Global Bottled Water Market Outlook to 2030

Region:Global

Author(s):Sunaiyna Varma

Product Code:KENGR046

September 2024

82

About the Report

Global Bottled Water Market Overview

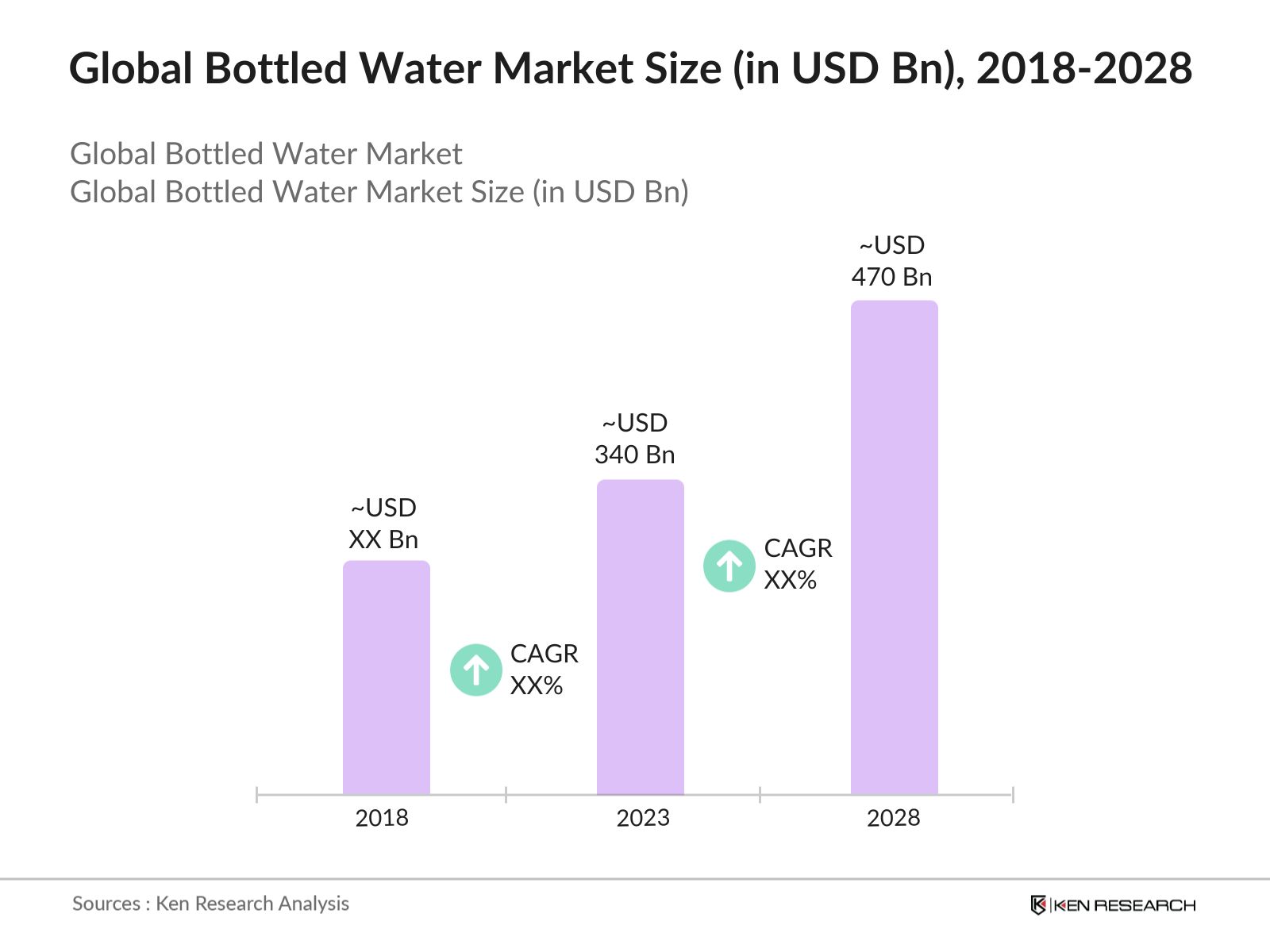

- The global bottled water market was valued at USD 340 Bn in 2023, is fueled by heightened health awareness, a greater understanding of the importance of hydration, and the increasing popularity of on-the-go consumption. The demand for clean and safe drinking water, especially in urban regions, has boosted bottled water sales globally. Additionally, advancements in water purification technology and innovative packaging are driving further market expansion.

