Global Cash Management System Market Outlook to 2030

Region:Global

Author(s):Sanjeev

Product Code:KROD1580

November 2024

99

About the Report

Global Cash Management System Market Overview

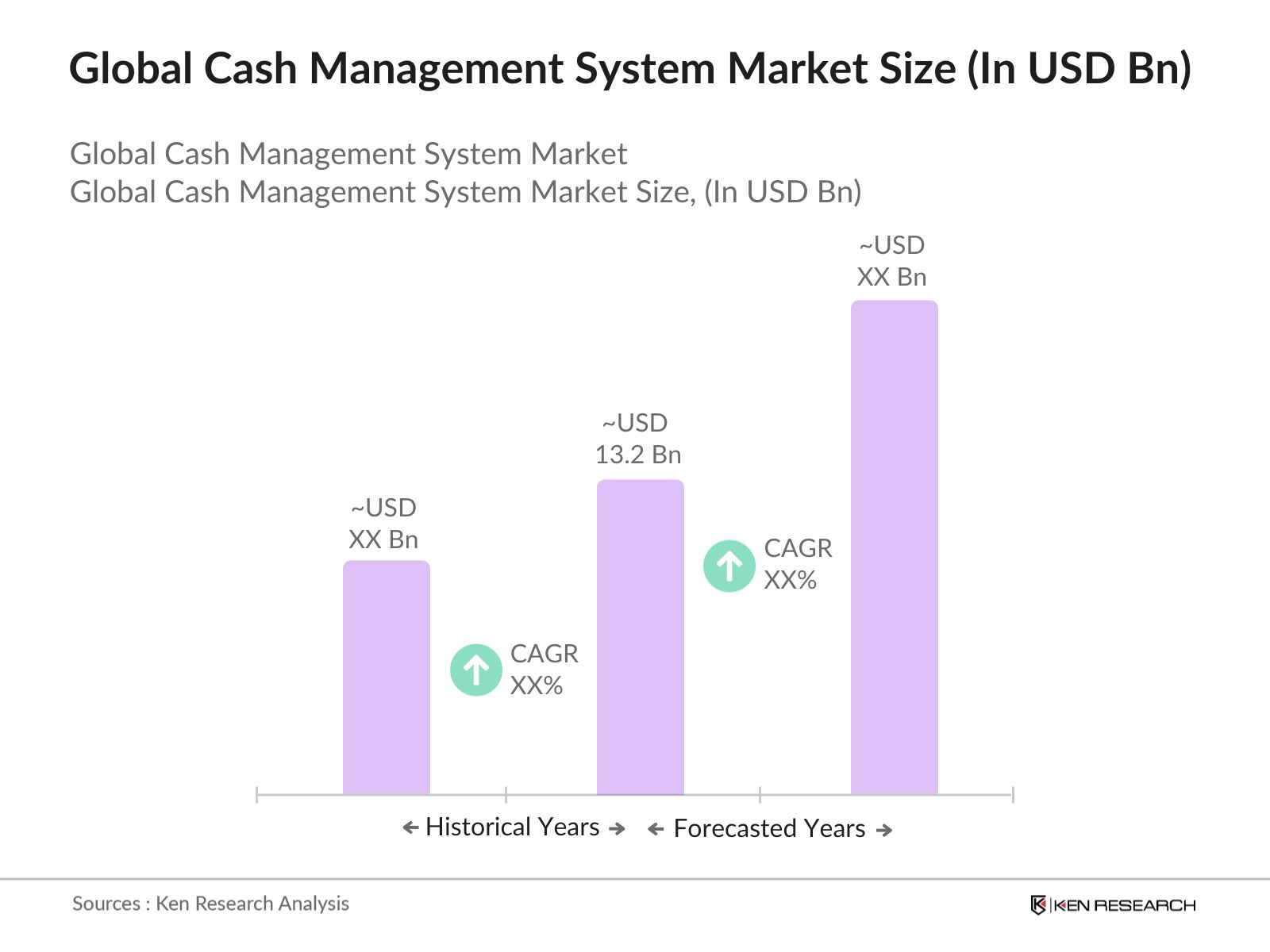

- In 2023, the Global Cash Management System Market was valued at USD 13.2 billion, propelled by the rising need for effective cash flow management across organizations. The market's growth is driven by increasing digitalization, automation in financial processes, and the integration of advanced analytics for optimized cash management. Businesses are increasingly adopting cash management systems to ensure liquidity, reduce risks, and enhance overall financial efficiency.

