Global Bulldozer Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD3971

December 2024

83

About the Report

Global Bulldozer Market Overview

- The Global Bulldozer Market is valued at USD 5 billion, based on a five-year historical analysis. This market is primarily driven by the growing demand for lightweight and high-performance materials in theautomotive and construction industries. The automotive sector is seeing increased usage of polyurethane in vehicle seating and interior components, contributing to enhanced fuel efficiency and sustainability. Similarly, the construction industry relies heavily on polyurethane products for insulation and structural components due to their superior thermal properties and durability, positioning the market for steady growth in these sectors.

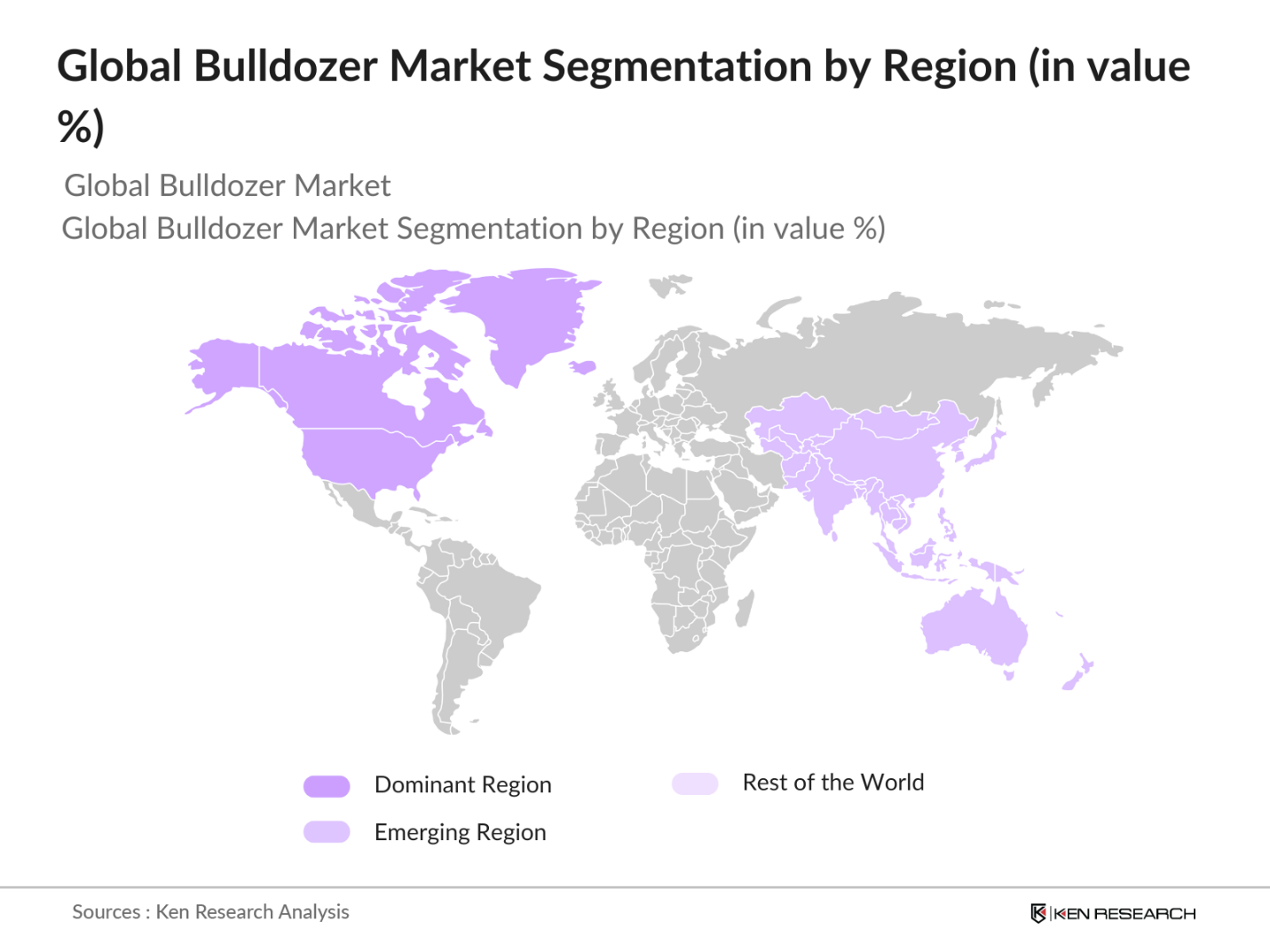

- Dominant regions within the global bulldozer market include North America, Asia Pacific, and Europe. The Asia Pacific region, especially countries like China, Japan, and India, dominates the market due to rapid industrialization, extensive government investment in infrastructure projects, and the presence of key manufacturers such as Komatsu and SANY. In North America, the market is primarily driven by the adoption of advanced construction technology and demand for efficient earthmoving equipment in large-scale public and private projects.

- Global emission standards are becoming increasingly stringent, particularly with the EU and U.S. implementing EU Stage V and Tier 4 Final regulations. These mandates require bulldozer manufacturers to adopt advanced technologies like particulate filters and enhanced exhaust systems, which significantly increase production costs and necessitate sophisticated engineering solutions to meet compliance requirements.

Global Bulldozer Market Segmentation

By Type: The market is segmented by type into small, mid-size, and large bulldozers. Recently, mid-size bulldozers have captured a dominant share within this segment due to their versatility and application in both small and large construction projects. They are preferred for their balance between power, efficiency, and operational costs, making them ideal for a variety of tasks such as grading and land clearing. Manufacturers like Caterpillar and Deere & Company offer models equipped with precision GPS control systems, making them suitable for infrastructure and residential projects.

By Product Type: The market is further divided into crawler bulldozers and wheeled bulldozers. Crawler bulldozers hold a dominant market share under this segment, largely due to their superior traction and stability on uneven terrain, which is essential for heavy-duty applications in construction and mining. These machines are preferred in regions where tough terrains and demanding applications are prevalent, and they are often equipped with advanced hydraulic systems for enhanced productivity.