- The market is led by major global companies such as Nestl Waters, Danone S.A., PepsiCo, The Coca-Cola Company, and Suntory Beverage & Food Ltd. Nestl Waters remains a frontrunner with brands like Pure Life and Perrier, while Danone has a significant market share with Evian and Volvic. These companies sustain their dominance by utilizing expansive distribution networks and powerful marketing strategies.

- In February 2023, PepsiCo teamed up with biotech firm LanzaTech to develop a novel method for producing bottled water from captured carbon emissions. This collaboration aims to reduce environmental impact by converting carbon dioxide into a sustainable material for bottling, advancing PepsiCo's sustainability goals and lowering its carbon footprint.

Global Bottled Water Current Market Analysis

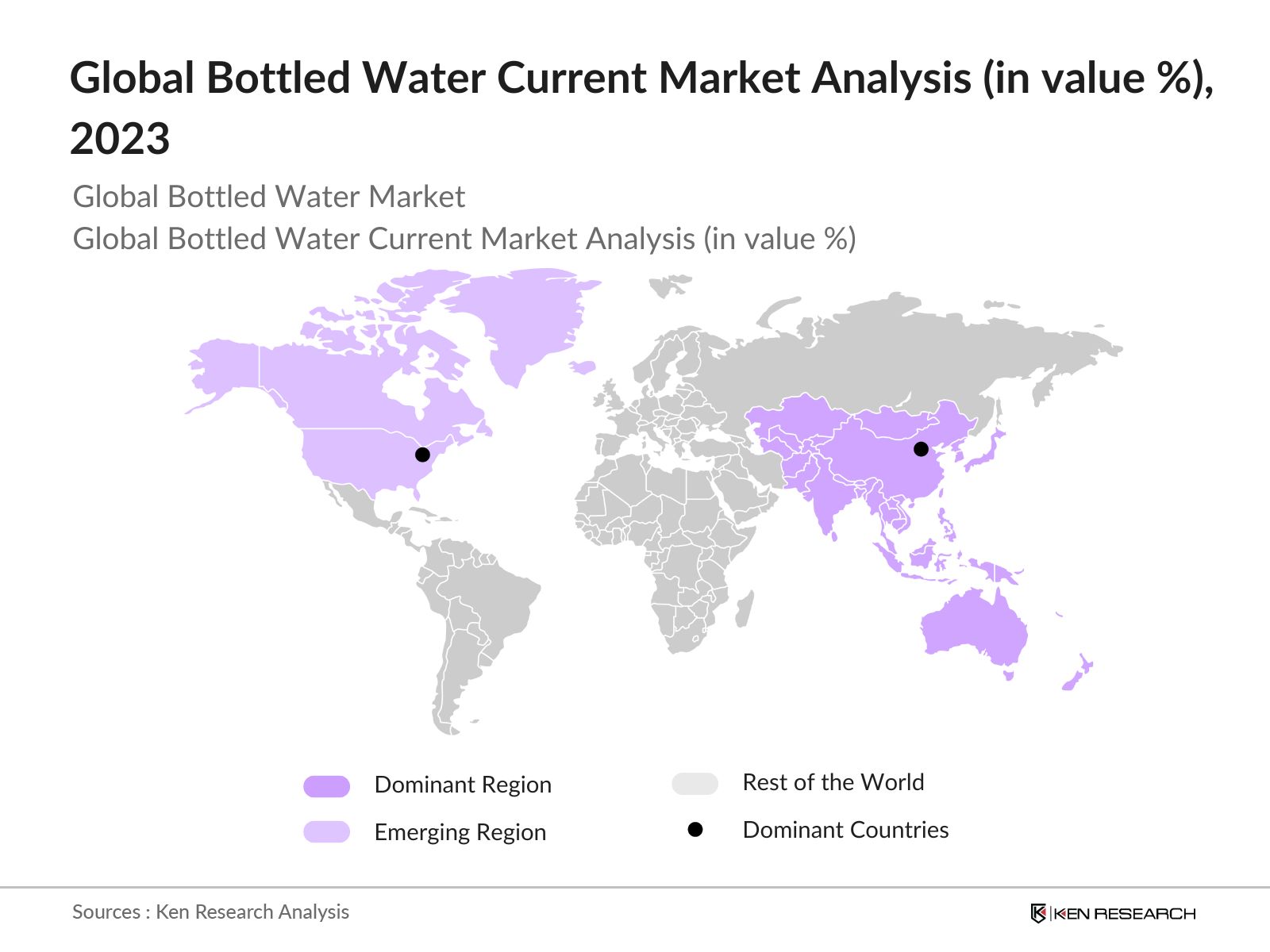

- APAC as dominant region: The Asia-Pacific (APAC) region leads the market, driven by rapid urbanization of over 45% in 2023, particularly in China and India, which has heightened demand for convenient and safe drinking water. With a middle class comprising 40% of the population and household wealth reaching USD 144 Bn in 2023, the region has seen increased consumption of premium bottled water brands. Growing health awareness and concern over waterborne diseases like dracunculiasis and schistosomiasis further boost market growth. Additionally, extensive distribution networks and aggressive marketing strategies by key players solidify APAC's dominant market position.

- North America as emerging region: North America is becoming a key market, driven by several crucial factors. Increasing health consciousness among consumers has led to greater demand for bottled water as a healthier alternative to sugary drinks. In the U.S., 46% of consumers are actively reducing their sugar intake, with this figure rising to 55% in Canada. Additionally, the growing trend of active lifestyles and outdoor activities has fueled on-the-go consumption, further propelling the bottled water market. The region has also seen an increased preference for premium and functional water products that address specific health and wellness needs.

- China as dominant country: China remains a dominant player in the global bottled water market, driven by a combination of critical factors. With a population exceeding 1.4 billion in 2024 and an urbanization rate of 66%, the demand for bottled water has surged as consumers prioritize convenient and safe hydration solutions. Health awareness among Chinese consumers, which was 27.78% in 2022, has grown, particularly in urban regions, leading to a preference for bottled water over tap water, which is often considered less safe. The expanding middle class, accounting for over 50% of the population in 2023, alongside a rise in Disposable Personal Income to CNY 51,821 in 2023, has further driven the consumption of premium bottled water brands.

Global Bottled Water Market Segmentation

The Global Bottled Water Market can be segmented based on several factors:

