Global Blockchain Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD10962

December 2024

87

About the Report

Global Blockchain Market Overview

- The global blockchain market is valued at USD 13 billion, based on a five-year historical analysis. The market has seen significant growth due to the increasing adoption of blockchain technology across various sectors, particularly in financial services, supply chain management, and digital identity verification. The demand is being driven by the technology's ability to offer decentralized, secure, and transparent solutions for data sharing, which is crucial for industries where data integrity is paramount, such as banking, logistics, and healthcare.

- In terms of geographic dominance, North America and Europe are the leading regions. The United States dominates the global blockchain market due to its advanced technological infrastructure, early adoption of blockchain solutions, and strong presence of key players such as IBM and Microsoft. Europe, led by Germany and the UK, has seen robust adoption due to regulatory frameworks that encourage blockchain innovation and adoption in sectors like finance, healthcare, and government services.

- Governments are increasingly recognizing the legal validity of smart contracts. In 2023, the U.K. Law Commission published a landmark report affirming that smart contracts can be legally binding under English law. Similar initiatives are underway in Australia and Singapore, where governments are incorporating smart contract frameworks into their legal systems. These developments could pave the way for widespread adoption of blockchain-based agreements, reducing legal costs and increasing efficiency in industries like real estate and corporate governance.

Global Blockchain Market Segmentation

By Type: The blockchain market is segmented by type into Public Blockchain, Private Blockchain, Consortium Blockchain, and Hybrid Blockchain. Recently, the public blockchain segment has gained dominance in the market due to its decentralized nature and widespread adoption in cryptocurrency platforms like Bitcoin and Ethereum. Public blockchains are preferred for their transparency and security, although they tend to face challenges related to scalability. Companies utilizing blockchain for financial transactions and decentralized applications (dApps) favor this type of blockchain, further contributing to its leading market share.

By Region: The blockchain market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America continues to dominate the global market, with the U.S. leading due to significant investments in blockchain startups, a favorable regulatory environment, and strong support from major financial institutions. In Europe, the UK and Germany are prominent players, with blockchain being integrated into government services and industrial applications.

By Application: The market is segmented by application into Payments, Supply Chain Management, Identity Management, Smart Contracts, and Digital Assets. Payments lead the blockchain market application, as blockchain technology offers enhanced security, faster transaction speeds, and reduced costs, making it an ideal solution for cross-border payments and cryptocurrency transactions. With the increasing adoption of digital currencies and the need for secure, real-time transactions, the payments segment continues to hold a substantial market share globally.

