Global Chipless Radio Frequency Identification Market Size, Segments, Outlook, and Revenue Forecast 2022-2028 by Component Type (Tag, Reader, and Middleware), Frequency (Low, High, and Ultra High), Application (Smart Card and Smart Ticket), End-user (Retail, Logistic & Transport, Healthcare, Banking, Financial Services and Insurance (BFSI)) and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa (LAMEA))

Region:Global

Product Code:KRBR35

Invalid Date

150

About the Report

Market Overview

A chipless RFID is a form of RFID tag that transmits data using radiofrequency (RF) radiation. A chipless RFID tag does not contain an application-specific integrated circuit (ASIC), hence the reader performs all signal processing to read the tags. It uses conductive polymers or plastic as an alternative to integrated circuits made from silicon.

Chipless Radio Frequency Identification (RFID) is used for access controls, automatic identifications, security and surveillance, tracking, database management, logistics, and inventory control in various industries like retail, healthcare, logistics, and transport among others.

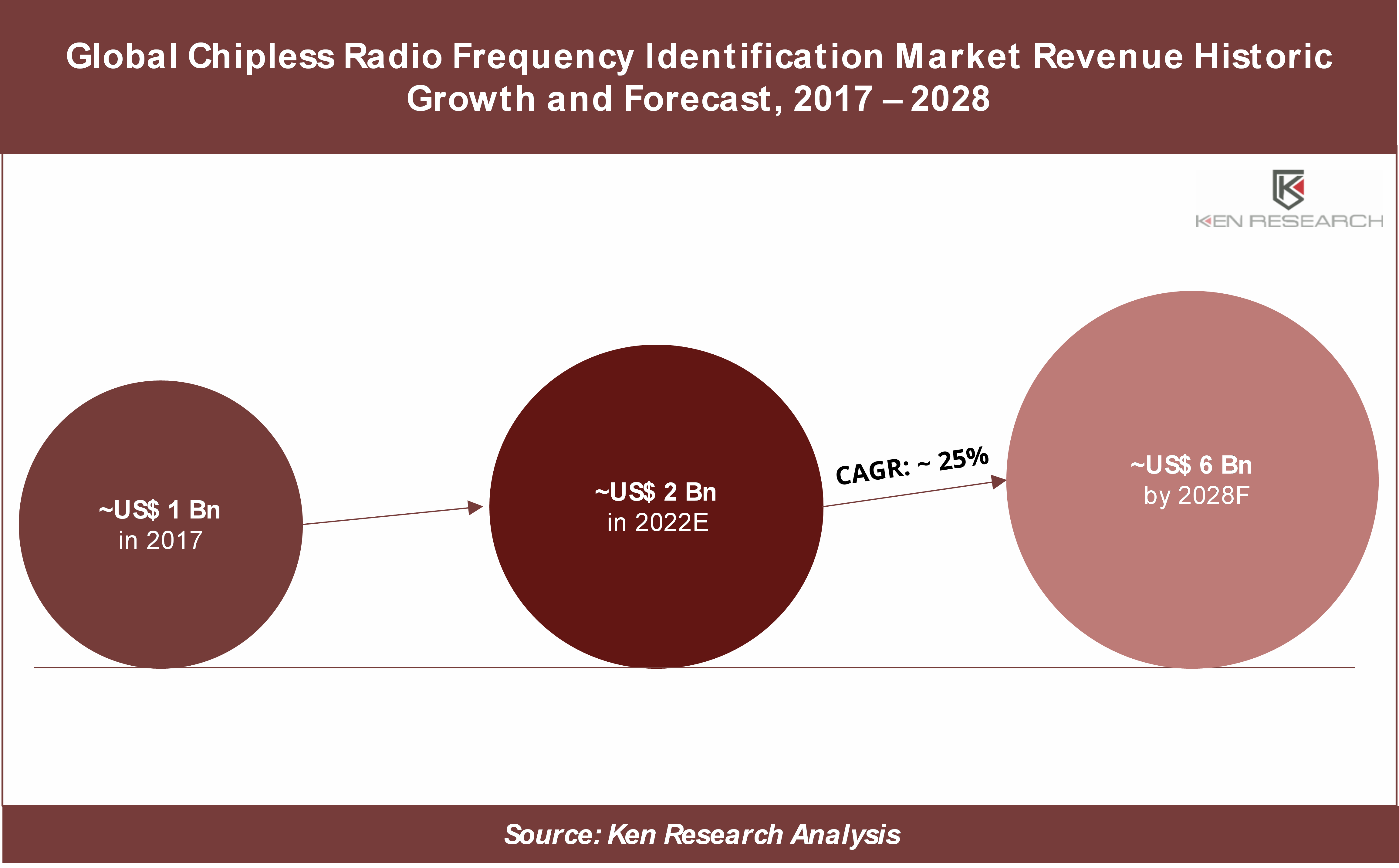

According to Ken Research analysis, the Global Chipless Radio Frequency Identification Market is expected to grow at a CAGR of 25% over the next six years (2022-2028) owing to high precision and advanced features for banking, healthcare, retail, and logistic industries. Furthermore, chipless RFID technology offers a wide number of characteristics at a lower price than conventional RFIDs, such as exceptional read/write capabilities, automation, and the ability to individually identify each asset or item. The market size is estimated to be US$ 2 Bn in 2022. It is further found in Ken Research’s study that the market size is expected to reach US$ 6 Bn by 2028.

The growing need for high accuracy and advanced features in RFID technology for banking, healthcare, retail and logistic industries, among other verticals is expected to propel the growth of the chipless radio frequency identification market. Moreover, the low cost of Chipless RFID tags over traditional RFID tags further accelerates the market growth.

