Global Bulletproof Vests Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD5555

November 2024

85

About the Report

Global Bulletproof Vests Market Overview

- The global bulletproof vests market is valued at USD 2 billion based on a five-year historical analysis. The market is primarily driven by the increasing demand for personal protection equipment (PPE) among law enforcement, military personnel, and civilians. Governments across various nations are investing heavily in defense modernization programs and providing their personnel with advanced body armor solutions.

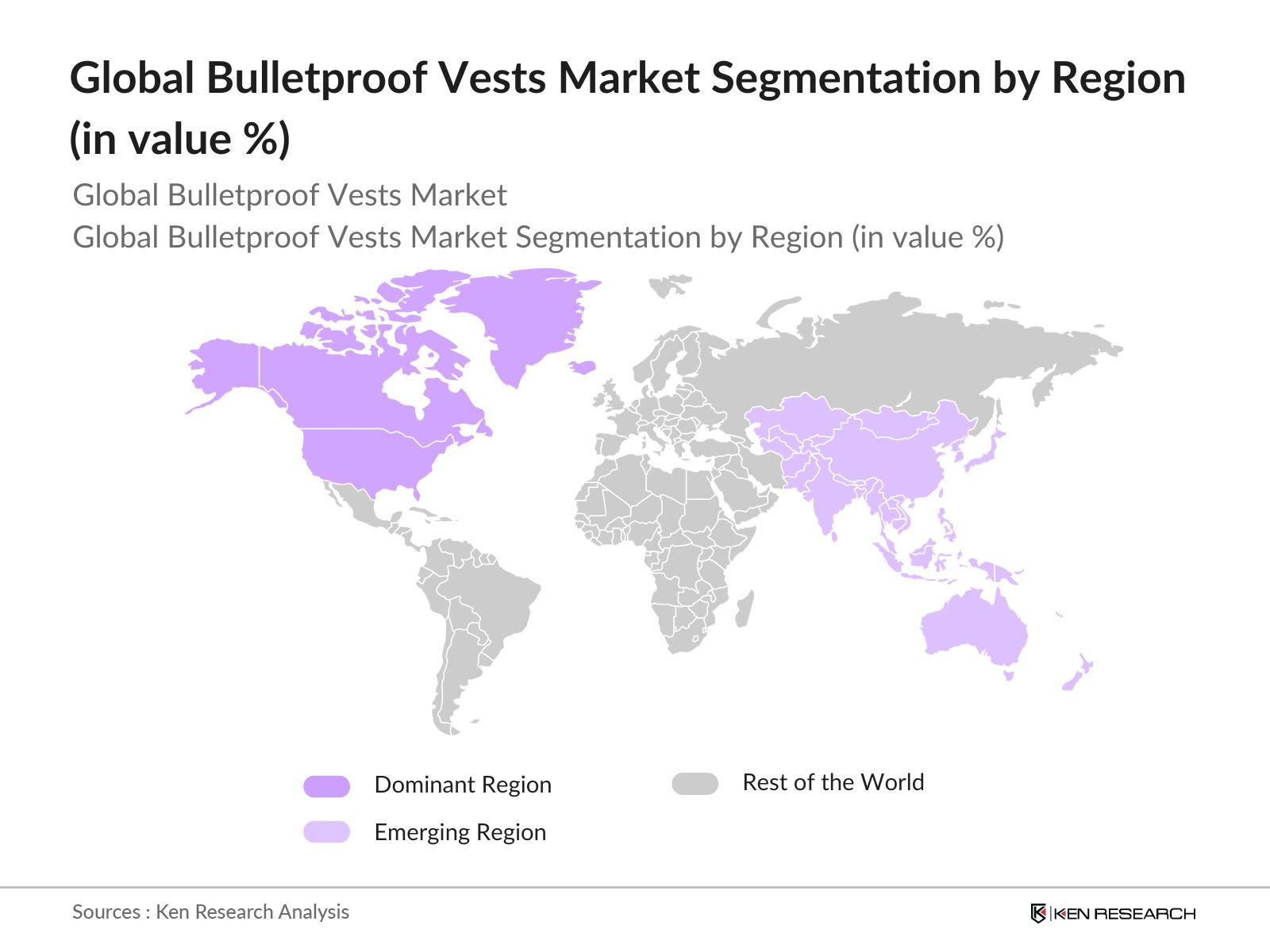

- Countries such as the United States, Russia, and China dominate the market due to their large defense budgets and high demand for modern body armor. These nations are at the forefront of defense technology innovation, driving the demand for next-generation bulletproof vests. Additionally, regions like North America and Europe have well-established law enforcement agencies that prioritize the safety of officers, further boosting market demand in these areas.