By Region: The market is segmented into regions, including North America, Asia Pacific, Europe, Latin America, and Middle East & Africa. The Asia Pacific region dominates the market with a significant share, attributed to robust infrastructure development, high urbanization rates, and the presence of major manufacturers. North America follows as the second-largest market, supported by technological advancements and high capital expenditure on construction activities.

Global Bulldozer Market Competitive Landscape

The global bulldozer market is dominated by several key players who have established a strong market presence through strategic partnerships, mergers and acquisitions, and continuous product innovation. Companies such as Caterpillar Inc., Komatsu Ltd., and Deere & Company are well-known for their extensive product portfolios and focus on developing energy-efficient equipment with low emissions.

Global Bulldozer Industry Analysis

Growth Drivers

- Infrastructure Development: The global investment in infrastructure has been a significant driver for the bulldozer market, as several countries are increasing their budget allocations for construction and development projects. According to the World Economic Outlook 2024, emerging economies such as India and Brazil are prioritizing infrastructure expansion, which is evident in India's capital expenditure on infrastructure rising to over $130 billion USD in 2024. This trend is expected to create a robust demand for construction machinery, including bulldozers, to support road, rail, and urban development projects.

- Technological Advancements in Earthmoving Equipment: Technological advancements are contributing to the growth of the bulldozer market. Manufacturers are incorporating AI-driven control systems and advanced hydraulics, which enhance operational efficiency and precision. For instance, automated grade control systems and integrated GPS have seen adoption in high-tech bulldozer models, leading to higher productivity and lower fuel consumption.

- Increasing Automation in Construction: Automation in the construction industry is increasing, driven by the need for efficiency and precision. Automation, including the use of remotely controlled and semi-automated bulldozers, is gaining traction, reducing the reliance on skilled labor. This is especially crucial in developed markets where labor costs are high. The use of automated earthmoving equipment is projected to rise significantly, given the shift towards smart construction sites that utilize telematics and machine control technologies.

