Global Blue Tea Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD8285

December 2024

98

About the Report

Global Blue Tea Market Overview

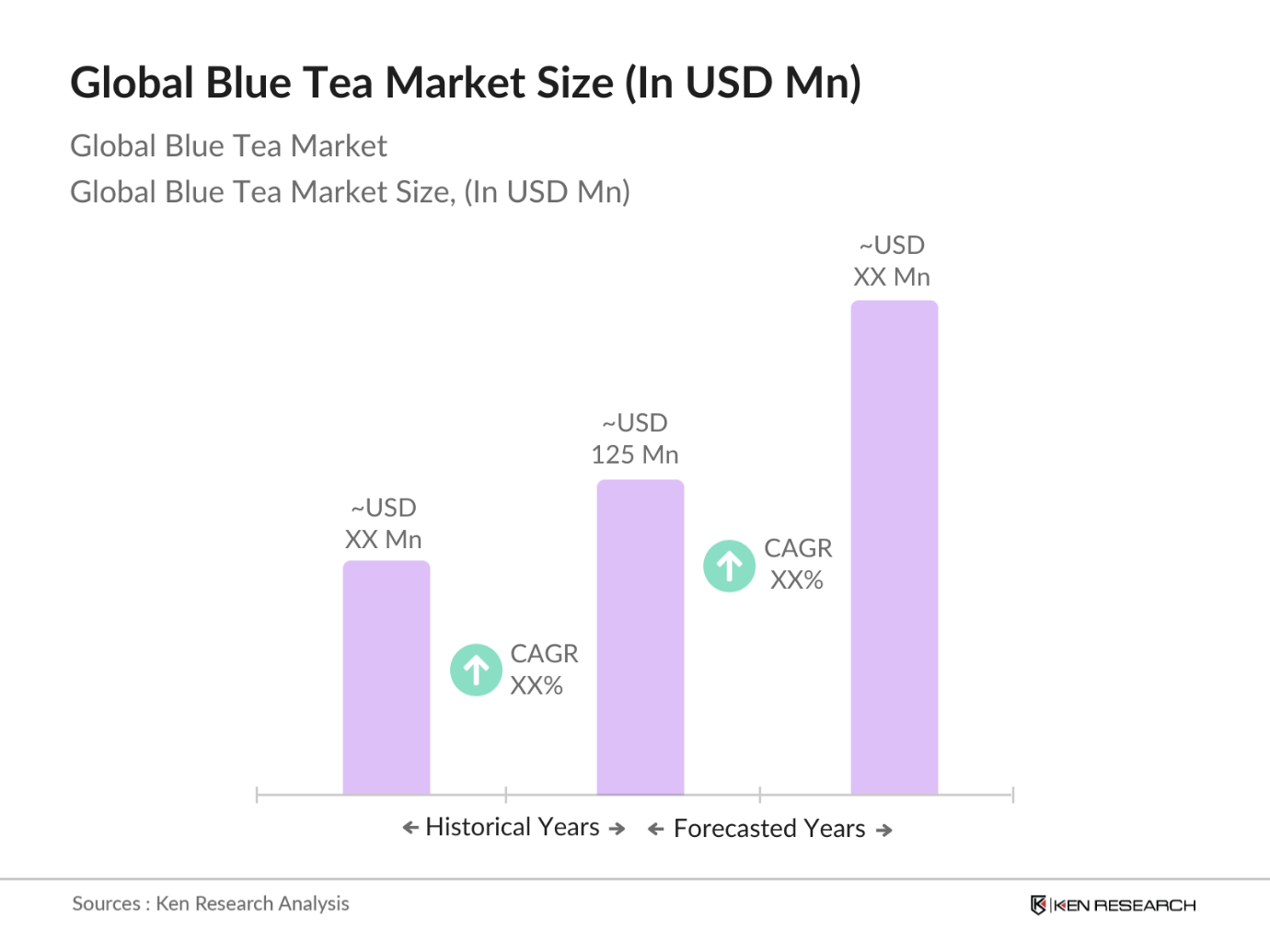

- The global blue tea market, valued at USD 125 million, is driven by a rising interest in functional beverages that offer both health benefits and aesthetic appeal. This growth has been spurred by consumers seeking wellness-oriented products with antioxidant and cognitive benefits, which blue tea offers due to its natural properties. The product's appeal is enhanced by its natural blue colour derived from butterfly pea flowers, which is gaining traction across social media platforms, especially among younger demographics keen on visually appealing beverages.