- Key players in the Cash Management System market include Oracle Corporation, FIS (Fidelity National Information Services), SAP SE, Infosys, and Fiserv. These companies lead the industry with innovative cash management solutions, such as automated cash forecasting, liquidity management, and real-time cash flow monitoring. For instance, Oracles Cash Management Cloud is renowned for providing comprehensive solutions that enhance cash visibility and improve financial decision-making.

- In North America, the United States stands out as a market for Cash Management Systems due to its advanced financial infrastructure and high adoption rate of digital solutions. The countrys financial services industry is characterized by strong regulatory compliance and the adoption of innovative technologies, contributing to its leadership in the global market.

- In 2023, SAP SE introduced an advanced version of its Cash Management solution, incorporating AI-driven analytics and real-time reporting capabilities to enhance cash flow management efficiency. This development underscores the continuous technological advancements within the Cash Management System market.

Global Cash Management System Market Segmentation

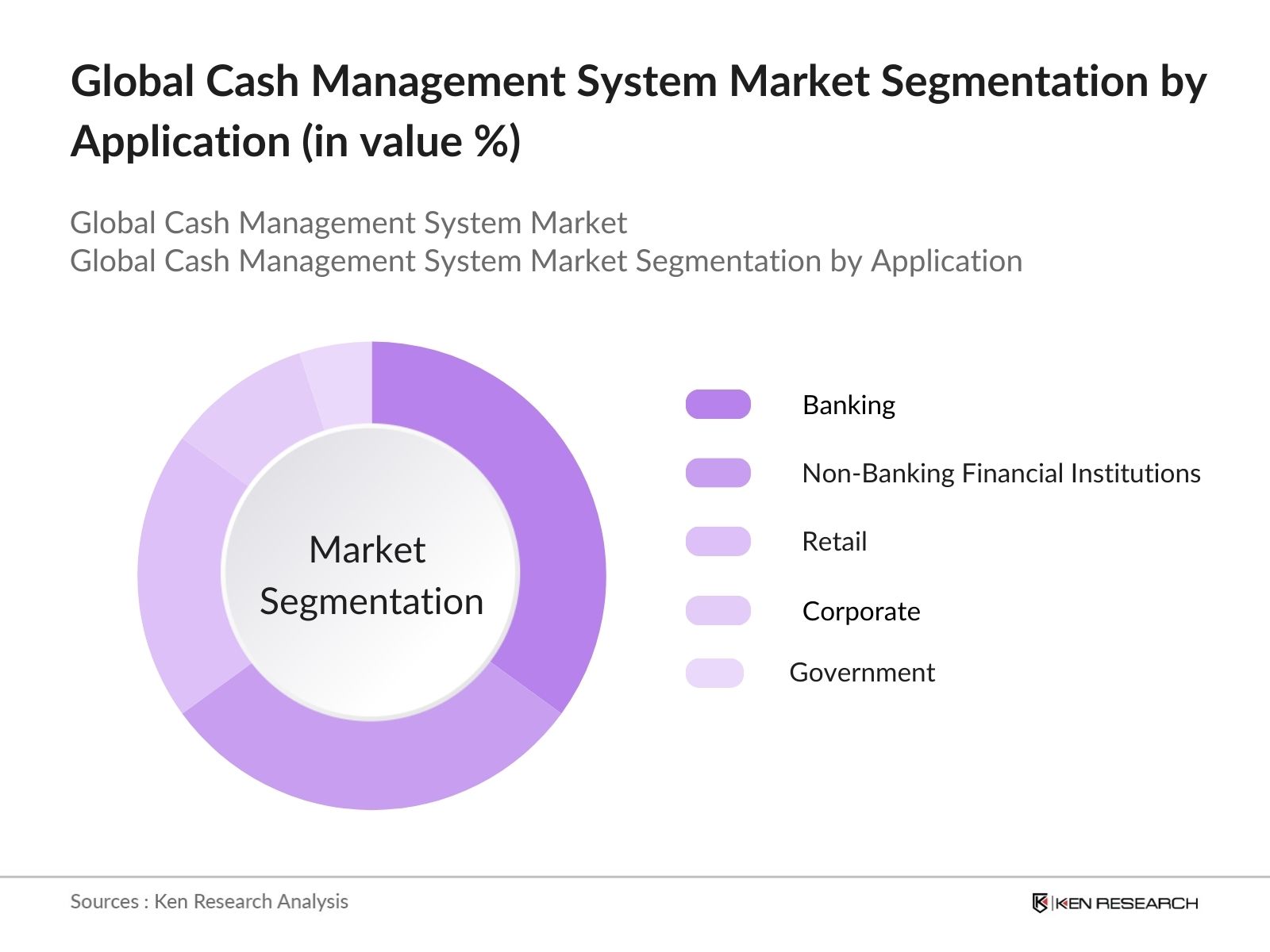

The Global Cash Management System Market can be segmented based on product type, application, and region:

- By Application: The market is segmented into Banking, Non-Banking Financial Institutions, Retail, Corporate, and Government. In 2023, the Banking segment led the market due to the widespread adoption of cash management solutions that offer improved cash flow visibility and risk management.

- By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America led the global market in 2023, holding the largest share due to the high adoption rate of advanced financial technologies and strong regulatory frameworks.

Global Cash Management System Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Oracle Corporation |

1977 |

Redwood Shores, USA |

|

FIS |

1968 |

Jacksonville, USA |

|

SAP SE |

1972 |

Walldorf, Germany |

|

Infosys |

1981 |

Bangalore, India |

|

Fiserv |

1984 |

Brookfield, USA |

