Global Cellulose Fiber Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD7984

October 2024

84

About the Report

Global Cellulose Fiber Market Overview

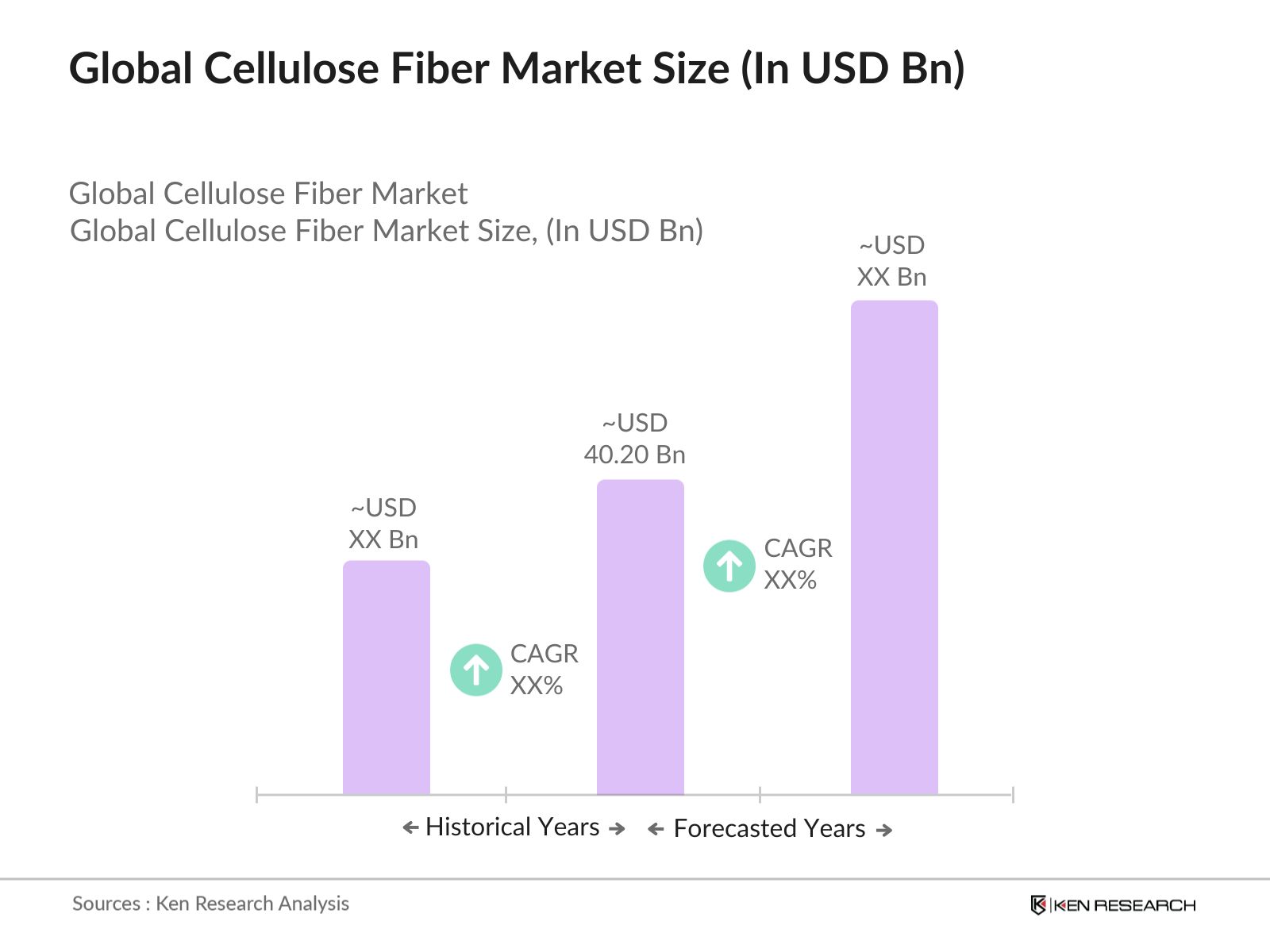

- The global cellulose fiber market, valued at USD 40.20 billion based on a five-year historical analysis, is primarily driven by the increasing demand for eco-friendly and sustainable materials in the textile industry. Cellulose fibers, such as viscose and lyocell, have seen increased adoption due to their biodegradable properties and lower environmental impact compared to synthetic fibers. The growing awareness about sustainability, along with stringent government regulations on plastic usage, has pushed manufacturers toward sustainable alternatives, further boosting the cellulose fiber market.

