Global Buy Pay Later Market Outlook to 2030

Region:Global

Author(s):Geetanshi

Product Code:KROD-007

June 2025

85

About the Report

Global Buy Now Pay Later Market Overview

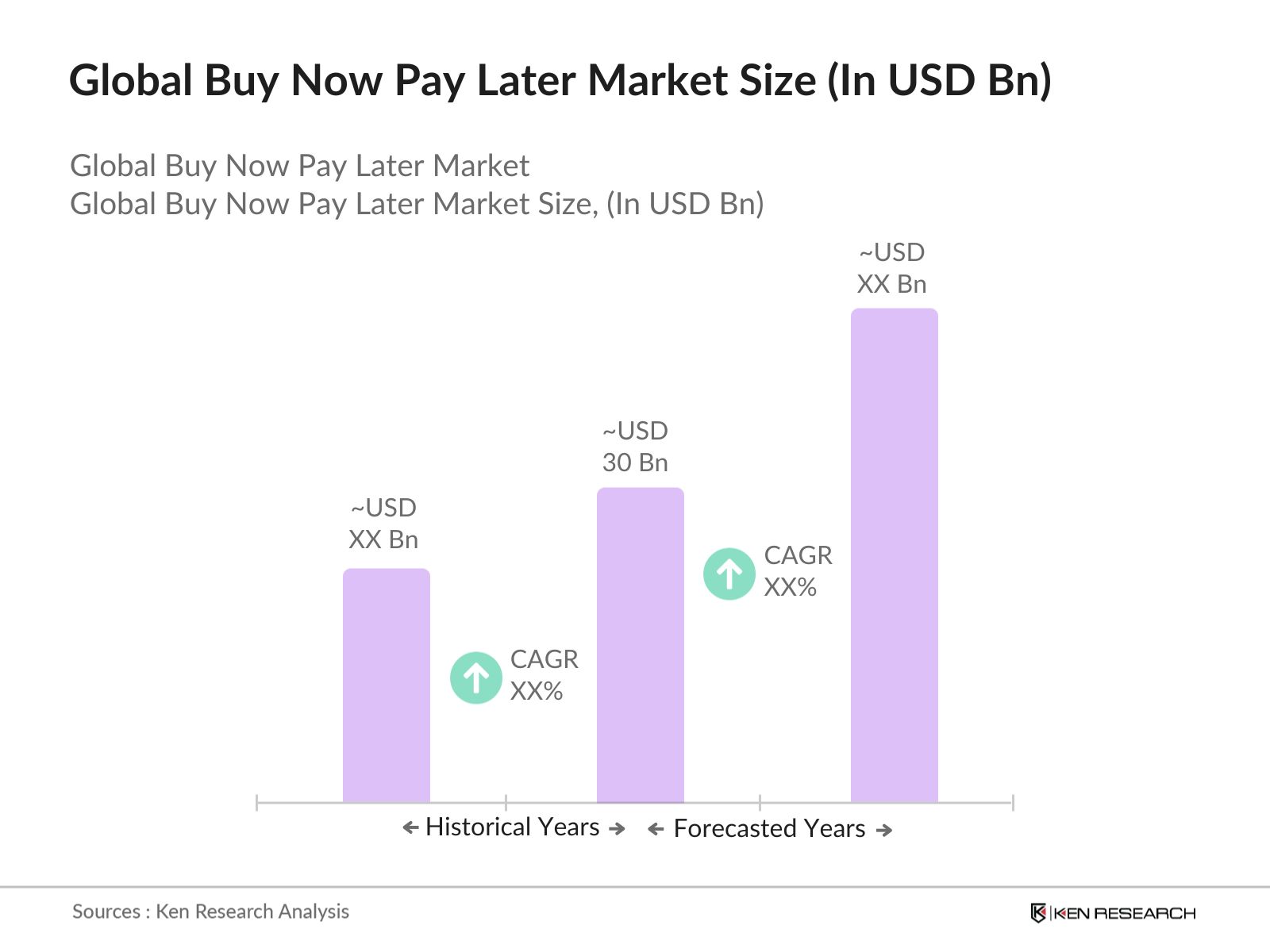

- The Global Buy Now Pay Later (BNPL) Market was valued at USD 30 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of e-commerce, consumer preference for flexible payment options, and the rise of digital wallets. The convenience and accessibility of BNPL services have attracted a diverse consumer base, contributing to the market's expansion.

