Global Ceramic Tiles Market Outlook to 2030

Region:Global

Author(s):Vanshika and Nishika

Product Code:KENGR049

October 2024

95

About the Report

Global Ceramic Tiles Market Overview

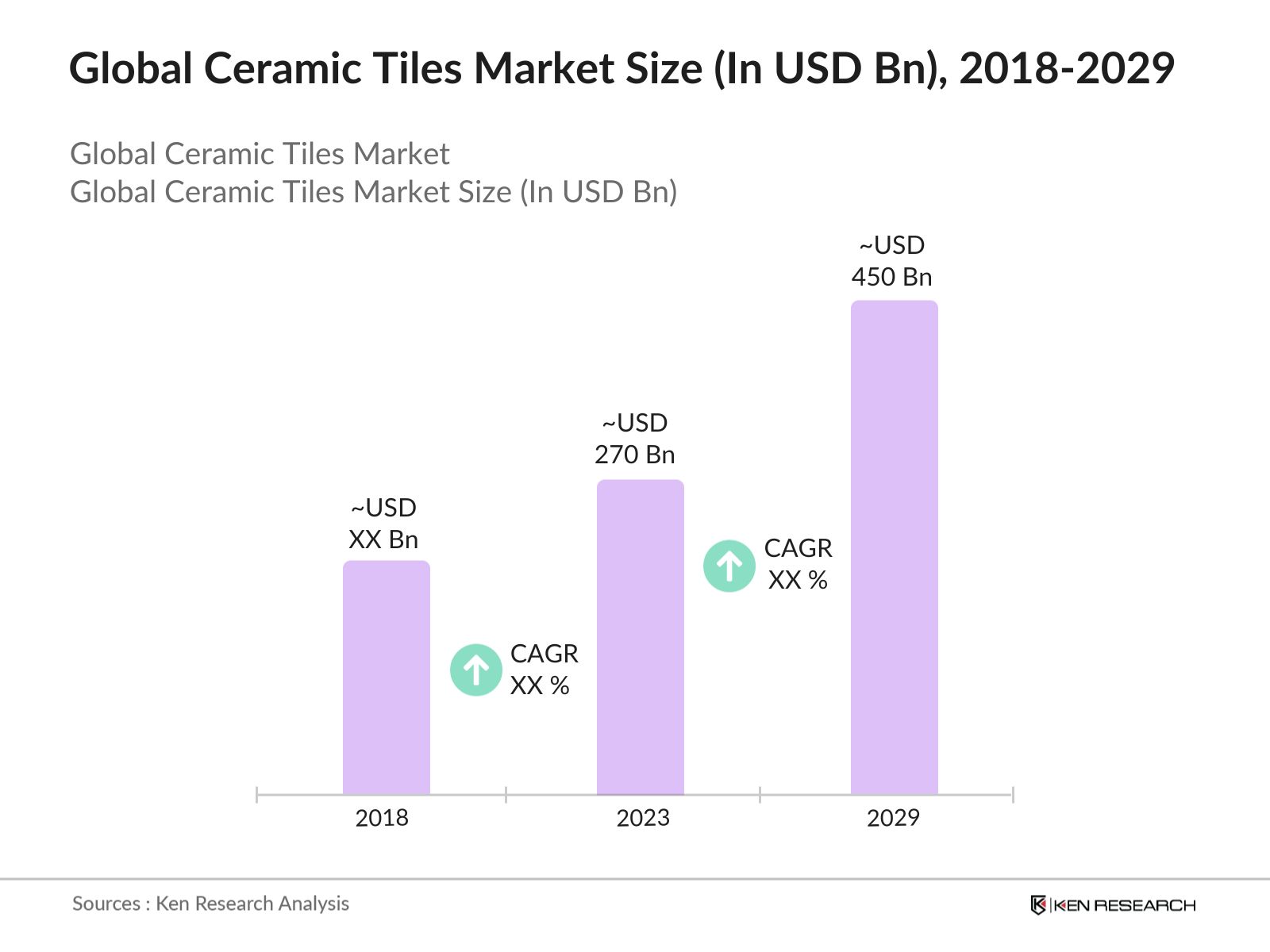

- In 2023, global ceramic tiles market was valued at USD 270 Bn witnessing remarkable growth between the historical period of 2018-2023. The market is driven by factors including Urbanization and Infrastructure development, Economic Growth and rising incomes, and increasing demand for sustainable and eco-friendly building materials, and technological advancements in tile manufacturing processes.

