Global Camping Equipment Market Overview

- The Global Camping Equipment Market is valued at USD 18.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing popularity of outdoor recreational activities, rising disposable incomes, and a growing trend towards sustainable living. The market has seen a surge in demand for high-quality camping gear as consumers seek durable and innovative products that enhance their outdoor experiences.

- Key players in this market include the United States, Canada, Germany, and Australia. These countries dominate the market due to their strong outdoor culture, extensive national parks, and well-established camping infrastructure. Additionally, the increasing number of camping enthusiasts and the rise of eco-tourism in these regions contribute significantly to their market leadership. North America, in particular, accounts for the largest share of the global camping equipment market.

- Recent years have seen a focus on promoting sustainable camping practices, with government agencies and park authorities in the U.S. and Europe introducing guidelines for eco-friendly camping equipment and waste management protocols in national parks. These initiatives encourage manufacturers to adopt environmentally responsible practices, aiming to preserve natural resources while enhancing the camping experience for future generations.

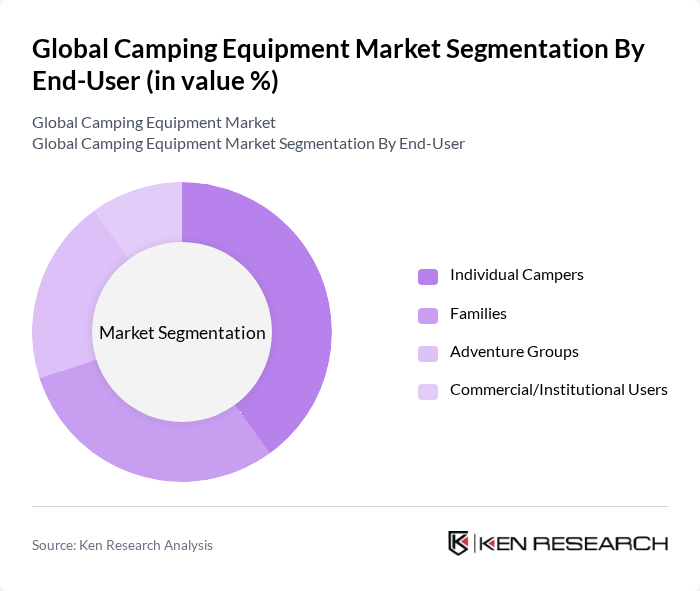

Global Camping Equipment Market Segmentation

By Product Type:The camping equipment market is segmented into various product types, including tents, sleeping bags, camping furniture, cooking systems & cookware, camping backpacks, camping gear & accessories, and others. Among these, tents and sleeping bags are the most popular due to their essential role in camping experiences. Tents provide shelter and comfort, while sleeping bags ensure warmth and convenience during outdoor activities. The demand for innovative designs, lightweight materials, and multifunctional features in these categories has led to significant market growth. Recent trends include the adoption of eco-friendly materials, compact and lightweight designs, and integration of smart technology such as solar-powered devices and GPS-enabled gear.

By End-User:The market is segmented based on end-users, including individual campers, families, adventure groups, and commercial/institutional users. Individual campers and families dominate the market, driven by the increasing trend of outdoor activities, family bonding experiences, and the influence of social media on outdoor lifestyles. The rise in adventure tourism has also led to a growing demand from adventure groups, while commercial users contribute to the market through organized camping events, outdoor education, and eco-tourism programs.

Global Camping Equipment Market Competitive Landscape

The Global Camping Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as The North Face, Coleman Company, Inc., REI Co-op, Patagonia, Inc., Black Diamond Equipment, Ltd., Big Agnes, Inc., MSR (Mountain Safety Research), Kelty, Eureka!, Outwell, Sea to Summit, Marmot Mountain, LLC, Therm-a-Rest, Vango, Nemo Equipment, Inc., Johnson Outdoors Inc., Oase Outdoors ApS, Zempire Camping Equipment, Newell Brands (owner of Coleman, Marmot, etc.) contribute to innovation, geographic expansion, and service delivery in this space.

Global Camping Equipment Market Industry Analysis

Growth Drivers

- Increasing Outdoor Recreational Activities:The global outdoor recreation market is projected to reach $887 billion by 2024, driven by a growing interest in activities such as hiking, camping, and fishing. In the U.S. alone, 50% of adults participated in outdoor activities recently, reflecting a significant increase from previous years. This surge in participation is expected to boost demand for camping equipment, as more individuals seek to engage with nature and enjoy outdoor experiences.

- Rising Popularity of Eco-Tourism:Eco-tourism is anticipated to grow to $1.2 trillion in the future, as travelers increasingly prioritize sustainable travel options. This trend is particularly evident in regions like Southeast Asia, where eco-friendly camping sites are emerging. The demand for environmentally responsible camping gear is rising, with 65% of travelers willing to pay more for sustainable products, thus driving innovation and sales in the camping equipment sector.

- Technological Advancements in Camping Gear:The camping equipment industry is witnessing rapid technological innovations, with smart gear sales projected to reach $1.5 billion in the future. Features such as solar-powered tents and portable water purifiers are becoming increasingly popular. These advancements not only enhance the camping experience but also attract tech-savvy consumers, contributing to the overall growth of the camping equipment market as more people seek high-tech solutions for outdoor adventures.

Market Challenges

- Intense Competition:The camping equipment market is characterized by fierce competition, with over 1,200 brands vying for market share. Major players like REI and The North Face dominate, making it challenging for new entrants to establish themselves. This competitive landscape can lead to price wars, reducing profit margins and making it difficult for smaller companies to sustain operations, particularly in a market projected to grow at a slower pace than anticipated.

- Seasonal Demand Fluctuations:The camping equipment market experiences significant seasonal demand fluctuations, with peak sales occurring during summer months. For instance, sales can drop by 35% during winter, impacting inventory management and cash flow for retailers. This seasonality can create challenges in maintaining consistent revenue streams, forcing companies to adapt their strategies to manage inventory effectively and mitigate financial risks associated with off-peak periods.

Global Camping Equipment Market Future Outlook

The future of the camping equipment market appears promising, driven by increasing consumer interest in outdoor activities and sustainable practices. As more individuals prioritize health and wellness, the demand for camping gear that promotes outdoor experiences is expected to rise. Additionally, the integration of smart technology into camping products will likely enhance user experiences, attracting a broader demographic. Companies that innovate and adapt to these trends will be well-positioned to capitalize on emerging opportunities in the market.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for camping equipment manufacturers. With rising disposable incomes and a growing middle class, more consumers are seeking outdoor experiences. For example, the outdoor recreation market in Asia is expected to grow by 18% annually, creating a lucrative environment for companies to introduce their products and expand their market presence.

- Development of Sustainable Products:The increasing consumer demand for eco-friendly products offers a substantial opportunity for innovation in the camping equipment sector. Companies that focus on developing sustainable materials and practices can tap into a market segment willing to pay a premium for environmentally responsible gear. This trend is supported by a recent survey indicating that 75% of consumers prefer brands that prioritize sustainability, highlighting the potential for growth in this area.