- Key players in this market include the United States, the United Kingdom, and Australia. These countries dominate due to their advanced financial technology ecosystems, high internet penetration rates, and a strong culture of online shopping. The regulatory environment in these regions also supports the growth of BNPL services, making them more appealing to consumers.

- In recent years, the European Union has introduced regulations aimed at enhancing consumer protection in the BNPL sector. These regulations require transparent disclosure of terms and conditions, ensuring that consumers are fully informed about their payment obligations. This initiative aims to promote responsible lending practices and reduce the risk of consumer debt accumulation.

Global Buy Now Pay Later Market Segmentation

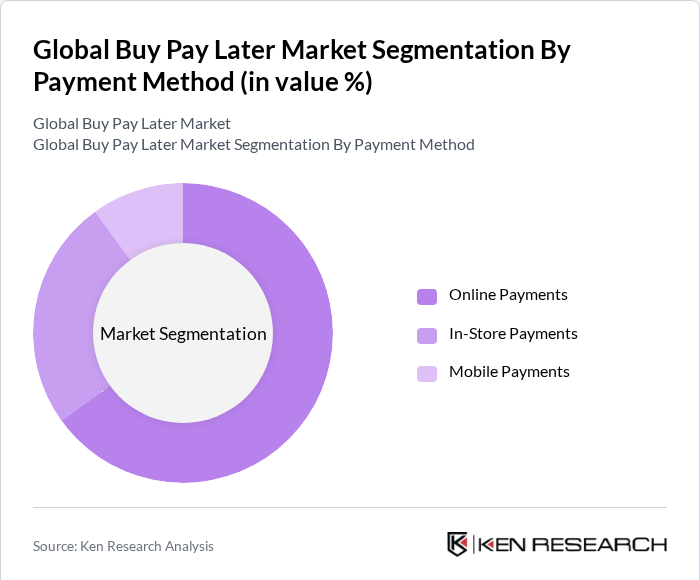

By Payment Method: The BNPL market can be segmented into three primary payment methods: online payments, in-store payments, and mobile payments. Among these, online payments dominate the market due to the rapid growth of e-commerce and the increasing preference for digital transactions. Consumers are increasingly opting for online payment solutions that offer flexibility and convenience, allowing them to manage their finances more effectively. The rise of mobile wallets and payment apps has further fueled this trend, making online payments the preferred choice for many consumers.

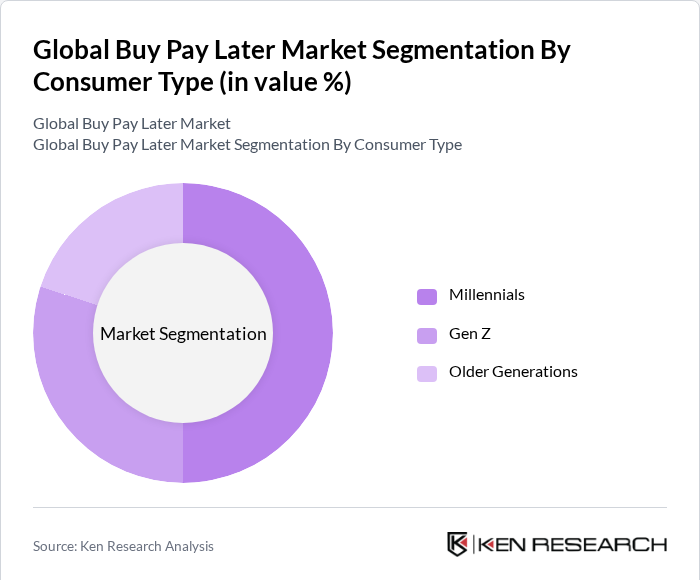

By Consumer Type: The market can also be segmented based on consumer type, which includes millennials, Gen Z, and older generations. Millennials are the dominant consumer group in the BNPL market, driven by their comfort with technology and preference for flexible payment options. This demographic is more likely to engage in online shopping and utilize BNPL services to manage their budgets effectively. As a result, they represent a significant portion of the market, influencing trends and driving innovation in payment solutions.

