Global Car Finance Market Outlook to 2030

Region:Global

Author(s):Geetanshi

Product Code:KROD-013

June 2025

90

About the Report

Global Car Finance Market Overview

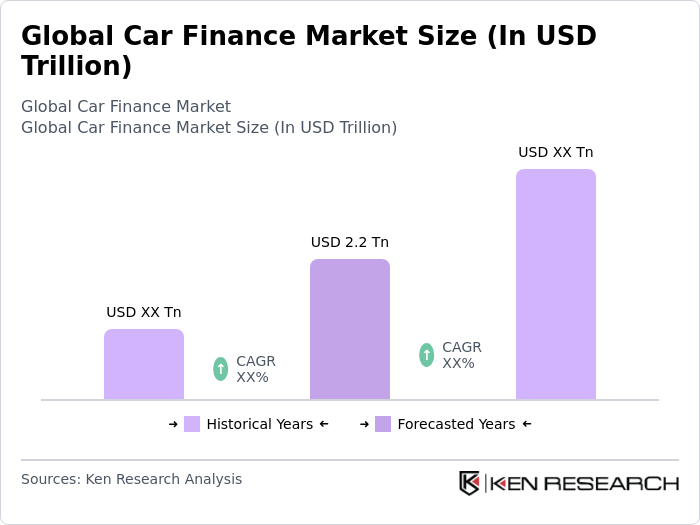

- The Global Car Finance Market was valued at USD 2.2 trillion, based on a five-year historical analysis. This robust market size is driven by increasing consumer demand for vehicles, the availability of flexible financing options, and the rapid adoption of digital platforms that streamline car loan processes. The industry has experienced a notable shift toward online financing solutions, enabling consumers to access credit and complete vehicle purchases more efficiently .

- Key markets such as the United States, Germany, and China continue to dominate the global landscape due to their expansive automotive sectors and large consumer bases. These regions benefit from the presence of established financial institutions and a rising trend toward electric vehicles, which further strengthens their leadership in shaping the future of car finance .

- n 2023, the European Union adopted Commission Implementing Regulation (EU) 2023/2083, which governs sales and transfers of credit agreements by credit institutions within the Union. This regulation enhances transparency and oversight in credit transactions, including those related to automotive financing, ensuring fair practices and consumer protection across member states.

Global Car Finance Market Segmentation

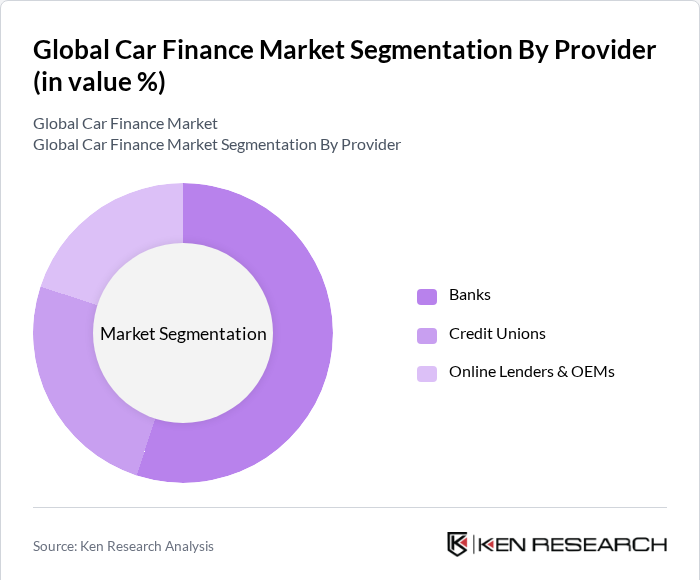

By Provider: The car finance market can be segmented by provider, including banks, credit unions, online lenders and original equipment manufacturers (OEMs). Banks remain the dominant provider, leveraging their extensive branch networks, broad financial product portfolios, and established reputations. Consumers often choose banks for their perceived reliability and competitive interest rates. Online lenders and OEMs are gaining traction, particularly among younger and tech-savvy consumers who value digital convenience and speed. The shift toward digital and direct-to-consumer platforms is reshaping the market, making financing more accessible and tailored to diverse consumer needs .

