Global Carpet Market Outlook to 2030

Region:Global

Author(s):Lakshyata and Nishika

Product Code:KENGR048

October 2024

80

About the Report

Global Carpet Market Overview

- Global carpet market was valued at USD 54 billion in 2023, driven by increasing urbanization and a rise in residential and commercial construction activities. The surge in home renovation trends, particularly post-pandemic, has fueled demand. Additionally, the growing popularity of eco-friendly and sustainable carpeting solutions has contributed to market expansion.

- Prominent players in the market include Mohawk Industries, Shaw Industries, Tarkett Group, and Beaulieu International Group. These companies dominate due to their extensive product offerings, technological innovations, and strong distribution networks.

- In 2023, Mohawk Industries Inc. made significant strides in expanding its insulation business by acquiring Xtratherm and Ballytherm. This strategic move has allowed the company to extend its reach into the United Kingdom and Ireland while simultaneously bolstering its sales in the Benelux region (Belgium, Netherlands, Luxembourg).

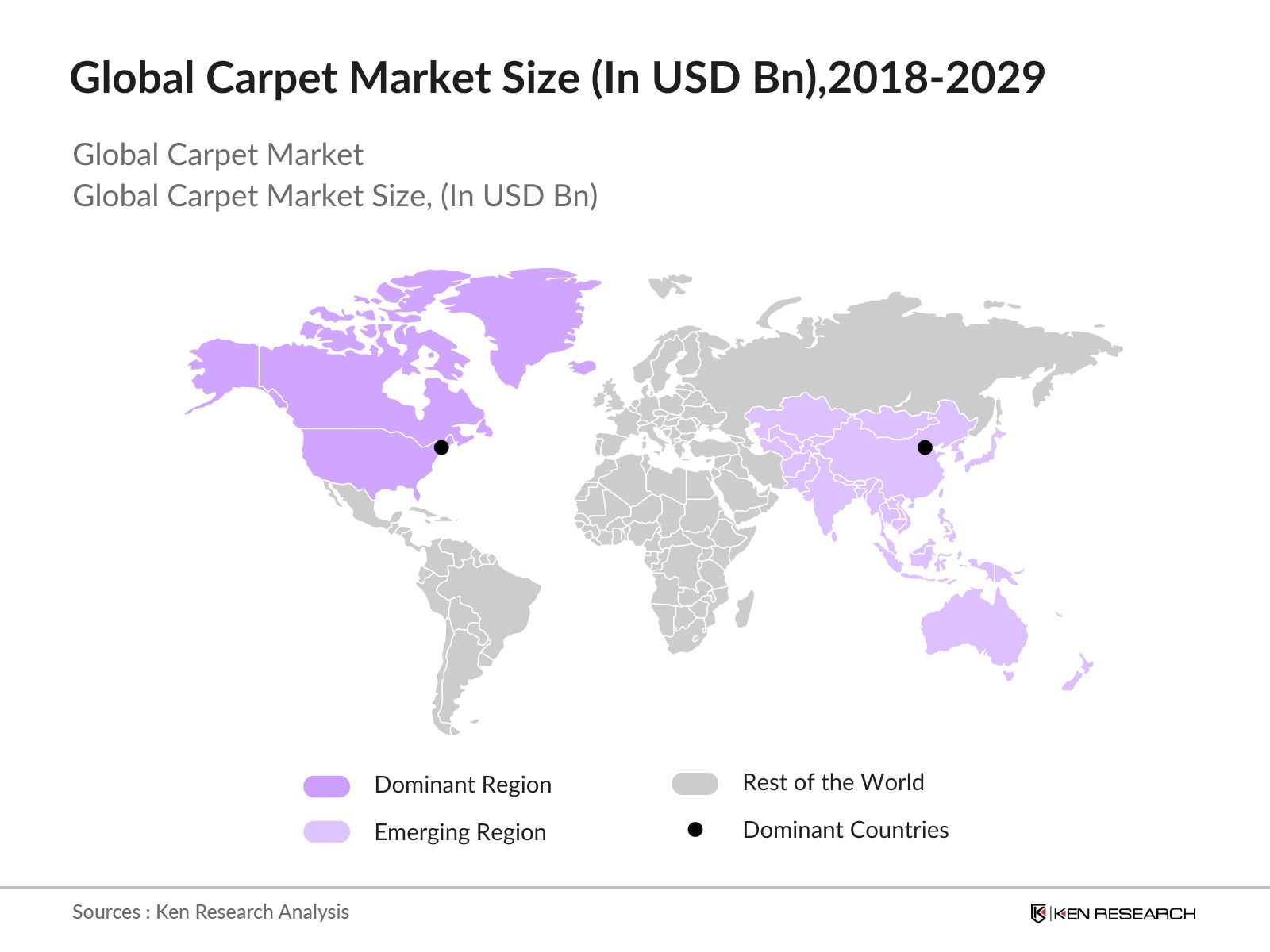

Global Carpet Current Market Analysis

- North America as dominant region: North America holds a prominent position in the global carpet market, driven by substantial consumer demand and advanced manufacturing capabilities. The region's market strength is underpinned by significant recent legislative support, such as the Inflation Reduction Act and the CHIPS and Science Act, which incentivize domestic manufacturing.Leading carpet manufacturers like Mohawk Industries, The Dixie Group, and Bentley are well-established in North America, supported by extensive retail networks.The market features a diverse range of carpet styles and technologies, including cut pile and loop pile carpets, catering to both residential and commercial sectors. In 2023, Mohawk Industries, for example, reported revenues of $11.1 billion, reflecting its significant role in the market.