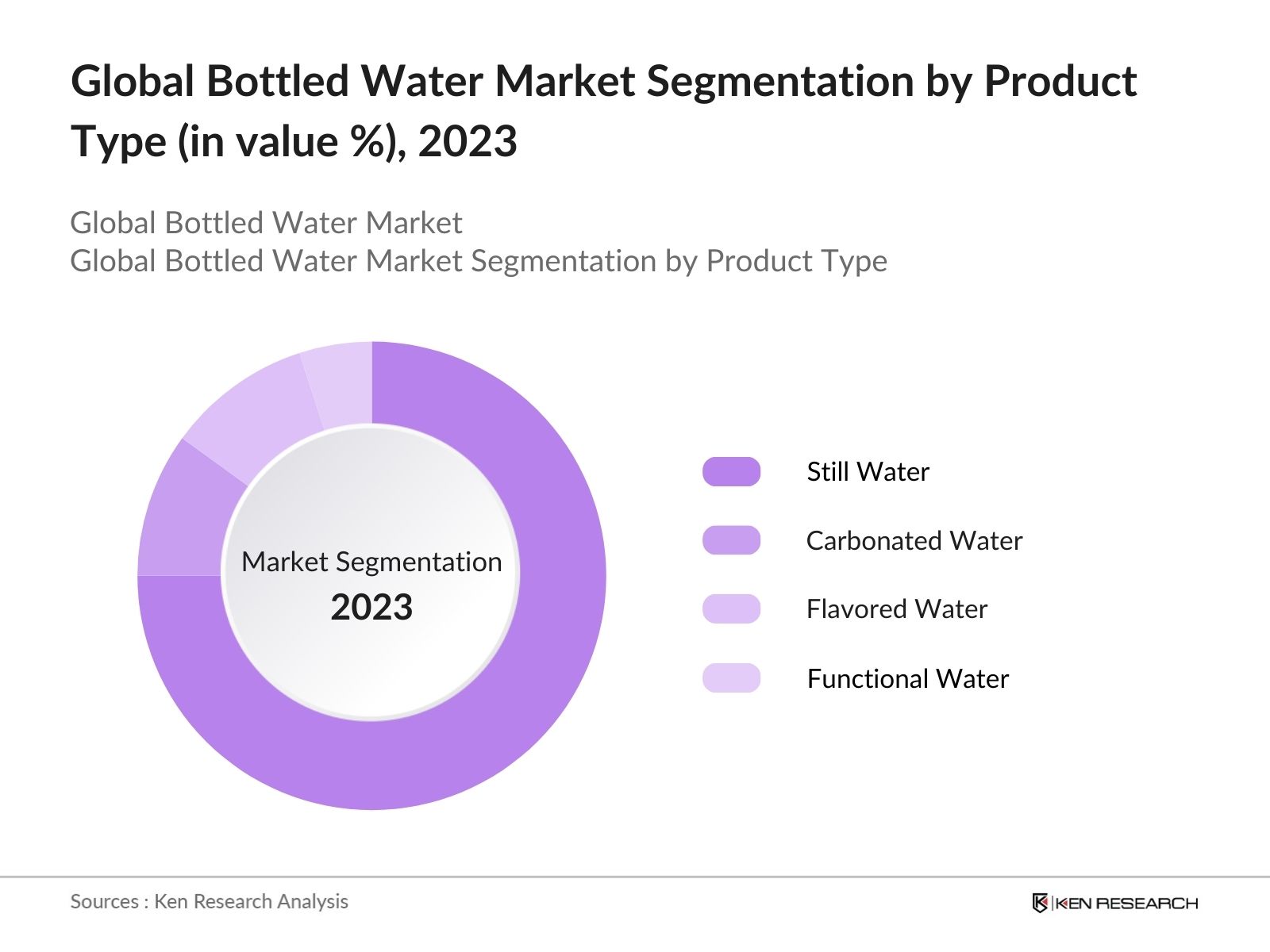

By Product Type: Global bottled water market segmentation by product type is divided into still water, carbonated water, flavored water and functional water. In 2023, still water dominated the market. This is driven by its widespread appeal due to its purity and health benefits. Increased health awareness and the convenience of various packaging options further boost its popularity. Advances in water purification technology also contribute to its market leadership by ensuring high quality and safety.