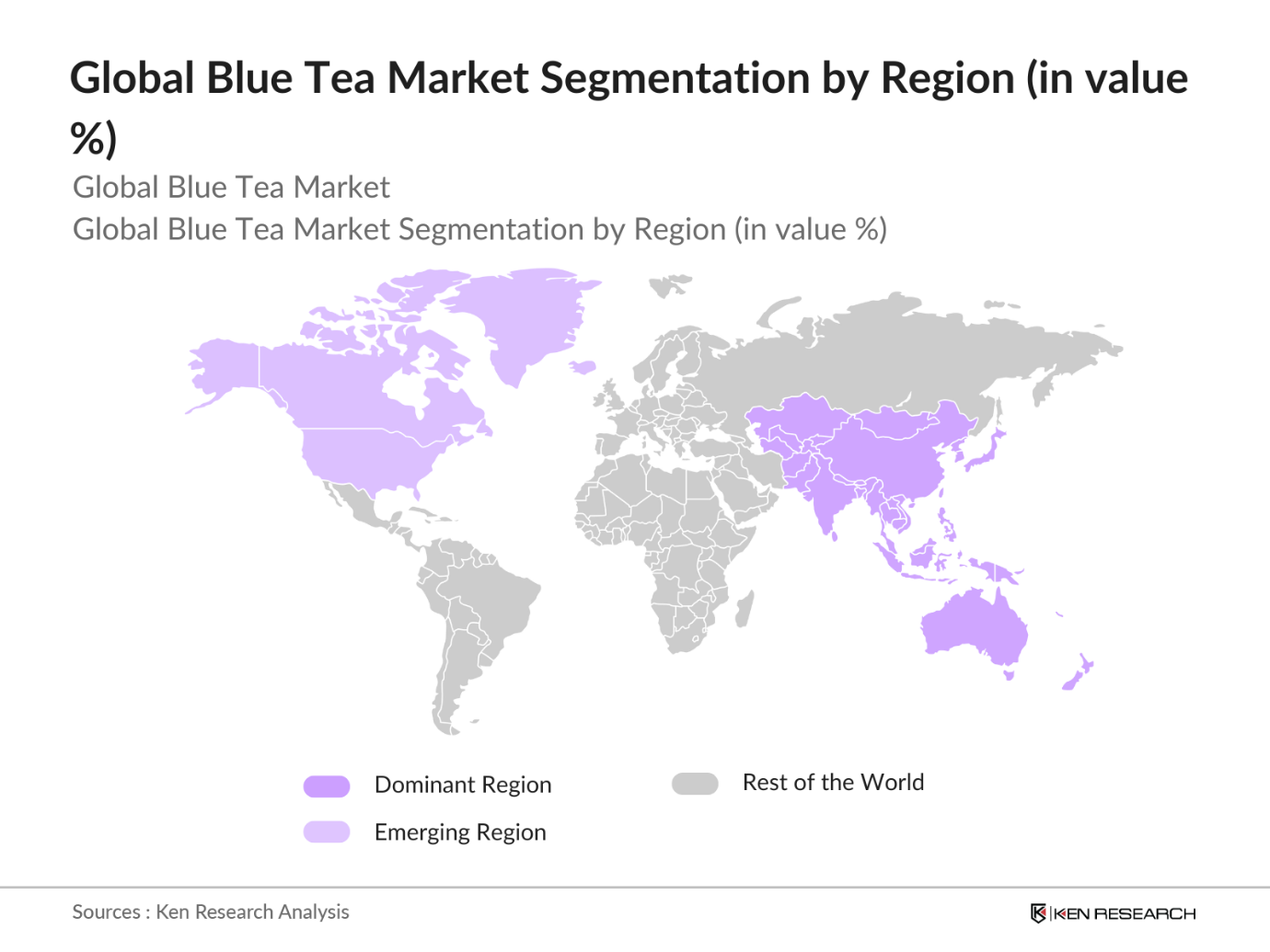

- The market is predominantly led by regions such as Asia-Pacific, North America, and Europe. In Asia-Pacific, blue tea is culturally embedded as a traditional beverage in Southeast Asian countries like Thailand, Vietnam, and Malaysia, where it has long been valued for its medicinal properties. In North America and Europe, the market has seen growth due to a trend toward unique, functional teas that cater to wellness-focused consumers. The North American market also benefits from the extensive e-commerce reach, which has helped popularize the product in the region.

- Herbal tea imports are subject to regulatory controls, especially within developed economies. Data from World Bank trade and tariff reports show increased regulatory scrutiny on herbal tea imports, affecting market entry timelines and costs for international blue tea brands.

Global Blue Tea Market Segmentation

- By Application: The blue tea market is segmented by application into beverages, cosmetics, and health supplements. Beverages remain the largest segment due to blue tea's versatility as an ingredient in various beverage types, including cocktails, teas, and health drinks. Its vibrant color and health benefits attract cafes, restaurants, and wellness brands, allowing for creative blue tea-based beverages that appeal to consumers seeking functional and visually appealing products.