- The market is highly fragmented with top players commanding only 5% of the market share. Mohawk Industries, Grupo Lamosa, SCG Ceramics, RAK Ceramics, Grupo Pamesa, Ceramica Carmelo Fior, and STN Group are some of the prominent players in the market.

- In a strategic move to strengthen its global footprint in the ceramic tile industry, Mohawk Industries Group made significant acquisitions in 2023 by purchasing two prominent ceramic tile businesses in Brazil and Mexico. This acquisition, valued at USD 515,509, was a part of Mohawk's broader strategy to expand its operations in key international markets.

Global Ceramic Tiles Current Market Analysis

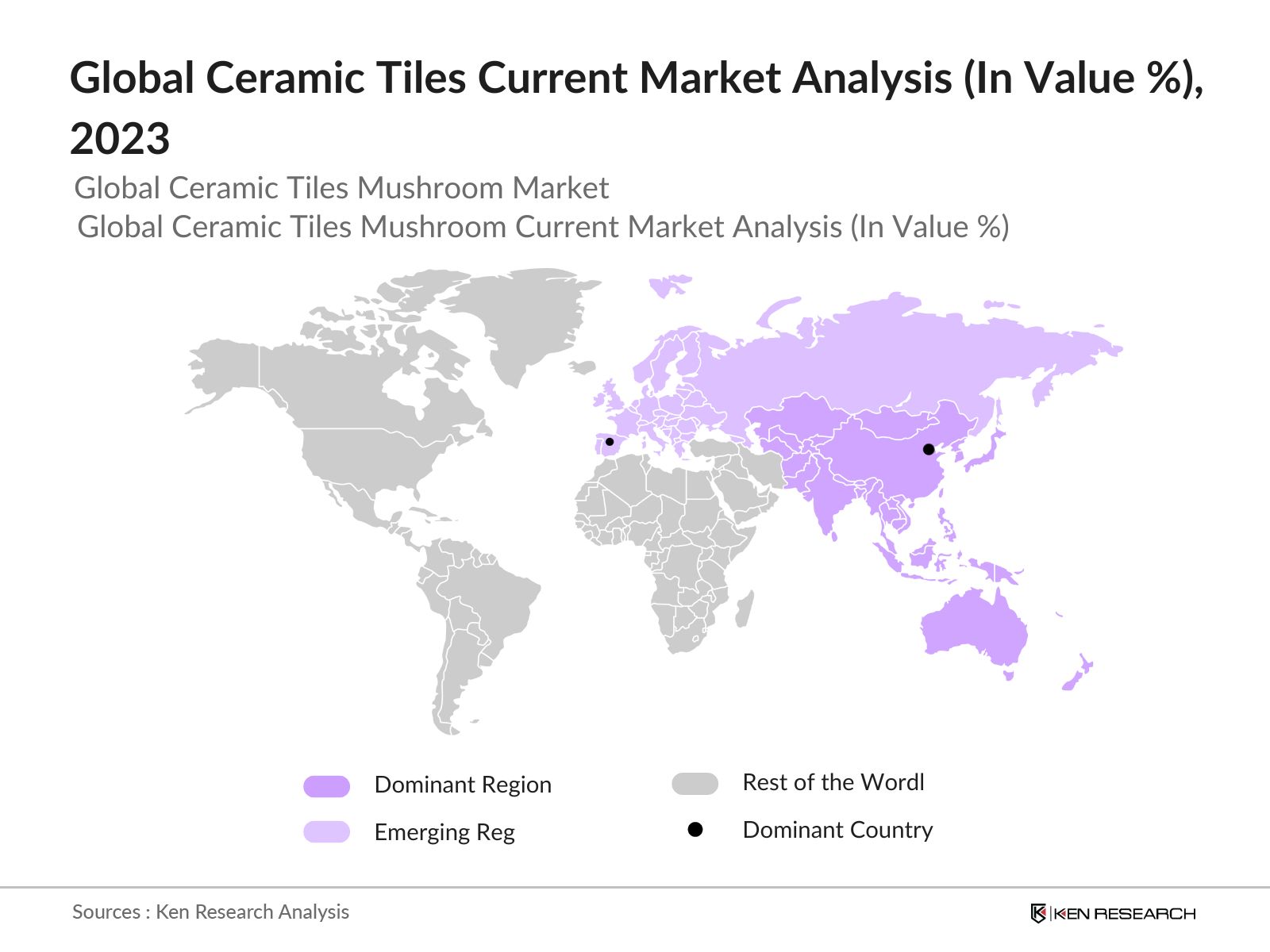

- APAC as a dominant region: APAC is the largest producer and consumer of ceramic tiles, accounting for two-thirds of the market. This dominance is driven by the significant potential in residential real estate in two highly populated countries, China and India, which supports a positive outlook for the ceramic tiles market. India is recognized as the second-largest manufacturer in the global ceramics industry, with a projected production increase from 2,500 million square meters (MSM) in 2023 to over 3,700 MSM by 2026. Additionally, China's ongoing infrastructure projects, with an estimated investment of USD 4.2 trillion during its 14th Five-Year Plan (2021-2025), further support the demand for ceramic tiles in both residential and commercial sectors.

- Europe as an emerging region: Europe is the second-largest region in the market owing to robust demand from the construction and renovation sectors. The region's market is supported by factors such as stringent regulations promoting sustainable and energy-efficient building materials, and a strong tradition of high-quality tile manufacturing. The