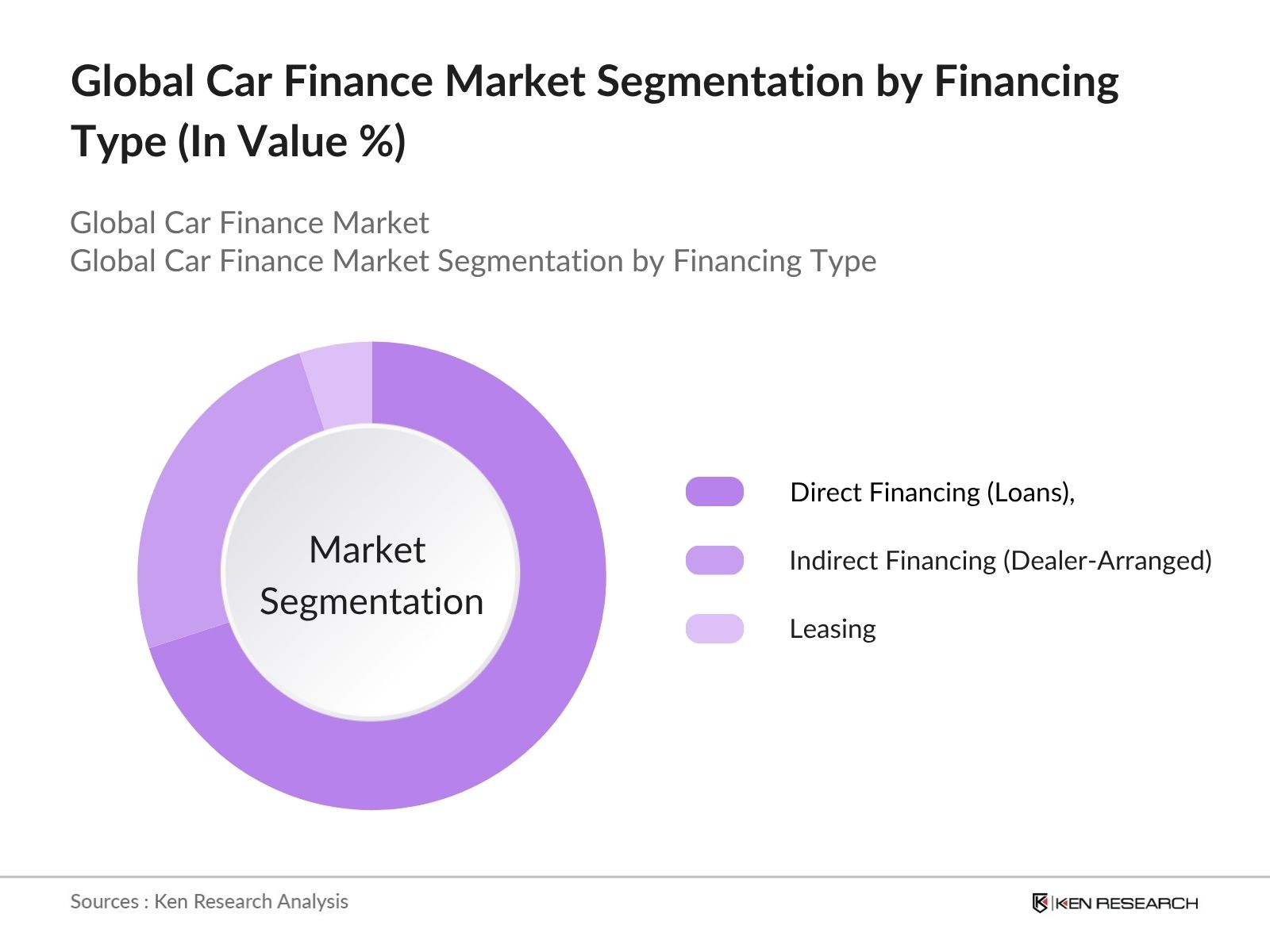

By Financing Type: The market can also be segmented by financing type, including direct financing (loans), indirect financing (dealer-arranged), and leasing. Direct financing for new vehicles remains the leading segment, propelled by strong new car sales and attractive promotional offers from manufacturers and financial institutions. Used car financing is significant as well, reflecting consumer interest in cost-effective vehicle options. Leasing continues to gain popularity, especially among younger consumers and urban populations who prefer lower monthly payments and the flexibility to upgrade vehicles more frequently.