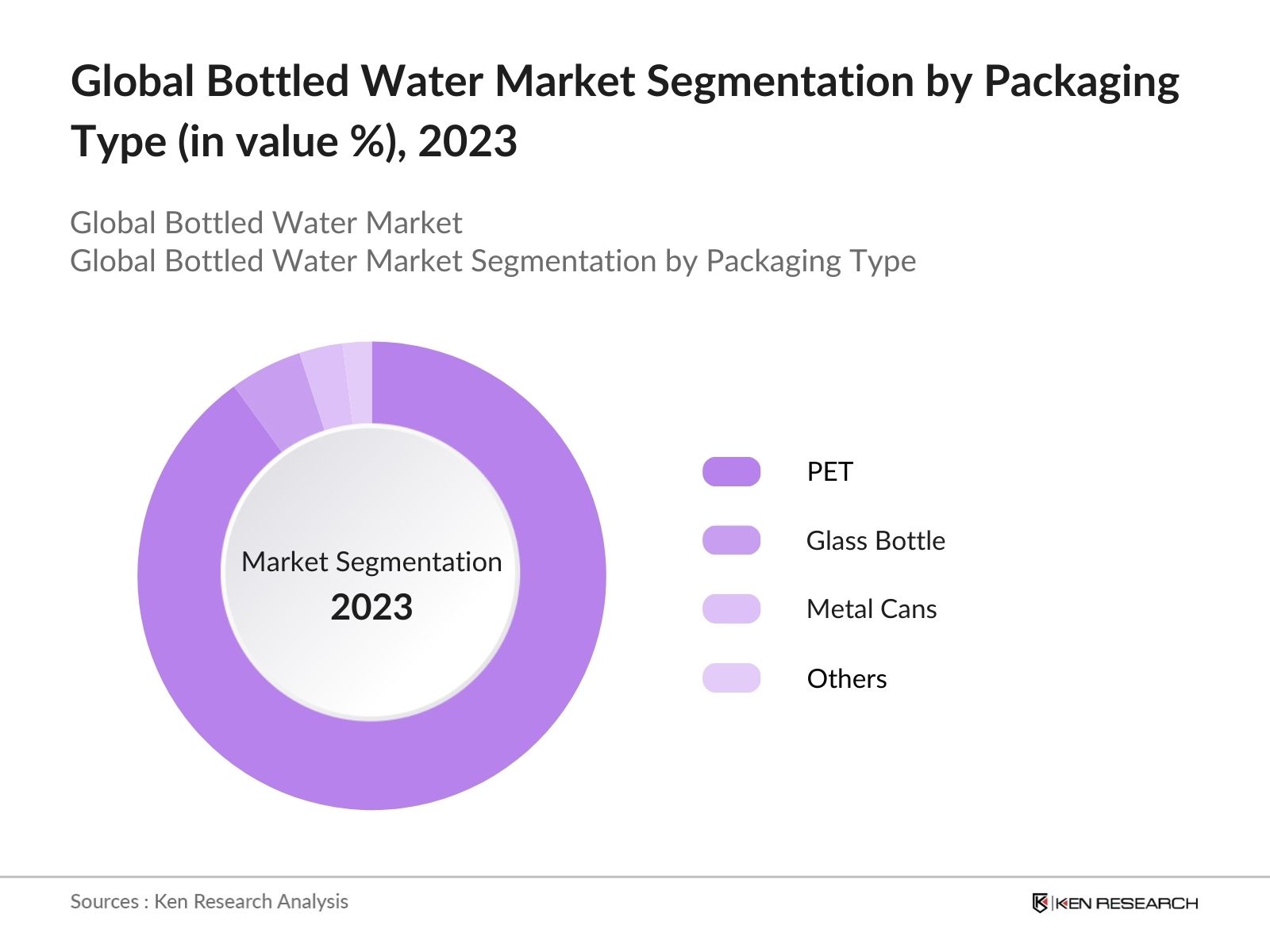

By Packaging Type: In the global bottled water market segmentation by packaging type is divided into PET, glass bottle, metal cans and others. In 2023, PET (polyethylene terephthalate) bottles lead the market. PET's dominance is driven by its affordability, lightweight nature, and strong barrier properties, which preserve water quality and extend shelf life. The material's recyclability and the growing emphasis on sustainability also support its widespread use. Additionally, PET's versatility in various bottle designs and sizes caters to diverse consumer preferences, further solidifying its market position.

By Distribution Channel: Global bottled water market segmentation by distribution channel is divided into off-trade and on-trade. In 2023, off-trade channels, such as supermarkets and convenience stores, dominate the market. Their widespread reach and convenience make them the preferred choice for consumers. These retail outlets support high-volume sales with competitive pricing and a wide variety of brands and packaging options, contributing to their market leadership. Frequent promotions and bulk purchasing options further drive their dominance.

Global Bottled Water Market Competitive Landscape

|

Company |

Vintage |

Headquarters |

Geographical Presence |

|

Nestle SA |

1867 |

Vevey, Switzerland |

Global |

|

The Coca-Cola Company |

1892 |

Atlanta, USA |

Global |

|

PepsiCo Inc. |

1965 |

Purchase, USA |

Global |

|

Danone S.A. |

1919 |

Paris, France |

Global |

|

Primo Water Corporation |

2004 |

Tampa, USA |

North America and Europe |

|

Otsuka Pharmaceutical Co. Ltd. |

1964 |

Tokyo, Japan |

Asia and North America |

