Global Blood Pressure Monitors Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD6851

December 2024

85

About the Report

Global Blood Pressure Monitors Market Overview

- The Global Blood Pressure Monitors Market is valued at USD 5.3 billion, driven by the rising prevalence of hypertension, the increasing awareness of preventive healthcare, and advancements in digital health technology. This market is also propelled by the growing aging population and the demand for home-based healthcare solutions. With more individuals taking an active role in managing their health, blood pressure monitoring devices, especially portable and digital ones, have gained widespread adoption in hospitals, clinics, and homes.

- North America and Europe dominate the global market due to well-established healthcare infrastructures, increased prevalence of hypertension, and a greater focus on preventive care. North America leads with the highest adoption of advanced digital monitors, largely driven by supportive government policies and health awareness campaigns. In Europe, robust healthcare spending and high levels of patient awareness contribute to its significant share, while countries in Asia-Pacific show rapid adoption due to expanding healthcare accessibility and rising chronic disease rates.

- Privacy regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in the EU govern the handling of patient data collected by blood pressure monitors. Compliance with these regulations is crucial, as non-compliance can result in significant fines. For instance, HIPAA violations can incur fines of up to $1.5 million annually, underscoring the importance of robust data privacy measures in the health monitoring market.

Global Blood Pressure Monitors Market Segmentation

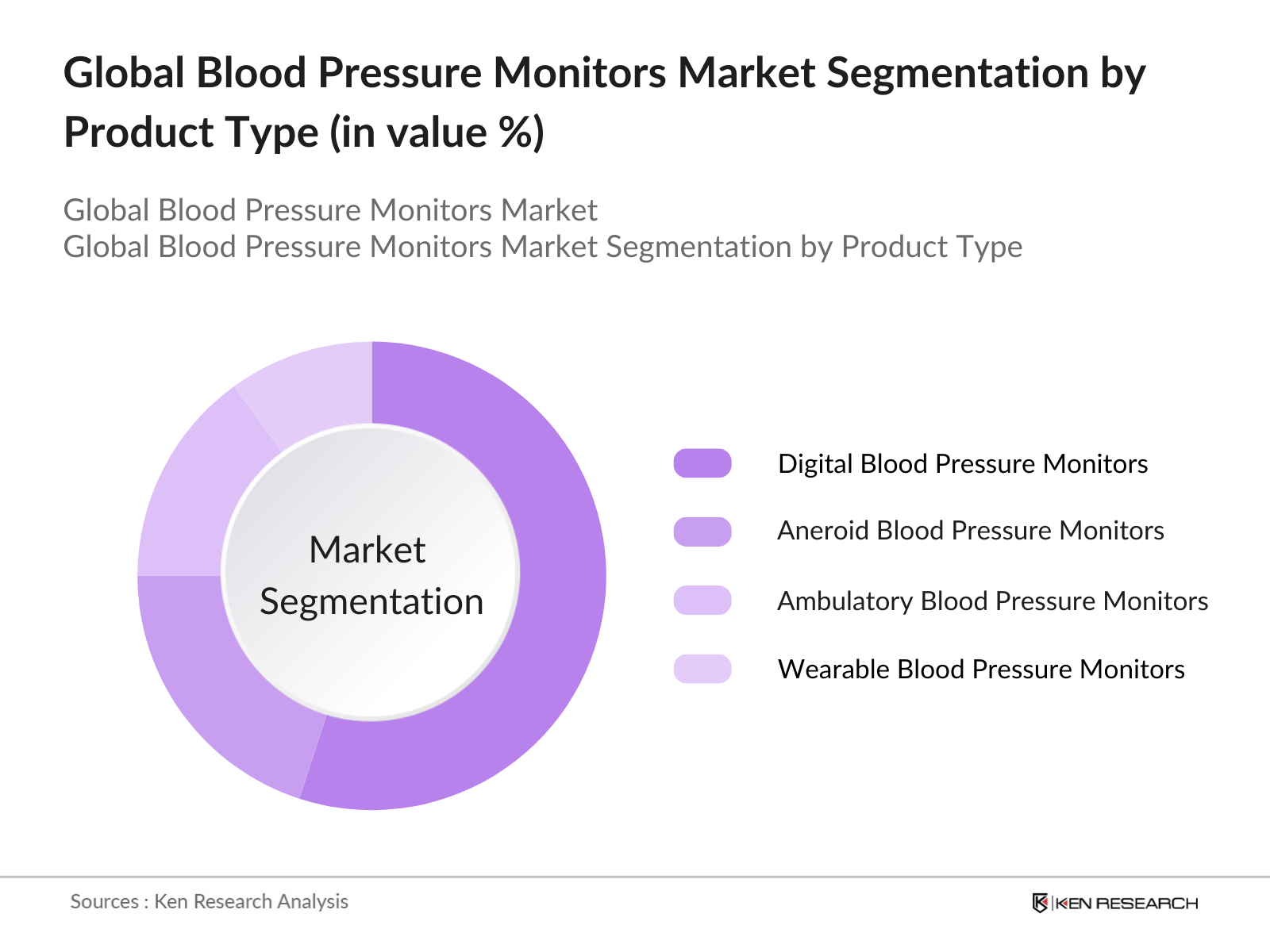

By Product Type: The global blood pressure monitor market is segmented by product type into Digital Blood Pressure Monitors, Aneroid Blood Pressure Monitors, Ambulatory Blood Pressure Monitors, Wearable Blood Pressure Monitors, and Sphygmomanometers. Digital blood pressure monitors hold a dominant market share due to their ease of use, accuracy, and ability to provide real-time data. These monitors are particularly popular among home users, as they allow non-invasive, convenient, and reliable blood pressure measurement.

By End-User: The market is segmented by end-user into Hospitals, Clinics, Homecare Settings, and Ambulatory Surgical Centers. Hospitals dominate the market in this segment due to the demand for accurate, clinical-grade blood pressure monitoring devices, which are critical in intensive care units, emergency rooms, and for long-term patient monitoring.