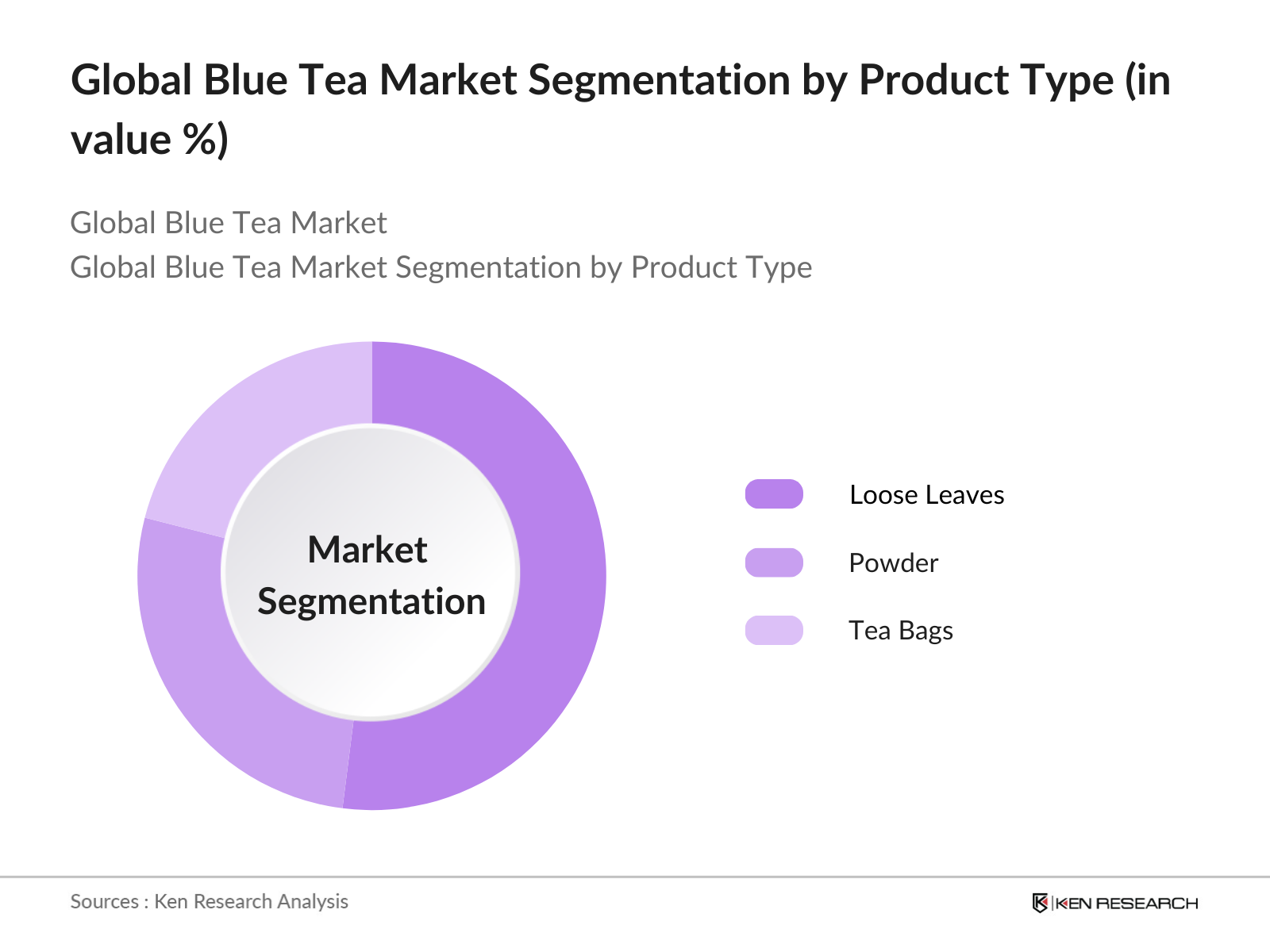

- By Product Type: The blue tea market is segmented by product type into loose leaves, powder, and tea bags. Loose leaves hold a dominant position within this segment due to the traditional consumption patterns in Asia-Pacific and the consumer perception that loose leaves provide a fresher and more authentic tea experience. Additionally, loose leaves are often marketed as premium options, appealing to consumers seeking high-quality and authentic tea products.

- By Region: The regional segmentation of the blue tea market includes Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa. Asia-Pacific holds the largest market share, driven by cultural familiarity and increasing awareness of blue tea's health benefits. The region also benefits from local production of butterfly pea flowers, making it more accessible and affordable for consumers.

