Global Cardless ATM Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD4818

October 2024

96

About the Report

Global Cardless ATM Market Overview

- The global cardless ATM market is valued at USD 2.8 billion, based on a five year historical analysis. This market is primarily driven by the growing demand for digital banking services, heightened by the increased use of smartphones and mobile applications that enable contactless transactions. Additionally, the environment accelerated the adoption of contactless services as users became more inclined toward secure, hygienic, and convenient financial solutions.

- The market is predominantly led by regions like North America, Europe, and Asia Pacific. North America, particularly the United States, dominates the market due to its advanced banking infrastructure and higher consumer adoption rates of digital banking solutions. Similarly, Europe, with countries like the United Kingdom and Germany, follows closely, thanks to a robust regulatory framework that encourages the development of innovative banking technologies.

- TheDigital Indiainitiative aims to transform India into a digitally empowered society. It focuses on three key areas like digital infrastructure, governance on demand, and citizen empowerment. The initiative aimed to make 6 crore rural households digitally literate, promoting inclusivity and economic growth.

Global Cardless ATM Market Segmentation

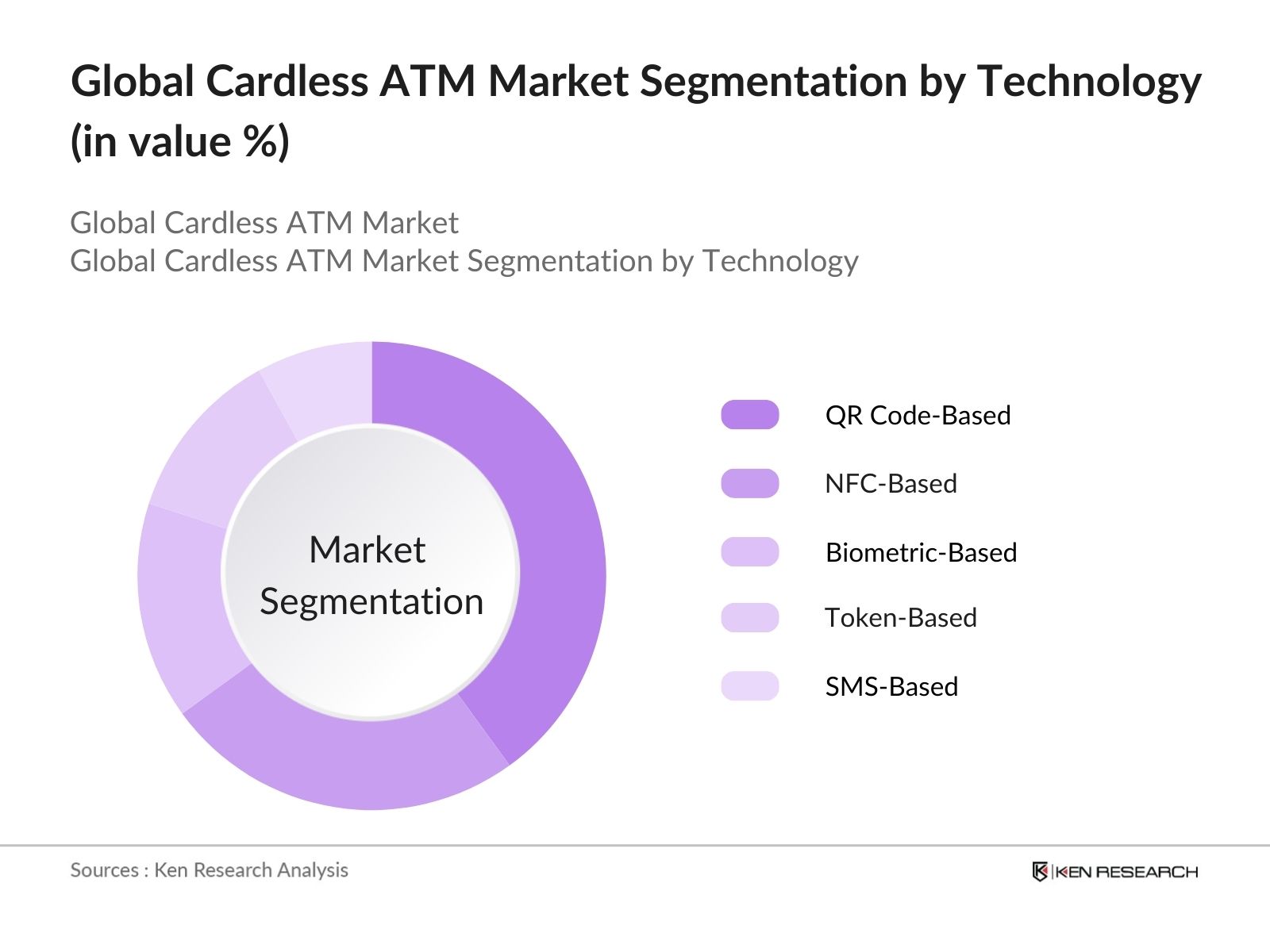

By Technology: The market is segmented by technology into QR code based, NFC-based, biometric-based, token based, and SMS based technologies. QR code-based technology has dominated the market share due to its simplicity and widespread adoption by banks and financial institutions. The technology's minimal hardware requirements and compatibility with existing ATM systems have made it a cost-effective and scalable solution for financial institutions.

By Application: The market is also segmented by application into bank owned ATMs, independent ATM deployers, commercial complexes, transportation hubs, and others. Bank owned ATMs hold the dominant market share, mainly because banks are the primary facilitators of the cardless ATM infrastructure. Financial institutions have been focusing on upgrading their ATMs to support cardless functionality, as it enhances customer convenience and reduces the likelihood of card fraud.

By Region: The market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads the market, driven by the early adoption of advanced banking technologies and the proliferation of digital wallets. The U.S., in particular, has a strong focus on upgrading financial infrastructure to enhance customer experience. Europe is another dominant region, driven by regulatory frameworks like PSD2, which promotes secure and efficient banking transactions.