- Oracle Corporation: In 2023, Oracle continued to lead the market with its advanced Cash Management Cloud, offering enhanced cash visibility and real-time cash positioning. This innovation solidifies Oracles position as a key player in the market. The Cash Management Cloud integrates with over 600 banks globally, enabling organizations to access real-time data on their cash positions.

- FIS: In 2022, FIS launched a new suite of cash management solutions that includes AI-powered forecasting and liquidity management tools, highlighting its commitment to advancing financial technology. By the end of 2022, the new suite was adopted by over 200 leading financial institutions, underscoring FIS's strong market presence and the effectiveness of its innovations in cash management.

Global Cash Management System Market Analysis

Market Growth Drivers:

- Increasing Digitalization in Financial Services: The ongoing digital transformation in financial services is driving the adoption of cash management systems. According to a report by Accenture, the global financial services industry is expected to invest over USD 500 billion in digital technologies by 2025. This investment is aimed at enhancing operational efficiency and customer experience, leading organizations to adopt cash management solutions that provide improved cash flow visibility and streamline financial management processes.

- Rising Need for Risk Management: The growing complexity of global financial markets is increasing the demand for cash management systems that provide real-time risk management solutions. Organizations are turning to advanced analytics and automation tools to proactively manage risks associated with cash flow, with an estimated USD 6 billion being spent annually on risk management solutions in the banking sector.

- Shift Towards Automation and AI: The shift towards automation and artificial intelligence in financial processes is a significant driver for the cash management market. Research from Gartner indicates that organizations implementing AI-driven solutions can expect to see substantial improvements in efficiency, with many achieving reduced processing times for cash management activities. Additionally, a report estimates that companies that effectively leverage AI in their operations could realize an economic impact of around USD 13 trillion globally by 2030, underscoring the transformative potential of these technologies in cash management practices.