Global Car Finance Market Competitive Landscape

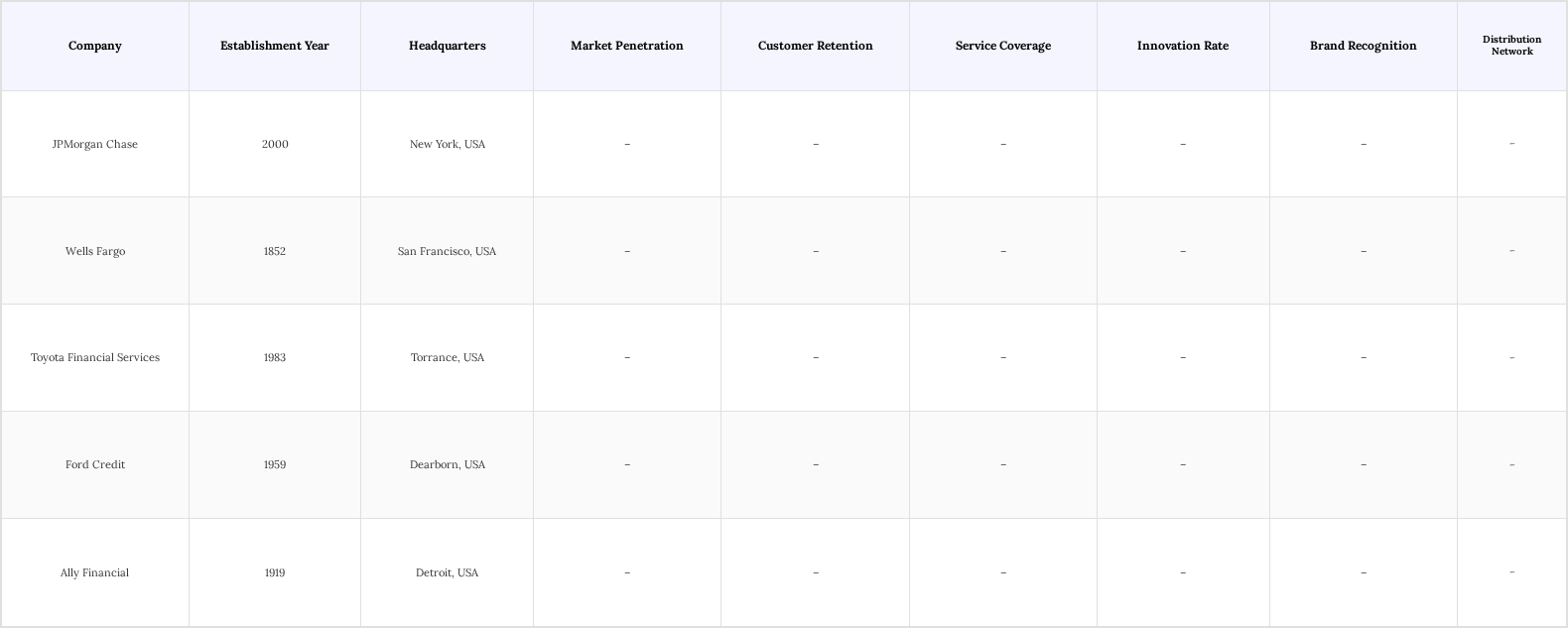

The Global Car Finance Market is characterized by a competitive landscape with several key players, including major banks and financial institutions that offer a range of financing options. Companies like JPMorgan Chase, Wells Fargo, and Toyota Financial Services are prominent in this market, leveraging their extensive networks and customer bases to provide tailored financing solutions. The market is also witnessing the emergence of fintech companies that are disrupting traditional financing models by offering innovative digital solutions.

Global Car Finance Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Vehicles: Global vehicle demand is projected to reach approximately 88.2 million units in 2024, reflecting a moderate growth of around 1.7% compared to 2023. This growth is driven by rising urbanization and population increases, particularly in emerging markets where vehicle registrations have been growing at about 5% annually. The steady rise in demand fuels the need for accessible car financing solutions, as consumers increasingly seek affordable options to purchase vehicles amid elevated prices and interest rates.