Global Cardless ATM Market Competitive Landscape

The market is dominated by several key players that hold a share of the market. These companies have established strong brand recognition, and they invest heavily in technology to maintain a competitive edge. Key players have also formed strategic partnerships with fintech firms to enhance their service offerings and ensure a seamless customer experience.

|

Company Name |

Establishment Year |

Headquarters |

Technology |

Market Reach |

Key Clients |

Innovations |

Global Revenue (USD Bn) |

Strategic Initiatives |

|

Diebold Nixdorf |

1859 |

Ohio, USA |

||||||

|

NCR Corporation |

1884 |

Georgia, USA |

||||||

|

Fujitsu |

1935 |

Tokyo, Japan |

||||||

|

Euro net Worldwide, Inc. |

1994 |

Kansas, USA |

||||||

|

Glory Ltd. |

1918 |

Tokyo, Japan |

Global Cardless ATM Market Analysis

Market Growth Drivers

- Increasing Adoption of Mobile Banking: As of 2024, around 5.3 billion people globally are using smartphones, leading to a surge in mobile banking solutions. This growing user base for mobile banking apps is driving the adoption of cardless ATMs, where users can withdraw cash without a physical card by using mobile banking applications. With mobile penetration reaching about 68% of the global population, cardless ATMs offer a seamless integration between smartphones and ATM withdrawals, enhancing customer convenience.

- Enhanced Security and Fraud Reduction: Cardless ATMs are increasingly seen as a secure option due to the elimination of physical card skimming and cloning, a problem responsible for an estimated loss of $2.1 billion globally in ATM frauds during 2023. The implementation of two factor authentication and biometric verification in cardless ATMs further enhances transaction security, thus encouraging both financial institutions and consumers to adopt this technology.

- Rise in Demand for Contactless Payments: Following the pandemic, there has been a rise in contactless payment methods. As of 2024, over 900 million people globally prefer using contactless payment methods for transactions. Cardless ATMs align with this shift in consumer behavior, offering a contactless way to withdraw cash, particularly appealing in a world where health concerns have accelerated the move towards touch free transactions.

Market Challenges

- Limited Network Coverage in Rural Areas: As of 2024, cardless ATM services are concentrated in urban and metropolitan areas, leaving rural regions underserved. In many countries, over 70% of ATMs with cardless features are located in cities, creating a significant gap in accessibility for rural populations who might benefit from such services.

