Global Catalysts & Chemicals Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11221

November 2024

99

About the Report

Global Catalysts & Chemicals Market Overview

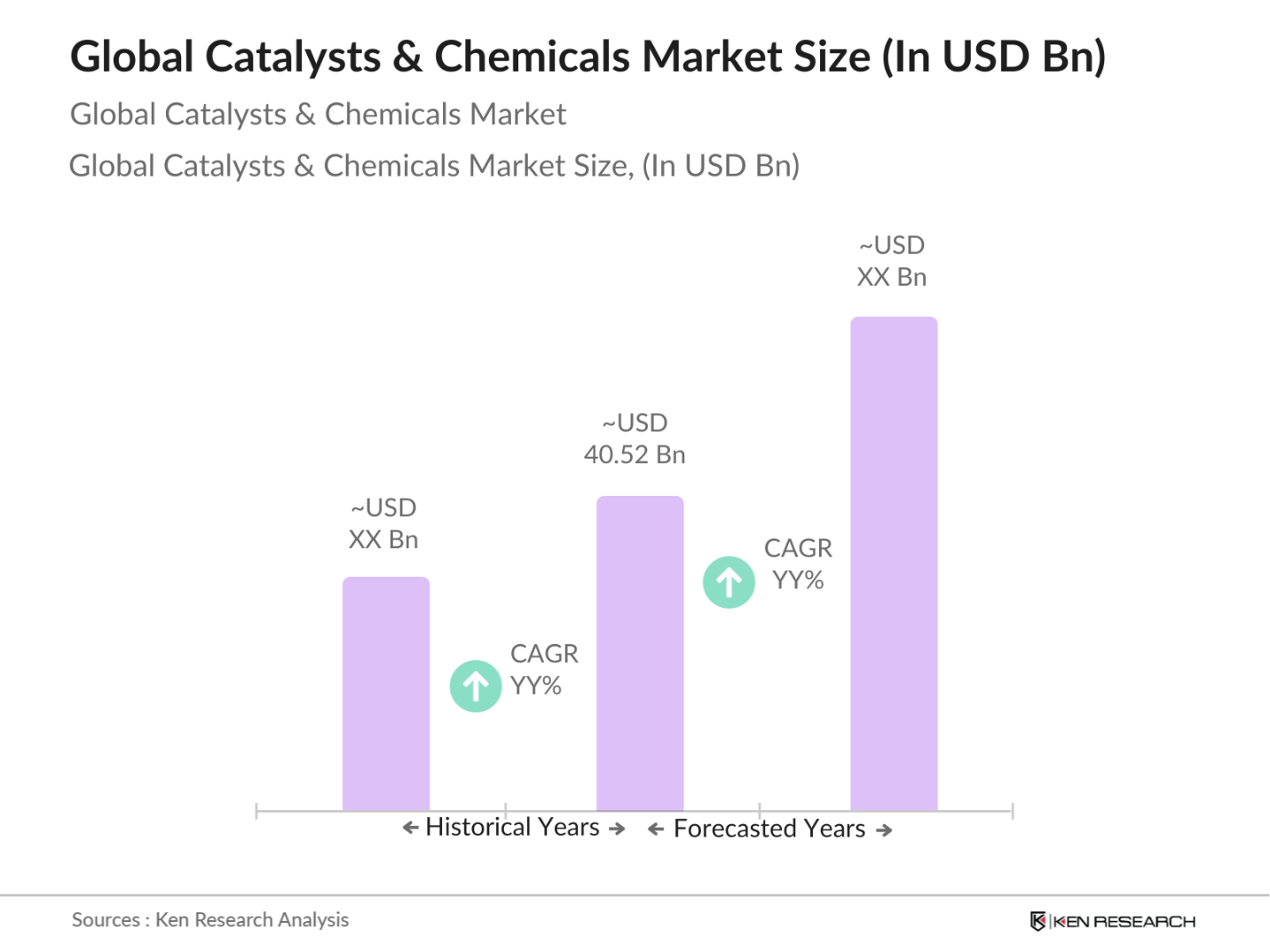

- The Global Catalysts & Chemicals Market has seen robust growth, driven by increased demand in petrochemical, refining, and environmental applications. Valued at approximately USD 40.52 billion, this market is characterized by significant advancements in catalyst technologies and the shift towards green and sustainable catalysts. Catalysts play a vital role in accelerating chemical reactions and are crucial in refining processes, environmental applications, and pharmaceuticals. Innovations such as nano and biocatalysts have enabled industries to improve efficiency, reduce emissions, and comply with stringent environmental standards.