- APAC as emerging region: The Asia-Pacific region is emerging as a key player in the global carpet market, driven by rapid economic growth, increasing urbanization, and rising disposable incomes. With a population of 2.5 billion in 2023, countries like China and India are leading this growth. China exported carpets worth $4 billion in 2023, a 3.82% increase from 2022.India, a major producer of handmade carpets, exported $916.15 million worth of carpets between April and November 2019, with 90% of its production going abroad. Key export markets for Indian carpets include the USA, Japan, Saudi Arabia, Malaysia, and Iraq.The region's cultural diversity and advancements in manufacturing technologies, such as digital printing, along with a focus on sustainability, are driving substantial growth in the Asia-Pacific carpet market.

- USA as dominant country: The USA leads the global carpet market due to its advanced manufacturing, technology, and strong domestic demand. With a 65.1% owner-occupation rate for single-family homes in 2021, well above the OECD average, and $427 billion spent on renovations in 2022, there is significant investment in flooring, including carpets.A 9.3% rise in new house sales in March 2023 is expected to further drive carpet demand. U.S. companies like Shaw Industries and Mohawk Industries are investing in innovative, sustainable practices, enhancing product quality and competitiveness. The robust export network also strengthens the USA's global market position.

Global Carpet Market Segmentation

The Global Carpet Market can be segmented based on several factors:

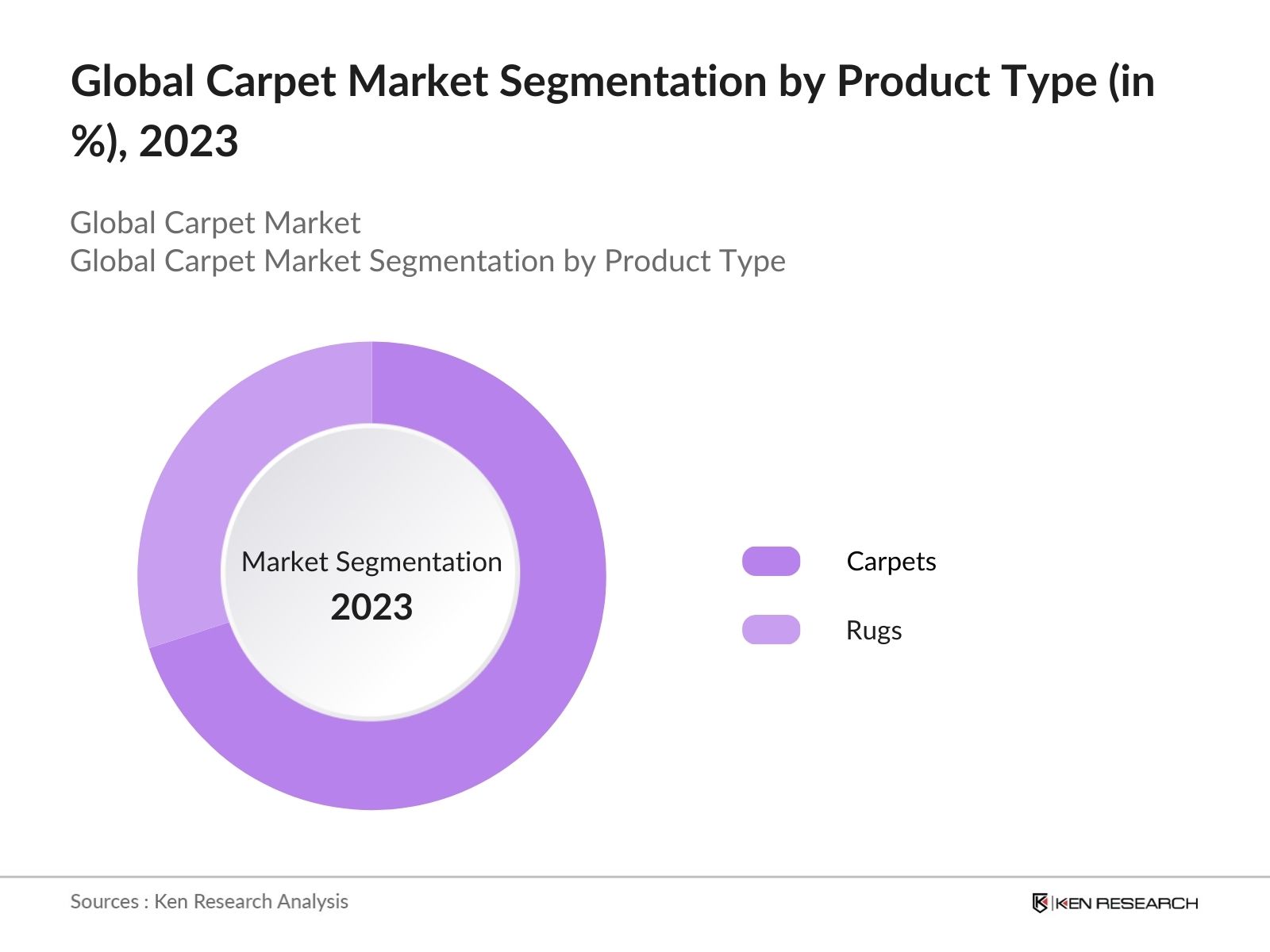

By Product Type: Global carpet market is segmented by product type into carpet and rugs. In 2023, carpets led the market by value. Carpets, known for their widespread use in both residential and commercial spaces, have seen increased demand due to factors such as urbanization, rising disposable incomes, and the growing trend of home renovations.