- Cybersecurity Concerns: Although cardless ATMs offer advanced security features, concerns about digital fraud and hacking remain high. In 2023, global cybercrime losses amounted to over $8 trillion, and the financial sector was one of the top targets. Ensuring robust cybersecurity measures for mobile based ATM transactions is a key challenge for the growth of this market.

Global Cardless ATM Market Future Outlook

Over the next five years, the global cardless ATM industry is expected to show substantial growth, driven by continuous technological advancements, increasing consumer demand for contactless and secure banking solutions, and expanding fintech collaborations. The growing penetration of mobile phones and internet services in emerging markets like Asia Pacific is likely to accelerate market expansion further.

Future Market Opportunities

- Expansion of Biometric Authentication: By 2029, biometric verification, such as facial recognition and fingerprint scanning, will be the standard across cardless ATMs globally. With more than 150,000 ATMs expected to adopt these biometric technologies, this will become the most secure and widely used method of cash withdrawal, driving adoption among users who prioritize security.

- Wider Deployment in Developing Markets: Over the next five years, cardless ATMs will expand significantly in developing regions, including Africa, South Asia, and Latin America. By 2028, it is projected that more than 50% of ATMs in these regions will be cardless enabled, bridging financial accessibility gaps for underserved populations in emerging economies.

Scope of the Report

|

By Technology |

QR Code Based |

|

NFC Based |

|

|

Biometric Based |

|

|

Token Based |

|

|

SMS Based |

|

|

By Application |

BankOwned ATMs |

|

Independent ATM Deployers |

|

|

Commercial Complexes |

|

|

Transportation Hubs |

|

|

Others |

|

|

By End User |

Retail Consumers |

|

Corporate Enterprises |

|

|

Government Organizations |

|

|

Financial Institutions |

|

|

By Transaction Type |

Cash Withdrawal |

|

Account Balance Inquiry |

|

|

Funds Transfer |

|

|

Mini Statement |

|

|

Mobile Recharges |

|

|

By Region |

North America |

|

Europe |

|

|

Asia Pacific |

|

|

Latin America |

|

|

Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institutions

Payment Service Providers

Government and Regulatory Bodies (e.g., European Central Bank, Reserve Bank of India)

Fintech Companies

Mobile Payment Providers

Investments and Venture Capitalist Firms

Biometric Technology Providers

Companies

Players Mentioned in the Report:

Diebold Nixdorf

NCR Corporation

Fujitsu

Euro net Worldwide, Inc.

Glory Ltd.

KAL ATM Software

Triton Systems

GRG Banking

HESS Cash Systems

Hyosung TNS

Auriga

Oki Electric Industry

Cennox

Cardtronics

Hitachi Omron Terminal Solutions

Table of Contents

1. Global Cardless ATM Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Cardless ATM Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Cardless ATM Market Analysis

3.1. Growth Drivers (Digital Banking, Consumer Convenience, Mobile Wallet Integration, Security Enhancements)

3.1.1. Increasing Adoption of Digital Banking

3.1.2. Rising Consumer Preference for Convenience and Contactless Transactions

3.1.3. Integration with Mobile Wallets

3.1.4. Advancements in Security and Fraud Prevention

3.2. Market Challenges (Cybersecurity, Infrastructure Development, Regulatory Compliance, Consumer Trust)

3.2.1. Cybersecurity Risks

3.2.2. High Costs for Infrastructure Development

3.2.3. Regulatory and Compliance Barriers

3.2.4. Limited Consumer Trust in Cardless Technologies

3.3. Opportunities (Emerging Markets, Fintech Partnerships, AI and Blockchain Integration, Cost Savings)

3.3.1. Expansion into Emerging Economies

3.3.2. Strategic Partnerships with Fintech Companies

3.3.3. Integration of AI and Blockchain for Enhanced Security

3.3.4. Reduced Operational Costs for Banks and Financial Institutions

3.4. Trends (Biometric Authentication, Tokenization, Multi-Layer Security Protocols, Open Banking Integration)

3.4.1. Increasing Use of Biometric Authentication

3.4.2. Growing Adoption of Tokenization for Secure Transactions

3.4.3. Evolution of Multi-Layer Security Protocols

3.4.4. Integration with Open Banking Systems

3.5. Regulatory Overview (PSD2, PCI-DSS, Data Privacy Laws, Regional Variances)

3.5.1. PSD2 Impact on Cardless ATM Transactions in Europe

3.5.2. PCI-DSS Compliance Requirements

3.5.3. Global and Regional Data Privacy Regulations

3.5.4. Regulatory Variances Across North America, Europe, and Asia-Pacific

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Cardless ATM Market Segmentation