European housing sector is experiencing a surge in demand, with 1.56 billion square meters of ceramic tiles consumed in 2019, making Europe the second-largest consumer after Asia. Additionally, the Consumer Confidence Index (CCI) in major European countries has consistently exceeded 100 since 2017, reflecting increased consumer purchasing power and confidence in the housing market, further boosting demand for building materials, including ceramic tiles.

- China as dominant country: The market is dominated by China which hold around half of the market, China dominates the market in each of production and consumption of ceramic tiles. This dominance is attributed to several key factors such as massive production capacity, high domestic demand, and cost-effective manufacturing. In 2022, China's ceramic tile production was estimated at 12 billion square meters, which represents a substantial portion of the global output. Additionally, China is the world's leading exporter of ceramic tiles, supplying products to over 180 countries. The country exported ceramic tiles worth approximately USD 3.5 billion in 2021.

Global Ceramic Tiles Market Segmentation

The Global Ceramic Tiles Market can be segmented based on several factors:

- By Material Type: The global ceramic tiles market is segmented by material type into ceramic, porcelain, and others, which includes materials such as quarry and terracotta. In 2023, the Porcelain sub-segment led the market by material type, capturing the largest market share. This dominance is attributed to Porcelain's superior durability, water resistance, and aesthetic appeal, making it the preferred choice for both residential and commercial applications. The Ceramic segment also holds a substantial share, driven by its affordability and versatility.