- Bisleri's Sustainable Initiative in Ladakh: In September 2023, Bisleri International successfully restored a reservoir in the Kyagar region of Ladakh, India. This project aims to support local communities by ensuring a reliable water supply, reflecting Bisleri's commitment to sustainability and corporate social responsibility.

- Nestls Sustainable Packaging: In April 2023, Nestl partnered with Acreto, a company committed to sustainable packaging, to launch a new line of bottled water made entirely from plant-based materials. This collaboration marks a significant step toward reducing plastic waste and promoting environmental sustainability in the beverage industry. By using renewable resources, the initiative aims to meet consumer demand for eco-friendly products while also contributing to global efforts to combat plastic pollution.

- Tata Consumer Products' Investment in Mineral Water: In March 2023, Tata Consumer Products announced substantial investments in its mineral water brands, Tata Copper+ and Himalayan. This move aims to strengthen Tata's presence in the Indian bottled water market following the unsuccessful bid to acquire Bisleri.

Global Bottled Water Industry Analysis

Global Bottled Water Market Growth Drivers:

- Increasing Consumer Preference for Health and Wellness Products: The global bottled water market is experiencing significant growth driven by the increasing consumer preference for health and wellness products. In 2023, a survey by the International Bottled Water Association (IBWA) revealed that 80 Mn consumers in the U.S. prefer bottled water over sugary drinks, citing it as a healthier choice. This shift is further supported by a World Health Organization (WHO) report that shows a rise in global obesity rates, leading to a higher demand for healthier beverage options like bottled water.