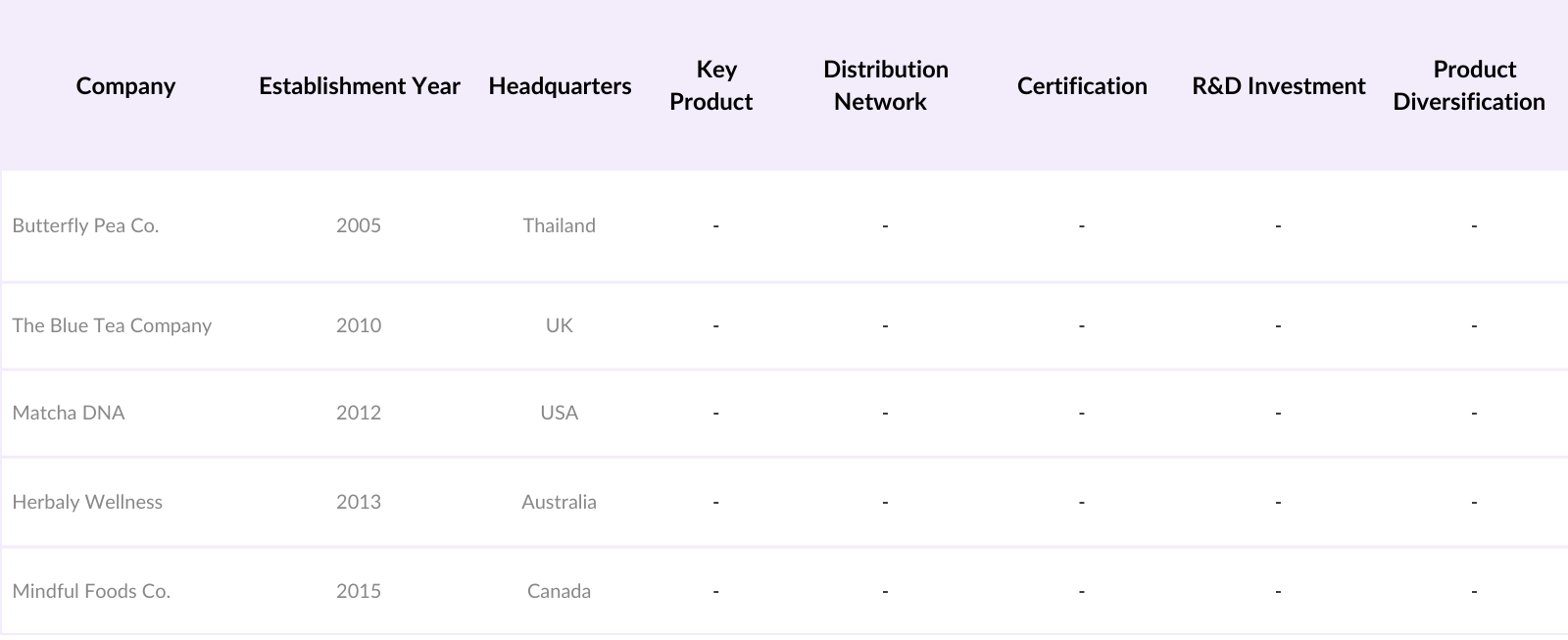

Global Blue Tea Market Competitive Landscape

The global blue tea market is characterized by a mix of small regional players and prominent international brands, each focusing on product innovation, quality, and brand positioning. Key players have differentiated themselves through strategic collaborations, expanded distribution channels, and organic and fair-trade certifications that appeal to health-conscious consumers.

Global Blue Tea Market Analysis

Global Blue Tea Market Growth Drivers

- Increasing Demand for Functional Beverages: The global push towards functional beverages is driven by increased consumer demand for natural and health-enhancing ingredients, as seen in the blue tea market. In countries like India, beverage sales that feature natural adaptogens, including butterfly pea flower tea, align with a 20% rise in consumer preference for natural health products (2023) reported by World Bank statistics. With wider acceptance in developed markets, functional beverages like blue tea show promise in global consumption for their adaptogenic benefits, providing consumers with alternative options to traditional, synthetic drinks.

- Rising Health Awareness: A heightened focus on health awareness, particularly related to antioxidants and anti-aging benefits, aligns with a substantial increase in antioxidant-based product sales. For instance, in 2022, over 65% of urban adults in high-income economies prioritized antioxidant-rich diets, with antioxidant-related consumption indicators showing strong correlations to products like blue tea, valued for its high antioxidant content. This trend, supported by World Bank health data, reflects a global market shift toward plant-based antioxidant sources and aligns well with the rising popularity of blue tea as a health beverage.

- E-commerce and Online Platforms Expansion: The global expansion of e-commerce has supported digital sales in the beverage market, with platforms showing a 30% increase in digital transactions for specialty teas from 2022 to 2024. This growth in digital retail provides a robust channel for products like blue tea to reach diverse consumer bases, particularly in emerging economies, where access to health-oriented beverages is now facilitated online. The World Bank's digital development insights further validate this trend, noting accelerated growth in digital infrastructure across developing nations, thereby widening market reach for niche products.

Global Blue Tea Market Challenges

- Competition from Traditional Tea Varieties and Functional Drinks: The blue tea market faces intense competition from traditional and established functional tea varieties, which account for a large share of the market. World Bank consumption data indicates that traditional tea consumption remains high in emerging markets due to cultural preference and affordability, posing a challenge for newer entries like blue tea. Market data suggests that established tea varieties maintain steady sales, with minimal market penetration by alternative teas in these regions.