Global Blockchain Market Competitive Landscape

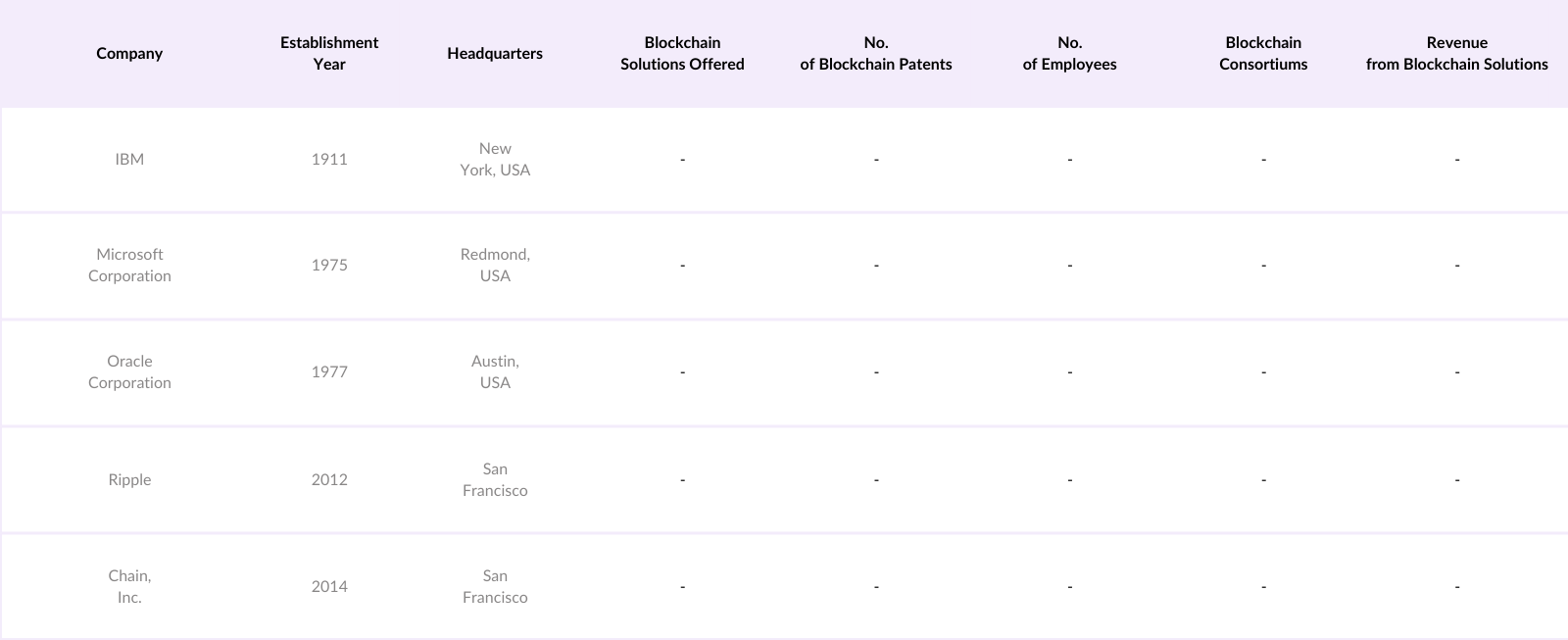

The global blockchain market is dominated by both established technology giants and innovative startups. Companies like IBM, Microsoft, and Oracle have maintained a strong foothold due to their comprehensive blockchain platforms and enterprise solutions, while newer players like Ripple and Chain focus on niche sectors like cross-border payments and decentralized finance (DeFi). The market is highly competitive, with consolidation efforts such as mergers and acquisitions to strengthen market positioning.

Global Blockchain Industry Analysis

Growth Drivers

- Increasing Demand for Transparency (Parameter: Transparency): Transparency has become a vital demand across sectors such as government, healthcare, and supply chain management due to rising concerns about data integrity and fraud. The blockchain market benefits from the inherent ability of distributed ledger technology (DLT) to provide tamper-proof, auditable data. In 2023, governments of over 50 countries, including the U.S. and Germany, adopted blockchain for transparency in procurement and financial reporting. The International Monetary Fund (IMF) reported that public trust in digital government systems increased by 25%, partly due to blockchains role in maintaining transparent, immutable records.

- Rising Adoption in Banking, Financial Services, and Insurance (Parameter: BFSI): Blockchain technology is increasingly adopted within the banking, financial services, and insurance (BFSI) sectors for secure and fast transactions. In 2022, more than 80% of the top global banks, such as JPMorgan and HSBC, implemented blockchain-based systems for cross-border payments, according to data from the World Bank. The efficiency blockchain brings to the remittance market resulted in annual savings of approximately USD 5 billion in transaction fees for these banks. Blockchain helps reduce transaction times from days to minutes in international transfers.

- Expansion of Smart Contracts (Parameter: Smart Contracts): Smart contracts have revolutionized sectors such as real estate, legal, and digital media. Blockchains ability to automate contract execution without intermediaries has reduced costs significantly. By 2023, over 40 million smart contracts were executed on platforms like Ethereum, supporting industries such as decentralized finance (DeFi) and intellectual property management. According to the European Commission, blockchain-enabled smart contracts are predicted to reduce global administrative costs by over USD 3.4 trillion annually by automating complex processes like mortgage agreements and supply chain financing.

Market Restraints

- Scalability Issues (Parameter: Scalability): Blockchain scalability remains a major hurdle, as public blockchains like Bitcoin and Ethereum can process only a limited number of transactions per second. For instance, Bitcoin handles approximately 7 transactions per second (tps), while Visa processes around 1,700 tps. This inefficiency hampers large-scale adoption, especially for high-frequency sectors like finance. According to the World Economic Forum (WEF), addressing scalability through technologies like sharding and layer-two solutions is crucial for blockchains growth. While some progress has been made, scalability continues to limit broader application in sectors requiring high throughput.

