Global Cardiopulmonary Bypass Accessory Equipment Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD9771

December 2024

86

About the Report

Global Cardiopulmonary Bypass Accessory Equipment Market Overview

- The global cardiopulmonary bypass (CPB) accessory equipment market is valued at USD 2.8 billion. This market has experienced consistent growth due to the rising number of cardiac surgeries, increasing prevalence of cardiovascular diseases, and advancements in medical technology, specifically in minimally invasive surgeries. Innovations in CPB equipment, designed to enhance safety and outcomes, have also fueled demand. Hospitals, ambulatory surgical centers, and specialty clinics have become key adopters, as the importance of high-quality CPB accessory equipment has become integral to improving patient care in cardiac surgeries.

- The United States, Japan, and Germany dominate the CPB accessory equipment market, attributed to their advanced healthcare infrastructures and high incidences of cardiovascular diseases. Additionally, these countries have strong healthcare spending and a greater number of cardiac care facilities, which increases the demand for cutting-edge equipment. These regions also benefit from a larger presence of key market players and robust funding in medical research and development, giving them a clear competitive advantage.

- The regulatory framework governing cardiopulmonary bypass accessory equipment is designed to ensure that all products meet safety and efficacy standards before they reach the market. In the U.S., for instance, medical devices must undergo a premarket approval (PMA) or 510(k) submission process with the FDA. This process requires extensive clinical data demonstrating the device's safety and effectiveness, which can take years to complete, impacting the speed of innovation and availability of new technologies in the market.