By Region: This market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America holds the largest share due to its advanced healthcare systems, high patient awareness, and regulatory support for innovative health monitoring technologies.

Global Blood Pressure Monitors Market Competitive Landscape

The global blood pressure monitors market is dominated by a mix of global and regional players, with established companies driving innovation and market expansion. The markets competitive landscape is characterized by strategic partnerships, product launches, and technological advancements.

Global Blood Pressure Monitors Industry Analysis

Growth Drivers

- Rise in Geriatric Population: The global aging population is a significant growth driver for blood pressure monitors, particularly as healthcare needs intensify. According to the World Bank, there are currently over 750 million individuals aged 65 and older, with an estimated 60% requiring regular health monitoring due to cardiovascular issues and age-related conditions, such as hypertension. The need for effective, consistent blood pressure monitoring is rising sharply, given that older adults often require daily monitoring to manage conditions like heart disease.

- Increasing Cases of Hypertension: Hypertension has become a prominent health issue, with the World Health Organization (WHO) reporting that over 1.28 billion people globally have high blood pressure. Nearly two-thirds of affected individuals live in low- and middle-income countries, highlighting the demand for accessible blood pressure monitors worldwide. This global hypertension prevalence creates a large user base for monitoring devices, especially with national healthcare agencies emphasizing hypertension awareness and management programs.

- Growing Awareness of Preventive Healthcare: Preventive healthcare has gained global traction, with governments allocating substantial budgets toward healthcare awareness programs. For instance, the United States healthcare expenditure reached $4.3 trillion, with a large portion dedicated to preventive healthcare, including cardiovascular health. This trend emphasizes the demand for at-home medical devices, such as blood pressure monitors, as governments and healthcare bodies actively encourage proactive health management.

Market Restraints

- High Costs of Digital Monitors: Digital blood pressure monitors, particularly those with advanced features, often come at a high cost, limiting accessibility. In developed markets, the average cost of these devices remains higher than the basic models, which can be prohibitive for low-income users. Government reports indicate that price sensitivity impacts uptake, especially in emerging economies where disposable incomes are lower. This cost barrier remains a significant challenge in expanding the market for high-quality, digital blood pressure monitors.