- Flavored and Functional Water Varieties: The emergence of flavored and functional bottled water options, including vitamin-enhanced and electrolyte-infused varieties, has significantly broadened the appeal of bottled water. These innovations go beyond basic hydration by providing added health benefits tailored to diverse consumer needs. Flavored waters cater to those seeking a more enjoyable drinking experience, while vitamin-enhanced and electrolyte-infused options offer additional nutritional benefits that support active lifestyles and overall well-being.

- Growing Urbanization and Infrastructure Development in Emerging Markets: The rapid urbanization and infrastructure development in emerging markets such as India and China are significant growth drivers for the bottled water market. In 2024, the United Nations projected that urban populations in these countries would grow by 170 million people over the next decade, driving up demand for bottled water. This increase in urban population, coupled with inadequate access to clean tap water in many urban areas, is pushing consumers towards bottled water as a safer and more convenient alternative.

Global Bottled Water Market Challenges:

- Environmental Concerns: The reliance on plastic bottles in the bottled water industry significantly impacts environmental pollution, particularly through ocean plastic pollution and landfill overflow. Plastic waste from bottled water contributes to the growing problem of marine debris, with many plastic bottles ending up in oceans, harming marine life and ecosystems. Additionally, plastic bottles contribute to landfill overflow, as they can take hundreds of years to decompose, leading to long-term waste management challenges. The rise in environmental awareness has heightened scrutiny and criticism of the bottled water industry's sustainability practices.

- Perception and Consumer Trust: Negative perceptions surrounding the environmental impact of plastic bottles, coupled with concerns about the purity of bottled water and skepticism about branding and marketing claims, can erode consumer trust. Issues such as the ecological footprint of plastic waste and doubts about the actual purity of bottled water contribute to growing consumer wariness. Additionally, skepticism about the authenticity and transparency of marketing claims further undermines confidence in bottled water products.

Global Bottled Water Market Government Initiatives:

- European Union's Single-Use Plastics Directive: In July 2021, the European Union implemented the Single-Use Plastics Directive, which directly impacts the bottled water industry by banning certain single-use plastic products and imposing stricter recycling requirements. This directive mandates that all plastic bottles must contain at least 25% recycled plastic by 2025. The directive has forced bottled water companies operating in the EU to invest heavily in sustainable packaging technologies and recycling infrastructure, significantly affecting their operational strategies.

- Indias National Action Plan for Climate Change (NAPCC): India's National Action Plan for Climate Change (NAPCC) has introduced new regulations in 2023 to reduce the carbon footprint of the bottled water industry. The plan includes incentives for companies that adopt energy-efficient production processes and use renewable energy sources. This initiative is part of India's broader effort to reduce greenhouse gas emissions by 30% by 2030. The government has also introduced subsidies for companies that produce biodegradable and recyclable bottles, encouraging the bottled water industry to shift towards more sustainable practices.

