Global Chiplets Market Outlook to 2030

Region:Global

Author(s):Sanjna Verma

Product Code:KROD9852

December 2024

86

About the Report

Global Chiplets Market Overview

- The Global Chiplets market, valued at USD 5.5 billion has shown significant growth over the past five years due to the increasing demand for high-performance computing (HPC) applications, especially in sectors such as artificial intelligence, data centers, and 5G infrastructure. The ability of chiplets to offer better customization and cost-effective scaling for semiconductor companies has been one of the major factors driving the market. This shift is helping companies reduce the costs associated with advanced node technologies, further expanding the market.

- The market is heavily dominated by the United States, Taiwan, and South Korea. The U.S. leads due to the presence of major players like Intel and AMD, which are heavily investing in chiplet technology to meet demand from sectors like AI and cloud computing. Taiwan, with TSMCs advanced chip manufacturing capabilities, plays a pivotal role in the markets dominance. South Korea's strength lies in its investment in memory chiplet technology and packaging, especially with companies like Samsung. These countries dominate the market due to their robust semiconductor manufacturing ecosystems and technological advancements.

- Export restrictions and tariff policies are impacting the chiplet supply chain, particularly in the USA and China. In 2023, the USA imposed export restrictions on advanced semiconductor technologies, affecting nearly $5.6 billion worth of chiplet components destined for China. These restrictions have led to supply chain disruptions, particularly in sectors like telecommunications and consumer electronics. Additionally, tariff policies in the European Union added $1.2 billion to semiconductor production costs, further complicating the Global Chiplets supply chain

