Global Camera Accessories Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3747

November 2024

100

About the Report

Global Camera Accessories Market Overview

- The global camera accessories market is valued at USD 32.85 billion, driven by the steady rise in demand for high-quality imaging accessories among professional and amateur photographers alike. The increase in photography for content creation, particularly on social media platforms, has bolstered this demand. Additionally, continuous advancements in imaging technology have led to the production of innovative and high-performance accessories, further fueling market growth. The expansion of e-commerce has facilitated easy access to a wide range of camera accessories, thereby increasing market penetration and overall growth.

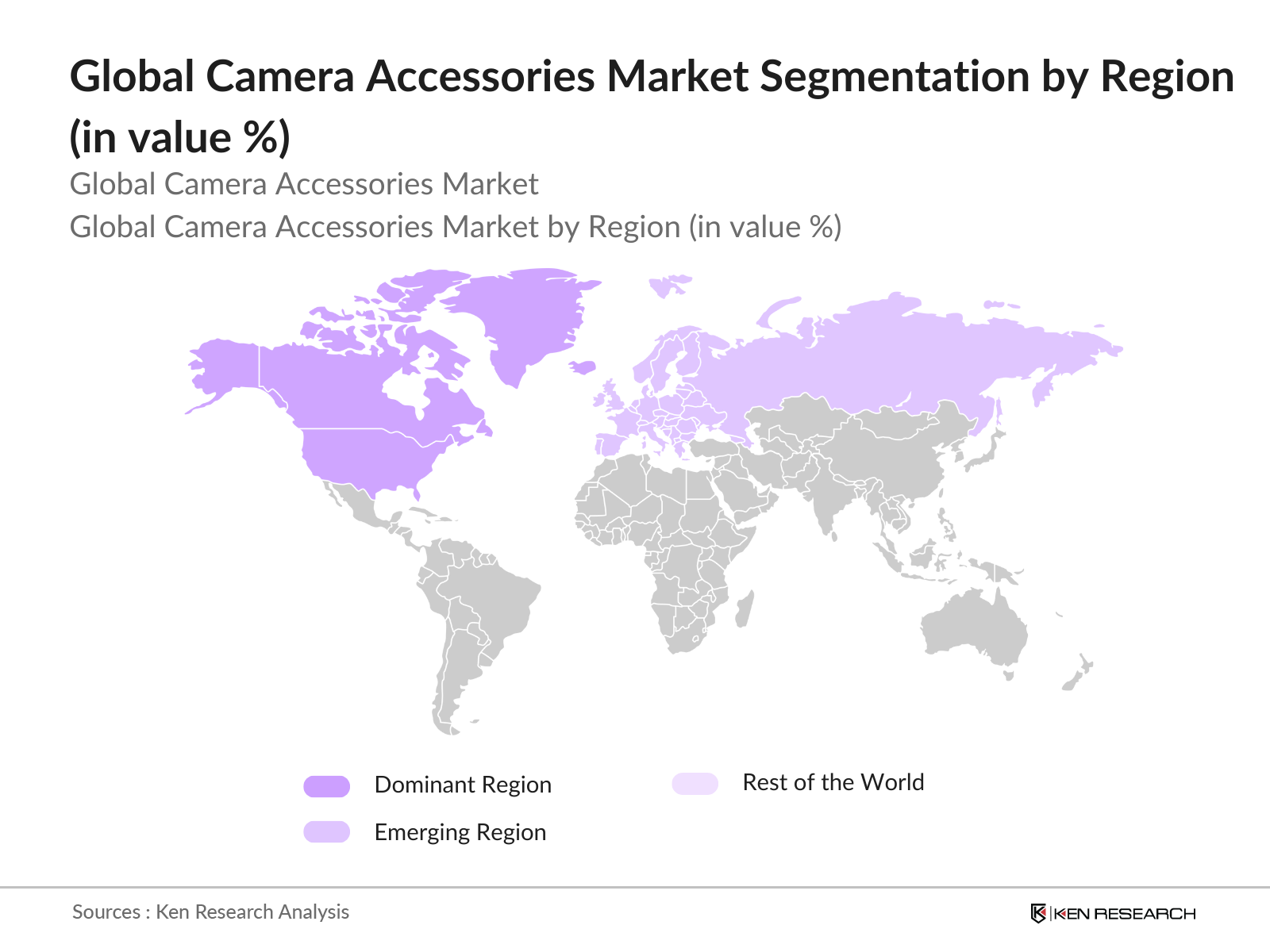

- The United States and Japan dominate the global camera accessories market due to their advanced technological infrastructure and strong consumer base for high-quality imaging products. The U.S. market benefits from a high concentration of professional photographers and videographers, while Japan is home to some of the largest camera manufacturers globally, which naturally extends to their accessory market. Both regions also have a high purchasing power, making premium camera accessories more accessible.

- Environmental compliance for material usage is becoming increasingly stringent, affecting how camera accessories are manufactured. In 2022, regulations in Europe mandated that electronic products must adhere to the Waste Electrical and Electronic Equipment Directive (WEEE). Companies found in violation face fines up to 10 million, urging manufacturers to adopt sustainable practices. This trend towards stricter compliance necessitates a focus on eco-friendly materials and responsible production methods, which can also drive innovation in the camera accessories market.

Global Camera Accessories Market Segmentation

By Product Type: The global camera accessories market is segmented by product type into lenses, tripods, lighting equipment, batteries and chargers, and memory cards. Lenses hold a dominant share within this segment, largely due to the high demand among both professionals and hobbyists seeking varied focal lengths, aperture settings, and other features for specialized photography. Lenses also experience high consumer loyalty due to the lasting impact of brand quality and performance, leading to a robust preference for established brands among photographers.

By Region: The global camera accessories market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds the leading market share due to a high concentration of professional photographers and content creators. The region also benefits from extensive e-commerce penetration, enabling consumers to access a wide variety of accessories. Additionally, the U.S. market features a robust demand for high-end accessories that can meet the needs of photographers working across various industries, including advertising, media, and wildlife conservation.