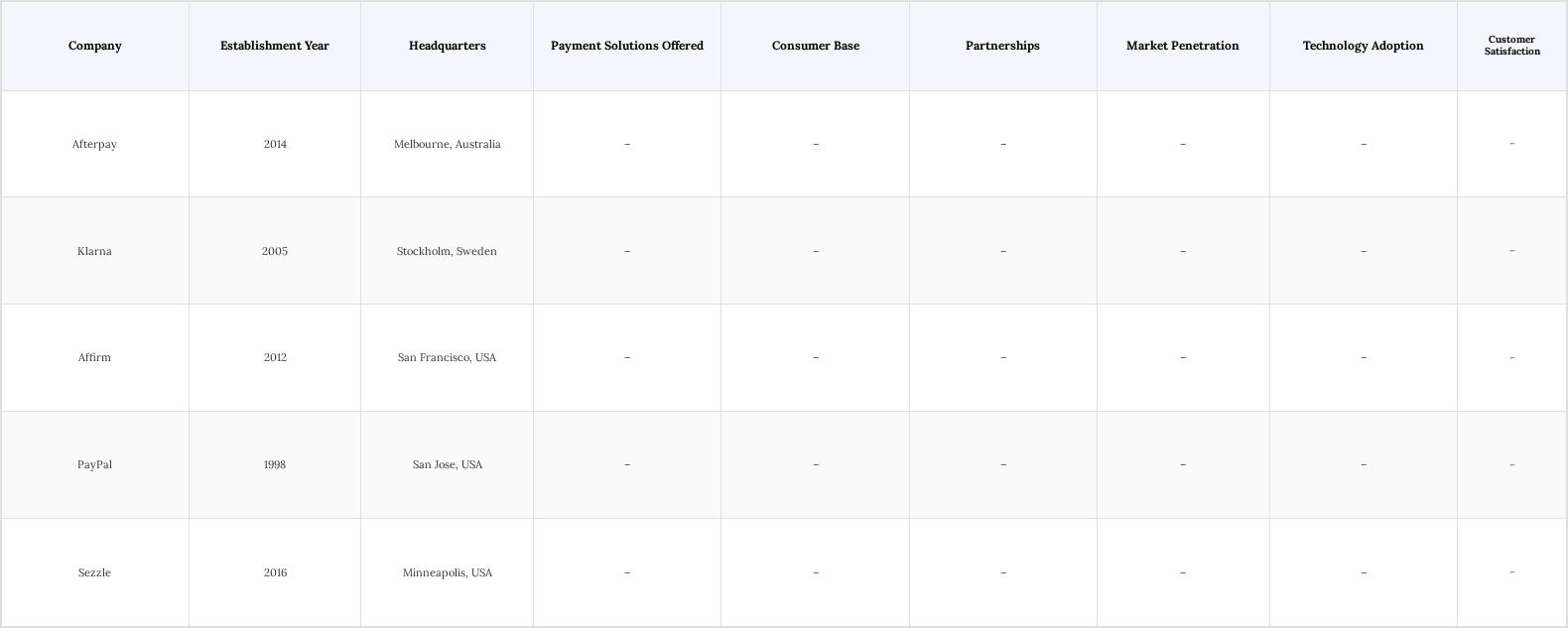

Global Buy Now Pay Later Market Competitive Landscape

The Global Buy Pay Later Market is characterized by a competitive landscape with several key players, including Afterpay, Klarna, Affirm, PayPal, and Sezzle. These companies are at the forefront of innovation, offering diverse payment solutions that cater to the evolving needs of consumers. The market is marked by a mix of established financial institutions and emerging fintech startups, creating a dynamic environment that fosters competition and drives growth.