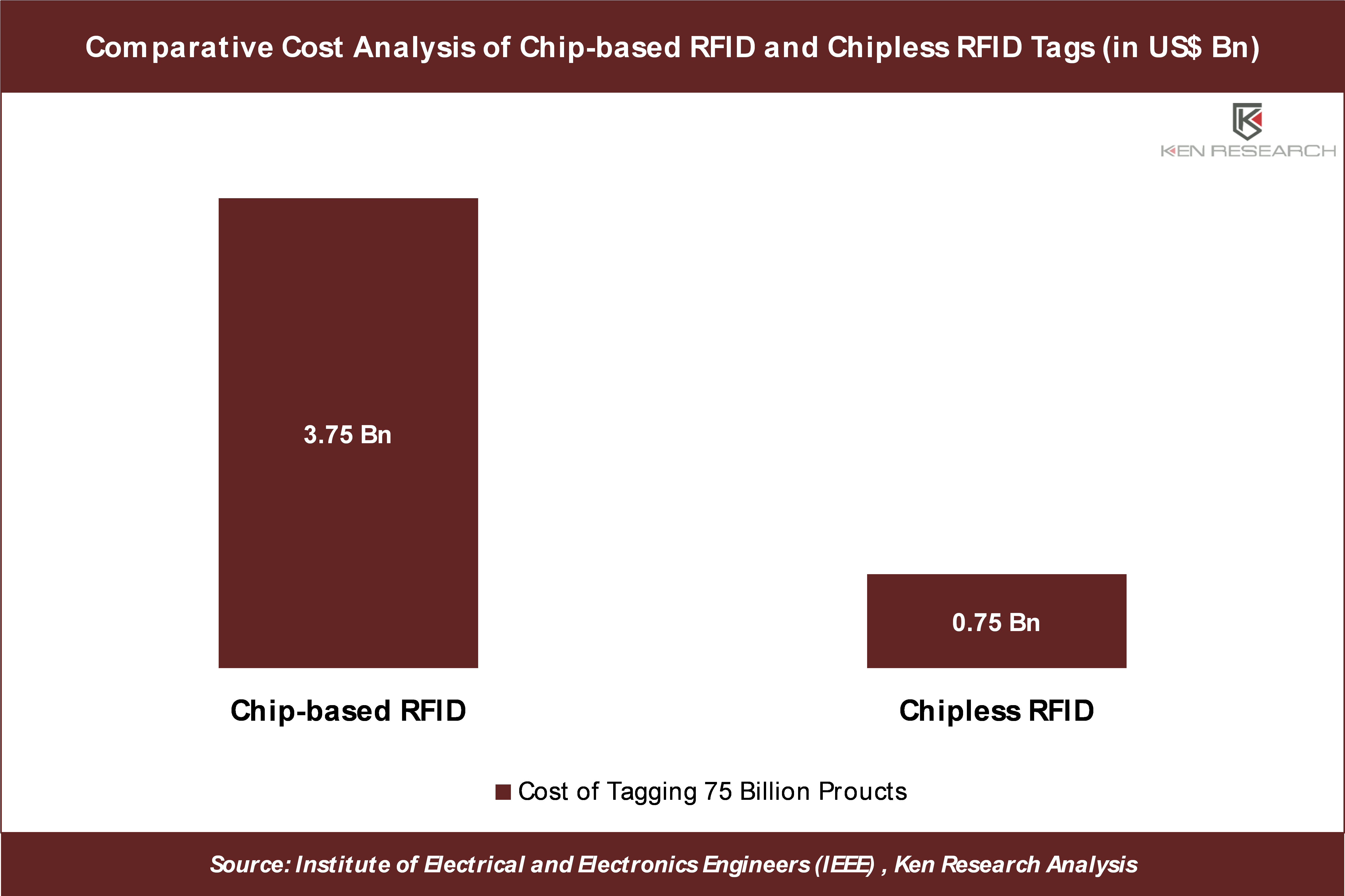

- Manufacturing of a chipless RFID tag is relatively inexpensive as it does not require a silicon chip or batteries inside the tag for tracking of product which reduces the hassle of maintenance and prices of these tags.

- According to a report published by the Institute of Electrical and Electronics Engineers (IEEE) International Symposium, a silicon chip-based RFID tag costs US$ 0.10-0.05 per tag whereas a chipless RFID tag costs about US$ 0.01 per tag. It was observed that the cost of tagging 75 billion products using silicon chip-based RFID tags could cost around US$ 3.75 Bn whereas the cost of tagging the same amount of products with chipless RFID cost about US$ 0.75 Bn. Therefore, by using chipless RFID, product tagging can be 80% cheaper than chip-based RFID tags. The below chart depicts the cost comparison between chipless RFID and chip-based RFID tags.

Information breach is a major challenge faced by the end-users in the Global Chipless Radio Frequency Identification Market. Additionally, the issues concerning data storage and utilization from a database are expected to hinder market growth.

- Despite all of its benefits, chipless radio frequency identification has an increased risk of a data breach as it lacks a locking system or security passcode. Owing to the risk of data breaches involving the use of medications and their composition, many businesses in the healthcare and other sectors avoid using chipless RFID tags for asset tracking. During the forecast period, this factor is expected to hamper the seamless growth of the market.

- According to a report shared by the Identity Theft Resource Center, in 2022, the security breach incidents in the USA reached 1862 breaches in 2021, which is almost 68% more than that of 2020. These security breaches involved a significant number of chipless RFID-based situations.

The outburst of the COVID-19 pandemic harmed the Chipless Radio Frequency Identification Market. Supply chain disruption was among the significant issues which led to reduced component manufacturing, component shortages, shipping delays, and restrictions. Additionally, in areas with high infection rates, operations had shut down entirely leading to largescale manufacturing interruptions across Europe and China which hindered the demand for chipless RFID. Restrictions on travel during the COVID-19 pandemic period resulted in a low deployment rate of RFID tags on vehicles for electronic toll collection. Moreover, low footfall in retail stores also reduced the need for product tagging on new stocks.