Market Challenges

- High Initial Capital Investment: The high initial capital investment required for bulldozers remains a significant barrier for smaller construction companies. A standard bulldozer equipped with advanced technologies can cost upwards of $250,000 USD, which makes it a substantial investment for companies with limited budgets. Additionally, the depreciation value and maintenance costs further add to the financial burden.

- Fluctuating Raw Material Prices: The bulldozer manufacturing industry is heavily dependent on steel and other metals, whose prices are subject to volatility. Global disruptions, such as supply chain issues and geopolitical tensions, have led to fluctuating prices for these raw materials, impacting the profitability of manufacturers. According to the World Economic Outlook, commodity prices have experienced a 15-20% increase in 2024 due to heightened demand and supply chain constraints.

Global Bulldozer Market Future Outlook

Over the next few years, the global bulldozer market is expected to show significant growth driven by continuous advancements in bulldozer technology, increased automation in construction activities, and rising demand for low-emission, energy-efficient machinery. Companies are focusing on developing electric and hybrid models that cater to environmental regulations while maintaining high productivity levels. Moreover, increasing infrastructure projects in emerging economies will likely boost market expansion, offering new opportunities for manufacturers to strengthen their presence in the global market.

Market Opportunities

- Adoption of Low-Emission and Electric Bulldozers: With growing concerns over environmental impact, there is a significant opportunity for the adoption of low-emission and electric bulldozers. Governments are providing subsidies and incentives for the use of electric machinery, which is leading to an increase in demand for these models. For example, the European Union has allocated 30 billion EUR towards the transition to low-emission construction equipment under its Green Deal initiative.

- Expansion into Emerging Markets: Emerging markets such as Southeast Asia and Africa are investing in urbanization and industrialization, creating new growth avenues for the bulldozer market. Countries like Indonesia and Nigeria are focusing on enhancing their infrastructure, which is evident from Indonesia's planned $35 billion USD capital relocation project. Such expansions offer significant growth potential for bulldozer manufacturers looking to establish a footprint in these regions.

Scope of the Report

|

By Type |

Small Bulldozers Mid-Size Bulldozers Large Bulldozers |

|

By Product Type |

Crawler Bulldozers Wheeled Bulldozers |

|

By Operating Weight |

Less than 10,000 KG 10,000-30,000 KG 30,000 KG-1,85,000 KG More than 1,85,000 KG |

|

By Horsepower |

Less Than 150 HP 151-260 HP 261-500 HP More Than 500 HP |

|

By End-Use Industry |

Construction Mining Infrastructure Agriculture Military |

|

By Region |

North America Asia Pacific Europe Latin America Middle East & Africa |

Products

Key Target Audience

Construction Equipment Manufacturers

Heavy Machinery Distributors

Government and Regulatory Bodies (Environmental Protection Agencies, Infrastructure Ministries)

Mining Companies

Agricultural Machinery Operators

Military and Defense Agencies (Logistics and Engineering Units)

Investments and Venture Capitalist Firms

Rental Equipment Providers

Companies

Players Mentioned in the Report

Caterpillar Inc.

Komatsu Ltd.

Deere & Company

CNH Industrial N.V.

Hitachi Construction Machinery Co., Ltd.

Liebherr Machines Bulle SA

BEML Limited

Zoomlion Heavy Industry Science & Technology Co., Ltd.

Cummins Inc.

