Global Cargo Drones Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD4887

December 2024

90

About the Report

Global Cargo Drones Market Overview

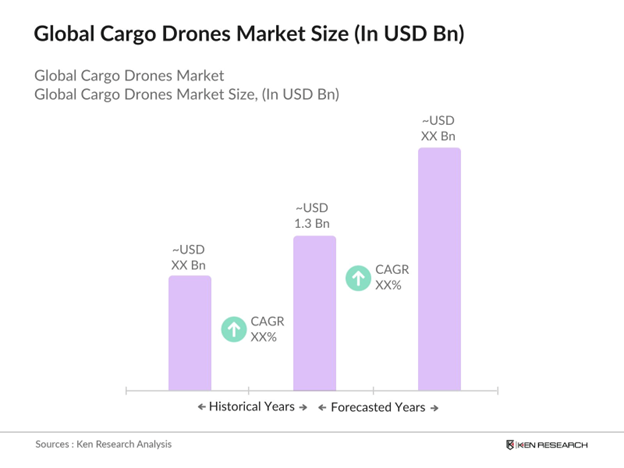

- Global Cargo Drones Market is valued at USD 1.3 billion, driven by the need for faster and more efficient delivery solutions across multiple industries, including e-commerce and healthcare. Cargo drones are increasingly being used to transport goods in areas that are difficult to access by traditional means of transportation. This shift is also supported by advancements in drone technology, such as improved payload capacity and extended flight ranges.

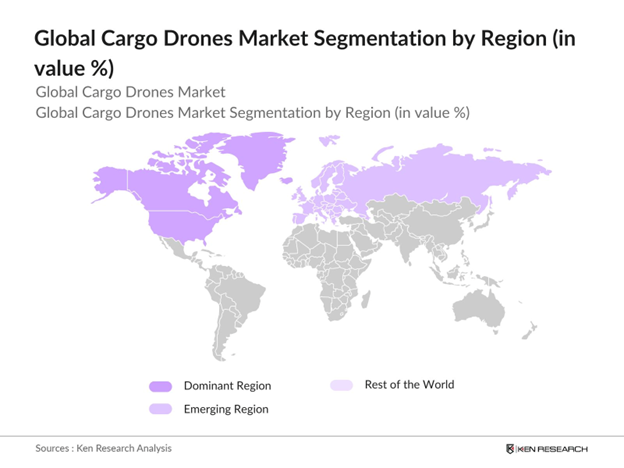

- Countries like the United States, China, and Germany dominate the cargo drones market due to their technological expertise, strong drone regulations, and significant investments in drone logistics infrastructure. The presence of large e-commerce players and a growing focus on reducing carbon footprints through green transportation solutions also contribute to the dominance of these regions.

- Governments are actively updating airspace policies to accommodate the rise of cargo drones. In 2023, the FAA in the U.S. launched a comprehensive Unmanned Aircraft System Traffic Management (UTM) initiative, facilitating the integration of commercial drones into national airspace. This system is designed to provide real-time traffic updates, allowing drones to safely navigate crowded airspaces alongside traditional aircraft. Similarly, in Europe, U-space regulations are being enforced, creating a standardized framework for drone operations across EU member states.

Global Cargo Drones Market Segmentation

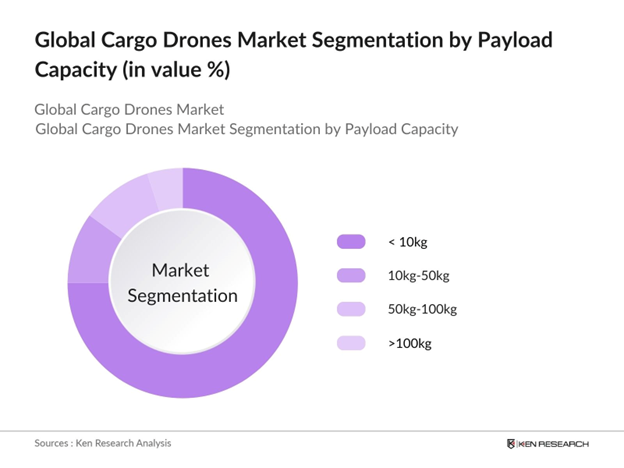

By Payload Capacity: The global cargo drones market is segmented by payload capacity into <10kg, 10kg-50kg, 50kg-100kg, and >100kg. The 10kg-50kg segment dominates the market, primarily due to its versatility in delivering goods for e-commerce and medical supplies. Drones in this segment strike a balance between cost efficiency and payload capacity, making them suitable for both short-distance urban deliveries and long-range rural applications. Major e-commerce platforms and logistics companies prefer this payload range for last-mile deliveries due to its adaptability across various use cases.

