Global Carbon Fiber Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD9809

December 2024

85

About the Report

Global Carbon Fiber Market Overview

- The global carbon fiber market, valued at USD 7 billion, has been driven primarily by the increased demand for lightweight and high-strength materials across multiple industries. Key sectors such as aerospace, automotive, energy, and sports equipment manufacturing are major contributors to the growth. Carbon fiber's high tensile strength, low weight, and corrosion resistance make it ideal for replacing metals in structural components, which further enhances its market appeal. The automotive industry, particularly the electric vehicle (EV) sector, continues to invest in carbon fiber for improving fuel efficiency and reducing emissions.

- The market is dominated by regions like North America, Europe, and Asia-Pacific, where advanced manufacturing capabilities and strong demand for carbon fiber across key industries such as aerospace and automotive are concentrated. North America's dominance is driven by large aerospace and defense projects, while Europe benefits from its leadership in automotive innovation, including EV production. Asia-Pacific, with a growing emphasis on renewable energy and wind power projects, is also a significant player due to its burgeoning manufacturing base.

- The carbon fiber manufacturing process is subject to increasing environmental regulations aimed at minimizing carbon footprints and ensuring sustainable practices. As of 2022, the U.S. Environmental Protection Agency (EPA) has established stricter emissions standards for manufacturing facilities, which directly affect carbon fiber producers. Compliance with these regulations is essential for maintaining market access, driving manufacturers to adopt cleaner technologies and processes.

Global Carbon Fiber Market Segmentation

By Product Type: The carbon fiber market is segmented by product type into continuous carbon fiber, long carbon fiber, and short carbon fiber. Continuous carbon fiber holds the dominant market share due to its superior mechanical properties and widespread application in critical industries such as aerospace and automotive. Its higher strength-to-weight ratio and ability to be woven into composite materials make it the most versatile and high-performing option across sectors, giving it a clear advantage in the market.

By Region: The carbon fiber market is segmented regionally into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America remains the leading region due to high investments in aerospace, defense, and automotive industries. The region's advanced research and development capabilities in these sectors make it a prime consumer of carbon fiber. Europe follows closely with its focus on lightweight vehicles and wind energy. Asia-Pacific is rapidly emerging as a key player due to its growing manufacturing capabilities and increased demand from the energy sector, particularly for wind turbine components.

By Raw Material: The market is segmented by raw materials into Polyacrylonitrile (PAN)-based carbon fiber, pitch-based carbon fiber, and rayon-based carbon fiber. PAN-based carbon fiber dominates the market due to its superior strength, stiffness, and cost-effectiveness. It is primarily used in aerospace, automotive, and construction applications where high-performance materials are required. Pitch-based carbon fiber is used in more niche applications like thermal insulation and high-temperature environments due to its heat resistance properties.