- The Indian government, under its "Make in India" initiative, has ramped up domestic production of bulletproof vests for military and law enforcement use. The government recently approved a USD 2 billion budget for indigenously developing advanced bulletproof vests to meet the countrys growing demand for body armor, further strengthening the domestic manufacturing ecosystem in 2024.

Global Bulletproof Vests Market Segmentation

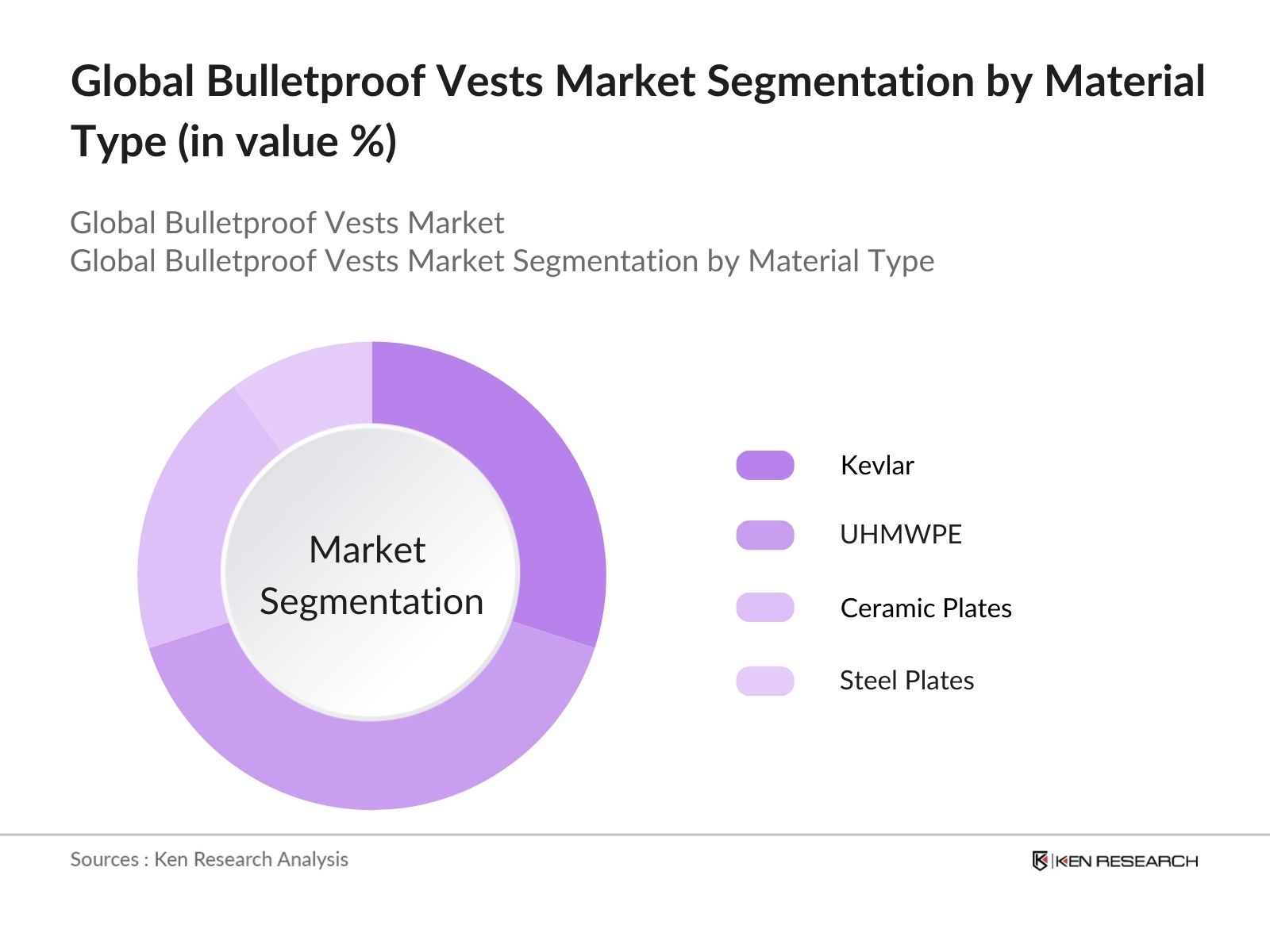

By Material Type: The market is segmented by material type into Kevlar, Ultra-High-Molecular-Weight Polyethylene (UHMWPE), Ceramic Plates, and Steel Plates. UHMWPE is emerging as the dominant material type in 2023 due to its lightweight properties and high resistance to ballistic threats. Its increasing adoption in modern vests is driven by demand for comfortable yet highly effective body armor, particularly for law enforcement personnel who require lighter equipment for operational efficiency.

By Product Type: The market is segmented by product type into Soft Vests, Hard Vests, and Tactical Vests. Soft vests hold the dominant market share due to their use in law enforcement and private security sectors. These vests provide flexibility and comfort for officers during regular patrols and day-to-day operations. Hard vests, although heavier, are preferred for military and tactical operations where maximum protection against high-caliber rounds is required.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America leads the market, driven by high defense spending in the U.S. and Canada, as well as stringent regulations for law enforcement safety. The U.S., with its expansive law enforcement agencies and military, continues to be a major buyer of advanced body armor solutions. Europe follows closely due to heightened concerns over terrorism and increased defense collaborations within the European Union.

Global Bulletproof Vests Market Competitive Landscape

The market is characterized by a few key players that dominate the market. These companies specialize in the design, development, and manufacturing of advanced body armor, utilizing the latest technology and materials.

|

Company |

Established Year |

Headquarters |

R&D Spending |

