Global Building Information Modeling (BIM) Software Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD9754

November 2024

93

About the Report

Global Building Information Modeling (BIM) Software Market Overview

- The global Building Information Modeling (BIM) software market is valued at USD 12.5 billion, based on a five-year historical analysis. The demand for BIM software has been driven by the rapid adoption of digital technologies in construction, growing government mandates for the use of BIM in public infrastructure projects, and the increasing focus on sustainable construction practices.

- Countries such as the United States, the United Kingdom, and China dominate the BIM software market. In the United States, dominance is largely attributed to extensive government initiatives for smart infrastructure development, whereas in the United Kingdom, stringent regulations mandating the use of BIM Level 2 for public sector projects have been a key driver. Chinas dominance stems from rapid urbanization and significant investments in infrastructure projects under its Belt and Road Initiative, making it a hub for large-scale construction projects requiring BIM adoption.

- Governments worldwide are implementing mandates that require the use of BIM for public infrastructure projects. The UK has led this movement with the BIM Level 2 mandate, while countries like Singapore, the UAE, and South Korea have introduced similar regulations. In the UAE, BIM is mandatory for government projects above a certain scale, driving compliance across the construction industry. These mandates ensure that construction projects are delivered efficiently, with BIM allowing for better cost control and resource management.

Global Building Information Modeling (BIM) Software Market Segmentation

By Solution Type: The global Building Information Modeling (BIM) software market is segmented by solution type into software and services. The software segment, which includes design, construction, and operation software, holds a dominant market share. This dominance can be attributed to the essential role software plays in streamlining project planning, execution, and facility management across large construction projects.