Global Buy Now Pay Later Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Flexible Payment Options: In 2024, global consumer spending on Buy Now Pay Later (BNPL) services reached approximately $9.6 billion, reflecting a strong preference for flexible payment solutions. According to the World Bank, 70% of consumers in developed markets express interest in alternative payment methods, highlighting a significant shift in purchasing behavior. This trend is especially prominent among younger demographics, such as Millennials and Gen Z, who prioritize convenience, financial flexibility, and budgeting control in their shopping experiences.

- Rise of E-commerce and Online Shopping: Global retail e-commerce sales reached approximately $6 trillion in 2024 and are projected to grow to around $6.56 trillion in 2025, with some forecasts estimating up to $8.3 trillion by 2025–2026. This rapid growth is driven by increased internet access, mobile commerce, and digital payment adoption worldwide. The convenience and accessibility of online shopping have led retailers to increasingly integrate Buy Now Pay Later (BNPL) and other flexible payment options to enhance customer experience.

- Enhanced Financial Technology and Digital Payment Solutions: In 2023, investments in the financial technology sector surpassed $100 billion, driving significant innovation in digital payment solutions. Companies are increasingly utilizing advanced technologies like artificial intelligence (AI) and machine learning to streamline credit assessments, personalize user experiences, and detect fraud more effectively. These advancements improve the efficiency and accessibility of Buy Now Pay Later (BNPL) services, making them more reliable and user-friendly.

Market Challenges

- Regulatory Scrutiny and Compliance Issues: The BNPL market is facing increasing regulatory scrutiny, particularly in regions such as Europe and North America, where consumer protection laws are becoming more stringent. Regulatory bodies are introducing new guidelines to ensure transparency and promote responsible lending practices. This heightened oversight can lead to increased operational costs for BPL providers, as they must invest in robust compliance frameworks to avoid penalties and maintain consumer trust.

- Consumer Debt Concerns and Financial Literacy: Rising consumer debt levels pose a significant challenge for the BNPL market. A lack of adequate financial literacy among users often leads to over-reliance on BNPL services. Many consumers may not fully understand the terms and conditions of these agreements, which can result in missed payments, growing debt burdens, and decreased financial well-being. This, in turn, can impact market growth and erode consumer confidence in BNPL platforms.

Global Buy Now Pay Later Market Future Outlook

The future of the Buy Pay Later market appears promising, driven by ongoing technological advancements and evolving consumer preferences. As digital payment solutions continue to gain traction, BPL services are expected to become more integrated into various retail platforms. Additionally, the increasing focus on financial education initiatives may enhance consumer understanding of these payment options, fostering responsible usage. Overall, the market is poised for sustained growth, with innovative solutions likely to emerge in response to changing consumer needs and regulatory landscapes.

Market Opportunities

- Expansion into Emerging Markets: Emerging markets offer substantial growth potential for Buy Now Pay Later (BNPL) services, driven by rising internet penetration and smartphone adoption. E-commerce penetration in these regions is expected to increase from around 20% in 2023 to approximately 30% by 2025, particularly in fast-growing markets such as Southeast Asia, India, and parts of Africa.

- Partnerships with Retailers and E-commerce Platforms: Collaborations between Buy Now Pay Later (BNPL) providers and major retailers have proven instrumental in boosting the visibility and adoption of flexible payment solutions. In 2023, such partnerships contributed to an estimated 25% increase in transaction volumes, as integrating BNPL options at checkout encourages higher conversion rates and larger average order values.