- As of October 2020, the reduction in auto demand reached 2.52 million below 2019 levels in North America while the output from the USA automotive industry was roughly 4,300 units in April 2020. As fewer vehicles were sold, it hindered the seamless growth of the chipless RFID market for tagging in the toll collection segment.

Scope of the Report

The Global Chipless Radio Frequency Identification Market is segmented by Component type, frequency, application, and end-user. In addition, the report also covers market size and forecasts for the world’s major regions' Chipless Radio Frequency Identification Markets. The revenue used to size and forecast the market for each segment is US$ Billion.

|

By Component Type |

|

|

By Frequency |

|

|

By Application |

|

|

By End-User |

|

|

By Geography |

|

Key Trends by Market Segment

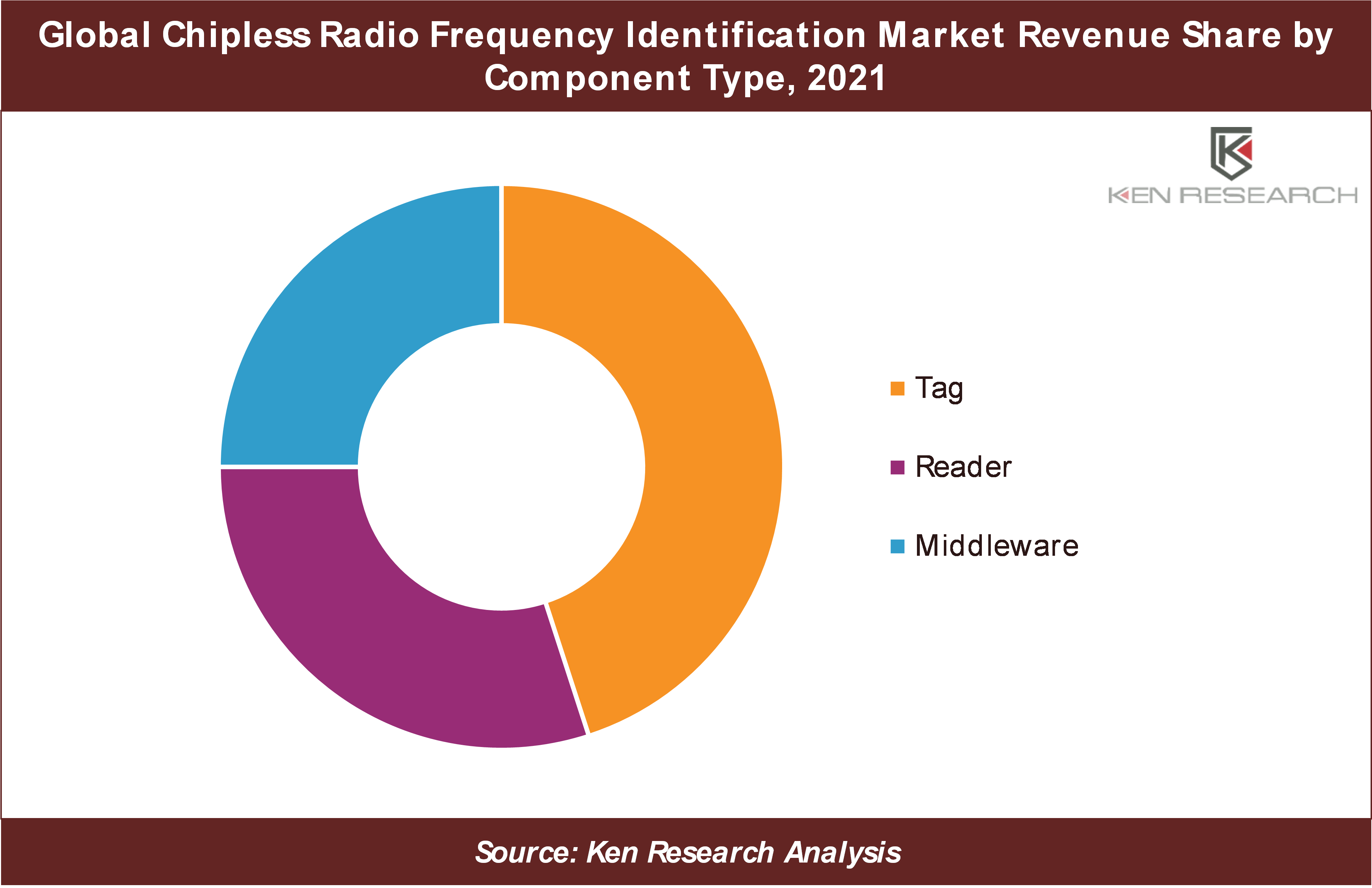

By Component Type: The chipless radio frequency identification tag segment dominated the Global Chipless Radio Frequency Identification Market by component type in 2021 and is expected to continue being the dominant segment during the forecast period.

- Chipless RFID tags can be instantly recognized by RFID readers and their data compared within the system database thus, it gives excellent accuracy while minimizing human mistakes and effort. Additionally, chipless RFID tags are cost efficient than chip-based RFID tags.

- In August 2018, the UC San Diego Jacobs School of Engineering and the Center for Wireless Communications at UC San Diego announced their chipless ID technology. The chipless RFID technology released by them is in the form of metal tags made from copper foil printed on thin, flexible substrates, like paper that can reflect Wi-Fi signals. The below chart depicts the revenue share of segments by component type.

By Frequency: The ultra-high-frequency segment dominated the Global Chipless Radio Frequency Identification market in 2021 and is expected to continue being the dominant segment during the forecast period.

- As these are widely used in electronic toll collection and parking access control, the ultra-high frequency segment holds a higher adoption rate over other frequency types market.

- To support the growth of the road network, Turkey’s Ministry of Transport and Infrastructure has implemented over 600 high-performance passive ultrahigh-frequency RFID technology for toll collection, as of 2020.