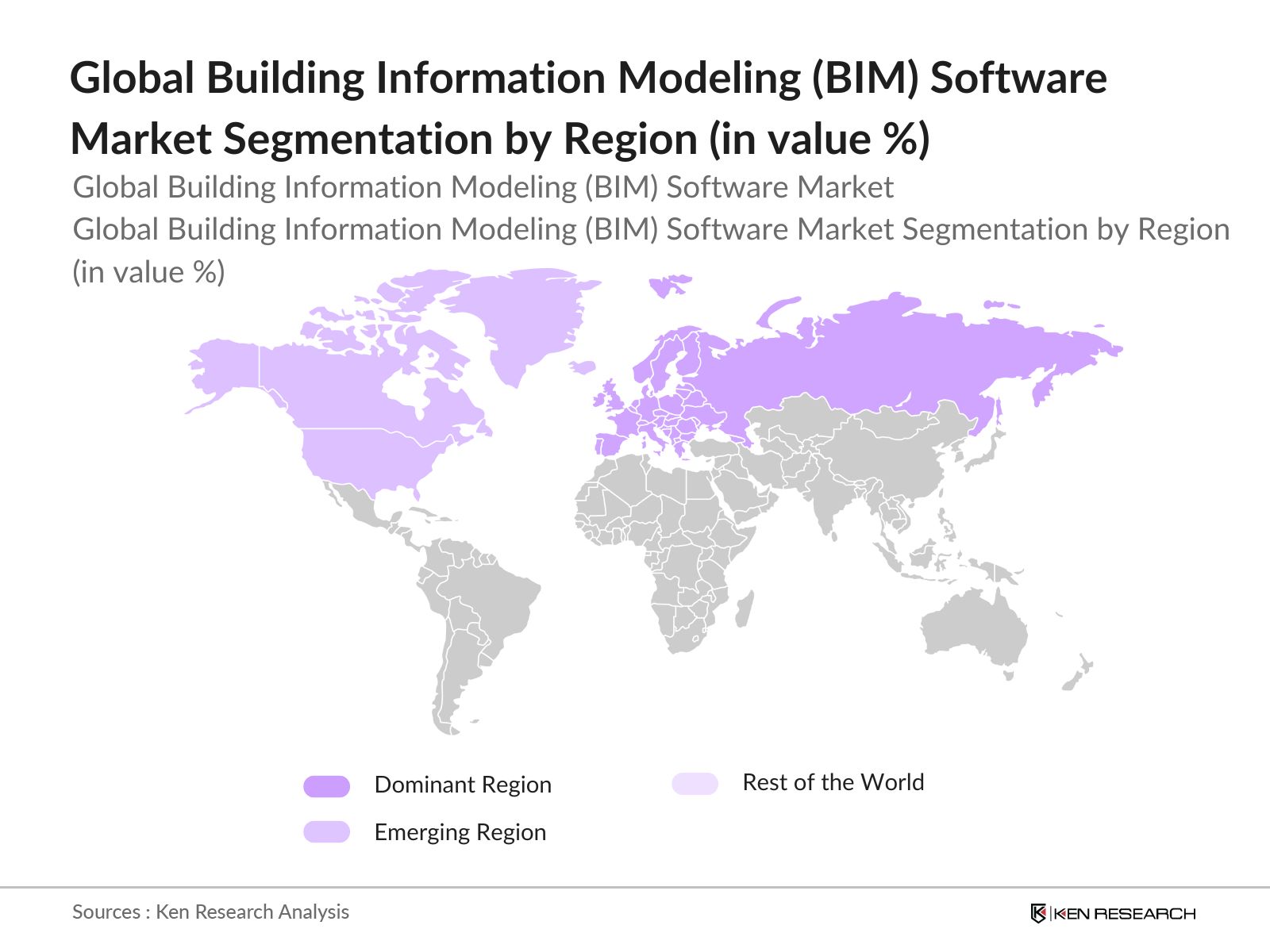

By Region: The global BIM software market is also segmented by region into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America holds the largest market share due to extensive government initiatives to digitize infrastructure development and promote sustainable building practices. The implementation of stringent construction regulations and green building standards across the United States and Canada has resulted in widespread BIM adoption. Additionally, the region's highly developed IT infrastructure has facilitated the integration of cloud-based BIM solutions, further boosting its dominance in the market.

By Region: The global BIM software market is also segmented by region into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America holds the largest market share due to extensive government initiatives to digitize infrastructure development and promote sustainable building practices. The implementation of stringent construction regulations and green building standards across the United States and Canada has resulted in widespread BIM adoption. Additionally, the region's highly developed IT infrastructure has facilitated the integration of cloud-based BIM solutions, further boosting its dominance in the market.

By End-Use Industry: The BIM software market is segmented by end-use industries into commercial, residential, industrial, and infrastructure. The commercial sector dominates the BIM software market due to the rising number of commercial real estate projects and the growing emphasis on energy efficiency and sustainability in commercial buildings. Commercial builders are increasingly relying on BIM to ensure that their projects are completed on time, within budget, and in compliance with sustainability regulations, making BIM an indispensable tool in this sector.

Global Building Information Modeling (BIM) Software Market Competitive Landscape

The global Building Information Modeling (BIM) software market is dominated by a few key players who have established a strong presence through a combination of advanced technology offerings, strategic partnerships, and acquisitions. These companies are focusing on expanding their product portfolios to include cloud-based and AI-integrated BIM solutions, thereby enhancing their competitiveness. The market is further characterized by collaborations between software providers and construction firms, aimed at promoting the use of BIM in large-scale infrastructure projects.

Global Building Information Modeling (BIM) Software Market Analysis

Growth Drivers

- Government Mandates for BIM Adoption: Global BIM software adoption is primarily driven by government mandates enforcing BIM standards, especially in regions like Europe and Asia. The UK government, for example, has mandated the use of BIM Level 2 for all centrally procured projects since 2016, driving construction firms to integrate BIM solutions. This regulatory push is mirrored in emerging markets, with India's Smart Cities Mission also promoting BIM integration for urban planning. Such initiatives increase the demand for BIM, fostering a structured framework for implementation.

- Increasing Adoption of Cloud-Based Solutions: Cloud-based BIM solutions are gaining traction due to their scalability and efficiency in managing large construction projects. By 2023, over 85% of global construction firms had integrated cloud-based collaboration tools, allowing seamless data access and real-time project updates across multiple locations. The flexibility of cloud platforms reduces the dependency on physical servers, which is essential for managing complex projects in infrastructure-heavy markets like China and India. With infrastructure investments in these economies growing steadily, reaching $5.6 trillion in India alone, cloud-based BIM solutions are becoming essential tools in project management.

- Rising Demand for Sustainable Construction: BIM plays a pivotal role in sustainable construction by aiding in energy-efficient building designs. Governments are increasingly mandating energy-efficient construction, exemplified by the European Unions directive that all new buildings must be nearly zero-energy buildings (NZEB) from 2021 onward. The use of BIM software helps reduce waste by 15% and improve material use efficiency by 10%. Moreover, the global shift towards green infrastructure has led to a $4.5 trillion investment in energy-efficient buildings by 2024, with BIM central to these sustainable initiatives.

Challenges

- High Initial Implementation Costs: The initial cost of implementing BIM software remains a significant challenge, especially for small and medium-sized construction firms. Industry reports show that BIM implementation costs can range from $30,000 to $100,000 per project, including software licensing and training. This financial barrier hinders widespread adoption, particularly in regions like Southeast Asia and Africa, where construction budgets are more constrained.

