Global Camping Cooler Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11352

November 2024

90

About the Report

Global Camping Cooler Market Overview

- The global camping cooler market is valued at approximately USD 925 billion, driven by increasing outdoor recreational activities and the rising popularity of adventure tourism. The market's growth has been supported by technological advancements in cooling technology and the demand for durable, portable coolers for outdoor use. The integration of features like electric cooling and hybrid designs has also contributed to the market's expansion. This data is supported by a five-year historical analysis from legitimate sources like industry reports and government-backed studies.

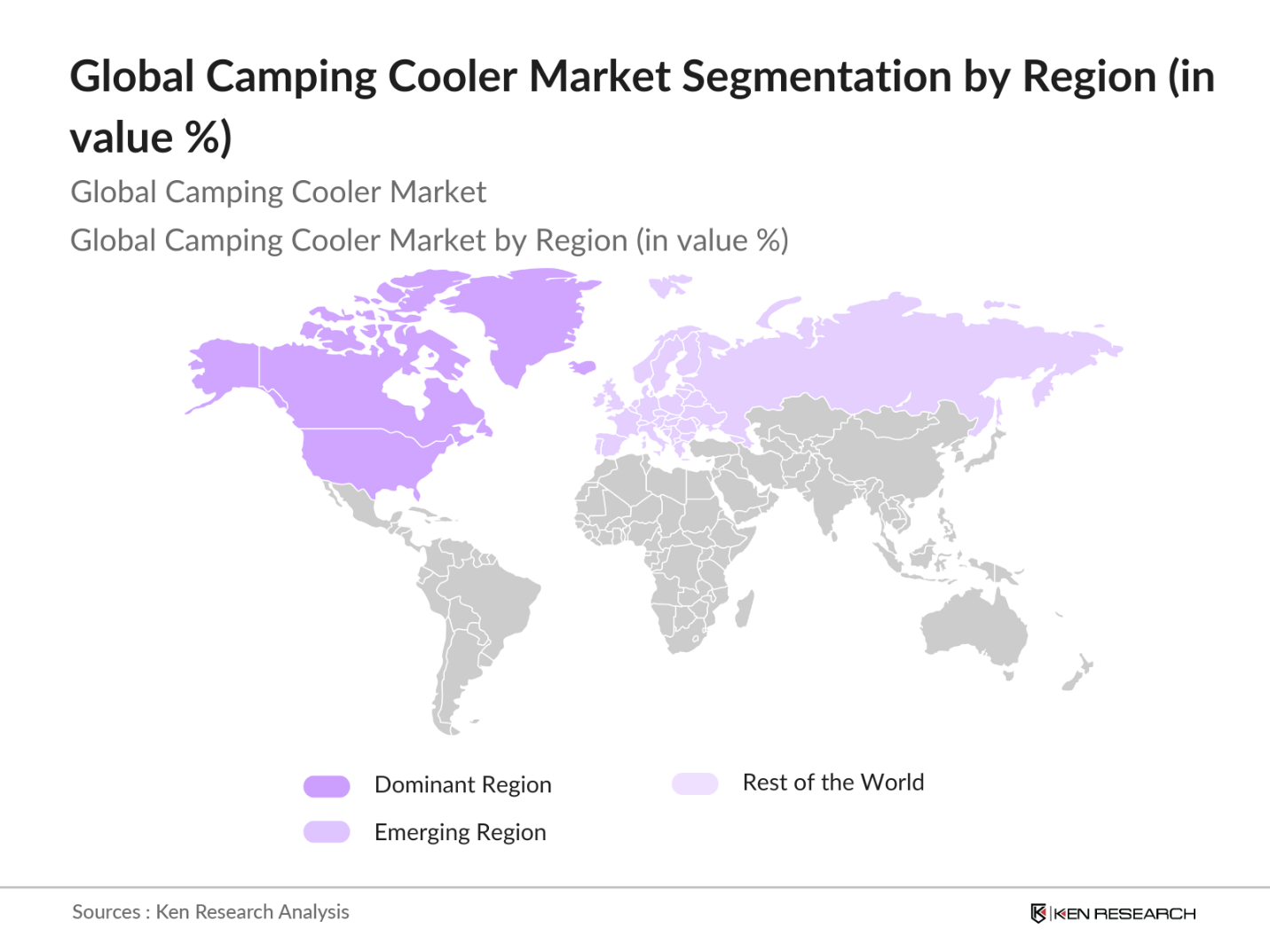

- North America dominates the global camping cooler market, largely due to a strong culture of outdoor recreational activities and a high disposable income level. The U.S., in particular, leads in product consumption, driven by popular activities like camping, fishing, and tailgating. Additionally, Europe, especially countries like Germany and the U.K., has seen rising demand for camping gear, fueled by the increasing trend toward eco-tourism and outdoor festivals. These regions maintain dominance due to strong consumer interest and the availability of high-quality coolers in retail and online stores.