- Limited Access in Emerging Markets: Access to blood pressure monitors in emerging markets remains limited due to logistical challenges, such as poor distribution infrastructure. According to the World Bank, over 50% of rural healthcare facilities in low-income countries lack adequate access to essential medical equipment, including blood pressure monitors. This lack of access significantly impacts market growth, as underserved areas still lack the infrastructure needed to support widespread adoption of monitoring technology.

Global Blood Pressure Monitors Market Future Outlook

Over the next five years, the blood pressure monitors market is expected to witness robust growth, propelled by advancements in wearable technology, increased prevalence of hypertension, and the demand for home healthcare solutions. Technological innovations, including IoT-enabled devices, are anticipated to enhance user experience and enable better remote monitoring. The expansion of healthcare accessibility in developing regions also points to significant growth opportunities, particularly in Asia-Pacific.

Market Opportunities

- Integration with IoT and Wearables: The integration of blood pressure monitors with Internet of Things (IoT) platforms and wearables opens new market opportunities, as it allows real-time data sharing with healthcare providers. According to the U.S. Federal Communications Commission, over 100 million wearable devices are currently connected to healthcare networks, underscoring the demand for connected health solutions. This trend positions IoT-enabled blood pressure monitors as a key growth area, enhancing monitoring precision and patient outcomes through connectivity.

- Emerging Markets Expansion: Emerging markets, particularly in Asia and Africa, present a significant opportunity for growth in the blood pressure monitors market. World Bank data highlights that over 70% of healthcare facilities in emerging economies lack essential monitoring devices, a gap that governments are actively working to address. Several initiatives are underway to improve healthcare infrastructure, which supports the demand for affordable blood pressure monitors as these economies aim to improve health outcomes through increased device accessibility.

Scope of the Report

|

By Product Type |

Digital Blood Pressure Monitors |

|

Aneroid Blood Pressure Monitors |

|

|

Ambulatory Blood Pressure Monitors |

|

|

Wearable Blood Pressure Monitors |

|

|

Sphygmomanometers |

|

|

By End-User |

Hospitals |

|

Clinics |

|

|

Homecare Settings |

|

|

Ambulatory Surgical Centers |

|

|

By Distribution Channel |

Online Retail |

|

Offline Retail |

|

|

Pharmacies |

|

|

By Technology |

Digital Technology |

|

Analog Technology |

|

|

Wearable Monitoring |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East & Africa |

Products

Key Target Audience

Hospitals and Healthcare Providers

Medical Device Distributors and Suppliers

Pharmaceutical Companies

Manufacturers of Medical Monitoring Equipment

Technology Firms in Health Monitoring

Government and Regulatory Bodies (FDA, CE)

Investors and Venture Capitalist Firms

Insurance Companies and Healthcare Finance Agencies

Companies

Players Mentioned in the Report:

Omron Healthcare

A&D Company, Limited

Philips Healthcare

SunTech Medical

Welch Allyn

Beurer GmbH

Rossmax International Ltd.

Microlife AG

Withings SA

Hill-Rom Holdings, Inc.

Table of Contents

1. Global Blood Pressure Monitors Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Blood Pressure Monitors Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Blood Pressure Monitors Market Analysis

3.1 Growth Drivers (e.g., aging population, hypertension prevalence, healthcare investments)

3.1.1 Rise in Geriatric Population

3.1.2 Increasing Cases of Hypertension

3.1.3 Growing Awareness of Preventive Healthcare

3.1.4 Expansion of Home-Based Monitoring

3.2 Market Challenges (e.g., device costs, data security, reimbursement policies)

3.2.1 High Costs of Digital Monitors

3.2.2 Limited Access in Emerging Markets

3.2.3 Reimbursement Challenges

3.3 Opportunities (e.g., wearable innovations, remote monitoring adoption)

3.3.1 Integration with IoT and Wearables

3.3.2 Emerging Markets Expansion

3.3.3 Innovations in Digital Health Monitoring

3.4 Trends (e.g., AI-powered monitors, integration with mobile apps)

3.4.1 Advancements in AI and Cloud Connectivity

3.4.2 Mobile App Integration

3.4.3 Rising Demand for Cuffless Monitors

3.5 Government Regulations

3.5.1 Regulatory Standards by FDA/CE

3.5.2 Guidelines for Accuracy and Calibration

3.5.3 Data Privacy Regulations (HIPAA, GDPR)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Global Blood Pressure Monitors Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Digital Blood Pressure Monitors