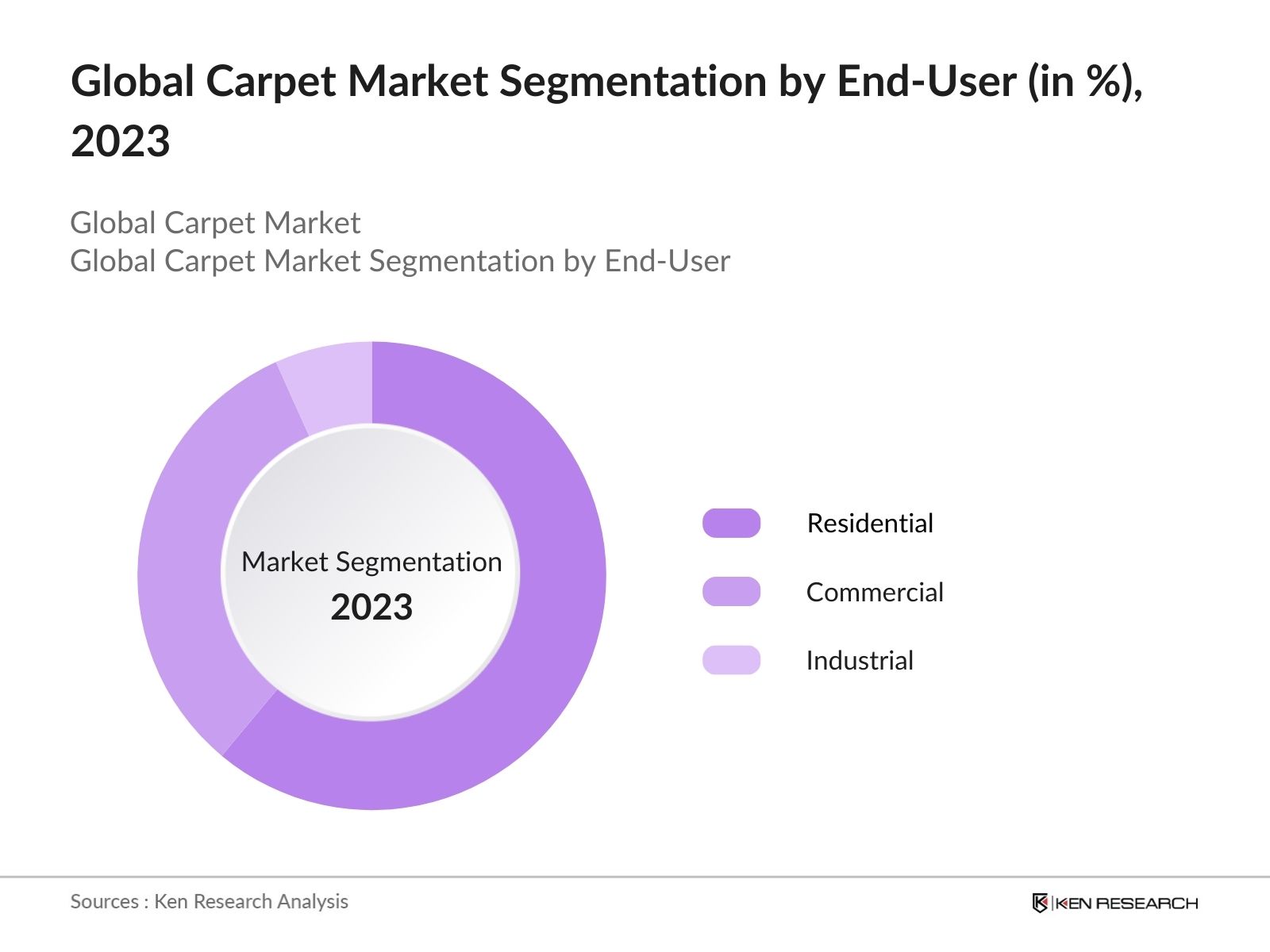

By End-User: Global carpet market is segmented by end-user into residential, commercial & industrial. In 2023, residential led the market driven by trends in interior design, increased urbanization, and rising disposable incomes. Homeowners are increasingly investing in high-quality carpets for their aesthetic appeal, comfort, and insulation properties, making the residential sector a key driver of growth in the market.

By Sales Channel: Global carpet market is segmented by sales channel is divided into Offline & Online. In 2023, Offline sales channel led the market reflecting consumers' preference for in-store purchases where they can physically experience the texture, color, and quality of carpets before making a decision. Traditional brick-and-mortar stores, showrooms, and specialty retailers continue to be the primary avenues for carpet sales, particularly for high-end and custom designs.

Global Carpet Market Competitive Landscape

|

Name of Company |

Establishment Year/Vintage |

Headquarter |

|

Mohawk Industries Inc. |

1992 |

Calhoun, Georgia, USA |

|

Victoria PLC |

1895 |

Worcester, Worcester |

|

Tarkett SA |

1997 |

France |

|

Shaw Industries Inc. (Owned by Berkshire Hathaway) |

1967 |

Dalton, Georgia, USA |

|

Mannington Mills |

1915 |

New Jersey, USA |

|

Dixie Group |

1920 |

Dalton, Georgia |

|

Interface Inc. |

1973 |

Atlanta, Georgia, USA |

- Interface Inc.: In 2024, Interface Inc., has introduced its latest collections: Etched & Threaded carpet tile and Earthen Forms luxury vinyl tile (LVT). These new offerings push design boundaries while upholding Interfaces commitment to purpose-driven, uncompromising flooring solutions. The modular tiles feature innovative, eye-catching textures, natural patterns, and neutral tones, allowing for seamless mixing and matching.

- Victoria PLC: In 2022, Victoria PLC completed the acquisition of Balta Group, marking a significant milestone in its growth strategy worth USD 176.53 million. This move has solidified Victoria's dominant position in the flooring industry, enhancing its product portfolio and market reach.