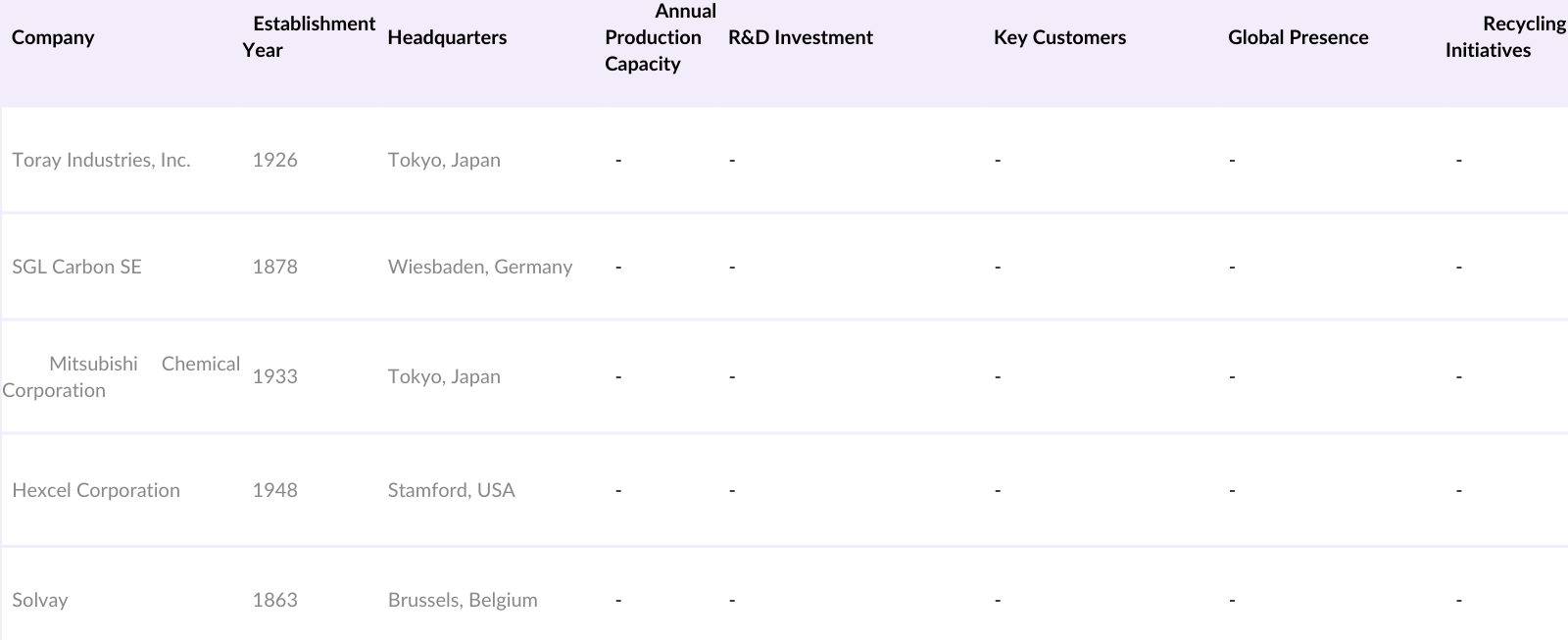

Global Carbon Fiber Market Competitive Landscape

The global carbon fiber market is characterized by the presence of a few key players who dominate due to their technological expertise, production capabilities, and established relationships with key industries such as aerospace, automotive, and energy. The market's consolidation is evident in the limited number of players who control a significant portion of the production and distribution. Companies like Toray Industries, Hexcel Corporation, and Mitsubishi Chemical Corporation have been at the forefront due to their innovations and large-scale production facilities.

Global Carbon Fiber Industry Analysis

Growth Drivers

- Increasing Demand for Lightweight Materials in Aerospace & Automotive: The aerospace and automotive industries are experiencing a significant shift towards lightweight materials, including carbon fiber, due to stringent fuel efficiency regulations and environmental concerns. In 2022, the aviation sector reported that fuel costs accounted for approximately 28% of operating expenses, driving manufacturers to seek lightweight alternatives to reduce weight and enhance efficiency. Carbon fiber composites, being lighter than aluminum and steel, contribute significantly to reducing emissions. As of 2024, the global aviation sector is projected to implement measures that could save 20 million metric tons of CO2 annually through weight reductions.

- Rising Adoption in Renewable Energy Applications (Wind Turbines): The renewable energy sector, particularly wind energy, is witnessing a substantial increase in the adoption of carbon fiber materials. Wind turbine blades made from carbon fiber are typically 20% lighter and exhibit superior strength compared to traditional materials, resulting in higher energy production efficiency. In 2022, the global wind energy sector contributed over 10% of the world's electricity supply, with a forecast of nearly 2,000 GW of installed capacity by 2025. This growth translates to a need for advanced materials like carbon fiber to support the manufacturing of larger and more efficient turbine blades.

- Expansion in Sports & Leisure Equipment Manufacturing: The sports and leisure equipment market is increasingly integrating carbon fiber into product designs due to its strength-to-weight ratio and durability. For instance, high-end bicycles, tennis rackets, and fishing rods have all adopted carbon fiber composites to enhance performance while minimizing weight. The global sports equipment market was valued at approximately $160 billion in 2022 and is expected to see a continuous rise as manufacturers shift to advanced materials, with carbon fiber being a key driver of innovation and performance. This trend is supported by consumer demand for high-performance, lightweight sporting goods.

Market Restraints

- High Production Costs of Carbon Fiber: Despite the advantages of carbon fiber, its high production costs remain a significant barrier to widespread adoption. The manufacturing process is complex and energy-intensive, with production costs reaching approximately $20 to $30 per kilogram as of 2022. This expense limits its use to high-value applications, thereby restricting market growth. Additionally, the global supply chain disruptions and raw material shortages faced in recent years have further exacerbated these costs, prompting manufacturers to seek more cost-effective alternatives while maintaining quality and performance.

