Global Burner Management System (BMS) Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD7908

November 2024

99

About the Report

Global Burner Management System Market Overview

- The Global Burner Management System (BMS) market is valued at USD 5.8 billion, based on a five-year historical analysis. This market is primarily driven by the increasing emphasis on industrial safety, automation, and energy efficiency across sectors such as oil & gas, power generation, and chemicals. With stricter safety regulations and the adoption of advanced technologies like IoT and AI, BMS systems are becoming critical for ensuring safe combustion processes and reducing operational risks. These systems are particularly vital in industries that require continuous monitoring and optimization of burner operations to minimize downtime and ensure compliance with safety standards.

- Regions such as North America, Europe, and Asia Pacific dominate the Burner Management System (BMS) market. North America leads due to its well-established power generation and oil & gas industries, which have a high reliance on advanced safety automation systems. The region also benefits from stringent safety regulations and a focus on industrial automation. Europe, known for its strict environmental standards, is seeing significant growth in BMS adoption, driven by its advanced manufacturing sector.

- In the U.S., OSHA regulations for burner management systems play a critical role in enforcing safety standards for industries utilizing combustion equipment. As of 2023, OSHA reported that industrial burner-related incidents have decreased by 10% in facilities that adopted modern BMS technologies. Compliance with OSHAs guidelines ensure reduced risk of workplace accidents and operational disruptions. Companies failing to meet these regulations can face significant fines, further driving the need for reliable BMS solutions in industries such as oil and gas, manufacturing, and chemical processing.