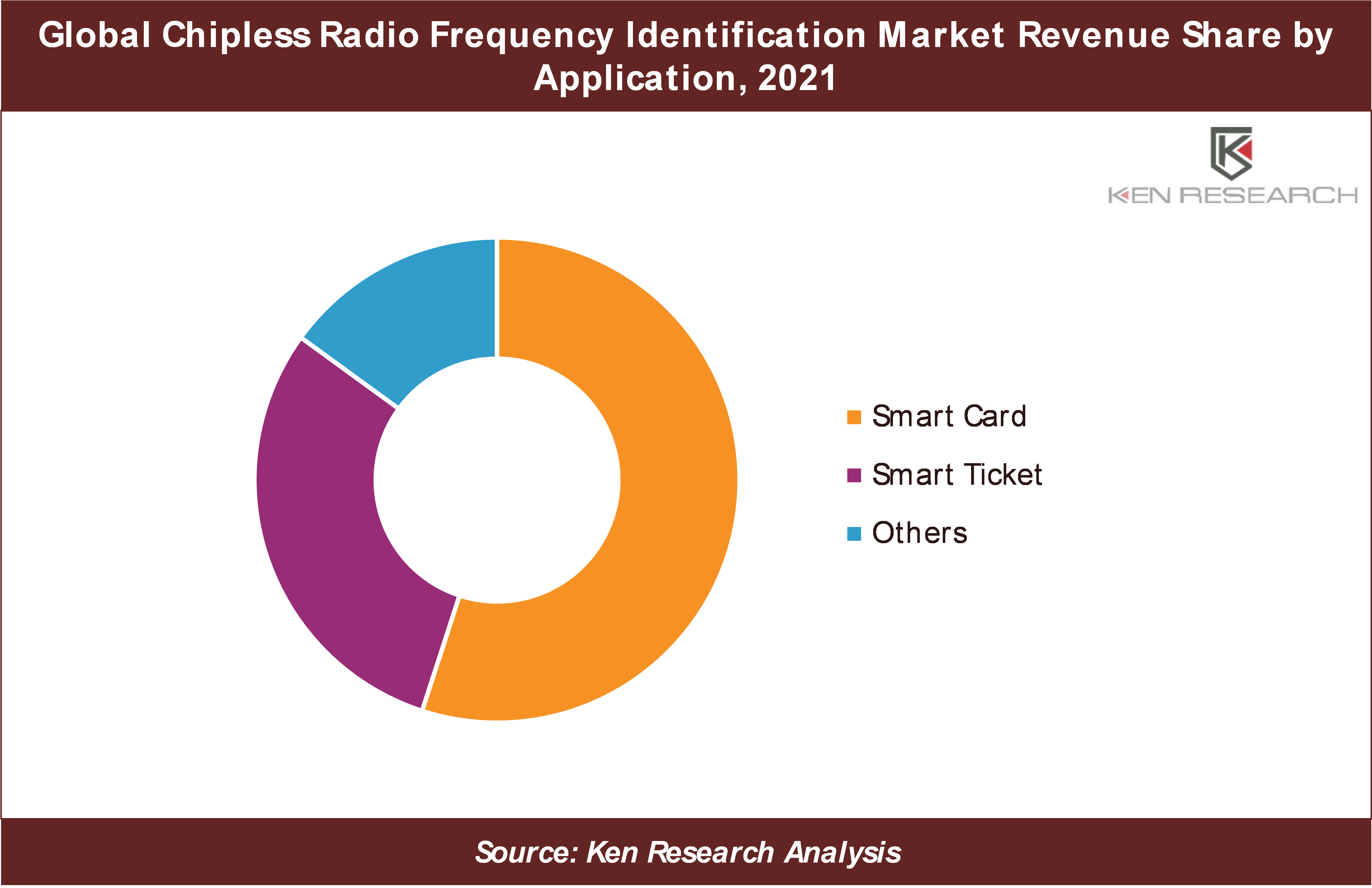

By Application: The Smart Card segment is the highest contributor to the Global Chipless Radio Frequency Identification market by application in 2021

- The characteristics of a smart card include its low cost, secure data, tracking, flexibility, and ease of use that helps fuel its demand in various end-user sectors including healthcare, banking, entertainment, transportation, access control, and government among others.

- The city of Toronto and surrounding municipalities have introduced a transit payment system, called Presto (an RFID smart card), based on ISO 14443, for payment and access to all transit systems in the area. This allows travelers to move seamlessly between trains, light rail, metro, and buses within Toronto and the greater area using one single, contactless ticketing solution. The below chart depicts the revenue share of segments by application type.

By End-user: The Retail segment is expected to be the fastest growing segment in the Global Chipless Radio Frequency Identification market during the forecast period.

- Retailers and customers use chipless RFID to identify, transact, engage, locate, and authenticate their assets and staff quickly and efficiently. The chipless RFID allows minimum contact and supervision which helps the retail stores in automating their facilities and manage their operations wirelessly. This has created a greater demand for chipless RFID in retail stores that earlier used to witness huge operational gaps in manual operations.

- In April 2021, Avery Dennison signed a partnership agreement with Target Corporation, an American retail corporation, to deploy RFID technology in more than 1,600 stores to assist Target Corporation in maximizing inventory availability and providing an improved customer experience.