Market Challenges:

- High Implementation Costs: The initial investment required to implement sophisticated cash management systems can be substantial, particularly for small and medium-sized enterprises. The costs associated with purchasing software, integrating it with existing systems, and training staff can be prohibitive.

- Slow Digital Transformation in Certain Regions: While digital transformation is accelerating in many parts of the world, certain regions still lag due to limited infrastructure, low digital literacy, and resistance to change. This slow adoption can hinder the global growth potential of the cash management system market.

- Data Integration Issues: Integrating cash management systems with existing enterprise resource planning (ERP) systems, treasury management systems (TMS), and other financial software can be challenging, especially when dealing with legacy systems. Poor integration can lead to data silos and inefficiencies in cash management processes.

Government Initiatives:

- Indias Digital India Initiative: Launched in 2015, the Digital India initiative aims to transform India into a digitally empowered society and knowledge economy. The initiative encourages the adoption of digital financial services, including cash management systems, to enhance financial inclusion and streamline government transactions. As of 2023, over 11,660 croresdigital transactions were processed monthly through government portals and digital payment systems, reflecting the widespread adoption of digital financial solutions across India.

- Australias New Payments Platform (NPP): The New Payments Platform (NPP), launched in 2018, is an industry-wide initiative supported by the Australian government to enable fast, flexible, and data-rich payments. The platform facilitates the integration of cash management systems with real-time payment capabilities. By 2023, the NPP had processed over 1.3 billion transactions, enhancing cash management efficiency for businesses across Australia.

Global Cash Management System Market Future Outlook

The Global Cash Management System Market is expected to maintain its growth, driven by the increasing demand for digital financial solutions, advancements in automation and AI, and the focus on efficient risk management.

Future Market Trends:

- Expansion of AI and Machine Learning: By 2028, the integration of AI and machine learning in cash management systems is expected to become more widespread. These technologies will enable predictive analytics, allowing companies to forecast cash flows more accurately and make informed financial decisions.

- Growth in Cloud-Based Solutions: The adoption of cloud-based cash management solutions is anticipated to increase, as organizations seek flexible and scalable financial management tools that can be accessed remotely. The shift towards cloud computing will drive innovation and reduce the total cost of ownership for cash management systems.

Scope of the Report

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

|

By Product Type |

Software Services |

|

By Application |

Banking Non-Banking Financial Institutions Retail Corporate Government |

|

By Technology |

Artificial Intelligence (AI) Machine Learning (ML) Blockchain Big Data Analytics Internet of Things (IoT) |

|

By End-User |

Financial Institutions Corporations Government Agencies |

Products

Key Target Audience:

Corporate Treasuries

Multinational Corporations

Banks and Financial Institutions

Government and Regulatory Bodies (Federal Reserve, Bank of Japan, IMF, World Bank)

Payment Service Providers

Insurance Companies

Investment Management Firms

Private Equity Firms

Venture Capital Firms

Financial Technology Startups

Consulting Firms

Accounting and Audit Firms

Retail and E-commerce Companies

Energy and Utility Companies

Real Estate Management Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Oracle Corporation

FIS (Fidelity National Information Services)

SAP SE

Infosys

Fiserv

Kyriba Corporation

Cashforce

HighRadius

TreasuryXpress

Gresham Technologies

Bottomline Technologies

Serrala

TIS (Treasury Intelligence Solutions)

GTreasury

ION Treasury

Table of Contents

1. Global Dairy Herd Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Dairy Herd Management Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Dairy Herd Management Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Dairy Products

3.1.2. Technological Advancements in Dairy Farming

3.1.3. Government Support and Subsidies

3.1.4. Increasing Demand for Organic Dairy Products

3.2. Restraints

3.2.1. High Initial Investment Costs

3.2.2. Integration Challenges with Existing Systems

3.2.3. Data Management and Security Issues

3.3. Opportunities

3.3.1. Expansion of Automated Systems

3.3.2. Integration of AI and Data Analytics

3.3.3. Growth in Precision Dairy Farming

3.4. Trends

3.4.1. Increased Adoption of IoT in Dairy Farming

3.4.2. Rise in Sustainable Farming Practices

3.4.3. Focus on Animal Welfare and Health

3.5. Government Regulation

3.5.1. EU Common Agricultural Policy (CAP)

3.5.2. U.S. Dairy Margin Coverage (DMC) Program

3.5.3. National Dairy Plan (NDP) - India

3.5.4. China's Dairy Industry Revitalization Plan

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global Dairy Herd Management Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Automated Milking Systems