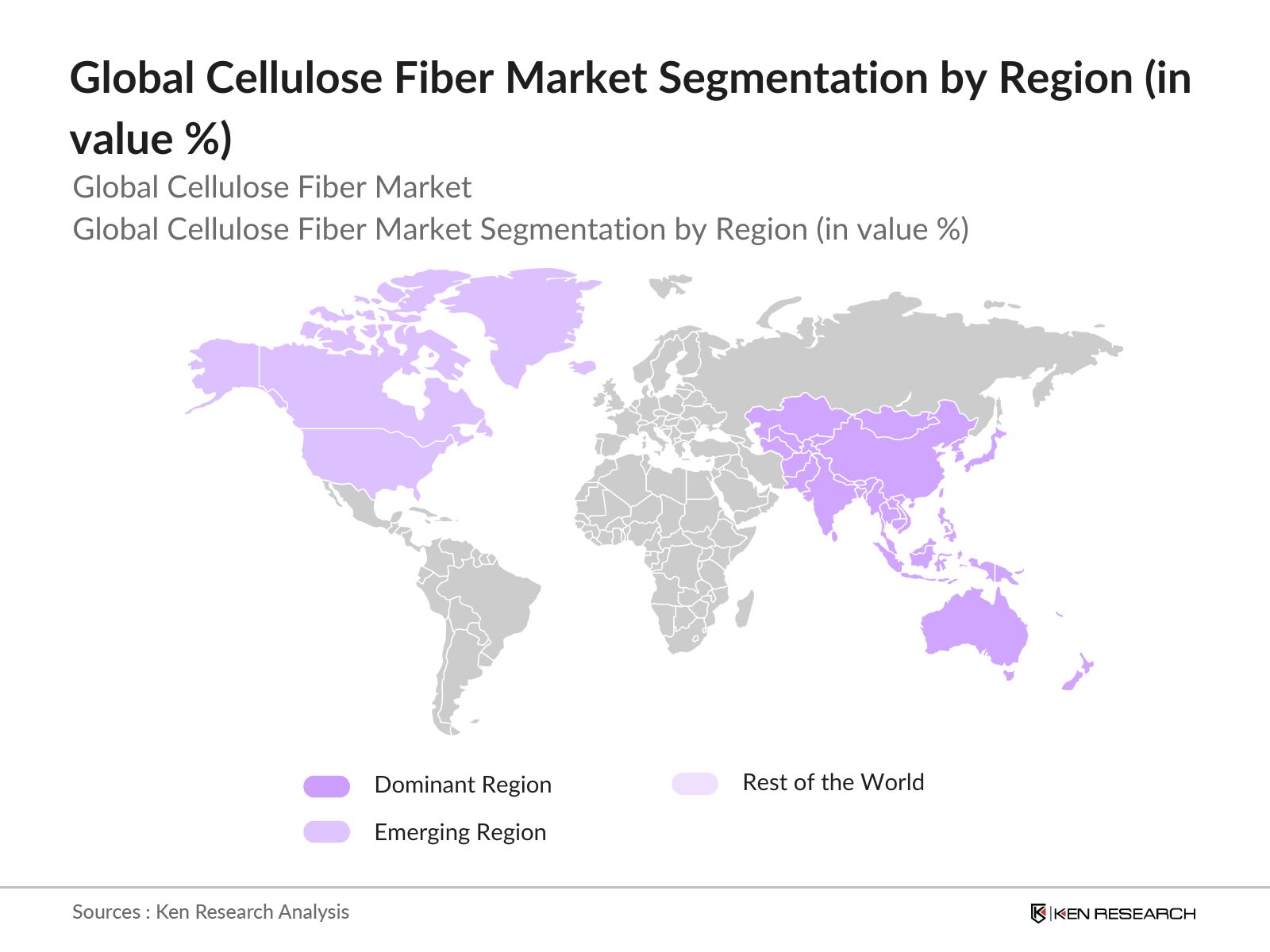

- Key regions dominating the cellulose fiber market include Asia-Pacific, particularly countries like China and India. China remains a significant leader due to its abundant raw material availability (wood pulp) and a well-established manufacturing infrastructure. Indias dominance is attributed to its large textile industry and government initiatives promoting sustainability. Both countries benefit from low production costs and government support for renewable materials, helping them maintain their strong market presence.