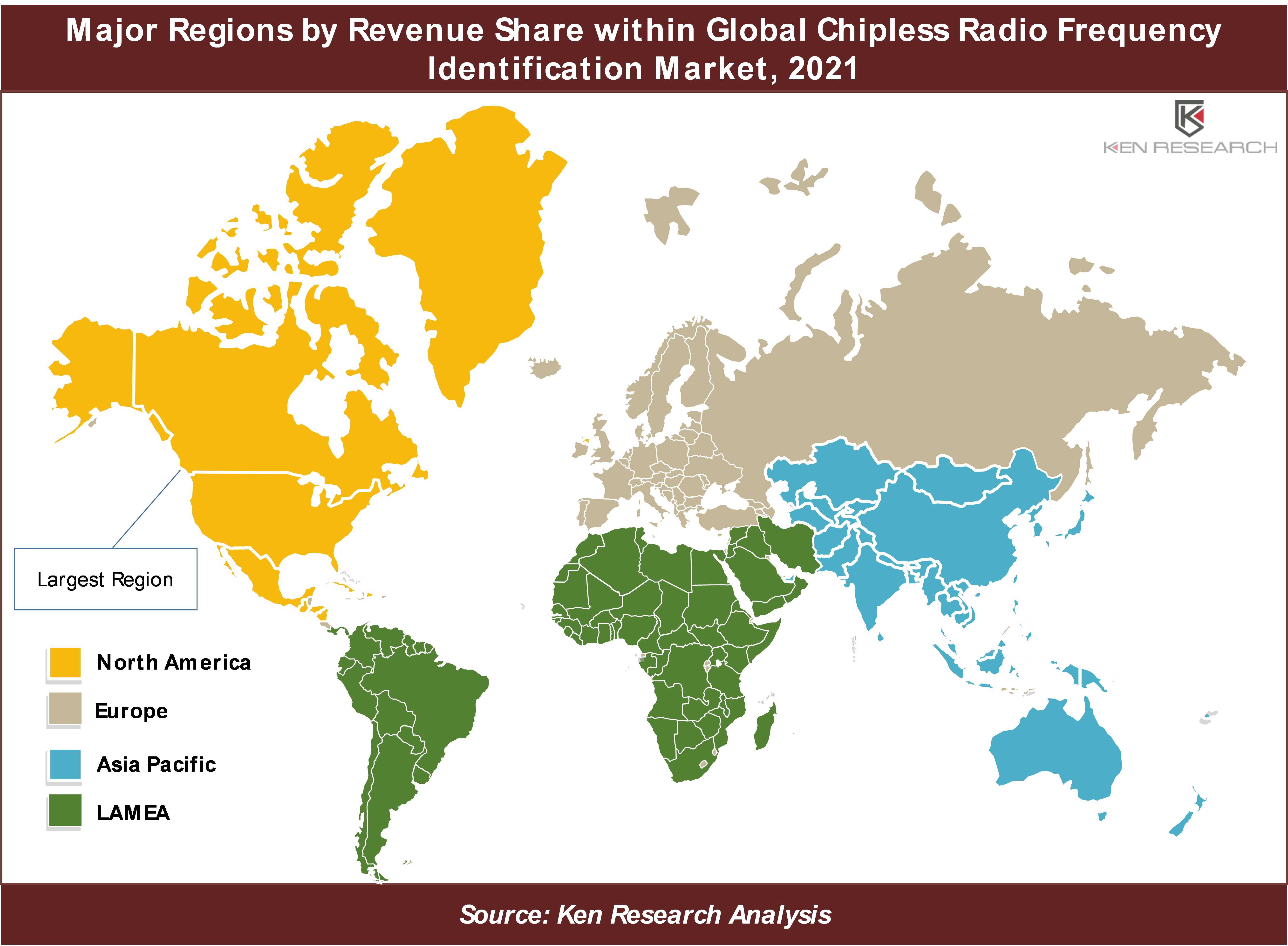

By Regions: North America accounted for the largest market share in 2021 among all regions within the Global Chipless Radio Frequency Identification Market. On the other hand, the Asia Pacific region is expected to record a higher growth rate during the forecast period owing to the adoption of new technologies and advancements in the healthcare, retail, and manufacturing sectors.

- Most of the large companies in the retail, healthcare, and logistic sector in the North American region is transitioning to implement automated item identification systems for supply chain management to improve the efficacy of inventory allocation. Additionally, the growing demand for RFID technology in the healthcare sector, to avoid drug counterfeiting and product tracking is propelling the growth of the market in the region

- In North America, major retailers like Walmart succeeded in adopting the chipless RFID technology found a reduction in out-of-stock and the bullwhip effect, and manual orders that resulted in excess inventory stock-up, improved service levels, and reduced administration.