- Limited Consumer Awareness in Emerging Markets: Although blue tea is increasingly popular in developed regions, consumer awareness remains limited in many emerging markets. In countries with lower health literacy, awareness about the specific benefits of butterfly pea tea remains low, with surveys showing that only 15% of urban consumers in emerging markets are familiar with functional teas beyond traditional offerings. This poses a major barrier to market expansion, as confirmed by recent World Bank indicators on consumer awareness disparities between emerging and developed economies.

Global Blue Tea Market Future Outlook

Over the next few years, the blue tea market is poised to grow substantially, driven by an increasing consumer preference for health-boosting, visually appealing beverages. The expansion of distribution channels, especially through e-commerce, will facilitate access to a wider audience. Additionally, consumer demand for sustainable, organic, and fair-trade products is anticipated to guide the future developments in this market.

Global Blue Tea Market Opportunities

- Application in Food and Beverage Innovation: The unique color and adaptogenic properties of blue tea are driving its application in innovative food and beverage products. In the U.S., for instance, new culinary applications of blue tea have led to increased demand, with 1 in 10 restaurants incorporating blue tea as a natural colorant in 2024, supported by global sustainable food trends data from the World Bank.

- Partnerships with Cafes and Specialty Stores: Collaborations between blue tea brands and specialty cafes have increased, with about 12% of cafes in urban U.S. and European areas offering blue tea by 2024. World Bank data on SME partnerships indicate that such collaborations foster market growth, offering blue tea exposure to health-conscious consumers seeking novel beverage experiences in urban markets.

Scope of the Report

|

By Product Type |

Loose Leaves Powder Tea Bags |

|

By Application |

Beverages Cosmetics Health Supplements |

|

By Distribution Channel |

Off-Trade (Supermarkets, E-commerce) On-Trade (Cafes, Restaurants) |

|

By Type |

Conventional Organic |

|

By Region |

Asia-Pacific North America Europe Middle East & Africa Latin America |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, European Food Safety Authority)

Health and Wellness Brands

Banks and Financial Institutions

Specialty Beverage Manufacturers

E-commerce Platforms

Organic Certification Agencies

High-end Cafes and Restaurants

Supermarkets and Retail Chains

Companies

Players Mentioned in the Report

Butterfly Pea Co.

The Blue Tea Company

Matcha DNA

Herbaly Wellness

Mindful Foods Co.

Lake Missoula Tea Company

Revival Tea Company

Tucson Tea Company

Asheville Tea Company

Noble Roots Urban Garden LLC

Table of Contents

1. Global Blue Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Health Benefits and Consumer Appeal (Antioxidant properties, Cognitive health)

1.4. Market Growth Overview

2. Global Blue Tea Market Size (USD Bn)

2.1. Current Market Size

2.2. Market Growth Drivers (Health-conscious consumer demand, Functionality in beverages)

2.3. Key Market Developments (Product launches, Ready-to-drink innovations)

3. Global Blue Tea Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand for functional beverages (Natural food coloring, Adaptogenic properties)

3.1.2. Rising health awareness (Antioxidants, Anti-aging)

3.1.3. E-commerce and Online Platforms Expansion (Digital retail penetration)

3.1.4. Premiumization of tea-based beverages

3.2. Market Challenges

3.2.1. Competition from traditional tea varieties and functional drinks

3.2.2. Limited consumer awareness in emerging markets

3.2.3. Regulatory hurdles (Ingredient certification, Quality standards)

3.3. Opportunities

3.3.1. Application in food and beverage innovation (Beverages, Culinary applications)

3.3.2. Partnerships with cafes and specialty stores

3.3.3. Expansion into wellness-focused retail

3.4. Trends

3.4.1. Rise of Instagram-worthy beverages (Social media influence)

3.4.2. Incorporation in beauty and wellness products

3.4.3. Demand for organic and ethically sourced tea

3.5. Government Regulations

3.5.1. Organic and Fair-Trade Certifications

3.5.2. Import/export regulations on herbal teas

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Local, International)