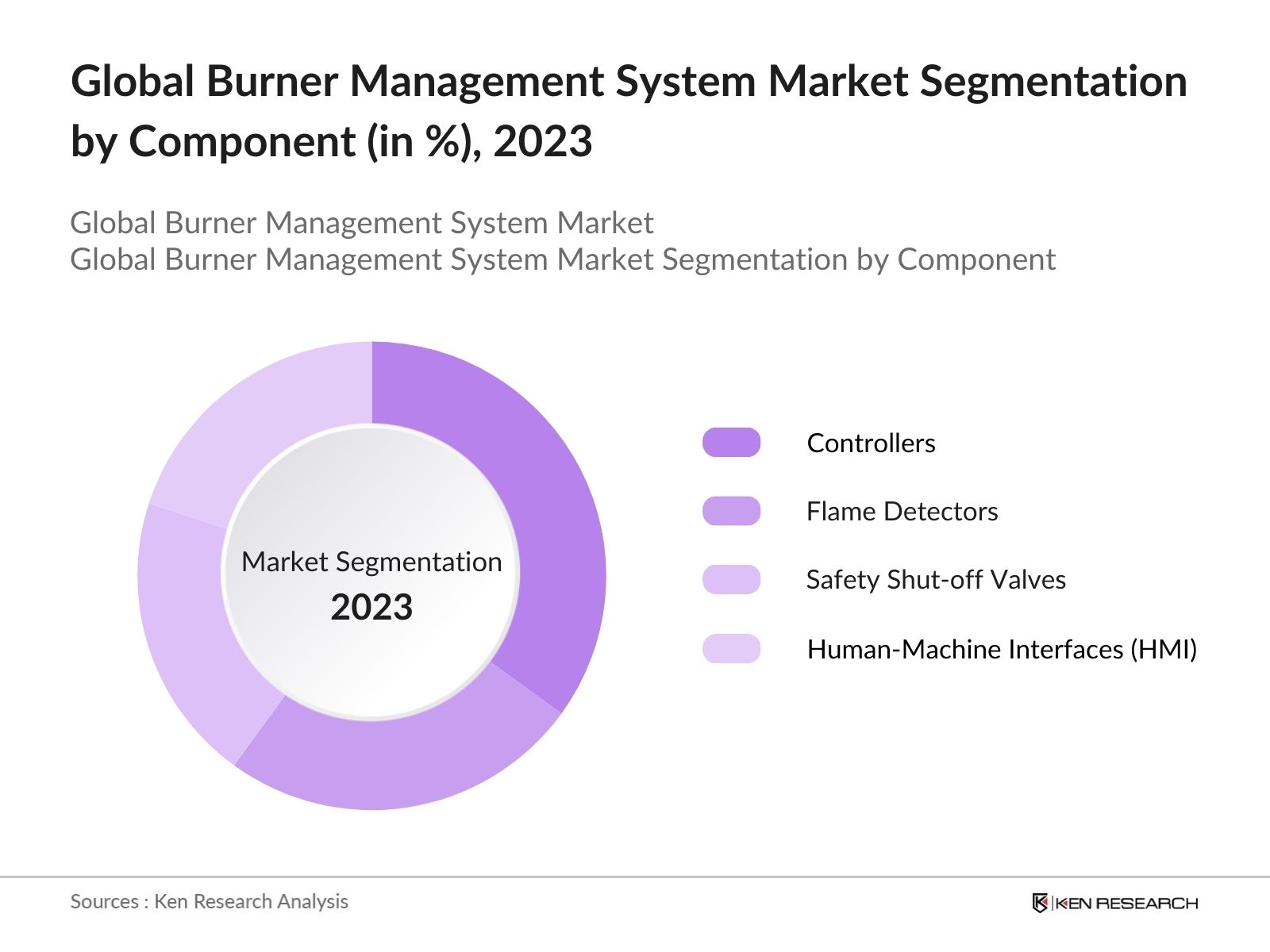

Global Burner Management System Market Segmentation

By Component: The Global Burner Management System market is segmented by component into controllers, flame detectors, safety shut-off valves, and human-machine interfaces (HMI). Among these, controllers hold the dominant market share. This is due to their central role in managing the overall functioning of burner systems, ensuring optimal combustion, and preventing safety incidents.

By Application: The Global Burner Management System market is segmented by application into oil & gas, power generation, chemical & petrochemical, food processing, and others (metals, glass). The oil & gas segment holds the largest share due to the stringent safety requirements in the industry and the widespread use of BMS systems in controlling burner operations across refining and gas processing plants.

By Region: Geographically, the Global Burner Management System market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America leads the market, primarily due to its advanced infrastructure in industries like power generation, oil & gas, and manufacturing. Strict safety standards, technological innovation, and the presence of major BMS providers in this region ensure its leadership position.

Global Burner Management System Market Competitive Landscape

The global Burner Management System market is highly competitive, with key players focusing on innovation, safety compliance, and geographic expansion. Leading companies include industry giants with extensive experience in automation and industrial safety. Technological advancements such as AI integration and IoT solutions are also being prioritized by market leaders.

Global Burner Management System Industry Analysis

Growth Drivers

- Increasing Energy Demand: The global energy consumption has seen a consistent rise, particularly in developing economies. According to the International Energy Agency (IEA), the global primary energy demand increased by 3% from 2022 to 2023, driven by industrialization and urbanization. In countries like India, energy consumption is projected to increase significantly due to ongoing industrial growth, while the U.S. Energy Information Administration (EIA) reported a 1% growth in natural gas consumption in the U.S. for 2023.

- Industrial Automation Advancements: The global market for industrial automation technologies has experienced steady growth, with automation-driven industries contributing significantly to the demand for Burner Management Systems (BMS). According to the World Bank, manufacturing value-added in high-tech industries, including energy and process industries, increased by 4% in 2023. As industries modernize, automated BMS solutions are required to improve safety and enhance operational efficiency, particularly in sectors like oil and gas, where over 60% of burner systems have adopted automation technologies.

- Stringent Safety Regulations: Regulations around burner safety and emissions have become more stringent, driving the adoption of Burner Management Systems. For instance, the U.S. Occupational Safety and Health Administration (OSHA) mandates strict compliance for industries using combustion processes, and the European Unions ATEX and IECEx safety directives apply to explosive atmospheres. In 2023, OSHA reported that approximately 35% of industrial fire-related incidents were due to non-compliance with burner management protocols.