4.1. By Technology (In Value %)

4.1.1. QR Code-Based

4.1.2. NFC-Based

4.1.3. Biometric-Based

4.1.4. Token-Based

4.1.5. SMS-Based

4.2. By Application (In Value %)

4.2.1. Bank-Owned ATMs

4.2.2. Independent ATM Deployers

4.2.3. Commercial Complexes

4.2.4. Transportation Hubs

4.2.5. Others

4.3. By End-User (In Value %)

4.3.1. Retail Consumers

4.3.2. Corporate Enterprises

4.3.3. Government Organizations

4.3.4. Financial Institutions

4.4. By Transaction Type (In Value %)

4.4.1. Cash Withdrawal

4.4.2. Account Balance Inquiry

4.4.3. Funds Transfer

4.4.4. Mini Statement

4.4.5. Mobile Recharges

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Cardless ATM Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Diebold Nixdorf

5.1.2. NCR Corporation

5.1.3. Fujitsu

5.1.4. Euronet Worldwide, Inc.

5.1.5. Glory Ltd.

5.1.6. KAL ATM Software

5.1.7. Triton Systems

5.1.8. GRG Banking

5.1.9. HESS Cash Systems

5.1.10. Hyosung TNS

5.1.11. Auriga

5.1.12. Oki Electric Industry

5.1.13. Cennox

5.1.14. Cardtronics

5.1.15. Hitachi-Omron Terminal Solutions

5.2. Cross Comparison Parameters (Inception Year, Revenue, No. of Employees, Headquarters, Global Reach, Market Share, Key Technologies, Recent Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Cardless ATM Market Regulatory Framework

6.1. Global and Regional Regulatory Environment

6.2. Compliance Requirements for Banks and Financial Institutions

6.3. Certification Processes for Cardless ATM Providers

7. Global Cardless ATM Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Cardless ATM Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Transaction Type (In Value %)

8.5. By Region (In Value %)

9. Global Cardless ATM Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping the global cardless ATM market ecosystem, covering major stakeholders like financial institutions, fintech companies, and ATM providers. This stage includes desk research using proprietary and secondary data to identify and define key variables affecting market dynamics.

Step 2: Market Analysis and Construction

This step includes analyzing historical data on market penetration, financial transaction volumes, and the adoption of various cardless technologies. This analysis helps quantify the market size and establish reliable growth estimates.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses will be validated through interviews with market experts, including ATM manufacturers, banks, and fintech companies. These consultations provide insights into operational efficiencies, transaction volumes, and future market trends.

Step 4: Research Synthesis and Final Output

Finally, primary and secondary data will be synthesized to develop a detailed report. Multiple rounds of validation with industry players ensure the accuracy and relevance of the market insights provided.

Frequently Asked Questions

01. How big is the Global Cardless ATM Market?

The global cardless ATM market was valued at USD 2.8 billion, driven by increasing demand for contactless banking solutions and the growing penetration of mobile banking apps.

02. What are the challenges in the Global Cardless ATM Market?

Challenges in the global cardless ATM market include cybersecurity risks, regulatory compliance hurdles, and consumer concerns regarding the security of cardless transactions, which may hinder faster adoption.

03. Who are the major players in the Global Cardless ATM Market?

Major players in the global cardless ATM market include Diebold Nixdorf, NCR Corporation, Fujitsu, Euro net Worldwide, Inc., and Glory Ltd., each contributing to technological innovations and infrastructure advancements in the cardless ATM sector.

04. What are the growth drivers of the Global Cardless ATM Market?

Key drivers in the global cardless ATM market include the increasing use of mobile banking, advancements in biometric and QR code technologies, and the growing demand for secure, contactless financial transactions.

05. What are the emerging trends in the Global Cardless ATM Market?

Emerging trends in the global cardless ATM market include the integration of AI for fraud detection, wider adoption of biometric authentication, and partnerships between banks and fintech companies to enhance cardless ATM offerings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.