- Tarkett: In 2022, Tarkett launched its DESSO Origin carpet tile collection, which features 100% recyclable tiles with the lowest circular carbon footprint in Europe, measuring just 1.4 kg CO2/m. This carbon footprint is at least six times lower than that of competing products in the market.

Global Carpet Industry Analysis

Global Carpet Market Growth Drivers:

- Growing Construction Industry: The global construction industry's expansion, particularly in residential and commercial sectors, drives carpet demand. With construction-related spending accounting for 13% of the world's GDP, increased urbanization and infrastructure development have significantly boosted the need for carpets in new buildings and renovations.

- Growth of E-commerce: By the end of 2023, 2.64 billion people were shopping online. Platforms like Amazon, Wayfair, and RugsUSA have facilitated easier carpet purchases, offering detailed product information and home delivery, leading to a substantial increase in online carpet sales. The rise of e-commerce has revolutionized the carpet industry, allowing consumers to browse extensive collections, compare prices, and read reviews from the comfort of their homes.

- Rising Disposable Income and Living Standards: Higher disposable incomes and improved living standards have led to increased spending on home decor. In the U.S., disposable income per capita was USD 60,276 in 2023. This surge in disposable income has empowered consumers to invest more in enhancing their living spaces, with a particular focus on home decor items like carpets, furniture, and artwork.

Global Carpet Market Challenges:

- Raw Material Price Volatility: The prices of raw materials like wool, nylon, and polyester are highly volatile, influenced by factors such as fluctuating oil prices, supply chain disruptions, and geopolitical tensions. For example, nylon, a common carpet fiber, experienced significant price increases in 2022 due to supply chain challenges, impacting the overall cost structure and profitability of carpet manufacturers.

- Environmental Concerns and Regulations: Carpet manufacturers face increasing pressure to comply with environmental regulations, such as the EU's REACH, aimed at reducing carbon footprints and promoting eco-friendly materials. Adhering to these regulations can be both costly and challenging, necessitating investments in sustainable practices and materials, which may increase production costs and impact the overall competitiveness of the carpet industry.

Global Carpet Market Government Initiatives:

- U.S. Infrastructure Investment and Jobs Act: Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law, was enacted on November 15, 2021, and represents a significant investment in U.S. infrastructure, totaling $1.2 trillion. This legislation aims to address the longstanding issues of deteriorating infrastructure across the country and is seen as a response to the urgent need for modernization and repair.

- India's Production-Linked Incentive (PLI) Scheme for Textiles: India's Production-Linked Incentive (PLI) Scheme for Textiles aims to enhance the country's manufacturing capabilities. The scheme was officially launched on September 24, 2021, with operational guidelines released on December 28, 2021. It is set to run for five years, from FY 2025-26 to FY 2029-30, with a budgetary allocation of USD 1.3 billion aimed at incentivizing incremental sales from domestic production.