Global Cardiopulmonary Bypass Accessory Equipment Market Segmentation

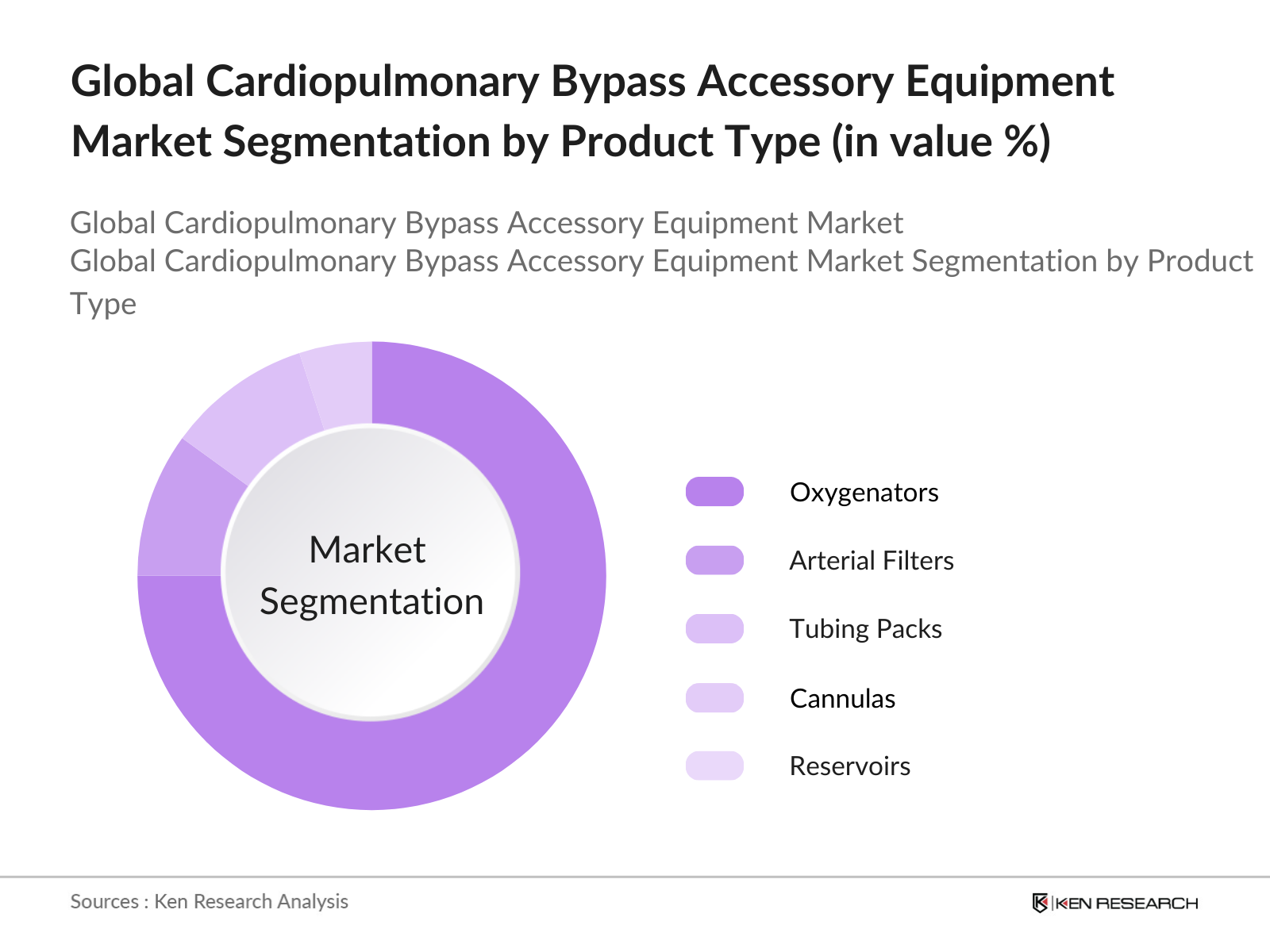

By Product Type: The market is segmented by product type into oxygenators, arterial filters, tubing packs, cannulas, and reservoirs. Oxygenators hold a dominant share within this segment due to their critical role in ensuring oxygenated blood during cardiac surgeries. Recent technological advancements in membrane oxygenators, which offer improved gas exchange efficiency, have increased their popularity among surgeons and medical professionals. These products are crucial in high-stakes cardiac procedures, making them an essential component in the product mix.

By Application: The CPB accessory equipment market is segmented by application into coronary artery bypass grafting (CABG), heart valve replacement, and other open-heart surgeries. CABG procedures dominate due to the high prevalence of coronary artery disease and the need for revascularization procedures. This segment has seen increasing adoption of CPB equipment, particularly in regions with a growing elderly population. CABGs critical nature has led to higher demand for reliable CPB accessories that enhance surgical success rates and patient recovery outcomes.