- Global carbon emission reduction targets are directly influencing the adoption of sustainable cellulose fibers. The Paris Agreement sets targets for carbon neutrality by 2050, and industries such as textiles are crucial to achieving this goal. In 2023, the global textile industry was responsible for 1.2 billion metric tons of CO2 emissions. To meet international climate targets, countries like Germany and Japan have introduced subsidies for sustainable textile manufacturing, with cellulose fibers playing a central role due to their lower environmental impact compared to synthetic fibers.

Global Cellulose Fiber Market Segmentation

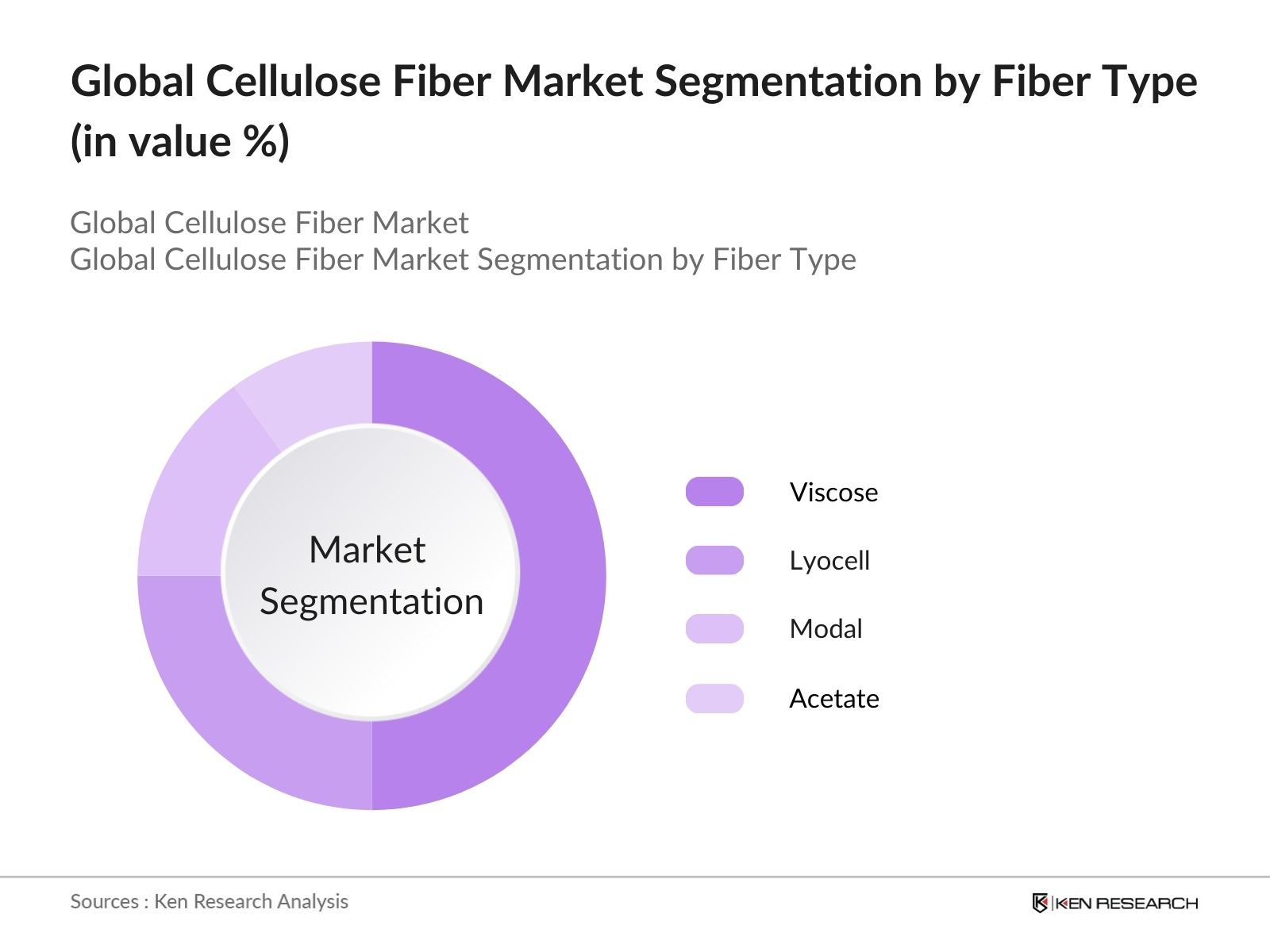

- By Fiber Type: The global cellulose fiber market is segmented by fiber type into viscose, lyocell, modal, acetate, and others (including bamboo and ramie). Among these, viscose held the largest market. the dominance of viscose can be attributed to its wide range of applications across apparel, home textiles, and hygiene products. Its versatility, cost-effectiveness, and growing demand in fast fashion industries have contributed to its strong market position. Additionally, viscose is favored for its ability to blend with both synthetic and natural fibers, enhancing its usability.

- By Region: The global cellulose fiber market is segmented into five key regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific leads the market, driven by the strong presence of manufacturing hubs, particularly in China and India. The regions dominance is further supported by government policies promoting renewable resources and the expansion of the textile industry. Meanwhile, North America and Europe are also experiencing significant growth due to rising environmental awareness and regulatory support for eco-friendly materials.

Global Cellulose Fiber Market Competitive Landscape

The global cellulose fiber market is consolidated with key players holding significant market share due to their established production capabilities, strong supply chains, and investment in sustainable practices. Companies are focusing on expanding their production capacity, product innovation, and enhancing sustainability in their processes to meet the increasing demand for eco-friendly fibers. The leading players include Lenzing AG, Sateri, and Grasim Industries, which dominate due to their strong raw material sourcing and integration across the value chain.

|

Company |

Establishment Year |

Headquarters |

Global Production Capacity |

R&D Investments |

Annual Output (GW) |

Bifacial Panel Efficiency (%) |

Warranty (Years) |

Degradation Rate (% per year) |

|

Lenzing AG |

1938 |

Austria |

||||||

|

Sateri |

2002 |

China |

||||||

|

Grasim Industries Ltd. |

1947 |

India |

||||||

|

Eastman Chemical Co. |