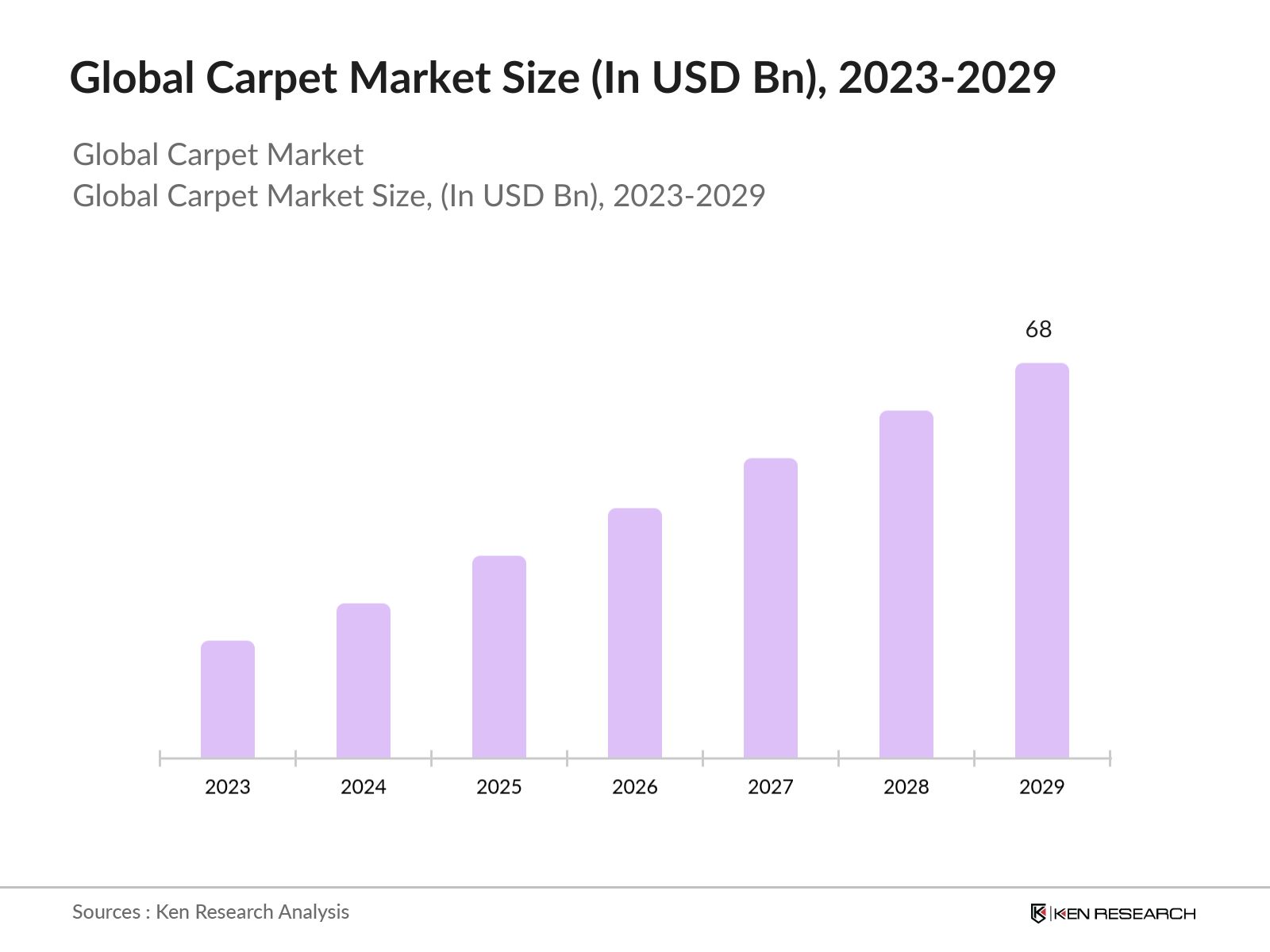

Global Carpet Future Market Outlook

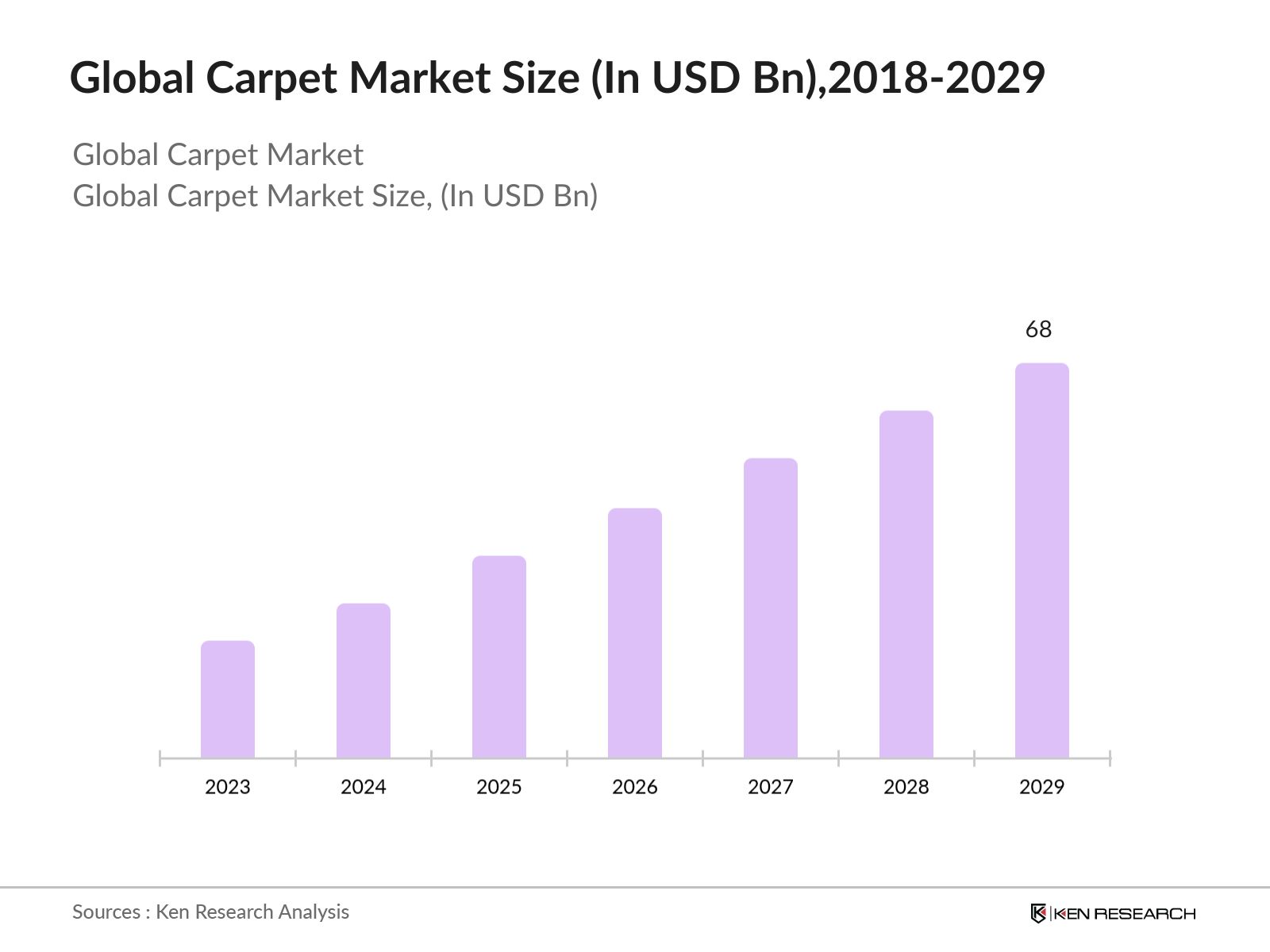

Global carpet market is poised for significant growth over the next five years, as the market is expected to reach USD 68 Bn, driven by a combination of rising consumer demand for sustainable products, technological advancements in smart home integration, and government initiatives aimed at promoting domestic manufacturing.

Future Market Trends

- Integration of Smart Technologies: Over the next five years, the carpet market will see increased integration of smart technologies, with products that can monitor room conditions, track foot traffic, and even detect spills gaining popularity. These innovations will be particularly attractive in the commercial and luxury residential sectors, where there is a growing demand for products that combine functionality with advanced technology.

- Rise of Sustainable and Recyclable Carpets: The demand for sustainable and recyclable carpets will continue to grow, driven by both consumer preferences and regulatory requirements. Manufacturers will increasingly invest in developing carpets made from recycled materials and those that are fully recyclable at the end of their lifecycle. This trend will be particularly strong in regions like Europe, where circular economy policies are becoming more entrenched.

Scope of the Report

|

By Region |

North America APAC Europe Latin America MEA |

|

By Product Type |

Carpets Rugs |

|

By Type |

Tufted Woven Needle Feet Knotted Flat-Weave Others |

|

By End-User |

Residential Commercial Industrial |

|

By Sales Channel |

Offline Online |

|

By Material |

Wool Polypropylene Polyester Others |

|

By Price Point |

Economy Luxury |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Carpet Manufacturers

Construction Companies

E-commerce Companies

Insurance Companies

Hospitality Companies

Freight & Shipping Companies

Investment & Venture Capitalist Firms

Government & Regulatory Bodies (U.S. Environmental Protection Agency)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

Mohawk Industries Inc.

Victoria PLC

Tarkett SA

Shaw Industries Inc. (Owned by Berkshire Hathaway)

Mannington Mills

Dixie Group

Interface Inc.

Balta

Oriental Weavers

Beaulieu International Group

Tai Ping Carpets International Limited

Suminoe Textile Co., Ltd.