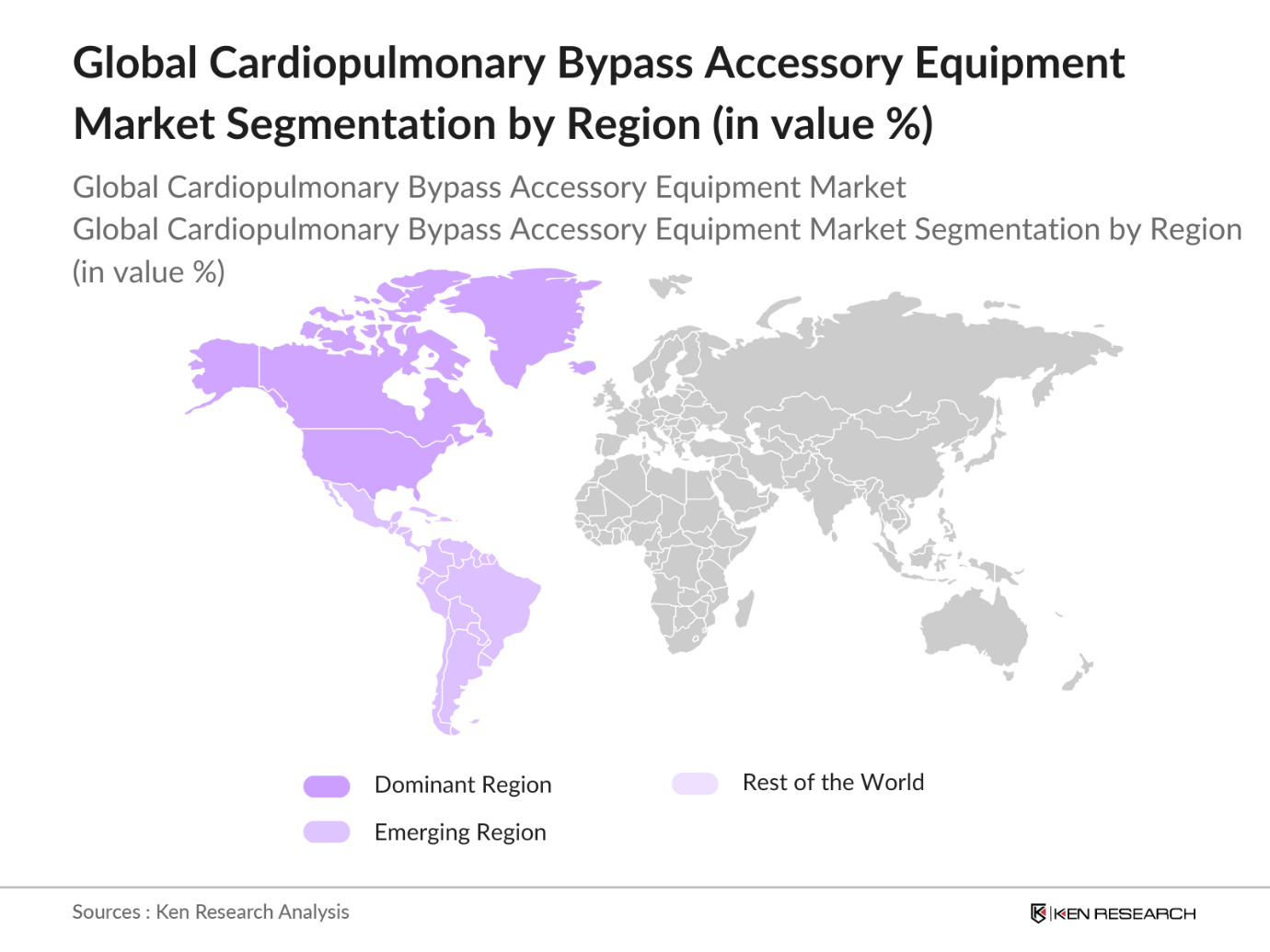

By Region

The market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America leads the market due to its advanced healthcare infrastructure, high healthcare expenditure, and supportive government policies. The availability of specialized cardiac surgery centers and high awareness of advanced treatment options also support North Americas market dominance. The Asia Pacific region, on the other hand, is experiencing significant growth due to rising healthcare investments and increasing incidences of cardiac diseases in densely populated countries like China and India.

Global Cardiopulmonary Bypass Accessory Equipment Market Competitive Landscape

The global CPB accessory equipment market is dominated by key players who lead through innovation, quality, and a strong distribution network. This concentration of market share among a few major players reflects the importance of technological expertise and brand reputation in this industry. The competitive environment encourages ongoing product advancements, particularly in oxygenators and arterial filters, to enhance patient outcomes in critical cardiac surgeries.

Global Cardiopulmonary Bypass Accessory Equipment Market Analysis

Growth Drivers

- Increasing Prevalence of Cardiovascular Diseases (CDs): Cardiovascular diseases are a leading cause of morbidity and mortality worldwide. In 2023, an estimated 17.9 million people died from CDs, representing 32% of all global deaths, as reported by the World Health Organization. This high prevalence of CDs significantly drives demand for cardiopulmonary bypass accessory equipment used in surgeries and interventions. The rising burden of conditions such as coronary artery disease, heart failure, and arrhythmias is expected to sustain the growth trajectory of the market.

- Rising Surgical Procedures and Interventions: The number of surgical procedures worldwide is on the rise, with millions of heart surgeries performed each year. In the United States alone, around 1.2 million coronary artery bypass grafting procedures are performed annually, a number projected to increase as the population ages and the prevalence of heart diseases rises. This surge in surgical interventions necessitates advanced cardiopulmonary bypass accessory equipment, providing substantial growth potential for manufacturers in this market.

- Technological Advancements in Medical Devices: The cardiopulmonary bypass equipment sector is witnessing rapid technological advancements, leading to more efficient, safer, and user-friendly devices. Innovations like integrated monitoring systems and miniaturized equipment are enhancing the performance and outcomes of cardiac surgeries. The adoption of advanced materials and smart technologies is creating opportunities for manufacturers to develop next-generation products, further stimulating market growth.