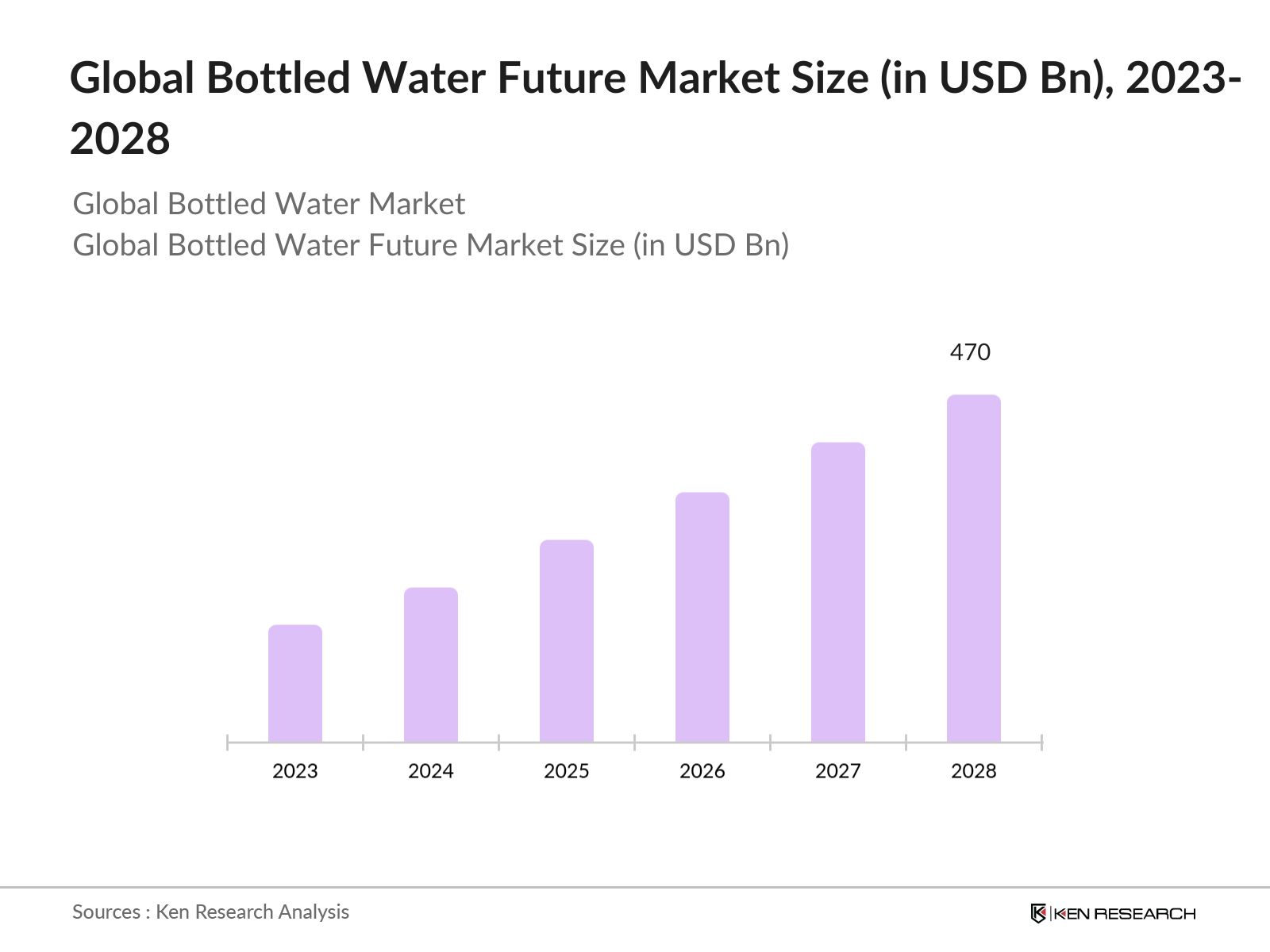

Global Bottled Water Future Market Outlook

The global bottled water market is expected to reach USD 470 Bn by 2028 driven by increasing consumer demand for health-conscious products, ongoing innovations in sustainable packaging, and the expansion of market players into emerging regions. By 2028, the market is anticipated to evolve with a stronger focus on environmental sustainability, as regulatory pressures and consumer awareness continue to rise.

Future Market Trends

- Flavored and Functional Waters: The market for bottled water will grow as flavored and functional varieties are becoming more popular. Flavored waters are offering enhanced taste with natural infusions, while functional waters will provide added nutrients or health benefits. This trend will cater to evolving consumer preferences for both taste and wellness, broadening the product range and supporting premium pricing.

- Plant-Based Packaging: The bottled water industry will increasingly adopt plant-based and recyclable packaging. Companies are adopting the use of materials like plant-based polyethylene (PLA) and recyclable PET and glass to reduce environmental impact and meet consumer demand for sustainable products. This shift will help minimize waste and enhance brand appeal.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Product Type |

Still Water Carbonated Water Flavored Water Functional Water |

|

By Packaging Type |

PET Metal cans Glass bottle Others |

|

By Distribution Channel |

On Trade Off Trade |

Products

Key Target Audience:

Bottled Water Manufacturers

Beverage Distributors and Retailers

Supermarket Chains

Online Grocery Platforms

Health and Wellness Stores

Packaging and Labeling Companies

Banks and Financial Institution

Investors and VCs

Regulatory Bodies (FDA and European Food Safety Authority)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Nestle SA

The Coca-Cola Company

PepsiCo Inc.

Danone S.A.

Primo Water Corporation

Otsuka Pharmaceutical Co. Ltd.

Hangzhou Wahaha Group Co., Ltd

BlueTriton Brands Inc.