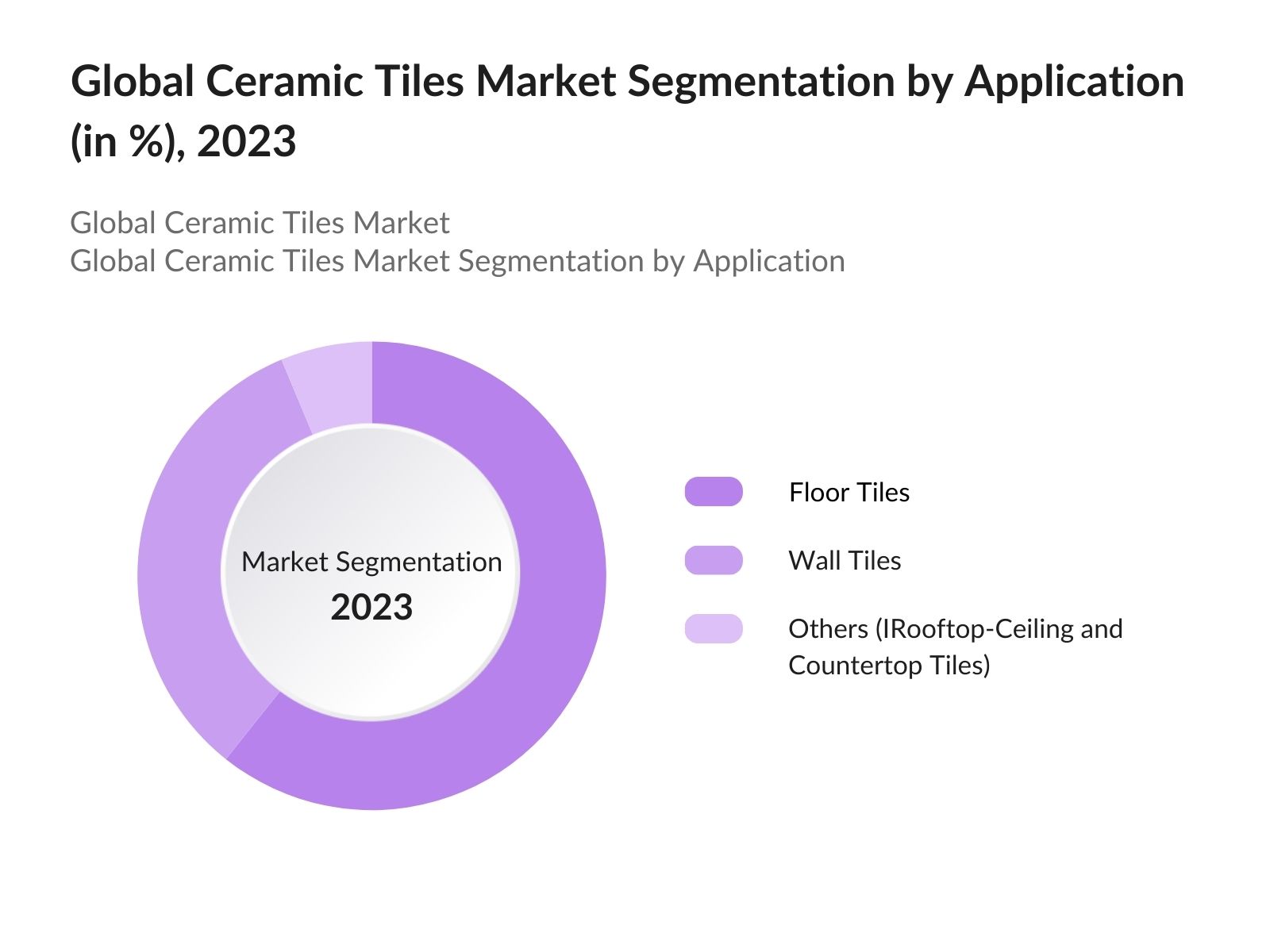

- By Application Type: The global ceramic tiles market is segmented by application type into floor tiles, wall tiles, and others, including rooftop-ceiling and countertop tiles. In 2023, the Floor Tiles sub-segment dominated the market, securing the largest market share. This dominance is driven by the extensive use of floor tiles in both residential and commercial projects, owing to their durability and wide range of design options. Wall Tiles also represent a significant portion of the market, popular for their role in enhancing interior aesthetics.