- Government regulations play a significant role in shaping the camping cooler market, particularly regarding product safety standards and environmental compliance. In 2023, over 50 countries enacted stricter regulations on the use of plastics and environmentally harmful materials, affecting cooler manufacturers globally. Furthermore, compliance with international trade policies such as tariffs and import restrictions influences the pricing and availability of camping coolers across borders. These regulations require manufacturers to adopt more sustainable materials and production methods to comply with environmental standards.

Global Camping Cooler Market Segmentation

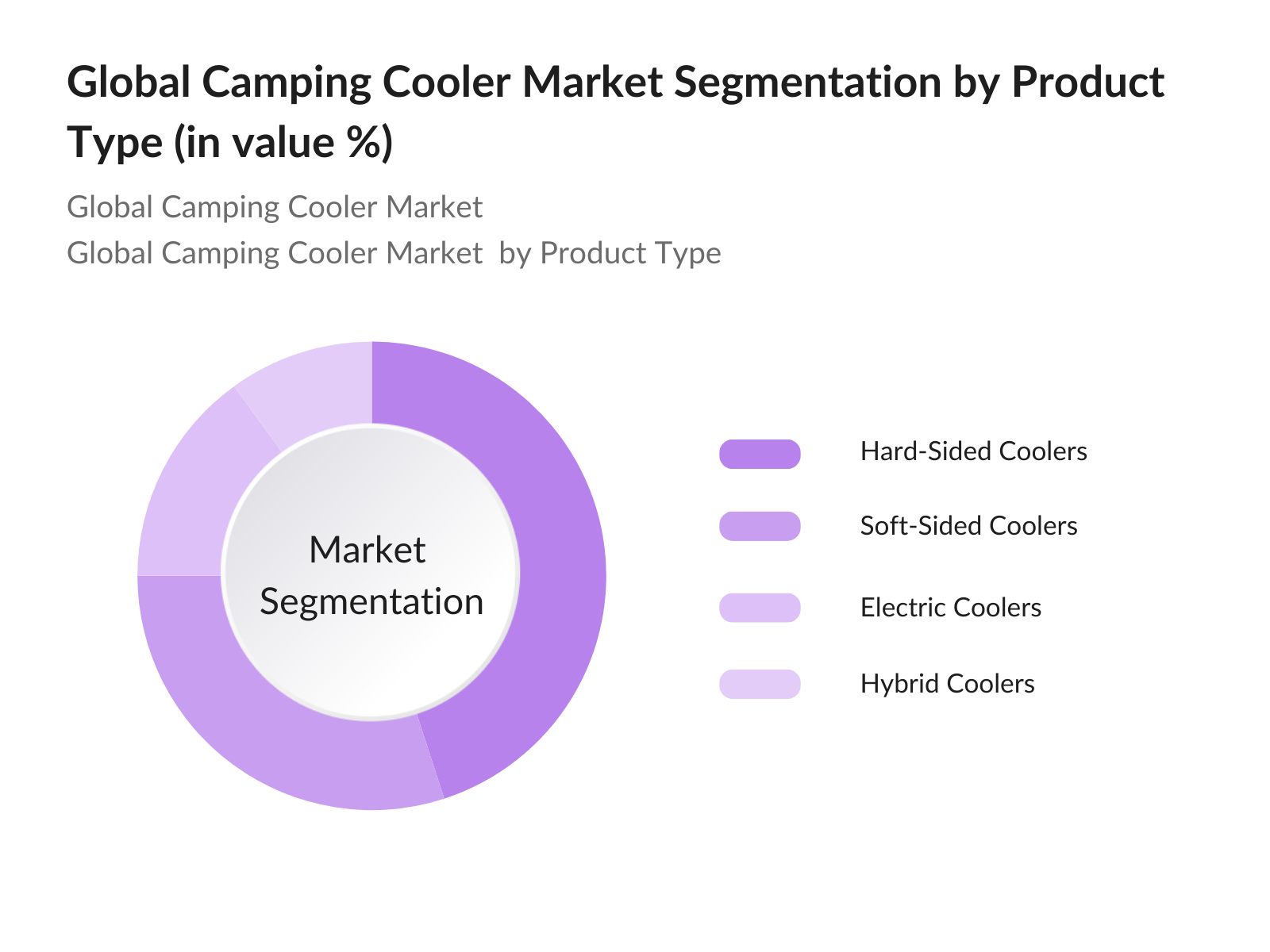

By Product Type: The global camping cooler market is segmented by product type into soft-sided coolers, hard-sided coolers, electric coolers, and hybrid coolers. Among these, hard-sided coolers hold the dominant market share the market. Their popularity is due to their superior durability, ability to retain ice for extended periods, and suitability for outdoor adventure activities. Leading brands like YETI and Igloo have reinforced this segments dominance by producing highly durable products tailored for harsh outdoor conditions.

By Region: The global camping cooler market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The driven by the U.S. and Canadas strong camping and outdoor recreation culture. In these countries, outdoor activities are part of the lifestyle, leading to consistent demand for high-quality coolers. while Asia Pacific is experiencing a growing market, spurred by the rise in adventure tourism.

Global Camping Cooler Market Competitive Landscape

The global camping cooler market is moderately consolidated, with key players dominating through brand loyalty, product innovation, and extensive distribution networks. These companies continue to invest in product innovation, focusing on features such as longer ice retention, lightweight designs, and eco-friendly materials. The market sees competition from both well-established brands and emerging local manufacturers.

|

Company Name |

Established |

Headquarters |

Product Range |

Innovation (Smart Coolers) |

Sustainability Focus |

Global Reach |

Brand Loyalty |

Distribution Network |

|

YETI Holdings Inc. |

2006 |

Austin, Texas, USA |

Hard & Soft Coolers |

- |

- |

- |

- |

- |

|

Igloo Products Corp. |

1947 |

Katy, Texas, USA |

Coolers & Freezers |

- |

- |

- |

- |

- |

|

Coleman Company, Inc. |

1900 |

Chicago, Illinois, USA |

Outdoor Gear |

- |

- |

- |

- |

- |

|

Pelican Products, Inc. |

1976 |

Torrance, California |

High-Durability |

- |

- |

- |

- |

- |

|

RTIC Outdoors |

2015 |

Houston, Texas, USA |

Premium Coolers |

- |

- |

- |

- |

- |

Global Camping Cooler Market Analysis