Bisleri International

Table of Contents

1. Executive Summary

1.1 Global Beverage Market

1.2 Global Bottled Water Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Beverage Industry

2.3 Global Beverage (Non-Alcoholic Beverages and Alcoholic Beverages) Revenue

2.4 Global Bottled Water Infrastructure

3. Global Bottled Water Market Overview

3.1 Ecosystem

3.2 Value Chain

3.3 Case Study

3.4 Placement of Major Countries in Import-Consumption Matrix

3.5 Heat Map Analysis of Bottled Water Producers

4. Global Bottled Water Market Size (in USD Bn), 2018-2023

5. Global Bottled Water Market Segmentation (in value %), 2018-2023

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2018-2023

5.2 By Product Type (Still Water, Carbonated Water, Flavored Water and Functional Water) in value%, 2018-2023

5.3 By Packaging Type (PET, Metal Cans, Glass Bottle and Others) in value %, 2018-2023

5.4 By Distribution Channel (On Trade and Off Trade) in value %, 2018-2023

6. Global Bottled Water Market Competition Landscape

6.1 Competition Overview

6.2 Market Share Analysis

6.3 Market Heat Map Analysis

6.4 Market Cross Comparison

6.5 Comparison Matrix

6.6 Investment Landscape

6.7 Opportunities for Bottled Water Players

7. Global Bottled Water Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Trends

7.4 Case Studies

7.5 Strategic Initiatives

7.6 Recent Developments

7.7 Opportunities

7.8 B2B Partnerships

8. Global Bottled Water Future Market Size (in USD Bn), 2023-2028

9. Global Bottled Water Future Market Segmentation (in value %), 2023-2028

9.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2023-2028

9.2 By Product Type (Still Water, Carbonated Water, Flavored Water and Functional Water) in value%, 2023-2028

9.3 By Packaging Type (PET, Metal Cans, Glass Bottle and Others) in value %, 2023-2028

9.4 By Distribution Channel (On Trade and Off Trade) in value %, 2023-2028

10. Analyst Recommendations

11. Research Methodology

11.1 Market Definitions and Assumptions

11.2 Abbreviations

11.3 Market Sizing Approach

11.4 Consolidated Research Approach

11.5 Understanding Market Potential Through In-Depth Industry Interviews

11.6 Primary Research Approach

11.7 Limitations and Future Conclusion

Disclaimer

Contact Us

Research Methodology

Step 1: Literature and Data Review:

Conducted an extensive review of existing literature, industry reports, and academic publications to gain insights into the global bottled water market. Collected secondary data on market trends, challenges, and key players.

Step 2: Market Segmentation:

Applied segmentation criteria to categorize the bottled water market based on value, including product types, packaging, and distribution channels. Used secondary data sources to gather value-specific information for each segment.

Step 3: Expert Consultation:

Identified and consulted various experts within the bottled water industry. Engaged in discussions to understand market trends, growth, and regional variations. Established a comprehensive understanding of market size and segments through industry reports.

Step 4: Regional Market Profiling:

Utilized collected data to create regional market profiles for each continent. Conducted comparative analysis to identify regional differences in consumer preferences and market growth.

Step 5: Market Size Calculation:

Calculated the overall market size for bottled water by integrating segmented data from each region. Applied pricing and volume trends to estimate market value for different bottled water segments.

Step 6: Global Market Overview:

Compiled data from individual regional reports to build a comprehensive global overview of the bottled water market. Highlighted the interplay between regional variations and global trends for a nuanced understanding of market dynamics.

Step 7: Data Validation:

Performed a rigorous validation process to ensure the accuracy and reliability of the data. Employed statistical methods to assess the robustness of findings and address potential biases.

Frequently Asked Questions

01. How big is Global Bottled Water Market?

The global bottled water market was valued at USD 340 Bn in 2023, is fueled by heightened health awareness, a greater understanding of the importance of hydration, and the increasing popularity of on-the-go consumption. The demand for clean and safe drinking water, especially in urban regions, has boosted bottled water sales globally.

02. What are the challenges in Global Bottled Water Market?

Challenges in the global bottled water market include environmental concerns related to plastic waste, rising raw material costs, and increasing regulatory pressures. Additionally, competition from alternative beverage options like flavored waters and functional drinks poses a threat to market share.

03. Who are the major players in Global Bottled Water Market?

Key players in the global bottled water market include Nestl Waters, Danone S.A., PepsiCo, The Coca-Cola Company, and Suntory Beverage & Food Ltd. These companies lead the market due to their extensive distribution networks, strong brand recognition, and continuous innovation in product offerings.

04 What are the growth drivers of the Global Bottled Water Market?

The global bottled water market is propelled by factors such as the rising consumer preference for health and wellness products, growing urbanization, and increasing disposable incomes in emerging markets. The demand for premium bottled water products also contributes to the markets growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.