1920 |

USA |

||||||

|

Kelheim Fibres GmbH |

1936 |

Germany |

Global Cellulose Fiber Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Textiles: The global shift towards sustainability has intensified the demand for cellulose fibers, driven by the textile industry's shift away from synthetic fibers like polyester. The United Nations Environment Programme (UNEP) reported that textiles account for 10% of global carbon emissions annually, which has motivated countries like China and India, the largest textile producers, to adopt eco-friendly alternatives. As of 2023, China's textile industry, valued at over USD 270 billion, is increasingly using cellulose fibers to meet sustainability goals. This demand is supported by governmental efforts to achieve net-zero emissions by 2060.

- Rising Applications in Non-Woven Fabrics (Biodegradability, Versatility): Non-woven fabric production is increasingly incorporating cellulose fibers due to their biodegradability and versatility in applications like hygiene products and medical textiles. In 2022, global non-woven fabric production reached approximately 15 million metric tons, with cellulose fibers contributing to over 30% of the raw materials used. This shift is particularly evident in Europe and the U.S., where consumer preference for biodegradable products is higher. The European Unions directives to reduce single-use plastics have propelled this growth, highlighting the push towards sustainable non-woven materials.

- Government Regulations Encouraging Eco-friendly Fibers (Sustainability Mandates): Governments are enforcing stricter regulations to promote the use of eco-friendly fibers, which has significantly influenced the adoption of cellulose fibers in industries like textiles and non-wovens. For instance, the European Unions 2023 Sustainable Textile Strategy aims to reduce textile waste by 55% by 2030. Meanwhile, Indias Ministry of Textiles has mandated the adoption of sustainable production practices, with cellulose fibers playing a key role. In 2024, Indias government allocated USD 200 million to boost eco-friendly textile manufacturing under the PLI (Production-Linked Incentive) scheme.

Market Restraints

- Competition from Synthetic Fibers: Despite the growing demand for eco-friendly materials, synthetic fibers like polyester continue to dominate the textile market. In 2023, synthetic fibers accounted for over 60% of global textile production due to their low cost and durability. While cellulose fibers offer significant environmental benefits, their production is costlier, making them less competitive in price-sensitive markets such as fast fashion. Additionally, synthetic fibers are still favored in regions like Southeast Asia, where the textile industry is heavily reliant on cost efficiency.