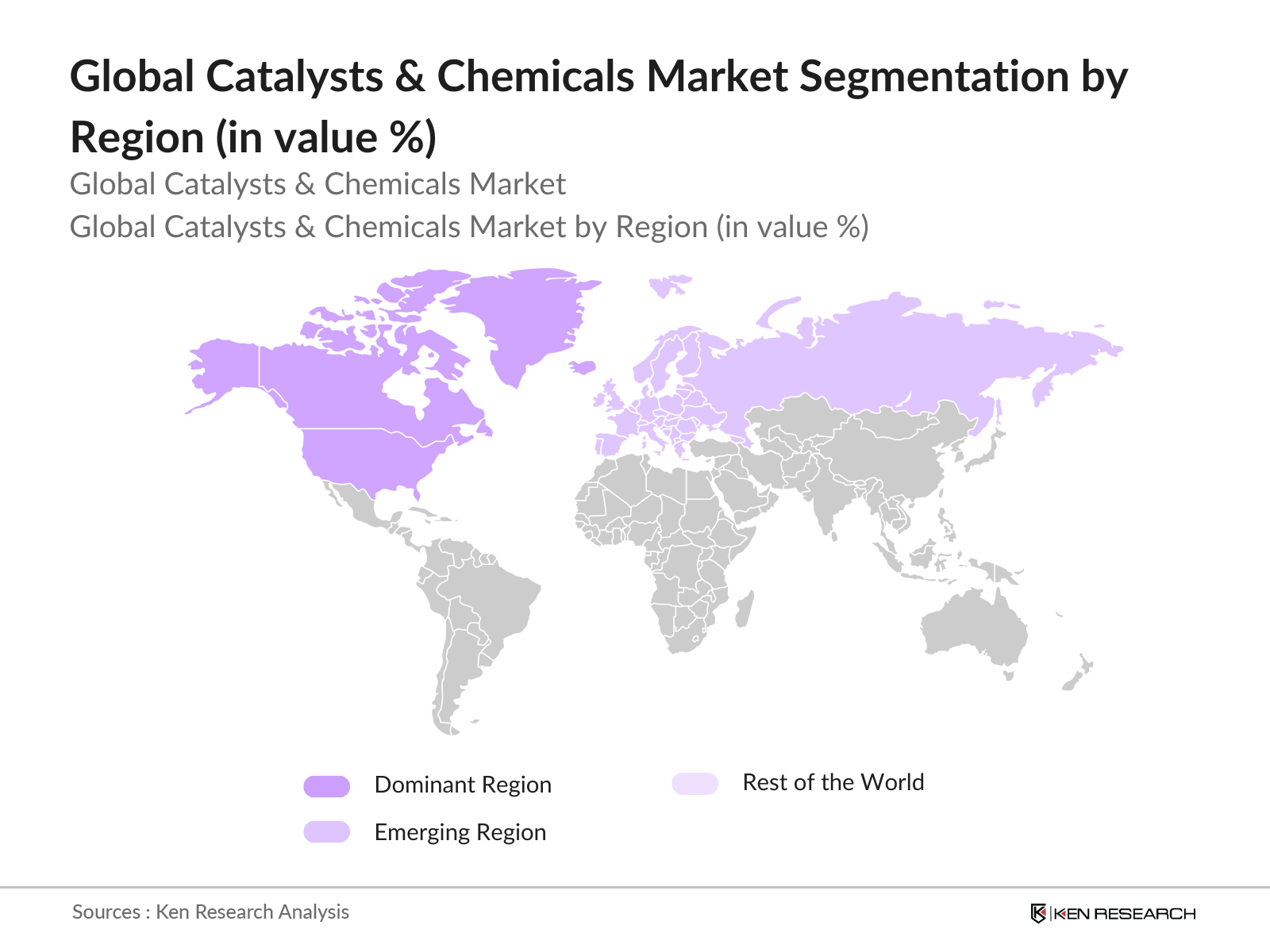

- North America holds the largest market share, benefiting from high demand in petrochemical and refining applications. Europe follows, driven by strict environmental regulations and high adoption of sustainable catalysts. The Asia-Pacific region is rapidly expanding, fueled by industrialization, growth in automotive manufacturing, and demand for environmental solutions, particularly in countries like China, Japan, and India.