Market Challenges

- Compliance with Regional Standards: Different countries and regions impose varying standards for burner management, making it difficult for companies operating in multiple regions to standardize their systems. For instance, in 2023, the International Energy Agency reported that 28% of companies faced difficulties in meeting differing safety and environmental standards in North America, Europe, and Asia. This lack of harmonization in regulations adds to the complexity of system installation, certification, and operation, particularly in industries where international operations are key.

- Complexity in Retrofitting: Many industrial facilities continue to operate with outdated combustion systems that are not easily retrofitted to accommodate modern BMS technologies. The retrofitting of older systems is technically challenging and expensive, often requiring significant downtime and re-engineering of the existing infrastructure. For example, a 2023 report from the U.K. Health and Safety Executive noted that only 40% of facilities with burners over 20 years old have successfully retrofitted modern BMS due to these complexities, leading to safety concerns and operational inefficiencies.

Global Burner Management System Market Future Outlook

The Burner Management System market is expected to grow significantly over the next five years, driven by the continuous demand for enhanced safety mechanisms, regulatory requirements, and technological advancements. The integration of AI and IoT for predictive maintenance and operational efficiency will play a crucial role in the growth of this market.

Market Opportunities

- Integration of AI and IoT in BMS: The integration of Artificial Intelligence (AI) and Internet of Things (IoT) into Burner Management Systems presents a significant opportunity for enhancing performance and safety. According to the World Economic Forum, AI adoption in energy and heavy industries increased by 20% in 2023. IoT integration enables real-time data collection from burners, providing predictive maintenance and energy consumption insights. These advancements improve operational efficiency and reduce unplanned downtimes by up to 30%, offering substantial cost savings.

- Demand in Emerging Economies: Emerging markets in Asia-Pacific and Latin America have shown an increasing demand for Burner Management Systems due to rapid industrialization and the development of energy infrastructure. For example, Indias energy sector expanded by 8% in 2023, largely driven by the growing use of natural gas and renewable energy sources. This industrial expansion requires enhanced safety and efficiency measures, making BMS solutions crucial in these regions.

Scope of the Report

|

By Component |

Controllers |

|

By Application |

Oil & Gas |

|

By Platform |

Distributed Control System (DCS) |

|

By Fuel Type |

Natural Gas |

|

By Region |

North America |

Products

Key Target Audience

Burner Management System Manufacturers

Industrial Automation Companies

Oil & Gas Companies

Power Generation Companies

Chemical and Petrochemical Industries

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (OSHA, NFPA, IEC)

Energy Efficiency and Environmental Agencies

Companies

Players Mentioned in the Report

Honeywell International Inc.

Siemens AG

ABB Ltd.

Emerson Electric Co.

Schneider Electric SE

Rockwell Automation

Yokogawa Electric Corporation

General Electric

Alfa Laval

John Zink Hamworthy Combustion

Table of Contents

1. Global Burner Management System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Burner Management System Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Burner Management System Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Energy Demand

3.1.2. Industrial Automation Advancements

3.1.3. Stringent Safety Regulations

3.1.4. Adoption of Smart BMS Solutions

3.2. Market Challenges

3.2.1. High Installation and Maintenance Costs

3.2.2. Complexity in Retrofitting

3.2.3. Compliance with Regional Standards

3.3. Opportunities

3.3.1. Integration of AI and IoT in BMS

3.3.2. Demand in Emerging Economies

3.3.3. Increased Focus on Energy Efficiency

3.4. Trends

3.4.1. Digitalization in Burner Management Systems

3.4.2. Use of Remote Monitoring Technologies

3.4.3. Growth in Renewable Energy Sectors

3.5. Government Regulations

3.5.1. OSHA Regulations

3.5.2. Environmental Emission Standards

3.5.3. Safety Directives from Regional Bodies

3.6. SWOT Analysis (Burner System Control Specific)

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (BMS Industry Dynamics)