- Expansion of Financing Options: The car finance landscape is evolving rapidly, with the number of online lenders expected to increase by around 20% in 2024, offering consumers more competitive and diverse financing solutions. Interest rates for auto loans are averaging approximately 6.5%, making financing more accessible and affordable for a broader range of buyers. In October 2024 alone, about 2.1 million auto loans were originated in the U.S., totaling $63.1 billion in new loan volume—an 8.4% year-over-year increase—indicating strong consumer demand for financing options

- Rise in Disposable Income: Rising disposable incomes, especially in developing regions such as Asia-Pacific, Latin America, and parts of Africa, are empowering more consumers to invest in personal vehicles. As financial capability improves, an increasing number of individuals are seeking flexible financing options to afford vehicle ownership. Enhanced digital financing platforms and innovative credit solutions are further enabling consumers to access loans and leases more easily, fueling demand for car financing and accelerating market expansion worldwide.

Market Challenges

- Economic Fluctuations: Economic instability poses a significant challenge to the car finance market. A slowdown in economic activity can reduce consumer purchasing power, making it more difficult for potential buyers to secure financing. As a result, lenders may experience higher default rates, ultimately impacting the overall growth and stability of the car finance sector.

- Regulatory Changes: The car finance market is subject to evolving regulations that can impact financing terms. In 2024, new consumer protection laws are anticipated to be implemented, potentially increasing compliance costs for lenders. These regulations may limit the flexibility of financing options available to consumers, thereby constraining market growth as lenders adjust to the new legal landscape and modify their offerings.

Global Car Finance Market Future Outlook

The future of the car finance market appears promising, driven by technological advancements and changing consumer preferences. The shift towards digital financing solutions is expected to enhance accessibility and streamline the loan application process. Additionally, the growing interest in electric vehicles will likely lead to innovative financing options tailored to this segment, further expanding market opportunities. As sustainability becomes a priority, financing solutions that support eco-friendly vehicles will gain traction, positioning the market for robust growth in the coming years.

Market Opportunities

- Growth of Electric Vehicle Financing: Global electric vehicle sales are projected to reach 17 million units in 2024, growing over 25% year-on-year. China, Europe, and the U.S. account for about 95% of sales, with incentives and regulations accelerating adoption. Financial institutions can develop tailored financing to capture this expanding market.

- Technological Advancements in Online Lending: The rise of fintech companies is revolutionizing the car finance landscape. By leveraging technology, lenders can offer faster loan approvals and personalized financing solutions. This trend is expected to attract a younger demographic, increasing market share and fostering competition among traditional and online lenders in the car finance market.

Scope of the Report

| By Provider |

Banks Credit Unions Original Equipment Manufacturers (OEMs) Online Lenders |

| By Financing Type |

Direct Financing (Loans) Indirect Financing (Dealer-Arranged) Leasing |

| By Vehicle Type |

Passenger Cars Commercial Vehicles Electric Vehicles |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Loan Duration |

Short-Term Loans Medium-Term Loans Long-Term Loans |

| By Customer Type |

Individual Customers Corporate Customers |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Financial Conduct Authority, Consumer Financial Protection Bureau)

Automobile Manufacturers

Automotive Dealerships

Financial Institutions (e.g., Banks, Credit Unions)

Insurance Companies

Leasing Companies

Fintech Companies specializing in Automotive Finance

Companies

Players Mentioned in the Report:

JPMorgan Chase

Wells Fargo

Toyota Financial Services

Ford Credit

Ally Financial

AutoLend Solutions

DriveCapital Finance

CarLease Innovations

FinAuto Partners

VehicleValue Finance

Table of Contents

1. Global Car Finance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Car Finance Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Car Finance Market Analysis

