Global Body Control Module (BCM) Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD6034

November 2024

99

About the Report

Global Body Control Module (BCM) Market Overview

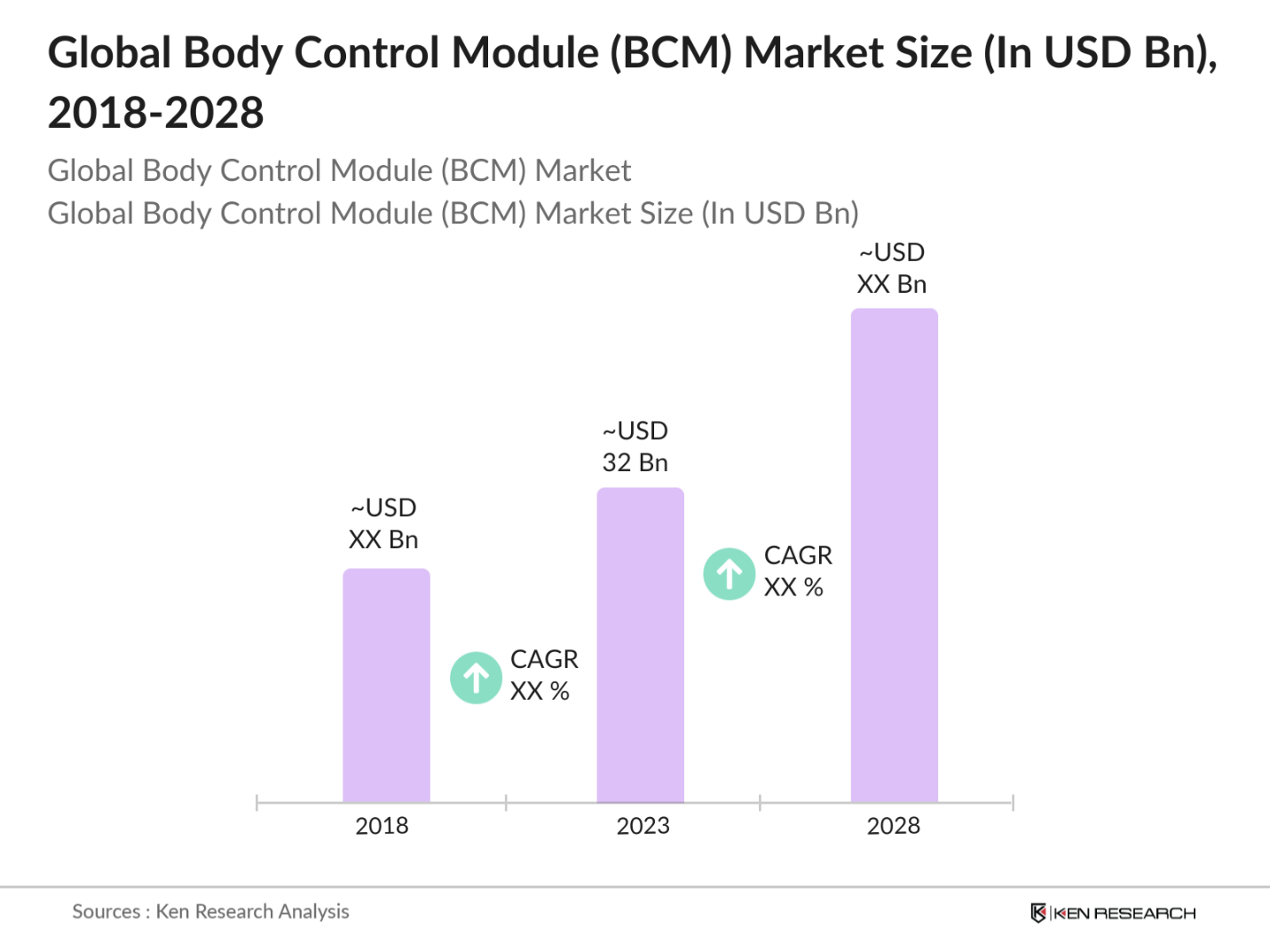

- The Global Body Control Module (BCM) market is valued at USD 32 billion, based on a five-year historical analysis. The market's growth is primarily fueled by the increasing electrification of vehicles, advancements in automotive safety features, and rising consumer demand for enhanced comfort and convenience. As electric and hybrid vehicles become more prevalent, BCMs play a critical role in managing the complex electronic functions, driving the adoption of sophisticated modules in the automotive industry.