Market Growth Drivers

- Rise in Outdoor Recreational Activities: The camping cooler market is being driven by a notable increase in outdoor recreational activities across many countries. Data from the World Bank indicates a growing participation in outdoor activities, with over 140 million people engaging in hiking, camping, and other recreational pursuits in the US alone in 2022. The trend of outdoor leisure has expanded to other regions such as Europe and Asia, driven by increased disposable incomes and a desire for nature-based tourism. Governments are also supporting these trends through investments in national parks and outdoor recreation infrastructure, fueling demand for portable coolers.

- Increasing Popularity of Portable Coolers (Camping, Hiking, Tailgating): Portable coolers are becoming essential equipment for camping and tailgating, which have surged in popularity. The rise in road trips and camping excursions, especially in developed economies like the U.S. and parts of Europe, shows a direct correlation with sales of portable coolers. In 2023, over 50 million camping trips were taken in North America, according to travel data. The demand for compact, durable, and easily transportable coolers has increased as more people prioritize convenience during outdoor activities, boosting the market for camping coolers.

- Technological Advancements (Insulation Techniques, Lightweight Materials): Technological innovation has greatly impacted the camping cooler market, particularly through advancements in insulation techniques and materials. New lightweight materials such as high-density polyethylene (HDPE) and eco-friendly insulation technology allow for enhanced cooling retention while reducing weight. These advancements have made coolers more portable and durable, aligning with consumer preferences for convenience during outdoor activities. This technological shift is supported by an increasing focus on energy efficiency, as governments promote the use of energy-saving materials and sustainability in product design, reflecting broader environmental goals in production processes.

Market Challenges

- High Competition from Local Manufacturers: Local manufacturers present a significant challenge in the global camping cooler market, offering lower-priced alternatives to premium international brands. Many Asian countries have a high concentration of local producers using cost-effective production techniques. These small-scale producers cater primarily to regional markets, offering competitive pricing and attracting a loyal consumer base. This high level of competition restricts the ability of larger global brands to expand aggressively in these regions, driving price competition and limiting their market share. As a result, global brands must differentiate themselves through innovation and product quality.