- By End-User Type: The global ceramic tiles market is segmented by end-user type into residential and non-residential sectors. In 2023, the Residential sub-segment led the market by end-user type, capturing the largest market share. This dominance is attributed to the rising demand for ceramic tiles in home renovation and new housing projects, where aesthetics and functionality are key considerations. The Non-Residential segment, encompassing commercial, industrial, and public infrastructure projects, also holds a significant share, reflecting the broad application of ceramic tiles in various large-scale projects.

Global Ceramic Tiles Market Competitive Landscape

|

Company |

Headquarters |

Establishment Year |

Geographical Presence |

|

Mohawk Industries Group |

Georgia, United States of America |

1988 |

170 |

|

Grupo Lamosa |

Nuevo Len, Mexico |

1890 |

9 |

|

SCG Group |

Bangkok, Thailand |

1913 |

50 |

|

RAK Ceramics |

Ras Al Khaimah, United Arab Emirates |

1989 |

150 |

|

Kajaria Ceramics |

New Delhi, India |

1988 |

35 |

|

Grupo Pamesa |

Castelln, Spain |

1972 |

150 |

|

Arwana Citramulia |

Jakarta, Indonesia |

1993 |

N/A |

|

Saudi Ceramics |

Riyadh, Saudi Arabia |

1982 |

80 |

|

Somany Ceramics |

Uttar Pradesh, India |

1968 |

55 |

|

Kaleseramik |

Istanbul, Turkey |

1957 |

86 |

- Grupo Lamosa: Grupo Lamosa, a leading Mexican manufacturer, acquired Baldocer, a renowned Spanish manufacturer of high-end ceramic products. Baldocer, known for its premium quality tiles and innovative designs, has a significant presence in over 120 countries, making it a key player in the international market.

- SCG Group: COTTO has unveiled its latest innovation, the X STRONG tile model, designed to meet the demands of both residential and commercial spaces. The X STRONG model features a highly durable surface, engineered to resist abrasion and withstand heavy foot traffic, making it an ideal choice for high-use areas. This new tile model combines strength with aesthetic appeal, offering a sleek and modern look without compromising on performance.

- RAK Ceramics: RAK Ceramics has solidified its position in the global ceramics market by acquiring the remaining 8% stake in RAK Porcelain LLC, thereby making it a wholly-owned subsidiary. This strategic acquisition allows RAK Ceramics to fully integrate RAK Porcelain into its operations, enhancing synergies across its product lines and expanding its influence in the high-end tableware and porcelain segment.

Global Ceramic Tiles Industry Analysis

Global Ceramic Tiles Market Growth Drivers:

- Urbanization and Infrastructure Development: Urbanization and infrastructure development are key growth drivers for the Global Ceramic Tiles Market. As urban populations continue to grow, there is an increased demand for housing, commercial spaces, and public infrastructure, all of which require durable and aesthetically pleasing building materials like ceramic tiles. According to the United Nations, 68% of the global population is projected to live in urban areas by 2050, up from 55% in 2018. This rapid urbanization is particularly evident in emerging economies such as India and China, where large-scale infrastructure projects and new residential developments are driving significant demand for ceramic tiles.

- Economic Growth and Rising Incomes: Economic growth and rising incomes in both developed and developing countries have led to an increase in consumer spending, particularly in home improvement and renovation projects. The World Bank reported a global GDP growth of 5.5% in 2021, reflecting a strong post-pandemic recovery that has continued into 2023. As disposable incomes rise, more consumers are investing in higher-quality, aesthetically superior products, including ceramic tiles, for their homes and commercial spaces.

- Increasing Demand for Sustainable and Eco-Friendly Building Materials: The growing emphasis on sustainability and environmental responsibility has significantly impacted the ceramic tiles market. In 2024, more than 50% of global builders now prefer eco-friendly materials, highlighting the increasing acceptance and integration of sustainable building practices. Consumers and builders are increasingly opting for eco-friendly building materials that contribute to energy efficiency and reduce environmental impact. Ceramic tiles, particularly those made from recycled materials or with low energy consumption during production, align well with these sustainability goals.