By Region: The cargo drones market is segmented by region into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. North America leads the market due to its advanced drone regulatory framework, a high number of key drone manufacturers, and the early adoption of drone technology in logistics. The United States, in particular, has a well-established infrastructure for drone operations, supported by favorable government policies and significant investment in drone R&D.

By Application: The market is segmented by application into e-commerce and retail, healthcare and medical supplies, industrial and manufacturing logistics, and defense and military. E-commerce and retail dominate the market, driven by the rise in online shopping and consumer expectations for same-day or next-day deliveries. Cargo drones are widely used to fulfill last-mile deliveries in urban settings, where they can bypass traffic congestion and reduce delivery times. Additionally, the growing focus on sustainability in logistics has further driven the adoption of cargo drones in the e-commerce industry.

Global Cargo Drones Market Competitive Landscape

The global cargo drones market is dominated by several key players, with significant market influence. Companies are focusing on innovations in drone technology, expanding their drone fleets, and forming strategic partnerships with logistics and e-commerce firms.

|

Company |

Established |

Headquarters |

Revenue (USD Mn) |

Fleet Size |

Payload Capacity |

Operational Range |

R&D Investment |

Technology Focus |

Global Reach |

|

Wing Aviation |

2019 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Zipline International |

2014 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Amazon Prime Air |

2016 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

DHL Parcelcopter |

2013 |

Germany |

- |

- |

- |

- |

- |

- |

- |

|

Matternet Inc. |

2011 |

USA |

- |

- |

- |

- |

- |

- |

- |

The market is highly competitive, with both global and regional players actively investing in expanding their drone fleets, enhancing technological capabilities, and improving operational efficiencies. Companies like Wing Aviation and Zipline have emerged as leaders due to their focus on innovation and large operational fleets, while players like DHL and Matternet are establishing themselves in specialized logistics sectors such as healthcare and cross-border deliveries.

Global Cargo Drones Market Analysis

Growth Drivers

- Increasing Demand for Same-Day Delivery: The global demand for same-day delivery continues to rise significantly, driven primarily by e-commerce growth and changing consumer expectations. As of 2023, the e-commerce sector accounts for over $5 trillion in global trade, according to the World Bank. Same-day delivery services have seen an uptick in adoption across urban centers, with an average penetration rate of 20%, especially in metropolitan areas like New York and London, where delivery speed metrics often fall under 2 hours.

- Advancements in Drone Technology: Technological advancements in the cargo drone market have significantly improved operational capabilities. Modern drones can now carry payloads of up to 500 kilograms and have a range of 150 kilometers. For instance, in 2024, drones utilized by logistics companies in North America demonstrate an average flight time of over 45 minutes on a single charge. Innovations in autonomous navigation, supported by AI integration, have made it possible for drones to autonomously avoid obstacles and follow optimized delivery routes, improving both safety and efficiency.

- Growing E-Commerce Sector: The e-commerce sector continues to thrive, with e-commerce accounting for 20% of global retail sales in 2023, according to the World Bank. The increasing demand for rapid, last-mile delivery has created an urgent need for efficient delivery systems, particularly in urban areas. Cargo drones, which can avoid road congestion, are emerging as a viable solution for speeding up deliveries in last-mile logistics.

Challenges

- Air Traffic Management: The integration of cargo drones into the existing air traffic management systems remains a major challenge, especially in high-density airspaces. Air Traffic Control (ATC) systems in regions like North America handle over 50,000 flights daily, which makes the addition of commercial drones a complex endeavor. Drones require specialized traffic management systems to operate safely alongside manned aircraft. Governments and regulatory bodies are investing in new Unmanned Aircraft Systems Traffic Management (UTM) protocols to integrate drones, but this infrastructure is still in its nascent stages.

- High Initial Costs: The deployment of cargo drones demands significant capital expenditure. A fully operational drone fleet, including autonomous capabilities, can cost logistics companies millions of dollars in initial setup and maintenance. Developing the necessary infrastructuresuch as dedicated takeoff/landing pads and drone storage facilitiesrequires substantial investment, especially in densely populated urban regions. These high upfront costs pose a significant barrier to entry for smaller logistics firms, limiting widespread adoption of cargo drone technology in the short term.