- Recycling and End-of-Life Disposal Issues: The carbon fiber industry faces substantial challenges regarding recycling and disposal at the end of product life. Currently, less than 5% of carbon fiber products are recycled due to the complexities involved in reclaiming the material, leading to significant environmental concerns. As of 2022, the disposal of carbon fiber waste contributes to the global issue of composite waste, which is projected to exceed 20 million metric tons by 2025. Addressing these environmental challenges is crucial for sustainable growth in the carbon fiber market, compelling manufacturers to invest in innovative recycling technologies.

Global Carbon Fiber Market Future Outlook

Over the next five years, the global carbon fiber market is expected to show significant growth, driven by increased demand for lightweight and high-strength materials across sectors such as aerospace, automotive, and renewable energy. The ongoing advancements in manufacturing technologies, such as automation and recycling solutions, will further reduce the cost of carbon fiber production, making it more accessible to a broader range of industries. Additionally, the global shift towards sustainability and carbon neutrality is anticipated to boost the adoption of carbon fiber in various applications, especially in electric vehicles and wind turbines.

Market Opportunities

- Technological Advancements in Manufacturing Processes: Technological advancements in carbon fiber manufacturing processes present significant opportunities for market growth. Innovations such as automated fiber placement and advanced weaving techniques have the potential to reduce production costs by up to 25% by improving efficiency and yield rates. In 2022, several companies reported investments exceeding $200 million in research and development focused on cost-effective carbon fiber production methods. As these technologies mature, the market is likely to expand, enabling broader adoption across various industries.

- Rising Demand from Emerging Markets: Emerging markets, particularly in the Asia-Pacific region, are experiencing a surge in demand for carbon fiber products. The Asia-Pacific aerospace sector alone is expected to reach an estimated value of $139 billion by 2025, driven by increasing passenger traffic and the expansion of low-cost carriers. This demand presents substantial growth opportunities for carbon fiber manufacturers, as the region seeks lightweight materials to enhance fuel efficiency and reduce emissions. Investment in local manufacturing capabilities is essential to capitalize on this growth trend.

Scope of the Report

|

Product Type |

Continuous Carbon Fiber Long Carbon Fiber Short Carbon Fiber |

|

Raw Material |

Polyacrylonitrile (PAN)-based Pitch-based, Rayon-based |

|

End-Use Industry |

Aerospace & Defense Automotive Energy Sports & Leisure Construction & Infrastructure |

|

Application |

Structural Parts Pressure Vessels Energy Storage Systems Composite Materials |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Aerospace and Defense Manufacturers

Automotive Manufacturers

Wind Energy Companies

Sports Equipment Manufacturers

Construction and Infrastructure Firms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Federal Aviation Administration, European Union Aviation Safety Agency)

Energy Companies (Wind Turbine Manufacturers)

Companies

Players Mentioned in the Report:

Toray Industries, Inc.

SGL Carbon SE

Mitsubishi Chemical Corporation

Hexcel Corporation

Solvay

Teijin Limited

Zoltek Corporation

Formosa Plastics Corporation

Hyosung Corporation

DowAksa

Table of Contents

1. Global Carbon Fiber Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Carbon Fiber Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Carbon Fiber Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Lightweight Materials in Aerospace & Automotive

3.1.2. Rising Adoption in Renewable Energy Applications (Wind Turbines)

3.1.3. Expansion in Sports & Leisure Equipment Manufacturing

3.1.4. Growing Use in Construction & Infrastructure (High-Tensile Strength, Low Weight)

3.2. Market Challenges

3.2.1. High Production Costs of Carbon Fiber

3.2.2. Recycling and End-of-Life Disposal Issues

3.2.3. Supply Chain Vulnerabilities (Raw Material Shortages, Manufacturing Constraints)

3.3. Opportunities

3.3.1. Technological Advancements in Manufacturing Processes (Lower-Cost Carbon Fiber Production)

3.3.2. Rising Demand from Emerging Markets (Asia-Pacific Expansion)

3.3.3. Growth in Electric Vehicle (EV) Manufacturing

3.3.4. Partnerships for Advanced Composite Solutions (Aerospace, Defense Sectors)

3.4. Trends

3.4.1. Automation in Carbon Fiber Production (Reduced Cycle Times, Enhanced Efficiency)

3.4.2. Increased Focus on Sustainable and Recyclable Carbon Fiber Solutions

3.4.3. Development of Multi-Material Composites (Hybrid Structures)

3.5. Regulatory Framework

3.5.1. Government Incentives for Lightweight Material Adoption (Carbon Neutrality Goals)

3.5.2. Environmental Regulations on Carbon Fiber Manufacturing

3.5.3. Certification Requirements (Aerospace, Automotive Standards)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Carbon Fiber Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Continuous Carbon Fiber