Welspun

Table of Contents

1. Executive Summary

1.1 Global Floor Covering Market

1.2 Global Carpet Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Floor Covering Industry

2.3 Global Floor Covering (Carpet, Hard Flooring, Specialty Flooring) Revenue

3. Global Carpet Market Overview

3.1 Ecosystem

3.2 Value Chain

4. Global Carpet Market Size (in USD Bn), 2018-2023

5. Global Carpet Market Segmentation (in value %), 2018-202

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2018-2023

5.2 By Product Type (Carpets & Rugs) in value%, 2018-2023

5.3 By Type (Tufted, Woven, Needle Feet, Knotted, Flat-Weave & Others) in value %, 2018-2023

5.4 By End-User (Residential, Commercial & Industrial) in value %, 2018-2023

5.5 By Sales Channel (Offline & Online) in value %, 2018-2023

5.6 By Material (Nylon, Wool, Polypropylene, Polyester & Others) in value %, 2018-2023

5.7 By Price Point (Economy & Luxury) in value %, 2018-2023

6. Global Carpet Market Competition Landscape

6.1 Market Share Analysis

6.2 Market Cross Comparison

6.3 Competition Framework

7. Global Carpet Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Trends

8. Global Carpet Future Market Size (in USD Bn), 2023-2029

9. Global Carpet Future Market Segmentation (in value %), 2023-2029

9.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2023-2029

9.2 By Product Type (Carpets & Rugs) in value%, 2023-2029

9.3 By Type (Tufted, Woven, Needle Feet, Knotted, Flat-Weave & Others) in value %, 2023-2029

9.4 By End-User (Residential, Commercial & Industrial) in value %, 2023-2029

9.5 By Sales Channel (Offline & Online) in value %, 2023-2029

9.6 By Material (Nylon, Wool, Polypropylene, Polyester & Others) in value %, 2023-2029

9.7 By Price Point (Economy & Luxury) in value %, 2023-2029

10. Analyst Recommendations

Research Methodology

Step 01 Secondary Resources:

Objective: Identify key players, revenue, product offerings, and average pricing to calculate market size.

Sources:

-

-

- Government reports (e.g., U.S. Department of Commerce, European Commission, Carpet and Rug Institute).

- Official company reports, investor presentations, press releases from major carpet manufacturers.

- Financial performance, product offerings, and market strategies.

- Public and proprietary databases (F&S, Euromonitor, Statista, McKinsey).

-

- Validate via Trade Desk Interviews:

Objective: Confirm market revenue, margins, segmentations, distribution, and future projections to gain insights into current market trends.

Step 02 Stakeholders & Interview Details:

-

-

- Carpet Manufacturers: CEOs, Product Managers, Development Leads (30+ respondents, 40-45 min interviews).

- Raw Material Suppliers: Business Development Managers, Procurement Managers (25+ respondents, 30-35 min interviews).

- Distributors/Retailers: Supply Chain Managers, Sales Managers (20+ respondents, 30-35 min interviews).

- Industry Experts: Carpet Industry Analysts, C-Suite Employees (15+ respondents, 30 min interviews).

- Regulatory Bodies: Representatives overseeing manufacturing standards and environmental regulations (10+ respondents, 25-30 min interviews).

-

- Proxy Modeling & Outcomes:

Step 03 Bottom-Top Approach:

Calculating revenue of major players by analyzing their sales and pricing for different products.

Step 04 Disguised Interviews:

Conducted with managers to gain their perspective on operational and financial performance, ensuring data accuracy.

Frequently Asked Questions

01. How big is Global Carpet Market?

Global carpet market was valued at USD 54 billion in 2023, driven by increasing urbanization and a rise in residential and commercial construction activities. The surge in home renovation trends, particularly post-pandemic, has fueled demand

02. What are the challenges in Global Carpet Market?

Challenges in the global carpet market include increasing demand for eco-friendly carpets, preference for modular & carpet tile solutions and health & wellness concerns. The prices of raw materials like wool, nylon, and polyester are highly volatile, influenced by factors such as fluctuating oil prices, supply chain disruptions, and geopolitical tension.

03. Who are the major players in Global Carpet Market?

Prominent players in the global carpet market include Mohawk Industries, Shaw Industries, Tarkett Group, and Beaulieu International Group. These companies dominate due to their extensive product offerings, technological innovations, and strong distribution networks.

04 What are the growth drivers of the Global Carpet Market?

Global carpet market is driven by the growing construction industry, rising disposable income and growth of ecommerce. Higher disposable incomes and improved living standards have led to increased spending on home decor.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.