Competitive Landscape

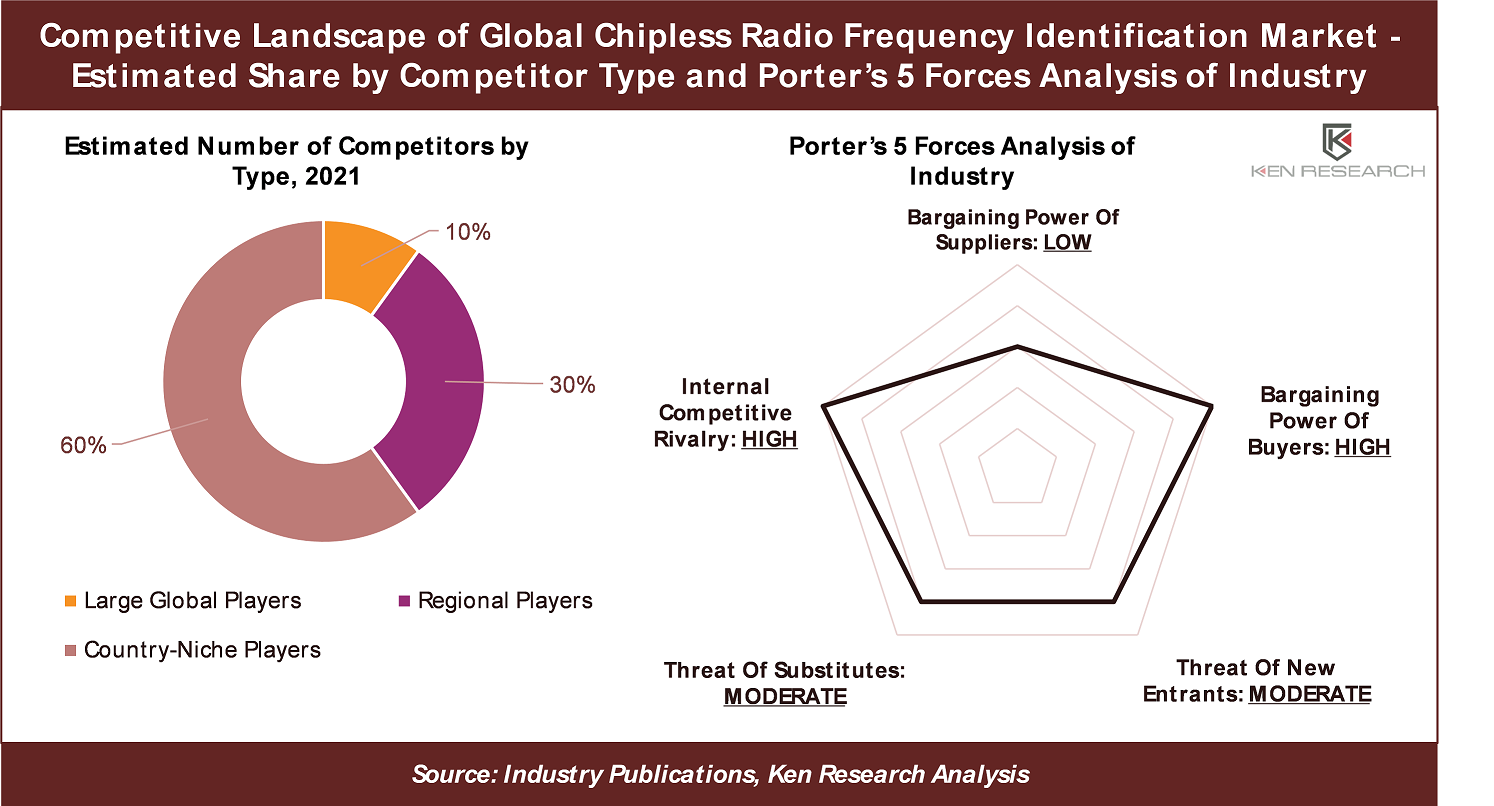

The Global Chipless Radio Frequency Identification Market is highly competitive with ~200 players which include globally diversified players, regional players as well as a large number of country-niche players.

Large global players control the majority share of the market in terms of revenue, while regional players hold the second largest share. Some of the major players in the market include Alien Technology, Applied Wireless, Inc., Avery Dennison Corporation, Checkpoint Systems, Inc., Honeywell International Inc, iDTRONIC GmbH, Impinj Inc., Invengo Technology Pte. Ltd., Zebra Technologies Corporation, NXP Semiconductors N.V., Ensurge Micropower ASA, Sato Vicinity pty Ltd among others.

The leading global companies such as Zebra Technologies Corporation, Avery Dennison Corporation, and Alien Technology highly focus on acquisition and partnership to increase their market presence. Additionally, these companies constantly develop their existing products and provide advanced chipless RFID solutions that can be used across the globe in various end-use applications.

Recent Developments Related to Major Players

- In June 2020, Zebra Technologies Corporation, a provider of digital solutions, hardware, and software, collaborated with Maikubo Artificial Intelligence (AI) Academy. Under this collaboration, Maikubo implemented the RFID solutions of Zebra Technologies to attain a faster, more accurate asset tagging and management of its training equipment. The solution saved staff time, enhanced accuracy and visibility as well as enhanced staff efficiency.

- In March 2020, Avery Dennison Corporation, a manufacturer and distributor of pressure-sensitive adhesive materials, apparel branding labels, tags, and RFID inlays, acquired Smartrac’s Transponder business. Smartrac is a manufacturer of high-security RFID inlays. Under this acquisition, the company aimed to develop a platform that offers long-term growth and profitability, with powerful research and development capabilities, an extended product portfolio, and added manufacturing capacity. The capabilities of Smartrac helped Avery to continue its delivery of this vision to various segments.

- In April 2019, Alien Technology, a quality supplier of RFID technologies and products, introduced the Higgs-9 IC, the first release of its next generation of Higgs RFID semiconductor integrated circuits. Higgs-9 enables enterprise-critical applications to run faster, smarter, and with quicker ROI in RFID deployments.

Conclusion

The Global Chipless Radio Frequency Identification Market is forecasted to continue exponential growth, which is primarily driven by the need for high precision and advanced feature in the banking, healthcare, retail, and logistic industries. The market size is estimated to be US$ 2 Bn by 2022 and is expected to reach US$ 6 Bn by 2028 growing with a CAGR of 25%. North America is the dominant region in terms of revenue generation; however, the Asia Pacific region is expected to grow at a higher pace. Though the market is highly competitive with ~200 participants, few global players control the dominant share while regional players also hold a significant share.

Note: This is an upcoming/planned report, so the figures quoted here for a market size estimate, forecast, growth, segment share, and competitive landscape are based on initial findings and might vary slightly in the actual report. Also, any required customizations can be covered to the best feasible extent for pre-booking clients, and the report delivered within a maximum of two working weeks.