4.1.2 Aneroid Blood Pressure Monitors

4.1.3 Ambulatory Blood Pressure Monitors

4.1.4 Wearable Blood Pressure Monitors

4.1.5 Sphygmomanometers

4.2 By End-User (In Value %)

4.2.1 Hospitals

4.2.2 Clinics

4.2.3 Homecare Settings

4.2.4 Ambulatory Surgical Centers

4.3 By Distribution Channel (In Value %)

4.3.1 Online Retail

4.3.2 Offline Retail

4.3.3 Pharmacies

4.4 By Technology (In Value %)

4.4.1 Digital Technology

4.4.2 Analog Technology

4.4.3 Wearable Monitoring

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Blood Pressure Monitors Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Omron Healthcare

5.1.2 A&D Company, Limited

5.1.3 Philips Healthcare

5.1.4 GE Healthcare

5.1.5 SunTech Medical

5.1.6 Welch Allyn

5.1.7 Beurer GmbH

5.1.8 Rossmax International Ltd.

5.1.9 Microlife AG

5.1.10 Withings SA

5.1.11 Hill-Rom Holdings, Inc.

5.1.12 Spacelabs Healthcare

5.1.13 Braun Healthcare

5.1.14 Citizen Systems Japan Co. Ltd.

5.1.15 Kaz Inc.

5.2 Cross Comparison Parameters (Revenue, Headquarters, Employees, Technology Portfolio, Distribution Reach, Product Portfolio, Key Clients, Patents)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Blood Pressure Monitors Market Regulatory Framework

6.1 Quality Control Standards

6.2 Compliance and Safety Guidelines

6.3 Certification Processes

6.4 Health Data Security and Compliance

7. Global Blood Pressure Monitors Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Influencing Future Market Growth

8. Global Blood Pressure Monitors Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By End-User (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

9. Global Blood Pressure Monitors Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step focuses on mapping the ecosystem of the blood pressure monitors market, encompassing manufacturers, healthcare providers, and technological innovators. Primary and secondary data sources, such as health department records and market analysis databases, provide a comprehensive view of market dynamics.

Step 2: Market Analysis and Construction

Historical data on market size, usage rates, and technological adoption were analyzed to evaluate market penetration and product demand. Additionally, revenue trends across different segments were examined for accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formed and validated via in-depth interviews with industry experts and stakeholders from leading companies. These consultations offered direct insights, which were crucial in refining our market data and understanding industry trends.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing data through interaction with major device manufacturers and health providers. This engagement helped validate our findings and ensured the analysis accurately represents the market structure and emerging trends in the blood pressure monitors market.

Frequently Asked Questions

01. How big is the Global Blood Pressure Monitors Market?

The Global Blood Pressure Monitors Market is valued at USD 5.3 billion, driven by a rise in healthcare awareness, growing demand for home monitoring, and advancements in monitoring technologies.

02. What are the challenges in the Global Blood Pressure Monitors Market?

The primary challenges include high costs associated with digital monitors, data security concerns, and limited access to advanced devices in rural or low-income regions, which can restrict market growth.

03. Who are the major players in the Global Blood Pressure Monitors Market?

Key players in the market include Omron Healthcare, A&D Company, Philips Healthcare, SunTech Medical, and Welch Allyn. Their dominance is due to extensive distribution networks, strong R&D investments, and technological advancements.

04. What are the growth drivers of the Global Blood Pressure Monitors Market?

Growth drivers include a rising geriatric population, increasing cases of hypertension globally, and the growing adoption of wearable and home monitoring devices, all contributing to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.