Challenges

- High Costs of Cardiopulmonary Bypass Equipment: The financial burden associated with cardiopulmonary bypass equipment poses a significant challenge to healthcare providers, particularly in developing regions. The average cost of advanced cardiopulmonary bypass machines can range from $30,000 to $200,000, making it difficult for hospitals, especially smaller facilities, to invest in such technology. This high cost can lead to delayed surgeries and limited access to necessary equipment, ultimately impacting patient outcomes and driving disparities in healthcare access.

- Stringent Regulatory Requirements: The cardiopulmonary bypass accessory equipment market is subject to rigorous regulatory scrutiny from health authorities like the FDA and EMA. These regulations encompass manufacturing standards, clinical trial requirements, and post-market surveillance, which can prolong the time to market and increase development costs. Compliance with these stringent guidelines is essential for ensuring patient safety and efficacy, yet can be a significant barrier for new entrants and innovators in the field, thereby hindering market growth.

Global Cardiopulmonary Bypass Accessory Equipment Market Future Outlook

The CPB accessory equipment market is expected to experience significant growth over the next five years, driven by increasing cardiac disease rates, technological advancements, and expansion of healthcare facilities in emerging economies. The rising global demand for effective cardiac care solutions will spur innovation in equipment design and performance, making the market a focal point for research and development activities. Additionally, ongoing support from healthcare providers and institutions will encourage further adoption of advanced CPB accessories.

Opportunities

- Growth in Emerging Markets: The increasing healthcare expenditure in emerging economies presents a significant opportunity for the cardiopulmonary bypass accessory equipment market. Countries such as India and Brazil are experiencing rapid growth in their healthcare sectors, driven by urbanization and rising incomes. In India, for instance, healthcare spending is projected to reach $280 billion by 2025, creating a demand for advanced medical technologies, including cardiopulmonary bypass equipment. This trend allows manufacturers to expand their market presence and tap into previously underserved regions, driving growth and innovation in product offerings.

- Innovations in Minimally Invasive Procedures: The shift towards minimally invasive surgical techniques is revolutionizing the cardiopulmonary bypass landscape. Innovations such as endoscopic heart surgery and robotic-assisted procedures are gaining traction due to their benefits, including reduced recovery times and lower complication rates. The adoption of these techniques increases the demand for specialized cardiopulmonary bypass accessories that cater to these evolving surgical practices. Companies that invest in R&D to develop compatible technologies are well-positioned to capitalize on this growing trend.

Scope of the Report

|

Segmentation |

Sub-segments |

|

Product Type |

Oxygenators, Cannulae, Heat Exchangers, Blood Reservoirs |

|

Application |

Adult Cardiac Surgery, Pediatric Cardiac Surgery, Thoracic Surgery |

|

End User |

Hospitals, Surgical Centers, Research Institutes |

|

Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Cardiovascular Hospitals and Surgical Centers

Cardiology Specialty Clinics

Medical Equipment Distributors

Cardiovascular Surgeons and Anesthesiologists

Academic Medical Centers and Research Institutes

Health Insurance Companies

Government and Regulatory Bodies (e.g., FDA, EMA)

Investor and Venture Capitalist Firms

Companies

Players mentioned in the report

Medtronic

Terumo Cardiovascular

LivaNova PLC

Getinge AB

Edwards Lifesciences

Sorin Group

Maquet Cardiovascular

Braile Biomdica

Boston Scientific Corporation

Abbott Laboratories

W. L. Gore & Associates

Nipro Corporation

Eurosets Srl

Kewei (Guangzhou) Medical Instrument Co., Ltd.