- Data Security and Privacy Concerns: Data security concerns are growing as BIM increasingly integrates with cloud platforms and IoT devices. In 2023, construction companies reported a 25% increase in cyberattacks targeting BIM platforms. The construction sector is now prioritizing data protection protocols, but the lack of uniform cybersecurity standards across regions leaves many firms vulnerable. Governments are stepping in with stricter regulations, such as the European General Data Protection Regulation (GDPR), to enforce secure data handling, but significant risks remain, particularly in emerging economies where cybersecurity infrastructure is underdeveloped.

Global Building Information Modeling (BIM) Software Market Future Outlook

Global Building Information Modeling (BIM) software market is expected to show significant growth driven by the continuous adoption of cloud-based solutions, government support for smart infrastructure, and increasing demand for energy-efficient construction solutions. As construction companies increasingly integrate BIM with advanced technologies such as artificial intelligence and the Internet of Things (IoT), the market will experience further advancements in operational efficiency and sustainability.

Market Opportunities

- Increasing Demand for Prefabrication and Modular Construction: The rise in prefabrication and modular construction methods presents significant opportunities for BIM software, which optimizes the design and construction process. By 2024, modular construction is expected to account for 10% of global residential housing, with countries like China and the US leading the adoption. BIM's precision in modeling components for prefabrication reduces construction waste by 25%, making it essential for large-scale housing projects.

- Technological Advancements (AI-driven BIM, Digital Twins): The integration of AI and Digital Twin technologies in BIM is opening new possibilities for smart infrastructure. AI-driven BIM enables predictive analysis of construction data, improving decision-making and project outcomes by 15%. Digital Twins, which create virtual replicas of physical assets, are increasingly used in smart city projects, with over $1 trillion invested in smart infrastructure globally by 2024. These technologies are transforming how cities manage urban spaces, making BIM a central tool in modern infrastructure projects.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Solution Type |

Software |

|

Services |

|

|

By End-Use Industry |

Commercial Residential Industrial Infrastructure |

|

By Deployment Type |

Cloud On-Premise |

|

By Project Lifecycle Stage |

Pre-Construction Construction Post-Construction |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Building Construction Firms

Architects and Engineers

Infrastructure Developers

Urban Planners and City Administrators

Software Developers and Solution Providers

Property Owners and Facility Managers

Government and Regulatory Bodies (e.g., US General Services Administration, UK BIM Task Group)

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Autodesk, Inc.

Trimble Inc.

Bentley Systems Inc.

Nemetschek Group

Dassault Systmes SE

Hexagon AB

RIB Software SE

AVEVA Group plc

Vectorworks, Inc.

Asite Solutions Ltd.

Table of Contents

1. Global Building Information Modeling (BIM) Software Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Ecosystem

1.4 Value Chain Analysis

1.5 Digital Transformation in Construction (Role of BIM in Digital Twin and Smart Cities Development)

2. Global Building Information Modeling (BIM) Software Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments (Innovative Technologies, M&A Activities, Partnerships)