Key Topics Covered in the Report

- Snapshot of Global Chipless Radio Frequency Identification Market

- Industry Value Chain and Ecosystem Analysis of Chipless Radio Frequency Identification Market

- Market size and Segmentation of Global Chipless Radio Frequency Identification Market

- Historic Growth of Overall Global Chipless Radio Frequency Identification Market and Segments

- Competition Scenario of the Market and Key Developments of Competitors

- Porter’s 5 Forces Analysis of Global Chipless Radio Frequency Identification Industry

- Overview, Product Offerings of Key Competitors

- Covid-19 Impact on Overall Global Chipless Radio Frequency Identification Market

- Future Market Forecast and Growth Rates of Total Global Chipless Radio Frequency Identification Market and By Segments

- Market Size of Application/End User Segments with Historical CAGR and Future Forecasts

- Analysis of Chipless Radio Frequency Identification Market in Major Regions

- Major Production/Supply and Consumption/Demand Hubs in Each Major Regions

- Major Region-wise Historic and Future Market Growth Rates of the Total Market and Segments

- Overview of Notable Emerging Competitor Companies within Each Major Regions.

Major Companies Profiled in the Report

- Alien Technology

- Applied Wireless, Inc.,

- Avery Dennison Corporation,

- Checkpoint Systems, Inc.,

- Honeywell International Inc

- iDTRONIC GmbH

- Impinj Inc.

- Invengo Technology Pte. Ltd.

- Zebra Technologies Corporation

- NXP Semiconductors N.V.

- Ensurge Micropower ASA

- SATO Holdings Corporation

Notable Emerging Companies Mentioned in the Report

- Infotek Software & Systems (P) Ltd.

- Omni-ID

- Nedap N.V.

- Datalogic S.p.A.

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

- Chipless Radio Frequency Identification Manufacturers

- Healthcare Chipless Radio Frequency Identification Suppliers

- Government and Policy Makers

- Regulatory Authorities in Chipless Radio Frequency Identification

- Chipless RFID Raw Material Suppliers

- Consulting Companies in the Chipless Radio Frequency Identification Market

- Automotive Industry Chipless Radio Frequency Identification Suppliers

- BFSI Industry Chipless Radio Frequency Identification Suppliers

- Retail Industry Chipless Radio Frequency Identification Suppliers

- Logistic & Transport Industry Chipless Radio Frequency Identification Suppliers

- Investors

- Research Institutes

- Technology Investors

- Private Equity Firms, and venture capitalists

- Transport & Logistic RFID manufacturers

- Plastic Material Suppliers

- ETC Solution Providers

- Supermarkets and Hypermarkets

Time Period Captured in the Report

- Historical Period: 2017H-2021H

- Forecast Period: 2022E-2028F

Frequently Asked Questions

- What is the Study Period of this Market Report?

The Global Chipless Radio Frequency Identification Market is covered from 2017–2028 in this report, which includes a forecast for the period 2022-2028.

- What is the Future Growth Rate of the Global Chipless Radio Frequency Identification Market?

The Global Chipless Radio Frequency Identification Market is expected to witness a CAGR of about 25% over the next six years.

- What are the Key Factors Driving the Global Chipless Radio Frequency Identification Market?

The increasing need for high accuracy, automation, and more features in the banking, healthcare, retail, logistics industries, and other sectors are expected to be the primary drivers of this market.

- Which is the Largest Segment by Component Type within Global Chipless Radio Frequency Identification Market?

The RFID Tag segment holds the largest share of the Global Chipless Radio Frequency IdentificationMarket.

- Who are the Key Players in the Global Chipless Radio Frequency Identification Market?

Alien Technology, Applied Wireless, Inc., Avery Dennison Corporation, Checkpoint Systems, Inc., Honeywell International Inc, iDTRONIC GmbH, Impinj Inc., Invengo Technology Pte. Ltd., Zebra Technologies Corporation, NXP Semiconductors N.V., Ensurge Micropower ASA, Sato vicinity pty ltd are some of the major companies operating in Global Chipless Radio Frequency Identification Market.

Products

Companies

Major Companies Profiled in the Report

Alien Technology

Applied Wireless, Inc.,

Avery Dennison Corporation,

Checkpoint Systems, Inc.,

Honeywell International Inc

iDTRONIC GmbH

Impinj Inc.

Invengo Technology Pte. Ltd.

Zebra Technologies Corporation

NXP Semiconductors N.V.

Ensurge Micropower ASA

SATO Holdings Corporation

Notable Emerging Companies Mentioned in the Report

Infotek Software & Systems (P) Ltd.

Omni-ID

Nedap N.V.

Datalogic S.p.A.

Table of Contents

- 1. Executive Summary

1.1 Highlights of Global Chipless Radio Frequency Identification Market Historic Growth & Forecast

1.2 Highlights of Market Trends, Challenges, and Competition

1.3 Highlights of Market Revenue Share by Segments

- 2. Market Overview and Key Trends Impacting Growth

2.1 Definition and Key Terms & Abbreviations

2.2 Global Chipless Radio Frequency Identification Market Taxonomy

2.3 Industry Value Chain

2.4 The Ecosystem of Major Entities in the Global Chipless Radio Frequency Identification Market

2.5 Government Regulations & Developments

2.6 Key Growth Drivers & Challenges Impacting the Market

2.7 COVID-19 Impact on Global Chipless Radio Frequency Identification Market

2.8 Total Global Chipless Radio Frequency Identification Market Historic Growth by Segment Type, 2017-2021

2.8.1 By Component Type

2.8.2 By Frequency

2.8.3 By Application Type

2.8.4 By End-user

2.8.5 By Region

2.9 Total Global Chipless Radio Frequency Identification Market Historic Growth and Forecast, 2017-2028

2.10 Key Takeaways

- 3. Total Global Chipless Radio Frequency Identification- Market Segmentation by Component Type, Historic Growth, Outlook & Forecasts

3.1 Market Definition - Segmentation by Component Type

3.2 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Component Type, 2017-2028

3.2.1 Tag

3.2.2 Reader

3.2.3 Middleware

3.3 Key Developments in Product Segments Impacting Market Future Growth

3.4 Covid-19 Impact on the segment

3.5 Key Takeaways from Market Segmentation by Component Type

4. Total Global Chipless Radio Frequency Identification- Market Segmentation by Frequency, Historic Growth, Outlook & Forecasts