3.9. Competitive Ecosystem

4. Global Burner Management System Market Segmentation

4.1. By Component (In Value %)

4.1.1. Controllers

4.1.2. Safety Shut-Off Valves

4.1.3. Flame Detectors

4.1.4. Human-Machine Interfaces (HMI)

4.2. By Application (In Value %)

4.2.1. Oil & Gas

4.2.2. Power Generation

4.2.3. Chemical & Petrochemical

4.2.4. Food Processing

4.2.5. Others (Metals, Glass)

4.3. By Platform (In Value %)

4.3.1. Distributed Control System (DCS)

4.3.2. Programmable Logic Controller (PLC)

4.3.3. Burner Management Systems (BMS)

4.4. By Fuel Type (In Value %)

4.4.1. Natural Gas

4.4.2. Oil

4.4.3. Coal

4.4.4. Others (Renewable Fuels)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Burner Management System Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Honeywell International Inc.

5.1.2. Siemens AG

5.1.3. Emerson Electric Co.

5.1.4. ABB Group

5.1.5. Rockwell Automation

5.1.6. Schneider Electric SE

5.1.7. Yokogawa Electric Corporation

5.1.8. General Electric

5.1.9. Combustion & Control Solutions, Inc.

5.1.10. Pilz GmbH & Co. KG

5.1.11. Schneider Electric

5.1.12. John Zink Hamworthy Combustion

5.1.13. Alfa Laval

5.1.14. Safety Instrumented Systems Ltd.

5.1.15. Sensus

5.2. Cross Comparison Parameters (Market-specific Parameters: No. of Employees, Headquarters, Inception Year, Annual Revenue, Product Range, Industry Expertise, Safety Certifications, Compliance with Global Standards)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Burner Management System Market Regulatory Framework

6.1. Environmental Standards (NOx, CO2 Emission Compliance)

6.2. Safety Compliance (NFPA 86, API Standards)

6.3. Certification Processes (ISO, ASME, SIL Ratings)

7. Global Burner Management System Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Burner Management System Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Application (In Value %)

8.3. By Platform (In Value %)

8.4. By Fuel Type (In Value %)

8.5. By Region (In Value %)

9. Global Burner Management System Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step of the research involves mapping the Burner Management System market ecosystem, which includes stakeholders across industrial automation, energy, and safety sectors. Extensive desk research using secondary and proprietary databases was conducted to gather critical variables influencing the market.

Step 2: Market Analysis and Construction

This phase involved analyzing historical data and trends related to the Burner Management System market. This data helped in understanding market penetration, geographical dominance, and revenue streams across different segments of the BMS market.

Step 3: Hypothesis Validation and Expert Consultation

We developed market hypotheses based on initial research, which were validated through consultations with industry experts. These experts provided detailed insights into market trends, technological advancements, and the regulatory environment.

Step 4: Research Synthesis and Final Output

In the final phase, we engaged directly with key market players to verify the data gathered. This step ensured that our market projections and revenue estimates are accurate and reliable, forming the basis of our comprehensive market analysis.

Frequently Asked Questions

01 How big is the Global Burner Management System Market?

The Global Burner Management System (BMS) market is valued at USD 5.8 billion, based on a five-year historical analysis. This market is primarily driven by the increasing emphasis on industrial safety, automation, and energy efficiency across sectors such as oil & gas, power generation, and chemicals.

02 What are the challenges in the Global Burner Management System Market?

Challenges include high installation and maintenance costs, retrofitting complexities in older plants, and compliance with varying global safety and environmental regulations.

03 Who are the major players in the Global Burner Management System Market?

Key players include Honeywell International Inc., Siemens AG, ABB Ltd., Emerson Electric Co., and Schneider Electric SE. These companies dominate due to their extensive industrial automation solutions and compliance with safety standards.

04 What are the growth drivers for the Global Burner Management System Market?

The market is primarily driven by the rising demand for automation in industrial safety, strict regulatory frameworks, and the increased adoption of energy-efficient systems in key industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.