Certifications |

Manufacturing Capability |

Global Export Presence |

Strategic Alliances |

Employee Count |

|

Point Blank Enterprises, Inc. |

1973 |

Florida, USA |

||||||

|

Safariland, LLC |

1964 |

Florida, USA |

||||||

|

Armor Express |

2005 |

Michigan, USA |

||||||

|

DuPont de Nemours, Inc. |

1802 |

Delaware, USA |

||||||

|

Honeywell International Inc. |

1906 |

New Jersey, USA |

Global Bulletproof Vests Market Analysis

Market Growth Drivers

- Increasing Global Defense Expenditure: In 2024, the global defense expenditure is growing, driven by increasing geopolitical tensions, rising military threats, and territorial disputes. Governments around the world are investing heavily in military modernization programs, which include the acquisition of advanced personal protection gear such as bulletproof vests. In 2024, the U.S. Department of Defense allocated over USD 850 billion towards defense, a significant portion of which is expected to be spent on improving the personal safety equipment of armed forces, including bulletproof vests.

- Law Enforcement Modernization Initiatives: In 2024, governments are allocating over USD 70 billion towards law enforcement modernization programs, which include the provision of advanced protective equipment for police forces. For instance, law enforcement agencies in the U.S. and EU nations are increasingly providing bulletproof vests as part of standard equipment for officers, aiming to improve safety in response to rising crime rates. The U.S. Federal Government's recent grant programs, which provided over USD 50 million in funding for the procurement of ballistic protection gear, highlight this trend.

- Emergence of Private Security Firms: The private security industry, which employs over 22 million people globally, has seen rapid expansion due to growing demand from corporations, individuals, and governments for security services. These firms are significant consumers of bulletproof vests, particularly in volatile regions. In 2024, the private security market's growing globally, and companies are investing in high-end protective equipment to enhance the safety of their personnel, boosting the demand for bulletproof vests.