Scope of the Report

| By Payment Method |

Online Payments In-store Payments Mobile Payments |

| By Consumer Type |

Millennials Gen Z Older Generations |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Industry |

E-commerce Retail Travel Healthcare Education |

| By Transaction Size |

Small Transactions Medium Transactions Large Transactions |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Financial Conduct Authority, Consumer Financial Protection Bureau)

Payment Service Providers

Retail Merchants and E-commerce Platforms

Credit Bureaus and Risk Assessment Agencies

Fintech Startups and Innovators

Consumer Advocacy Groups

Insurance Companies and Underwriters

Companies

Players Mentioned in the Report:

Afterpay

Klarna

Affirm

PayPal

Sezzle

FlexiPay

PayLater Pro

SplitIt

EasyPay Later

BuyNow PayLater Solutions

Table of Contents

1. Global Buy Pay Later Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Buy Pay Later Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Buy Pay Later Market Analysis

3.1. Growth Drivers

3.1.1. Increasing consumer demand for flexible payment options

3.1.2. Rise of e-commerce and online shopping

3.1.3. Enhanced financial technology and digital payment solutions

3.2. Market Challenges

3.2.1. Regulatory scrutiny and compliance issues

3.2.2. Consumer debt concerns and financial literacy

3.2.3. Competition from traditional credit options

3.3. Opportunities

3.3.1. Expansion into emerging markets

3.3.2. Partnerships with retailers and e-commerce platforms

3.3.3. Development of innovative payment solutions and features

3.4. Trends

3.4.1. Increasing adoption of mobile payment solutions

3.4.2. Growing popularity of subscription-based models

3.4.3. Integration of artificial intelligence in credit assessment

3.5. Government Regulation

3.5.1. Overview of current regulations affecting the market

3.5.2. Impact of consumer protection laws

3.5.3. Guidelines for responsible lending practices

3.5.4. Future regulatory trends and potential changes

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Buy Pay Later Market Segmentation

4.1. By Payment Method

4.1.1. Online Payments

4.1.2. In-store Payments

4.1.3. Mobile Payments

4.2. By Consumer Type

4.2.1. Millennials

4.2.2. Gen Z

4.2.3. Older Generations

4.3. By Region

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

4.4. By Industry

4.4.1. E-commerce

4.4.2. Retail

4.4.3. Travel

4.4.4. Healthcare

4.4.5. Education

4.5. By Transaction Size

4.5.1. Small Transactions

4.5.2. Medium Transactions

4.5.3. Large Transactions

5. Global Buy Pay Later Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Afterpay

5.1.2. Klarna

5.1.3. Affirm

5.1.4. PayPal

5.1.5. Sezzle

5.1.6. FlexiPay

5.1.7. PayLater Pro

5.1.8. SplitIt

5.1.9. EasyPay Later

5.1.10. BuyNow PayLater Solutions

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Customer Satisfaction Ratings

5.2.4. Product Offerings

5.2.5. Geographic Presence

5.2.6. Technological Advancements

5.2.7. Partnership Strategies

5.2.8. Marketing Strategies

6. Global Buy Pay Later Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Buy Pay Later Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Buy Pay Later Market Future Market Segmentation

8.1. By Payment Method

8.1.1. Online Payments

8.1.2. In-store Payments

8.1.3. Mobile Payments

8.2. By Consumer Type

8.2.1. Millennials

8.2.2. Gen Z

8.2.3. Older Generations

8.3. By Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia-Pacific

8.3.4. Latin America

8.3.5. Middle East & Africa

8.4. By Industry

8.4.1. E-commerce

8.4.2. Retail

8.4.3. Travel

8.4.4. Healthcare

8.4.5. Education

8.5. By Transaction Size

8.5.1. Small Transactions

8.5.2. Medium Transactions

8.5.3. Large Transactions

9. Global Buy Pay Later Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Buy Pay Later Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Buy Pay Later Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Buy Pay Later Market.

Frequently Asked Questions

01. How big is the Global Buy Pay Later Market?

The Global Buy Pay Later Market is valued at USD 30 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Buy Pay Later Market?

Key challenges in the Global Buy Pay Later Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Buy Pay Later Market?

Major players in the Global Buy Pay Later Market include Afterpay, Klarna, Affirm, PayPal, Sezzle, among others.

04. What are the growth drivers for the Global Buy Pay Later Market?

The primary growth drivers for the Global Buy Pay Later Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.