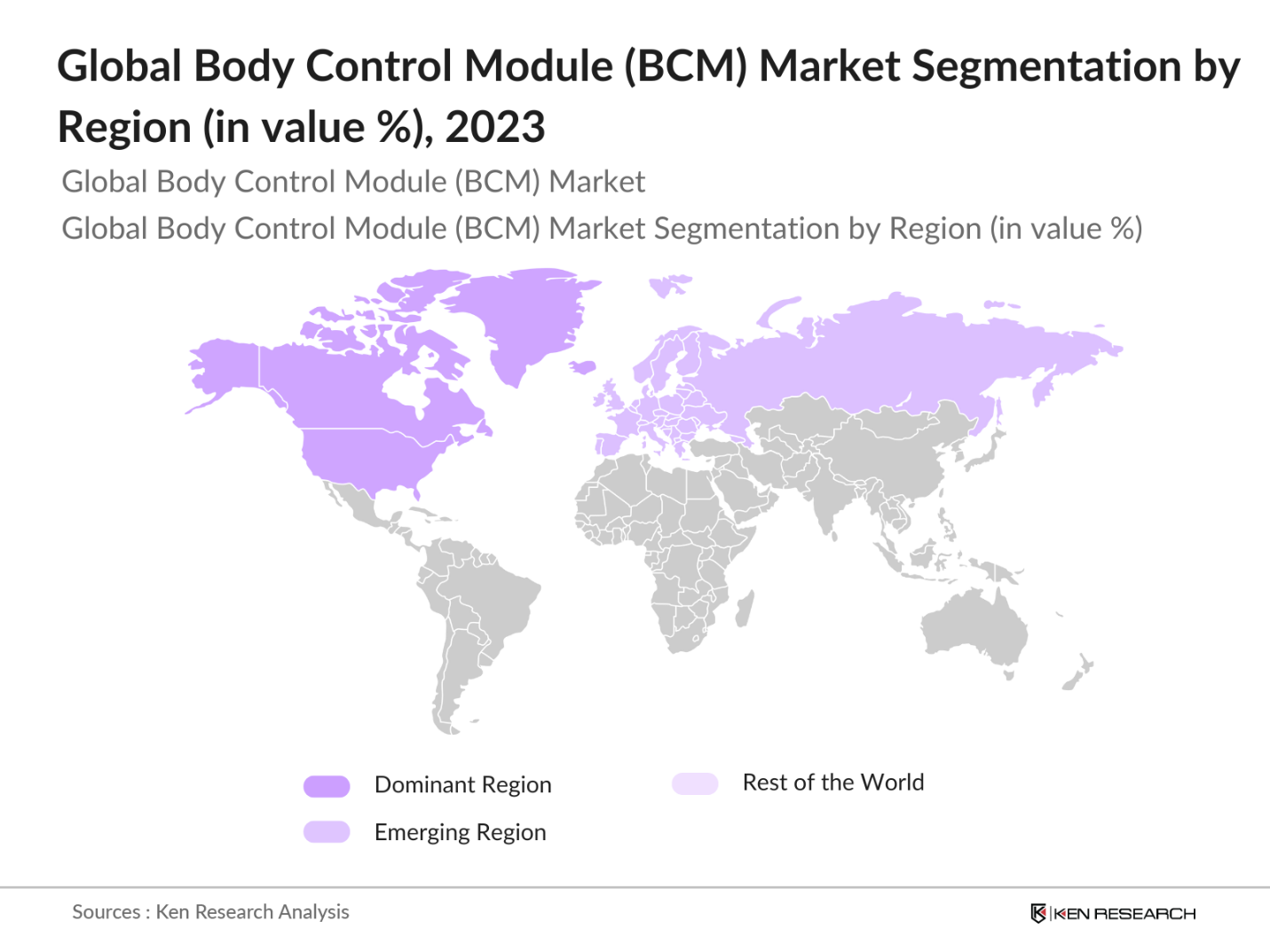

- Asia-Pacific emerges as the dominant region in the BCM market. Countries like China, Japan, and South Korea lead due to their robust automotive manufacturing industries, substantial investments in electric vehicle development, and the presence of major automotive OEMs. The region's focus on technological innovation and favorable government policies supporting automotive advancements contribute to its market leadership.

- Stringent emission standards set by regulatory bodies worldwide are influencing the design and functionality of BCMs. The European Union's Euro 6 standards, implemented in 2023, require vehicles to emit no more than 80 mg/km of nitrogen oxides. BCMs are integral in managing engine functions and emission control systems to ensure compliance with these regulations, prompting manufacturers to innovate and enhance BCM capabilities.

Global Body Control Module (BCM) Market Segmentation

By Functionality: The market is segmented into high-end and low-end functionalities. High-end BCMs dominate the market, driven by the increasing integration of advanced features such as adaptive cruise control, automatic climate control, and sophisticated infotainment systems. Consumers' growing preference for enhanced comfort and safety features in vehicles propels the demand for high-end BCMs.

