Region:Global

Author(s):Dev

Product Code:KRAD0366

Pages:90

Published On:August 2025

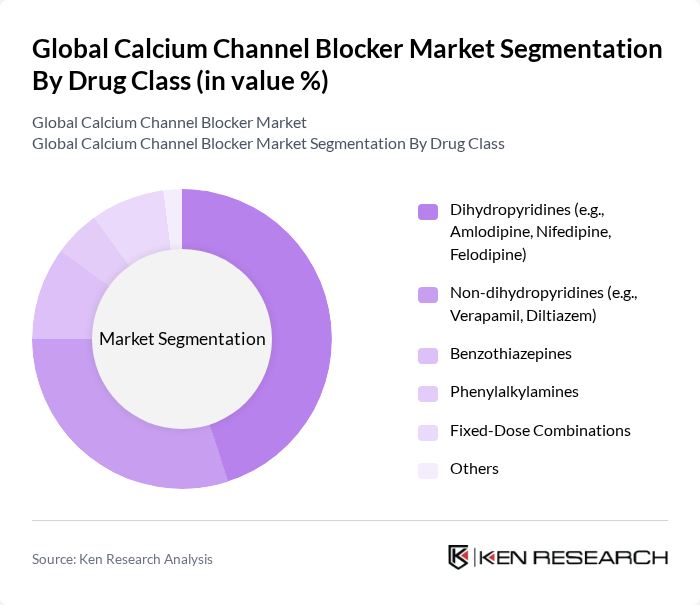

By Drug Class:The drug class segmentation includes various types of calcium channel blockers, each with distinct pharmacological properties and therapeutic applications. Dihydropyridines, such as Amlodipine and Nifedipine, are widely used for hypertension and angina due to their efficacy and favorable safety profile. Non-dihydropyridines, including Verapamil and Diltiazem, are preferred for arrhythmias and angina, particularly where heart rate control is required. Benzothiazepines and Phenylalkylamines are less commonly prescribed but remain important in specific clinical scenarios. Fixed-dose combinations are increasingly adopted for their convenience and improved patient adherence, especially in chronic disease management.

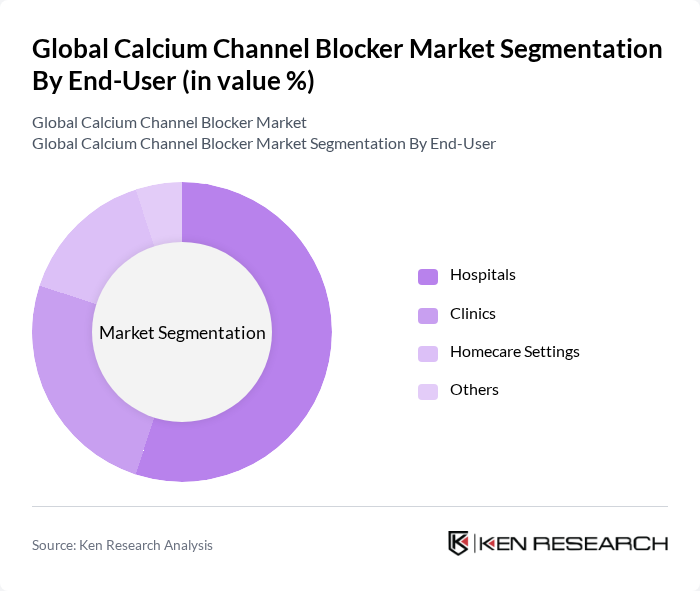

By End-User:The end-user segmentation reflects the diverse settings where calcium channel blockers are utilized. Hospitals remain the primary users due to the acute management of cardiovascular conditions and the need for intravenous formulations in critical care. Clinics and homecare settings are increasingly adopting these medications for chronic disease management, supported by the growing trend toward outpatient care and home healthcare services. Retail pharmacies play a significant role in dispensing maintenance therapy, driven by generic substitution policies and predictable refills.

The Global Calcium Channel Blocker Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Novartis AG, Merck & Co., Inc., AstraZeneca PLC, Sanofi S.A., Johnson & Johnson, GlaxoSmithKline plc (GSK), Teva Pharmaceutical Industries Ltd., Bayer AG, Boehringer Ingelheim GmbH, Daiichi Sankyo Company, Limited, Aurobindo Pharma Limited, Sun Pharmaceutical Industries Ltd., Lupin Limited, Cipla Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the calcium channel blocker market inappears promising, driven by ongoing advancements in drug formulations and a growing emphasis on personalized medicine. As healthcare providers increasingly adopt telemedicine and remote monitoring technologies, patient access to treatment is expected to improve significantly. Furthermore, the rising focus on preventive healthcare will likely lead to increased screening and early intervention, creating a favorable environment for calcium channel blockers as a primary treatment option for hypertension and related cardiovascular conditions.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Dihydropyridines (e.g., Amlodipine, Nifedipine, Felodipine) Non-dihydropyridines (e.g., Verapamil, Diltiazem) Benzothiazepines Phenylalkylamines Fixed-Dose Combinations Others |

| By End-User | Hospitals Clinics Homecare Settings Others |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Hospital Pharmacies Others |

| By Formulation | Tablets Capsules Injectable Others |

| By Therapeutic Area | Hypertension Angina Arrhythmia Migraine and Neurological Disorders Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiology Practices | 100 | Cardiologists, Nurse Practitioners |

| Neurology Clinics | 70 | Neurologists, Physician Assistants |

| Pharmacy Chains | 90 | Pharmacists, Pharmacy Managers |

| Patient Advocacy Groups | 50 | Patient Representatives, Health Educators |

| Healthcare Policy Makers | 40 | Health Economists, Policy Analysts |

The Global Calcium Channel Blocker Market is valued at approximately USD 16.9 billion, driven by the increasing prevalence of hypertension and cardiovascular disorders, along with the growing geriatric population requiring long-term antihypertensive therapy.