Global Chiplets Market Segmentation

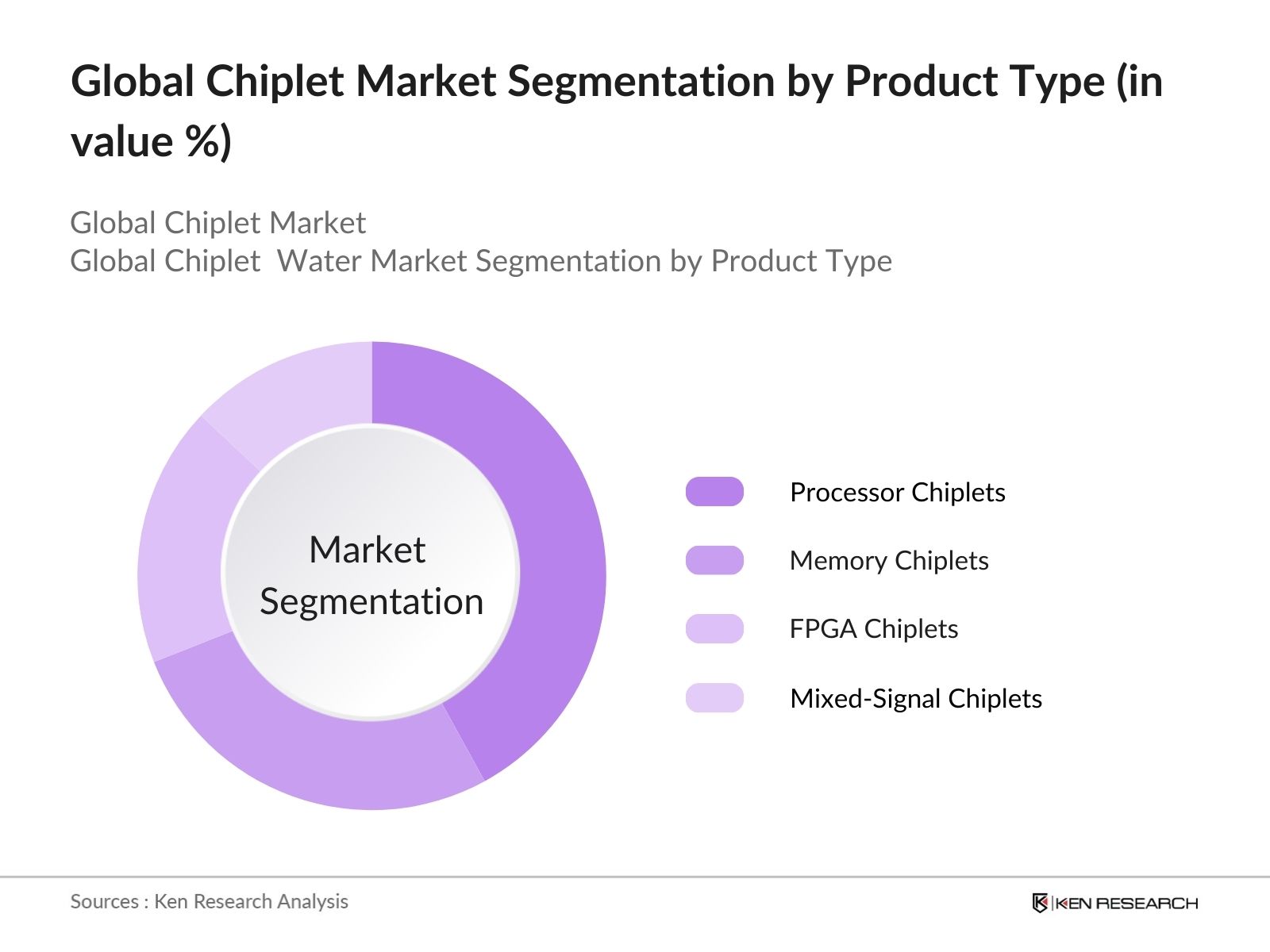

By Product Type: The Global Chiplets market is segmented by product type into processor chiplets, memory chiplets, FPGA chiplets, and mixed-signal chiplets. Processor chiplets hold a dominant position in this category, driven by their widespread application in data centers and high-performance computing. Companies like AMD and Intel have pioneered the use of processor chiplets to improve performance while reducing the costs associated with manufacturing larger monolithic chips. The rise of AI, cloud services, and big data applications has further accelerated the demand for processor chiplets.

By Region: The Global Chiplets market is also segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America leads the regional segmentation, driven by the presence of major semiconductor manufacturers and R&D facilities, especially in the U.S. Companies like AMD, Intel, and NVIDIA are making significant investments in chiplet technology. In Asia-Pacific, Taiwan and South Korea are important contributors, with their well-established foundries and memory chip industries.

By Technology: The market is segmented by technology into 2D chiplet integration, 2.5D chiplet integration, and 3D chiplet integration. Currently, 2.5D chiplet integration holds the largest market share. Its ability to offer better performance than traditional 2D designs while avoiding the high cost and complexity of full 3D integration makes it an attractive option. Semiconductor companies use 2.5D chiplet technology to meet the growing need for enhanced computing power in a cost-effective manner, especially in applications like GPUs and AI accelerators.

Global Chiplets Market Competitive Landscape

The Global Chiplets market is competitive, with key players investing heavily in research and development to maintain their market position. The market is dominated by both established semiconductor giants and emerging players focusing on specific chiplet technologies. The market's competitive landscape is marked by strategic partnerships, mergers, and acquisitions, with companies aiming to expand their chiplet portfolios and packaging capabilities. For example, AMD has significantly advanced its chiplet designs, gaining a strong foothold in the high-performance computing market.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investment |

Manufacturing Facilities |

Chiplet Technology Focus |

Key Customers |

Revenue |

|

AMD |

1969 |

Santa Clara, USA |

- |

- |

- |

- |

- |

- |

|

Intel Corporation |

1968 |

Santa Clara, USA |

- |

- |

- |

- |

- |

- |

|

TSMC |

1987 |

Hsinchu, Taiwan |

- |

- |

- |

- |

- |

- |

|

Samsung Electronics |

1969 |

Suwon, South Korea |

- |

- |

- |

- |

- |

- |

|

NVIDIA Corporation |

1993 |

Santa Clara, USA |

- |

- |

- |

- |

- |

- |

Global Chiplets Market Competitive Landscape

Growth Drivers

- Increased Demand for High-Performance Computing: The global demand for high-performance computing (HPC) has been significantly rising due to advancements in sectors such as scientific research, financial modeling, and autonomous systems. HPC demand reached unprecedented levels in 2023, with semiconductor consumption hitting 4.8 billion units globally. This surge is particularly noticeable in North America, which accounted for 30% of the total demand, primarily due to its advanced tech ecosystem. According to the World Bank, the ICT sector's contribution to global GDP rose by $1.2 trillion between 2022 and 2023, accelerating the adoption of chiplet architecture.

- Cost Efficiency in Advanced Semiconductor Production: Chiplets allow semiconductor manufacturers to reduce production costs by enabling modular designs, reducing waste, and optimizing wafer space. This has led to an 18% reduction in chip production costs in regions like East Asia by 2023. In the USA, semiconductor plants reported savings of up to $1.5 billion due to the integration of chiplet-based production lines. These savings contribute to increased production capacity and availability of high-end chips in industries such as telecommunications and automotive.