4.1.2. Long Carbon Fiber

4.1.3. Short Carbon Fiber

4.2. By Raw Material (In Value %)

4.2.1. Polyacrylonitrile (PAN)-based Carbon Fiber

4.2.2. Pitch-based Carbon Fiber

4.2.3. Rayon-based Carbon Fiber

4.3. By End-Use Industry (In Value %)

4.3.1. Aerospace & Defense

4.3.2. Automotive

4.3.3. Energy (Wind Turbines, Oil & Gas)

4.3.4. Sports & Leisure

4.3.5. Construction & Infrastructure

4.4. By Application (In Value %)

4.4.1. Structural Parts (Chassis, Body Panels, Frames)

4.4.2. Pressure Vessels

4.4.3. Energy Storage Systems

4.4.4. Composite Materials

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Carbon Fiber Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Toray Industries, Inc.

5.1.2. SGL Carbon

5.1.3. Mitsubishi Chemical Corporation

5.1.4. Hexcel Corporation

5.1.5. Solvay

5.1.6. Teijin Limited

5.1.7. Formosa Plastics Corporation

5.1.8. Zoltek Corporation

5.1.9. Hyosung Corporation

5.1.10. DowAksa

5.1.11. Zhongfu Shenying Carbon Fiber Co., Ltd.

5.1.12. Jiangsu Hengshen Co., Ltd.

5.1.13. Carbon Nexus

5.1.14. Park Aerospace Corp.

5.1.15. Nippon Carbon Co., Ltd.

5.2. Cross Comparison Parameters (Number of Production Plants, Fiber Output Capacity, Regional Presence, Revenue, R&D Investment, Carbon Fiber Recycling Capabilities, Partnerships, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Carbon Fiber Market Regulatory Framework

6.1. Environmental Standards (Emissions, Waste Handling)

6.2. Compliance Requirements (Industry-Specific Certifications)

6.3. Certification Processes (Aerospace, Automotive)

7. Global Carbon Fiber Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Carbon Fiber Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Raw Material (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Global Carbon Fiber Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involved the mapping of the carbon fiber market, identifying key industry stakeholders such as manufacturers, raw material suppliers, and end-users in aerospace, automotive, and energy. Extensive desk research was conducted using industry reports, government publications, and proprietary databases to gather information on market size, production capacities, and key trends.

Step 2: Market Analysis and Construction

In this phase, historical market data was analyzed, focusing on carbon fiber production, consumption patterns, and industry penetration rates. Industry-specific variables such as material strength, cost, and environmental regulations were taken into account to project future market developments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through structured interviews with industry experts from major carbon fiber manufacturers and end-user industries. Their insights on operational challenges, pricing trends, and future market opportunities helped refine the market estimates and forecasts.

Step 4: Research Synthesis and Final Output

The final synthesis combined data from industry reports and expert consultations to provide a detailed market analysis. Production statistics, competitive landscape data, and consumer preferences were integrated to ensure a comprehensive and accurate representation of the market dynamics.

Frequently Asked Questions

01. How big is the global carbon fiber market?

The global carbon fiber market was valued at USD 7 billion, driven by its growing use in the aerospace, automotive, and renewable energy sectors.

02. What are the challenges in the global carbon fiber market?

Challenges include the high production costs, recycling difficulties, and supply chain vulnerabilities that arise from dependence on specific raw materials.

03. Who are the major players in the global carbon fiber market?

Key players include Toray Industries, SGL Carbon, Mitsubishi Chemical Corporation, Hexcel Corporation, and Solvay. These companies dominate due to their advanced production techniques and established relationships with key industries.

04. What are the growth drivers of the global carbon fiber market?

Growth drivers include increasing demand for lightweight and high-strength materials in aerospace and automotive industries, alongside the growing emphasis on renewable energy projects like wind turbines.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.