Global Ceramic Tiles Market Challenges:

- Slowdown in Production: The Ceramic Tiles Market faced a significant challenge due to a slowdown in production, primarily driven by the situation in China, the worlds largest producer of ceramic tiles. This slowdown was largely a result of reduced demand from key exporting countries, which had a ripple effect on production levels. As global economic uncertainties and trade disruptions took hold, many importing countries scaled back their orders, leading to excess inventory and lower production rates in Chinese manufacturing facilities.

- Rising Energy Prices: The Ceramic Tiles Market also encountered increased operational costs due to rising energy prices, a challenge exacerbated by geopolitical tensions that disrupted energy supplies, particularly in Europe. The region experienced a substantial hike in gas prices, a critical input for tile production, which directly impacted the cost structure of tile manufacturers. The energy-intensive nature of ceramic tile manufacturing meant that these rising costs significantly squeezed profit margins.

Global Ceramic Tiles Market Government Initiatives:

- European Union - European Green Deal: The European Green Deal is a comprehensive initiative by the European Union to make Europe climate-neutral by 2050. As part of this initiative, the EU promotes the use of sustainable building materials, including eco-friendly ceramic tiles. The deal includes policies and incentives for reducing carbon emissions in the manufacturing sector, encouraging the adoption of green technologies in ceramic tile production.

- China - "Made in China 2025": The "Made in China 2025" initiative is a strategic plan by the Chinese government to upgrade its manufacturing sector, including the ceramic tiles industry. The plan focuses on innovation, quality improvement, and environmental sustainability. It encourages Chinese manufacturers to adopt advanced technologies and increase the production of high-quality ceramic tiles for both domestic consumption and export.