- Growth in Artificial Intelligence (AI) Applications: AI applications are driving the global demand for chiplet technologies, particularly in data centers and machine learning platforms. In 2023, AI infrastructure investments reached $350 billion globally, fueling the need for faster, more efficient processors. Chiplet designs have been critical in supporting AI workloads, with AI-driven enterprises increasing their chip consumption by 20 million units by 2023.

Challenges

- High Initial R&D Costs: Developing chiplets requires significant investment in R&D, particularly in advanced packaging technologies. In 2023, semiconductor firms globally spent approximately $98.8 billion on R&D, with a considerable portion allocated to advanced packaging solutions. The USA alone accounted for $60.2 billion of this expenditure, as firms push for more efficient packaging techniques. The lack of immediate returns on these investments remains a challenge for smaller players, creating barriers to entry in the chiplet market.

- Lack of Industry-Wide Standardization for Chiplet Design: The absence of standardized chiplet design protocols hampers interoperability and increases production complexity. This issue is particularly evident in Europe, where chiplet manufacturers face significant challenges due to fragmented design standards across the region. In 2023, only 40% of chiplet designs were compliant with existing industry standards, slowing down the mass adoption of chiplet-based solutions. The lack of unified guidelines continues to complicate cross-border production and integration.

Global Chiplets Market Future Outlook

Global Chiplets market is expected to experience significant growth, driven by the rapid expansion of data centers, AI workloads, and 5G infrastructure. As the demand for higher performance and energy-efficient computing continues to rise, chiplet technology will play a crucial role in addressing these needs. Furthermore, as semiconductor companies seek to optimize costs, chiplet integration will become more widespread across industries. Strategic partnerships between foundries and chip manufacturers will further accelerate innovation in this space.

Future Market Opportunities

- Strategic Collaborations Among Semiconductor Foundries and Chiplet Designers: Collaborations between semiconductor foundries and chiplet designers present significant opportunities for market growth. In 2023, companies like Intel and TSMC engaged in strategic partnerships to develop next-generation chiplets, increasing their production capacity by 40%. These partnerships are crucial for scaling up chiplet production, especially in regions like the USA and Taiwan, which dominate the global semiconductor market. Such collaborations are also vital for driving innovation in advanced semiconductor packaging, which is essential for chiplet integration.

- Increased Customization Options for End Users: Chiplets offer greater customization for end users, particularly in sectors such as automotive, consumer electronics, and telecommunications. Chiplet architectures provide manufacturers with the flexibility to integrate custom features while optimizing production costs. This trend is particularly prominent in Europe, where automotive manufacturers are increasingly adopting chiplet solutions for electric vehicle (EV) platforms

Scope of the Report

|

Product Type |

Processor Chiplets Memory Chiplets FPGA Chiplets Mixed-Signal Chiplets |

|

End User |

Data Centers Automotive Consumer Electronics Healthcare |

|

Technology |

2D Chiplet Integration 2.5D Chiplet Integration 3D Chiplet Integration |

|

Packaging Type |

Fan-out Wafer-Level Packaging (FOWLP) Embedded Die Packaging Flip-chip Packaging |

|

Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Semiconductor Manufacturers

Chip Packaging Companies

Data Centers and Cloud Providers

High-Performance Computing Providers

Consumer Electronics Companies

Automotive Electronics Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Commerce, European Commission)

Companies

Players Mentioned in the Report

AMD

Intel Corporation

TSMC

Samsung Electronics

NVIDIA Corporation

Qualcomm Incorporated

Broadcom Inc.

Marvell Technology Group

Xilinx, Inc.

ASE Group

Table of Contents

Global Chiplets Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Value Chain (Chiplet Integration in Semiconductor Manufacturing, Packaging, and Testing)

1.4. Market Segmentation Overview

Global Chiplets Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Advanced Node Technology Integration, New Packaging Innovations, Supply Chain Updates)

Global Chiplets Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand for High-Performance Computing (HPC)