- Governments globally have implemented emission standards that necessitate the use of catalysts in automotive and industrial applications. For instance, the Euro 6 standard in Europe and similar regulations in North America require vehicles to incorporate catalytic converters to reduce emissions. These standards drive demand for high-performance catalysts that meet stringent pollution control requirements, particularly in the automotive and energy sectors. Compliance with these emission standards is essential for manufacturers to access regulated markets.

Global Catalysts & Chemicals Market Segmentation

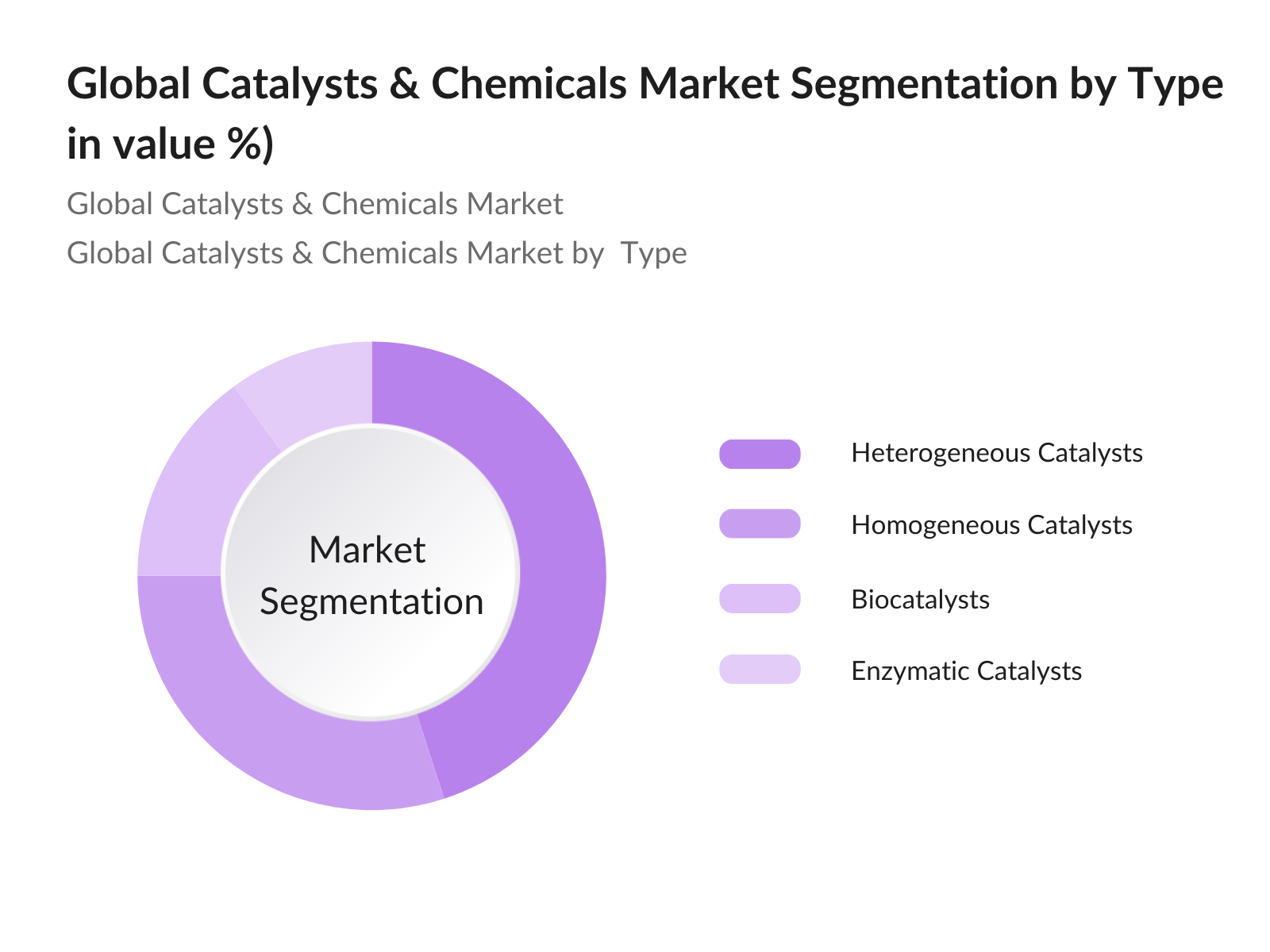

By Type: The Catalysts & Chemicals Market is segmented by type into heterogeneous catalysts, homogeneous catalysts, biocatalysts, and enzymatic catalysts. Heterogeneous catalysts hold the largest market share due to their versatility in refining and petrochemical industries. Biocatalysts are also gaining traction, particularly in the pharmaceutical and food processing sectors.