Global Cargo Drones Market Future Outlook

The global cargo drones market is expected to experience significant growth due to advancements in autonomous flight technologies, increasing investment in drone logistics infrastructure, and the growing demand for efficient and eco-friendly transportation solutions. Governments across the world are gradually easing regulations to allow the use of drones in commercial deliveries, further boosting the potential for market expansion.

Additionally, the integration of artificial intelligence and machine learning into drone systems will enable better navigation, improved safety, and more efficient route planning, contributing to the overall growth of the market. This technological evolution is expected to pave the way for the adoption of drones in new sectors such as industrial logistics and agricultural supply chains.

Market Opportunities

- Expanding Beyond Urban Delivery: Cargo drones offer a significant opportunity for expanding delivery services to rural and remote areas. In regions with poor infrastructure, drones can cover vast distances in a fraction of the time it takes ground-based transport. In Africa, for instance, drones have been instrumental in delivering medical supplies to remote villages, covering distances of over 100 kilometers within 45 minutes. This capability is also being adopted in parts of Southeast Asia and South America, where poor road infrastructure hinders efficient cargo delivery.

- Partnership Opportunities with Logistics Firms: Partnerships between drone manufacturers and logistics firms are a significant growth driver for the cargo drone market. Strategic collaborations allow firms to optimize supply chain operations, reducing delivery times and operational costs. In 2023, large logistics companies, such as UPS and FedEx, entered into agreements with drone technology providers to enhance their last-mile delivery capabilities.

Scope of the Report

|

Payload Capacity |

< 10kg 10kg-50kg 50kg-100kg >100kg |

|

Application |

E-Commerce and Retail Healthcare and Medical Supplies Industrial and Manufacturing Logistics Defense and Military |

|

Drone Type |

Fixed-Wing Cargo Drones Multi-Rotor Cargo Drones Hybrid VTOL Drones |

|

End-User |

Logistics Companies E-Commerce Platforms Healthcare Providers Military and Government Agencies |

|

Region |

North America Europe Asia-Pacific Middle East and Africa Latin America |

Products

Key Target Audience

Logistics Companies

E-Commerce Platforms

Telecommunication companies

Military and Defense Companies

Technology Investors and Venture Capitalist Firms

Drone Manufacturers

Government and Regulatory Bodies (FAA, EASA, Civil Aviation Authorities)

Companies

Major Players

Wing Aviation

Zipline International

Amazon Prime Air

DHL Parcelcopter

Matternet Inc.

Flytrex

Volocopter

Airbus Aerial

Boeing Cargo Air Vehicles

JD.com

Pipistrel Vertical Solutions

UPS Flight Forward

Elroy Air

Skyports

Lilium

Table of Contents

1. Global Cargo Drones Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Cargo Drones Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Cargo Drones Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Same-Day Delivery (Market Penetration Rate, Delivery Speed Metrics)

3.1.2. Advancements in Drone Technology (Range, Payload Capacity, Autonomous Navigation)

3.1.3. Growing E-Commerce Sector (Demand from Last-Mile Logistics)

3.1.4. Favorable Government Regulations (Regulatory Approvals, Safety Guidelines)

3.2. Market Challenges

3.2.1. Air Traffic Management (Integration with Existing Systems)

3.2.2. High Initial Costs (Capex, Infrastructure Investment)

3.2.3. Security Concerns (Data Privacy, Risk of Drone Hijacking)

3.3. Opportunities

3.3.1. Expanding Beyond Urban Delivery (Rural and Remote Area Operations)

3.3.2. Partnership Opportunities with Logistics Firms (Strategic Collaborations, Supply Chain Optimization)

3.3.3. Green Supply Chain Initiatives (Reduced Emissions, Sustainability Focus)

3.4. Trends

3.4.1. Adoption of AI and Machine Learning for Autonomous Flights (AI-Powered Navigation, Automated Route Planning)

3.4.2. Integration with Smart Cities (Smart Infrastructure Integration)

3.4.3. Development of Hybrid Drone Systems (Vertical Takeoff and Landing, Multi-Rotor and Fixed-Wing Drones)

3.5. Government Regulations

3.5.1. Airspace Policy Updates (UAS Traffic Management)

3.5.2. Drone Certification Programs (Licensing, Compliance with Aviation Standards)

3.5.3. Commercial Drone Operation Laws (Flight Approvals, Operational Restrictions)

3.5.4. Environmental Impact Guidelines (Noise Pollution, Carbon Footprint Limits)

3.6. SWOT Analysis

3.6.1. Strengths (Technological Leadership, Cost-Effective Transportation)

3.6.2. Weaknesses (Regulatory Barriers, Limited Battery Life)

3.6.3. Opportunities (Global Trade Facilitation, Evolving Supply Chain Models)

3.6.4. Threats (Competitor Innovation, Regulatory Shifts)

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Cargo Drones Market Segmentation