SynCardia Systems, LLC

Table of Contents

1. Global Cardiopulmonary Bypass Accessory Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR)

1.4. Market Segmentation Overview

2. Global Cardiopulmonary Bypass Accessory Equipment Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Cardiopulmonary Bypass Accessory Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Cardiovascular Diseases (Prevalence Rate)

3.1.2. Advancements in Surgical Techniques (Technological Adoption Rates)

3.1.3. Rise in Elderly Population (Demographic Trends)

3.1.4. Increasing Healthcare Expenditure (Government Spending on Healthcare)

3.2. Market Challenges

3.2.1. High Cost of Equipment (Market Pricing Dynamics)

3.2.2. Complications Associated with Cardiopulmonary Bypass (Clinical Data on Complications)

3.2.3. Shortage of Skilled Professionals (Workforce Statistics)

3.3. Opportunities

3.3.1. Growth in Emerging Markets (Market Expansion Potential)

3.3.2. Technological Innovations (Research & Development Investment)

3.3.3. Partnerships and Collaborations (M&A Activity)

3.4. Trends

3.4.1. Adoption of Minimally Invasive Techniques (Market Shifts)

3.4.2. Integration of AI in Cardiac Surgery (AI Implementation Rates)

3.5. Government Regulation

3.5.1. Regulatory Frameworks for Medical Devices (Compliance Guidelines)

3.5.2. Safety Standards and Guidelines (Health Authority Recommendations)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Cardiopulmonary Bypass Accessory Equipment Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Oxygenators

4.1.2. Cannulae

4.1.3. Heat Exchangers

4.1.4. Blood Reservoirs

4.2. By Application (In Value %)

4.2.1. Adult Cardiac Surgery

4.2.2. Pediatric Cardiac Surgery

4.2.3. Thoracic Surgery

4.3. By End User (In Value %)

4.3.1. Hospitals

4.3.2. Surgical Centers

4.3.3. Research Institutes

4.4. By Region (In Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

5. Global Cardiopulmonary Bypass Accessory Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Terumo Corporation

5.1.2. Medtronic PLC

5.1.3. Sorin Group

5.1.4. Getinge AB

5.1.5. Abbott Laboratories

5.1.6. Boston Scientific Corporation

5.1.7. Edwards Lifesciences Corporation

5.1.8. JenaValve Technology, Inc.

5.1.9. LivaNova PLC

5.1.10. MAQUET GmbH & Co. KG

5.1.11. St. Jude Medical, Inc.

5.1.12. Canon Medical Systems Corporation

5.1.13. EBM, Inc.

5.1.14. Biotronik SE & Co. KG

5.1.15. Renu Medical, Inc.

5.2. Cross Comparison Parameters (Market Share, Product Portfolio, Innovation Index, Revenue, Global Reach, Distribution Network, Manufacturing Capabilities, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Cardiopulmonary Bypass Accessory Equipment Market Regulatory Framework

6.1. International Regulatory Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Cardiopulmonary Bypass Accessory Equipment Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Cardiopulmonary Bypass Accessory Equipment Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End User (In Value %)

8.4. By Region (In Value %)

9. Global Cardiopulmonary Bypass Accessory Equipment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the cardiopulmonary bypass accessory equipment market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data for the CPB accessory equipment market, including assessing market penetration, provider ratios, and revenue generation. An evaluation of service quality statistics will ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert consultations with industry professionals. These consultations provide operational and financial insights directly from practitioners, instrumental in refining the market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with major CPB accessory equipment manufacturers to gain insights into product segments, sales performance, and consumer preferences, verifying and complementing the data derived from other methodologies for a comprehensive analysis.

Frequently Asked Questions

01. How big is the Global Cardiopulmonary Bypass Accessory Equipment Market?

The global CPB accessory equipment market is valued at USD 2.8 billion, driven by the growing number of cardiac surgeries and innovations in medical technology.

02. What are the growth drivers in the Global CPB Accessory Equipment Market?

Key growth drivers include the increasing prevalence of cardiovascular diseases, advancements in surgical technologies, and the expansion of cardiac specialty clinics worldwide.

03. Which regions lead the Global CPB Accessory Equipment Market?

North America and Europe are leaders in the market due to advanced healthcare infrastructures and a high demand for high-quality cardiopulmonary equipment.

04. Who are the major players in the Global CPB Accessory Equipment Market?

Major players include Medtronic, Terumo Cardiovascular, LivaNova PLC, Getinge AB, and Edwards Lifesciences, recognized for their technological expertise and strong market presence.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.