4. Global Blue Tea Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Loose Leaves

4.1.2. Powder

4.1.3. Tea Bags

4.2. By Application (In Value %)

4.2.1. Beverages

4.2.2. Cosmetics

4.2.3. Health Supplements

4.3. By Distribution Channel (In Value %)

4.3.1. Off-Trade (Supermarkets, E-commerce)

4.3.2. On-Trade (Cafes, Restaurants)

4.4. By Type (In Value %)

4.4.1. Conventional

4.4.2. Organic

4.5. By Region (In Value %)

4.5.1. Asia-Pacific

4.5.2. North America

4.5.3. Europe

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Blue Tea Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Butterfly Pea Co.

5.1.2. The Blue Tea Company

5.1.3. Matcha DNA

5.1.4. Herbaly Wellness

5.1.5. Mindful Foods Co.

5.1.6. Lake Missoula Tea Company

5.1.7. Revival Tea Company

5.1.8. Tucson Tea Company

5.1.9. Asheville Tea Company

5.1.10. Noble Roots Urban Garden LLC

5.1.11. The Hale Tea Company

5.1.12. Blue Willow Tea

5.1.13. Butterfly Tea House

5.1.14. Zen Tea Traders

5.1.15. Serenity Herbs

5.2. Cross Comparison Parameters (Product offerings, Distribution network, Organic certification, Revenue, R&D expenditure, Market presence, Brand value, Strategic initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Product launches)

5.5. Investment Analysis

5.6. Mergers and Acquisitions

5.7. Government Grants and Funding

6. Global Blue Tea Market Regulatory Framework

6.1. Organic Certification Requirements

6.2. Import/Export Compliance

6.3. Fair-Trade Certification Processes

7. Global Blue Tea Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Blue Tea Market Future Segmentation

8.1 By Product Type

8.2 By Application

8.3 By Distribution Channel

8.4 By Type

8.5 By Region

9. Global Blue Tea Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The study began with an ecosystem map of major stakeholders, examining players in the blue tea market, including regional tea producers, wellness brands, and distributors. Key variables, such as health benefits and organic certifications, were identified through secondary research across reputable databases.

Step 2: Market Analysis and Construction

Historical data for market penetration, consumer preferences, and revenue sources were compiled and analyzed to construct an accurate market framework. Key parameters like market demand across beverage and wellness applications were assessed for credibility and relevance.

Step 3: Hypothesis Validation and Expert Consultation

Through interviews with industry experts, insights on product innovation, consumer trends, and regulatory challenges were validated. This feedback provided a comprehensive understanding of market needs and verified market data accuracy.

Step 4: Research Synthesis and Final Output

The final phase involved direct insights from blue tea manufacturers and distributors, enhancing data accuracy on product segment performance and identifying consumer preferences, thereby strengthening the market analysis with first-hand insights.

Frequently Asked Questions

01. How big is the Global Blue Tea Market?

The global blue tea market, valued at USD 125 million, is driven by the demand for functional beverages that offer aesthetic appeal and health benefits.

02. What are the challenges in the Global Blue Tea Market?

Challenges include limited consumer awareness in new markets, competition from established teas, and stringent quality certifications for organic products.

03. Who are the major players in the Global Blue Tea Market?

Key players include Butterfly Pea Co., The Blue Tea Company, Matcha DNA, and Herbaly Wellness, known for product quality, strong branding, and strategic partnerships.

04. What are the growth drivers of the Global Blue Tea Market?

The market is propelled by the demand for antioxidant-rich beverages, the rise of social media marketing, and increased accessibility through e-commerce channels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.