- Supply Chain Constraints in Source Regions: The cellulose fiber industry is highly dependent on a stable supply of raw materials like wood pulp, primarily sourced from forests in North America and Scandinavia. However, geopolitical tensions, such as the Russia-Ukraine conflict, have disrupted trade routes and increased transportation costs. In 2023, wood pulp exports from Russia, which accounted for 12% of global supply, were halted due to sanctions, leading to a 10% drop in global cellulose fiber production. These constraints are exacerbated by environmental regulations limiting deforestation, further tightening supply chains.

Global Cellulose Fiber Market Future Outlook

Over the next five years, the global cellulose fiber market is expected to witness significant growth driven by advancements in fiber production technology, increasing demand for sustainable materials, and rising consumer awareness about eco-friendly products. As governments continue to enforce regulations against synthetic materials, the cellulose fiber market will benefit from favorable policies supporting green technologies. Additionally, new applications in filtration, industrial uses, and hygiene products are expected to further drive market expansion.

Market Opportunities

- Development of Novel Applications (Hygiene Products, Industrial Filters): The versatility of cellulose fibers is unlocking new applications, especially in hygiene products and industrial filters. For example, in 2023, the hygiene sector saw a 25% increase in the use of cellulose-based materials in diapers and sanitary products due to their superior absorbency and biodegradability. Similarly, industrial filters, which are critical in sectors like mining and pharmaceuticals, are increasingly using cellulose fibers for their durability and eco-friendly characteristics. Chinas industrial filter market, worth over USD 15 billion in 2023, is rapidly adopting cellulose-based alternatives.

- Expansion in Emerging Markets (Asia-Pacific, Latin America): Emerging markets such as Asia-Pacific and Latin America are witnessing rapid growth in the use of cellulose fibers, driven by industrialization and increased environmental awareness. In 2023, Asia-Pacific accounted for over 45% of global cellulose fiber consumption, with India and Indonesia being key markets. India, for instance, produced over 600,000 metric tons of cellulose fibers in 2023, spurred by government initiatives promoting sustainable textiles. Latin America is also becoming a significant player, with Brazil investing USD 150 million in expanding its cellulose fiber production capacity to meet growing regional demand.

Scope of the Report

|

By Fiber Type |

Viscose, Lyocell, Modal, Acetate, Others (Bamboo, Ramie) |

|

By Application |

Textiles, Non-woven Fabrics, Filtration, Hygiene Products, Industrial Applications |

|

By Process |

Natural Cellulose Fiber Process, Regenerated Cellulose Fiber Process |

|

By Source |

Wood Pulp, Agricultural By-products, Recycled Materials |

|

By Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Cellulose Fiber Manufacturers

Textile and Apparel Companies

Industrial Filtration Providers

Hygiene Product Manufacturers

Non-woven Fabric Producers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Environmental Protection Agency, Ministry of Textiles)

Wood Pulp Suppliers

Companies

Players Mentioned in the Report:

Lenzing AG

Sateri

Grasim Industries Ltd.

Eastman Chemical Co.

Kelheim Fibres GmbH

CFF GmbH & Co. KG

Thai Rayon Public Co., Ltd.

China Bambro Textile (Group) Co., Ltd.

Fulida Group Holding Co., Ltd.

Tangshan Sanyou Group Xingda Chemical Fibre Co., Ltd.

Shandong Helon Textile Sci. & Tech. Co., Ltd.

Aditya Birla Group

Birla Cellulose

Cordenka GmbH & Co. KG

Tembec Inc.

Table of Contents

1. Global Cellulose Fiber Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Cellulose Fiber Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Cellulose Fiber Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Sustainable Textiles

3.1.2. Rising Applications in Non-Woven Fabrics (Biodegradability, Versatility)

3.1.3. Government Regulations Encouraging Eco-friendly Fibers (Sustainability Mandates)

3.1.4. Technological Advancements in Fiber Production (Manufacturing Process Efficiency)

3.2. Market Challenges

3.2.1. High Raw Material Costs (Wood Pulp, Agricultural By-products)

3.2.2. Competition from Synthetic Fibers

3.2.3. Supply Chain Constraints in Source Regions (Forestry Resources, Geopolitical Barriers)

3.3. Opportunities

3.3.1. Development of Novel Applications (Hygiene Products, Industrial Filters)

3.3.2. Expansion in Emerging Markets (Asia-Pacific, Latin America)

3.3.3. Shifting Consumer Preferences Towards Organic and Sustainable Products

3.4. Trends

3.4.1. Adoption of Closed-Loop Production Systems

3.4.2. Increasing Focus on Textile Recycling and Circular Economy

3.4.3. Innovations in Bio-based and Regenerated Cellulose Fibers

3.5. Government Regulation

3.5.1. EU Sustainable Textile Strategy (Recycling, Waste Reduction)

3.5.2. Carbon Emission Reduction Targets

3.5.3. Certification Standards (OEKO-TEX, FSC Certification)

3.5.4. Public-Private Initiatives for Green Textiles

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Cellulose Fiber Market Segmentation