Global Ceramic Tiles Future Market Outlook

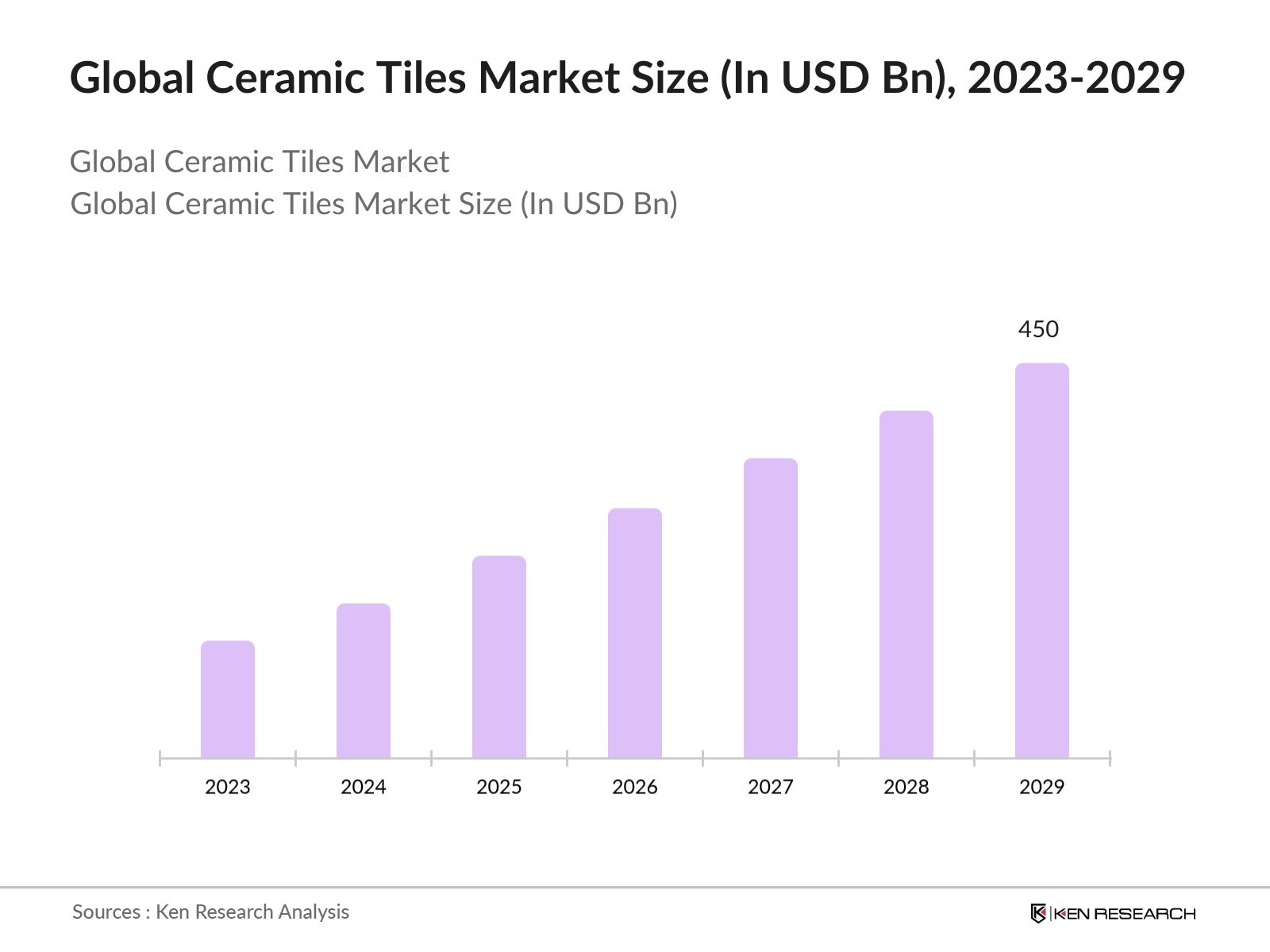

The global Ceramic Tiles market is predicted to grow exceptionally in the forecasted period of 2023-2029 reaching a market size of USD 450 Bn driven by a combination of robust demand, technological advancements, and a growing emphasis on sustainability.

- Sustainability and Green Building Practices: As environmental concerns become increasingly important, the market is expected to see a growing demand for eco-friendly and sustainable ceramic tiles. Manufacturers will focus on reducing carbon footprints, adopting energy-efficient production processes, and increasing the use of recycled materials. Green building certifications and stricter environmental regulations in regions like Europe and North America will drive the adoption of sustainable ceramic tile products.

- Rising Demand in Residential and Commercial Sectors: The residential sector will continue to be a major contributor to market growth, driven by new housing projects and home renovation activities. Meanwhile, the commercial sector, including retail, hospitality, and office spaces, will also see increased demand for high-quality ceramic tiles that offer durability and design flexibility. The trend towards luxury and premium tiles is expected to gain momentum, particularly in developed markets.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Material |

Ceramic Porcelain Others (Incl. Quarry, Terracota, among others) |

|

By Application |

Floor Tiles Wall Tiles Others (Incl. Rooftop-Ceiling and Countertop Tiles) |

|

By End-User |

Residential Non-Residential |

|

By Construction |

Renovation New Construction |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Ceramic Tile Manufacturers

Construction Companies

Real Estate Developers

Architects and Interior Designers

Tile Distributors and Retailers

Banks and Financial Institutions

Investors and VCs

Government and Regulatory Bodies (EC, EPA, and CNBM)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