Global Camera Accessories Market Competitive Landscape

The global camera accessories market is dominated by several major players with a strong presence across various product segments. This consolidation underscores the significant influence of these companies, which are key to driving the market's technological advancements and catering to both consumer and professional segments.

Global Camera Accessories Market Analysis

Market Growth Drivers

- Rising Demand for High-Resolution Photography (Increasing Adoption of DSLRs and Mirrorless Cameras): The global demand for high-resolution photography is significantly driven by the increasing adoption of DSLRs and mirrorless cameras, with around 21 million units sold in 2022. This surge is fueled by the enhanced image quality and versatility these cameras offer, focusing on capturing professional-grade photos. A survey indicated that a considerable segment of consumers prioritizing photography and videography chose DSLRs or mirrorless systems, leading to higher accessory sales. Additionally, the global digital camera market's revenue was projected to exceed $10 billion in 2023, reflecting a growing consumer interest in high-resolution photography.

- Expansion of Social Media and Content Creation (Influence on Accessory Purchases): The rapid expansion of social media platforms has revolutionized content creation, resulting in a surge in camera accessory purchases. In 2022, around 4.7 billion people globally used social media, leading to a dramatic increase in demand for quality content creation tools. Influencers and amateur photographers are increasingly investing in accessories to enhance their content quality, with a significant number of content creators believing that better camera equipment directly improves their audience engagement. As a result, the accessories market is benefiting from this increased focus on high-quality visual content.

- Advancements in Imaging Technology (Compatibility with Newer Camera Models): Advancements in imaging technology are critical growth drivers for the camera accessories market. With over 40 new camera models introduced in 2022, the compatibility of accessories with these models is crucial. For instance, the adoption of 4K and 8K video recording capabilities in new cameras has spurred demand for high-quality lenses and stabilizers. In 2023, the global imaging technology market was valued at approximately $5.3 billion, demonstrating a robust trend towards innovation. This growing demand for compatible accessories not only enhances user experience but also drives sales in the accessories market.