4.1 Market Definition - Segmentation by Frequency

4.2 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Frequency, 2017-2028

4.2.1 Low

4.2.2 High

4.2.3 Ultra-high

4.3 Key Developments in Frequency Segments Impacting Market Future Growth

4.4 Covid-19 Impact on the segment

4.5 Key Takeaways from Market Segmentation by Frequency

- 5. Total Global Chipless Radio Frequency Identification- Market Segmentation by Application, Historic Growth, Outlook & Forecasts

5.1 Market Definition - Segmentation by Application

5.2 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Application, 2017-2028

5.2.1 Smart Card

5.2.2 Smart Tickets

5.2.3 Others

5.3 Key Developments in Application Segments Impacting Market Future Growth

5.4 Covid-19 Impact on the segment

5.5 Key Takeaways from Market Segmentation by Application

- 6. Total Global Chipless Radio Frequency Identification- Market Segmentation by End-user, Historic Growth, Outlook & Forecasts

6.1 Market Definition - Segmentation by End-user

6.2 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-user, 2017-2028

6.2.1 Retail

6.2.2 Logistic & Transport

6.2.3 Healthcare

6.2.4 BFSI

6.2.5 Others

6.3 Key Developments in End-user Segments Impacting Market Future Growth

6.4 Key Takeaways from Market Segmentation by End-user

6.5 Key Developments in End-user Segments Impacting Market Future Growth

6.6 Key Takeaways from Market Segmentation by End-user

7. Industry / Competition Analysis - Competitive Landscape

7.1 Types of Players (Competitors) & Share of Competition

7.2 Porter’s 5 Forces Analysis of Global Chipless Radio Frequency Identification Competitors

7.3 Comparison of Leading Competitors Within Global Chipless Radio Frequency Identification Market, 2021

7.4 Comparison of Leading Competitors Within Global Chipless Radio Frequency Identification Market by Coverage of Component Type, 2021

7.5 Comparison of Leading Competitors Within Global Chipless Radio Frequency Identification Market by Coverage of Frequency Type, 2021

7.6 Comparison of Leading Competitors Within Global Chipless Radio Frequency Identification Market by Coverage of Application Type, 2021

7.7 Comparison of Leading Competitors Within Global Chipless Radio Frequency Identification Market by Coverage of End-user, 2021

7.8 Comparison of Leading Competitors Within Global Chipless Radio Frequency Identification Market by Geographic Coverage, 2021

7.9 Key Takeaways from Competitive Landscape

- 8. Key Competitor Profiles (Company Overview, Product Offerings, Developments)

8.1 Alien Technology

8.2 Applied Wireless, Inc.

8.3 Avery Dennison Corporation

8.4 Checkpoint Systems, Inc

8.5 Honeywell International Inc

8.6 iDTRONIC GmbH

8.7 Impinj Inc

8.8 Invengo Technology Pte. Ltd.

8.9 Zebra Technologies Corporation

8.10 NXP Semiconductors N.V.

8.11 Ensurge Micropower ASA

8.12 SATO Holdings Corporation

- 9. Geographic Analysis & Major Countries Market Historic Growth, Outlook, and Forecasts

9.1 Major Countries Comparison of Macroeconomic Factors

9.2 Total Global Chipless Radio Frequency Identification - Market Revenue Share, Historic Growth, Outlook and Forecasts by Geography, 2017-2028

9.3 Major Regions Market Analysis, Historic Growth, Outlook & Forecasts

9.4 North America – Chipless Radio Frequency Identification Market Analysis

9.4.1 Major Production and Consumption Hubs in North America

9.4.2 Notable Emerging Chipless Radio Frequency Identification Companies in North America

9.4.3 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Component Type, 2017-2028

9.4.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Frequency, 2017-2028

9.4.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Application, 2017-2028

9.4.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-user, 2017-2028

9.4.7 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Major Countries, 2017-2028

- USA

- Canada

- Mexico

9.5 Europe – Chipless Radio Frequency Identification Market Analysis

9.5.1 Major Production and Consumption Hubs in Europe

9.5.2 Notable Emerging Chipless Radio Frequency Identification Companies in Europe

9.5.3 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Component Type, 2017-2028

9.5.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Frequency, 2017-2028

9.5.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Application, 2017-2028

9.5.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-user, 2017-2028

9.5.7 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Major Countries, 2017-2028

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

9.6 Asia Pacific – Chipless Radio Frequency Identification Market Analysis

9.6.1 Major Production and Consumption Hubs in the Asia Pacific

9.6.2 Notable Emerging Chipless Radio Frequency Identification Companies in the Asia Pacific

9.6.3 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Component Type, 2017-2028

9.6.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Frequency, 2017-2028

9.6.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Application, 2017-2028

9.6.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-user, 2017-2028

9.6.7 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Major Countries, 2017-2028

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

9.7 LAMEA – Chipless Radio Frequency Identification Market Analysis

9.7.1 Major Production and Consumption Hubs in LAMEA

9.7.2 Notable Emerging Chipless Radio Frequency Identification Companies in LAMEA

9.7.3 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Component Type, 2017-2028

9.7.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Frequency, 2017-2028

9.7.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Application, 2017-2028

9.7.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-user, 2017-2028

9.7.7 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Major Sub-regions, 2017-2028

- Latin America

- Middle East

- Africa

- 10. Industry Expert’s Opinions/Perspectives

10.1 Notable Statements/Quotes from Industry Experts and C-Level Executives on Current Status and Future Outlook of the Market

- 11. Analyst Recommendation

10.1 Analyst Recommendations on Identified Major Opportunities and Potential Strategies to Gain from Opportunities

- 12. Appendix

12.1 Research Methodology - Market Size Estimation, Forecast, and Sanity Check Approach

12.2 Sample Discussion Guide

Disclaimer

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.