By Component: The market is divided into hardware and software components. Hardware components hold a significant market share, attributed to the necessity of physical units like microcontrollers, power supply units, and sensors that form the backbone of BCMs. The continuous advancement in hardware technology ensures efficient and reliable performance of BCMs, maintaining their dominance in the market.

By Region: Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific leads the market, supported by its strong automotive production capabilities, rapid technological adoption, and supportive government initiatives. The region's emphasis on electric vehicle development and smart automotive technologies further solidifies its leading position.

Global Body Control Module (BCM) Market Competitive Landscape

The BCM market is characterized by the presence of several key players who drive innovation and competition. These companies focus on technological advancements, strategic partnerships, and expanding their product portfolios to maintain a competitive edge.

Global Body Control Module (BCM) Industry Analysis

Growth Drivers

- Increasing Vehicle Electrification: The global automotive industry is witnessing a significant shift towards electrification. In 2023, approximately 10 million electric vehicles (EVs) were sold worldwide, marking a substantial increase from previous years. This surge is driven by governmental policies promoting cleaner transportation and consumer demand for sustainable alternatives. For instance, the European Union aims to have at least 30 million zero-emission vehicles on its roads by 2030. This trend necessitates advanced electronic systems, including Body Control Modules (BCMs), to manage the complex functionalities of modern vehicles.

- Rising Demand for Advanced Safety Features: Consumer preference for enhanced safety in vehicles has led to the integration of advanced driver-assistance systems (ADAS). Features such as automatic emergency braking, lane departure warnings, and adaptive cruise control are becoming standard in new vehicles. The National Highway Traffic Safety Administration (NHTSA) reported that in 2023, over 90% of new vehicles sold in the U.S. were equipped with at least one ADAS feature. BCMs play a crucial role in managing these systems, ensuring seamless operation and improved vehicle safety.

- Expansion of Electric and Hybrid Vehicles: The global fleet of electric and hybrid vehicles is expanding rapidly. According to the International Energy Agency (IEA), the number of electric cars on the road reached 16.5 million in 2023, a 43% increase from 2022. This growth is supported by substantial investments in charging infrastructure and advancements in battery technology. BCMs are integral to these vehicles, managing functions such as battery monitoring, energy distribution, and integration with regenerative braking systems.

Market Challenges

- High Development and Integration Costs: Developing and integrating advanced BCMs involve significant financial investment. The Center for Automotive Research (CAR) estimates that the cost of electronic components in vehicles has risen by 15% over the past five years, primarily due to the complexity of modern systems. This increase poses challenges for manufacturers in maintaining profitability while delivering technologically advanced vehicles.

- Complexity in System Integration: Modern vehicles incorporate numerous electronic systems that must function seamlessly together. The integration of BCMs with other vehicle control units is complex and requires meticulous engineering. The Automotive Electronics Council (AEC) reports that integration issues account for approximately 20% of vehicle recalls related to electronic systems in 2023, highlighting the challenges in ensuring compatibility and reliability.

Global Body Control Module (BCM) Market Future Outlook

Over the next five years, the BCM market is expected to witness significant growth, driven by continuous advancements in automotive electronics, the rise of autonomous vehicles, and the increasing adoption of electric vehicles. The integration of Internet of Things (IoT) technologies and the development of smart cities are anticipated to further enhance the demand for advanced BCMs.

Market Opportunities

- Integration with IoT and Connected Vehicles: The Internet of Things (IoT) is transforming the automotive industry by enabling vehicles to communicate with external devices and infrastructure. The International Data Corporation (IDC) projects that by 2025, there will be over 75 billion connected devices globally. This connectivity allows BCMs to facilitate features such as remote diagnostics, over-the-air updates, and vehicle-to-everything (V2X) communication, enhancing vehicle functionality and user experience.

- Development of Autonomous Vehicles: The pursuit of autonomous driving technology presents significant opportunities for BCMs. The World Economic Forum (WEF) estimates that by 2030, autonomous vehicles could account for up to 15% of global car sales. BCMs are essential in managing the complex systems required for vehicle autonomy, including sensor integration, data processing, and control of various vehicle functions, positioning them as critical components in the evolution of self-driving cars.

Scope of the Report

|

By Functionality |

High-End BCM Low-End BCM |

|

By Component |

Hardware Software |

|

By MCU Bit Size |

8-bit 16-bit 32-bit |

|

By Vehicle Type |

Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles |

|

By Communication Protocol |

Controller Area Network (CAN) Local Interconnect Network (LIN) FlexRay Ethernet |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Automotive Original Equipment Manufacturers (OEMs)

Automotive Component Suppliers

Semiconductor Manufacturers

Automotive Electronics Integrators

Government and Regulatory Bodies (e.g., National Highway Traffic Safety Administration)

Investment and Venture Capitalist Firms

Automotive Research and Development Institutes

Automotive Aftermarket Service Providers

Companies

Players Mentioned in the Report

Robert Bosch GmbH

Continental AG

DENSO Corporation

ZF Friedrichshafen AG

Aptiv PLC

HELLA GmbH & Co. KGaA

Mitsubishi Electric Corporation

NXP Semiconductors N.V.

