Region:Global

Author(s):Geetanshi

Product Code:KRAD0154

Pages:90

Published On:August 2025

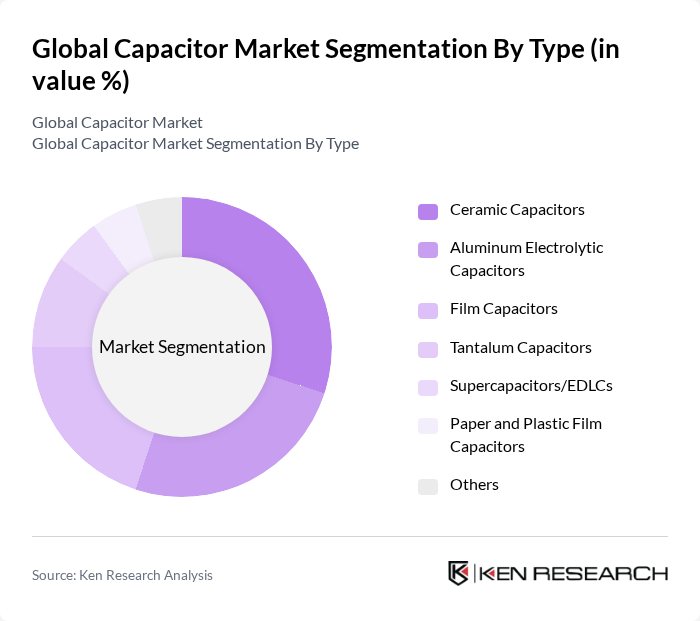

By Type:The capacitor market can be segmented into various types, including Ceramic Capacitors, Aluminum Electrolytic Capacitors, Film Capacitors, Tantalum Capacitors, Supercapacitors/EDLCs, Paper and Plastic Film Capacitors, and Others. Each type serves distinct applications and industries, with varying performance characteristics and cost structures. The demand for specific types of capacitors is influenced by technological advancements and the evolving needs of end-user industries.

The Ceramic Capacitors segment is currently dominating the market due to their widespread use in consumer electronics, automotive applications, and telecommunications. Their compact size, reliability, and cost-effectiveness make them a preferred choice for manufacturers. Additionally, advancements in materials and manufacturing processes have enhanced their performance, further driving their adoption across various industries. The increasing trend towards miniaturization in electronic devices is also contributing to the growth of ceramic capacitors.

By End-User Industry:The capacitor market is segmented by end-user industries, including Automotive, Industrial, Aerospace and Defense, Energy, Communications/Servers/Data Storage, Consumer Electronics, Medical, and Others. Each industry has unique requirements for capacitors, influencing the types and specifications of capacitors used. The automotive and consumer electronics sectors are particularly significant, driving demand for advanced capacitor technologies.

The Automotive sector is the leading end-user industry for capacitors, driven by the increasing adoption of electric vehicles and advanced driver-assistance systems (ADAS). Capacitors play a crucial role in managing power supply and energy storage in these applications. The growing trend towards electrification and automation in vehicles is expected to sustain the demand for capacitors in this sector, as manufacturers seek reliable and efficient components to enhance vehicle performance.

The Global Capacitor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Murata Manufacturing Co., Ltd., Vishay Intertechnology, Inc., AVX Corporation (a KYOCERA Group Company), KEMET Corporation (a Yageo Company), Nichicon Corporation, Panasonic Corporation, TDK Corporation, Samsung Electro-Mechanics Co., Ltd., Yageo Corporation, Rubycon Corporation, Taiyo Yuden Co., Ltd., EPCOS AG (a TDK Group Company), Illinois Capacitor (a Cornell Dubilier Company), Elna Co., Ltd., and Maxwell Technologies (a Tesla Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the capacitor market appears promising, driven by technological advancements and increasing demand across various sectors. As industries continue to prioritize energy efficiency and sustainability, the integration of capacitors in innovative applications will likely expand. Furthermore, the ongoing shift towards electric vehicles and smart grid technologies will create new avenues for growth. Companies that invest in research and development to enhance capacitor performance and sustainability will be well-positioned to capitalize on these emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Ceramic Capacitors Aluminum Electrolytic Capacitors Film Capacitors Tantalum Capacitors Supercapacitors/EDLCs Paper and Plastic Film Capacitors Others |

| By End-User Industry | Automotive Industrial Aerospace and Defense Energy Communications/Servers/Data Storage Consumer Electronics Medical Others |

| By Application | Power Supply Systems Signal Processing Energy Storage Systems Motor Drives Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Geography | Americas Europe, Middle East and Africa Asia Pacific (Excl. Japan and South Korea) Japan and South Korea |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Traditional Capacitors Advanced Capacitors Hybrid Capacitors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ceramic Capacitor Market | 100 | Product Engineers, R&D Managers |

| Electrolytic Capacitor Applications | 80 | Procurement Managers, Quality Assurance Specialists |

| Film Capacitor Usage in Renewable Energy | 70 | Project Managers, Sustainability Officers |

| Automotive Capacitor Integration | 90 | Automotive Engineers, Supply Chain Managers |

| Consumer Electronics Capacitor Trends | 85 | Product Development Managers, Market Analysts |

The Global Capacitor Market is valued at approximately USD 39 billion, driven by the increasing demand for electronic devices, renewable energy systems, and electric vehicles. This growth reflects a significant expansion in various applications, including power supply systems and energy storage solutions.