4.1. By Fiber Type (In Value %)

4.1.1. Viscose

4.1.2. Lyocell

4.1.3. Modal

4.1.4. Acetate

4.1.5. Others (Bamboo, Ramie)

4.2. By Application (In Value %)

4.2.1. Textiles

4.2.2. Non-woven Fabrics

4.2.3. Filtration

4.2.4. Hygiene Products

4.2.5. Industrial Applications

4.3. By Process (In Value %)

4.3.1. Natural Cellulose Fiber Process

4.3.2. Regenerated Cellulose Fiber Process

4.4. By Source (In Value %)

4.4.1. Wood Pulp

4.4.2. Agricultural By-products

4.4.3. Recycled Materials

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Cellulose Fiber Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lenzing AG

5.1.2. Sateri

5.1.3. Grasim Industries Ltd.

5.1.4. Eastman Chemical Company

5.1.5. Kelheim Fibres GmbH

5.1.6. CFF GmbH & Co. KG

5.1.7. Thai Rayon Public Co. Ltd.

5.1.8. China Bambro Textile (Group) Co., Ltd.

5.1.9. Fulida Group Holding Co., Ltd.

5.1.10. Tangshan Sanyou Group Xingda Chemical Fibre Co., Ltd.

5.1.11. Shandong Helon Textile Sci. & Tech. Co., Ltd.

5.1.12. Aditya Birla Group

5.1.13. Birla Cellulose

5.1.14. Cordenka GmbH & Co. KG

5.1.15. Tembec Inc.

5.2. Cross Comparison Parameters (Fiber Capacity, Global Production Share, Environmental Certifications, Supply Chain Resilience, Product Innovation, Geographical Presence, Sustainability Initiatives, Research & Development Expenditure)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Cellulose Fiber Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Cellulose Fiber Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Cellulose Fiber Future Market Segmentation

8.1. By Fiber Type (In Value %)

8.2. By Application (In Value %)

8.3. By Process (In Value %)

8.4. By Source (In Value %)

8.5. By Region (In Value %)

9. Global Cellulose Fiber Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the research involved identifying the key variables influencing the global cellulose fiber market. This was achieved through extensive desk research, involving both secondary and proprietary data sources, to create a comprehensive market ecosystem map.

Step 2: Market Analysis and Construction

The second phase entailed a detailed analysis of historical data, focusing on production capacity, raw material availability, and the adoption of cellulose fibers across various applications. This analysis helped to provide insights into the market's performance over recent years.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, hypotheses related to market trends, demand patterns, and potential growth drivers were developed and validated through interviews with industry experts from major cellulose fiber producers. This consultation provided direct insights into the evolving market landscape.

Step 4: Research Synthesis and Final Output

Finally, the collected data was synthesized and validated through triangulation with bottom-up and top-down approaches. This step ensured that the research outputs were accurate, providing a holistic view of the global cellulose fiber market.

Frequently Asked Questions

01. How big is the global cellulose fiber market?

The global cellulose fiber market is valued at USD 40.20 billion based on a five-year historical analysis, driven by the increasing demand for sustainable and biodegradable materials in various industries, particularly in textiles.

02. What are the challenges in the global cellulose fiber market?

Challenges include high raw material costs, supply chain constraints in sourcing wood pulp, and competition from synthetic fibers. Additionally, geopolitical factors affecting forestry resources can disrupt supply chains.

03. Who are the major players in the global cellulose fiber market?

Key players include Lenzing AG, Sateri, Grasim Industries, Eastman Chemical Company, and Kelheim Fibres. These companies dominate due to their established supply chains, product innovation, and sustainability initiatives.

04. What are the growth drivers of the global cellulose fiber market?

The market is driven by increasing demand for sustainable and biodegradable materials, technological advancements in fiber production, and government regulations promoting eco-friendly products across industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.