Renesas Electronics Corporation

Texas Instruments Incorporated

Table of Contents

1. Global Body Control Module Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Body Control Module Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Body Control Module Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Vehicle Electrification

3.1.2. Rising Demand for Advanced Safety Features

3.1.3. Expansion of Electric and Hybrid Vehicles

3.1.4. Technological Advancements in Automotive Electronics

3.2. Market Challenges

3.2.1. High Development and Integration Costs

3.2.2. Complexity in System Integration

3.2.3. Cybersecurity Concerns

3.3. Opportunities

3.3.1. Integration with IoT and Connected Vehicles

3.3.2. Development of Autonomous Vehicles

3.3.3. Expansion in Emerging Markets

3.4. Trends

3.4.1. Adoption of Centralized Computing Architectures

3.4.2. Miniaturization of BCMs

3.4.3. Use of Over-the-Air (OTA) Updates

3.5. Regulatory Landscape

3.5.1. Emission Standards

3.5.2. Safety Regulations

3.5.3. Data Privacy Laws

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Global Body Control Module Market Segmentation

4.1. By Functionality (Value %)

4.1.1. High-End BCM

4.1.2. Low-End BCM

4.2. By Component (Value %)

4.2.1. Hardware

4.2.2. Software

4.3. By MCU Bit Size (Value %)

4.3.1. 8-bit

4.3.2. 16-bit

4.3.3. 32-bit

4.4. By Vehicle Type (Value %)

4.4.1. Passenger Cars

4.4.2. Light Commercial Vehicles

4.4.3. Heavy Commercial Vehicles

4.5. By Communication Protocol (Value %)

4.5.1. Controller Area Network (CAN)

4.5.2. Local Interconnect Network (LIN)

4.5.3. FlexRay

4.5.4. Ethernet

4.6. By Region (Value %)

4.6.1. North America

4.6.2. Europe

4.6.3. Asia Pacific

4.6.4. Latin America

4.6.5. Middle East & Africa

5. Global Body Control Module Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Robert Bosch GmbH

5.1.2. Continental AG

5.1.3. DENSO Corporation

5.1.4. Delphi Technologies

5.1.5. ZF Friedrichshafen AG

5.1.6. Aptiv PLC

5.1.7. HELLA GmbH & Co. KGaA

5.1.8. Mitsubishi Electric Corporation

5.1.9. NXP Semiconductors N.V.

5.1.10. Renesas Electronics Corporation

5.1.11. Texas Instruments Incorporated

5.1.12. Infineon Technologies AG

5.1.13. Lear Corporation

5.1.14. STMicroelectronics N.V.

5.1.15. Visteon Corporation

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, R&D Investment, Market Share, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Global Body Control Module Market Regulatory Framework

6.1. Automotive Safety Standards

6.2. Emission Regulations

6.3. Data Security and Privacy Laws

6.4. Compliance Requirements

6.5. Certification Processes

7. Global Body Control Module Future Market Size (USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Body Control Module Future Market Segmentation

8.1. By Functionality (Value %)

8.2. By Component (Value %)

8.3. By MCU Bit Size (Value %)

8.4. By Vehicle Type (Value %)

8.5. By Communication Protocol (Value %)

8.6. By Region (Value %)

9. Global Body Control Module Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the BCM market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the BCM market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple automotive manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the BCM market.

Frequently Asked Questions

01 How big is the Global Body Control Module Market?

The Global Body Control Module (BCM) market is valued at USD 32 billion, based on a five-year historical analysis. The market's growth is primarily fueled by the increasing electrification of vehicles, advancements in automotive safety features, and rising consumer demand for enhanced comfort and convenience.

02 What are the challenges in the Global Body Control Module Market?

Key challenges include high development and integration costs, cybersecurity concerns due to increased connectivity, and the complexity of system integration across diverse vehicle models.

03 Who are the major players in the Global Body Control Module Market?

Major players include Robert Bosch GmbH, Continental AG, DENSO Corporation, ZF Friedrichshafen AG, and Aptiv PLC, who lead through innovation, expansive product portfolios, and strategic partnerships.

04 What drives the growth of the Global Body Control Module Market?

Growth is propelled by the increasing adoption of electric vehicles, advancements in IoT for automotive applications, and demand for enhanced safety, comfort, and convenience features in vehicles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.