Market Challenges:

- High Initial Costs of Premium Accessories: The high initial costs of premium camera accessories pose a significant challenge to market growth. In 2022, the average price of high-end camera lenses reached around $1,200, deterring many potential consumers. Additionally, premium accessories such as stabilizers and professional-grade tripods can cost between $300 and $800, making them less accessible to amateur photographers. This cost barrier limits the market's potential, particularly in developing regions, where the average household income is considerably lower than in developed markets, affecting purchasing power and overall sales.

- Market Saturation in Developed Regions: Market saturation in developed regions is becoming a critical concern for the camera accessories market. In North America and Europe, growth rates for camera sales have plateaued, with many consumers holding onto their existing equipment longer. For example, the average lifespan of a DSLR camera has extended to about seven years, resulting in decreased accessory purchases. A significant number of consumers in these regions have indicated satisfaction with their current gear, leading to challenges in driving new sales. This saturation is forcing companies to explore new markets and innovative product offerings to maintain revenue growth.

Global Camera Accessories Market Future Outlook

The global camera accessories market is expected to experience significant growth over the next five years, supported by a rising demand for high-quality imaging products among professionals and hobbyists alike. Technological advancements, such as integration with mobile platforms and improvements in accessory compatibility with new camera models, will likely attract more consumers. The growing trend of sustainability and the shift towards compact, lightweight accessories are anticipated to create new opportunities in the market, especially within the Asia-Pacific and North American regions.

Market Opportunities:

- Shift Towards Sustainable and Eco-Friendly Accessories: The shift towards sustainable and eco-friendly accessories is gaining momentum in the camera accessories market. As of 2022, a considerable number of consumers expressed a preference for products made from recycled materials. This trend is driving manufacturers to innovate by developing eco-friendly products, such as biodegradable camera bags and sustainable packaging solutions. In 2023, the eco-friendly accessory segment saw notable growth, indicating strong consumer support for sustainable practices. Companies embracing this trend are likely to enhance their brand image and attract environmentally conscious consumers.

- Increased Integration with Digital Platforms (e.g., Mobile App Compatibility): The integration of camera accessories with digital platforms is increasingly prevalent, enhancing user experience. In 2022, the global market for smart camera accessories reached $2 billion, driven by the demand for app-compatible products. A significant number of consumers reported using mobile applications to control their camera settings and enhance functionality, showcasing the growing intersection of technology and photography. Manufacturers focusing on this trend are likely to gain a competitive edge by offering innovative solutions that integrate seamlessly with digital ecosystems.

Scope of the Report

|

By Product Type |

Lenses, Tripods Lighting Equipment Batteries and Chargers Memory Cards |

|

By Application |

Professional Photography Videography Casual Photography Sports and Wildlife Photography |

|

By Distribution Channel |

Online Retail Offline Retail Specialty Stores |

|

By Price Range |

Premium Mid-range Economy |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Professional Photographers and Videographers

Content Creators and Social Media Influencers

Camera Manufacturers and Retailers

Online Marketplaces and E-commerce Platforms

Consumer Electronics Distributors

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Environmental Protection Agencies)

Film Production and Entertainment Studios

Companies

Players Mention in the Report

Canon Inc.

Sony Corporation

Nikon Corporation

Panasonic Corporation

Sigma Corporation

Fujifilm Holdings Corporation

GoPro, Inc.

Olympus Corporation

Manfrotto (Vitec Group)

Sandisk (Western Digital)

Transcend Information, Inc.

Leica Camera AG

DJI Innovations

Joby (DayMen US, Inc.)

Benro Precision Industry (Zhongshan) Co., Ltd.

Table of Contents

01. Global Camera Accessories Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate and Projections

1.4 Market Segmentation Overview

02. Global Camera Accessories Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

03. Global Camera Accessories Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for High-Resolution Photography (Increasing Adoption of DSLRs and Mirrorless Cameras)