3.1.2. Cost Efficiency in Advanced Semiconductor Production

3.1.3. Growth in Artificial Intelligence (AI) Applications

3.1.4. Rising Adoption of 5G and IoT Technologies

3.2. Market Challenges

3.2.1. High Initial R&D Costs (Advanced Packaging Technologies)

3.2.2. Lack of Industry-Wide Standardization for Chiplet Design

3.2.3. Limited Ecosystem for Testing and Validation

3.2.4. Complex Supply Chain for Multichip Solutions

3.3. Opportunities

3.3.1. Strategic Collaborations Among Semiconductor Foundries and Chiplet Designers

3.3.2. Expansion of Chiplet-based Solutions in AI and Data Centers

3.3.3. Increased Customization Options for End Users

3.3.4. Growing Investment in Heterogeneous Computing

3.4. Trends

3.4.1. Emergence of Open-Source Chiplet Architectures

3.4.2. Integration with 3D Stacked ICs

3.4.3. Expansion of Chiplet Ecosystem in Automotive and Consumer Electronics

3.4.4. Rising Demand for Energy-Efficient Semiconductor Solutions

3.5. Government Regulation

3.5.1. Export Restrictions and Tariff Policies (Impact on Chiplet Supply Chain)

3.5.2. Semiconductor Subsidies and Incentives (Regional Focus: USA, China, EU)

3.5.3. National Semiconductor Security Policies (Implications for Chiplet Manufacturing)

3.5.4. Compliance with Environmental Standards (E-Waste Regulations, Energy Efficiency Mandates)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Chip Manufacturers, Foundries, OEMs, and Integrators)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

Global Chiplets Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Processor Chiplets

4.1.2. Memory Chiplets

4.1.3. FPGA Chiplets

4.1.4. Mixed-Signal Chiplets

4.2. By End User (In Value %)

4.2.1. Data Centers

4.2.2. Automotive

4.2.3. Consumer Electronics

4.2.4. Healthcare

4.3. By Technology (In Value %)

4.3.1. 2D Chiplet Integration

4.3.2. 2.5D Chiplet Integration

4.3.3. 3D Chiplet Integration

4.4. By Packaging Type (In Value %)

4.4.1. Fan-out Wafer-Level Packaging (FOWLP)

4.4.2. Embedded Die Packaging

4.4.3. Flip-chip Packaging

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

Global Chiplets Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. AMD

5.1.2. Intel Corporation

5.1.3. NVIDIA Corporation

5.1.4. TSMC (Taiwan Semiconductor Manufacturing Company)

5.1.5. Broadcom Inc.

5.1.6. Samsung Electronics

5.1.7. Qualcomm Incorporated

5.1.8. Xilinx, Inc.

5.1.9. Marvell Technology Group

5.1.10. ASE Group

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Key Products, R&D Investment, Global Presence, Key Customers, Manufacturing Capacity, Chiplet Technology Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Acquisitions, Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Semiconductor Equipment and Facilities)

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Global Chiplets Market Regulatory Framework

6.1. Industry Standards for Chiplet Design and Integration (ISO, JEDEC, SEMI)

6.2. Compliance Requirements for Foundries and Manufacturers

6.3. Certification Processes for Semiconductor Components

Global Chiplets Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (AI, 5G, Data Center Expansion, Automotive Semiconductor Demand)

Global Chiplets Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By End User (In Value %)

8.3. By Technology (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

Global Chiplets Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing and Sales Strategies for Entry into Emerging Markets

9.3. White Space Opportunity Analysis for Custom Chiplet Solutions

9.4. Customer Cohort Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in this research involved identifying key variables that drive the Global Chiplets Market. This was accomplished by gathering data from multiple sources, including industry reports, government publications, and proprietary databases. Stakeholders were mapped out to ensure a comprehensive understanding of the market ecosystem.

Step 2: Market Analysis and Construction

In this phase, historical data was gathered to assess the current market size and penetration of chiplet technology across different applications. This step also involved evaluating technological advancements, product innovation, and strategic initiatives of major players to gauge the impact on market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

To validate initial findings, in-depth interviews were conducted with experts from leading semiconductor companies and industry associations. Their insights helped refine market estimates and confirm hypotheses related to the growth drivers and challenges in the chiplet market.

Step 4: Research Synthesis and Final Output

Finally, the collected data was synthesized to create a cohesive report, outlining key findings, market trends, and future projections. This involved cross-referencing insights from primary research with secondary data, ensuring accuracy and reliability of the final output.

Frequently Asked Questions

01 How big is the Global Chiplets Market?

The Global Chiplets Market is valued at USD 5.5 billion, driven by demand for high-performance computing applications and growing investments in advanced semiconductor manufacturing.

02 What are the challenges in the Global Chiplets Market?

Key challenges in Global Chiplets Market include the high costs of initial R&D, the lack of industry-wide standards for chiplet design, and the complex supply chain required for chiplet manufacturing and integration.

03 Who are the major players in the Global Chiplets Market?

Major players in Global Chiplets Market include AMD, Intel Corporation, TSMC, Samsung Electronics, and NVIDIA, all of which have a significant focus on chiplet technology for high-performance computing applications.

04 What are the growth drivers of the Global Chiplets Market?

Growth drivers in Global Chiplets Market include increasing demand for AI and cloud computing, advancements in semiconductor packaging technologies, and the need for cost-effective scaling in semiconductor manufacturing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.