- Regulatory Uncertainty (Parameter: Regulatory Framework): Blockchain adoption is impeded by inconsistent regulatory frameworks across nations, particularly in sectors like financial services and healthcare. For example, the lack of a clear regulatory environment in major economies like India and China discourages firms from fully adopting blockchain solutions. The Financial Action Task Force (FATF) emphasized in a 2023 report that around 30% of global economies have no standardized regulations for digital assets and blockchain technology, creating a high-risk environment for businesses operating across borders. This regulatory uncertainty continues to stymie innovation and capital flow into the blockchain sector.

Global Blockchain Market Future Outlook

Over the next five years, the global blockchain market is expected to experience substantial growth, driven by the increasing adoption of blockchain technology across industries, advancements in blockchain scalability solutions, and growing interest in decentralized finance (DeFi) and tokenization of assets. The continued development of blockchain standards and the rise of central bank digital currencies (CBDCs) will play a pivotal role in driving the future market landscape.

Market Opportunities

- Expansion of Blockchain-as-a-Service (BaaS) (Parameter: BaaS): Blockchain-as-a-Service (BaaS) is gaining traction as enterprises seek cost-effective ways to deploy blockchain solutions without managing infrastructure. In 2023, cloud service providers like Microsoft and IBM reported a 35% year-on-year increase in BaaS subscriptions among small and medium-sized enterprises (SMEs). According to data from the International Trade Centre, BaaS helps SMEs reduce blockchain implementation costs by approximately 60%, making it an attractive solution for startups looking to leverage blockchain for operations such as supply chain management and digital identity verification.

- Growth in Non-Financial Sectors (Parameter: Non-Financial Adoption): Blockchain technology is expanding beyond financial services, with industries such as healthcare, supply chain, and government sectors adopting decentralized solutions. In 2023, the healthcare sector alone witnessed blockchain adoption in over 20 countries for managing patient records, clinical trials, and drug supply chains, according to the World Health Organization (WHO). Blockchains ability to provide immutable, auditable records has enhanced trust and data integrity in non-financial sectors, driving adoption in fields such as supply chain management and government transparency initiatives.

Scope of the Report

|

By Type |

Public Blockchain, Private Blockchain, Consortium Blockchain, Hybrid Blockchain |

|

By Application |

Payments, Supply Chain Management, Identity Management, Smart Contracts, Digital Assets |

|

By Industry Vertical |

Banking and Financial Services, Healthcare, Supply Chain & Logistics, Government, Retail |

|

By Organization Size |

Large Enterprises, SMEs |

|

By Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Blockchain Solution Providers

Financial Institutions (including banks and insurance companies)

Government and Regulatory Bodies (e.g., Financial Conduct Authority, SEC)

Venture Capital and Private Equity Firms

Cryptocurrency Exchanges and Wallet Providers

Supply Chain and Logistics Companies

Healthcare Providers

Technology and IT Service Providers

Companies

Players Mentioned in the Report:

IBM Corporation

Microsoft Corporation

Oracle Corporation

Ripple

Chain, Inc.

SAP SE

Accenture

R3 LLC

Bitfury Group

ConsenSys

Table of Contents

1. Global Blockchain Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Blockchain Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Blockchain Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Transparency (Parameter: Transparency)