- Volatile Raw Material Prices (Plastic, Metal): The market for camping coolers faces challenges due to fluctuating prices of key raw materials, including plastics and metals. Data from 2022 highlights that global plastic prices fluctuated between $1,200 to $1,600 per ton, affecting manufacturers' ability to maintain consistent pricing. The rising cost of aluminum, which is used in high-end coolers, also adds pressure. Such volatility impacts profit margins and forces manufacturers to adjust pricing, potentially affecting demand. As a result, companies are looking for alternative materials and more stable supply chains.

Global Camping Cooler Market Future Outlook

Over the next five years, the global camping cooler market is expected to continue its growth trajectory, driven by increasing participation in outdoor activities and rising consumer demand for durable, portable cooling solutions. Key factors contributing to this growth include advancements in cooler insulation technology, the introduction of smart coolers with IoT capabilities, and the rising popularity of eco-friendly and sustainable coolers. Manufacturers are expected to focus on catering to the eco-conscious consumer segment while integrating smart features that appeal to tech-savvy campers.

Market Opportunities:

- Growth in Adventure Tourism (Camping Culture, Outdoor Festivals): The rise of adventure tourism is creating opportunities in the camping cooler market. Countries like Canada, the U.S., and Australia saw an increase in tourism revenue from camping and outdoor festivals, contributing to higher demand for portable coolers. According to tourism data, adventure tourism in these countries generated over $15 billion in 2023 alone. The increasing popularity of outdoor festivals, such as music and food festivals, further boosts demand for durable coolers that can withstand prolonged outdoor use. This trend is expected to continue, with outdoor tourism gaining further traction globally.

- Growing Consumer Preference for Premium Coolers (High-Durability, Brand Appeal): Consumer preferences are shifting towards premium coolers that offer enhanced durability, brand appeal, and additional features. In 2023, sales data from high-end cooler brands indicated a significant rise in demand, particularly in North America and Europe, where consumers are willing to invest in durable, high-performance products. This trend is supported by growing consumer disposable income, with the average American household spending over $3,000 annually on leisure and outdoor activities. Premium coolers cater to this market by offering extended durability, better insulation, and premium branding.

Scope of the Report

|

By Product Type |

Soft-Sided Coolers Hard-Sided Coolers Electric Coolers Hybrid Coolers |

|

By Capacity |

Small (Below 25 Liters) Medium (25-50 Liters) Large (Above 50 Liters) |

|

By End-Use |

Camping & Hiking Fishing & Boating Sports & Adventure Household Use |

|

By Distribution Channel |

Offline Stores (Specialty Stores, Mass Retailers) Online Platforms (E-commerce Giants, Niche Retailers) |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Camping Equipment Manufacturers

Outdoor Retailers and Distributors

E-commerce Platforms (Amazon, Walmart)

Outdoor Enthusiasts and Adventure Tour Operators

Sustainability Advocates and Green Technology Firms

Government and Regulatory Bodies (Environmental Protection Agencies)

Investment and Venture Capitalist Firms

Adventure Tourism Promoters

Companies

Players Mention in the Report

YETI Holdings Inc.

Igloo Products Corporation

Coleman Company, Inc.

Pelican Products, Inc.

RTIC Outdoors

Stanley (A PMI Brand)

Orca Coolers

Dometic Group

Grizzly Coolers LLC

Bison Coolers

Frost River

K2 Coolers

Engel Coolers

OtterBox

Polar Bear Coolers

Table of Contents

01. Global Camping Cooler Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Volume of units sold, Retail Expansion, Seasonal Demand)

1.4 Market Segmentation Overview (Product Types, Distribution Channels, End-Use Industries)

02. Global Camping Cooler Market Size (in USD Bn)

2.1 Historical Market Size (Regional Split, Segment Split)

2.2 Year-On-Year Growth Analysis (Units Sold, Regional Demand)

2.3 Key Market Developments and Milestones (Product Innovations, Regulatory Changes, Consumer Preferences)

03. Global Camping Cooler Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Outdoor Recreational Activities

3.1.2 Increasing Popularity of Portable Coolers (Camping, Hiking, Tailgating)

3.1.3 Technological Advancements (Insulation Techniques, Lightweight Materials)

3.2 Market Challenges

3.2.1 High Competition from Local Manufacturers

3.2.2 Volatile Raw Material Prices (Plastic, Metal)

3.2.3 Environmental Concerns (Sustainability of Materials)

3.3 Opportunities

3.3.1 Rise in Eco-Friendly Coolers (Sustainable Materials, Recyclable Packaging)

3.3.2 Growth in Adventure Tourism (Camping Culture, Outdoor Festivals)

3.3.3 Integration with Digital Technologies (Smart Coolers, IoT)

3.4 Trends

3.4.1 Growing Consumer Preference for Premium Coolers (High-Durability, Brand Appeal)

3.4.2 Customization and Personalization (Custom Graphics, Branded Coolers)

3.4.3 Lightweight and Compact Designs for Urban Use

3.5 Government Regulations (Product Safety, Environmental Compliance, Trade Policies)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Suppliers, Manufacturers, Distributors, End Users)