3.1.2 Expansion of Social Media and Content Creation (Influence on Accessory Purchases)

3.1.3 Advancements in Imaging Technology (Compatibility with Newer Camera Models)

3.2 Market Challenges

3.2.1 High Initial Costs of Premium Accessories

3.2.2 Competition from Smartphone Photography

3.2.3 Market Saturation in Developed Regions

3.3 Opportunities

3.3.1 Growth of E-commerce and Direct-to-Consumer Sales

3.3.2 Technological Advancements (Compact, Lightweight Accessories)

3.3.3 Emerging Markets Demand (Expansion in Asia-Pacific and Latin America)

3.4 Trends

3.4.1 Shift Towards Sustainable and Eco-Friendly Accessories

3.4.2 Increased Integration with Digital Platforms (e.g., Mobile App Compatibility)

3.4.3 Rise of Compact and Portable Accessories for Travelers

3.5 Government Regulation

3.5.1 Import and Export Regulations on Electronic Accessories

3.5.2 Environmental Compliance for Material Usage

3.5.3 Intellectual Property Rights for Accessory Designs

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

04. Global Camera Accessories Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Lenses

4.1.2 Tripods

4.1.3 Lighting Equipment

4.1.4 Batteries and Chargers

4.1.5 Memory Cards

4.2 By Application (In Value %)

4.2.1 Professional Photography

4.2.2 Videography

4.2.3 Casual Photography

4.2.4 Sports and Wildlife Photography

4.3 By Distribution Channel (In Value %)

4.3.1 Online Retail

4.3.2 Offline Retail

4.3.3 Specialty Stores

4.4 By Price Range (In Value %)

4.4.1 Premium

4.4.2 Mid-range

4.4.3 Economy

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

05. Global Camera Accessories Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Canon Inc.

5.1.2 Sony Corporation

5.1.3 Nikon Corporation

5.1.4 Panasonic Corporation

5.1.5 Sigma Corporation

5.1.6 Fujifilm Holdings Corporation

5.1.7 GoPro, Inc.

5.1.8 Olympus Corporation

5.1.9 Manfrotto (Vitec Group)

5.1.10 Sandisk (Western Digital)

5.1.11 Transcend Information, Inc.

5.1.12 Leica Camera AG

5.1.13 DJI Innovations

5.1.14 Joby (DayMen US, Inc.)

5.1.15 Benro Precision Industry (Zhongshan) Co., Ltd.

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Market Reach, Technological Innovations, Brand Reputation, Regional Presence, Strategic Partnerships, Environmental Compliance)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

06. Global Camera Accessories Market Regulatory Framework

6.1 Environmental Standards and Regulations

6.2 Import-Export Compliance

6.3 Certification Requirements for Safety and Quality

07. Global Camera Accessories Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08. Global Camera Accessories Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Price Range (In Value %)

8.5 By Region (In Value %)

09. Global Camera Accessories Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research began by mapping all significant stakeholders in the global camera accessories market. This step utilized a combination of proprietary databases and secondary research to outline market dynamics, including key factors influencing product demand.

Step 2: Market Analysis and Construction

Historical data on the global camera accessories market was compiled and analyzed, with particular emphasis on revenue trends and growth patterns across major regions. An in-depth analysis was conducted to ensure accuracy in estimating market size and sub-segment performance.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on key market drivers and challenges were validated through consultations with industry experts via CATI. These interactions provided direct insights into industry practices, preferences, and innovations, ensuring that market estimates were precise.

Step 4: Research Synthesis and Final Output

The final phase involved direct collaboration with accessory manufacturers and retailers. These interactions offered insights into product preferences, purchasing patterns, and emerging trends, ensuring the validity and robustness of our findings on the global camera accessories market.

Frequently Asked Questions

01. How big is the global camera accessories market?

The global camera accessories market is valued at USD 32.85 billion, driven by increased demand among professional and casual photographers and continuous advancements in imaging technology.

02. What are the growth drivers in the global camera accessories market?

Growth drivers include technological advancements, an increase in social media content creation, and rising e-commerce platforms, enabling broader access to camera accessories worldwide.

03. Who are the major players in the global camera accessories market?

Key players include Canon Inc., Sony Corporation, Nikon Corporation, Panasonic Corporation, and Fujifilm Holdings Corporation, which have a strong market presence due to their high-quality products and brand loyalty.

04. What challenges does the global camera accessories market face?

Challenges include high competition from smartphone photography, high initial costs for premium accessories, and market saturation in developed regions, which can limit new market entry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.