4.1.2. Herd Health Monitoring Systems

4.1.3. Feeding Management Systems

4.1.4. Breeding Management Software

4.1.5. Milk Cooling & Storage Systems

4.2. By Application (in Value %)

4.2.1. Milk Harvesting

4.2.2. Feeding Management

4.2.3. Breeding

4.2.4. Health Management

4.3. By Technology (in Value %)

4.3.1. Automated Systems

4.3.2. Software Solutions

4.3.3. Sensors and Monitoring Devices

4.4. By End-User (in Value %)

4.4.1. Financial Institutions

4.4.2. Corporations

4.4.3. Government Agencies

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Dairy Herd Management Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. DeLaval Inc.

5.1.2. GEA Group

5.1.3. Lely

5.1.4. BouMatic

5.1.5. SCR Dairy

5.1.6. Afimilk Ltd.

5.1.7. Fullwood Packo

5.1.8. Dairymaster

5.1.9. Nedap N.V.

5.1.10. Pearson International LLC

5.1.11. Waikato Milking Systems

5.1.12. Trioliet B.V.

5.1.13. VAS (Valley Agricultural Software)

5.1.14. Sum-It Computer Systems, Ltd.

5.1.15. Connecterra B.V.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Dairy Herd Management Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Dairy Herd Management Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Dairy Herd Management Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Dairy Herd Management Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Technology (in Value %)

9.4. By End-User (in Value %)

9.5. By Region (in Value %)

10. Global Dairy Herd Management Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Our research begins by identifying the key entities within the Global Cash Management System Market. This involves referencing multiple secondary and proprietary databases to conduct comprehensive desk research. We gather industry-level information on market drivers, challenges, key players, and technological advancements impacting the market.

Step 2: Market Building

We collect data on the global Cash Management System market over the years, including historical market size, growth rates, and the adoption of digital financial technologies. Our analysis includes evaluating market share, revenue generated by major players, and emerging trends to ensure the accuracy and reliability of the data presented.

Step 3: Validating and Finalizing

To validate our findings, we formulate market hypotheses and conduct Computer-Assisted Telephone Interviews (CATIs) with industry experts from leading financial technology companies. These interviews provide direct insights into the operational and financial aspects of the market, helping us validate the collected statistics.

Step 4: Research Output

Our team engages with multiple cash management solution providers to understand the dynamics of market segments, customer preferences, and sales trends. This process involves validating the derived statistics using a bottom-up approach, ensuring that the final data accurately reflects actual market conditions.

Frequently Asked Questions

01. How big is the Global Cash Management System Market?

In 2023, the Global Cash Management System Market was valued at USD 13.2 billion. The market is driven by the increasing demand for efficient cash flow management, coupled with advancements in digital financial solutions and automation. The markets growth reflects the critical role of these systems in enhancing financial efficiency and risk management.

02. What are the challenges in the Global Cash Management System Market?

Challenges in the Global Cash Management System Market include high initial implementation costs, integration and compatibility issues with existing financial infrastructures, and growing concerns about data security and cybersecurity risks.

03. Who are the major players in the Global Cash Management System Market?

Major players in the Global Cash Management System Market include Oracle Corporation, FIS, SAP SE, Infosys, and Fiserv. These companies are at the forefront of innovation in financial technology, offering comprehensive solutions that cater to various aspects of cash and treasury management.

04. What are the growth drivers of the Global Cash Management System Market?

Key growth drivers in the Global Cash Management System Market include the increasing adoption of digital financial solutions, the growing complexity of global financial markets requiring sophisticated cash management tools, and the rising need for real-time risk management capabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.