3.1. Growth Drivers

3.1.1. Increasing consumer demand for vehicles

3.1.2. Expansion of financing options and competitive interest rates

3.1.3. Rise in disposable income and urbanization trends

3.2. Market Challenges

3.2.1. Economic fluctuations affecting consumer purchasing power

3.2.2. Regulatory changes impacting financing terms

3.2.3. High levels of debt among consumers

3.3. Opportunities

3.3.1. Growth of electric vehicle financing options

3.3.2. Technological advancements in online lending platforms

3.3.3. Increasing partnerships between automakers and financial institutions

3.4. Trends

3.4.1. Shift towards digital and mobile financing solutions

3.4.2. Growing popularity of subscription-based vehicle financing

3.4.3. Enhanced focus on sustainability and green financing options

3.5. Government Regulation

3.5.1. Consumer protection laws affecting financing agreements

3.5.2. Regulations on interest rates and lending practices

3.5.3. Environmental regulations influencing vehicle financing

3.5.4. Tax incentives for electric vehicle financing

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Car Finance Market Segmentation

4.1. By Provider

4.1.1. Banks

4.1.2. Credit Unions

4.1.3. Original Equipment Manufacturers (OEMs)

4.1.4. Online Lenders

4.2. By Financing Type

4.2.1. Direct Financing (Loans)

4.2.2. Indirect Financing (Dealer-Arranged)

4.2.3. Leasing

4.3. By Vehicle Type

4.3.1. Passenger Cars

4.3.2. Commercial Vehicles

4.3.3. Electric Vehicles

4.4. By Region

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

4.5. By Loan Duration

4.5.1. Short-Term Loans

4.5.2. Medium-Term Loans

4.5.3. Long-Term Loans

4.6. By Customer Type

4.6.1. Individual Customers

4.6.2. Corporate Customers

5. Global Car Finance Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. JPMorgan Chase

5.1.2. Wells Fargo

5.1.3. Toyota Financial Services

5.1.4. Ford Credit

5.1.5. Ally Financial

5.1.6. AutoLend Solutions

5.1.7. DriveCapital Finance

5.1.8. CarLease Innovations

5.1.9. FinAuto Partners

5.1.10. VehicleValue Finance

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Customer Satisfaction Index

5.2.4. Loan Approval Turnaround Time

5.2.5. Interest Rate Competitiveness

5.2.6. Product Diversification

5.2.7. Digital Presence and Accessibility

5.2.8. Brand Reputation and Trustworthiness

6. Global Car Finance Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Car Finance Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Car Finance Market Future Market Segmentation

8.1. By Provider

8.1.1. Banks

8.1.2. Credit Unions

8.1.3. Original Equipment Manufacturers (OEMs)

8.1.4. Online Lenders

8.2. By Financing Type

8.2.1. Direct Financing (Loans)

8.2.2. Indirect Financing (Dealer-Arranged)

8.2.3. Leasing

8.3. By Vehicle Type

8.3.1. Passenger Cars

8.3.2. Commercial Vehicles

8.3.3. Electric Vehicles

8.4. By Region

8.4.1. North America

8.4.2. Europe

8.4.3. Asia-Pacific

8.4.4. Latin America

8.4.5. Middle East & Africa

8.5. By Loan Duration

8.5.1. Short-Term Loans

8.5.2. Medium-Term Loans

8.5.3. Long-Term Loans

8.6. By Customer Type

8.6.1. Individual Customers

8.6.2. Corporate Customers

9. Global Car Finance Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key stakeholders and components within the Global Car Finance Market. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather relevant industry insights. The primary goal is to pinpoint and define the essential variables that drive market behavior and trends.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical data related to the Global Car Finance Market. This includes evaluating market penetration rates, the relationship between service providers and consumers, and the resulting financial outcomes. Additionally, we will assess service quality metrics to ensure the accuracy and reliability of the revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts from various sectors. These consultations will yield critical operational and financial insights, enhancing the understanding of market dynamics and helping to refine the initial data collected.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple stakeholders to gather in-depth insights into product categories, sales trends, consumer behavior, and other relevant factors. This engagement will help to validate and enrich the data obtained through previous steps, ensuring a thorough and accurate analysis of the Global Car Finance Market.

Frequently Asked Questions

01. How big is the Global Car Finance Market?

The Global Car Finance Market is valued at USD 2.2 trillion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Car Finance Market?

Key challenges in the Global Car Finance Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Car Finance Market?

Major players in the Global Car Finance Market include JPMorgan Chase, Wells Fargo, Toyota Financial Services, Ford Credit, Ally Financial, among others.

04. What are the growth drivers for the Global Car Finance Market?

The primary growth drivers for the Global Car Finance Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.