4.1. By Payload Capacity (In Value %)

4.1.1. < 10kg

4.1.2. 10kg-50kg

4.1.3. 50kg-100kg

4.1.4. >100kg

4.2. By Application (In Value %)

4.2.1. E-Commerce and Retail

4.2.2. Healthcare and Medical Supplies

4.2.3. Industrial and Manufacturing Logistics

4.2.4. Defense and Military

4.3. By Drone Type (In Value %)

4.3.1. Fixed-Wing Cargo Drones

4.3.2. Multi-Rotor Cargo Drones

4.3.3. Hybrid VTOL Drones

4.4. By End-User (In Value %)

4.4.1. Logistics Companies

4.4.2. E-Commerce Platforms

4.4.3. Healthcare Providers

4.4.4. Military and Government Agencies

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East and Africa

4.5.5. Latin America

5. Global Cargo Drones Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Wing Aviation

5.1.2. Zipline International Inc.

5.1.3. Amazon Prime Air

5.1.4. DHL Parcelcopter

5.1.5. Matternet Inc.

5.1.6. Flytrex

5.1.7. Volocopter

5.1.8. Airbus Aerial

5.1.9. Boeing Cargo Air Vehicles

5.1.10. JD.com

5.1.11. Pipistrel Vertical Solutions

5.1.12. UPS Flight Forward

5.1.13. Elroy Air

5.1.14. Skyports

5.1.15. Lilium

5.2 Cross Comparison Parameters (Revenue, Drone Type, Payload Capacity, Headquarters, Operational Range, Fleet Size, R&D Investment, Geographic Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Cargo Drones Market Regulatory Framework

6.1. Aviation Safety Standards

6.2. Compliance Requirements

6.3. Drone Licensing and Certifications

6.4. International Airspace Agreements

7. Global Cargo Drones Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Cargo Drones Future Market Segmentation

8.1. By Payload Capacity (In Value %)

8.2. By Application (In Value %)

8.3. By Drone Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global Cargo Drones Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Entry Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first stage, we identify the key stakeholders and ecosystem players within the global cargo drones market. Extensive desk research is conducted using secondary databases, publications, and proprietary reports to gather insights on market dynamics, technological trends, and regulatory frameworks.

Step 2: Market Analysis and Construction

We then compile and analyze historical data related to the market, such as drone fleet size, operational costs, and revenue generation. This analysis also includes the evaluation of product efficiency, customer adoption rates, and geographic reach to build a robust market model.

Step 3: Hypothesis Validation and Expert Consultation

Through a series of interviews with industry experts, we validate key assumptions and projections. These consultations are aimed at gaining insights on market trends, technological innovations, and competitive landscapes to ensure that our analysis is both comprehensive and accurate.

Step 4: Research Synthesis and Final Output

Finally, we synthesize our research into a detailed report, incorporating feedback from manufacturers, logistics companies, and government agencies. This stage ensures that the report provides a holistic view of the cargo drones market, with well-validated data and actionable insights for business professionals.

Frequently Asked Questions

01. How big is the Global Cargo Drones Market?

The global cargo drones market is valued at USD 1.3 billion, driven by the increasing demand for fast and efficient last-mile deliveries and significant advancements in drone technology.

02. What are the challenges in the Global Cargo Drones Market?

Key challenges include regulatory barriers, high initial costs, and air traffic management issues, particularly in densely populated urban areas.

03. Who are the major players in the Global Cargo Drones Market?

Key players in the market include Wing Aviation, Zipline International, Amazon Prime Air, DHL Parcelcopter, and Matternet, all of which lead the industry in terms of innovation and operational efficiency.

04. What are the growth drivers of the Global Cargo Drones Market?

The market is primarily driven by advancements in drone technology, the growing demand for same-day delivery in e-commerce, and government support in establishing regulatory frameworks for commercial drone use.

05. What is the future outlook for the Global Cargo Drones Market?

The future outlook of the cargo drones market is promising, with expectations of rapid growth due to continuous technological advancements, increased investment in drone infrastructure, and the expansion of drone applications across multiple industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.