Market Challenges

- Supply Chain Disruptions: The ongoing supply chain issues exacerbated by the Russia-Ukraine conflict in 2024 have impacted the availability of raw materials for bulletproof vest manufacturing. The disrupted global supply chains, particularly for high-performance ballistic fibers, have caused production delays and increased costs. This has slowed the growth of manufacturers trying to keep up with rising demand in the defense and law enforcement sectors.

- Lack of Standardization in Testing Protocols: Despite the growing demand for bulletproof vests, there is no global standardization for testing and certifying ballistic protection. Different countries and regions have varying standards, such as NIJ (National Institute of Justice) in the U.S. and VPAM in Europe. This creates complexity for manufacturers, requiring them to meet multiple certification requirements, which can delay product launches and increase costs.

Global Bulletproof Vests Market Future Outlook

Over the next five years, the global bulletproof vests industry is expected to experience substantial growth, driven by continuous advancements in ballistic protection technologies, rising defense budgets, and increased concerns over personal safety.

Future Market Opportunities

- Increased Use of Lightweight Materials: Over the next five years, bulletproof vests are expected to increasingly utilize advanced lightweight materials such as carbon nanotubes and spider silk fibers. By 2029, the widespread adoption of these materials is projected to reduce the average weight of vests by nearly 40%, improving both comfort and mobility for users, especially in tactical situations.

- Integration of Smart Technologies: By 2029, bulletproof vests are expected to integrate smart sensors and biometric systems that monitor the wearers health in real-time. These innovations will provide critical data such as heart rate, temperature, and stress levels to command centers, enhancing situational awareness and decision-making for military and law enforcement teams.

Scope of the Report

|

Material Type |

Kevlar UHMWPE Ceramic Plates Steel Plates |

|

Product Type |

Soft Vests Hard Vests Tactical Vests |

|

End-Use |

Military Law Enforcement Civilian |

|

Protection Level |

Level IIA Level II Level IIIA Level III Level IV |

|

Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (e.g., U.S. Department of Defense, Ministry of Defense, European Defense Agency)

Armored Manufacturing companies

Private Security Companies

Bulletproof Vest Manufacturers

Distributors and Suppliers of Personal Protection Equipment

Investment and Venture Capitalist Firms

Banks and Financial Institution

Companies

Players Mentioned in the Report:

Point Blank Enterprises, Inc.

Safariland, LLC

Armor Express

DuPont de Nemours, Inc.

Honeywell International Inc.

EnGarde Body Armor

KDH Defense Systems, Inc.

U.S. Armor Corporation

Survival Armor

Mehler Vario System GmbH

Seyntex N.V.

Elmon Armored Vehicle

TenCate Advanced Armour

MKU Limited

3M Company

Table of Contents

Global Bulletproof Vests Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Global Bulletproof Vests Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Global Bulletproof Vests Market Analysis

3.1. Growth Drivers

3.1.1. Rising Military and Defense Expenditures (Defense Budget, Tactical Requirements)

3.1.2. Increasing Law Enforcement Demand (Homeland Security, Police Force Expansion)

3.1.3. Growing Threats from Cross-Border Conflicts (Geopolitical Tensions, Crime Rates)

3.1.4. Adoption of Advanced Ballistic Materials (Lightweight Kevlar, Ceramic Plates)

3.2. Market Challenges

3.2.1. High Manufacturing and Material Costs (Raw Material Price, Supply Chain Disruptions)

3.2.2. Strict Regulatory Requirements (NIJ Certification, Global Trade Compliance)

3.2.3. Limited Consumer Awareness in Civilian Applications (Public Safety, Self-Defense)

3.3. Opportunities

3.3.1. Technological Advancements in Body Armor (Nanotechnology, 3D-Printed Armor)

3.3.2. Emerging Markets in Asia-Pacific (Government Investments, Modernization Programs)

3.3.3. Rising Demand for Female-Specific Armor Designs (Customization, Ergonomics)

3.4. Trends

3.4.1. Integration of Smart Technologies (Wearable Sensors, GPS Tracking)

3.4.2. Lightweight and Concealable Vest Development (Covert Operations, Urban Warfare)

3.4.3. Hybrid and Modular Armor Systems (Versatile Configurations, Multi-Threat Protection)

3.5. Government Regulation

3.5.1. National Institute of Justice (NIJ) Standards (Armor Protection Levels)

3.5.2. Export Control and Trade Agreements (ITAR, Dual-Use Regulations)

3.5.3. Public Sector Procurement Policies (Defense Contracts, Tendering Process)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Component Manufacturers, End Users, Distributors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