3. Global Building Information Modeling (BIM) Software Market Analysis

3.1 Growth Drivers

3.1.1 Government Mandates for BIM Adoption (Impact of Regulations and BIM Mandates Globally)

3.1.2 Increasing Adoption of Cloud-Based Solutions (Cloud Collaboration in Construction Projects)

3.1.3 Rising Demand for Sustainable Construction (Environmental Regulations and BIM Role in Energy Efficiency)

3.1.4 Infrastructure Development in Emerging Economies

3.1.5 Integration with Advanced Technologies (AI, IoT, AR/VR in BIM)

3.2 Market Challenges

3.2.1 High Initial Implementation Costs

3.2.2 Lack of Skilled Professionals (BIM Expertise Gaps Across Regions)

3.2.3 Data Security and Privacy Concerns

3.2.4 Interoperability Issues (Compatibility with Existing Software and Tools)

3.3 Opportunities

3.3.1 Increasing Demand for Prefabrication and Modular Construction

3.3.2 Technological Advancements (AI-driven BIM, Digital Twins)

3.3.3 Expansion into SMEs and Small Construction Firms (Adoption Beyond Large Enterprises)

3.3.4 Growing Investments in Smart Infrastructure

3.4 Trends

3.4.1 Adoption of BIM for Facility Management (Post-Construction Maintenance and Operations)

3.4.2 Increased Use of 4D/5D BIM (Integration with Time and Cost Models)

3.4.3 Collaborative Project Delivery Models (IPD, Integrated Project Delivery in BIM)

3.4.4 Emergence of Green BIM (Sustainability Metrics and Certification Through BIM)

3.5 Government Regulations

3.5.1 Regional Mandates for BIM (BIM Level 2, Level 3 Adoption Across Countries)

3.5.2 BIM Standards and Certifications (ISO 19650, PAS 1192)

3.5.3 Public-Private Partnerships (PPP Initiatives Using BIM)

3.5.4 Impact of Urban Development Policies

3.6 SWOT Analysis

3.7 Porters Five Forces Analysis

3.8 Industry Stakeholder Ecosystem

3.9 Competitive Landscape Analysis

4. Global Building Information Modeling (BIM) Software Market Segmentation

4.1 By Solution Type (in Value %)

4.1.1 Software (Design, Construction, Operation Software)

4.1.2 Services (Consulting, Training, Implementation)

4.2 By End-Use Industry (in Value %)

4.2.1 Commercial

4.2.2 Residential

4.2.3 Industrial

4.2.4 Infrastructure (Transportation, Utilities, Water Management)

4.3 By Deployment Type (in Value %)

4.3.1 Cloud

4.3.2 On-Premise

4.4 By Project Lifecycle Stage (in Value %)

4.4.1 Pre-Construction

4.4.2 Construction

4.4.3 Post-Construction

4.5 By Region (in Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global Building Information Modeling (BIM) Software Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Autodesk, Inc.

5.1.2 Trimble Inc.

5.1.3 Bentley Systems, Incorporated

5.1.4 Nemetschek Group

5.1.5 Hexagon AB

5.1.6 Dassault Systmes SE

5.1.7 RIB Software SE

5.1.8 Asite Solutions Ltd.

5.1.9 AVEVA Group plc

5.1.10 Vectorworks, Inc.

5.2 Cross Comparison Parameters (Revenue, Market Presence, Technological Expertise, R&D Investment, Industry Vertical Focus, Product Portfolio, Client Base, Regional Expansion)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Product Launches, Collaborations, Partnerships)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Venture Capital, Private Equity Funding, Government Grants)

5.7 Technological Innovations

6. Global Building Information Modeling (BIM) Software Market Regulatory Framework

6.1 Industry Standards for BIM (ISO Standards, Regional Certification Programs)

6.2 Compliance and Legal Requirements (Data Protection, IP, BIM Contractual Obligations)

6.3 International and National BIM Guidelines (Building Codes, Green Building Certifications)

7. Global Building Information Modeling (BIM) Software Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Emerging Technologies, Infrastructure Development)

8. Global Building Information Modeling (BIM) Software Future Market Segmentation

8.1 By Solution Type (in Value %)

8.2 By End-Use Industry (in Value %)

8.3 By Deployment Type (in Value %)

8.4 By Project Lifecycle Stage (in Value %)

8.5 By Region (in Value %)

9. Global Building Information Modeling (BIM) Software Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis (Industry-Specific BIM Solutions)

9.3 White Space Opportunity Analysis

9.4 Go-To-Market Strategies for New Entrants

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a stakeholder map of the BIM ecosystem, identifying key players such as software developers, construction firms, and government bodies. Desk research and proprietary databases are utilized to define critical variables such as technology adoption rates and government regulations driving market growth.

Step 2: Market Analysis and Construction

In this phase, historical data on BIM adoption rates and construction industry trends are analyzed. A detailed assessment of regional demand for BIM solutions is conducted, focusing on key sectors such as residential and commercial construction, as well as infrastructure projects.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and growth drivers are validated through consultations with industry experts, leveraging their insights on project lifecycles, construction efficiency, and technological advancements. These consultations provide nuanced understanding of market dynamics.

Step 4: Research Synthesis and Final Output

This step involves synthesizing primary and secondary research data to generate a comprehensive market report. The findings are cross-verified with BIM software developers and construction firms to ensure accuracy and provide actionable insights for stakeholders in the global BIM market.

Frequently Asked Questions

1. How big is the global Building Information Modeling (BIM) software market?

The global Building Information Modeling (BIM) software market is valued at USD 12.5 billion, driven by the increasing adoption of digital solutions in construction and government mandates for BIM in infrastructure projects.

2. What are the challenges in the global Building Information Modeling (BIM) software market?

Challenges of global Building Information Modeling (BIM) software market include high initial costs for BIM implementation, a lack of skilled BIM professionals, and concerns over data security and privacy, particularly in cloud-based solutions.

3. Who are the major players in the global Building Information Modeling (BIM) software market?

Key players in global Building Information Modeling (BIM) software market include Autodesk, Inc., Trimble Inc., Bentley Systems Inc., Nemetschek Group, and Dassault Systmes SE, all of whom have significant influence due to their advanced software offerings and strategic partnerships.

4. What are the growth drivers for the global Building Information Modeling (BIM) software market?

Global Building Information Modeling (BIM) Software market is driven by increasing demand for energy-efficient construction, government mandates for BIM adoption, and the integration of advanced technologies such as AI, IoT, and cloud-based solutions in construction projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.