Kubota Corporation

Table of Contents

1. Global Bulldozer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Bulldozer Market Size (USD Billion)

2.1. Historical Market Size Analysis

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Bulldozer Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development

3.1.2. Technological Advancements in Earthmoving Equipment

3.1.3. Increasing Automation in Construction

3.1.4. Government Investment in Large-Scale Projects

3.2. Market Challenges

3.2.1. High Initial Capital Investment

3.2.2. Regulatory Compliance and Emission Norms

3.2.3. Fluctuating Raw Material Prices

3.3. Opportunities

3.3.1. Adoption of Low-Emission and Electric Bulldozers

3.3.2. Expansion into Emerging Markets

3.3.3. Integration of AI and Telematics

3.4. Trends

3.4.1. Compact Bulldozers for Limited Space Applications

3.4.2. Integration of IoT for Fleet Management

3.4.3. Use of Smart Blades and Attachments

3.5. Government Regulations

3.5.1. Emission Control Standards

3.5.2. Safety and Operational Standards

3.5.3. Subsidies for Sustainable Equipment

3.6. SWOT Analysis

3.7. Value Chain Analysis

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem Analysis

4. Global Bulldozer Market Segmentation

4.1. By Type (In Value %)

4.1.1. Small Bulldozers

4.1.2. Mid-Size Bulldozers

4.1.3. Large Bulldozers

4.2. By Product Type (In Value %)

4.2.1. Crawler Bulldozers

4.2.2. Wheeled Bulldozers

4.3. By Operating Weight (In Value %)

4.3.1. Less than 10,000 KG

4.3.2. 10,000-30,000 KG

4.3.3. 30,000 KG-1,85,000 KG

4.3.4. More than 1,85,000 KG

4.4. By Horsepower (In Value %)

4.4.1. Less Than 150 HP

4.4.2. 151-260 HP

4.4.3. 261-500 HP

4.4.4. More Than 500 HP

4.5. By End-Use Industry (In Value %)

4.5.1. Construction

4.5.2. Mining

4.5.3. Infrastructure

4.5.4. Agriculture

4.5.5. Military

5. Global Bulldozer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

Caterpillar Inc.

Komatsu Ltd.

Hitachi Construction Machinery Co., Ltd.

Deere & Company

CNH Industrial N.V.

Liebherr Machines Bulle SA

Shantui Construction Machinery Co., Ltd.

AB Volvo

BEML Limited

Zoomlion Heavy Industry Science & Technology Co., Ltd.

Cummins Inc.

Kubota Corporation

Doosan Infracore Co. Ltd.

J. C. Bamford Excavators Ltd. (JCB)

Liugong Machinery Co., Ltd.

5.2. Cross-Comparison Parameters

Company Revenue

Product Portfolio

Market Presence

R&D Investment

Technological Capabilities

Strategic Initiatives

Number of Employees

Geographical Presence

5.3. Market Share Analysis

5.4. Strategic Initiatives and Developments

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding and Private Equity Analysis

6. Global Bulldozer Market Regulatory Framework

6.1. Emission Standards

6.2. Safety Regulations

6.3. Certification Requirements

7. Global Bulldozer Market Future Market Size (USD Billion)

7.1. Market Forecast and Projections

7.2. Key Factors Driving Future Market Growth

8. Global Bulldozer Market Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Product Type (In Value %)

8.3. By Operating Weight (In Value %)

8.4. By Horsepower (In Value %)

8.5. By Region (In Value %)

9. Global Bulldozer Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Cohort Analysis

9.3. Product Positioning Strategies

9.4. White Space and Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global bulldozer market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the global bulldozer market. This includes assessing market penetration, product demand, and the resultant revenue generation. Furthermore, an evaluation of technological adoption will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple bulldozer manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the global bulldozer market.

Frequently Asked Questions

01. How big is the global bulldozer market?

The USA Polyurethane Market is valued at USD 5 billion, based on a five-year historical analysis. This market is primarily driven by the growing demand for lightweight and high-performance materials in theautomotive and construction industries.

02. What are the challenges in the global bulldozer market?

Challenges include high initial capital investment, compliance with stringent emission norms, and fluctuating raw material prices, all of which impact profitability.

03. Who are the major players in the global bulldozer market?

Key players in the market include Caterpillar Inc., Komatsu Ltd., CNH Industrial N.V., Deere & Company, and Hitachi Construction Machinery Co., Ltd.

04. What are the growth drivers of the global bulldozer market?

Growth drivers include increased investment in infrastructure projects, the adoption of energy-efficient bulldozers, and advancements in construction technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.