By Region: The Catalysts & Chemicals Market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads due to extensive use in petrochemical applications and high investment in R&D. Europe is a key market for environmental catalysts due to stringent regulations, while the Asia-Pacific region is growing rapidly due to industrial and automotive expansions.

Global Catalysts & Chemicals Market Competitive Landscape

The Global Catalysts & Chemicals Market is highly competitive, with major players focusing on R&D, sustainable production, and expansion into emerging markets. Leading companies such as BASF SE, Johnson Matthey, and Evonik Industries hold strong positions due to their comprehensive product portfolios, innovation in catalyst technologies, and extensive global networks. The competitive landscape is shaped by strategic acquisitions, technological advancements, and a focus on environmentally friendly catalysts.

|

Company |

Establishment Year |

Headquarters |

Employees |

Revenue |

Product Range |

Key Innovations |

Customer Satisfaction Ratings |

Global Presence |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

||||||

|

Johnson Matthey |

1817 |

London, UK |

||||||

|

Evonik Industries |

2007 |

Essen, Germany |

||||||

|

W.R. Grace & Co. |

1854 |

Columbia, USA |

||||||

|

Albemarle Corporation |

1994 |

Charlotte, USA |

Global Catalysts & Chemicals Market Analysis

Market Growth Drivers

- Rising Demand for Catalysts in Petrochemical Processing: The petrochemical industry, which processed over 430 million metric tons of oil and gas derivatives in 2023, is a major consumer of catalysts used to increase efficiency and yield. Catalysts play a critical role in cracking and refining processes, essential for producing plastics, synthetic fibers, and other petrochemical products. With growing global demand for petrochemicals, particularly in Asia and North America, the demand for catalysts in these sectors continues to rise, supporting both process efficiency and output optimization in large-scale production facilities.

- Growth in Environmental Catalysts Due to Emission Regulations: Environmental regulations have intensified the demand for catalysts that reduce harmful emissions in industrial and automotive applications. In 2023, the European Union and the United States implemented stringent standards requiring industries to lower sulfur and nitrogen oxide emissions, boosting the demand for environmental catalysts. Catalysts used in catalytic converters, for example, reduce vehicular emissions, helping automotive manufacturers comply with these regulations. This regulatory-driven demand supports the growth of the catalyst market, especially in sectors focused on emissions reduction.

- Expansion in Automotive Catalysts due to Emission Control Needs: The automotive industry has increased its reliance on catalytic converters to meet stringent emission standards, especially in developed markets. With over 90 million vehicles produced globally in 2023, automotive catalysts are essential for reducing pollutants such as carbon monoxide and nitrogen oxides. As emission standards become more rigorous worldwide, including targets for electric and hybrid vehicles, demand for advanced automotive catalysts, including those for exhaust after-treatment systems, continues to rise, supporting environmental compliance.

Market Challenges:

- High Production and R&D Costs in Catalyst Manufacturing: Catalyst manufacturing is capital-intensive, with high costs associated with raw materials, specialized equipment, and R&D for innovative catalyst formulations. In 2023, catalyst production costs were particularly high for materials like platinum and palladium, essential for automotive catalysts. Additionally, R&D expenses in developing customized catalysts for industrial applications further increase operational costs, impacting profit margins. These high production and development costs pose a challenge for manufacturers, particularly in competitive markets with tight cost structures.

- Environmental Regulations on Catalyst Production and Disposal: Environmental regulations on catalyst production and disposal add compliance costs for manufacturers. Standards governing hazardous waste disposal and emissions during production are particularly stringent in regions like the EU and North America. Non-compliance can result in fines and operational restrictions, requiring catalyst manufacturers to adopt cleaner production methods and invest in waste management. These regulatory requirements increase operational complexity and cost, challenging manufacturers to maintain profitability while meeting environmental standards.