3.8 Porters Five Forces

3.9 Competition Ecosystem (Global and Regional Players, Niche Players)

04. Global Camping Cooler Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Soft-Sided Coolers

4.1.2 Hard-Sided Coolers

4.1.3 Electric Coolers

4.1.4 Hybrid Coolers

4.2 By Capacity (In Value %)

4.2.1 Small (Below 25 Liters)

4.2.2 Medium (25-50 Liters)

4.2.3 Large (Above 50 Liters)

4.3 By End-Use (In Value %)

4.3.1 Camping & Hiking

4.3.2 Fishing & Boating

4.3.3 Sports & Adventure

4.3.4 Household Use

4.4 By Distribution Channel (In Value %)

4.4.1 Offline Stores (Specialty Stores, Mass Retailers)

4.4.2 Online Platforms (E-commerce Giants, Niche Retailers)

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

05. Global Camping Cooler Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 YETI Holdings Inc.

5.1.2 Coleman Company, Inc.

5.1.3 Igloo Products Corporation

5.1.4 Pelican Products, Inc.

5.1.5 Stanley (A PMI Brand)

5.1.6 OtterBox

5.1.7 The Coleman Company, Inc.

5.1.8 Grizzly Coolers LLC

5.1.9 RTIC Outdoors

5.1.10 Orca Coolers

5.1.11 Dometic Group

5.1.12 Bison Coolers

5.1.13 Engel Coolers

5.1.14 Frost River

5.1.15 K2 Coolers

5.2 Cross Comparison Parameters (Revenue, Market Presence, Distribution Reach, Product Innovation, Sustainability Efforts, Manufacturing Capabilities, Product Range, After-Sales Services)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

06. Global Camping Cooler Market Regulatory Framework

6.1 Product Safety Standards (Durability, Food Safety)

6.2 Compliance Requirements (Material Certifications, Environmental Regulations)

6.3 Certification Processes (ISO, Eco-friendly Certifications)

07. Global Camping Cooler Future Market Size (in USD Bn)

7.1 Future Market Size Projections (Volume and Revenue, Regional Growth)

7.2 Key Factors Driving Future Market Growth (Consumer Preferences, Technological Integration, Product Innovation)

08. Global Camping Cooler Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Capacity (In Value %)

8.3 By End-Use (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

09. Global Camping Cooler Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the camping cooler ecosystem, covering stakeholders from manufacturers to distributors. Desk research utilizing secondary databases is conducted to define critical variables such as product innovation, distribution channels, and market drivers.

Step 2: Market Analysis and Construction

This phase compiles historical data, assessing market penetration, distribution network growth, and the expansion of outdoor recreational activities globally. The analysis will cover production capabilities, pricing strategies, and end-user preferences.

Step 3: Hypothesis Validation and Expert Consultation

Through CATI (Computer Assisted Telephone Interviews) with industry experts, key market trends, product performance, and distribution strategies are validated. These interviews provide deeper insights into the operational challenges and emerging opportunities.

Step 4: Research Synthesis and Final Output

The final output includes synthesizing primary and secondary data into a coherent market outlook. This step involves validating data through cross-reference with manufacturers and distributors in key regions to ensure accuracy and comprehensiveness.

Frequently Asked Questions

01. How big is the global camping cooler market?

The global camping cooler market is valued at USD 925 billion, supported by increasing outdoor recreational activities and rising consumer demand for portable, high-quality coolers.

02. What are the key challenges in the global camping cooler market?

Challenges include fluctuating raw material prices, environmental concerns over plastic use, and the growing competition from local manufacturers offering lower-cost alternatives.

03. Who are the major players in the global camping cooler market?

Key players include YETI Holdings Inc., Igloo Products Corporation, Coleman Company, Inc., Pelican Products, Inc., and RTIC Outdoors, known for their brand strength, innovation, and wide distribution.

04. What is driving growth in the global camping cooler market?

Growth is driven by the increasing popularity of outdoor activities, product innovations like electric and hybrid coolers, and the rise of adventure tourism, particularly in North America and Europe.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.