Global Bulletproof Vests Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Kevlar

4.1.2. Ultra-High-Molecular-Weight Polyethylene (UHMWPE)

4.1.3. Ceramic Plates

4.1.4. Steel Plates

4.2. By Product Type (In Value %)

4.2.1. Soft Vests

4.2.2. Hard Vests

4.2.3. Tactical Vests

4.3. By End-Use (In Value %)

4.3.1. Military

4.3.2. Law Enforcement

4.3.3. Civilian

4.4. By Protection Level (In Value %)

4.4.1. Level IIA

4.4.2. Level II

4.4.3. Level IIIA

4.4.4. Level III

4.4.5. Level IV

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

Global Bulletproof Vests Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Point Blank Enterprises, Inc.

5.1.2. Safariland, LLC

5.1.3. Armor Express

5.1.4. DuPont de Nemours, Inc.

5.1.5. Honeywell International Inc.

5.1.6. EnGarde Body Armor

5.1.7. KDH Defense Systems, Inc.

5.1.8. U.S. Armor Corporation

5.1.9. Survival Armor

5.1.10. Mehler Vario System GmbH

5.1.11. Seyntex N.V.

5.1.12. Elmon Armored Vehicle

5.1.13. TenCate Advanced Armour

5.1.14. MKU Limited

5.1.15. 3M Company

5.2. Cross Comparison Parameters (Revenue, Headquarters, R&D Spending, Certifications, Manufacturing Capabilities, Export Presence, Strategic Alliances, Employee Count)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Global Bulletproof Vests Market Regulatory Framework

6.1. Ballistic Testing Standards

6.2. Compliance Requirements (ISO, ASTM)

6.3. Certification Processes (NIJ, EN, STANAG)

Global Bulletproof Vests Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Global Bulletproof Vests Market Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Product Type (In Value %)

8.3. By End-Use (In Value %)

8.4. By Protection Level (In Value %)

8.5. By Region (In Value %)

Global Bulletproof Vests Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase focuses on identifying critical variables that influence the global bulletproof vests market. This process involves extensive desk research across credible databases and industry reports. A comprehensive market ecosystem is mapped, considering stakeholders, supply chains, and end-users.

Step 2: Market Analysis and Construction

Historical data is analyzed to establish growth patterns and revenue generation metrics within the global bulletproof vests market. Market penetration rates are evaluated for key regions and end-use sectors to validate market size estimations.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are developed based on the initial market analysis and validated through structured interviews with industry experts and manufacturers. These consultations offer insights into product developments, technological advancements, and procurement patterns.

Step 4: Research Synthesis and Final Output

The final phase of research synthesizes all gathered data into a validated market forecast. The findings are corroborated through engagement with key industry stakeholders and supplemented with data from a bottom-up approach to ensure accuracy.

Frequently Asked Questions

How big is the global bulletproof vests market?

The global bulletproof vests market is valued at USD 2 billion, driven by the increasing need for personal protection among law enforcement, military personnel, and civilians.

What are the challenges in the global bulletproof vests market?

Challenges in the global bulletproof vests market include high production costs, stringent regulatory requirements, and limited consumer awareness regarding the use of body armor in civilian applications.

Who are the major players in the global bulletproof vests market?

Key players in the global bulletproof vests market include Point Blank Enterprises, Inc., Safariland, LLC, Armor Express, DuPont de Nemours, Inc., and Honeywell International Inc.

What are the growth drivers for the global bulletproof vests market?

Growth in the global bulletproof vests market is driven by rising defense expenditures, increased adoption of advanced ballistic materials, and the growing need for personal protection due to rising global security threats.

What trends are shaping the global bulletproof vests market?

Trends in the global bulletproof vests market include the development of lightweight and ergonomic body armor, the integration of smart technologies into vests, and the rising demand for modular and customizable armor solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.