Mohawk Industries Group

Grupo Lamosa

SCG Group

RAK Ceramics

Kajaria Ceramics

Grupo Pamesa

Arwana Citramulia

Saudi Ceramics

Somany Ceramics

Kaleseramik

Table of Contents

1. Executive Summary

1.1 Global Tiles Market

1.2 Global Ceramic Tiles Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Ceramic Tiles Industry

2.3 Global Ceramic Tiles Revenue

3. Global Ceramic Tiles Market Overview

3.1 Ecosystem

3.2 Value Chain

3.3 Case Study

4. Global Ceramic Tiles Market Size (in USD Bn), 2018-2023

5. Global Ceramic Tiles Market Segmentation (in value %), 2018-2023

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2018-2023

5.2 By Material (Ceramic, Porcelain, and Others (Incl. Quarry, Terracota, among others)) in value%, 2018-2023

5.3 By Application (Floor Tiles, Wall Tiles, and Others (Rooftop-Ceiling and Countertop Tiles) in value %, 2018-2023

5.4 By End-User (Residential and Non-Residential sectors) in value %, 2018-2023

5.5 By Construction (Renovation and New Construction) in value %, 2018-2023

6. Global Ceramic Tiles Market Competition Landscape

6.1 Market Share Analysis

6.2 Market Heat Map Analysis

6.3 Market Cross Comparison

6.4 Comparison Matrix

6.5 Investment Landscape

7. Global Ceramic Tiles Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Trends

7.4 Case Studies

7.5 Strategic Initiatives

8. Global Ceramic Tiles Future Market Size (in USD Bn), 2023-2029

9. Global Ceramic Tiles Future Market Segmentation (in value %), 2023-2029

9.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2023-2029

9.2 By Material (Ceramic, Porcelain, and Others (Incl. Quarry, Terracota, among others)) in value%, 2023-2029

9.3 By Application (Floor Tiles, Wall Tiles, and Others (Rooftop-Ceiling and Countertop Tiles) in value %, 2023-2029

9.4 By End-User (Residential and Non-Residential sectors) in value %, 2023-2029

9.5 By Construction (Renovation and New Construction) in value %, 2023-2029

10. Analyst Recommendations

Research Methodology

Step 1: Secondary Resources

Objective: Identify players, revenue, product offerings of key players, and average pricing to calculate the market size.

- Government Reports: Ministry of Communications and Information Technology, Federal Communications Commission (FCC), European Commission.

- Official Company Reports and Press Releases: Annual reports, investor presentations, and press releases from major Digital Marketing Software Manufacturers for Product Offerings, Financial Performance, and Market Strategies.

- Public and Proprietary Database: F&S, Euromonitor, Statista, Gartner, IDC for Market Sizing, Industry Analysis & Forecasts.

Step 2 Validate Via Trade Desk Interviews:

Objective: Confirm market revenue, margins, segmentations, distribution, and future projections to gauge insights in the current market trends.

Step 3 Proxy Modelling & Outcomes:

- Bottom-Top Approach: Calculating revenue of major players by analyzing their sales and pricing for different products.

- Disguised interviews with multiple managers to get their viewpoint on their operational and financial performance. This approach has supported the team to validate the information that was shared by their top management to ensure data accuracy.

Frequently Asked Questions

01 How big is the Global Ceramic Tiles Market?

The global ceramic tiles market was valued at USD 450 billion in 2023, driven by factors such as urbanization, infrastructure development, and increasing demand for sustainable building materials.

02 What are the challenges in the Global Ceramic Tiles Market?

Challenges in the global ceramic tiles market include rising energy prices, particularly due to geopolitical tensions, and production slowdowns, especially in major manufacturing hubs like China, due to reduced demand from export markets.

03 Who are the major players in the Global Ceramic Tiles Market?

Key players in the global ceramic tiles market include Mohawk Industries, RAK Ceramics, Grupo Lamosa, and Kajaria Ceramics. These companies lead the market with their extensive product portfolios, advanced manufacturing capabilities, and strong global distribution networks.

04 What are the growth drivers of the Global Ceramic Tiles Market?

The global ceramic tiles market is driven by urbanization and infrastructure development, economic growth and rising incomes, increasing demand for sustainable building materials, and technological advancements in tile manufacturing processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.