate the market through their strong research capabilities, product portfolios, and collaborations with academic institutions and tech companies.

04. What are the growth drivers of the global biotechnology market?

Key drivers include the increasing demand for biopharmaceuticals, technological advancements in gene editing and CRISPR, and the growing use of biotechnology in industrial and agricultural sectors. Government support for biotech R&D is also contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.