Global Catalysts & Chemicals Market Future Outlook

Over the next five years, the Catalysts & Chemicals Market is expected to grow due to increasing demand for sustainable solutions, technological advancements, and expansion into emerging markets. Innovations in green and bio-based catalysts, alongside developments in nano-catalysts, will further drive growth. Additionally, stringent environmental regulations will support the adoption of catalysts in various sectors, including automotive, refining, and industrial manufacturing.

Market Opportunities:

- Increasing Adoption of Green and Sustainable Catalysts: The demand for green and sustainable catalysts is rising as industries prioritize environmentally friendly practices. Green catalysts, which reduce energy consumption and produce fewer byproducts, align with corporate sustainability goals. In 2023, green catalysts saw significant adoption in sectors like petrochemicals and pharmaceuticals, where eco-friendly alternatives are increasingly prioritized. This trend supports manufacturers developing catalysts that reduce carbon emissions and chemical waste, aligning with global sustainability initiatives.

- Expansion of Catalyst Applications in Emerging Markets: Emerging markets, particularly in Asia-Pacific and Latin America, present growth opportunities for catalyst applications due to rapid industrialization and infrastructure development. In 2023, investment in industrial projects exceeded $500 billion in these regions, driving demand for catalysts in refining, chemical processing, and pollution control. Expanding catalyst applications in these markets provides manufacturers with growth opportunities as emerging economies modernize their industrial processes and increase environmental regulation compliance.

Scope of the Report

|

By Type |

Heterogeneous Catalysts Homogeneous Catalysts Biocatalysts Enzymatic Catalysts |

|

By Application |

Petrochemical and Refining Chemical Synthesis Environmental Pharmaceuticals Food Processing |

|

By Material |

Zeolites Metals Enzymes Chemical Compounds Ceramics |

|

By End-User |

Industrial Manufacturing |

|

By Region |

North America |

Products

Key Target Audience

Chemical and Petrochemical Manufacturers

Environmental Regulatory Bodies (e.g., Environmental Protection Agencies)

Investments and Venture Capitalist Firms

Automotive and Industrial Equipment Manufacturers

Pharmaceutical and Biotechnology Companies

Research and Development Institutes

Food and Beverage Industry Stakeholders

Sustainability and Green Chemistry Advocates

Companies

Players Mention in the Report

BASF SE

Johnson Matthey

Evonik Industries

W.R. Grace & Co.

Albemarle Corporation

Clariant AG

ExxonMobil Chemical Company

Honeywell International Inc.

Arkema Group

LyondellBasell Industries

Chevron Phillips Chemical Company

Sinopec Limited

Mitsubishi Chemical Holdings

Dow Inc.

Air Products and Chemicals, Inc.

Table of Contents

Research Methodology

Step 1: Identification of Key Variables

Research began with identifying factors like demand for sustainable catalysts, technological innovations, and regional market dynamics. Data was gathered from proprietary databases, government reports, and industry publications.

Step 2: Market Analysis and Construction

Historical data on catalyst sales, segmentation by type and application, and emerging trends in environmental and industrial catalysts were analyzed. Key trends such as nano-catalysts and green chemistry were also examined.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through consultations with industry experts, environmental regulatory bodies, and chemical engineers. Their insights ensured projections aligned with the latest advancements and regulatory impacts.

Step 4: Research Synthesis and Final Output

The final synthesis integrated qualitative insights and quantitative data, providing a comprehensive analysis of the Catalysts & Chemicals Market, covering growth drivers, challenges, and future opportunities.

Frequently Asked Questions

01. How big is the Global Catalysts & Chemicals Market?

The global catalysts and chemicals market is valued at approximately USD 40.52 billion, driven by high demand in petrochemical, refining, and environmental applications.

02. What are the challenges in the Global Catalysts & Chemicals Market?

Challenges include high production costs, fluctuating raw material prices, and strict environmental regulations impacting catalyst production and disposal.

03. Who are the major players in the Global Catalysts & Chemicals Market?

Key players include BASF SE, Johnson Matthey, Evonik Industries, Albemarle Corporation, and W.R. Grace & Co., known for their innovation and global reach.

04. What are the growth drivers of the Global Catalysts & Chemicals Market?

Growth drivers include rising demand in petrochemical processing, technological advancements, and increased adoption of environmental catalysts due to emission regulations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.