3.1.2. Rising Adoption in Banking, Financial Services, and Insurance (Parameter: BFSI)

3.1.3. Expansion of Smart Contracts (Parameter: Smart Contracts)

3.1.4. Growing Integration with IoT (Parameter: IoT Integration)

3.2. Market Challenges

3.2.1. Scalability Issues (Parameter: Scalability)

3.2.2. Regulatory Uncertainty (Parameter: Regulatory Framework)

3.2.3. Energy Consumption Concerns (Parameter: Energy Efficiency)

3.3. Opportunities

3.3.1. Expansion of Blockchain-as-a-Service (BaaS) (Parameter: BaaS)

3.3.2. Growth in Non-Financial Sectors (Parameter: Non-Financial Adoption)

3.3.3. Advancements in Blockchain Interoperability (Parameter: Interoperability)

3.4. Trends

3.4.1. Integration with Artificial Intelligence (Parameter: AI Integration)

3.4.2. Use in Supply Chain Management (Parameter: Supply Chain Optimization)

3.4.3. Tokenization of Assets (Parameter: Asset Tokenization)

3.5. Government Regulations

3.5.1. Data Privacy Regulations (Parameter: Data Privacy)

3.5.2. Central Bank Digital Currencies (CBDC) Initiatives (Parameter: CBDCs)

3.5.3. Smart Contracts Legalization (Parameter: Smart Contract Legality)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Blockchain Market Segmentation

4.1. By Type (In Value %)

4.1.1. Public Blockchain

4.1.2. Private Blockchain

4.1.3. Consortium Blockchain

4.1.4. Hybrid Blockchain

4.2. By Application (In Value %)

4.2.1. Payments

4.2.2. Supply Chain Management

4.2.3. Identity Management

4.2.4. Smart Contracts

4.2.5. Digital Assets

4.3. By Industry Vertical (In Value %)

4.3.1. Banking and Financial Services

4.3.2. Healthcare

4.3.3. Supply Chain & Logistics

4.3.4. Government

4.3.5. Retail

4.4. By Organization Size (In Value %)

4.4.1. Large Enterprises

4.4.2. SMEs

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Blockchain Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Corporation

5.1.2. Microsoft Corporation

5.1.3. Oracle Corporation

5.1.4. SAP SE

5.1.5. Accenture

5.1.6. Ripple

5.1.7. Coinbase

5.1.8. Bitfury Group

5.1.9. ConsenSys

5.1.10. Guardtime

5.1.11. Chain, Inc.

5.1.12. Huawei Technologies

5.1.13. R3 LLC

5.1.14. Blockstream

5.1.15. Digital Asset Holdings

5.2. Cross Comparison Parameters (Revenue, Blockchain Solutions Offered, Number of Blockchain Patents, No. of Employees, Inception Year, Headquarters, Blockchain Consortium Participation, Number of Deployed Networks)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Blockchain Market Regulatory Framework

6.1. Data Protection Regulations

6.2. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) Norms

6.3. Cross-Border Payment Regulations

6.4. Tokenization Regulations

6.5. Environmental Impact Regulations

7. Global Blockchain Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Blockchain Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Organization Size (In Value %)

8.5. By Region (In Value %)

9. Global Blockchain Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map is developed encompassing all major stakeholders in the blockchain industry. Extensive desk research using proprietary and secondary databases is employed to identify critical variables that influence market dynamics, such as technology adoption, regulation, and market drivers.

Step 2: Market Analysis and Construction

Historical data pertaining to blockchain market penetration, adoption rates across industries, and revenue generation from blockchain services is compiled and analyzed. This step also includes an evaluation of the industry ecosystem to assess the balance between market providers and consumers.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through direct consultation with industry experts via telephone interviews, webinars, and expert panels. Insights from blockchain developers, financial experts, and enterprise blockchain users help refine and validate data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with blockchain solution providers and industry practitioners to obtain insights on deployment trends, customer adoption rates, and revenue estimates. This information is synthesized with bottom-up market data to deliver a validated and comprehensive market analysis.

Frequently Asked Questions

01. How big is the global blockchain market?

The global blockchain market was valued at USD 13 billion, driven by growing adoption across financial services, supply chain, and healthcare industries.

02. What are the challenges in the global blockchain market?

Key challenges include scalability issues, regulatory uncertainty, and concerns around energy consumption, particularly in public blockchain networks.

03. Who are the major players in the global blockchain market?

Key players include IBM Corporation, Microsoft Corporation, Ripple, Chain, Inc., and Oracle Corporation. These companies dominate due to their comprehensive blockchain platforms and extensive R&D investments.

04. What are the growth drivers of the global blockchain market?

Growth is driven by the increasing demand for secure, decentralized data solutions, widespread adoption of blockchain in financial services, and the rise of tokenization and smart contracts.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.